End of Dollar Seigniorage, Supercycle for Stablecoins

TechFlow Selected TechFlow Selected

End of Dollar Seigniorage, Supercycle for Stablecoins

YBS is essentially a customer acquisition cost.

Author: Zuoye

-

De-dollarization of native yield in YBS, such as greater adoption of purely on-chain assets through staking forms like BTC/ETH/SOL;

-

YBS "Lego" composability—Pendle is just the beginning. More DeFi protocols need to support YBS until on-chain USDT emerges;

-

Payment products: technically straightforward and interest-bearing mechanisms help user acquisition, but the main challenges lie in compliance and scaling operations. Even for USDT/USDC, payments mostly serve as a backend clearing "middleware," rarely acting directly as transaction mediums.

Equity, bond, and currency markets all suffered within 100 days, accelerating the breakdown of fiat order.

The 2008 financial crisis gave rise to Bitcoin's earliest believers. The "self-destruction" of the fiat system in 2025 will similarly catalyze the growth of on-chain stablecoins, especially non-dollar, non-fully reserved yield-bearing stablecoins (YBS, Yield-Bearing Stablecoins).

However, non-fully reserved stablecoins remain theoretical. Lingering aftermath from Luna-UST’s 2022 collapse still affects sentiment. Yet driven by capital efficiency demands, fractional-reserve stablecoins will inevitably become mainstream.

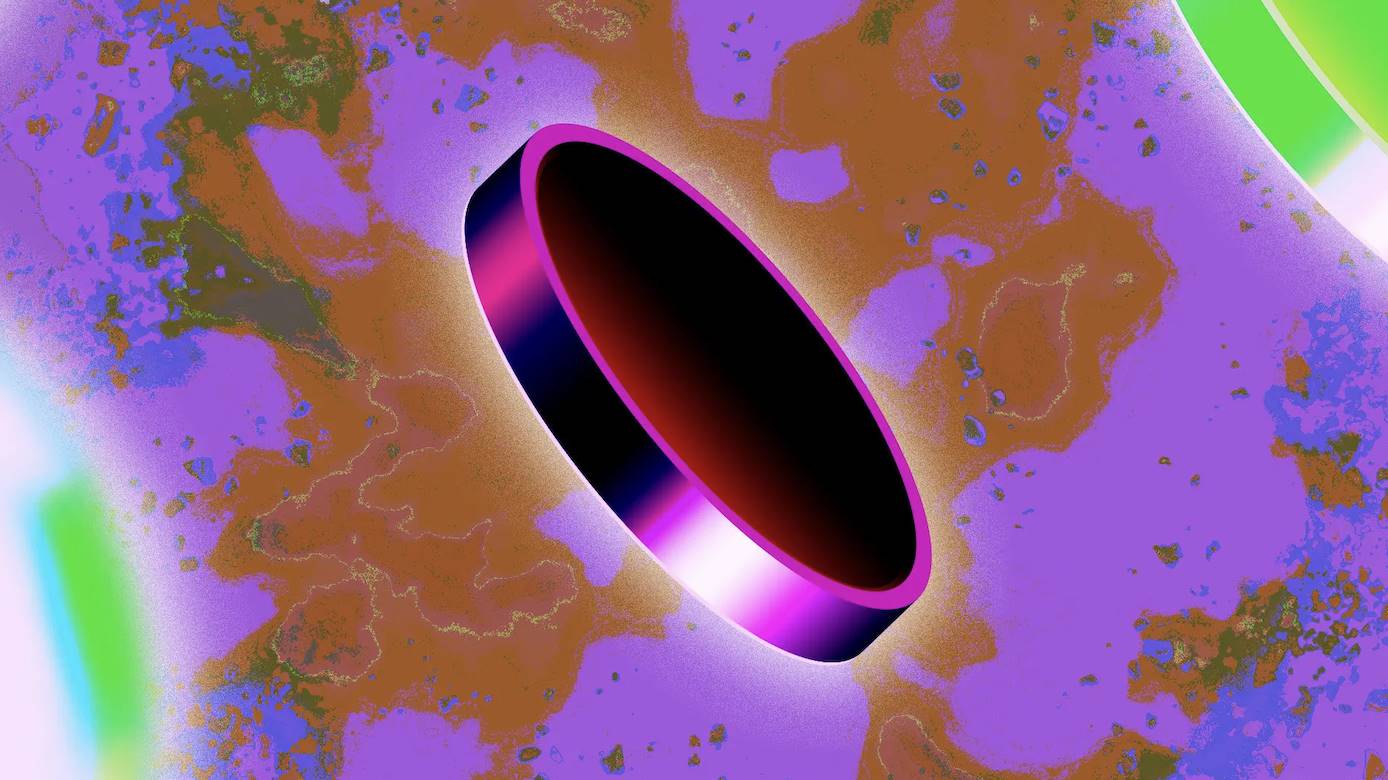

Non-dollar stablecoins are still experimental. The dollar’s global monetary status remains widely accepted. To maintain industrial capacity and employment, China won’t actively internationalize the RMB at scale. Replacing the dollar will be an extremely long process.

Caption: Non-dollar stablecoins

Source: https://dune.com/base_ds/international-stablecoins

Based on these two points, this article primarily examines the current stage of existing stablecoins—the overall landscape of YBS. Dollar-denominated, fully reserved on-chain stablecoin systems already contain the basic blueprint for post-dollar, non-fully reserved stablecoins.

Seigniorage manifests internally as inflation—commonly known as “domestic debt isn’t real debt”—and externally as the U.S. dollar tidal cycle.

Trump Abandons Dollar Hegemony

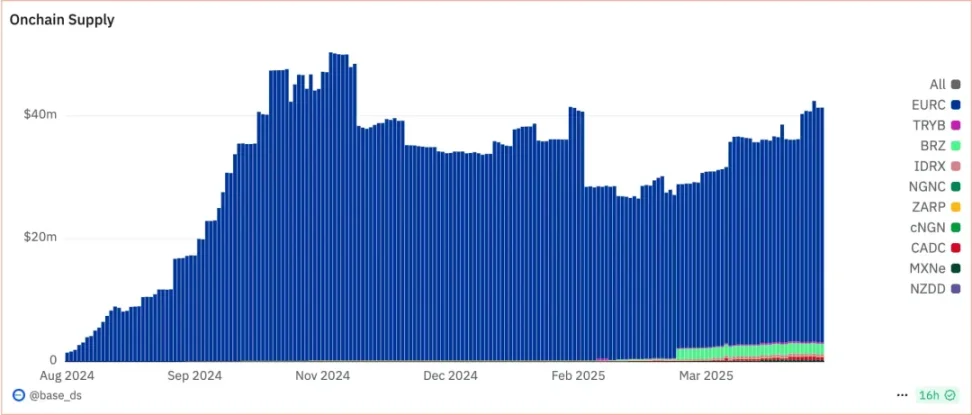

Dollar issuance, technically speaking, involves coordination between the Federal Reserve and the Treasury Department, leveraging commercial banks’ credit relationships to amplify the money multiplier, creating different statistical layers of money supply such as M0/M1/M2/M3...

In this issuance model, U.S. Treasuries (T-Bills, T-Notes, T-Bonds) of varying maturities maintain slow inflation and short-term exchange rate stability. Treasury yields become the pricing foundation of the entire financial world. The dollar becomes global currency at the cost of America’s external deficits and global dependence on dollars.

The costs are always bidirectional. America’s sole real product is effectively the dollar itself, while countries worldwide must obtain dollars and access their purchasing power.

The dollar’s purchasing power will depreciate over time, regardless of Trump’s intentions. Countries must acquire dollars to minimize transaction intermediary costs—barter isn't impossible, but using dollars is simply more cost-effective.

Hard-earned dollars must be spent quickly, either on production or financial arbitrage, to preserve their purchasing power and sustain future export competitiveness to the U.S.

This cyclical loop is now being disrupted by Trump’s Schrödinger-style tariff regime. Trump is raising tariffs and pressuring Powell to cut rates. Countries no longer wish to hold dollars, fleeing the Treasury market en masse. Dollars and Treasuries are becoming risk assets.

Caption: How the Dollar Works

Source: Pozsar

Slow dollar inflation functions as seigniorage extracting value globally, only sustainable when nations must hold dollars and allocate some into Treasuries to limit damage to the dollar itself.

Consider this scenario:

-

Alice is a textile worker sweating in a factory, earning $1,000 in cash;

-

Bob is a Treasury salesperson. Alice invests $100/$200/$200 in short-, medium-, and long-term Treasuries, leaving $500 for reinvestment in expanded production;

-

Bob uses Alice’s purchased bonds as collateral, leverages them 100x, and borrows $50,000 from bank Cindy;

-

Bob spends $25,000 on real estate, $20,000 on Mag7 stocks, and the remaining $5,000 on Alice’s new handbag.

In this cycle, Alice’s motivation is labor-for-dollar exchange and preserving value via reinvestment and Treasuries; Bob aims to recycle dollars and inflate Treasury asset values; Cindy earns risk-free income from Treasuries plus fees.

The danger lies in two aspects: if Alice puts all $1,000 into Treasuries, Bob and Cindy have no clothes to wear—$50,000 can’t buy a single loaf of bread. Second, if Bob cannot use Treasuries as risk-free collateral to borrow, Cindy loses her job, Bob can’t buy Alice’s bag (only underwear), and Alice faces losses from failed reinvestment.

There’s no turning back. After Trump abandons dollar hegemony, the dollar’s global seigniorage extraction will face a death spiral similar to Luna-UST—though it may take longer.

A fragmented global trade and financial system ironically becomes a catalyst for crypto “globalization.” Aligning with centralized power creates single points of failure. Bitcoin’s bondification won’t harm Bitcoin, but crypto dollarization could erase crypto altogether.

More interestingly, ongoing turbulence in the global economic system will keep stablecoin battles alive. A fractured world needs glue languages and cross-chain bridges. The era of global arbitrage will inevitably manifest through on-chain stablecoins.

Froggy entertains the masses; memers change the world. We’re here to explain why.

Tail Wags Dog: Stablecoins Displace Volatile Coins

Crypto market cap is “fake”; stablecoin supply is “real.”

The $2.7 trillion cryptocurrency market cap reflects only our perception of crypto market “size,” whereas $230 billion in stablecoins has at least some real backing, despite questionable reserves for USDT, which accounts for 60% of the total.

As DAI or USDS become increasingly USDC-like—backed by on-chain assets—fully or over-collateralized stablecoins based on on-chain assets have effectively died out. On the flip side, real backing means drastically reduced capital efficiency or money multipliers: issuing $1 stablecoin per $1 reserve, buying $1 in off-chain Treasuries, lending on-chain for at most 4x reissuance.

In contrast, BTC and ETH derive value seemingly from nothing—priced at $84,000 and $1,600 respectively. Against the dollar, crypto’s M0 should be BTC+ETH: 19.85 million BTC and 120.68 million ETH. M1 adds $230 billion in stablecoins. Reissued YBS volumes and the broader DeFi ecosystem form M2 or M3, depending on the measurement criteria.

This framework better reflects the actual state of the crypto market than market cap or TVL. Calculating BTC’s market cap lacks practical meaning—you can’t fully convert it into USDT or USD due to insufficient market liquidity.

The crypto market is an “inverted” market where volatile cryptocurrencies lack corresponding fully backed stablecoins.

Only under this structure does YBS make sense—converting crypto volatility into stablecoins. But this remains theoretical. In reality, it has never materialized. Instead, $230 billion in stablecoins must provide liquidity and entry/exit channels for a $2.7 trillion market.

Ethena represents pragmatism—an imperfect replication of the Treasury-dollar system.

USDe, Ethena’s token, grew from $620 million at launch to $6.2 billion by February this year, briefly capturing 3% market share, ranking third after USDT and USDC. It’s the most successful non-fiat-reserve stablecoin since UST.

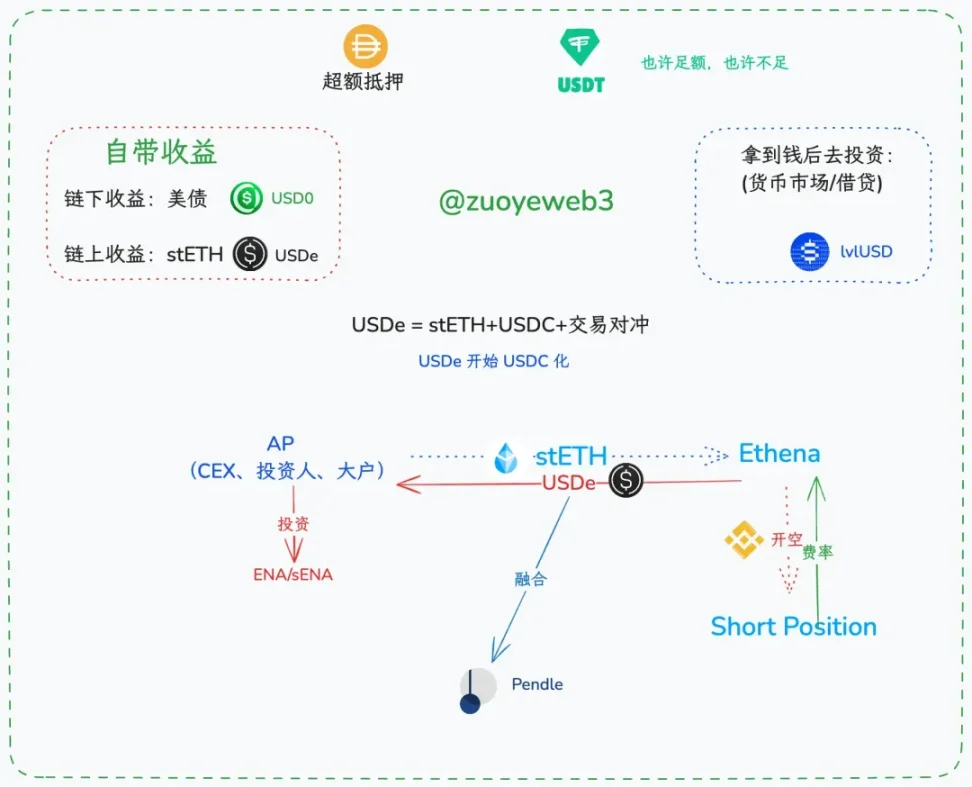

USDe’s hedging mechanism is actually simple: APs (Authorized Participants) deposit income-generating assets like stETH, while Ethena opens equivalent short positions on Perp CEX. Historically, longs often fund shorts, making funding rate arbitrage Ethena’s native protocol revenue.

Why not use Hyperliquid for the short leg? Because Perp DEX is still a derivative of Spot CEX, and Hyperliquid’s price oracle primarily sources data from Binance. USDe goes straight to the most liquid CEX.

But that’s not all. Ethena attempts to mimic the real dollar system even further.

Caption: YBS Classification and Operation Flow

Source: @zuoyeweb3

On the surface, Ethena operates four tokens: USDe, sUSDe, ENA, and sENA. But its core has always been USDe alone. The key metric is USDe’s adoption beyond staking and wealth management—its usage in trading and payments.

Recall how the dollar works: dollars cannot be entirely reinvested into Treasuries. Ideally, only a small portion flows back into bond markets, while most remain abroad—preserving both the dollar’s global status and its purchasing power.

Earlier this year, USDe offered a 9% yield, attracting about 60% of USDe to be staked as sUSDe. This is essentially a protocol liability. Theoretically, the remaining 40% of USDe must pay 9% returns to the 60%—clearly unsustainable.

Hence, alliances between ENA and CEXs are crucial. Just as Circle shares profits with Coinbase and Binance for holding USDC, ENA must also “bribe” APs. As long as large holders don’t dump, everything stays fine. sENA serves as another layer to stabilize big players.

Nested incentives mean the best model to emulate isn’t the dollar or USDC—but USDT: $14 billion in profits go to Tether Inc., while $160 billion in risks are distributed among CEXs and retail investors.

No other reason: P2P transfers, spot trading pairs, U-margined contracts, retail and institutional assets—all rely on USDT as the most universally accepted transaction medium. USDe doesn’t even have spot trading pairs yet.

Of course, whether Ethena’s collaboration with Pendle can reshape the DeFi ecosystem—from lending-centric to yield-centric—remains to be seen. I’ll cover this separately in a future article.

YBS Is Essentially Customer Acquisition Cost

In 2014, USDT first explored the Bitcoin ecosystem before partnering with Bitfinex, embedding itself in CEX trading pairs. Later, around 2017–2018, it migrated to Tron, becoming the dominant force in P2P scenarios.

All subsequent stablecoins—USDC, TUSD, BUSD, FDUSD—have merely imitated, never surpassed. (Side note: Binance seems inherently incompatible with stablecoins—has killed several already.)

Ethena, through its “bribery” mechanism, captured part of the CEX market but barely touched USDC’s regulated use cases or displaced USDT-dominated trading and transfer scenes.

YBS can’t enter transaction scenarios—even CEXs won’t adopt them—and fails in payment applications off-chain too. Relying solely on yield leaves DeFi as its only path forward.

Existing YBS can be categorized as follows:

YBS yields are protocol liabilities—essentially customer acquisition costs. Sustainability depends on broader user recognition of their dollar-equivalent status, encouraging holding rather than staking participation.

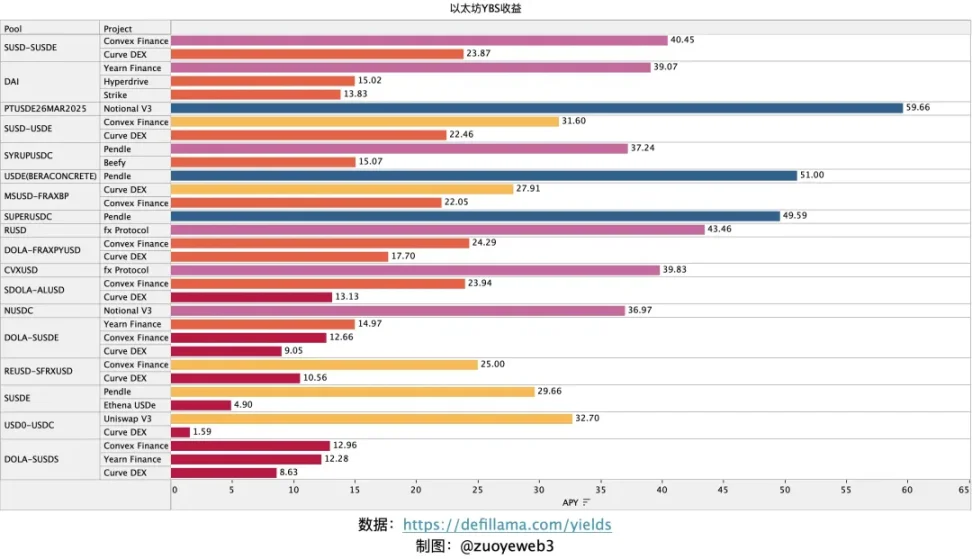

Among the top 50 stablecoins by market cap, $50 million acts as a rough dividing line. Below is the APY list for YBS:

Caption: Ethereum YBS Yields

Source: @zuoyeweb3

According to DefiLlama data, current Ethereum-based YBS yields are dominated by Ethena and Pendle—a stark contrast to the thousand-fold returns seen since DeFi Summer.

The era of excessive profits has ended; low-yield wealth management is here.

Risk and reward share the same source. Today, Treasuries underpin most YBS yields—this is risky. Moreover, on-chain yields require strong secondary market liquidity. Without sufficient user participation, yield guarantees become an unbearable burden crushing YBS projects.

This isn’t surprising. Usual, backed by Binance, manually adjusted its peg ratio. Sun’s USDD still claims a 20% yield. Kids, this isn’t funny. If even the most successful USDe offers only 4.9% native yield, where does USDD’s 20% come from? I can’t figure it out.

A clarification: the yields shown above reflect individual pool returns, including inherent yields from LSD assets—not fully equivalent to native YBS yields. DeFi yield sources may very well be the participants themselves—a truth that’s always existed.

More YBS projects emerge every day. Undoubtedly, competition centers on market share. Only when most users prioritize stability over yield can YBS sustain high yields while encroaching on USDT’s usage space.

Otherwise, if 100% of users chase yield, the yield source vanishes. Whether it’s Ethena’s funding rate arbitrage or on-chain Treasuries, there must be counterparties losing yield or principal. If everyone profits, then the world is one giant Ponzi scheme.

Additional Minor Points for Discussion

-

This article omits discussion of CDP mechanisms like Aave/Curve’s GHO/crvUSD, which seem unlikely to become mainstream. MakerDAO failed to establish an on-chain central bank model; other lending protocols likely face the same fate;

-

Algorithmic stablecoins like UST and AMPL are outdated and no longer attract market attention. Users now prefer stablecoins backed by real-world or major on-chain assets;

-

Pendle and Berachain: the former represents new DeFi trends, the latter a fusion of public chain and YBS mechanics. These topics are too significant—saved for a dedicated future piece;

-

This article excludes institutional issuance or adoption, off-chain payments, and transaction use cases, focusing instead on YBS yield sources and potential market opportunities.

-

Additionally, I’m currently building a visualization tool for on-chain yield strategies. Entrepreneurs and developers interested can DM me to chat.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News