How significant is Trump's overturning of IRS rules for the crypto sector?

TechFlow Selected TechFlow Selected

How significant is Trump's overturning of IRS rules for the crypto sector?

The crypto industry needs to work with regulators to create frameworks that both protect consumers and drive genuine innovation.

By: Token Dispatch, Prathik Desai

Translated by: Block unicorn

On Thursday last week, President Donald Trump signed a resolution repealing the IRS's controversial decentralized finance (DeFi) broker rule—marking his first crypto victory and making history as the first U.S. president to sign a crypto-related bill. After years of regulatory uncertainty, the industry finally has concrete proof that Washington is listening.

The resolution passed with strong bipartisan support—70 to 28 in the Senate and 292 to 132 in the House—indicating that cryptocurrency may have finally transcended political divisions.

This reversal is about more than just scrapping a problematic tax rule; it could be a prelude to shaping how the DeFi ecosystem evolves within the world’s largest economy.

In this article, we’ll walk you through the origins of the DeFi broker rule, why its repeal matters, and more importantly, how it sets the foundation for an entirely new approach to crypto regulation under a potential Trump 2.0 administration.

Biden’s Parting “Gift”

On December 27, 2024, during its final weeks in office, the Biden administration finalized a contentious IRS rule requiring "DeFi brokers" to collect and report user transaction data—a last-minute crackdown on crypto innovation before the presidential transition.

The rule expanded the definition of “broker” from the 2021 Infrastructure Act to include DeFi platforms, mandating them to issue 1099 forms and report transaction details to the IRS. It was originally set to take effect on January 1, 2027.

The move shocked industry experts and triggered immediate backlash.

Why? Seven words: Technically impossible to comply.

The Biden administration specifically targeted “front-end service providers”—think MetaMask or Uniswap websites, which millions use to swap tokens. These intuitive interfaces allow ordinary users to access decentralized protocols.

Under the rule, these front-ends would have been required to collect names, addresses, phone numbers, and transaction details—information they simply cannot access within a truly decentralized system.

When confronted with criticism over this contradiction, the IRS offered a dismissive response:

“Individuals with technical expertise engaged in a trade or business related to financial services should follow the same rules as others operating financial services businesses.”

This revealed a fundamental misunderstanding of how decentralized systems work. Industry leaders called it an “irreconcilable conflict”—demanding entities collect information they fundamentally cannot obtain.

The implication? Platforms would either have to reengineer protocols to gather data in ways that violate user privacy and decentralization principles—or exit the U.S. market entirely.

The Treasury Department’s eleventh-hour expansion of broker rules into DeFi was widely seen as executive overreach without congressional approval.

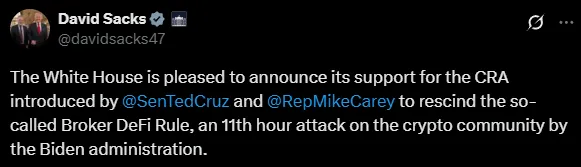

David Sacks, Trump’s lead advisor on AI and crypto, bluntly labeled it a “midnight regulation,” saying it would “stifle American innovation, raise serious privacy concerns, and impose unprecedented compliance burdens on U.S. DeFi firms.”

A Turning Point

The significance of repealing the rule extends far beyond minor tax policy adjustments.

Thanks to the Congressional Review Act (CRA), which Congress used to overturn the rule, the IRS cannot now issue a “substantially similar” regulation without new congressional authorization. This isn’t just a pause—it creates breathing room for developers and entrepreneurs who can now build with greater confidence.

The passage of the resolution signals that the crypto industry has finally achieved something long sought: meaningful political capital in Washington.

Want more good news? This might only be the beginning. Treasury Secretary Scott Bessent recently stated at the White House Digital Assets Summit that the administration plans to “rescind and revise” other related crypto tax rules.

Bipartisan and Industry Support

The most significant aspect of this reversal is its bipartisan nature.

When Republicans joined dozens of Democrats in voting to overturn a rule issued by a Democratic administration, it signaled a shift in the political weight of crypto—and recognition that financial technology innovation deserves space to grow.

This marks a stark departure from the SEC era under Gary Gensler, when Democratic leadership largely backed aggressive enforcement actions against crypto companies.

Even Senate Minority Leader Chuck Schumer broke with party leadership to support the measure—an indication of crypto’s growing electoral importance.

Once-marginalized industry groups are now influential voices.

The Blockchain Association and DeFi Education Fund led aggressive lobbying campaigns, successfully flipping Democratic votes and securing a veto-proof majority. Their success shows that crypto advocacy has rapidly matured—with sophisticated outreach to key lawmakers focused on specific policy issues rather than broad blockchain education.

When the Biden administration released the rule, the Blockchain Association vowed “aggressive action.” They delivered.

Four months after filing a lawsuit, they’re now celebrating the repeal of a rule that threatened to end U.S. crypto innovation.

Crucially, this victory was achieved despite opposition from some influential Democrats who argued the resolution could enable tax evasion.

Democratic Congressman Richard Neal of Massachusetts warned the repeal could cost the government $4 billion in lost tax revenue. That estimate—based on unreported capital gains—will remain a point of contention as crypto advocates push for further regulatory relief.

Global Positioning

The signing of the resolution dramatically shifts America’s position in the global race for crypto dominance.

Just months ago, due to regulatory uncertainty, crypto firms were abandoning the U.S. market.

Coinbase had contingency plans to relocate overseas. Now, Trump’s campaign promise to make America the “crypto capital of the world” appears to be gaining traction.

As global investment in DeFi surges—around $90 billion locked in protocols according to DefiLlama—nations that create friendly regulatory environments stand to gain enormous economic benefits: high-skilled jobs, tax revenue from legitimate operations, and technological leadership.

The resolution also sends a strong signal to regions positioning themselves as crypto-friendly alternatives—such as Hong Kong, the UAE, and Japan.

For global crypto entrepreneurs and investors, Thursday’s signing sent one clear message: The U.S. is open for business.

Striking the Balance

The resolution raises legitimate questions about balancing innovation with tax compliance.

Critics like Democratic Congressman Lloyd Doggett of Texas argue that repealing the rule creates loopholes exploitable by wealthy investors.

These concerns aren’t entirely unfounded.

The decentralized nature of DeFi protocols means transactions occur without traditional intermediaries to record them. While blockchains themselves are transparent, linking wallet addresses to taxpayers remains challenging. Without some reporting mechanism, tax compliance relies heavily on voluntary disclosure.

Some policy experts propose compromise solutions—creating optional compliance frameworks where certain disclosures earn regulatory clarity. A “safe harbor” approach like this would allow DeFi protocols to operate legally while gradually introducing appropriate safeguards.

Our Take

Trump’s signing of this resolution represents a breakthrough in resolving crypto’s core regulatory dilemma—one that has plagued the industry since day one: the collision between industrial-era regulatory frameworks and digitally native financial systems.

This victory shows that Washington has finally acknowledged that forcing decentralized systems into centralized regulatory molds simply doesn’t work. Innovation needs appropriate guardrails—not retrofitted obstacles.

This moment reveals a deeper shift in U.S. regulatory philosophy. For decades, American financial regulation followed a pattern: innovation happens, problems emerge, regulation responds. The DeFi broker rule attempted preemptive regulation before understanding the natural evolution of the technology. Its failure suggests the U.S. is returning to its traditional strength—allowing innovation to flourish while addressing specific issues as they arise.

Celebration should remain grounded. The crypto industry now faces a critical credibility test. Having gained regulatory breathing room, it must now deliver tangible benefits beyond trader profits. Can DeFi significantly improve financial inclusion? Will it reduce everyday transaction costs? Can it create more efficient markets that benefit the broader economy?

The bipartisan nature of this win is both an opportunity and a warning. While crypto has today transcended partisan lines, its continued support depends on demonstrating real-world utility. If the industry fails to move beyond speculation and solve practical problems, today’s allies may become tomorrow’s critics.

To global competitors who believed the U.S. had ceded leadership in digital asset innovation, this reversal is a wake-up call. The United States possesses unmatched capital markets, technical talent, and regulatory flexibility—when aligned, these forces create formidable competitive advantages.

The road ahead remains challenging. SEC oversight of tokens, CFTC jurisdiction over derivatives, bank concerns about stablecoins—these issues remain unresolved. But this resolution proves that well-organized advocacy focused on specific technical issues can succeed—even where broad ideological arguments often fail.

The window for innovation has opened. Now, the industry must work with regulators to build frameworks that protect consumers while enabling genuine innovation. Thursday’s signing suggests, for the first time, that both sides may be ready for such a dialogue.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News