Opinion: Why Should We Be Bullish on the Medium- to Long-Term Outlook for the Crypto Market?

TechFlow Selected TechFlow Selected

Opinion: Why Should We Be Bullish on the Medium- to Long-Term Outlook for the Crypto Market?

The Fed is expected to cut interest rates before June, followed by a bottoming out and rebound in the U.S. stock market and crypto market.

Author: DeFi Cheetah, Crypto KOL

Translation: Felix, PANews

As previously predicted, U.S. equities were due for at least a 20% correction, pulling Bitcoin back toward $50,000. The first target has been achieved: amid a VIX index of around 55, U.S. stocks corrected by 20%, triggered by Trump imposing harsher tariffs on many other countries. Bitcoin, however, only briefly dipped to $74,000—demonstrating greater resilience than historical price patterns would have suggested.

Looking ahead, it is expected that the Federal Reserve will cut interest rates before June, followed by a bottoming out and rebound in both U.S. equities and crypto markets. In fact, Trump has just explicitly called on Fed Chair Powell to lower rates. This article explains in detail why Trump is so fixated on rate cuts—and why the crypto market outlook remains positive.

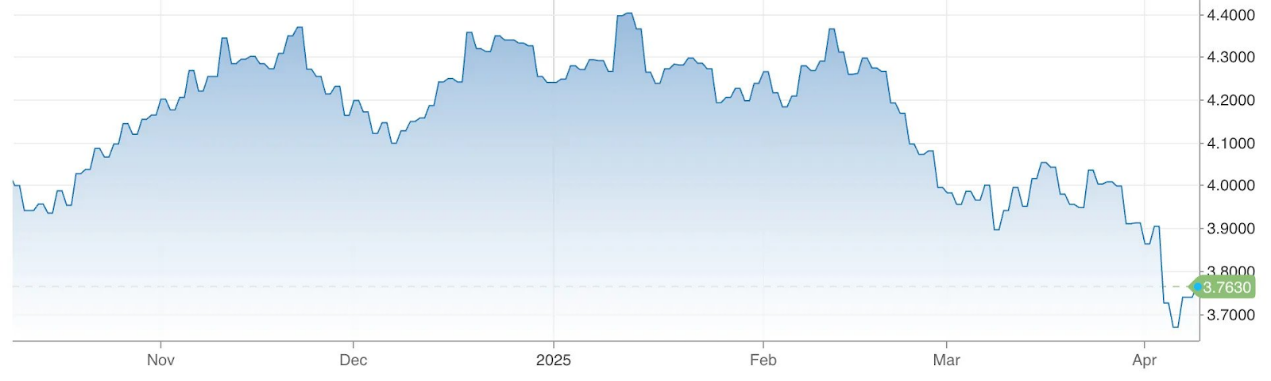

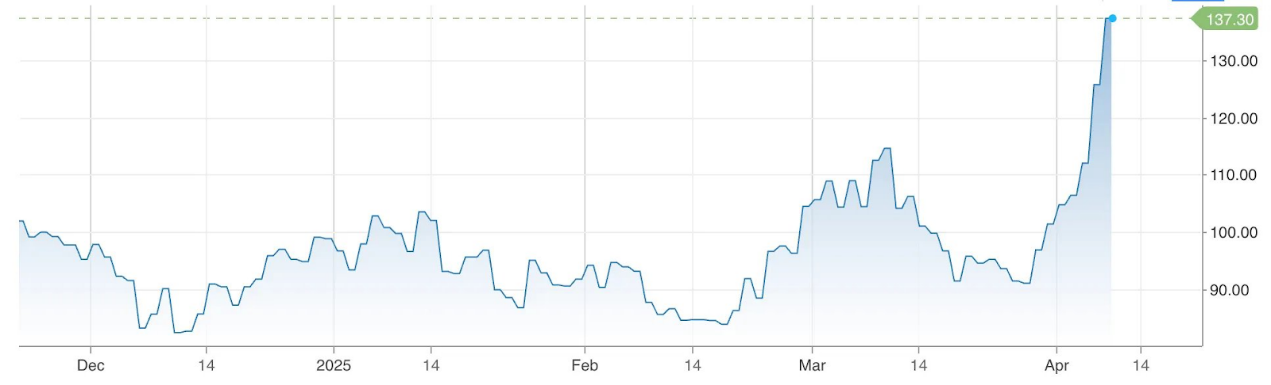

Two Pressing Issues Caused by High Interest Rates

In the coming months, two critical issues are forcing the Fed into significant rate cuts. First, the "$9 trillion maturity wall"—referring to the schedule of maturing Treasuries this year—is compelling the Trump administration to pursue aggressive rate cuts to save trillions in refinancing costs. From the Fed’s perspective, current inflation levels leave little room for rapid easing. Therefore, the best explanation for seemingly irrational and aggressive policies by the Trump administration (such as tariffs and establishing DOGE) is that they form a coordinated mechanism designed to create macroeconomic uncertainty, thereby pressuring the Fed into cutting rates. Otherwise, the U.S. government would face paying at least 3–4 times more in interest after rolling over its debt. In fact, yields on short-term two-year Treasuries have been declining, reflecting market risk aversion and capital flowing into government bonds.

The urgency of rate cuts from the Trump administration's viewpoint can be illustrated by the chart below:

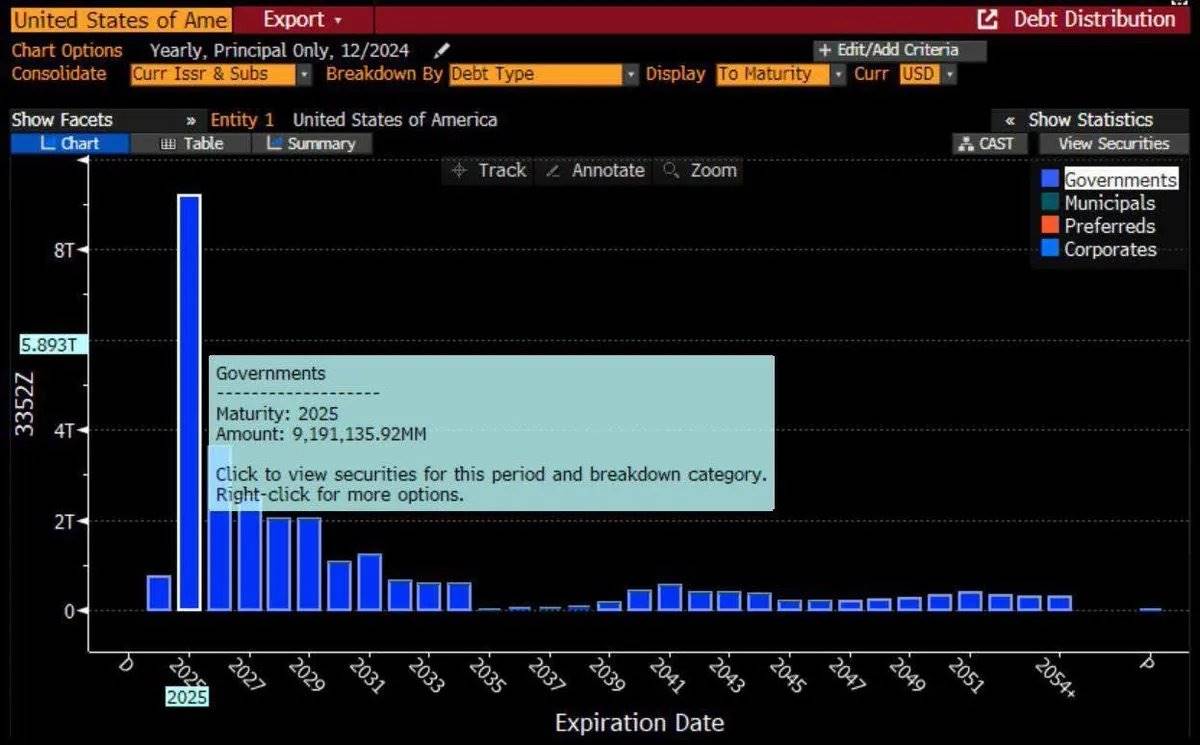

Furthermore, the sharp rise in the Merrill Lynch Option Volatility Estimate (MOVE) Index—a gauge of interest rate volatility in the U.S. Treasury market—adds weight to the likelihood of Fed rate cuts. The MOVE Index serves as a proxy for term premium in U.S. Treasuries (the yield spread between long- and short-term bonds). As the index rises, anyone involved in Treasury or corporate bond financing trades faces higher margin requirements, forcing them to sell. A sustained increase in the MOVE Index, especially above 140, signals extreme market instability and could compel the Fed to cut rates to stabilize the Treasury and corporate bond markets—both vital to the functioning of the financial system. (Note: The last time the MOVE Index surged past 140 was during the collapse of Silicon Valley Bank—the largest bank failure since 2008.)

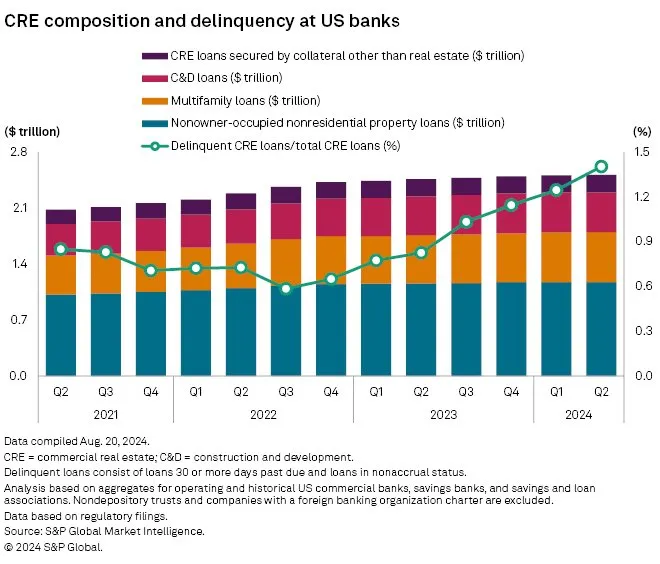

The second reason for significant rate cuts in the coming months also stems from the "maturity wall," but this time referring to over $500 billion in U.S. commercial real estate (CRE) loans maturing this year. Many CRE loans originated during the pandemic at low interest rates and now face refinancing challenges in a persistently high-rate environment, potentially increasing default risks—especially for highly leveraged properties. The growing prevalence of remote work has caused structural shifts, leading to persistently high office vacancy rates post-pandemic. In fact, widespread defaults on CRE loans could trigger another spike in the MOVE Index.

In Q4 2024, CRE loan delinquency rates reached 1.57%, up from 1.17% in Q4 2023. Historical data shows that delinquency rates above 1.5% are concerning, particularly under monetary tightening. Meanwhile, with vacancy rates as high as 20%, rising cap rates (around 7–8%), and a wave of loan maturities, office property values have fallen 31% from their peak, increasing default risks.

The logic here is: high vacancy rates reduce net operating income (NOI), lower debt service coverage ratios (DSCR) and debt yields, while pushing cap rates higher. High interest rates exacerbate this situation—particularly for loans maturing in 2025, where refinancing at significantly higher rates may become unsustainable. If CRE loans cannot be refinanced at reasonable low rates similar to those during the pandemic, banks will inevitably accumulate more bad debt, potentially triggering a "domino effect" and further bank failures (recall the severity of SVB and other bank collapses in 2023 amid rising rates).

Given these two urgent problems caused by current high interest rates, the Trump administration must take aggressive measures to cut rates quickly. Otherwise, these debts will need to be rolled over, exposing the U.S. government to much higher refinancing costs, while many CRE loans may fail to refinance, resulting in massive non-performing loans.

Catalyst for the Next Bull Run—Stablecoins

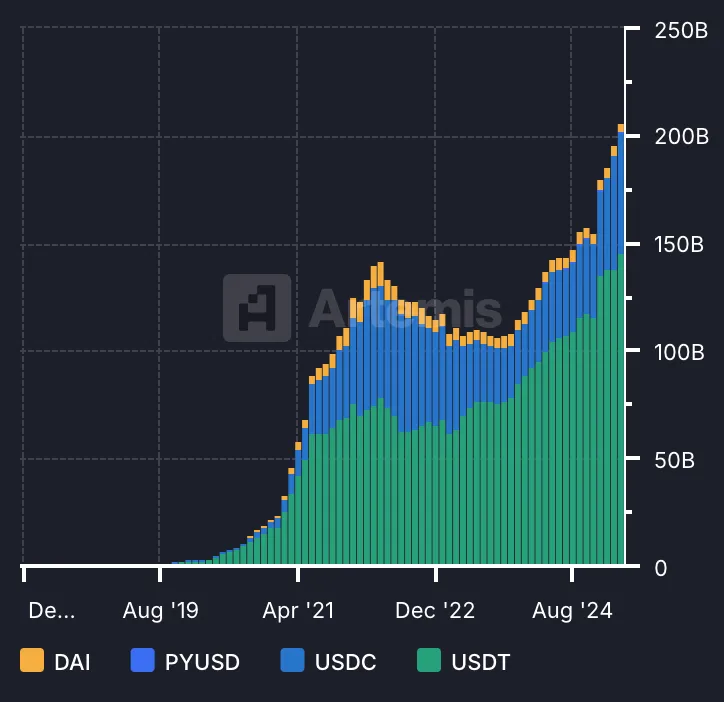

The most significant factor influencing the crypto market is liquidity. And the two biggest drivers of liquidity are (i) monetary policy and (ii) the adoption of stablecoins. Under dovish monetary policy, increased stablecoin adoption can further accelerate capital inflows during a bull market. The upside potential of a bull run depends directly on growth in the total supply of stablecoins. During the previous bull market (2019–2022), stablecoin supply grew tenfold from trough to peak. By contrast, from 2023 to early 2025, supply has increased by only about 100%, as shown in the chart below.

Below are key developments signaling rapid growth in stablecoin adoption over the next 12 months:

-

U.S. Stablecoin Legislation Progress: In Q1 2025, the Senate Banking Committee approved the GENIUS Act in March, outlining regulatory and reserve requirements for stablecoin issuers. The bill aims to integrate stablecoins into the mainstream financial system, reflecting growing recognition of their role in crypto markets. Additionally, the House Financial Services Committee passed a stablecoin framework bill—the STABLE Act—allowing non-bank entities to issue stablecoins if approved by federal regulators. Regulatory clarity has long been seen as the most critical factor influencing stablecoin adoption and, consequently, capital flows into the crypto industry via stablecoins.

-

Accelerated Institutional Adoption: Fidelity began testing a dollar-pegged stablecoin in late March, marking a major step by a traditional finance giant into the crypto space. Meanwhile, Wyoming announced plans to launch a state-backed stablecoin by July, aiming to become the first fiat-collateralized, fully reserved token issued by a U.S. entity.

-

World Liberty Financial Stablecoin: World Liberty Financial, linked to Trump, announced on March 25 its plan to launch USD1, a dollar-pegged stablecoin, after raising $500 million through a separate token sale. This move aligns with the Trump administration’s policy of supporting stablecoins as key infrastructure for crypto transactions.

-

USDC Expansion into Japan: On March 26, Circle partnered with SBI Holdings to launch USDC in Japan, making it the first stablecoin officially authorized under Japan’s regulatory framework. This reflects Japan’s proactive stance on integrating stablecoins into its financial system and may serve as a model for other nations.

-

PayPal and Gemini Advancing Stablecoin Development: Throughout Q1, PayPal and Gemini strengthened their positions in the stablecoin market. Adoption of PayPal’s PYUSD and Gemini’s GUSD increased, with PayPal leveraging its payment network and Gemini focusing on institutional clients. This intensifies competition among U.S. stablecoin issuers.

-

More Use Cases from Payroll Platform Rise: On March 24, payroll platform Rise expanded its services to offer stablecoin payments for international contractors across more than 190 countries. Employers can pay salaries in stablecoins, and employees can withdraw funds in local currencies.

-

Circle’s IPO: Circle has filed for an IPO. If approved, it will become the first stablecoin issuer listed on the New York Stock Exchange. This would formalize the legitimacy of stablecoin businesses in the U.S. and encourage more companies—especially large institutions—to explore the sector, as stablecoin operations increasingly depend on institutional resources, distribution channels, and business development.

Why is the Trump administration so actively promoting stablecoin development? This ties back to the first section: the collateral backing stablecoins in circulation consists largely of short-term U.S. Treasuries. Therefore, as the U.S. government rolls over trillions in maturing debt this year, the broader the adoption of stablecoins, the higher the demand for short-term Treasuries.

The market direction is clear: in the short term, we may experience market turbulence, high volatility, and even further declines from current levels. But in the medium term, a dovish monetary policy featuring significant rate cuts—combined with growing stablecoin adoption—could spark another strong bull run comparable in scale to the last cycle.

We are approaching an ideal window to achieve solid returns through investing in the crypto market.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News