Binance's Most Profitable Stablecoin? A Complete Guide to LDUSDT and Earning "Fees + Yields"

TechFlow Selected TechFlow Selected

Binance's Most Profitable Stablecoin? A Complete Guide to LDUSDT and Earning "Fees + Yields"

LDUSDT is a "yield-bearing collateral asset" designed specifically for futures trading, introduced by Binance. The official notice emphasizes that it is not a stablecoin.

Author: BUBBLE

Yesterday, Binance announced the upcoming launch of a new reward-bearing collateral asset called LDUSDT. This marks another "stablecoin" financial product launched by Binance that can be used as margin for futures trading, following the introduction of BFUSD in November 2024. What exactly is this new product, and how does it differ from BFUSD?

A "Stablecoin" That Isn't a Stablecoin

LDUSDT is a "yield-generating margin asset" specifically designed for futures trading on Binance. The platform has explicitly clarified that LDUSDT is not a stablecoin. Users can convert their USDT holdings in Binance's Flexible Simple Earn products into LDUSDT.

LDUSDT serves two functions: it acts both as tradable margin and generates yield. Binance allows users to use LDUSDT as collateral for perpetual contracts (USDT-margined), while simultaneously enabling holders to earn real-time annualized returns from Binance’s principal-guaranteed "Simple Earn" flexible savings product.

In short, similar to BFUSD, LDUSDT enables users to enjoy both "low-risk returns" and "liquidity." At the same time, Binance also benefits significantly—earning more lending interest and higher funding fees from derivatives trading. Loki, founder of the established crypto community Benmo, pointed out: "If Binance chooses FDUSD to rebuild liquidity for lending and perpetual contracts, the underlying USD could even earn yields from U.S. Treasuries." According to First Digital Labs' reserve report published on February 28, 85% of FDUSD’s underlying USD reserves consist of U.S. Treasury bonds. This creates a triple-win scenario. In essence, LDUSDT is Binance's way of sharing these layered earnings with its users.

How Is It Different From BFUSD?

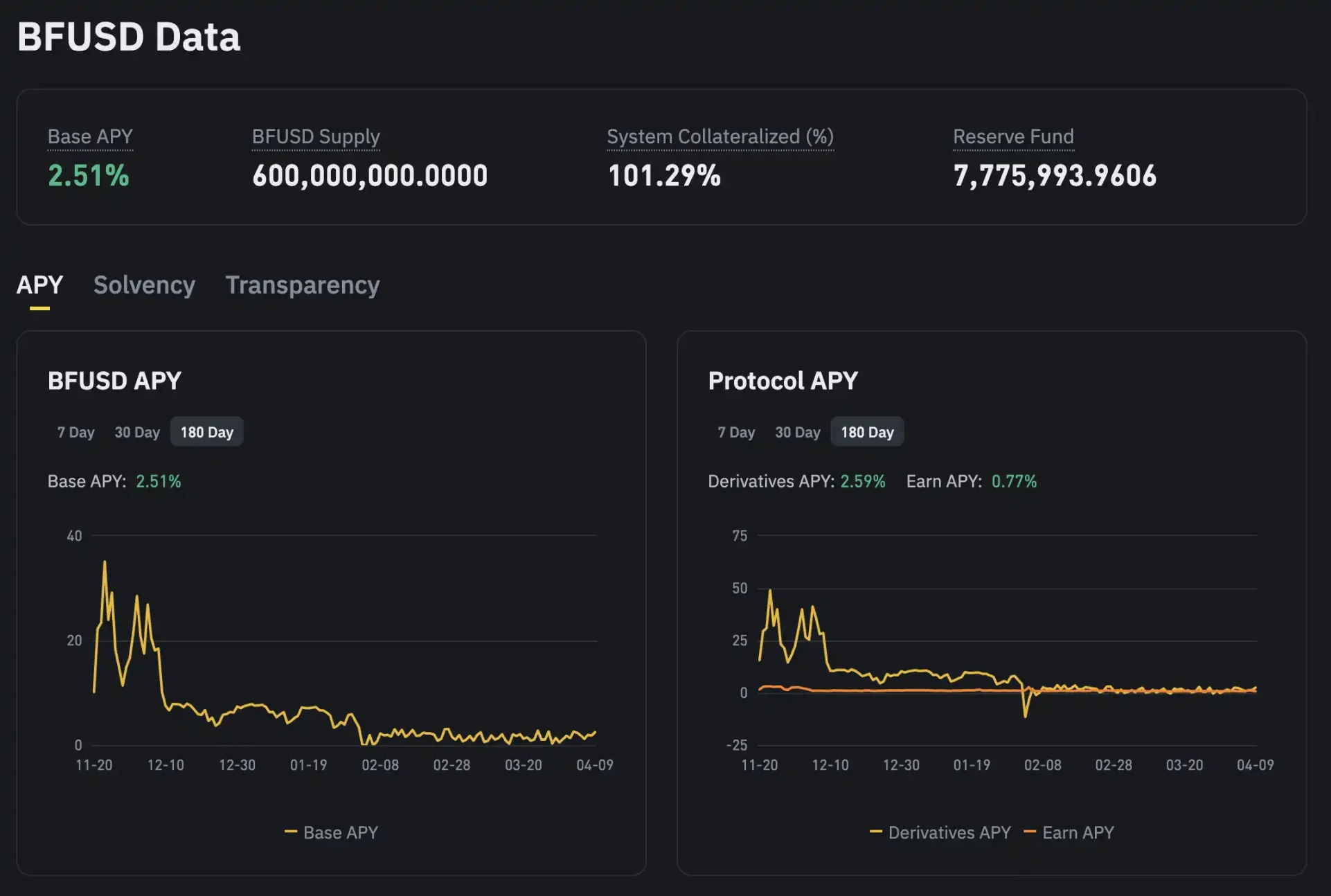

After launching BFUSD on November 27, 2024, other platforms such as Dex Backpack and Huobi introduced similar products, but none have matched the impact of Binance’s BFUSD. While the BFUSD model was innovative and widely seen as beneficial for improving market liquidity, several issues emerged post-launch.

One major issue is high volatility in returns. BFUSD yields comprise a base rate plus a trading performance bonus, with holding limits tied to user VIP levels. This structure heavily depends on market conditions and individual trading activity. At its peak, BFUSD offered an APY exceeding 38%. However, during one-sided market trends or periods of low trading volume, actual returns may fall far below expectations—even approaching the minimum base rate. During late last year, when market liquidity was high, APY remained around 20–30%, but starting in February and March this year, APY frequently dropped close to 0%.

Another issue is unequal returns between retail and professional traders. Extra rewards under BFUSD are linked to futures trading volume, meaning high-frequency traders and large accounts can significantly boost their earnings. Ordinary users with low trading volumes may only receive the base rate, making the product less cost-effective. As a result, BFUSD inherently favors professional traders over average retail investors.

While LDUSDT shares a similar usage pattern with BFUSD, its yield mechanism differs fundamentally. BFUSD's returns are derived from hedging strategies and staking activities, whereas LDUSDT's income comes from Binance sharing profits generated by its principal-guaranteed "Simple Earn" program—including portions of platform fees, lending income, and returns from low-risk investments.

Due to these differences, BFUSD has lost popularity in the current market environment. Unlike BFUSD, whose yield fluctuates dramatically based on funding rates, LDUSDT offers relatively stable returns—at the cost of lower overall yield potential. While such returns may seem insignificant during bull markets, they represent an attractive option in the current period of weak liquidity for users seeking steady returns combined with ready access to funds. Additionally, because LDUSDT doesn’t require active trading strategies, it is simpler to use and thus more accessible to a broader range of retail participants.

Why Is Binance Releasing Yield-Bearing "Stablecoins" One After Another?

In summary, BFUSD functions more like an investment tool—an additional "buff" for active traders during bull markets—where Binance creates extra value through proactive mechanisms. In contrast, LDUSDT serves as a bridge connecting Simple Earn with futures trading, designed to incentivize conservative users to participate in trading during bear markets.

KOL Loki_Zeng commented: "Binance is incredibly aggressive. We anticipated that the separation between yield generation and circulation in stablecoins would eventually become standard—but we never expected Binance itself would lead the revolution." Whether it's BFUSD or LDUSDT, Binance aims to activate vast amounts of idle stablecoins sitting on exchanges, wrapping them in leveraged structures, and keeping them circulating within the Binance ecosystem to fuel ongoing business vitality.

The water trapped within this towel of liquidity is now being squeezed by a much larger hand. Can this help us endure the drought before the next wave of monetary easing? Binance has yet to release detailed information about LDUSDT. TechFlow will continue to monitor developments closely.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News