Ethereum falls below $1,500, what does Vitalik think?

TechFlow Selected TechFlow Selected

Ethereum falls below $1,500, what does Vitalik think?

"I don't watch"

By Leek, Foresight News

On the morning of April 8, Ethereum founder Vitalik Buterin returned to Hong Kong for the first time in a year to attend the Web3 Scholars Summit. As usual, his talk drew a packed audience with continuous applause.

At the same time, market data shows that Ethereum's latest price has reached $1,580, down more than 60% from its all-time high of $4,000, and broke below the $1,500 mark on April 7, plunging over 15% in a single day.

Given this performance, what does Vitalik—the community leader—think about it? The unfortunate truth is that he doesn't care. His focus remains firmly on Ethereum’s technological development.

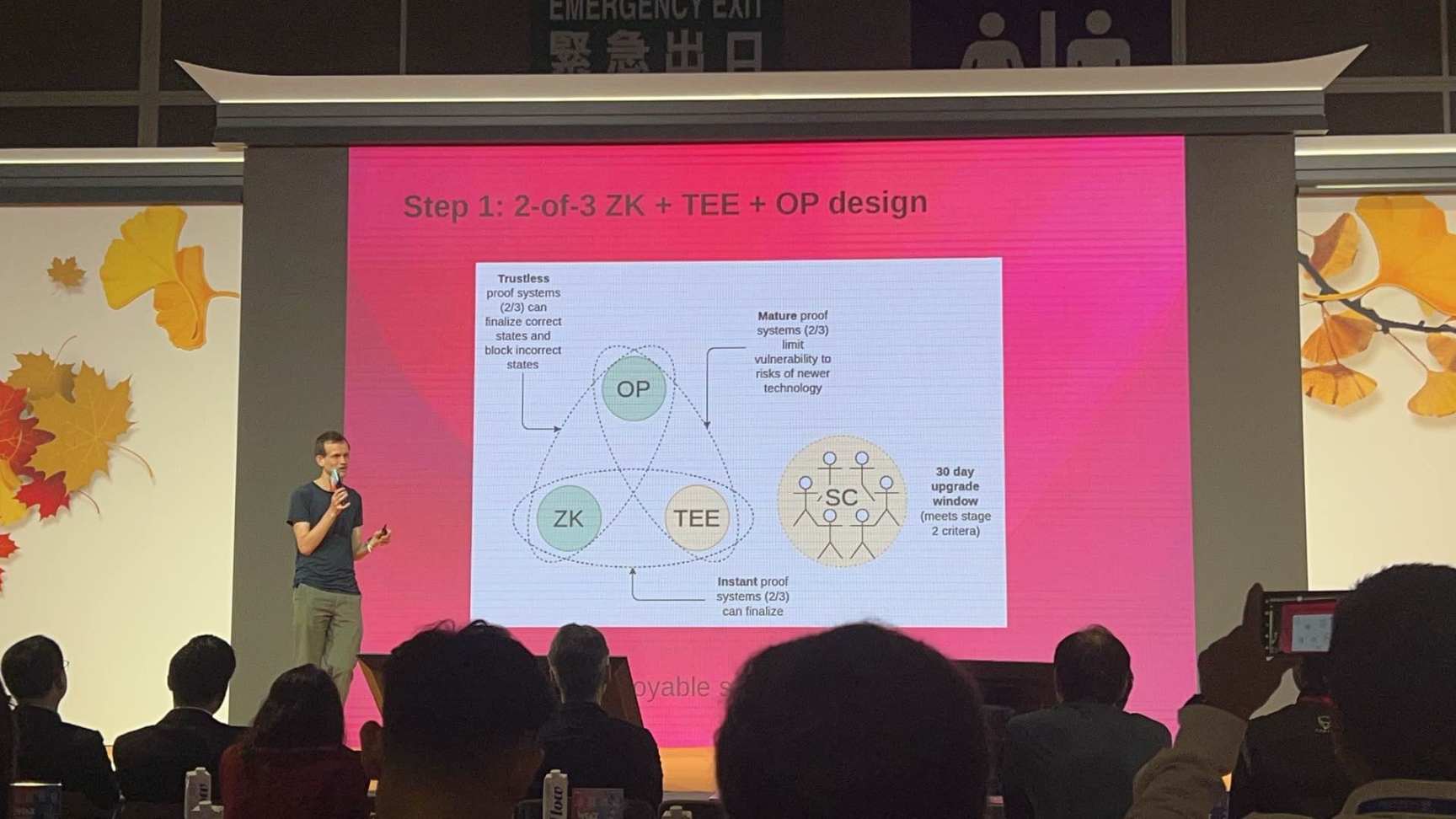

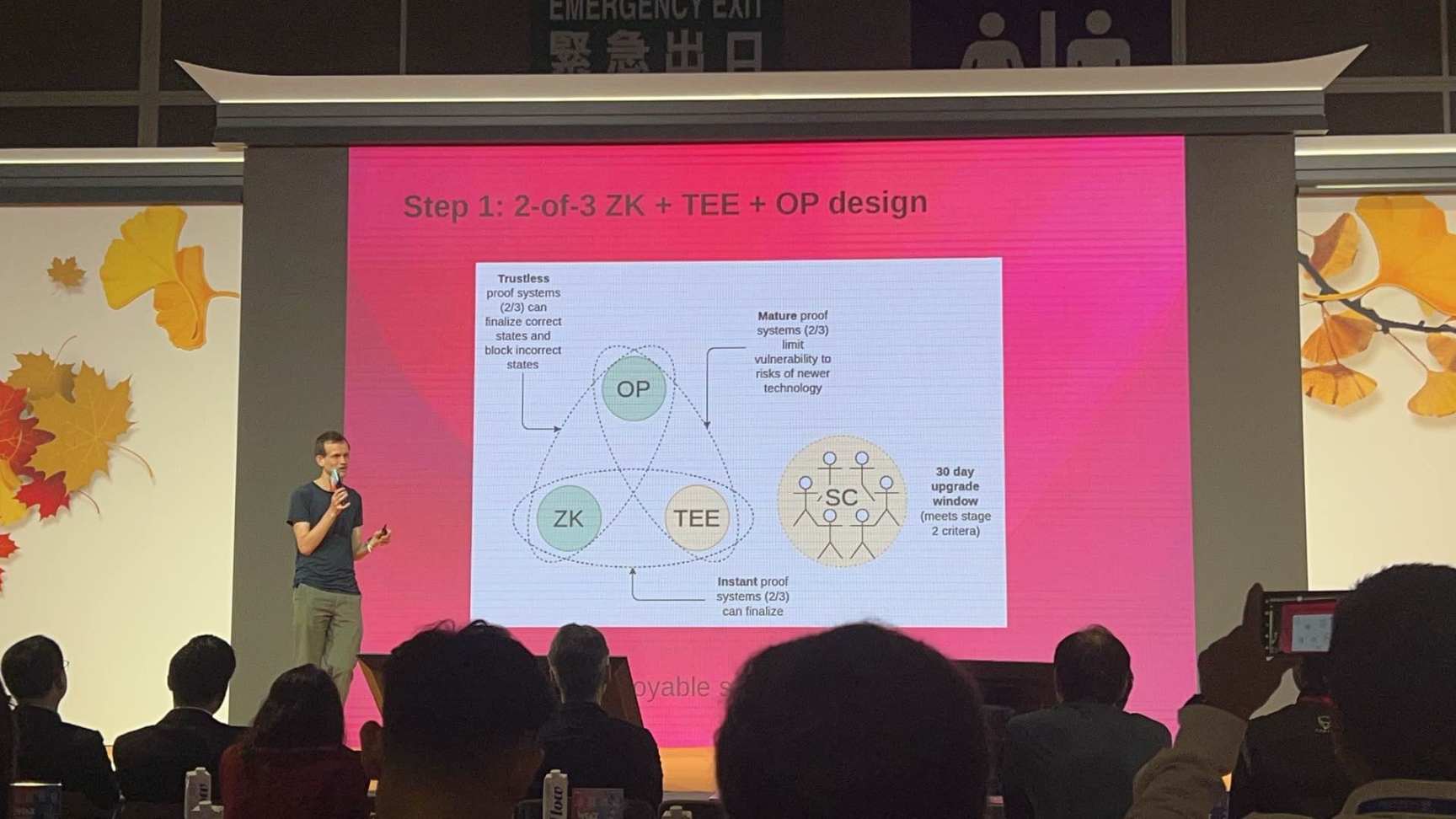

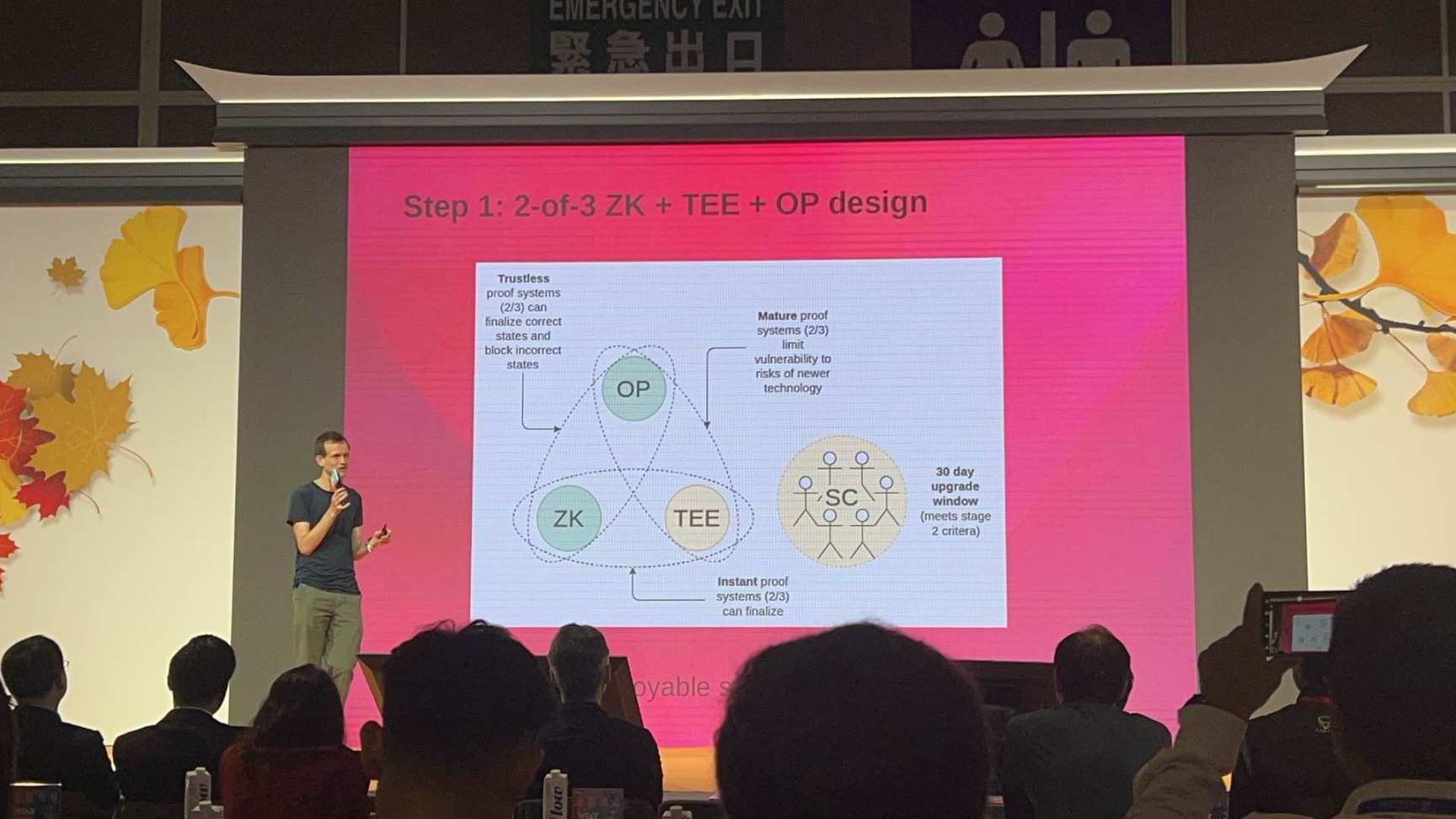

The key points of this speech: Vitalik once again outlined Ethereum’s long-term vision, including achieving native asynchronous communication between Layer 2 (L2) and Layer 1 (L1) within 12 seconds. Users could still use intent-centric models to achieve operations such as sub-12-second latency or better cost efficiency, but liquidity costs would become extremely low. He emphasized significantly strengthening the coupling between L2 and L1, encouraging more applications to deploy components across both layers simultaneously. Vitalik Buterin also stated that accelerating L2 confirmation times and building a more integrated and unified Ethereum system requires several steps: a "two-out-of-three" design combining ZK + TEE + OP, asynchronous L1 load processing, proof aggregation, and reduced proof latency.

Unlike previous cycles where Ethereum dominated the market, this cycle has seen sharply divergent views from different institutions.

In its March 2025 report, Standard Chartered slashed its Ethereum price target from $8,500 to $2,500—a staggering 70% reduction. The report highlighted three major risks: tightening global regulatory policies, stalled growth in the Layer 2 ecosystem, and large-scale withdrawals by institutional investors. It particularly warned of the “regulatory nuclear bomb” posed by the U.S. SEC potentially classifying ETH as a security. Data shows that the top 100 Ethereum addresses hold 39% of all ETH, indicating far lower decentralization compared to Bitcoin (14%), while also facing substitution risks from competing blockchains like Solana and Cardano. Morgan Stanley predicts the ETH/BTC exchange rate will fall to 0.015 by 2027, hitting its lowest level since 2017.

However, Grayscale continues to list ETH as a core asset in its Q1 2025 crypto holdings, citing its irreplaceable technical foundation and ecosystem. Galaxy Digital emphasizes that staking economics (offering ~4% annual yield) and Layer 2 integration (with 70% of on-chain activity now migrated to L2s) will strengthen ETH’s long-term value, forecasting ETH could surpass $5,500 in 2025. Additionally, emerging use cases such as tokenized assets (e.g., 70% of U.S. Treasuries issued on Ethereum) and AI agents (such as Virtual Protocol on Base) may serve as new growth engines.

Vitalik’s proposed “two-out-of-three” technology roadmap—ZK + TEE + OP—aims to deeply couple L2 and L1 through a combination of zero-knowledge proofs, trusted execution environments, and optimistic rollups. If critical upgrades such as asynchronous L1 load handling and proof aggregation are completed by 2025, Ethereum could regain its performance edge. Galaxy Digital forecasts the Pectra upgrade will activate between April and May 2025, improving network efficiency through enhancements to the proof-of-stake mechanism and expanded data availability. Furthermore, collaborations with traditional financial institutions (such as Standard Chartered issuing tokenized bonds on Ethereum) and the real-world deployment of AI agent technologies could inject fresh momentum into Ethereum.

The current market divide over Ethereum fundamentally reflects a bet on its speed of technical iteration and ability to integrate its ecosystem. Under Vitalik’s price-agnostic, technology-first approach, whether Ethereum can transform from a “congested chain” into a “modular network” by 2025 will determine if it can maintain leadership in the Web3 era. Institutional investors must closely monitor progress on technical upgrades, shifts in regulatory policy, and competitive dynamics from emerging blockchains, seeking balance in a market defined by both risk and opportunity.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News