Crypto Market Under Tariff Shocks: Increased Volatility and Investor Flight to Safety

TechFlow Selected TechFlow Selected

Crypto Market Under Tariff Shocks: Increased Volatility and Investor Flight to Safety

The most aggressive round of tariff policies since the 1930s is having profound effects on the macroeconomy and cryptocurrency markets.

Author: Moulik Nagesh, Binance Research

Key Takeaways

In 2025, U.S.-led trade protectionism has made a strong comeback. Since Donald Trump resumed the presidency in January 2025, the United States has triggered global concerns over a trade war by implementing a series of sweeping new tariffs—targeting both specific countries and industries. Just within the past week, the U.S. introduced another round of "reciprocal" tariffs, prompting other nations to announce retaliatory measures.

This report analyzes how these tariffs—the most aggressive since the 1930s—are impacting the macroeconomy and cryptocurrency markets. We will examine tariff levels, macroeconomic trends (including inflation, growth, interest rates, and Federal Reserve outlook), and their effects on crypto asset performance, volatility, and correlations. Finally, we explore key watchpoints ahead and the potential market outlook for digital assets in an environment marked by stagflation and rising protectionism.

Tariff Resurgence in 2025

After several years of relative trade stability, 2025 has seen a sharp reversal. Within days of returning to the White House, President Trump began fulfilling campaign promises by invoking emergency authority to impose broad-based import tariffs—both country-specific and sector-wide.

Tensions escalated further on April 2, when the U.S. announced comprehensive "reciprocal" tariffs, dubbing the day "Liberation Day"—marking the latest turning point in this unfolding global trade war. Trade relationships many countries viewed as normalized with the U.S. have now fundamentally shifted. Key developments over the past week include:

● Base Tariff: The U.S. imposed a new 10% uniform tariff on all imported goods, reversing decades of trade liberalization. This base rate took effect on April 5.

● Targeted Tariffs: On top of the base rate, higher country-specific tariffs were layered. President Trump labeled these as "reciprocal" tariffs aimed at nations that maintain high barriers against U.S. products. Notably, Chinese goods face an additional 34% tariff—adding to the existing 20%, resulting in a total tariff rate of 54%. Other targeted rates include: 20% for EU goods, 24% for Japan, 46% for Vietnam, and 25% for automobile imports. Canada and Mexico, already subject to a 20% tariff since February, were not included in the new list.

● Global Retaliation: U.S. trading partners responded swiftly. By mid-February, several early-targeted nations had announced countermeasures. Canada, after failing to secure a U.S. tariff extension, decided to impose a 25% tariff on all American imports. China also responded early and escalated further on April 4 by announcing a 34% tariff on all U.S. imports.

With the implementation of "reciprocal" tariffs and escalating trade tensions, more countries are expected to roll out retaliatory measures. The European Union has clearly signaled it will respond soon, and multiple other major economies have already prepared counter-strategies. While the full scope of the global reaction remains unclear, all signs indicate that a broad, multi-front trade war is taking shape.

Chart 1: The April 2, 2025 "Liberation Day" tariffs cover up to 60 countries, including many of America’s largest trade partners

Note: This table reflects the "reciprocal" tariffs imposed by the U.S. on its top ten import sources as of April 2.

Source: BBC, X (@WhiteHouse), Binance Research, as of April 3, 2025

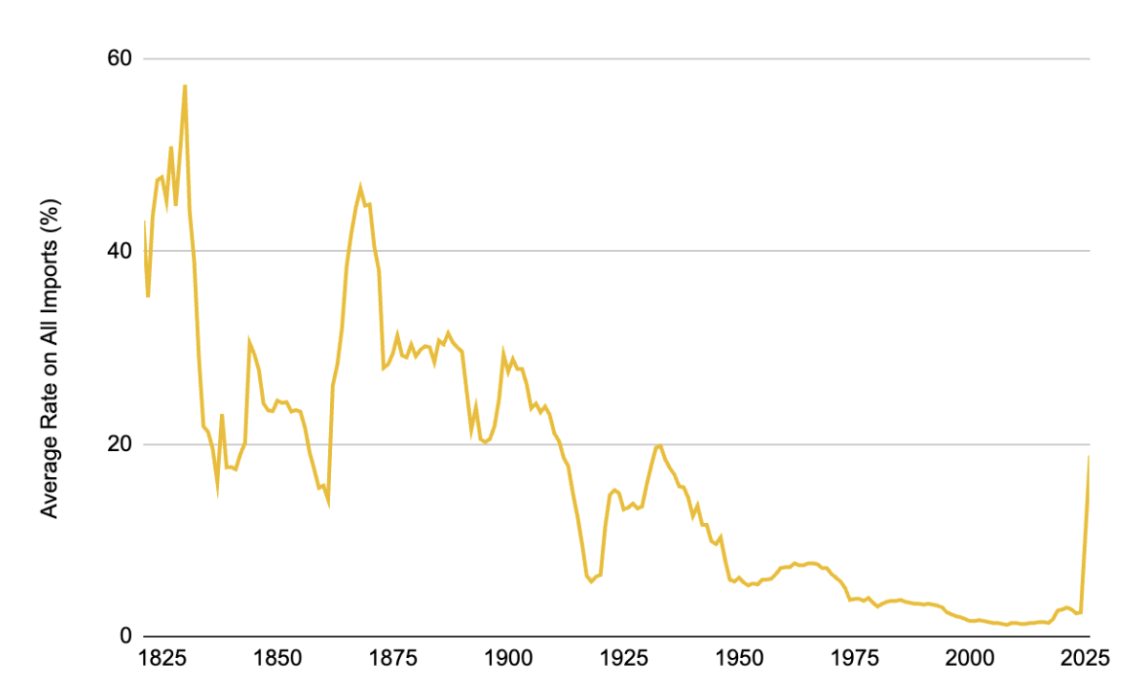

These policies have pushed U.S. import tariffs to their highest level since the Smoot-Hawley Tariff Act of 1930, which levied broad tariffs on thousands of goods during the Great Depression. Based on available data, the average U.S. tariff rate has surged to approximately 18.8%, with some estimates reaching as high as 22%—a dramatic increase from 2.5% in 2024.

For context, over recent decades, the U.S. average tariff rate has typically remained between 1–2%; even during the 2018–2019 U.S.-China trade dispute, it rose only to around 3%. Thus, the 2025 measures represent an unprecedented tariff shock in modern history—almost equivalent to a return to 1930s-style protectionism.

Chart 2: Rising U.S. tariffs have pushed import duties to near-century highs

Source: Tax Foundation, Binance Research, as of April 3, 2025

Market Impact: Cooling Demand, Risk-Off Sentiment, and Soaring Volatility

1. Cooling Demand and Rising Risk Aversion

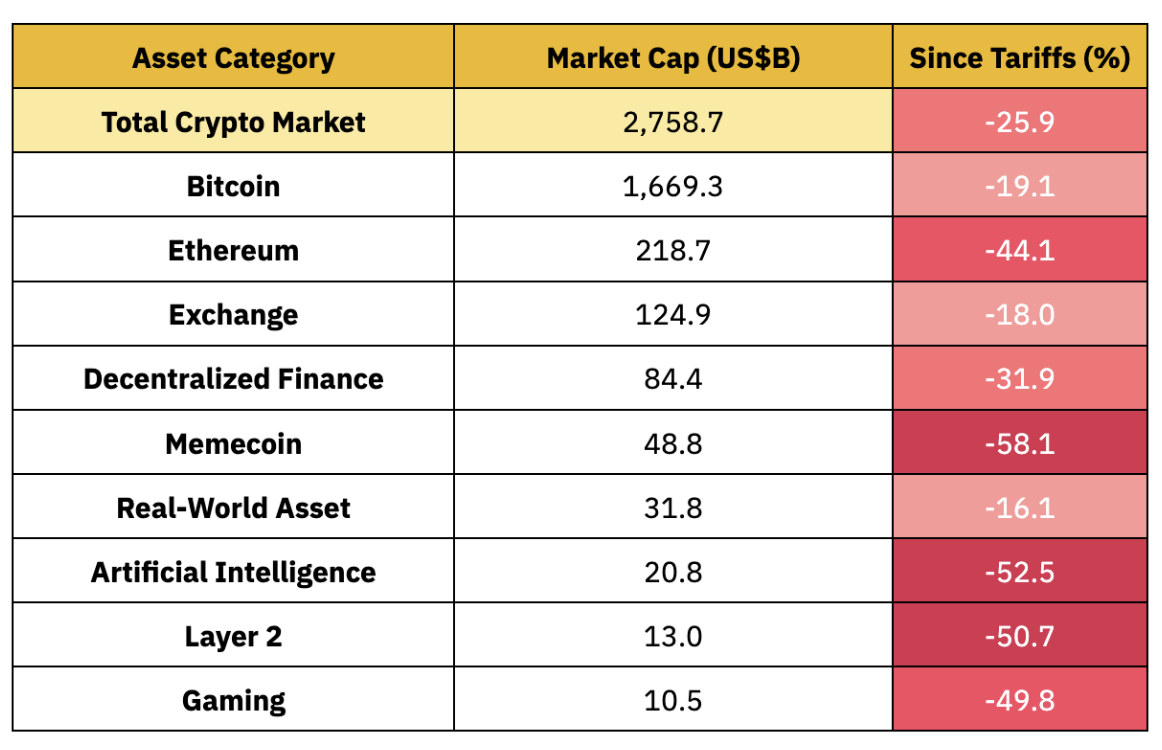

Market sentiment has clearly turned cautious, with investors reacting to tariff announcements with typical "risk-off" behavior. The total cryptocurrency market capitalization has declined by about 25.9% from its January peak, erasing nearly $1 trillion in value—highlighting its high sensitivity to macroeconomic instability.

Crypto assets have moved in lockstep with equities, both facing weakening demand, broad sell-offs, and entering correction territory. In contrast, traditional safe-haven assets such as bonds and gold have performed strongly, with gold hitting consecutive record highs as investors seek refuge amid rising macro uncertainty.

Chart 3: Since initial tariff announcements, the crypto market has fallen 25.9%, the S&P 500 dropped 17.1%, while gold rose 10.3%, setting new all-time highs

Source: Investing.com, CoinGecko, Binance Research, as of April 4, 2025

The sharp market reaction also highlights crypto's behavior during intense risk-off episodes: Bitcoin (BTC) fell 19.1%, while most major altcoins declined by similar or greater magnitudes. Ethereum (ETH) dropped over 40%, and high-beta segments (such as meme coins and AI-related tokens) plunged more than 50%. This sell-off erased most of the crypto market’s year-to-date gains; by early April, even BTC’s YTD returns had turned negative—despite its strong performance in 2024.

Chart 4: During tariff-driven macro panic, altcoins declined significantly more than Bitcoin, amplifying market pessimism

Source: CoinGecko, Binance Research, as of April 4, 2025

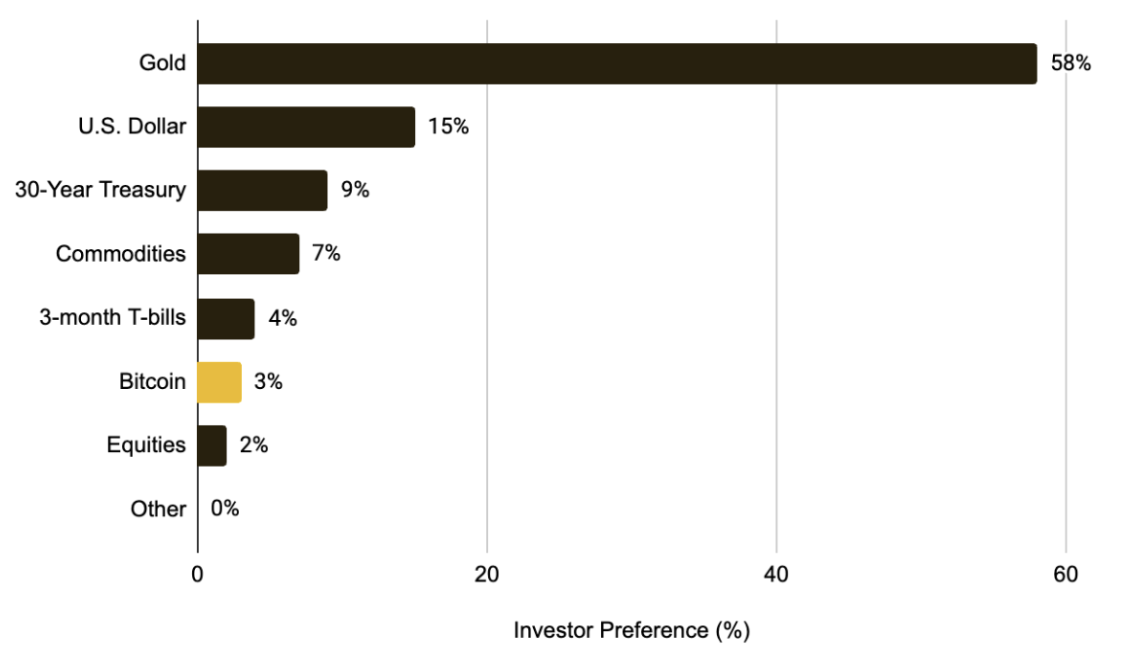

As crypto increasingly exhibits characteristics of a risk asset, prolonged trade wars could continue to suppress capital inflows and dampen digital asset demand in the near term. Capital may remain on the sidelines or shift toward safer assets like gold. This sentiment is reflected in recent fund manager surveys: only 3% of respondents said they would allocate to Bitcoin under current conditions, compared to 58% who prefer gold.

Chart 5: Only 3% of global fund managers view Bitcoin as a preferred asset class amid the trade war

Source: BofA Global Fund Manager Survey, Binance Research, as of February 2025

2. Surging Volatility

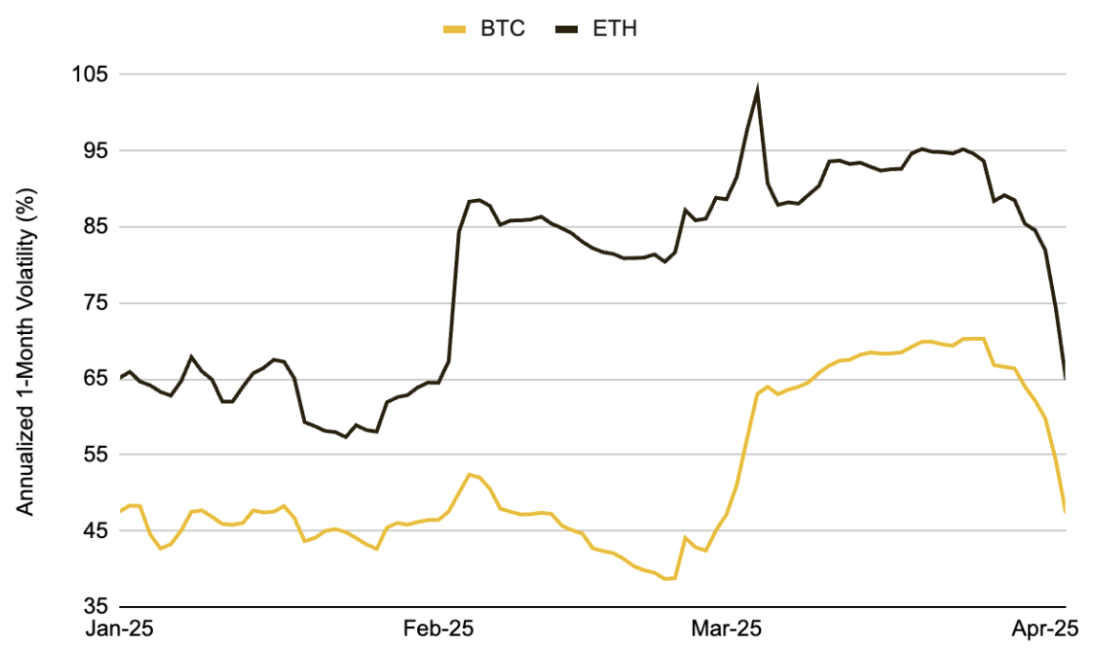

The market’s sensitivity to tariff policy is evident—each major announcement triggers sharp price swings. Over recent months, BTC has experienced multiple large price dislocations, including one of its biggest daily drops since the March 2020 pandemic crash. At the end of February 2025, when Trump abruptly announced plans to impose tariffs on Canada and the EU, BTC fell roughly 15% in the following days, accompanied by a significant spike in realized volatility. ETH followed a similar pattern, with its one-month volatility surging from around 50% to over 100%.

These dynamics underscore crypto’s extreme sensitivity to policy surprises amid high macro uncertainty. In the coming period, if policy direction remains unclear or the trade war intensifies, markets are likely to stay highly volatile. Historical precedent suggests volatility will only subside once markets fully absorb and price in the new tariff regime.

Chart 6: BTC's one-month realized volatility rose above 70%, ETH exceeded 100%, reflecting extreme market turbulence post-tariff announcements

Source: Glassnode, Binance Research, as of April 4, 2025

Macroeconomic Impact: Inflation, Stagflation Fears, Interest Rates, and Fed Outlook

1. Inflation and Stagflation Concerns

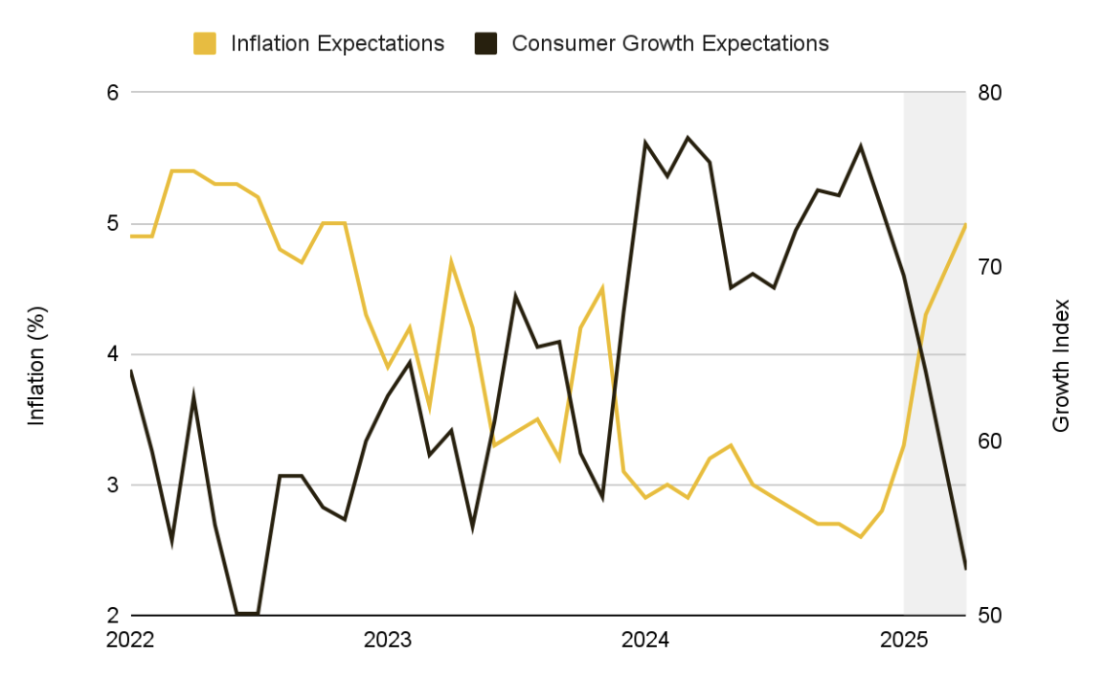

The new tariffs effectively impose substantial additional taxes on imported goods—exacerbating inflationary pressures just as the Federal Reserve attempts to bring down price growth. There is growing concern that these measures could derail the disinflation process. Market indicators such as one-year inflation swaps have spiked above 3%, while consumer surveys show expectations nearing 5%, indicating widespread anticipation of continued price increases over the next 12 months.

Meanwhile, economists warn that if the trade war escalates fully and triggers global retaliation, global output losses could reach $1.4 trillion. Real GDP per capita in the U.S. is projected to decline by nearly 1% initially. Fitch Ratings noted that if the full tariff regime persists, most economies could enter recession, stating, “U.S. tariff levels are so high today that they render most economic forecasting models ineffective.”

Amid rising inflation expectations and slowing growth, the risk of stagflation—a combination of stagnant growth and rising prices—is becoming increasingly pronounced.

Chart 7: Shifting macro conditions in 2025 push 1-year inflation expectations higher while growth outlook weakens

Source: University of Michigan, Binance Research, as of April 5, 2025

2. Rate Outlook and Fed Stance

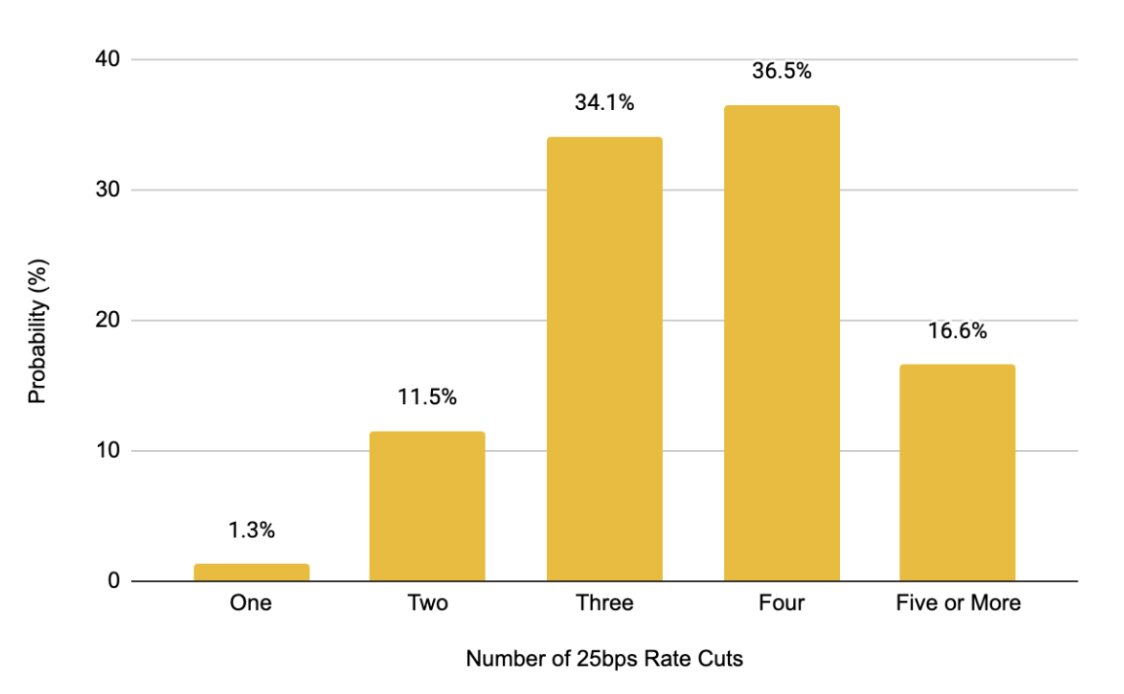

Futures on the Federal Funds rate indicate a sharp rise in market expectations for rate cuts over the coming months. This marks a clear shift in sentiment—just weeks ago, the Fed was firmly committed to fighting inflation, but now, amid growing concerns over economic growth, markets anticipate a pivot toward monetary easing to support the economy.

Chart 8: Market expectations for rate cuts in 2025 continue to climb, currently pricing in four 25-basis-point cuts—far exceeding earlier expectations of just one

Source: CME Group, Binance Research, as of April 4, 2025

This shift is echoed in public comments from Fed officials, who have expressed concern, emphasizing that the new tariffs contradict previous economic policy frameworks. Now, the Fed faces a difficult dilemma: tolerate the additional inflation caused by tariffs, or maintain a hawkish stance and risk further damaging growth?

“The scale of tariffs announced in recent weeks has exceeded expectations, and their impact on inflation and growth—especially cumulative effects—needs close monitoring.”

— Jerome Powell, April 4, 2025

In the short term, the Fed appears committed to anchoring long-term inflation expectations. However, policy decisions will remain data-dependent, guided by whether inflation or growth signals appear weaker. If inflation runs well above target, a stagflationary environment could constrain the Fed’s ability to respond. This uncertain policy outlook further fuels market volatility.

Outlook

1. Correlations and Portfolio Diversification

The evolving relationship between crypto assets and traditional markets is drawing increasing attention—and Bitcoin, as the dominant crypto asset, offers the clearest lens into this dynamic. This trade-war-driven risk-off episode has significantly altered BTC’s correlation structure with equities and traditional safe-havens.

Following the first tariff mention on January 23, initial market reactions were mixed—Bitcoin decoupled slightly from stocks, driving their 30-day correlation down to –0.32 by February 20. But as trade rhetoric intensified and risk aversion spread, the correlation climbed to 0.47 by March, showing stronger alignment between BTC and broader risk assets in the short term.

In contrast, Bitcoin’s correlation with traditional safe-havens like gold weakened notably—shifting from neutral-to-positive to a negative –0.22 by early April.

These shifts reveal that macro factors—especially trade policy and rate expectations—are increasingly dominating crypto market behavior, temporarily overshadowing supply-demand-driven market structures. Monitoring whether this correlation pattern persists will be key to understanding Bitcoin’s long-term positioning and diversification value.

Chart 9: Initial divergence gave way to stronger BTC–S&P 500 linkage as trade tensions rose, while BTC–gold correlation weakened steadily

Source: Investing.com, Binance Research, as of April 5, 2025

2. Reclaiming the Safe-Haven Narrative

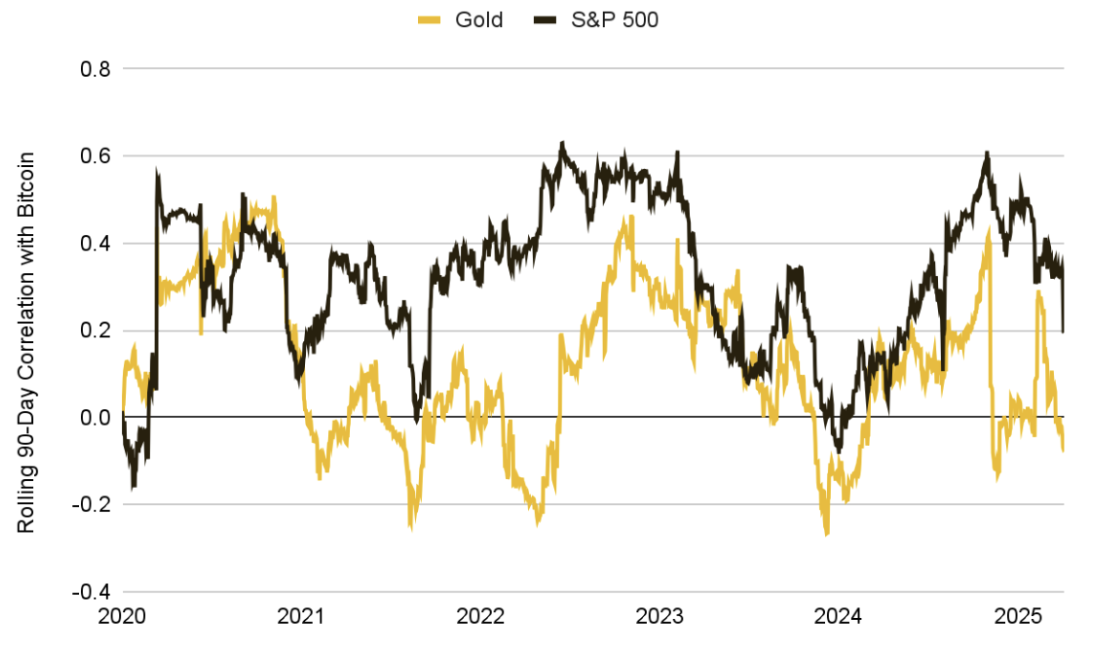

Although recent macro and liquidity shocks have highlighted crypto’s “risk asset” traits, long-term trends remain intact: Bitcoin’s correlation with traditional markets tends to rise during periods of extreme stress but gradually declines as markets stabilize. Since 2020, BTC’s 90-day average correlation with equities has been around 0.32, and with gold just 0.12—indicating persistent differentiation from traditional asset classes.

Even amid the recent tariff shock, BTC showed resilience on certain trading days when traditional risk assets weakened. Additionally, supply held by long-term holders continues to rise—suggesting core holders are not materially reducing exposure, but rather maintaining strong conviction through volatility.

This behavior implies that despite heightened short-term price swings, Bitcoin may yet reestablish a more independent macro identity.

Chart 10: Since 2020, Bitcoin has maintained moderate long-term correlations with traditional assets: 0.32 with the S&P 500, 0.12 with gold

Source: Investing.com, Binance Research, as of April 5, 2025

The key question is whether BTC can revert to its historically low correlation with equities. A similar pattern emerged during the banking turmoil of March 2023, when BTC decoupled from falling equities and strengthened.

Now, as tariff conflicts escalate and global markets adapt to a reality of prolonged trade fragmentation, whether Bitcoin can again be seen as a “non-sovereign, permissionless” safe-haven asset will define its future macro role. Market participants will closely watch whether BTC can preserve this unique value proposition.

A potential path involves reclaiming appeal during currency inflation and fiat devaluation—especially if the Fed turns dovish. Should the Fed begin cutting rates while inflation remains elevated, Bitcoin may regain favor as a form of “hard asset” or inflation hedge.

Ultimately, this process will determine BTC’s long-term positioning as an asset class—and its utility in portfolio diversification. The same applies to other major altcoins, which exhibit stronger risk characteristics in the current environment and may continue to follow BTC-led market sentiment.

3. Crypto Markets in a World of Stagflation and Protectionism

Looking ahead, crypto markets face a complex macro backdrop dominated by trade policy risks, stagflationary pressures, and fractured global coordination. If global growth remains weak and crypto fails to develop a clear narrative, investor sentiment could deteriorate further.

Prolonged trade wars will test the industry’s resilience—potentially drying up retail flows, slowing institutional adoption, and reducing venture capital funding. Key macro variables to monitor in the coming months include:

● Trade Developments: Any new tariff lists, unexpected de-escalations, or major bilateral shifts (e.g., U.S.-China negotiations or further escalation) will directly impact market sentiment and inflation expectations.

● Core Inflation Data: Upcoming CPI and PCE reports are critical. An unexpected rise driven by higher import costs would amplify stagflation fears; weaker data could ease central bank pressure and boost risk assets—including crypto.

● Global Growth Indicators: Declining consumer confidence, slowing business activity (PMI), labor market softness (rising jobless claims, slower nonfarm payrolls), corporate earnings warnings, and yield curve inversion (a common recession signal) may fuel risk aversion in the near term. However, if weak macro data accelerates expectations of monetary easing, it could provide support for crypto markets.

● Central Bank Policy Paths: How the Fed and other major central banks balance inflation and recession risks will determine liquidity across asset classes. If they resist rate cuts despite slowing growth, risk assets will remain under pressure; a dovish pivot could spark a broad rebound. Lower real interest rates—whether due to policy or persistent inflation—could benefit long-duration assets like Bitcoin. Divergent central bank stances (e.g., Fed dovish vs. ECB hawkish) might also trigger cross-border capital flows, further amplifying crypto volatility.

● Internal Crypto Policy Events: ETF approvals, strategic BTC reserves, or key legislative advances could serve as independent catalysts in the current macro climate, potentially breaking crypto’s “macro dependency” and highlighting its distinctiveness. Conversely, regulatory delays or adverse legal developments pose downside risks that could create negative feedback loops.

Conclusion

The most aggressive tariff regime since the 1930s is having profound impacts on both the macroeconomy and cryptocurrency markets. In the near term, crypto markets are likely to remain highly volatile, with investor sentiment swaying on every trade war headline.

If inflation remains elevated while growth slows, the Fed’s response will become the pivotal factor: a dovish shift could spark a crypto rebound on renewed liquidity; continued hawkishness would prolong pressure on risk assets.

Should macro conditions stabilize, new narratives emerge, or Bitcoin reclaim its status as a long-term safe haven, the market may recover. Until then, expect continued choppy trading and high sensitivity to macro news. Investors should closely track global developments, maintain diversified portfolios, and seek opportunities amid potential market mispricings caused by the trade conflict.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News