Sun Yuchen: The Night Watchman of the Crypto World

TechFlow Selected TechFlow Selected

Sun Yuchen: The Night Watchman of the Crypto World

Turn these pages, and you'll see the figure of a night watchman—choosing to light a lamp when the industry was at its coldest.

On April 2, 2025, Sun Yuchen once again made headlines in the crypto world.

According to CoinDesk, Sun provided critical financial support when stablecoin TrueUSD (TUSD) faced a reserve shortfall of nearly $456 million, averting a potential "meltdown" — the risk of losing its 1:1 peg to the U.S. dollar.

In his signature flamboyant and dramatic style, the Tron founder told Hong Kong’s Sing Tao Daily: "Godzilla destroyed the city; I am Ultraman, striking Godzilla down with one palm. So I'm the hero who came to save everyone."

During this crisis, Sun not only confronted FDT's financial fraud head-on but also pointed directly at regulatory loopholes, calling on Hong Kong’s financial regulators and law enforcement agencies to intervene and rebuild trust frameworks and oversight mechanisms for licensed companies. His stance was not just self-defense—it was advocacy for the entire crypto industry. "These are public funds. To protect public interests and uphold Hong Kong’s reputation as an international financial center, I decided to provide liquidity support. While shocked by the scale of the fraud, I feel an immense sense of responsibility. The perpetrators must be severely punished by law."

The world of cryptocurrency resembles an endless adventure—stellar gains during bull runs, devastation during crashes. Yet amid chaos, some still light the way. Sun Yuchen is one such "night watchman," embodying both idealism and ambition through action in the intersection between dreams and reality.

Ethereum Faith Battle: Two Last Stands

Sun Yuchen’s relationship with Ethereum has been a tug-of-war of faith.

On May 19, 2021, the crypto market plunged—Bitcoin dropped below $31,000, Ethereum under $2,000. Sun’s 606,000 ETH collateralized on Liquity Protocol hung by a thread, mere minutes from liquidation. He poured in $300 million to repay debt, blocking the liquidation axe, then boldly invested another $280 million to buy 54,000 ETH and 4,145 BTC.

He wrote on Weibo: "Funds are safe, but there was a moment when bullets whizzed past my scalp—I broke into cold sweat. Never thought the price spike would hit so hard."

At that moment, he claimed to have "successfully saved the crypto market"—a mix of post-crisis relief and heroic bravado. But it wasn’t just a trade; it was a defense of belief—protecting his position while preserving a flicker of hope for the broader community.

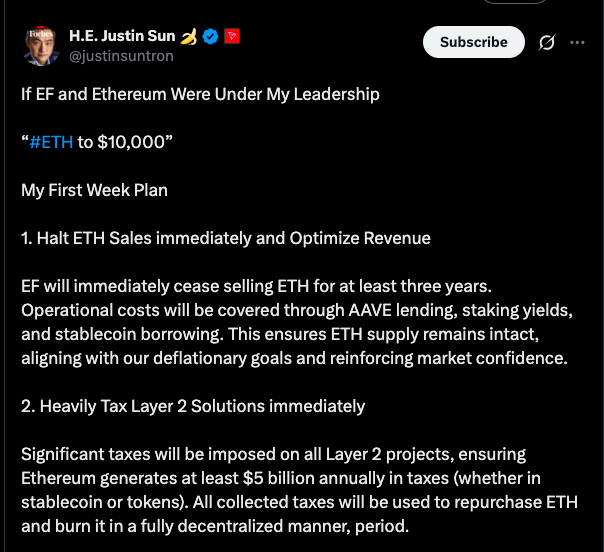

In 2024, amid weak Ethereum performance, Sun found himself back in the spotlight due to his massive ETH holdings. Rumors swirled—losses, shorting, dumping. Instead, he repositioned as an ecosystem builder, making a bold claim: if he led the Ethereum Foundation, he could drive price growth.

His "market rescue" plan included halting ETH sales, optimizing Layer 2 tax revenue for buybacks and burns, streamlining foundation operations, adjusting node rewards to strengthen deflationary mechanics, and increasing R&D investment in Layer 1—not empty boasts, but another forging of his conviction.

Taking Over Huobi: From “Hot Potato” to “Golden Goose”

Even after two years, people still joke that “Brother Sun got burned taking over Huobi.”

In October 2022, Sun became global advisor of Huobi HTX. At the time, FTX had just collapsed, centralized exchanges were on edge, and Huobi—the former industry leader—was fading under regulatory pressure and market shifts: morale low, users fleeing, capital draining.

The crypto community dismissed it—a hot potato passed to Sun. But what seemed toxic turned golden. Today, Huobi’s trading volume and user activity are steadily recovering, regaining former glory. Its global competitiveness strengthens—euro stablecoin trading ranks among the top three worldwide, CIS market share firmly third—and it was named one of the “World’s Most Trustworthy Crypto Exchanges 2025” by Forbes, earning industry recognition and respect.

Sun didn’t just keep Huobi alive—he reinvented it. That kind of ambition and execution isn’t common.

FTX Storm: A Glimmer in the Dark

FTX’s collapse was another test of Sun Yuchen’s role as guardian of the crypto space.

In early November 2022, FTX imploded. CoinDesk exposed financial troubles at affiliated firm Alameda Research and alleged misuse of customer funds. Within 72 hours, FTX faced ~$6 billion in withdrawal requests. Users rushed to exit, markets crashed—Bitcoin fell below $16,000.

Sun stepped up. On November 10, he publicly offered to collaborate with FTX on solutions, pledging 1:1 rigid redemption support for Tron-based tokens (TRX, BTT, JST, SUN) and Huobi Token (HT). The next day, FTX restored trading and withdrawals for these assets.

In an interview with Bloomberg, Sun revealed he was ready to offer FTX “billions of dollars” in aid—contingent on thorough due diligence.

In the end, FTX filed for bankruptcy due to insurmountable issues. But Sun’s intervention bought crucial time for Tron and Huobi users.

Curve Crisis: $28.8 Million to Stabilize DeFi

Sun didn’t stop at rescuing centralized platforms—he ventured into DeFi’s turbulent waters. The Curve crisis stands as another testament to his interventions.

In 2023, Curve Finance suffered a hack, CRV token plummeted, and founder Michael Egorov’s $100 million loan teetered on liquidation. Panic loomed over DeFi. At the critical moment, Sun teamed up with Du Jun, DCFGod, and Andrew Kang, buying 72 million CRV at $0.40 apiece—injecting $28.8 million to stabilize Egorov’s position. Even JPMorgan praised: “This collaboration prevented crisis spillover.”

Better yet, Sun launched a stUSDT pool on Tron—saving Curve while boosting Tron’s TVL against the market tide.

Some accused him of self-interest, but stepping up at all takes courage. The crypto world has no shortage of smart players—but few willing to bet their own capital for the greater good.

The Night Watchman’s “Lone Courage”: Unyielding Belief Amid Controversy

Sun Yuchen’s story is never black-and-white. He carries controversy—accused of being too flashy, too profit-driven, with every rescue seemingly advancing his own ventures. But look closer, and you’ll see the silhouette of a night watchman—lighting a lamp in the industry’s coldest hours.

After Huobi changed hands, he became global advisor, weathering hacker attacks and capital outflows, pushing through the HT-to-HTX token transition and revitalizing the ecosystem. Despite unrealized losses on ETH, he held firm, doubled down, and partnered with Trump family-backed World Liberty Financial (WLFI), integrating TRX into reserve assets. This resilience convinces markets he always finds his footing amid chaos.

He once said: “I’m not here to make quick money. I want to build something for the future.” Sounds like youthful dream talk—laced with audacity and obsession. Yet who can deny that in those darkest moments, he acted to preserve hope for the entire ecosystem?

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News