Sonic After a Complete Overhaul: How Is It Doing Now?

TechFlow Selected TechFlow Selected

Sonic After a Complete Overhaul: How Is It Doing Now?

Unlike other projects that solely pursue short-term explosions, Sonic has chosen a path of "slow and meticulous craftsmanship."

Author: TechFlow

At a time of market silence, the once-thriving "hundred chains in full bloom" scene has gradually quieted down. Users are no longer swayed solely by narratives but have begun deeply evaluating the intrinsic value of projects.

On a macro level, market attention is increasingly fragmented. Users no longer blindly chase hot trends, making it difficult for any single ecosystem to capture the majority through FOMO. Instead, everyone plays their own game, with no one stepping in to take over from another. Yet on a micro level, once users recognize an ecosystem's value, they engage deeply—seeking certainty through building and exploration.

When discussing ecosystems that truly captivate user interest and immersion, one cannot overlook the currently red-hot Sonic.

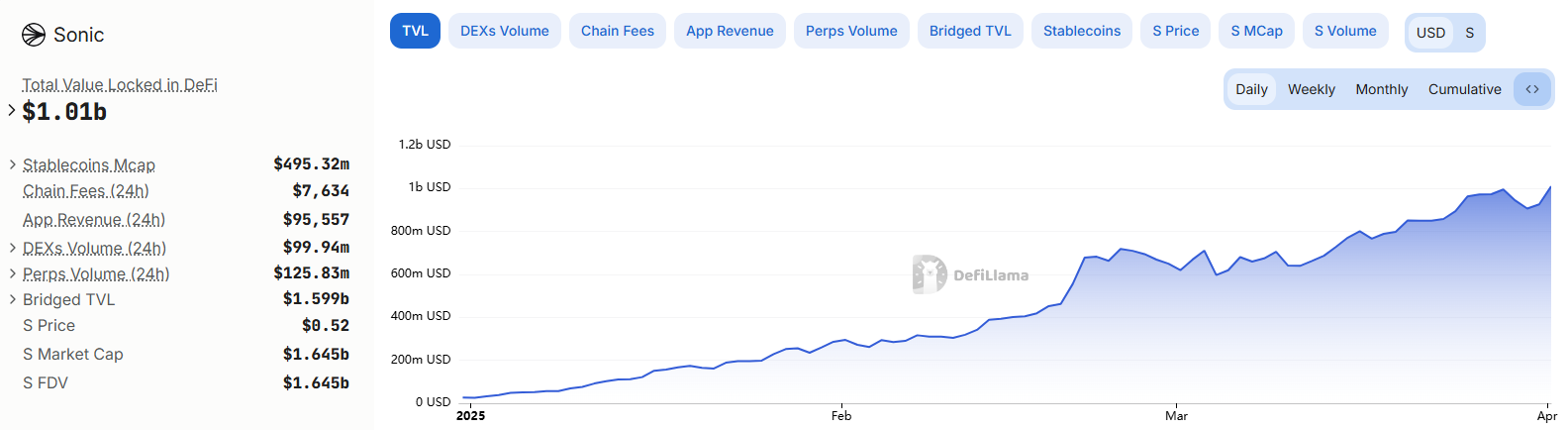

Since its launch four months ago, Sonic has consistently drawn market attention. Andre Cronje (AC) has been highly active, engaging closely with the community and regularly updating on technical progress. Meanwhile, high-yield DeFi projects and gamified point incentives continue attracting new users, driving the ecosystem’s TVL to rapidly grow to $1 billion.

Data source: DefiLlama

The growth curve illustrates a journey from slow initial traction to sustained attraction of quality projects and a solid user base—a complete evolutionary process. What exactly makes this ecosystem so appealing that players feel confident settling in?

Sonic: Powered by Iconic Figures and Hard-Core Fundamentals

When people hear "Sonic," many immediately think: "Isn’t this just Andre Cronje rebranding Fantom as a ‘shell relaunch’?" To outsiders, Sonic may seem like a mere replication of Fantom’s success formula. But a closer look reveals that Sonic’s upgrade goes far beyond a name change.

Iconic Leadership

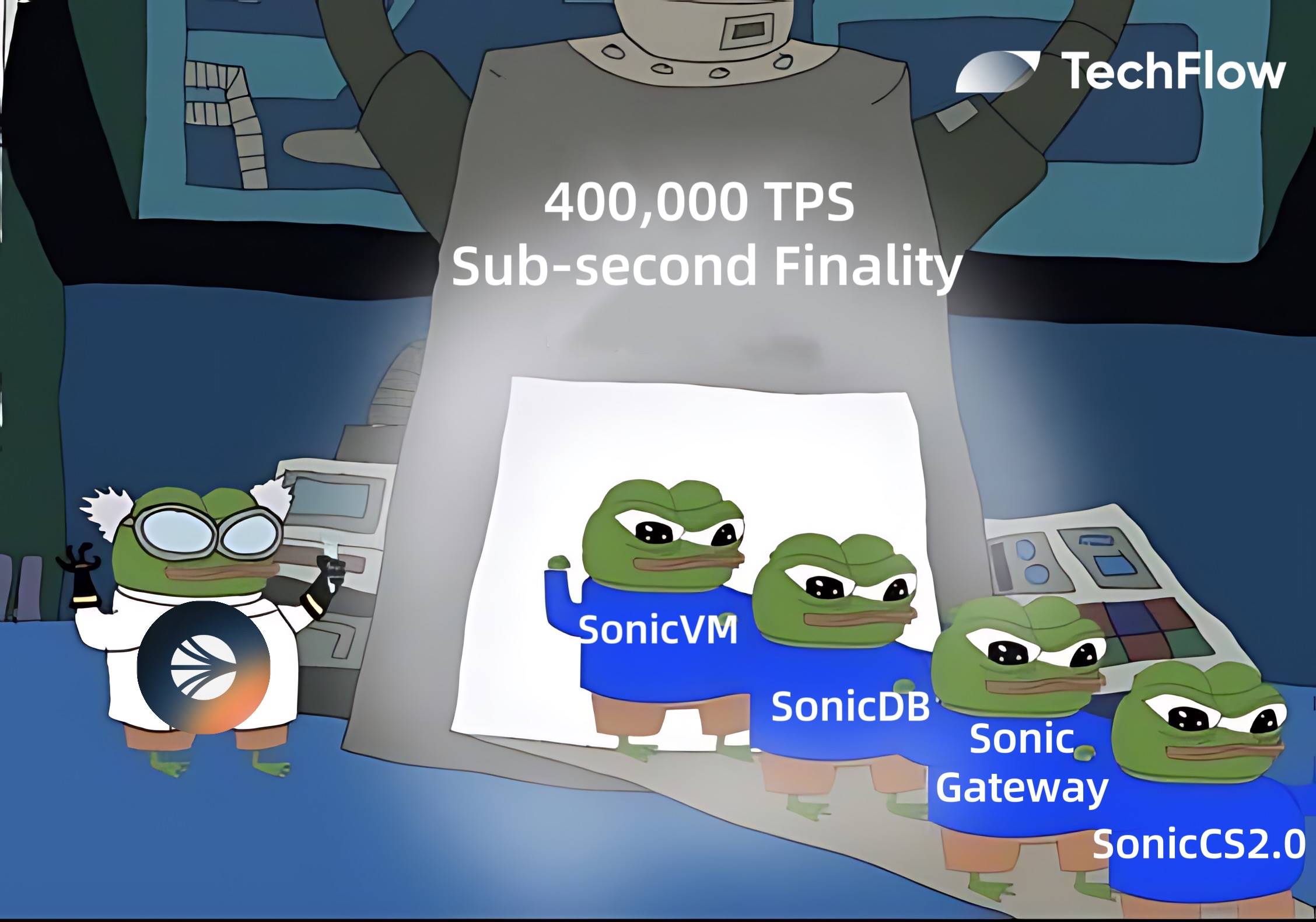

From Fantom to Sonic, AC’s presence remains strong. While Fantom performed well, there was still room for performance improvement, and AC played more of a supporting role than a leading one. With Sonic, however, AC has transitioned from advisor to leader, directly steering the ecosystem’s development. Under his guidance, Sonic has built a core technical framework comprising SonicVM, SonicDB, and SonicCS 2.0, complemented by the native cross-chain solution Sonic Gateway, which provides users with secure and convenient asset migration. This not only carries forward Fantom’s technological DNA but also firmly establishes Sonic in the Layer1 competitive landscape from day one.

If Andre Cronje brought OG credibility and technical backbone to Sonic, Daniele Sestagalli has transformed that foundation into vibrant ecosystem momentum. Having worked alongside AC on technical projects during the Fantom era, Daniele now focuses primarily on ecosystem marketing within Sonic. He has shown particular commitment to the Chinese crypto community—deploying a coordinated campaign where female KOLs simultaneously posted selfies with identical promotional text for his DeFAI project ANON (@HeyAnonai). To further integrate into the Chinese community, he even registered a personal Chinese-language X account @bigdzhao, actively engaging with local users.

Daniele’s approachable, community-first image has won widespread goodwill, giving users a unique window into understanding Sonic more deeply.

Sonic’s Technical Foundation: Real Substance

In today’s environment where EVM public chains face performance bottlenecks and Layer2 solutions proliferate, Sonic’s path to technical evolution stands out: achieving performance breakthroughs through architectural reengineering while maintaining full EVM compatibility.

Benchmarks show Sonic has already achieved over 10,000 TPS. By comparison, Ethereum handles only 30 TPS, and Fantom about 2,000. Sonic’s actual performance and theoretical potential significantly surpass both. This robust throughput supports high-volume use cases across the ecosystem.

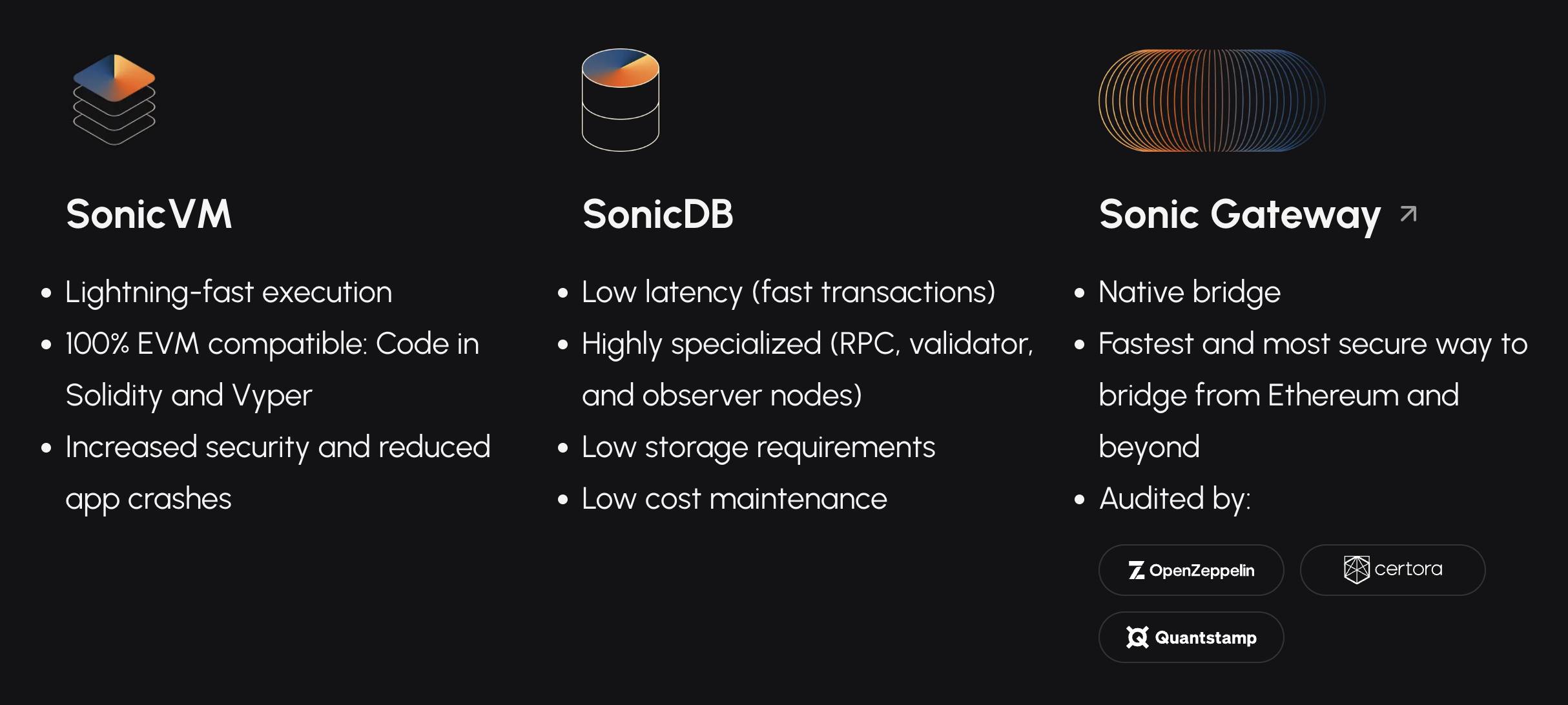

Technological innovation underpins Sonic’s superior performance. At the heart of this innovation lie SonicVM, SonicDB, Sonic Gateway, and SonicCS 2.0.

-

SonicVM: Fully Compatible and Blazing Fast

If traditional EVM is like an old family sedan, then SonicVM is a fully modified supercar. SonicVM ensures full compatibility with legacy Ethereum code (100% EVM compatible, supporting Solidity and Vyper), while dramatically boosting performance. According to the Sonic Labs official website, SonicVM’s key selling points are “lightning-fast execution” and “reduced application crashes”—critical advantages for Sonic’s high-throughput demands.

To understand SonicVM’s technical depth, consider its foundational logic:

-

EVM Compatibility & Developer Friendliness: SonicVM is 100% EVM-compatible, allowing developers to write code using familiar languages like Solidity and Vyper without needing to refactor existing Ethereum applications. It executes the same bytecode as Ethereum, ensuring smooth ecosystem migration.

-

Just-In-Time (JIT) Compilation & Super Instructions: Traditional EVM uses interpreted execution, translating code line-by-line—an inherently inefficient process. SonicVM introduces JIT compilation, converting bytecode into machine code at runtime, eliminating intermediate steps and accelerating execution. Additionally, it employs “super instructions,” combining common operation sequences into single commands, further reducing latency and resource consumption. Think of it as installing a turbocharger for smart contracts, enabling faster performance—especially crucial in high-frequency trading scenarios.

Thanks to these optimizations, SonicVM supports over 10,000 TPS with sub-second confirmation times, far exceeding the performance ceiling of traditional EVM chains.

-

SonicDB: Flat Storage for Cost Efficiency and Speed

SonicDB serves as the storage layer of the Sonic blockchain, introducing a key innovation by changing how data is stored.

Traditional blockchains typically use tree-like structures such as Merkle Trees for data storage—effective for integrity verification but prone to redundant data. SonicDB adopts a flat storage design, organizing related data together and minimizing hierarchical depth.

When DeFi protocols need to quickly query user balances or transaction histories, SonicDB can directly locate target data without traversing multiple layers, unlike conventional blockchains. Simply put, SonicDB is like a specially designed super filing cabinet. Traditional blockchain storage resembles placing files in a multi-drawer cabinet requiring sequential drawer opening. SonicDB, however, places all files on the same level, each clearly labeled for instant retrieval.

Additionally, reduced redundancy lowers hardware costs for node operators. Per Sonic’s official technical documentation, benchmark tests show that when processing the same volume of transaction data, SonicDB uses only 60% of the storage space required by traditional methods, while data retrieval speed improves by 40%.

-

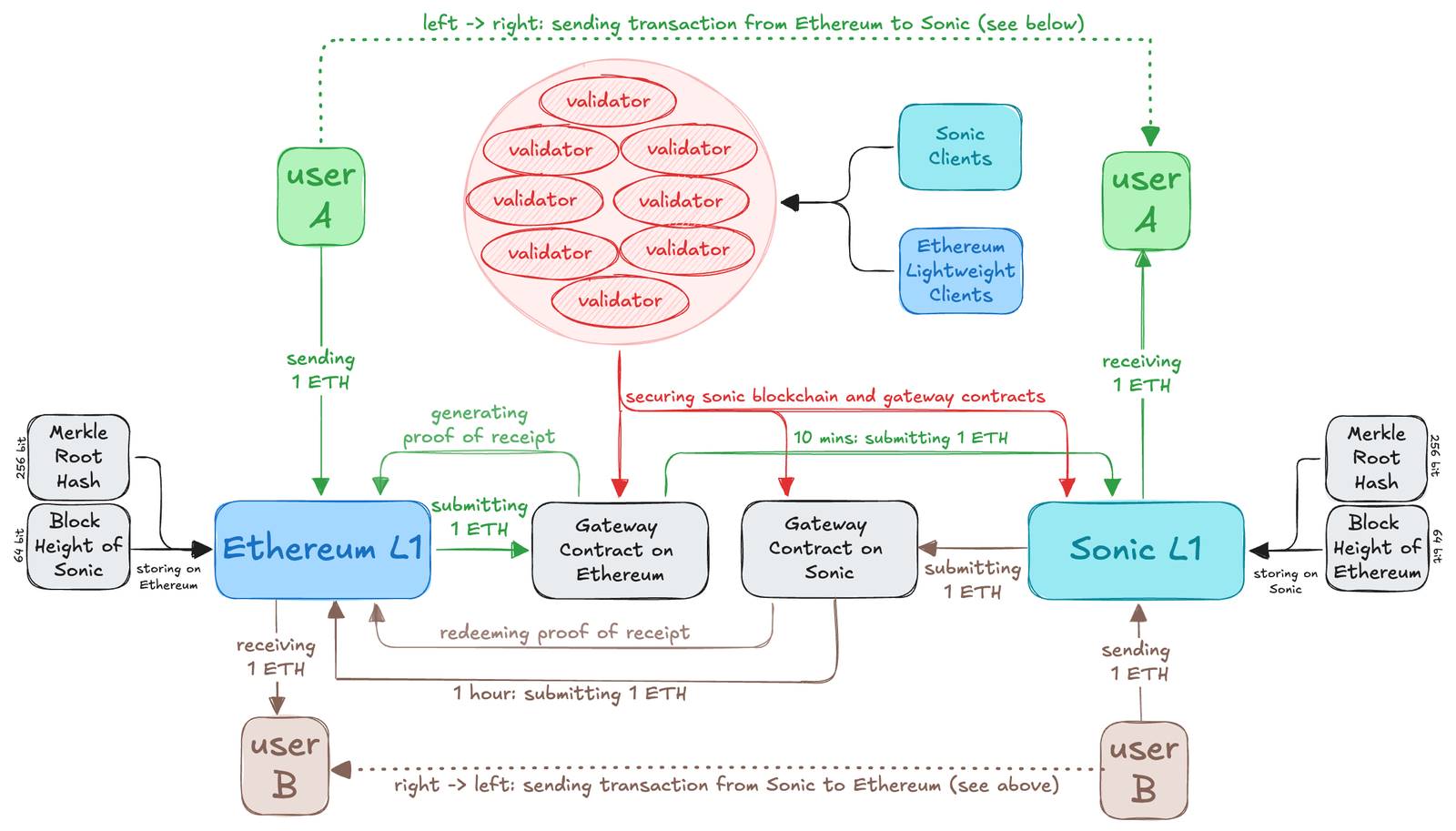

Sonic Gateway: The Safest Cross-Chain Bridge

For cross-chain functionality, Sonic Labs developed the native Sonic Gateway bridge, offering a highly secure solution. Sonic Gateway uses an innovative heartbeat mechanism, batching asset transfers from Ethereum to Sonic every 10 minutes, and vice versa hourly.

It also features a built-in 14-day fault protection mechanism ensuring absolute user asset safety—if the gateway fails continuously for 14 days, users can reclaim bridged assets directly on Ethereum. Once deployed, this mechanism cannot be altered by any party. For users prioritizing speed, Sonic Gateway offers a “Fast Lane” option: paying an additional 0.0065 ETH triggers an immediate heartbeat, shortening cross-chain transfer time to just a few minutes.

Image source: Sonic Official Technical Documentation

-

SonicCS 2.0: A Multithreaded Consensus Protocol

SonicCS 2.0 is Sonic’s latest consensus protocol, based on an asynchronous Byzantine Fault Tolerance (ABFT) mechanism utilizing a Directed Acyclic Graph (DAG). This protocol is specifically optimized for high-concurrency environments. Unlike Bitcoin or Ethereum, which sequentially bundle transactions into blocks, SonicCS 2.0 allows multiple validators to simultaneously process different groups of transactions.

Specifically, when multiple transactions arrive at the network concurrently, different validators can handle them in parallel, without waiting for prior block confirmations. These processed transactions form a mesh structure, with each new transaction referencing several previous ones, naturally creating a DAG. This design enables the network to remain stable even if some nodes experience delays or failures. To further boost efficiency, SonicCS 2.0 innovatively implements an overlapping election mechanism—the next validator set selection begins early, partially overlapping with the current consensus cycle—reducing handover delays. Combined with an optimized voting system, the entire network achieves sub-second transaction finality while maintaining high security.

For example, imagine 100 transactions needing processing. Previously, they would queue up, confirmed one after another. With SonicCS 2.0, multiple validators work simultaneously—like multiple cashiers serving customers at once—greatly increasing throughput. To make the system even smoother, SonicCS 2.0 cleverly starts selecting the next group of validators before the current ones finish their work.

Rewards: What Users Care About Most

Beyond social media marketing and cutting-edge technology, what initially drew users and developers to Sonic was its genuinely compelling reward mechanism.

-

FeeM Model: Transaction Fees Reinvested into Developers

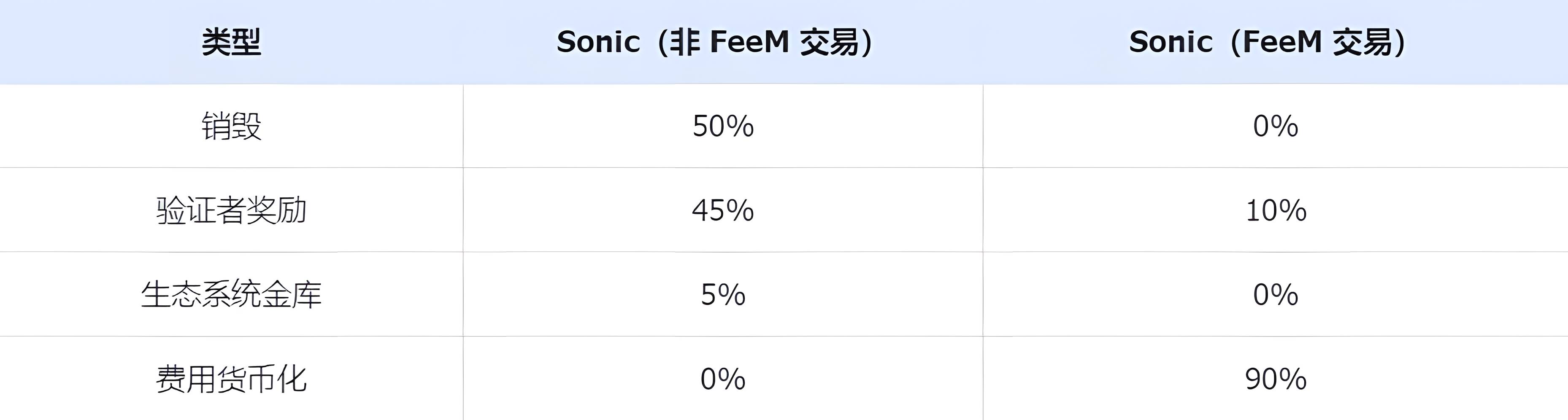

FeeM (Fee Monetization) draws inspiration from Web2 revenue-sharing models, similar to how YouTube compensates content creators based on viewership. On Sonic, developers deploy apps to attract users and transaction volume. If users trade on FeeM-participating apps, up to 90% of transaction fees go directly to developers, with the remainder distributed as tips to validators. If users trade on non-FeeM apps, 50% of fees are burned, and the rest are split between the treasury and validators.

Figure: FeeM distribution rules, data source: Sonic Official Technical Documentation

This model differs fundamentally from traditional blockchain “take rate” logic. By directly linking network revenue to developer effort, it incentivizes creators to build high-traffic, high-quality applications. With real returns, developers naturally invest more in optimization, improving user experience and driving network activity. In this way, Sonic creates a simple yet effective flywheel for sustainable ecosystem growth.

-

Reward Points System: Passive Points, Activity Points, and Gems

If the FeeM model reflects Sonic’s commitment to developers, the points-based reward system is its direct回馈 to users and the community. Sonic has designed a multi-tiered rewards structure—Passive Points, Activity Points, and Gems—with approximately 200 million $S tokens to be distributed via airdrops across multiple seasons.

-

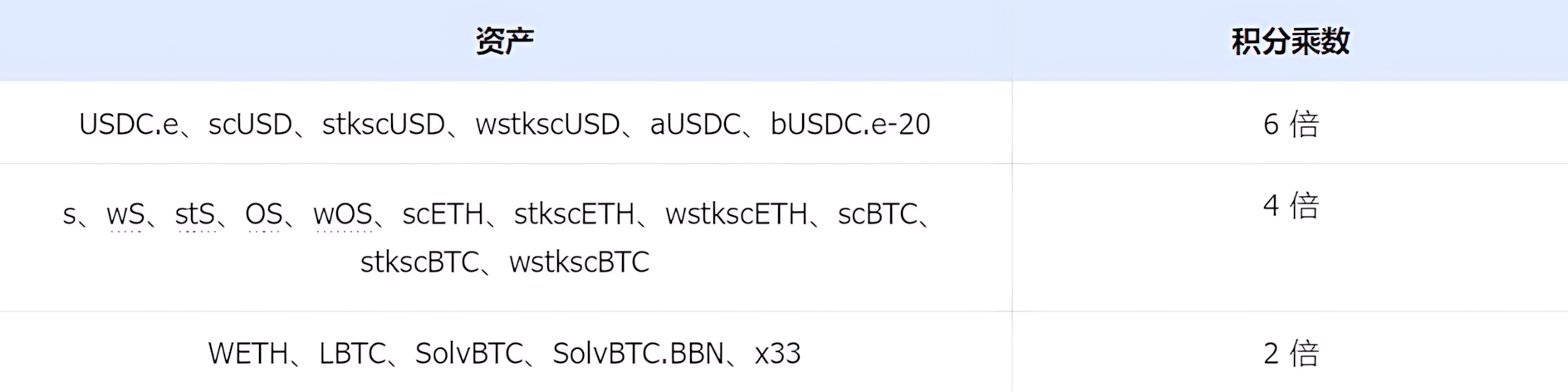

Passive Points: Users earn points simply by holding whitelisted assets (see table below) in Web3 wallets such as Rabby or MetaMask. Assets held on centralized exchanges (e.g., WETH, scUSD) do not qualify.

-

Activity Points: By providing liquidity or participating in activities using whitelisted assets within Sonic ecosystem apps, users receive rewards up to 2x higher than Passive Points.

-

Gems: Distributed by Sonic Labs based on app performance (e.g., trading volume, user count), Gems can be redeemed for $S tokens. Projects receiving Gems may also allocate portions to their own users.

To qualify for $S airdrops, users must hold or use assets from the whitelist, with different assets earning varying point multipliers.

Figure: Whitelisted Assets, data source: Sonic Official Technical Documentation

WETH, scUSD, scETH, scBTC, aUSDC, bUSDC.e-20, LBTC, SolvBTC, and SolvBTC.BBN earn only Activity Points, not Passive Points. Some whitelisted assets receive multiplier bonuses during Sonic’s first three months post-launch to encourage adoption and attract liquidity. This may be extended or adjusted later.

The whitelist and multipliers are subject to change. $S staked via MySonic does not qualify for points. Users wishing to stake should instead use stS, a liquid staking token provided by Beets.

Season One of the airdrop ends in June 2025. Progress can be tracked anytime via the official dashboard, encouraging continuous contributions from developers.

Full details available here:

https://docs.soniclabs.com/funding/sonic-airdrop/sonic-points

Skilled in marketing, generous with incentives, and backed by solid technology—how should users participate in this opportunity-rich Sonic ecosystem? Below, we outline promising entry points in the current Sonic ecosystem.

Sonic Ecosystem Overview: Strong in DeFi, But Not Limited to It

Sonic’s DeFi projects carry forward Fantom’s strong legacy, with recent micro-innovations winning consistent market favor. Naturally, when people first mention Sonic, they often think of its diverse DeFi offerings. Yet while DeFi continues to shine, Sonic’s ecosystem has expanded well beyond it. AI, GameFi, NFTs, and Meme coins are also thriving on Sonic, showcasing diversified potential (see ecosystem showcase: Sonic Labs Apps).

Figure: Sonic Ecosystem, image source @Delphi_Digital

DeFi: Steady Momentum

Shadow (@ShadowOnSonic)

Recent DeFi buzz around Sonic is inseparable from Shadow’s token $SHADOW. Shadow is a DEX on Sonic based on the x(3,3) model. Its innovation lies in transforming the traditional ve(3,3) lock-up-for-rewards mechanism into an x(3,3) “mutual support” model: “Penalty for early exit, rewards for staying.”

Users deposit $SHADOW to receive $xSHADOW, entitling them to protocol-generated revenues. They can unstake anytime, but an early-exit penalty (proportional to holding duration) applies. The penalized tokens are redistributed to those who remain staked.

Currently, Shadow maintains a daily trading volume above $30 million, with cumulative transaction fees exceeding $10 million.

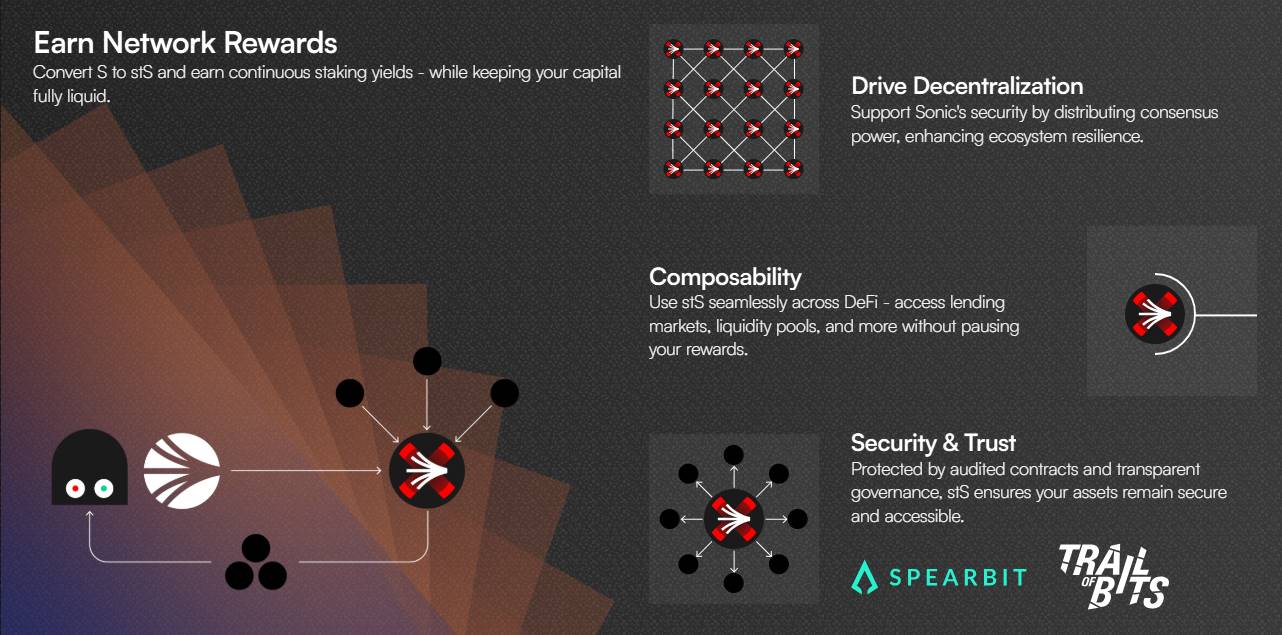

Beets.fi (@beets_fi)

Beets.fi (short for Beets) is the LST hub of the Sonic ecosystem, evolved from the Beethoven X team. Transitioning from Fantom to Sonic, Beets has shifted from a DEX to become a core staking and liquidity infrastructure project—now a pillar of the Sonic ecosystem, ideal for users seeking stable returns and long-term participation.

By staking $S, users receive a liquid staking derivative $stS, preserving both staking yield and asset liquidity. Beets’ auto-compounding mechanism ensures continuous yield accumulation. The platform builds diverse liquidity pools using $stS, such as the $wOS/$stS pool in collaboration with Origin Protocol, enabling users to maintain $S exposure while capturing multiple revenue streams.

$EGGS (@eggsonsonic)

Eggs Finance (Eggs) is a leveraged yield protocol on Sonic, integrating leveraged yield tools with Sonic’s native token $S to create an internal capital recycling system. Its goal: “Let $S holders amplify returns while maintaining their positions.”

Eggs Finance operates via a “mint, leverage, yield loop”:

Users stake $S into Eggs Finance to mint a derivative token $EGGS—pegged to $S but with leveraged characteristics. Minting cost increases over time; early participants pay less, while later minter fees partially flow back to earlier users. Then, users can use $EGGS as collateral to borrow more $S and reinvest into other pools (e.g., ShadowOnSonic or Beets) for high yields. Some on X reported short-term annualized yields on the $EGGS/$S pool reaching as high as 1800%.

Eggs Finance is now listed on DeFi Llama, with trading mainly occurring on Sonic’s DEXs.

Silo Finance (@SiloFinance)

Silo Finance is the highest TVL protocol on Sonic, with $250 million—accounting for a quarter of the ecosystem’s total TVL. Its isolated lending model limits risk contagion. Users deposit $S or $scUSD to perform high-leverage circular borrowing, amplifying yields. Depositing $scUSD earns an 18x SonicPoint bonus; USDE offers 12% APR. However, a significant portion of its TVL likely comes from recursive lending, meaning actual underlying capital may be smaller than reported—making it ideal for users chasing high积分 (point rewards).

Data source: DefiLlama

NFT

-

Derp (@derpedewdz): NFT & Meme

Derp series is the leading NFT collection in the Sonic ecosystem. Most Sonic team members and OGs—including AC—own Derp NFTs and use them as profile pictures.

The first-generation Derpe Dewdz series originally sold via auction on Paintswap, starting with 100 pieces and now totaling 99. It holds the highest floor price weight among Derp series, currently priced at 8,900 $S.

The most popular second-generation Derps series has a total supply of 2,000. As of April 2025, Derps floor price on secondary markets stands at 3,100 $S, with a peak sale of 4,850 $S.

Derp’s value extends beyond collectibility—it unlocks ecosystem benefits. Derp holders have received airdrops from projects including goglz, oil, and shadow.

Additionally, Derp NFT holders can mint 100 meme tokens $derp every 24 hours. They can use $derp to craft Snacks (snacks), then feed Snacks back to the Derp NFT to burn 45% of $derp tokens. Feeding enough Snacks also mints third-generation Derp NFTs called Berps, creating token deflation.

-

Paintswap (@paint_swap): NFT & GameFi & AI

Carried over from the Fantom era, Paintswap is currently the largest NFT marketplace in the Sonic ecosystem, supporting NFT creation and trading. Paintswap also launched its own NFT collection Beardies; holders receive 3% of Paintswap’s trading fees.

More than just an NFT platform, Paintswap functions as a comprehensive application layer. Beyond NFT trading, the team has developed its own game EstforKingdom (@EstforKingdom), a classic medieval-themed idle adventure game where players explore worlds using NFT characters to earn tokens and rewards. Notably, EstforKingdom shares the $BRUSH token with the Paintswap platform, preventing fragmentation of capital and reputation.

Recently, Paintswap unveiled a GameFAI (AI Game Engine) tokenomics framework centered on its $BRUSH token, enabling users with zero experience to create Web3 games and design token systems using AI. (Product not yet live.)

GameFi

-

Petroleum Finance (@Petroleum_Defi)

Petroleum Finance combines NFTs and DeFi mechanisms around virtual “oil plot” NFTs (Petroleum Plot) and the native token $OIL. Users purchase Petroleum Plot NFTs on Paintswap (current floor price: 50 $S), stake them to mine $cOIL (crude oil), which must be locked (“refined”) before becoming tradable $OIL (currently $0.79). The longer the lock-up period, the lower the withdrawal tax. NFT rarity determines output efficiency, with rarer plots yielding higher returns.

-

Fate Adventure (@FateAdventure)

Fate Adventure is a fully on-chain 2D RPG game on Sonic.

Set in a conflict-ridden fantasy world, players act as adventurers who partner with trainers to summon, train, and evolve monster pets called “Lings,” battling against the “Consensus” threat attempting to reset the world. The core token $FA reached a high of $1.75 and currently trades around $0.24, with a circulating market cap of ~$2.4M. Players earn $FA through PvE battles, quests, or cooperative modes, and can stake $FA to obtain equipment NFTs.

All in-game assets (e.g., Lings and gear) are NFTs tradable on Paintswap. Additionally, account abstraction technology lowers the barrier to blockchain interaction, allowing newcomers to participate without deep private key knowledge.

-

Abysscards (@abysscards)

Abysscards is a 1v1 collectible card game on Sonic. Starting March 25, players could mint one unique AI-generated NFT card per day for free, featuring original art and lore. Characters and clans were randomly assigned based on wallet address. The 30-day event has concluded. Now, players use their cards for open combat. No more cards can be minted; all cards circulated during the Genesis event are final versions.

Meme

-

GOGLZ (@GOGLZ_SONIC) vs INDI (@indi_sonic): Meme & NFT & GameFi

GOGLZ is the leading meme project on Sonic, themed around “goggles.” Recently, GOGLZ partnered with fellow Sonic meme project Indi to launch Goglz vs Indi, a wolf-sheep game on Sonic blending IP characters into NFTs with risk strategy and reward distribution mechanics.

Core gameplay of Goglz vs Indi:

-

Indi NFT (Sheep): Representing the “sheep,” users stake Indi NFTs to mine the in-game token $MEOW. Daily total emission: 7,500 $MEOW, distributed per second among all staked sheep. When claiming, users receive 80% of accumulated $MEOW; the remaining 20% is claimed by wolves. Unstaking requires at least 15,000 $MEOW mined and carries a chance of $MEOW being eaten by wolves.

-

GOGLZ NFT (Wolf): Representing the “wolf,” it doesn’t produce $MEOW directly. Instead, wolves earn by “raiding” 20% of sheep-generated rewards upon staking. Wolf earnings are tied to “energy points.”

$MEOW is the core in-game token. Users can exchange it for Sonic’s native token $S or reinvest it to mint more NFTs, continuing the gameplay loop.

Similar to classic wolf-sheep games, sheep holders face risks of loss (NFTs or earnings), while wolves depend on sheep for income.

TinHat Cat (@TinHat_Cat)

TinHat Cat features a pink cat wearing a tin foil hat. It ranked among the top entries in Sonic’s inaugural Meme competition, trailing only $GOGLZ in trading热度.

AI

-

Hey Anon (@HeyAnonai): DeFi + AI

Hey Anon is a DeFAI protocol developed by Daniele Sestagalli, enabling users to retrieve price movements, community sentiment, and development updates via natural language input, while executing complex DeFi operations. For example, saying “Stake 100 $S for me” or “Swap $scUSD to $stS” triggers automatic execution by Hey Anon.

Hey Anon is tightly integrated with Sonic’s primary assets, supporting operations on $S, $scUSD, $stS, and others. Meanwhile, its native token $ANON circulates across multiple chains including Sonic.

-

Allora Network (@AlloraNetwork)

Allora Network, developed by Allora Labs and built on Cosmos SDK, is a decentralized AI network designed for on-chain data prediction and optimization. In early 2025, Allora joined the Sonic ecosystem.

Within Sonic, Allora enhances DeFi and GameFi applications—providing market trend forecasts for Shadow and Wagmi to adjust liquidity pool yields; analyzing user behavior for Sonic’s point system (Passive and Activity Points) to dynamically optimize reward weights; supporting games like Fate Adventure with data to balance economic models. Allora has already launched its Dev Mainnet.

-

Yoko (@yokodotlive)

Yoko is an AI agent economy platform on Sonic, enabling users to easily create personalized AI agents that perform various on-chain trading operations.

Rebuilt to Withstand the Storm

Clearly, after repeated waves of bear market sentiment, demand for public chains has quietly shifted. While short-term gains remain tempting, more and more users now realize that projects capable of enduring market cycles are often those with greater patience and long-term vision.

Sonic’s development trajectory exemplifies this perfectly. Unlike projects chasing short-term hype, Sonic has chosen a meticulous, sustainable path. From its reconstruction launch last December to today, we’ve seen not a fleeting meme frenzy, but a steady evolution—from a handful of initial projects to a flourishing, innovative, and interconnected ecosystem. Achieving a stable $1 billion TVL within just four months, the market has voted with real capital.

While get-rich-quick stories drive traffic elsewhere, Sonic’s approach may seem “slow,” but its step-by-step strategy steers the entire ecosystem toward long-term sustainability. Sonic is building an ecosystem resilient enough to withstand market tests.

As the market moves past narrative-driven speculation, the projects that will ultimately thrive are those consistently focused on value creation and committed to long-term principles. Rebuilt and refined, Sonic is calmly advancing into the next cycle.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News