Trump's "reciprocal tariffs" impact exceeds expectations

TechFlow Selected TechFlow Selected

Trump's "reciprocal tariffs" impact exceeds expectations

Equivalent tariffs could increase uncertainty and market concerns, and exacerbate the risk of stagflation in the U.S. economy.

Authors: Xiao Jiewen, Lin Yuxin, CICC Research

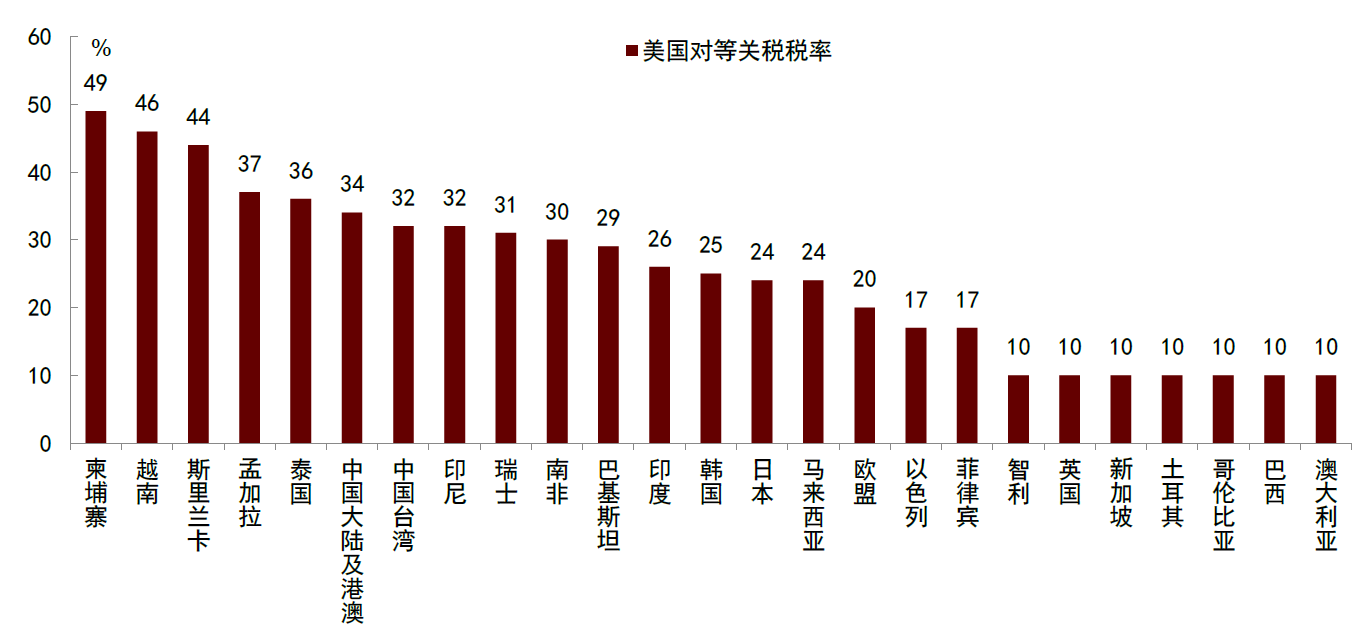

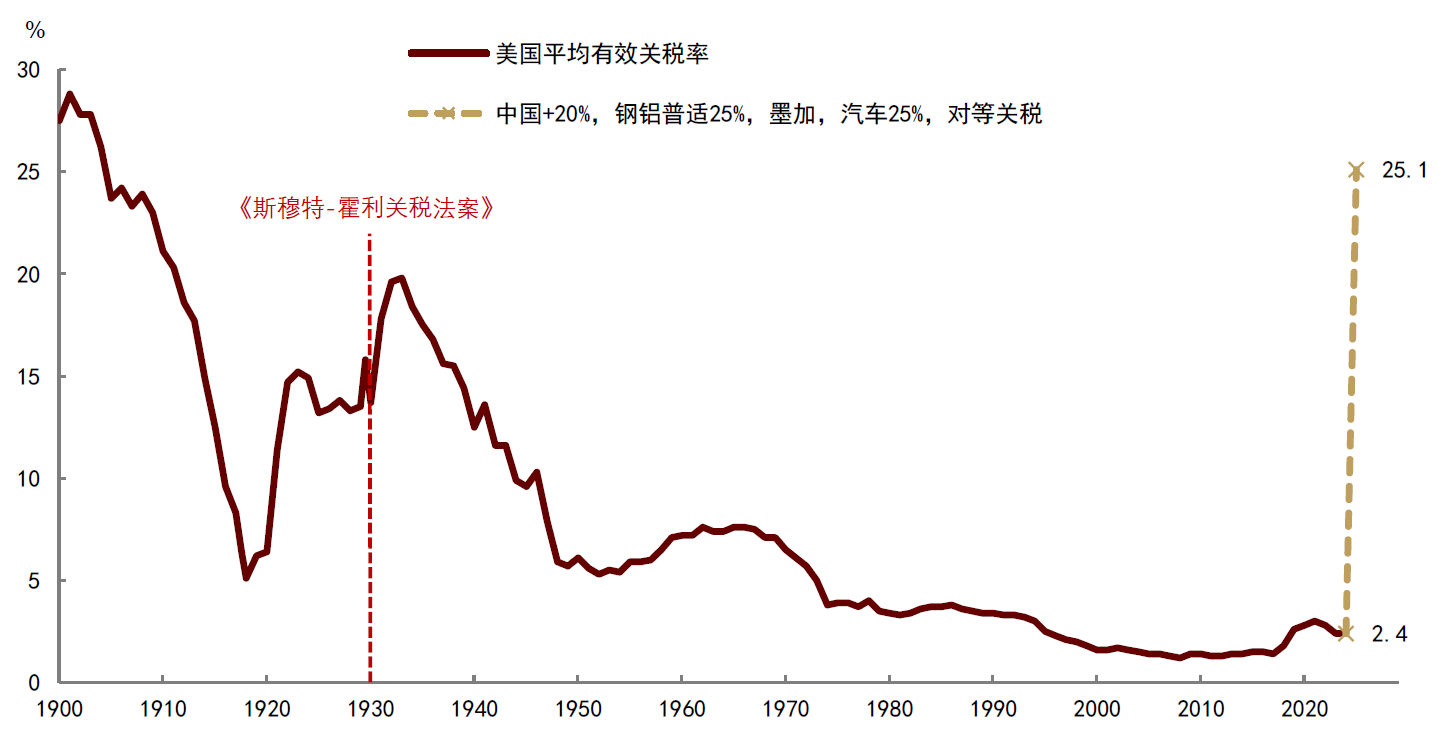

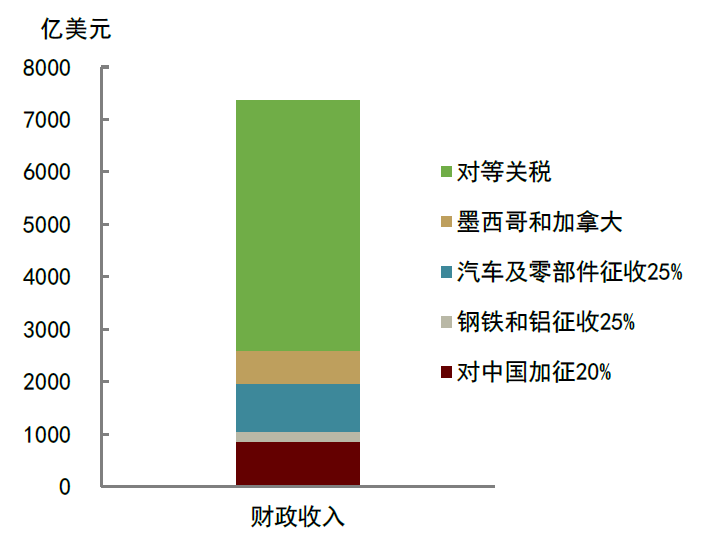

On April 2, Trump announced "reciprocal tariffs" at a level exceeding market expectations. The reciprocal tariff framework combines broad-based "blanket tariffs" with a "country-by-country" approach, covering over 60 major economies. Our calculations indicate that if fully implemented, these tariffs could raise the U.S. effective tariff rate by 22.7 percentage points from 2.4% in 2024 to 25.1%, surpassing the tariff levels seen after the 1930 Smoot-Hawley Tariff Act. We believe the reciprocal tariffs may heighten uncertainty and market concerns, exacerbating the risk of stagflation in the U.S. economy. Our estimates suggest the tariffs could increase U.S. PCE inflation by 1.9 percentage points and reduce real GDP growth by 1.3 percentage points, though they may also generate over $700 billion in fiscal revenue. Facing stagflation risks, the Federal Reserve will likely choose to wait and see, making rate cuts unlikely in the short term. This would further increase downside economic risks and pressure markets toward downward adjustments.

1. Specifics of Reciprocal Tariffs

At 4:00 PM U.S. time on April 2, Trump announced policies related to reciprocal tariffs and signed an executive order[1]. Under the reciprocal tariff framework, a combination of comprehensive "blanket" tariffs and "country-specific" tariffs has been adopted. According to the White House:

► The U.S. will impose a baseline 10% tariff on all imported goods.

This aligns with Trump’s earlier campaign pledge of a 10% blanket tariff. Industries such as steel, aluminum, and automobiles, which already face a 25% tariff, are unaffected by this new measure. Additionally, copper, pharmaceuticals, semiconductors, lumber, and certain critical metals and energy products are excluded from the reciprocal tariff framework. These were previously mentioned by Trump as candidates for higher sector-specific tariffs, but specific implementation timing and rates have not yet been disclosed[2].

► Some countries and regions will face higher rates.

The detailed annex listing specific rates has not yet been published on the White House website. However, according to Trump's statements, higher reciprocal tariff rates will apply to the European Union (20%), Japan (24%), South Korea (25%), China (34%), Taiwan (32%), India (26%), Thailand (36%), among others[3]. Additionally, another White House fact sheet states that Trump has signed an executive order ending the tariff exemption for packages valued under $800, effective May 2. Such packages will now be subject to either a 30% tariff or a flat $25 per package ($50 per package after June 1)[4].

Overall, the list of countries and regions facing higher tariffs broadly matches what U.S. Treasury Secretary Bessent previously indicated—that the Trump administration is focusing reciprocal tariffs on economies with persistent trade imbalances against the U.S.[5], consistent with our prior assessment in "Previewing Trump’s 'Reciprocal Tariffs'", where countries with larger surpluses and higher existing tariff gaps were more likely targets. However, the actual implemented rates exceed even our previous extreme-case assumptions.

► Mexico and Canada remain exempt under the existing USMCA framework and are not subject to additional reciprocal tariffs.

The executive order states that previous tariffs imposed in response to illegal immigration and fentanyl issues remain in effect, but exemptions are extended—meaning all Canadian or Mexican goods meeting USMCA criteria continue to enjoy preferential access to the U.S. market. However, Canadian or Mexican goods failing to meet USMCA requirements currently face an additional 25% ad valorem tariff (10% for Canadian energy).

► Regarding implementation timeline, per the executive order, all goods entering U.S. customs territory will incur an additional 10% ad valorem tariff starting April 5, 2025. For trading partners facing higher reciprocal tariffs, the new rates will take effect starting April 9.

Our calculations show that if fully implemented, the U.S. effective tariff rate would rise sharply by 22.7 percentage points from 2.4% in 2024 to 25.1%. This exceeds even the extreme scenario outlined in our outlook report "Previewing Trump’s 'Reciprocal Tariffs'" and would surpass the U.S. tariff level following the 1930 Smoot-Hawley Tariff Act (Chart 2).

2. Reciprocal Tariffs Intensify Uncertainty

We believe reciprocal tariffs do not alleviate uncertainty but instead amplify concerns.

First, given their broad scope and high magnitude, reciprocal tariffs will significantly impact the U.S. and global economies. How will other countries respond once tariffs are implemented? Will they retaliate or absorb the costs? If retaliatory measures are taken, a full-blown tariff war could ensue, increasing downward pressure on the global economy—a risk worth monitoring.

Second, will there be more tariffs after reciprocal tariffs? Trump previously stated plans to impose tariffs on semiconductors, medical products, lumber, and copper. When might these be implemented? Moreover, reciprocal tariffs currently exclude Mexico and Canada, whose qualifying imports under the USMCA remain tariff-exempt. Future changes to this policy add another layer of uncertainty.

Third, how long will reciprocal tariffs last? Can they be reduced through negotiations? If so, when might talks begin? In the long run, Trump aims to use tariffs to incentivize manufacturing repatriation and to offset fiscal deficits caused by tax cuts using tariff revenues. If he remains committed to these goals, does this imply the tariffs may not be temporary but rather persist for some time? These questions remain unanswered.

3. Impact on the U.S. Economy

If these tariffs persist, the U.S. economy faces heightened stagflation risks. First, economic slowdown appears inevitable. At the micro level, firms face two choices post-tariff: raise prices or absorb the cost. If they raise prices, consumers bear higher costs, demand slows, and downward economic pressure intensifies. If they absorb the cost, profit margins shrink, reducing labor demand and ultimately leading to slower growth.

At the macro level, tariffs represent a form of government taxation, with costs borne by businesses and consumers—functionally equivalent to fiscal tightening. Trump’s tariffs would shift money from the private sector to the government, reducing private-sector net wealth and suppressing investment and consumption. Within the private sector, the distribution of tariff burdens depends on the relative bargaining power between foreign producers and U.S. consumers, as well as exchange rate movements of partner countries against the dollar. While tariff revenues could eventually be returned via tax cuts, in the short term, they negatively affect aggregate demand.

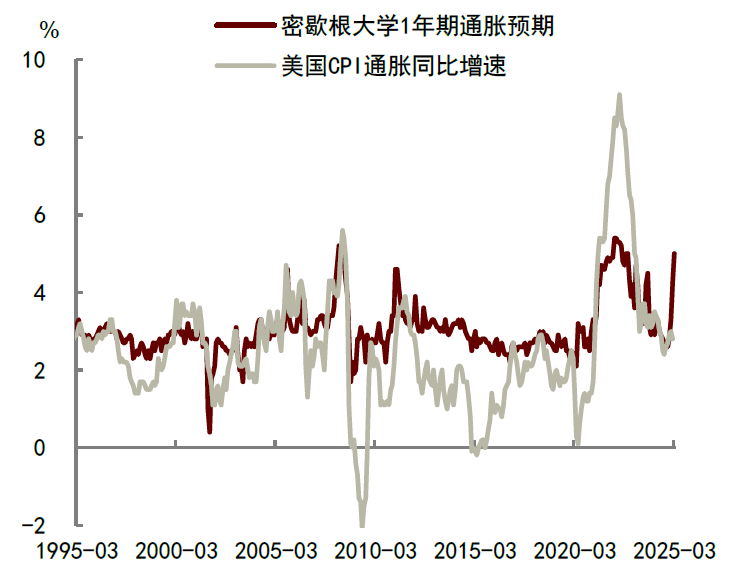

Second, tariffs push up price levels, increasing near-term inflationary pressures. Although weak demand may eventually curb inflation, consumers may first experience a wave of price increases. According to the University of Michigan survey, U.S. consumer inflation expectations for the next year surged to 5% in March—the highest since 2022—while expectations for the next 5–10 years rose to 4.1%, the highest since 1993 (Chart 3). The implementation of reciprocal tariffs will amplify near-term price pressures, raising the risk of self-fulfilling inflation expectations.

Our calculations suggest that stacking reciprocal tariffs on top of existing ones could raise U.S. PCE inflation by 1.9 percentage points, boost federal revenue by $737.4 billion, and reduce real GDP growth by 1.3 percentage points (Chart 4). Our estimates above do not account for exchange rate fluctuations. A stronger dollar would mitigate the impact on the U.S., while a weaker dollar would worsen it. We assume equal sharing of tariff costs between U.S. consumers and foreign producers—i.e., half the cost passed on to U.S. consumers, half absorbed by trade partners—and adopt a one-year tax multiplier[6] of approximately 1. If U.S. consumers have weaker bargaining power, the negative economic impact would be even greater.

4. Implications for Monetary Policy

Facing stagflation risks, the Federal Reserve can only opt for a wait-and-see approach, making near-term rate cuts unlikely. Based on our analysis above, reciprocal tariffs pose significant inflation risks, compounded by rising consumer inflation expectations, forcing the Fed to refocus on inflation control. We believe the Fed will need at least two months to assess the actual inflationary impact of the tariffs. Therefore, unless the U.S. economy shows severe weakness, the Fed is unlikely to cut rates in the first half of the year. The absence of rate cuts implies the “Fed put” is no longer reliable, further increasing downside risks to the economy and adding pressure for market corrections.

Chart 1: U.S. Reciprocal Tariff Rates

Source: White House, NBC News, CICC Research

Chart 2: U.S. Effective Tariff Rate Set for Sharp Rise

Note: 1900–1918 and 2024 refer to U.S. fiscal years; 1919–2023 refer to calendar years; 2025 is author estimate.

Source: USITC, Wind, CICC Research

Chart 3: U.S. Consumer Inflation Expectations Surge

Source: Haver, CICC Research

Chart 4: U.S. Fiscal Revenue Expected to Rise Due to Tariffs

Source: USITC, Wind, CICC Research

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News