Bitcoin Price Forecast for the Year: Gradual Decline to $50K or a Surge to $250K?

TechFlow Selected TechFlow Selected

Bitcoin Price Forecast for the Year: Gradual Decline to $50K or a Surge to $250K?

In 2025, Bitcoin's price fell from a peak of $109,000 to $83,000, sparking intense debate in the market about its future trajectory.

By Luke, Mars Finance

On March 31, 2025, Bitcoin teetered at the edge of $83,000—down roughly 24% from its peak of $109,000 just over two months prior. The market resembles a colossal seesaw, one end whispering the abyss, the other beckoning the stars.

Today, we focus on two heavyweight sages of the crypto world: Quinn Thompson, founder of Lekker Capital, who predicts Bitcoin will slowly bleed down to $50,000–$59,000; and Arthur Hayes, godfather of Maelstrom, who boldly bets it will ride the QE wave all the way to $250,000—a target he reaffirmed in his latest article, though he has also playfully hinted at a million-dollar ultimate vision. Their logics are like black and white stones on a Go board—opposite, yet deeply compelling.

Quinn Thompson: Wall Street’s "Cold-Blooded Prophet"

Quinn Thompson is the founder of Lekker Capital, a “veteran” who transitioned from traditional finance to crypto. He once managed billions on Wall Street and earned a reputation for sharp macro insights. In 2024, while Bitcoin was still near its highs, his X posts already sounded bearish alarms, later hailed as “prophetic last words.” Thompson's style is calm and incisive—a surgeon with a scalpel, adept at dissecting economic veins. His predictions often carry a cold sense of fate, as if he’s already seen through the market’s rise and fall.

Thompson’s forecast unfolds like a slow-moving tragedy: Bitcoin won’t crash suddenly but will instead deteriorate gradually like a chronic patient, eventually falling to $50,000–$59,000. “This isn’t a lightning drop,” he said in a CoinDesk interview, “but that maddening kind of slow torture. Investors will keep asking, ‘Is this the bottom?’ only to suffer in the fog.” His pessimism rests on four “headwinds” from the Trump administration—each logical step tightening the noose:

"Cliff-Like Contraction" in Government Spending

The Department of Government Efficiency (D.O.G.E.), led by Elon Musk, plans to cut $1 trillion in spending by late May, with a long-term goal of slashing $7 trillion. Thompson points out that government spending has been the backbone of recent economic and employment growth: “That money flows into people’s pockets, funding vacations and grocery bills. Now that pillar is being yanked away—how can the economy not wobble?” He mocks: “Love it or hate it, those education department dollars were real financial bloodlines.”

"Iron-Fisted Squeeze" in the Labor Market

Trump’s hardline stance on illegal immigration will tighten labor supply. In the past, waves of immigrants suppressed wages and fueled growth; now, border closures and increased deportations will force companies to raise wages, with some potentially collapsing. “This isn’t a charity gala—it’s a survival game,” Thompson says with a sneer. “With fewer workers, who’s going to do the work?”

The "Suspense Drama" of Tariffs

Trump’s tariff policy plays out like an unfinished thriller—one day escalating, the next retreating. Thompson argues that this very uncertainty is toxic: “Businesses are left hanging, afraid to invest or hire. Economic vitality gets suffocated alive.” He calls it the perfect recipe for “chronic asphyxiation.”

The Fed’s "Cold Shoulder"

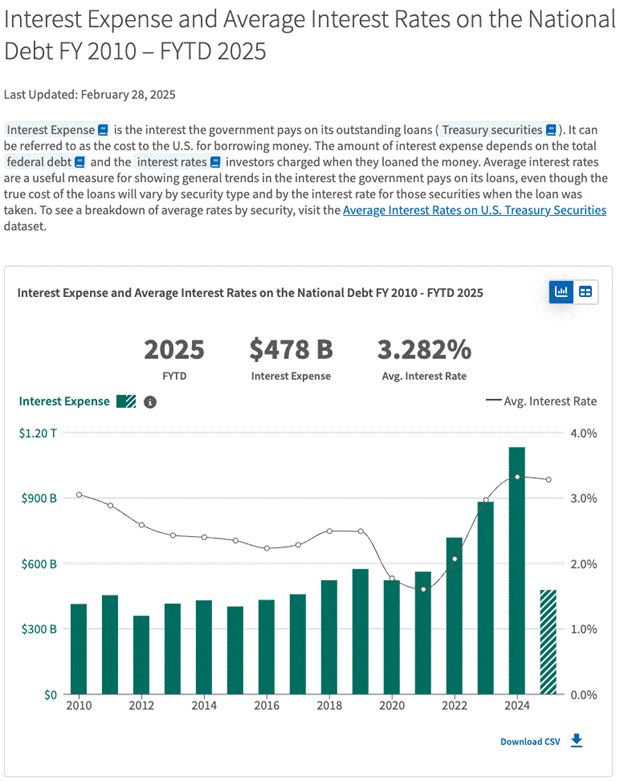

Despite cutting rates by 100 basis points to 4.25%-4.5% by the end of 2024, Bitcoin failed to break $110,000—indicating limited easing impact. Thompson expects only sporadic cuts of 25–75 basis points in 2025, mostly in the second half. “The Fed is like a miser, clinging to inflation fears,” he quips, mocking the White House: “Bessent’s ‘course correction’ is meant to pop asset bubbles—and Bitcoin is first in line.”

He likens it to a “controlled burn”: the government tries to clear economic “deadwood,” but if it spirals, it could leave behind ruins. He warns this “slow bleed” may last until early 2026, ending only when political pressure forces Trump to pivot. As a risk asset, Bitcoin cannot escape this slow, grinding fate.

Arthur Hayes: Crypto’s "Monetary Alchemist"

Arthur Hayes is a legend in crypto, having founded BitMEX and turned it into a derivatives trading powerhouse. After leaving BitMEX, he launched Maelstrom, evolving into a macro strategist known for bold forecasts and biting prose. His writings read like dark comedies—packed with insight and laced with mockery of power. Hayes is more than a trader; he’s a “monetary alchemist,” skilled at extracting gold from policy ashes. While his million-dollar vision shocks, his latest article focuses on a practical $250,000 target for this year—revealing a pragmatic side.

Hayes’ prophecy reads like a sci-fi epic: Bitcoin will ride the quantitative easing (QE) wave, soaring from last month’s low of $76,500 to $250,000. In his latest piece, he writes: “I still believe Bitcoin can hit $250,000 by year-end, because Bessent’s ‘BBC’ has pinned Powell in place—the Fed will flood the market with dollar liquidity.” His optimism stands on three pillars, each layer unfolding like alchemical transformation:

Trump’s "Debt Frenzy"

Hayes believes Trump aims to become the “greatest president ever” and will never follow Herbert Hoover’s path of austerity. Instead, he’ll emulate FDR’s money-printing legacy. In his article *KISS*, Hayes asks: “Does Trump want to be remembered as the architect of economic collapse, or the hero who printed his way to salvation?” The answer is obvious: debt financing is his instinct. D.O.G.E.’s cuts appear contractionary, but are actually a “grand strategy” to force the Fed to open the floodgates. “He’s a real estate showman—borrowing cheap money is his specialty,” Hayes smirks. “The cuts are just foreplay. The real climax is printing.”

The Fed’s "Forced Easing"

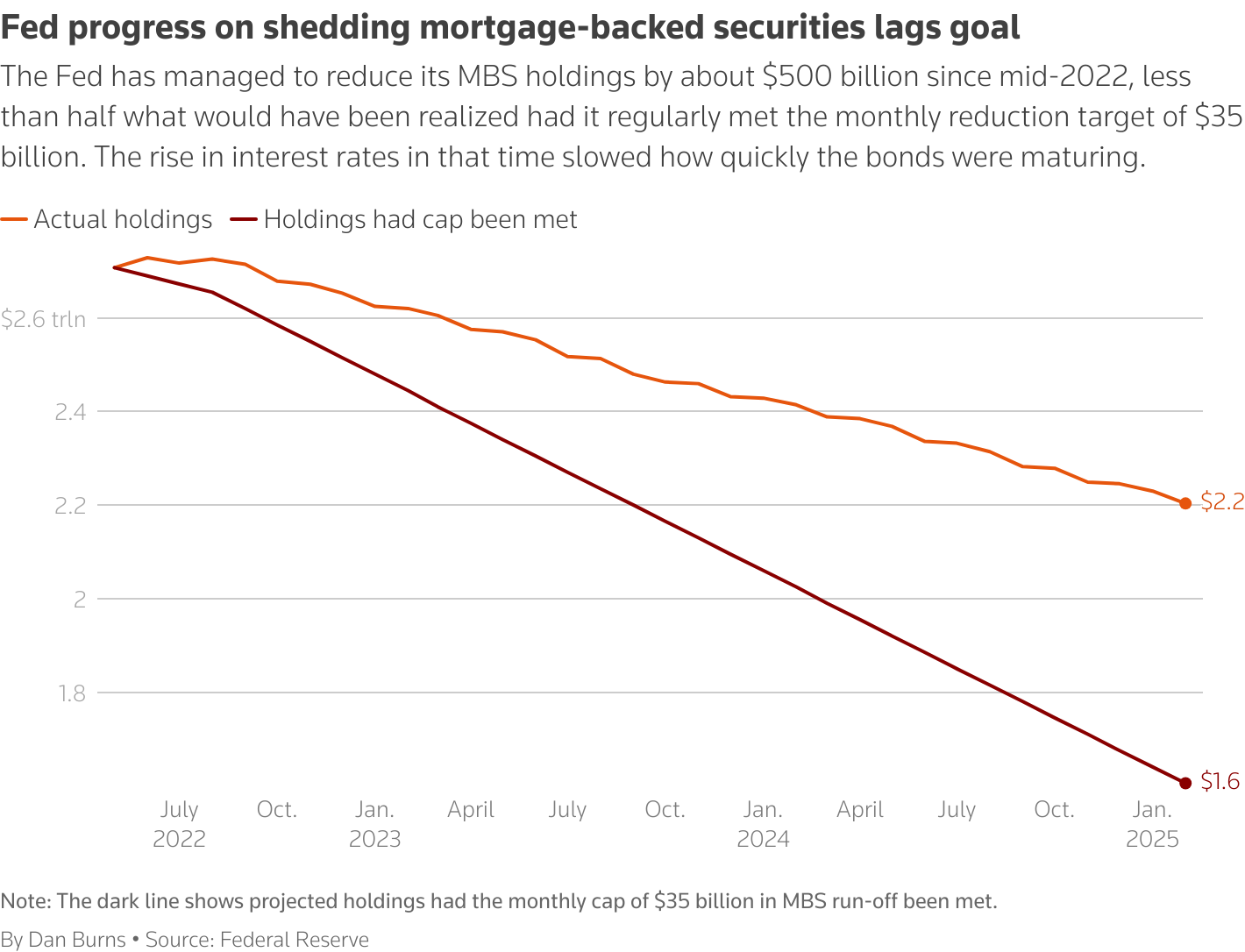

Hayes jokes that Powell is subdued by Bessent’s “BBC” (Big Bessent Cock), sitting helplessly in the “Cuck Chair.” The March 19 FOMC meeting marked a turning point: Powell slowed QT, reducing monthly Treasury roll-offs from $25 billion to $5 billion, releasing $240 billion annually. More crucially, he hinted at future net Treasury purchases and possibly lifting SLR restrictions on banks, freeing up $420 billion or more. “The Fed was never independent,” Hayes mocks, citing Arthur Burns’ speech. “When debt looms large, Powell must kneel.” He predicts QE will restart in Q3, combining rate cuts and SLR exemptions to inject up to $3.24 trillion in total liquidity.

The "Domino Effect" of Global Liquidity

Hayes’ view extends beyond America. He argues that the dollar tsunami will trigger a chain reaction: “Xi Jinping will loosen monetary policy to stabilize the yuan, increasing RMB supply; Germany will print euros to rebuild its military, and other European nations, fearing a ‘1939 repeat,’ will follow suit.” This global easing will give Bitcoin wings. “Bitcoin is the child of technology and liquidity,” he says. “Technology is mature—the only variable left is liquidity.” He estimates $250,000 as the year-end target, with a million dollars as the ultimate dream within Trump’s term.

Hayes also sees D.O.G.E. as “economic tank drivers”: cutting spending, laying off 400,000 workers, cracking down on fraud—all designed to trigger recession and force Powell’s hand. “This isn’t an accident—it’s the script,” he jokes. “Powell either acts early or cleans up after the collapse. Either way, the result is printing.”

Core Divide: Austerity Abyss or Liquidity Carnival?

Their clash is a philosophical and strategic summit, centered on policy paths and the battle over liquidity:

Policy Intent

Thompson sees Trump as a “cold-blooded surgeon,” using D.O.G.E., immigration crackdowns, and tariffs to deflate economic bubbles—even at the cost of recession. In his view, the White House would rather let the economy bleed to “cure” it. Hayes, however, sees a “real estate madman” using D.O.G.E. to fake a downturn, forcing the Fed to print, ultimately paving the way for “America First.” Thompson focuses on the immediate effects of austerity; Hayes uncovers the hidden motive of engineered loosening.

Fed Reaction

Thompson sees the Fed as a “lukewarm spectator,” too cautious under inflation pressure to launch full-scale easing—QE remains distant. He expects Powell to tread lightly, unable to reverse the tide. Hayes counters that the Fed is a “tamed beast,” forced by fiscal dominance and recession threats to restart QE, even deploying SLR waivers to become a fountain of liquidity. He believes Powell has no choice but to submit.

Liquidity Outcome

Thompson predicts a “slow bear”: economic slowdown drags down risk assets, and Bitcoin bleeds slowly to $50,000–$59,000. Hayes anticipates a “fast bull”: a liquidity surge pushes Bitcoin to $250,000, perhaps setting the stage for a million. Their views on liquidity diverge completely—one bearish, one bullish.

In Reality, Is Hayes’ $250K Forecast Gaining Ground?

In this $50K vs $250K showdown, data suggests Hayes’ “$250K wave” may be more forward-looking. Thompson’s “slow bear” logic holds short-term merit: D.O.G.E.’s cuts have already caused Washington home prices to drop 11% and worsened job data, bringing recession closer. The Fed’s caution aligns with his view—Powell slowed QT in March but remained vague on QE. If tightening exceeds expectations, Bitcoin falling to $60,000–$70,000 is possible. But this is only surface-level. Hayes has grasped the deeper pulse.

In *KISS*, Hayes cuts straight to the core: Trump is no economic puritan but a true believer in debt financing. He won’t allow depression to destroy his political capital. Instead, he’ll use D.O.G.E.’s “austerity illusion” to blackmail Powell into opening the gates. The March FOMC decision to slow QT and release $240 billion in liquidity, along with Powell’s hint at “net Treasury purchases,” is already a prelude to QE. Hayes’ estimated $3.24 trillion in potential liquidity (1.7T from rate cuts + 540B from QT halt + 500B from QE/SLR - 1T) hasn’t fully materialized—but the direction is clear. Moreover, the potential global easing effect—China stabilizing exchange rates, Europe rearming—will amplify this flood. As a “liquidity barometer,” Bitcoin has already stabilized at $76,500, signaling the market senses a turning point.

Thompson underestimates Trump’s pragmatism and the Fed’s passivity. Hayes, however, understands the game of human nature and policy: Trump’s “real estate showman” DNA ensures he’ll choose printing, and Powell’s “forced easing” under fiscal dominance is historical destiny. My take: in the short term (6–9 months), Bitcoin may trade between $70,000–$90,000, digesting tightening pressures. But if QE restarts in Q3, a year-end sprint to $250,000 is no fantasy. Hayes’ “alchemy” wins by seizing the lifeline of liquidity—not the illusion of austerity.

Finale: The Symphony of $50K vs $250K

This duel between $50,000 and $250,000 is a clash between a cool “scalpel” and a fiery “alchemical furnace.” Thompson plays like a chess master—methodical, his pessimism laced with cold realism. Hayes is like a high-stakes gambler—bold, his optimism rooted in deep policy insight. Whoever prevails, this debate reveals Bitcoin’s essence: it is not an island, but a mirror reflecting macro tides. Investors might do well to “hold Thompson’s caution in one hand, Hayes’ frenzy in the other,” waiting quietly for the thunderclap of QE amidst the volatility. Will the chime of $250,000 ring by year-end? Are you ready for the crescendo of this symphony?

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News