In-depth Analysis: Timeline and Comprehensive Landscape of Traditional Institutions Embracing the Crypto Industry

TechFlow Selected TechFlow Selected

In-depth Analysis: Timeline and Comprehensive Landscape of Traditional Institutions Embracing the Crypto Industry

The next few years will be a critical period determining whether TradFi and DeFi can achieve deep integration within the global financial system.

Author: insights4.vc

Translation: TechFlow

Since 2020, major U.S. banks, asset management firms, and payment institutions have gradually shifted from cautious observation of cryptocurrencies to active investment, collaboration, or launching related products.

As of early 2025, institutional investors hold approximately 15% of the total Bitcoin supply, and nearly half of all hedge funds have begun allocating to digital assets.

Key trends driving this integration include the launch of regulated crypto investment vehicles (such as the January 2024 approval of the first spot Bitcoin and Ethereum ETFs in the U.S.), the rise of real-world asset (RWA) tokenization on blockchains, and increasing institutional use of stablecoins for settlement and liquidity management.

Institutions broadly view blockchain networks as effective tools for streamlining traditional back-end systems, reducing costs, and accessing new markets.

Many banks and asset managers are piloting permissioned decentralized finance (DeFi) platforms that combine the efficiency of smart contracts with KYC (Know Your Customer) and AML (Anti-Money Laundering) compliance.

At the same time, they are also exploring permissionless public DeFi in a controlled manner. The strategic rationale is clear: DeFi’s automated and transparent protocols enable faster settlements, 24/7 market operations, and novel yield opportunities—addressing long-standing inefficiencies in traditional finance (TradFi).

However, significant barriers remain, including regulatory uncertainty in the U.S., technical integration challenges, and market volatility—all of which continue to constrain adoption speed.

Overall, as of March 2025, the interaction between TradFi and crypto shows a trend of cautious but steadily accelerating engagement. Traditional finance is no longer merely observing from the sidelines; it has begun carefully entering specific use cases with tangible advantages—such as digital asset custody, on-chain lending, and tokenized bonds. The next few years will be critical in determining whether TradFi and DeFi can achieve deep integration within the global financial system.

Paradigm Report – “The Future of Traditional Finance” (March 2025)

As a leading crypto venture capital fund, Paradigm surveyed 300 traditional finance (TradFi) professionals across multiple developed economies for its latest report. Below are some of the most insightful statistics and findings from the report.

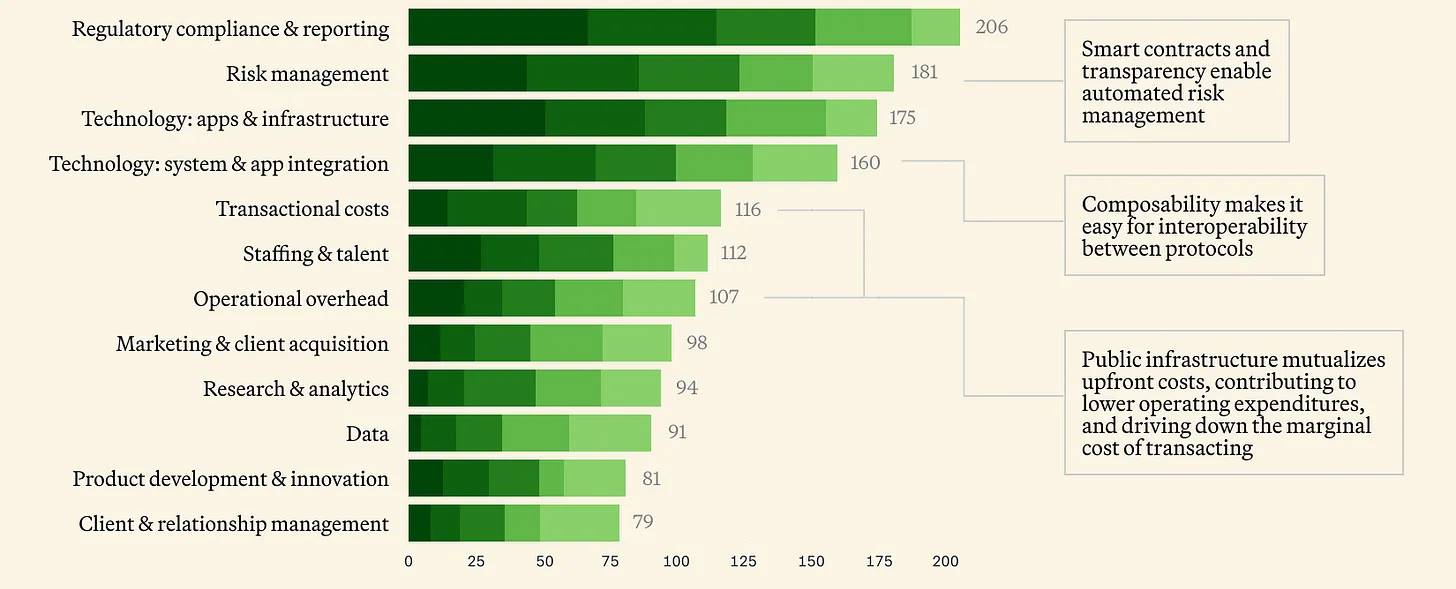

Which areas contribute most to the cost of delivering financial services?

What cost-reduction strategies does your organization employ when providing financial services?

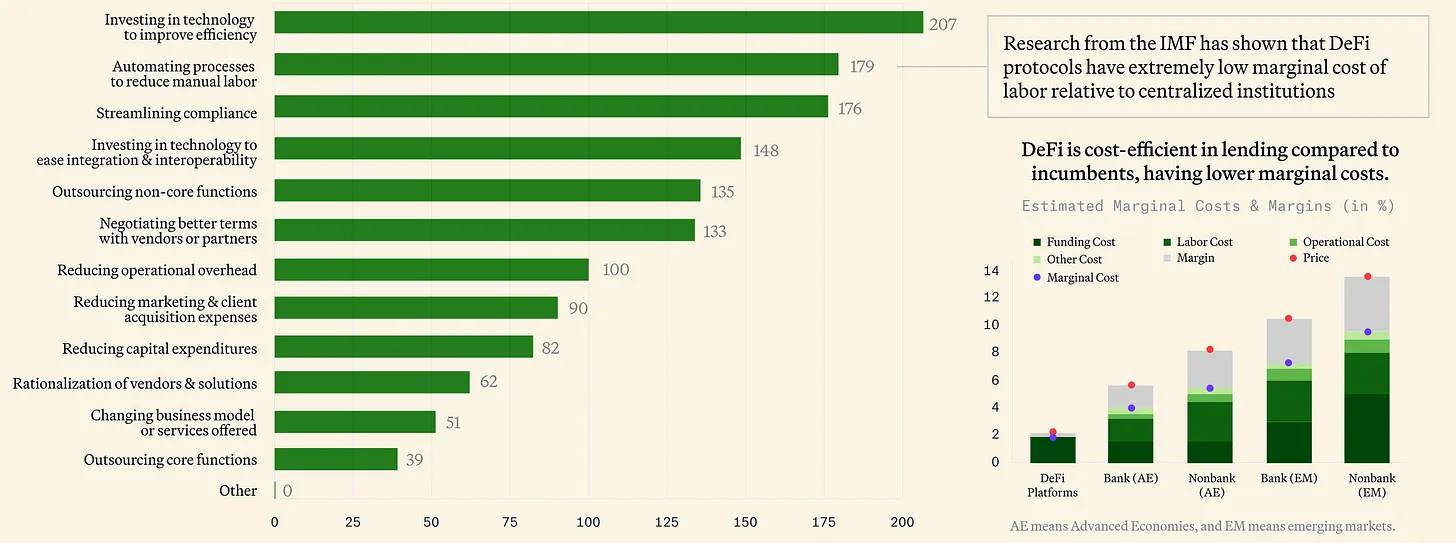

Approximately 76% of companies are currently involved in cryptocurrency.

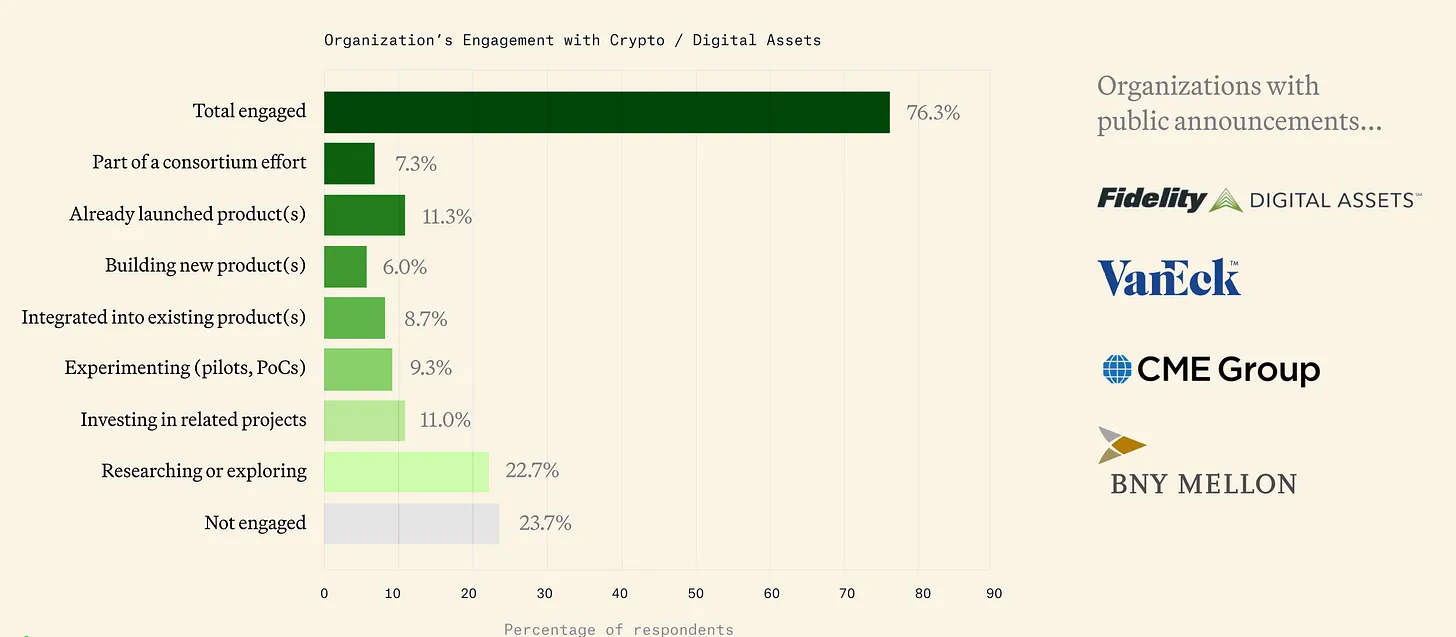

About 66% of traditional financial firms are associated with decentralized finance (DeFi).

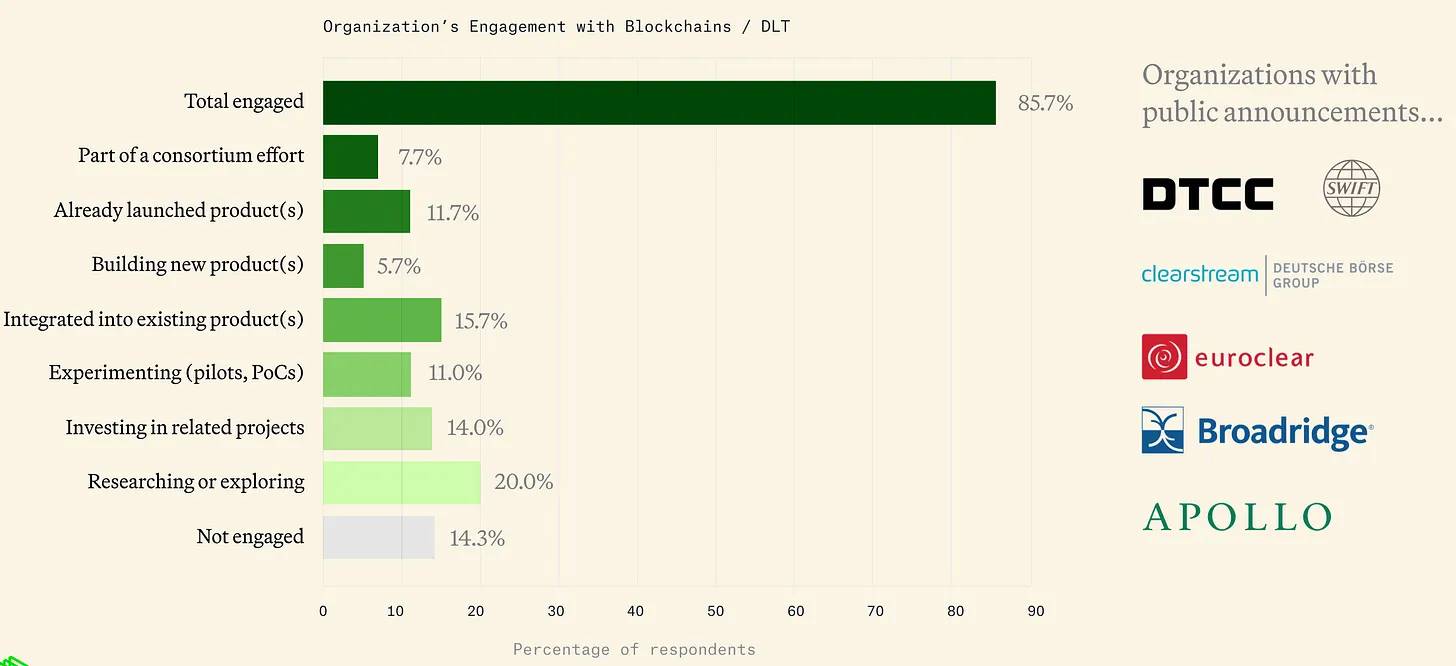

Approximately 86% of firms are currently engaged with blockchain and distributed ledger technology (DLT).

Timeline of Institutional Entry into Crypto (2020–2024)

2020 – Initial Exploration:

Banks and traditional financial institutions began tentatively entering the crypto market. In mid-2020, the U.S. Office of the Comptroller of the Currency (OCC) clarified that banks could custody crypto assets, opening the door for custodians like BNY Mellon.

BNY Mellon subsequently announced in 2021 that it would offer digital asset custody services. That same year, corporate treasuries began entering the space—MicroStrategy and Square made high-profile Bitcoin purchases, treating it as a reserve asset, signaling growing institutional confidence.

Payment giants also took action—PayPal launched cryptocurrency buying and selling services for U.S. customers at the end of 2020, bringing digital assets to millions of users. These moves marked the beginning of mainstream institutions recognizing crypto as a legitimate asset class.

2021 – Rapid Expansion:

With the bull market in full swing, 2021 saw accelerated integration between TradFi and crypto. Tesla’s purchase of $1.5 billion worth of Bitcoin and Coinbase’s landmark IPO on Nasdaq in April 2021 became key bridges connecting Wall Street and crypto.

Investment banks responded to client demand: Goldman Sachs restarted its crypto trading desk, while Morgan Stanley began offering wealthy clients access to Bitcoin funds. In October of that year, the U.S.’s first Bitcoin futures ETF (ProShares BITO) officially launched, providing institutions with a regulated crypto investment vehicle.

Major asset managers such as Fidelity and BlackRock started forming dedicated digital asset divisions. Meanwhile, Visa and Mastercard partnered with stablecoins (e.g., Visa’s USDC pilot program), demonstrating confidence in crypto-based payment networks.

The report clearly outlines how traditional finance evolved from tentative exploration to rapid expansion, laying the groundwork for deeper convergence between crypto and TradFi in the coming years.

2022 – Bear Market and Infrastructure Building:

Despite a downturn in the crypto market in 2022—marked by events such as the Terra collapse and FTX bankruptcy—institutions continued building infrastructure. In August, BlackRock, the world’s largest asset manager, partnered with Coinbase to provide crypto trading services for institutional clients and launched a private Bitcoin trust for investors—an action that sent strong signals of market confidence.

Traditional exchanges and custodians also expanded their digital asset offerings. For example, BNY Mellon rolled out crypto custody services for select clients, while Nasdaq developed a custodial platform. Meanwhile, JPMorgan used blockchain via its Onyx division for interbank transactions, with JPM Coin processing hundreds of billions of dollars in wholesale payments.

Tokenization pilot projects also emerged: Institutions like JPMorgan participated in "Project Guardian," simulating DeFi trades of tokenized bonds and foreign exchange using public blockchains.

However, U.S. regulators adopted a stricter stance amid market turmoil, causing some firms (like Nasdaq, which paused plans in late 2023) to delay or slow down crypto product rollouts pending clearer rules.

2023 – Renewed Institutional Interest:

2023 brought a cautious resurgence of institutional interest. Mid-year, BlackRock filed for a spot Bitcoin ETF, followed by similar filings from Fidelity, Invesco, and others. This wave of applications was a pivotal moment, especially given the SEC’s prior rejections of similar proposals. That same year, TradFi-backed crypto infrastructure went live: EDX Markets, a digital asset exchange supported by Charles Schwab, Fidelity, and Citadel, officially launched, offering institutions a compliant trading venue.

Simultaneously, the wave of traditional asset tokenization accelerated—for instance, private equity giant KKR tokenized part of its fund on the Avalanche blockchain, and Franklin Templeton migrated its U.S. Treasury-backed money market fund onto a public blockchain.

The international regulatory environment also improved (the EU passed MiCA, Hong Kong reopened crypto trading under new regulations), prompting U.S. institutions to prepare for global competition.

By the end of 2023, Ethereum futures ETFs were approved, and anticipation grew for spot ETF approvals. By year-end, it was evident that institutional adoption of crypto assets would accelerate if regulatory hurdles were removed.

Early 2024 – Approval of Spot ETFs:

In January 2024, the U.S. Securities and Exchange Commission (SEC) finally approved the first batch of spot Bitcoin ETFs (followed by Ethereum ETFs), marking a milestone in the mainstreaming of crypto assets on U.S. exchanges. This unlocked billions in capital for pensions, registered investment advisors (RIAs), and conservative portfolios previously unable to hold crypto.

Within weeks, crypto ETFs attracted massive inflows, significantly expanding investor participation. During this period, institutional crypto products continued to grow—from stablecoin initiatives (such as PayPal’s PYUSD) to investments by banks (like Deutsche Bank and Standard Chartered) in digital asset custody startups. As of March 2025, nearly every major U.S. bank, brokerage, and asset management firm has either launched crypto-related products or formed strategic partnerships within the crypto ecosystem—reflecting a comprehensive institutional entry since 2020.

Traditional Finance's View of DeFi (2023–2025)

Traditional finance (TradFi) approaches decentralized finance (DeFi) with both curiosity and caution.

On one hand, many institutions recognize the innovative potential of permissionless DeFi—public liquidity pools and automated markets performed robustly even during crises (e.g., decentralized exchanges continued operating smoothly during the 2022 market turmoil). Industry surveys show that most TradFi practitioners expect public blockchain networks to gradually become integral parts of their operations.

On the other hand, concerns about compliance and risk management lead most institutions to favor “permissioned DeFi” environments in the short term. These platforms typically run on private or semi-private blockchains, preserving DeFi’s efficiency while restricting participants to vetted entities.

A prime example is JPMorgan’s Onyx network, which operates proprietary stablecoins (JPM Coin) and payment channels for institutional clients—a kind of “walled garden” version of DeFi. Similarly, Aave Arc launched a permissioned liquidity pool in 2023, where all participants undergo KYC verification through whitelisted provider Fireblocks, combining DeFi technology with TradFi compliance requirements.

This dual-track perspective—embracing automation and transparency while maintaining control over participants—has defined TradFi’s approach to DeFi exploration through 2025.

Institutional DeFi Pilot Projects

Between 2023 and 2025, several prominent institutions explored the potential of decentralized finance (DeFi) through high-profile pilot programs. JPMorgan’s Onyx platform, in collaboration with other banks and regulators, participated in the Monetary Authority of Singapore (MAS)-led “Project Guardian,” completing tokenized bond trades and foreign exchange swaps on public blockchains, achieving instant atomic settlement via smart contracts.

These experiments demonstrated that even permissionless protocols (like Aave and Uniswap, after KYC-compliant modifications) can be utilized by regulated entities with appropriate safeguards. Asset management giant BlackRock launched the BlackRock USD Digital Liquidity Fund (BUIDL) at the end of 2023, tokenizing a U.S. Treasury money market fund.

Distributed via Securitize to qualified investors, BUIDL offered institutions a compliant way to hold tokenized yield-bearing assets on the Ethereum network—indicating rising acceptance of public blockchains, provided intermediaries ensure compliance.

Other examples include Goldman Sachs’ Digital Asset Platform (DAP), issuing tokenized bonds and facilitating digital repo transactions, and HSBC using the Finality blockchain platform for FX settlement.

These initiatives reflect a “learn-by-doing” strategy—large institutions conducting limited-scope trials of core activities like payments, lending, and trading to assess DeFi’s potential advantages in speed and efficiency.

Venture-Supported Infrastructure Development

A robust ecosystem of crypto infrastructure is emerging, often backed by venture capital and traditional financial institutions to bridge TradFi and DeFi. Custody and security providers such as Fireblocks, Anchorage, and Copper have raised substantial funding to develop “institutional-grade” platforms for storing and trading digital assets—including tools enabling secure access to DeFi protocols.

Compliance tech firms like Chainalysis and TRM Labs offer transaction monitoring and analytics, allowing banks to meet anti-money laundering (AML) requirements when interacting with public blockchains. Additionally, brokerages and fintech startups are simplifying DeFi complexity, offering user-friendly interfaces for institutions.

For example, crypto prime brokers now offer access to yield farming or liquidity pools as a service, handling complex on-chain operations off-chain. This VC-driven development of wallets, APIs, identity solutions, and risk management layers is gradually overcoming operational barriers for TradFi’s entry into DeFi, paving the way for deeper future integration.

By 2025, decentralized exchanges (DEXs) and lending platforms had begun integrating institutional gateways to verify counterparty identities.

Overall, TradFi’s perception of DeFi has undergone a profound shift: DeFi is no longer seen as a “wild west” to avoid, but rather a collection of financial innovations that can be cautiously leveraged within a compliant framework. Major banks are becoming **early adopters of DeFi in a controlled manner**, recognizing that ignoring DeFi’s growth could leave them behind in the next financial transformation.

U.S. Regulatory Environment and Global Comparison

In the crypto space, U.S. regulatory clarity has consistently lagged behind technological innovation, creating both friction and opportunity for TradFi’s entry. The SEC has taken a hardline stance: in 2023, it filed multiple high-profile lawsuits against major exchanges, accusing them of offering unregistered securities, and proposed rules that could classify many DeFi platforms as securities exchanges. This environment makes U.S. institutions more cautious about engaging with DeFi, as most DeFi tokens lack clear legal status.

However, from late 2024 to early 2025, a significant shift occurred. Under pressure, the SEC approved spot crypto ETFs—a pragmatic turn signaling changing attitudes. Court rulings such as Grayscale’s 2024 case began clarifying the scope of the SEC’s authority. The CFTC also played a role, maintaining its position that Bitcoin and Ethereum are commodities. While the CFTC penalized non-compliant DeFi operators in 2023, it also advocated for clearer frameworks to support innovation.

Meanwhile, the U.S. Treasury focused on DeFi from an AML perspective. Its 2023 DeFi illicit finance risk assessment highlighted how DeFi’s anonymity could be exploited by bad actors, foreshadowing potential future KYC obligations for decentralized platforms. Actions like the 2022 sanctions on Tornado Cash showed that even code-based services aren’t immune to legal scrutiny if linked to illicit flows.

For banks, U.S. banking regulators (OCC, Federal Reserve, FDIC) issued guidance limiting direct exposure to crypto assets, effectively steering institutional involvement toward regulated custody services and ETFs rather than direct use of DeFi protocols. As of March 2025, Congress had not passed comprehensive crypto legislation, though several proposals (e.g., stablecoin regulation, clearer definitions between securities and commodities) were in advanced discussion stages. This means U.S. financial institutions must proceed with extreme caution in DeFi: they often limit DeFi activities to sandbox trials or offshore subsidiaries, awaiting clearer regulatory direction. Clarity around stablecoins (which federal law may designate as a new form of payment tool) and custody rules (such as the SEC’s custody proposal) will significantly impact the depth of institutional participation in DeFi protocols within the U.S.

Europe: MiCA and Forward-Looking Regulation

In stark contrast to the U.S., the EU has enacted a comprehensive crypto regulatory framework—the Markets in Crypto-Assets Regulation (MiCA). By 2024, MiCA provided clear rules for crypto asset issuance, stablecoins, and service provider operations across member states. Combined with pilot programs for tokenized securities trading, MiCA gave European banks and asset managers certainty for innovation. By early 2025, European firms clearly understood how to apply for licenses to operate crypto exchanges or wallet services, and guidelines for institutional stablecoins and even DeFi were being developed. This relatively clear regulatory environment spurred European TradFi institutions to pilot tokenized bonds and on-chain funds.

For example, several EU commercial banks issued digital bonds through regulatory sandboxes and legally processed tokenized deposits under supervision. The UK followed a similar path, explicitly aiming to become a “crypto hub.” As of 2025, the UK Financial Conduct Authority (FCA) was finalizing rules for crypto trading and stablecoins, while the Law Commission had incorporated crypto assets and smart contracts into legal definitions. These steps could allow London-based institutions to launch DeFi-based services earlier than their U.S. counterparts—within certain limits.

Asia: Regulatory Balance and Innovation-Driven Approaches

Singapore and Hong Kong offer contrasting global regulatory models. Since 2019, the Monetary Authority of Singapore (MAS) has implemented a strict licensing regime for crypto firms while actively fostering DeFi innovation through public-private collaboration.

For example, DBS, a major Singaporean bank, launched a regulated crypto trading platform and participated in DeFi trades (such as tokenized bond transactions with JPMorgan). Singapore treats permissioned DeFi as a controllable experimental domain, reflecting a philosophy of developing sound rules through regulated experimentation.

Hong Kong, after years of restrictions, changed course in 2023 by introducing a new framework to license virtual asset exchanges and allow retail crypto trading under supervision. Backed by government support, this policy attracted global crypto firms and encouraged local banks to consider offering digital asset services within regulated environments.

Switzerland has promoted tokenized securities through its DLT Act, while the UAE established dedicated crypto rules via Dubai’s Virtual Assets Regulatory Authority (VARA). These examples illustrate a global spectrum of regulatory attitudes—from cautious acceptance to proactive promotion—highlighting the diversity and potential of crypto finance.

Impact and Differences in DeFi Participation

For U.S. financial institutions, fragmented regulations still largely restrict direct DeFi participation until compliant solutions emerge. Currently, U.S. banks focus more on consortium blockchains or trading tokenized assets that fit existing legal definitions. Conversely, in jurisdictions with clearer regulatory frameworks, institutions interact more freely with DeFi-like platforms.

For instance, European asset managers might provide liquidity to a permissioned lending pool, while Asian banks may internally use decentralized trading protocols for FX swaps—all while keeping regulators informed. However, the lack of global regulatory harmonization presents challenges: multinational institutions must balance strict rules in one region against opportunities in another. Many call for international standards or “safe harbor” policies specifically for DeFi to unlock its benefits—such as efficiency and transparency—without compromising financial integrity.

In summary, regulation remains the primary determinant of TradFi’s pace of DeFi adoption. As of March 2025, despite progress—such as the U.S. approving spot crypto ETFs and global regulators issuing tailored licenses—much work remains to establish sufficient legal clarity for institutions to embrace permissionless DeFi at scale.

Key DeFi Protocols and Infrastructure: Bridges to Traditional Finance

Many leading DeFi protocols and infrastructure projects are directly addressing TradFi needs, creating entry points for institutional use:

Aave Arc (Institutional Lending Market)

Aave Arc is a permissioned version of the popular Aave liquidity protocol, launched between 2022 and 2023, designed specifically for institutional users. It offers a private lending pool where only whitelisted participants who have completed KYC (Know Your Customer) verification can borrow and lend digital assets. By incorporating AML and KYC compliance mechanisms (supported by whitelisting agents like Fireblocks) and accepting only pre-approved collateral, Aave Arc addresses key TradFi concerns—counterparty trust and regulatory compliance—while retaining the lending efficiency driven by DeFi smart contracts. This design enables banks and fintech lenders to access secured loans via DeFi liquidity without exposure to the anonymity risks of public liquidity pools.

Maple Finance (On-Chain Capital Markets)

Maple is an institutional-grade, low-collateral lending market on-chain, akin to a syndicated loan market on blockchain. Through Maple, certified institutional borrowers (such as trading firms or mid-sized enterprises) can access global liquidity, with terms vetted and facilitated by “Pool Delegates.” This model fills a gap in traditional finance: low-collateral lending typically relies on personal networks and lacks transparency, whereas Maple brings transparency and 24/7 settlement. Since its 2021 launch, Maple has facilitated hundreds of millions in loans, demonstrating how creditworthy businesses can raise capital more efficiently on-chain. For TradFi lenders, Maple offers a way to earn stablecoin yields by lending to vetted borrowers, effectively simulating private debt markets while lowering operational costs. Maple exemplifies how DeFi can streamline loan origination and servicing (e.g., interest payments) via smart contracts, significantly reducing administrative overhead. This innovation provides traditional institutions with an efficient, compliant solution for on-chain capital markets.

Centrifuge (Real-World Asset Tokenization)

Centrifuge is a decentralized platform focused on bringing real-world assets (RWAs) into DeFi as collateral. It allows originators (in trade finance, invoice factoring, or real estate lending) to tokenize assets like invoices or loan portfolios into fungible ERC-20 tokens. These tokens can then be financed through DeFi liquidity pools (via Centrifuge’s Tinlake platform). This mechanism effectively connects traditional financial assets with DeFi liquidity—for example, small business invoices can be pooled and funded by global stablecoin lenders. For institutions, Centrifuge offers a template for converting illiquid assets into investable on-chain instruments, while transparent risk tranching reduces investment risk. It addresses a core pain point in TradFi: difficulty in credit access for certain industries. By leveraging blockchain, Centrifuge taps into a global pool of investors. By 2025, even large protocols like MakerDAO were sourcing collateral through Centrifuge, and traditional institutions were studying how this technology could lower capital costs and unlock new funding sources.

Ondo Finance (Tokenized Yield Products)

Ondo Finance offers tokenized funds, bringing traditional fixed-income opportunities to crypto investors. Notably, Ondo launched products like OUSG (Ondo Short-Term U.S. Treasury Fund)—a token fully backed by short-term U.S. Treasury ETFs—and USDY, a tokenized share of a high-yield money market fund. These tokens are issued under Regulation D to accredited investors and can be traded on-chain 24/7. Ondo acts as a bridge, packaging real-world bonds into DeFi-compatible tokens.

For instance, stablecoin holders can swap into OUSG to earn ~5% yield from short-term Treasuries, then seamlessly exit back to stablecoins. This innovation solves a shared challenge in both TradFi and crypto: bringing safety and yield from traditional assets into digital finance, while giving traditional fund managers new distribution channels via DeFi. Ondo’s multi-hundred-million-dollar tokenized Treasury products have drawn competitors and inspired traditional firms to follow suit, blurring the line between money market funds and stablecoins. This model not only expands investor choice but accelerates TradFi-DeFi convergence.

EigenLayer (Restaking and Decentralized Infrastructure)

EigenLayer is a new Ethereum-based protocol launched in 2023, enabling “restaking”—reusing the security of staked ETH to protect new networks or services. Though nascent, this technology holds significant implications for infrastructure scalability. EigenLayer allows new decentralized services (like oracle networks, data availability layers, or even institutional settlement systems) to inherit Ethereum’s security without building separate validator sets. For TradFi, this means future decentralized trading or clearing systems could operate atop existing trust networks (Ethereum), rather than starting from scratch. Practically, banks might deploy a smart contract service (e.g., for interbank loans or FX trades) and secure it via restaking—backed by billions in staked ETH—achieving levels of security and decentralization unattainable on permissioned ledgers. EigenLayer represents the cutting edge of decentralized infrastructure. While not yet directly used by TradFi, by 2025–2027 it may become a foundational pillar for next-generation institutional DeFi applications.

These examples show that the DeFi ecosystem is actively developing solutions aligned with TradFi needs—whether compliance (Aave Arc), credit analysis (Maple), RWA access (Centrifuge/Ondo), or robust infrastructure (EigenLayer). This convergence is bidirectional: TradFi is learning to use DeFi tools, while DeFi projects adapt to meet TradFi requirements. This dynamic interaction will ultimately foster a more mature, interconnected financial system, paving the way for future innovation.

The Future of Real-World Asset Tokenization

One of the most substantive intersections between traditional finance (TradFi) and crypto is the tokenization of real-world assets (RWA)—migrating traditional financial instruments (such as securities, bonds, and funds) onto blockchains. As of March 2025, institutional involvement in tokenization has moved beyond proof-of-concept to actual product deployment:

Tokenized Funds and Deposits

Several major asset managers have launched tokenized versions of their funds. For example, BlackRock’s BUIDL fund and Franklin Templeton’s OnChain U.S. Government Money Fund (which uses public blockchains to record shares) allow accredited investors to trade fund units as digital tokens. WisdomTree has introduced a series of blockchain-based funds (covering Treasuries, gold, etc.) aimed at enabling 24/7 trading and simplified investor access. These offerings typically comply with existing regulatory structures (e.g., issued as private securities under exemptions), but represent a crucial step toward trading traditional assets on blockchain infrastructure.

Additionally, some banks are exploring tokenized deposits (regulated liability tokens) representing bank deposits that can circulate on blockchains—attempting to combine bank-level security with crypto-speed transactions. These projects indicate institutions see tokenization as an effective way to enhance liquidity and shorten settlement times for traditional financial products.

Tokenized Bonds and Debt

The bond market is one of the early success stories of tokenization. Between 2021 and 2022, institutions like the European Investment Bank issued digital bonds on Ethereum, completing settlement and custody via blockchain instead of relying on traditional clearing systems. By 2024, firms like Goldman Sachs and Santander were facilitating bond issuances via private blockchains or public networks, showing that even large-scale debt offerings can be executed via distributed ledger technology (DLT).

Tokenized bonds offer instant settlement (T+0 vs. traditional T+2), programmable interest payments, and easier fractional ownership. This reduces issuance and management costs for issuers and offers investors broader market access and real-time transparency. Even government treasuries are exploring blockchain for bonds—for example, the Hong Kong government issued a tokenized green bond in 2023.

Although the current on-chain bond market remains small (in the hundreds of millions), growth is accelerating as legal and technical frameworks mature.

Tokenization of Private Market Securities

Private equity and venture capital firms are using tokenization to partially convert traditionally illiquid assets (like private fund shares or pre-IPO stock) into tradable forms, offering investors greater liquidity. For example, KKR and Hamilton Lane partnered with fintech firms (such as Securitize and ADDX) to launch tokenized fund shares, allowing accredited investors to buy tokens representing economic interests in these alternative assets. While still limited in scale, these efforts suggest that secondary markets for private equity or real estate may eventually operate on blockchains, reducing the liquidity premium investors demand for holding such assets.

From an institutional standpoint, tokenization’s core value lies in expanding distribution channels and unlocking capital potential by turning locked-up assets into tradable micro-units. This innovation not only enhances asset accessibility but injects new vitality into traditional finance.

Rise of Native DeFi Platforms

Notably, the tokenization trend isn't solely led by traditional institutions—native DeFi RWA platforms are tackling the same problems from another angle. Protocols like Goldfinch and Clearpool (alongside previously mentioned Maple and Centrifuge) are advancing on-chain financing for real-world economic activity without waiting for big banks.

For example, Goldfinch uses liquidity from crypto holders to fund real-world loans (such as to fintech lenders in emerging markets), effectively acting as a decentralized global credit fund. Clearpool offers a marketplace where institutions can launch uncollateralized lending pools anonymously (with credit scores), priced and funded by the market.

These platforms often collaborate with traditional institutions, forming hybrid models that blend DeFi transparency with TradFi trust mechanisms. For instance, fintech borrowers in Goldfinch’s lending pools may undergo third-party financial audits. This collaborative model ensures on-chain transparency while incorporating traditional financial prudence, laying a solid foundation for further tokenization development.

The future of real-world asset (RWA) tokenization is promising. In today’s high-interest-rate environment, demand for RWA yields in crypto markets is strong, further driving tokenization of bonds and credit (Ondo’s success is a prime example). For institutions, the efficiency gains from tokenized markets are highly attractive: transactions settle in seconds, markets operate 24/7, and reliance on intermediaries like clearinghouses is reduced. Industry estimates suggest that if regulatory hurdles are resolved, trillions of dollars in RWAs could be tokenized over the next decade. By 2025, early network effects are already visible—for instance, a tokenized Treasury bill can serve as collateral in a DeFi lending protocol, allowing institutional traders to borrow stablecoins against tokenized bonds for short-term liquidity—a capability impossible in traditional finance. This blockchain-native composability has the potential to revolutionize how institutions manage collateral and liquidity.

In conclusion, tokenization is bridging the gap between TradFi and DeFi more directly than any other trend. It not only brings traditional assets into the DeFi ecosystem (providing stable collateral and real cash flows on-chain) but also gives traditional institutions a testing ground (since tokenized tools can often operate in permissioned environments or under known legal frameworks). In the coming years, we may see larger-scale pilots—such as major exchanges launching tokenized platforms or central banks exploring wholesale CBDCs interoperable with tokenized assets—further cementing tokenization’s central role in the future of finance.

Challenges and Strategic Risks for Traditional Finance in DeFi

Regulatory Uncertainty

Despite vast opportunities, traditional financial institutions face numerous challenges and risks when integrating into DeFi and crypto. Among them, regulatory uncertainty is paramount. In the absence of clear and consistent regulations, banks fear that collaborating with DeFi protocols could be deemed illegal securities trading or unregistered asset dealing, exposing them to enforcement actions. Until laws are settled, institutions face potential regulatory backlash or penalties, making legal and compliance teams cautious about approving DeFi-related initiatives. This uncertainty is global, and differing cross-jurisdictional rules further complicate the cross-border use of crypto networks.

Compliance and KYC/AML

Public DeFi platforms often allow anonymous or pseudonymous participation, conflicting with banks’ Know-Your-Customer (KYC) and Anti-Money Laundering (AML) obligations. Institutions must ensure counterparties are not sanctioned or involved in money laundering. Although technologies enabling on-chain compliance—such as whitelists, on-chain identity verification, or dedicated compliance oracles—are evolving, the field remains immature. The operational risk of inadvertently facilitating illicit fund flows in DeFi poses significant reputational and legal threats, pushing TradFi toward permissioned or heavily regulated environments.

Custody and Security

Secure custody of crypto assets requires new solutions. Private key management introduces significant custody risks—loss or theft can be catastrophic. Institutions typically rely on third-party custodians or internal cold storage, but high-profile hacks in the crypto space make executives wary of security. Smart contract risk is also significant—funds locked in DeFi smart contracts may be lost due to bugs or attacks. These security concerns often lead institutions to limit crypto exposure or require strong insurance, which itself remains in early development.

Market Volatility and Liquidity Risk

Crypto markets are notoriously volatile. Institutions providing liquidity to DeFi pools or holding crypto on their balance sheets must endure sharp price swings, potentially impacting returns or regulatory capital. Moreover, during crises, DeFi liquidity can dry up rapidly, exposing institutions to slippage when unwinding large positions—or even counterparty risk if borrowers default (e.g., in undercollateralized loans). This unpredictability contrasts sharply with the more manageable volatility in traditional markets and the backstop provided by central banks.

Integration and Technical Complexity

Integrating blockchain systems with legacy IT infrastructure is complex and costly. Banks must upgrade systems to interact with smart contracts and manage 24/7 real-time data—a formidable task. Additionally, talent shortages pose a major hurdle—assessing DeFi code and risk requires specialized skills, forcing institutions to recruit or train experts in a competitive job market. These factors result in high initial entry costs.

Reputational Risk

Financial institutions must also consider public and client perception. Engaging with crypto is a double-edged sword: while it signals innovation, it may concern conservative clients or board members, especially after exchange collapses. If an institution becomes involved in a DeFi hack or scandal, its reputation could suffer. Many therefore proceed cautiously, running pilots behind the scenes until confident in risk management. Reputational risk also extends to unpredictable regulatory sentiment—negative comments from officials about DeFi could cast a shadow over affiliated institutions.

Legal and Accounting Challenges

Unresolved legal issues remain around digital asset ownership and enforceability. For example, if a bank holds a token representing a loan, is that legally recognized as owning the loan? Smart contract-based agreements lack mature legal precedent, adding further uncertainty. While accounting treatment is improving (expected to allow fair-value measurement by 2025), past issues (such as impairment rules) persisted, and regulatory capital requirements for crypto assets remain high (e.g., Basel III treating unsecured crypto as high-risk). These factors diminish the economic appeal of holding or using crypto assets from a capital perspective.

Faced with these challenges, many institutions adopt strategic risk management: starting with small pilot investments, testing via subsidiaries or partners, and proactively engaging regulators to shape favorable outcomes. They also join industry consortia to help define compliant DeFi standards (e.g., identity-embedded tokens or “DeFi passport” proposals for institutions). Overcoming these barriers is essential for broader adoption, and the timeline will depend primarily on regulatory clarity and the ongoing maturation of crypto infrastructure toward institutional standards.

Outlook 2025–2027: Scenario Analysis for TradFi-DeFi Convergence

Looking ahead, the degree of fusion between traditional finance and decentralized finance over the next 2–3 years may unfold along multiple paths. Below is an overview of optimistic, pessimistic, and neutral scenarios:

Optimistic Scenario (Rapid Integration)

In this positive scenario, regulatory clarity improves significantly by 2026.

For example, the U.S. might pass federal legislation clearly defining crypto asset categories and establishing regulatory frameworks for stablecoins and even DeFi protocols (perhaps creating new licenses or charters for compliant DeFi platforms). With clear rules, major banks and asset managers accelerate their crypto strategies—offering clients direct crypto trading and yield products, and using DeFi protocols for certain back-end functions (e.g., stablecoins for overnight funding markets).

Notably, stablecoin regulation could become a key catalyst: if dollar-backed stablecoins receive official approval and insurance, banks may begin widespread use for cross-border settlement and liquidity management, embedding stablecoins into traditional payment networks.

Technological improvements also play a role: Ethereum upgrades and Layer-2 scaling solutions make transactions faster and cheaper, while robust custody and insurance solutions become industry standards—enabling institutions to enter DeFi with lower operational risk.

By 2027, interbank lending, trade finance, and securities settlement may largely occur on hybrid decentralized platforms. In this scenario, Ethereum staking integration could also become common.

For example, corporate treasuries might treat staked ETH as a yield-generating asset (similar to digital bonds), adding a new asset class to institutional portfolios. This scenario envisions deep integration: TradFi institutions not only invest in crypto but actively participate in DeFi governance and infrastructure, helping build a regulated, interoperable DeFi ecosystem that complements traditional markets.

Pessimistic Scenario (Stagnation or Retreat)

In the pessimistic scenario, regulatory crackdowns and adverse events severely hinder TradFi-DeFi convergence. The SEC and other regulators may intensify enforcement without offering new compliant pathways—effectively banning banks from open DeFi and allowing contact only with a few approved crypto assets. By 2025–2026, most institutions would remain观望, limited to ETF investments and a few permissioned networks, avoiding public DeFi due to legal risk.

Additionally, one or two high-profile failures could further damage sentiment. For example, a major stablecoin collapse or systemic DeFi protocol hack causing institutional losses could reinforce the perception that “crypto is too risky.” In this scenario, global fragmentation worsens: the EU and Asia may advance crypto integration while the U.S. lags, causing American firms to lose competitiveness and possibly lobby against crypto to maintain fair market conditions. Traditional institutions might even resist DeFi, especially if they perceive it as a threat without viable regulatory support. This could lead to slowed innovation (e.g., banks promoting only private DLT solutions and discouraging clients from on-chain finance). Essentially, the pessimistic scenario depicts a failure to realize the promise of TradFi-DeFi synergy, with crypto remaining a niche or minor institutional investment area by 2027.

Neutral Scenario (Gradual, Steady Integration)

The most likely scenario lies between the two—a continuous, gradual integration that is slow but steady. In this baseline outlook, regulators will continue issuing guidance and narrow rules (e.g., stablecoin legislation may pass by 2025, the SEC may adjust its stance, perhaps exempting certain institutional DeFi activities or approving more crypto products case by case). While comprehensive reform won’t happen, each year brings incremental clarity.

Traditional financial institutions cautiously expand crypto involvement: more banks offer custody and execution services, more asset managers launch crypto or blockchain-themed funds, and more pilots connect bank infrastructure to public blockchains—especially in trade finance documents, supply chain payments, and secondary trading of tokenized assets. We may see consortium-led networks selectively interconnecting with public networks—e.g., a group of banks running a permissioned lending protocol that bridges to public DeFi protocols when additional liquidity is needed, all under agreed rules.

In this scenario, stablecoins may be widely used by fintech firms and some banks as settlement tools, but won’t replace major payment networks. Ethereum staking and crypto yield products may enter institutional portfolios at small scales (e.g., some pension funds allocating a tiny fraction to yield-generating digital asset funds). By 2027, in this neutral case, TradFi-DeFi integration is visibly deeper than today—say, 5–10% of certain market volumes or loans occurring on-chain—but it remains a parallel track to traditional systems, not a full replacement. More importantly, the trend is upward: successful early adopters will convince more conservative peers to join, especially as competitive pressures and client interest grow.

Key Drivers to Watch

Across all scenarios, several key drivers will determine the ultimate outcome of TradFi-DeFi convergence.

Foremost among them is regulatory dynamics—any move toward legal clarity (or conversely, new restrictions) will directly influence institutional behavior.

Of particular importance is the evolution of stablecoin policy: safe, regulated stablecoins could become the cornerstone of institutional-grade DeFi trading. Technological maturity is another major driver—ongoing improvements in blockchain scalability (via Ethereum Layer 2s, alternative high-performance chains, or interoperability protocols) and better tools (e.g., enhanced compliance integration, privacy-preserving transactions) will increase institutional comfort with DeFi.

Macroeconomic factors may also play a role: if traditional yields remain high, the urgency for DeFi yields may wane, dampening interest; but if yields fall, the appeal of DeFi’s extra yield could rise again.

Finally, market education and industry performance are crucial—each year that DeFi protocols prove resilient, each successful pilot (e.g., a major bank smoothly settling a $100M transaction via blockchain) builds market trust.

By 2027, we expect the debate over “whether TradFi should adopt DeFi” to shift to “how TradFi can best leverage DeFi,” much like how cloud computing in banking transitioned from skepticism to widespread adoption. Overall, the next few years may witness a move from cautious probing to deeper collaboration between TradFi and DeFi, with the pace shaped by the interplay of technological innovation and regulatory frameworks.

Highly Recommended:

“Tomorrow’s TradFi: The Rise of DeFi and Scalable Finance”

Risk Disclaimer:

insights4.vc and its newsletter provide research and information for educational purposes only and should not be considered professional advice of any kind. We do not endorse any investment activity, including buying, selling, or holding digital assets.

The content herein reflects the author’s personal views and is not financial advice. Please conduct your own due diligence before participating in cryptocurrency, DeFi, NFTs, Web3, or related technologies, as these areas carry high risk and significant value volatility.

Note: This research report did not receive sponsorship from any company mentioned.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News