Opinion: Why Do L1s Seem More Valuable Than L2s?

TechFlow Selected TechFlow Selected

Opinion: Why Do L1s Seem More Valuable Than L2s?

You'll see many L1s with low activity but valuations reaching billions of dollars, yet rarely find such L2s.

Author: taetaehoho, Chief Strategy Officer at Eclipse

Translation: Luffy, Foresight News

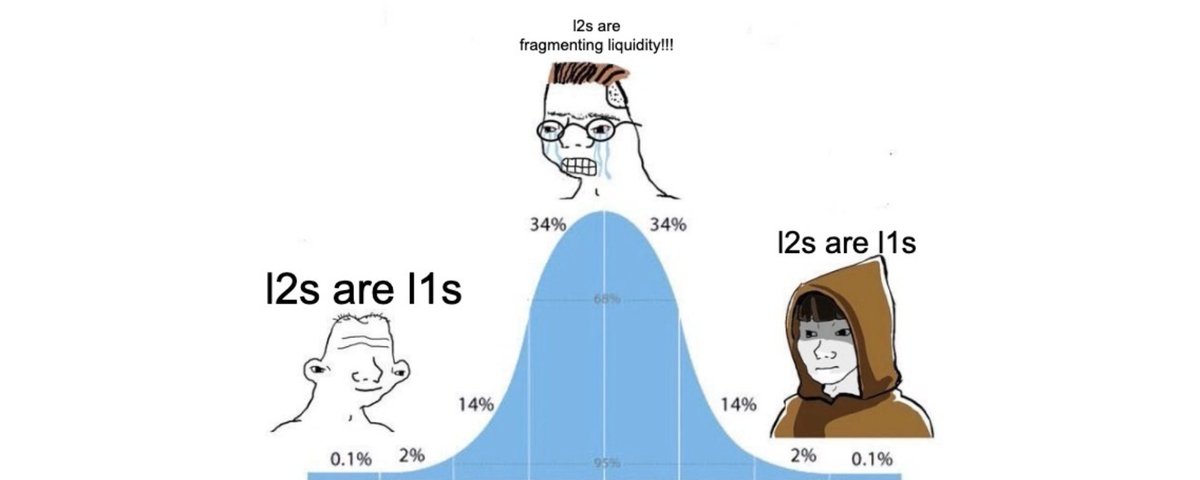

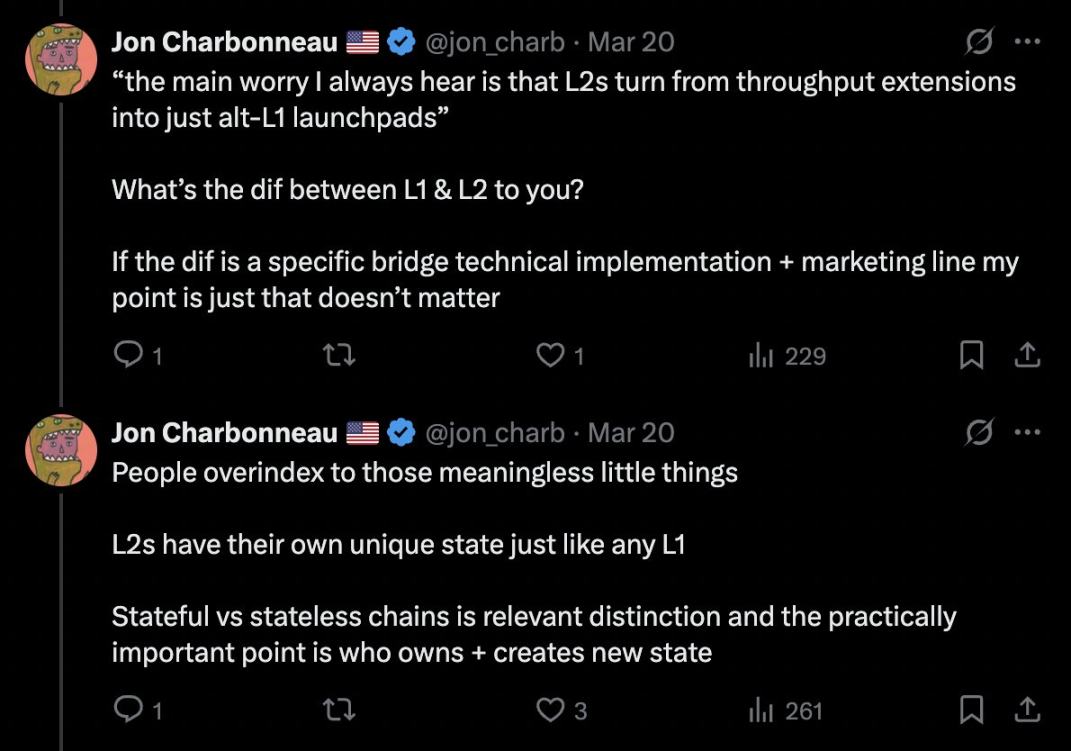

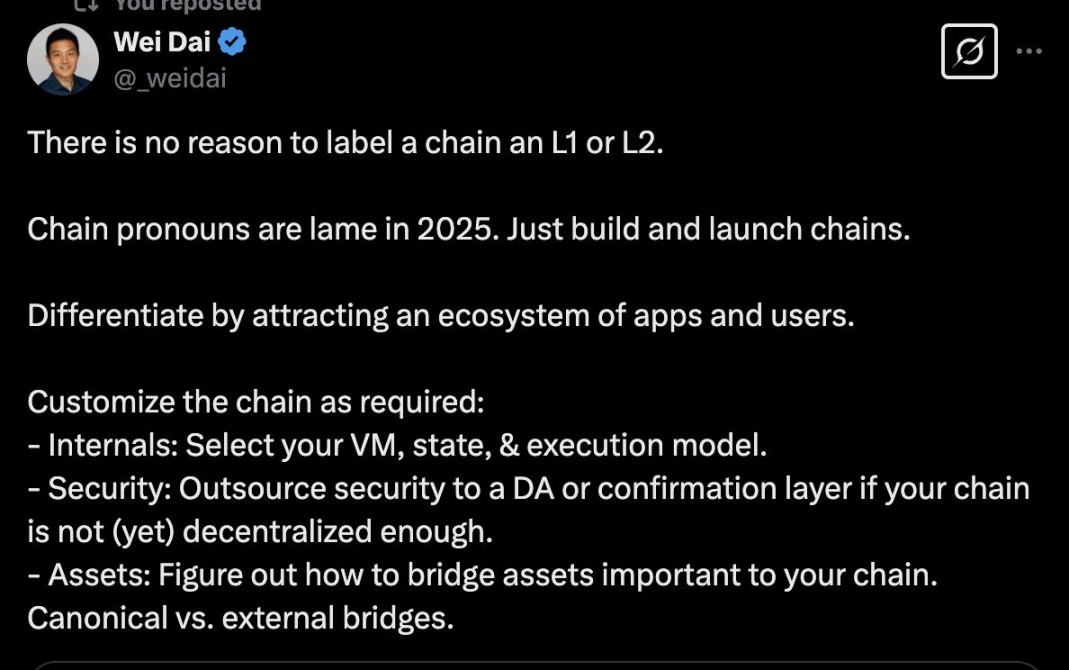

It's 2025—stop being confused about L1 and L2 blockchains.

You should really read these tweets a hundred times over.

From an end-user perspective, there is no product-level difference between L1s and L2s. There’s also no fundamental distinction or limitation regarding liquidity. A new L1 must bootstrap its liquidity by attracting stablecoins or non-native liquidity from other chains. Similarly, an L2 also needs to bring in stablecoins or non-native liquidity across chains to establish initial liquidity. An L2 is simply connected to an L1 via a trust-minimized bridge, whereas alternative L1s (non-mainstream L1s) lack such a bridging mechanism. We’ve seen that some whales are sensitive to these trust assumptions, but most regular users don’t care.

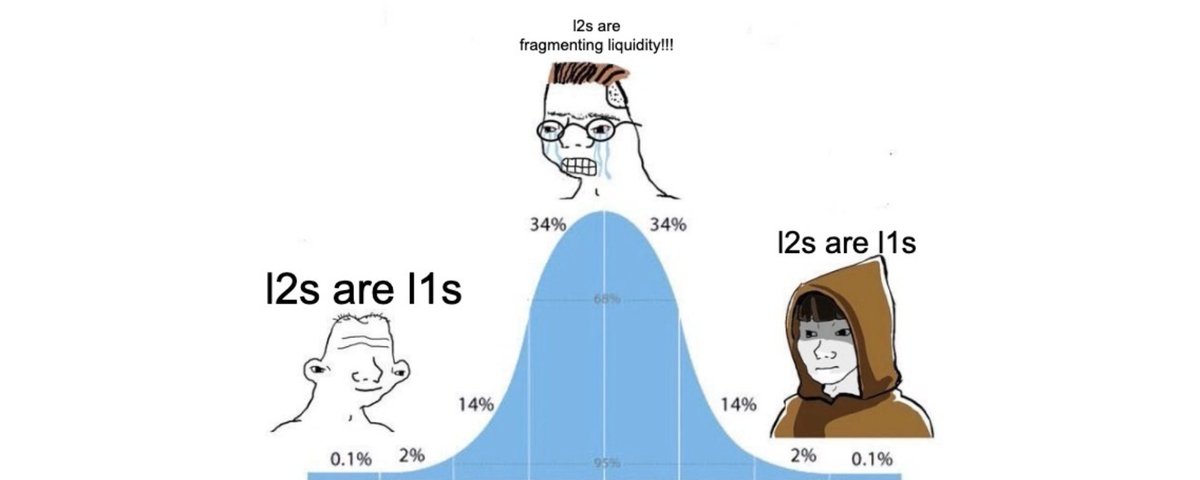

A rather mediocre argument—mostly pushed by those building alternative L1s—is that “L2s fragment liquidity.”

L2s merely offer a trust-minimized bridging method to an L1, and every L2 launched today connects not only to all alternative L1s but also to other L2s.

Every valuable L2 launches with cross-chain messaging bridges. Via the L1 as an intermediary, any participant connected to the base layer can transfer large amounts of capital between alternative L1s and L2s through Ethereum or Solana. If an alternative L1 isn’t directly connected to an L2, it might make capital outflows slightly harder—but if it integrates messaging bridges, this argument becomes self-contradictory.

The essence of an L2’s product isn’t defined by its relationship to an L1. It’s simply an execution layer, just like other execution layers with different characteristics.

So why are L1s more valuable than L2s?

Two reasons.

1. Are L1s inherently more valuable than L2s?

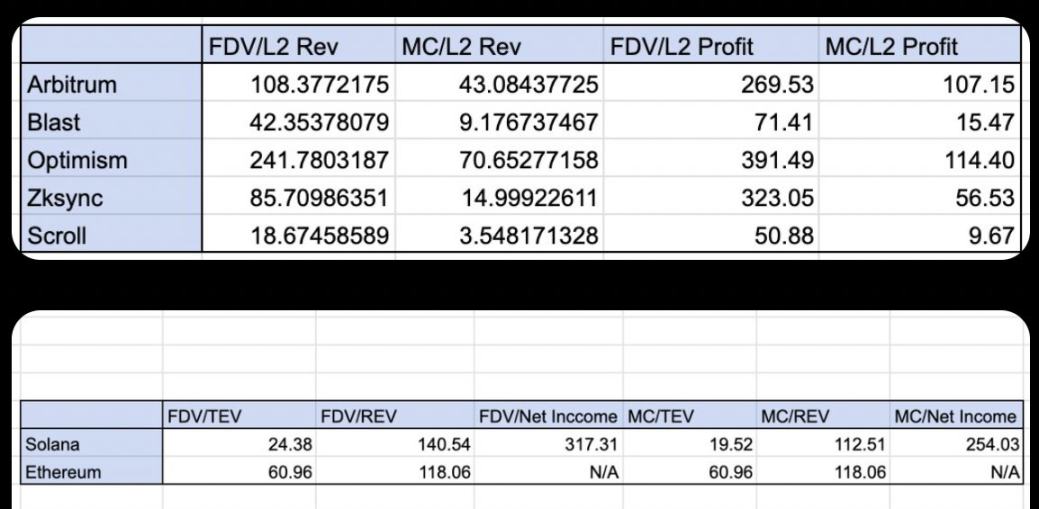

Not necessarily more valuable: Higher activity on L1s. Solana and Ethereum have market cap-to-revenue (REV) multiples around 100x. Mature L2s fall into a similar range, roughly between 10x and 200x. (Data from October 2024, but the point still holds.)

From this angle, the valuation multiples of mature L1s and mature L2s are relatively close—for example, comparing Arbitrum and Optimism to Solana and Ethereum.

More valuable case: L1s see far more frequent occurrences of unjustifiably high valuations than L2s. In other words, you’ll find many low-activity L1s valued at billions, while such outliers are rarer among L2s.

-

L1s: Sui, Mantra, Pi, ICP, IP

-

L2s: Move

In my view, this stems from an early positioning misstep by the first L2s. Arbitrum and Optimism positioned themselves as Ethereum extensions—execution layers helping scale Ethereum. Combined with Ethereum’s rollup-centric roadmap, this was a solid initial go-to-market strategy.

But the downside is that it capped their total addressable market (TAM) within the Ethereum user base, setting hard ceilings on the total liquidity, attention, and revenue these chains could capture. Arbitrum and Optimism initially marketed themselves as Ethereum scaling solutions—even though they had the capability to attract entirely new decentralized applications and participants, including projects that weren’t originally on Ethereum. This is precisely why they continue to be perceived as subsets of Ethereum (and thus valued only as a fraction of the base layer). To be fair, when they launched, Ethereum was practically the only major blockchain in the market.

2. Token Model

L1 token models benefit from a core network flywheel effect: increased activity on the L1 directly drives token demand from two distinct participant groups—searchers/users and stakers.

Higher activity means users (searchers) are willing to pay more to get their transactions included in blocks. Greater entropy from diverse activities increases the probability, frequency, and scale of competition for economic opportunities. On the staking side, the more fees a chain earns, the more people want to stake the L1’s native token to earn a share of those revenues. Activity also correlates with new asset issuance, which often ties back to the L1’s native token—users must acquire the native token to participate (e.g., minting NFTs with ETH, buying memecoins with SOL).

How should L2s respond?

1. Mindset Shift

L2s need to decide whether they want to remain aligned as an L2 of a specific L1 or aim to attract users from any source. L2 builders should fully leverage the unique technical advantages of L2s—trusted/customizable block building, performance optimization.

2. Improved Tokenomics

L2s should refine their token economics so they too can create a flywheel: increasing network activity should drive token demand from both searchers/users and stakers.

Today, L2s are experimenting with custom gas tokens, which only addresses the searcher/user side—not benefiting stakers. Theoretically, since most L2s funnel sequencer profits into a decentralized autonomous organization (DAO) treasury, and tokens govern access to that DAO, this may seem equivalent. But for token holders to perceive real value, they need stronger governance rights and clearer economic alignment.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News