GameStop's "unexpected" entry into the market? Can BTC hold its ground?

TechFlow Selected TechFlow Selected

GameStop's "unexpected" entry into the market? Can BTC hold its ground?

The U.S. February core PCE price index, to be released this Friday, could become the key variable disrupting market equilibrium.

Article: BitpushNews

Over the past 24 hours, the cryptocurrency market has shown a mild rebound, with Bitcoin price fluctuating narrowly around $87,400 and Ethereum slightly pulling back to $2,070. Among major cryptocurrencies, Solana (SOL) rose逆势 by 2%, reaching a daily high of $146.

As of March 26 Beijing time, the total crypto market cap edged up 0.4% to $2.87 trillion, while the Market Sentiment Index (Fear & Greed Index) dropped to 34, indicating investors remain cautious.

On the news front, former "Wall Street meme" stock and game retailer GameStop officially announced on the 25th local time that its board had unanimously approved adding Bitcoin to its balance sheet reserves. GameStop surged 7% in after-hours U.S. trading, lifting its share price to $27.19.

This decision was foreshadowed two months ago when photos emerged of GameStop CEO Ryan Cohen meeting with BTC bull Michael Saylor. Afterward, major shareholder Strive Asset Management publicly urged the company to follow MicroStrategy's holding strategy. Strive CEO Matt Cole stated at the time: "We believe GameStop can improve its financial position by purchasing Bitcoin—a strategic allocation."

Is BTC Emerging from Consolidation?

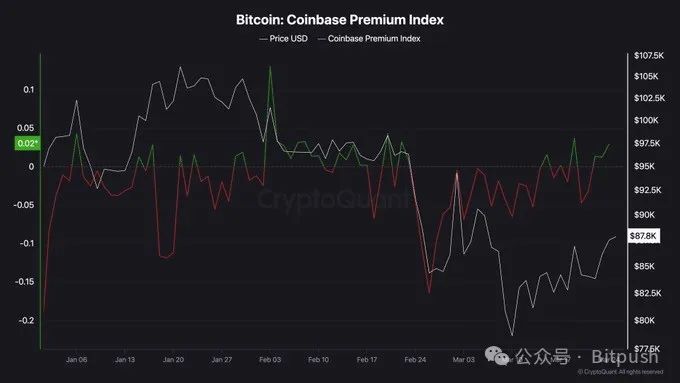

On-chain data reveals new capital flow trends. According to CryptoQuant, despite stable Bitcoin price movements, key signals are emerging:

Institutional fund migration: Over the past 24 hours, there were 17 single BTC transfers exceeding $100 million each, with total on-chain transfer volume surging 268%, hitting a three-month high.

Exchange flows: Coinbase showed a premium as high as 0.3%, while exchange BTC reserves dropped by 1%, with approximately 12,000 BTC flowing into cold wallets. This "low volatility, high turnover" pattern suggests institutional investors may be conducting large-scale custodial asset shifts.

Derivatives market equilibrium: Perpetual contract funding rates have returned to a neutral 0.01%, while options volatility surfaces show the put/call ratio (PCR) has declined to 0.85, indicating a slight recovery in bullish sentiment.

Notably, Bitcoin's Net Unrealized Profit/Loss (NUPL) indicator has fallen from last week's 0.68 to 0.55, suggesting some short-term holders are taking profits. However, Glassnode data shows addresses holding over 1,000 BTC increased by 12, indicating whales continue accumulating quietly.

Hani Abuagla, Senior Analyst at XTB MENA, believes Bitcoin is emerging from the second-deepest correction phase of this cycle. If Fed rate cut expectations align with easing trade policies, the possibility of breaking above $100,000 this spring remains viable.

Macro Variable: PCE Data as Key Litmus Test

This Friday (March 28), the release of the U.S. February core PCE price index could become the key variable disrupting market balance. As the Fed's most watched inflation metric, market expectations suggest the core PCE year-on-year growth may slightly rise from January’s 2.6% to 2.7%. Should the figure exceed expectations, it could further delay market expectations for rate cuts.

Current CME FedWatch tool data shows traders have narrowed their expectations for Fed rate cuts this year to 50–75 basis points, with the first cut potentially delayed until Q3. If PCE data reinforces the "sticky inflation" narrative, U.S. Treasury yields could rise again, strengthening the dollar and creating short-term pressure on risk assets. In the current market environment, even minor fluctuations in inflation data could indirectly influence crypto market direction by altering liquidity expectations.

TradingView analysts suggest that for short-term traders, monitoring Bitcoin's breakout direction from the $87,000 support and $90,000 resistance levels—combined with volatility strategies using low-IV options—is advisable. For medium-to-long-term holders, the on-chain MVRV ratio (1.98) remains below historical bull market peaks (3.5), and holder distribution metrics indicate healthy coin concentration. Dipping in on pullbacks with staggered entries remains a viable strategy.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News