From Faking Circulating Supply to Price Manipulation: The New Harvesting Logic of High-FDV Tokens

TechFlow Selected TechFlow Selected

From Faking Circulating Supply to Price Manipulation: The New Harvesting Logic of High-FDV Tokens

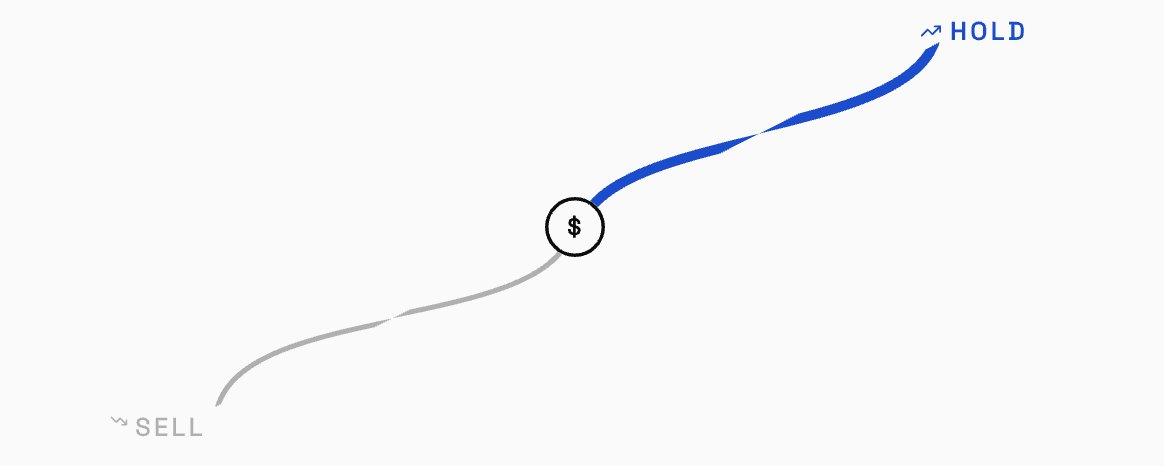

Reducing circulation is beneficial for these projects, as it makes price manipulation easier.

Author: Mosi

Translation: TechFlow

In the token space, perception is everything. Much like Plato’s “Allegory of the Cave,” many investors remain trapped in shadows—misled by distorted projections of value created by bad actors. In this article, I will expose how some venture capital (VC)-backed projects systematically manipulate their token prices through the following methods:

-

Maintaining an artificially high FALSE float.

-

Keeping the REAL float as low as possible (to make price manipulation easier).

-

Leveraging the fact of extremely low real supply circulation to inflate token prices.

Shifting from the “low float / high FDV” model to the “false float / high FDV” model.

Image: No! I'm not a low-float/high-FDV token! I'm "community-first"!

Earlier this year, memecoins surged in popularity, pushing many VC-backed tokens out of the mainstream spotlight. These tokens were labeled as “low float / high FDV.” However, with the launch of Hyperliquid, investing in many VC-backed tokens has become increasingly difficult. Faced with this reality, rather than fixing flawed tokenomics or focusing on building real products, some projects have doubled down—intentionally suppressing circulating supply while publicly claiming otherwise.

Suppressing circulation benefits these projects because it makes price manipulation significantly easier. Through behind-the-scenes arrangements—such as foundations selling locked tokens for cash and then repurchasing them on open markets—capital efficiency is greatly enhanced. Moreover, this creates extreme risk for short sellers and leveraged traders, as low real float makes these tokens highly vulnerable to sudden price pumps and dumps.

Next, let's examine some real-world examples. This is by no means an exhaustive list:

-

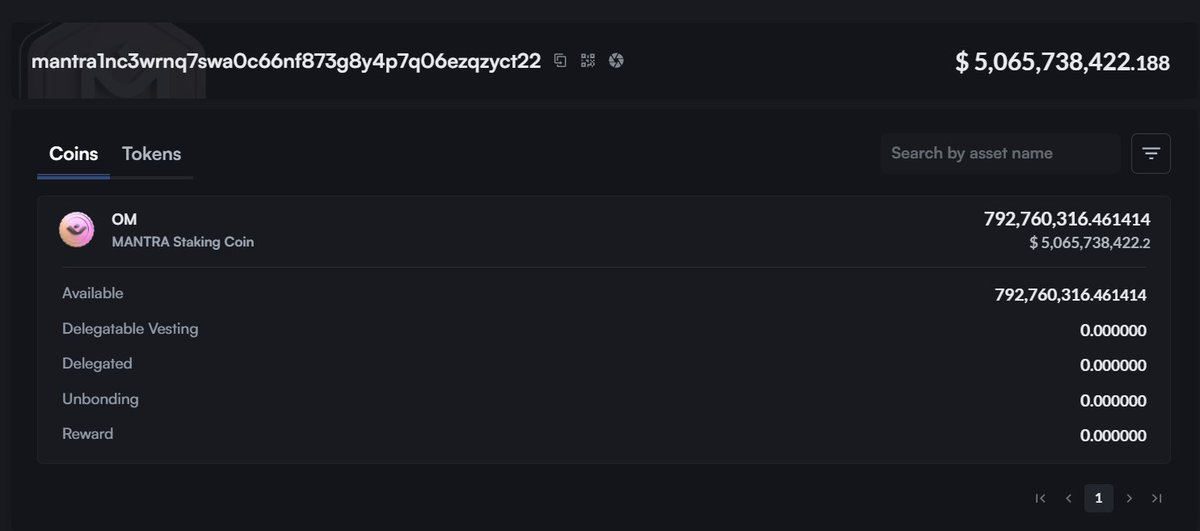

@MANTRA_Chain: This is perhaps the most blatant case. For those wondering how a project with only $4 million in total value locked (TVL) can boast a fully diluted valuation (FDV) exceeding $10 billion, the answer is simple: they control the vast majority of the $OM supply. Mantra holds 792M $OM (90% of total supply) in a single wallet. It’s not complicated—they didn’t even bother distributing these holdings across multiple wallets.

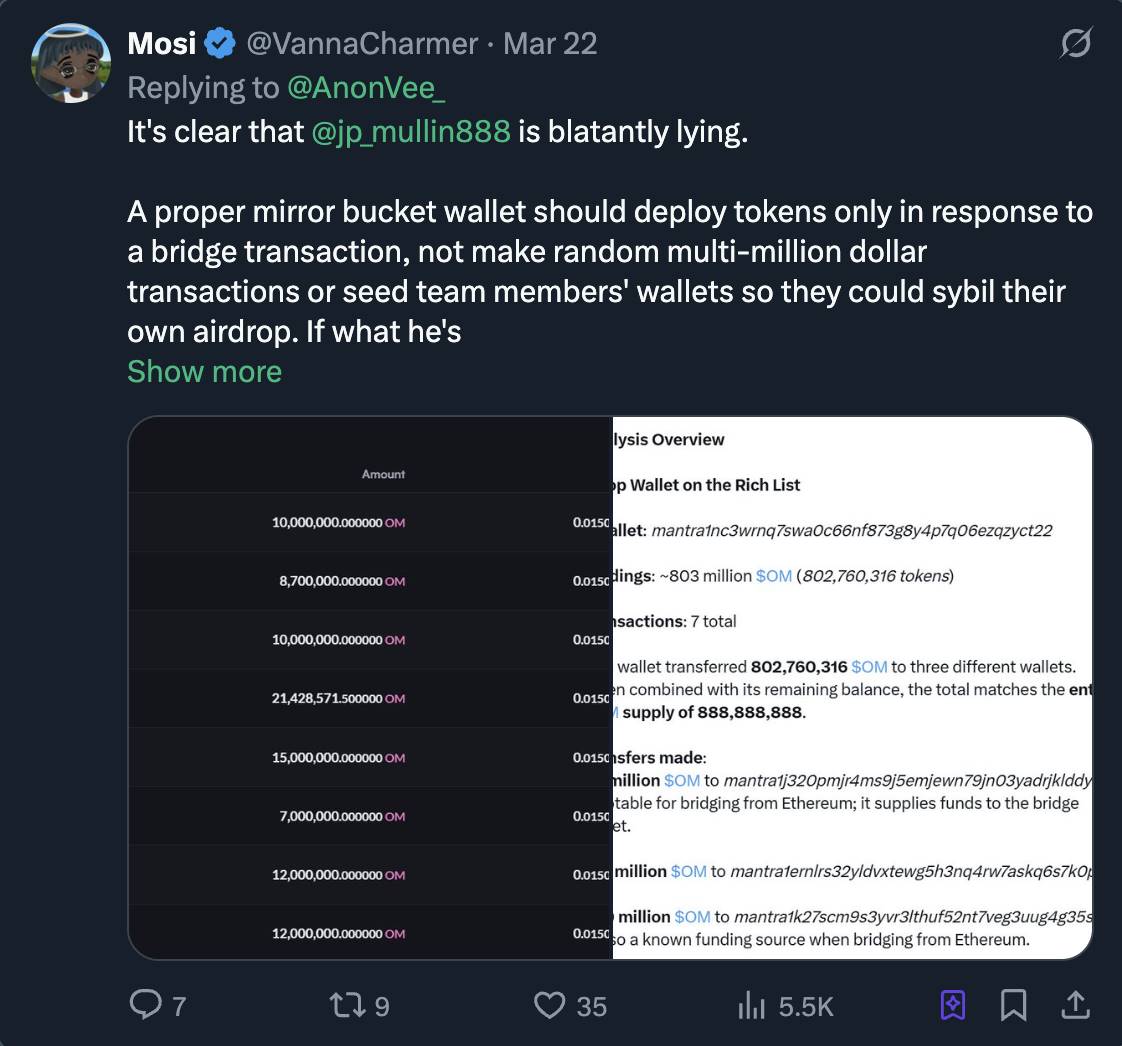

When I asked @jp_mullin888 about this, he claimed it was a “mirror storage wallet.” That’s complete nonsense.

So how do we determine Mantra’s actual circulating supply (real float)?

We can calculate it as follows:

980M (reported circulating supply) - 792M $OM (controlled by team) = 188M $OM

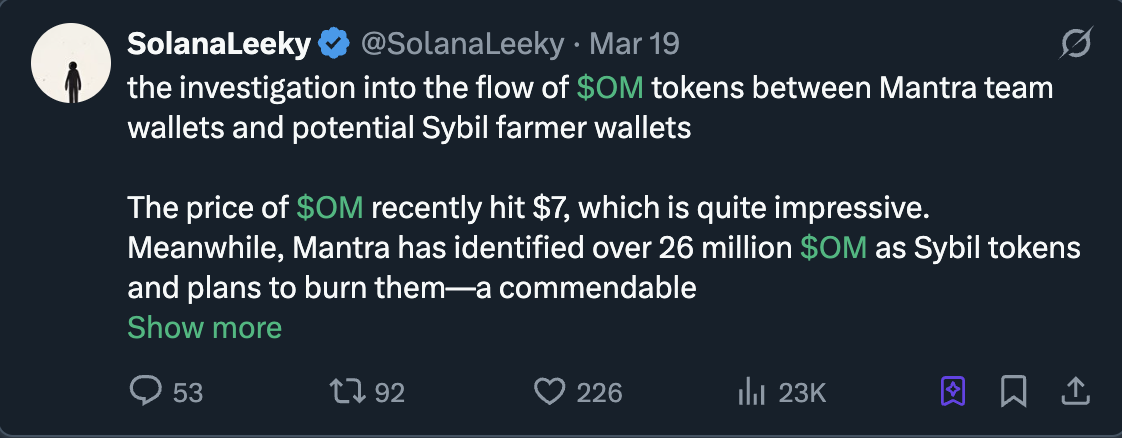

However, even this 188M number may be inaccurate. The team still controls a significant portion of $OM, which they use to sybil-attack their own airdrop, extract exit liquidity, and maintain control over circulation. They deployed approximately 100M $OM to sybil their own airdrop, so we must also subtract that amount from the real float. More details here:

Ultimately, the true circulating supply is… drumroll… just 88M $OM! (Assuming the team doesn’t control more supply—an assumption that clearly doesn’t hold water). This results in a real float market cap of merely $5.26 million, starkly contrasting with the $6.3 billion shown on CoinMarketCap.

A low real float makes manipulating $OM’s price effortless and allows easy liquidation of any short positions. Traders should fear shorting $OM, as the team controls most of the supply and can pump or dump at will. It’s akin to gambling against @DWFLabs on some shitcoin. I suspect current price action might involve Tritaurian Capital—which borrowed $1.5 million from @SOMA_finance (@jp_mullin888 is a co-founder of SOMA, and Tritaurian is owned by Jim Preissler, JPM’s boss at Trade.io)—alongside funds and market makers from the Middle East. These operations further compress the real float, making accurate calculations even harder.

This may also explain their reluctance to distribute airdrops and insistence on vesting periods. Had they truly distributed the airdrop, the real float would have increased significantly, likely causing a sharp price drop.

This isn’t sophisticated financial engineering—it appears to be a deliberate strategy aimed at minimizing real token circulation to inflate $OM’s price.

-

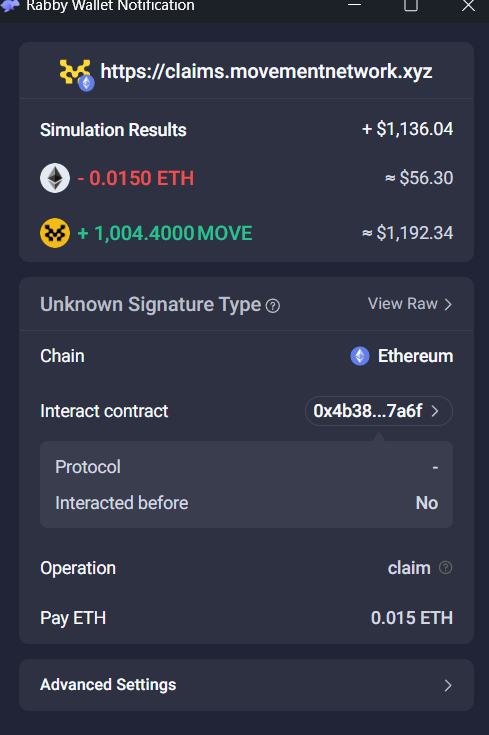

@movementlabsxyz: During the airdrop claim process, Movement allowed users to choose between claiming on Ethereum Mainnet or, for a small bonus, on their yet-to-be-launched chain. However, just hours after claims opened, they implemented several restrictive measures:

-

Added a 0.015 ETH fee (around $56 at the time), plus gas fees, for all claims on Ethereum Mainnet—discouraging many testnet users with small balances;

-

Reduced Ethereum Mainnet allocation by over 80%, while keeping the fee;

-

Limited the claim window to a very short timeframe.

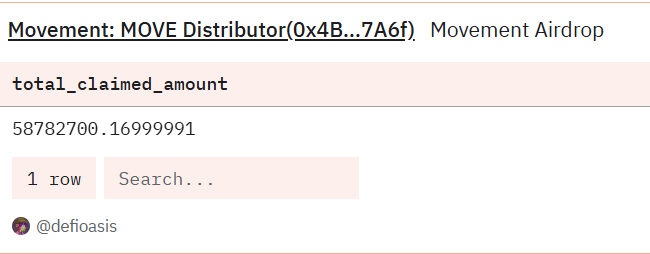

The result? Only 58.7 million MOVE were claimed—just 5% of the planned 1 billion distribution.

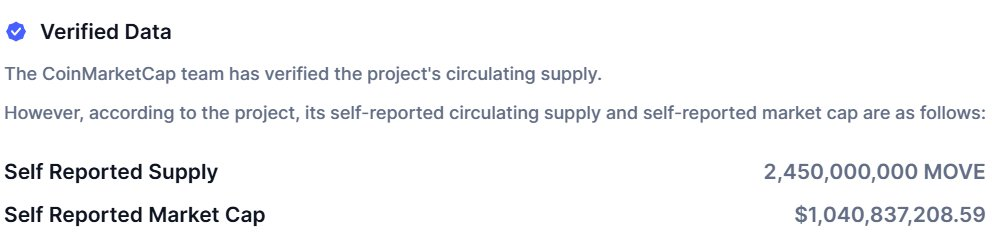

Now, let’s apply the same analysis used for Mantra to calculate MOVE’s real float. According to CoinMarketCap, MOVE’s self-reported circulating supply is 2.45 billion (2,450,000,000).

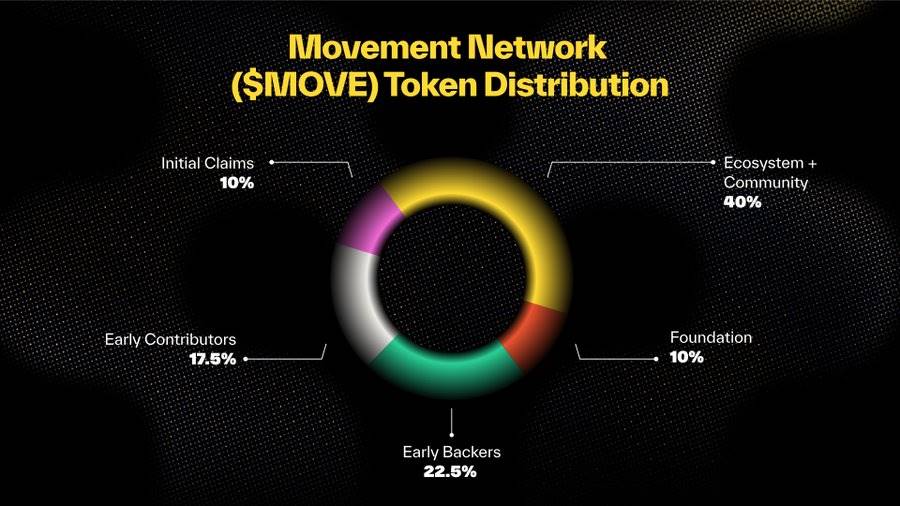

Yet, according to Move’s pie chart data, only 2 billion (2B) MOVE (foundation + initial claims) should be in circulation post-airdrop. Already, there’s a discrepancy—450 million unaccounted MOVE raises red flags.

Calculation:

2,450,000,000 MOVE (self-reported circulating supply) - 1,000,000,000 MOVE (foundation allocation) - 941,000,000 MOVE (unclaimed supply) = 509 million (509,000,000) MOVE, or a REAL float valued at $203 million.

This means the real float is only 20% of the reported circulating supply! Furthermore, I find it hard to believe every one of these 509 million MOVE is actually in users’ hands—but assuming it is, let’s accept this as the real float for now.

What happened during this period of extremely low real float?

-

Movement paid WLFI to buy MOVE tokens.

-

Movement paid REX-Osprey to file an ETF application for MOVE.

-

Rushi (project lead) visited the New York Stock Exchange (NYSE).

-

Movement engaged in complex arrangements with funds and market makers, selling locked tokens for cash so institutions could bid up the price.

-

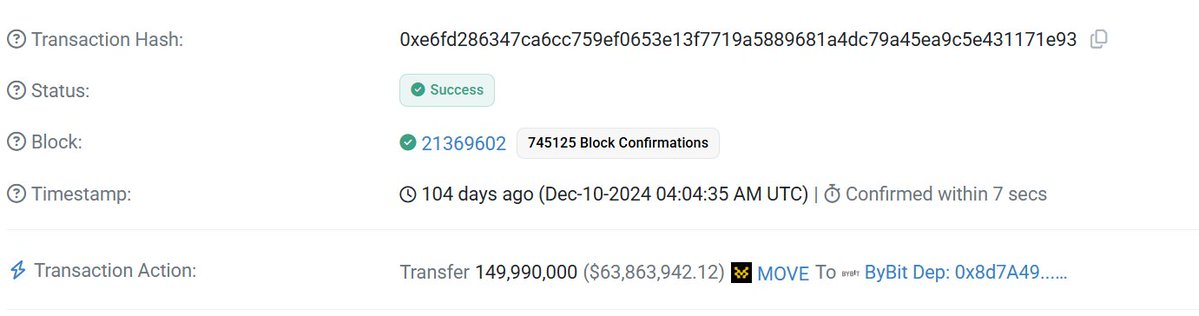

The team deposited 150 million MOVE into Bybit at the price peak. They likely began dumping from the top, as the price has been declining ever since.

-

In the months leading up to and following the token generation event (TGE), the team paid a Chinese KOL marketing agency $700,000 per month to secure Binance listing and gain more exit liquidity in Asian markets.

Is this a coincidence? I don’t think so.

As Rushi put it:

Kaito:

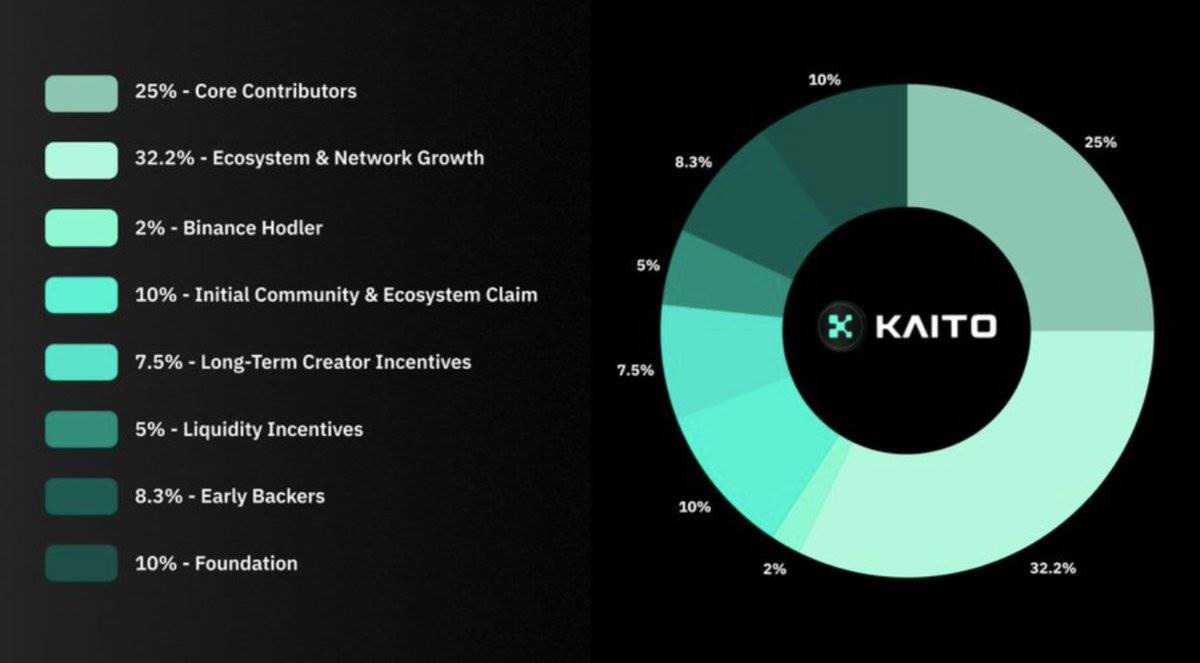

@Kaitoai is the only project on this list with an actual product. However, they’ve exhibited similar behavior in their current airdrop campaign.

As CBB pointed out above, Kaito distributed their airdrop, but only a tiny fraction was actually claimed—again affecting the real float. Let’s calculate:

CoinMarketCap reports Kaito’s circulating supply at 241 million (241,000,000), with a market cap of $314 million. I assume this includes Binance holders, liquidity incentives, foundation allocation, and initial community/claim shares.

Let’s break it down to find the real float:

Real Float = 241,000,000 KAITO - 68,000,000 (unclaimed) - 100,000,000 (foundation-held) = 73,000,000 KAITO

This implies a real float market cap of just $94.9 million—far below the figure reported by CMC.

Kaito is the only project here I’m somewhat willing to trust, as they at least have a revenue-generating product and, to my knowledge, haven’t engaged in the same level of questionable activities as the other two teams.

Solutions & Conclusion

-

CMC and Coingecko should display real circulating supply instead of relying on unverified numbers submitted by teams.

-

Exchanges like Binance should actively penalize such behavior. The current listing model is broken—projects like Movement can simply pay a KOL marketing firm to boost Asian engagement before TGE.

-

Prices may have changed since I wrote this, but for reference, the prices I used were: Move at $0.4, KAITO at $1.3, and Mantra at $6.

-

If you're a trader, stay away from these tokens. The teams can manipulate prices at will. They control nearly all the supply, meaning they also control liquidity flows and price movements. (Not financial advice, NFA)

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News