Investment Analysis of PoL Model, U.S. Stock Tokenization, and AI Agents

TechFlow Selected TechFlow Selected

Investment Analysis of PoL Model, U.S. Stock Tokenization, and AI Agents

Two promising annual narratives I'm particularly bullish on: humanoid robots + Nasdaq listing of U.S. stocks.

Author: Rain Sleeping

1. Berachain's PoL is essentially a larger two-pool system. @0xYond has already made this clear in his tweets.

At least in the short term, I’m bullish on $BERA’s price performance.

2. I was more involved with Sonic earlier, but recently hold only a small amount of $S and haven’t participated much in its ecosystem, so I won’t comment much. However, Sonic’s热度 (heat) remains solid—worth watching and engaging more.

Personally, I think $SUI is bottoming out, so I bought ZLP from @zofaiperps, which consists of 60% $SUI, 20% $DEEP, and 20% USDC.

Link: https://app.zofinance.io?r=sleeping

After the UUU incident, I cleared all tokens on BSC except $BID. During the community vote, $BID received support from many AI projects like $IO and $ATH—this surprised me.

3. Bittensor $TAO

No major catalysts lately, but the dTAO model has indeed intensified subnet competition, leading to encouraging product progress. However, it hasn’t impacted dTAO’s price. I’m bullish on SN52 (Yzi invested in Tensorplex), SN64 (Bittensor infrastructure), and SN34 (underperforming). Some new subnets have emerged—I haven’t reviewed them yet but will check and update later.

4. Base

Two macro narratives I’m currently bullish on: humanoid robots and tokenized stocks on U.S. exchanges. Base has projects in both categories, though they’re not widely discussed—e.g., @BackedFi, @AukiNetwork, @SamIsMoving.

Also, $CLANKER—I’m bullish for two reasons:

-

Clanker is confirmed for listing on Coinbase;

-

Many projects are already building on Clanker—its ecosystem is growing rapidly. You could even crudely view Clanker as Base’s token issuance engine.

Another direction for Base is Layer3, but I haven’t seen significant near-term catalysts yet (Parallel/Wayfinder’s Colony game is launching on Solana; the next one will be on B3).

Btw, Injective is also working on tokenizing U.S. stocks—could become $INJ’s next growth driver.

5. AI Agent

I’m particularly bullish on prediction-focused agents, so I bought $BILLY. Already took profits. Will keep monitoring this space.

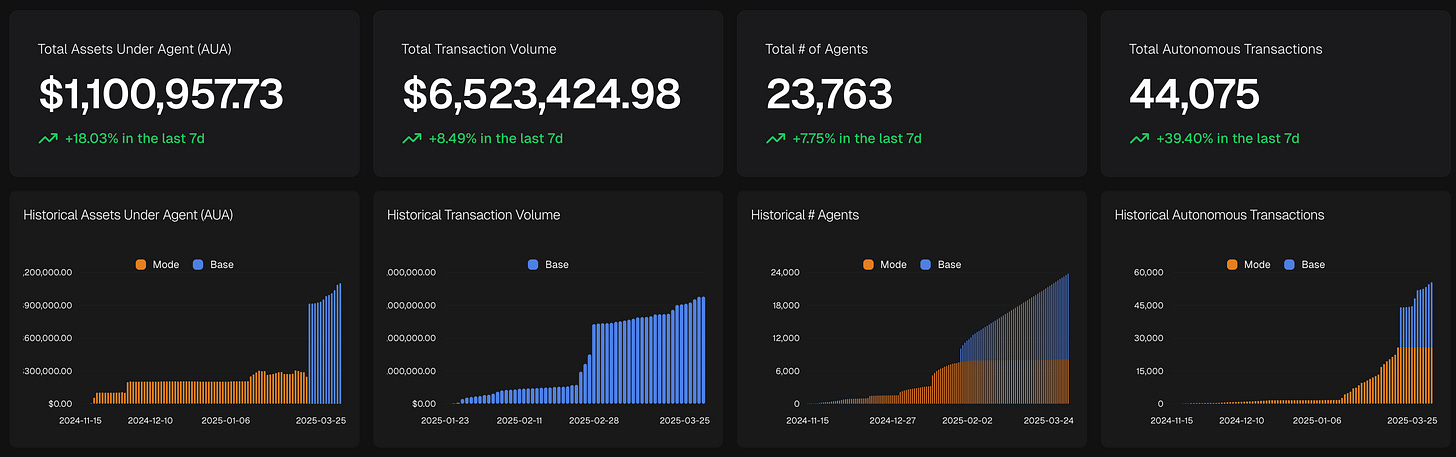

In the current DeFAI phase, I’ve only seen one decent product: ARMA by @gizatechxyz, a financial advisor agent with strong growth metrics. Giza is better than ElizaOS, less vulnerable to Context Manipulation attacks.

https://x.com/renckorzay/status/1904192278572179583

I find his point very valid⬇️—too many people underestimate the complexity of UI/UX similar to ChatGPT. This leads to excessive abstraction layers in DeFAI and extremely low user adoption. While DeFAI’s vision is great, most teams struggle at the “reasoning” layer—platforms require highly specific prompts from users, rather than letting the platform interpret and understand intent like ChatGPT does.

https://x.com/Defi0xJeff/status/1903078552981172558

This is exactly why I believe Giza ARMA stands out.

For gaming, my top pick right now is @AIWayfinder. That’s why I bought a Parallel Avatar NFT—not sure if there’ll be a $PROMPT airdrop, so it’s somewhat speculative. I could’ve staked $PRIME instead, but I prefer to avoid lock-up staking mechanics. Also, Colony’s game launch should benefit Avatar NFTs.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News