Fed holds benchmark rate steady in March, BSC reignites MEME frenzy

TechFlow Selected TechFlow Selected

Fed holds benchmark rate steady in March, BSC reignites MEME frenzy

Hotcoin Research Market Insights: March 17 - March 21, 2025.

Cryptocurrency Market Performance

Currently, the total market capitalization of cryptocurrencies stands at $2.83 trillion, with BTC accounting for 60.6%, or $1.72 trillion. The market cap of stablecoins is $230.3 billion, up 0.87% over the past seven days, with USDT representing 62.46%.

This week, BTC has shown range-bound price action, currently trading at $83,936; ETH has also traded sideways, now at $1,967.

Among the top 200 projects on CoinMarketCap, most have risen while a minority declined: FORM gained 109.18% over seven days, CAKE rose 47.98%, AUCTION surged 79.15%, and ZRO increased 78.05%.

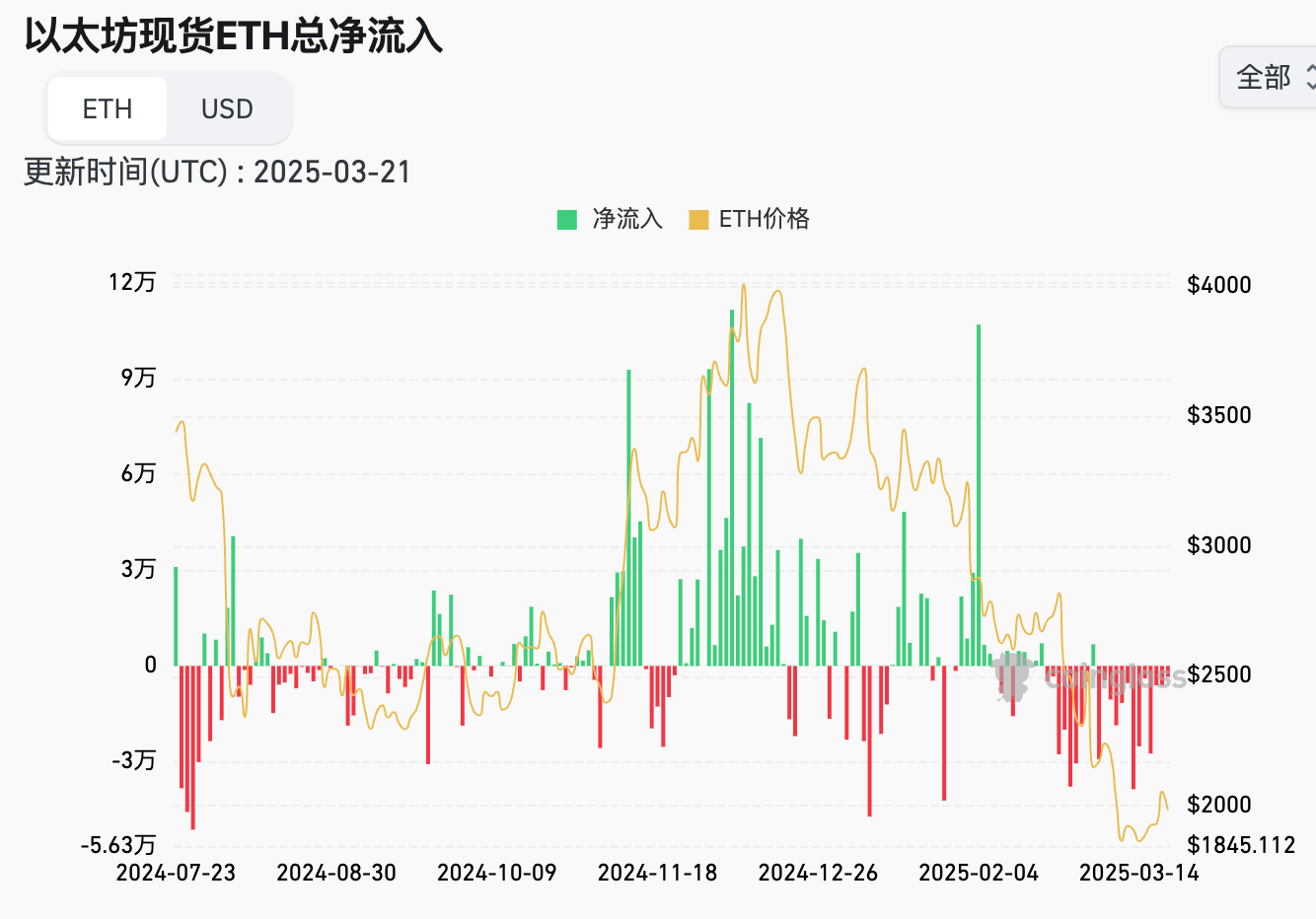

This week, U.S. spot Bitcoin ETFs recorded net inflows of $639.9 million; U.S. spot Ethereum ETFs saw net outflows of $91 million.

The "Fear & Greed Index" on March 21 stood at 31 (down from last week), with fear prevailing for five days and neutral sentiment for two days this week.

Market outlook: The market remained range-bound this week, sentiment shifting from extreme fear to fear. Stablecoins experienced slight issuance growth, U.S. spot Bitcoin ETFs attracted inflows while Ethereum ETFs faced outflows. BSC chain activity surged significantly, sparking a wave of BSC meme coins. The Fed confirmed maintaining rates unchanged in March. Market participants remain concerned about weakening U.S. economic conditions but still hold hopes for rate cuts in the second half of the year.

The broader market is expected to form a short-term bottom and continue trading within a range. Investors may focus on trending new projects on chains such as BSC, Tron, and Base. Additionally, it’s advisable to closely monitor the “Hotcoin New Coin List” to uncover more wealth opportunities.

Understanding the Present

Weekly Recap of Major Events

1. On March 16, on-chain data showed that Monad testnet addresses surpassed 14.55 million, with daily active users reaching 2.0198 million on March 15;

2. On March 18, WLFI's "Macro Strategy" allocated various digital assets including BTC, ETH, TRX, LINK, SUI, and ONDO tokens into its strategic reserve program. This macro strategy may partially support WLFI-funded innovation initiatives, promote ecosystem growth, and create new opportunities in the rapidly evolving DeFi space;

3. Between March 10 and March 16, Strategy purchased 130 BTC at an average price of $82,981 per coin, totaling $10.7 million;

4. On March 19, according to Arkham monitoring, Justin Sun's address staked 60,000 ETH (~$116 million) to Lido yesterday;

5. On March 19, Raydium announced the launch of a token launch platform similar to pump.fun called LaunchLab. This comes less than a month after popular Solana meme coin launcher pump.fun revealed plans to develop its own AMM;

6. On March 20, Coinbase released an Ethereum staking report showing it currently operates 3.84 million ETH in staking—representing 11.42% of total staked ETH—and has become the largest Ethereum node operator;

7. On March 19, according to Defillama data, Jupiter generated $31.7 million in revenue in February, setting a new all-time high;

8. On March 21, Santiment reported that due to numerous DeFi and staking options available, Ethereum holders have reduced exchange-tradable supply to just 8.97 million ETH—the lowest level in nearly a decade (previous low was November 2015). Exchange-held ETH decreased by 16.4% compared to just seven weeks ago;

9. On March 21, Japanese listed company Metaplanet officially announced the establishment of its Strategic Advisory Committee and appointed Eric Trump, son of former U.S. President Donald Trump, as a committee member.

Macroeconomic Developments

1. On March 17, Korea Economic TV reported that the Bank of Korea clearly stated it “has never considered including Bitcoin in foreign exchange reserves”;

2. On March 18, former U.S. President Donald Trump posted on Truth Social announcing the appointment of current Federal Reserve Board member Michelle Bowman as Vice Chair of Supervision;

3. On March 18, Polymarket showed a 100% probability that “the Fed will end quantitative tightening before May,” with cumulative trading volume exceeding $6.25 million;

4. On March 19, the Bank of Japan kept its benchmark interest rate unchanged at 0.5%, in line with market expectations;

5. On March 20, the U.S. Federal Reserve maintained its benchmark interest rate at 4.25%-4.50%, consistent with market expectations.

ETFs

Data shows that between March 17 and March 21, U.S. spot Bitcoin ETFs had net inflows of $639.9 million. As of March 21, GBTC (Grayscale) has seen cumulative outflows of $22.48 billion and currently holds $16.256 billion, while IBIT (BlackRock) holds $47.885 billion. The total market value of U.S. spot Bitcoin ETFs reached $96.294 billion.

U.S. spot Ethereum ETFs had net outflows of $91 million.

Looking Ahead

Upcoming Events

1. Southeast Asia Blockchain Week 2025 will be held from March 30 to April 5, 2025, in Bangkok, Thailand;

2. The 2025 Hong Kong Web3 Festival will take place from April 6 to 9, 2025, at Halls 5BCDE of the Hong Kong Convention and Exhibition Centre.

Project Updates

1. U.S. Bitcoin miner CleanSpark will be added to the S&P SmallCap 600 Index before market open on March 24. The index includes small-cap U.S. public companies with market caps over $1 billion meeting specific financial criteria. CleanSpark becomes the second crypto mining firm to join the index, following Marathon Digital last year;

2. Berachain’s airdrop claim portal will reopen at 22:00 Beijing time on March 24;

3. Taproot Wizards’ Bitcoin Ordinals collection sale begins on March 25, featuring 2,121 Wizard NFTs inspired by the Bitcoin Wizard meme first appearing on Reddit in 2013. The sale occurs in two phases: first a whitelist sale priced at 0.2 BTC per NFT, followed by a public Dutch auction starting above 0.2 BTC;

4. Celo will activate a hard fork transitioning to an Ethereum L2 at 11:00 on March 26. After the upgrade, Celo L2 block times will shorten from 5 seconds to just 1 second. Full historical data and block heights will remain intact, allowing users to access past transactions;

5. IRIS Network mainnet plans a v4.0 upgrade on March 30. This update introduces cross-chain NFT functionality, enhances cross-chain interoperability, and optimizes network performance. Validators and node operators must prepare in advance to ensure smooth transition;

6. Investment management firm VanEck offers zero management fees on its spot Bitcoin ETF HODL from March 13 to March 31, 2025. If assets exceed $150 million by the deadline, the fee on excess amounts will be 0.2%. After March 31, 2025, the standard management fee of 0.2% will resume.

Key Economic Events

1. On March 24, Eurozone and UK will release preliminary March manufacturing PMI figures;

2. On March 27, the U.S. will report weekly initial jobless claims;

3. On March 28, the U.S. will release the year-over-year core PCE price index for February.

Token Unlocks

1. Axelar (ALX) will unlock 13.51 million tokens worth approximately $5.37 million on March 27, representing 1.13% of circulating supply;

2. Jupiter (JUP) will unlock 100 million tokens valued at around $52 million on March 27, accounting for 1% of circulating supply.

About Us

Hotcoin Research, as the core investment research hub of the Hotcoin ecosystem, is dedicated to providing global cryptocurrency investors with professional, in-depth analysis and forward-looking insights. We have built a three-pillar service system of “trend analysis + value discovery + real-time tracking.” Through deep dives into industry trends, multi-dimensional evaluations of promising projects, and round-the-clock market volatility monitoring—combined with our twice-weekly *Selected Hotcoins* strategy livestreams and daily *Blockchain Headlines* briefings—we deliver precise market interpretations and practical strategies tailored to investors at all levels. Leveraging cutting-edge data analytics models and extensive industry networks, we continuously empower novice investors to build cognitive frameworks and help institutional clients capture alpha returns, jointly seizing value growth opportunities in the Web3 era.

Risk Disclaimer

The cryptocurrency market is highly volatile and inherently risky. We strongly advise investors to fully understand these risks and conduct investments strictly within a sound risk management framework to safeguard their capital.

Website: https://lite.hotcoingex.cc/r/Hotcoinresearch

Mail: labs@hotcoin.com

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News