Binance Embraces Fan Economy with Token "Voting" and "Ranking Rush"

TechFlow Selected TechFlow Selected

Binance Embraces Fan Economy with Token "Voting" and "Ranking Rush"

The current version of the voting mechanism might be Binance's latest solution to address the dilemma of filtering through 13 million tokens.

By Alex Liu, Foresight News

On March 20, 2025, Binance, the world's largest cryptocurrency exchange, launched its "Vote to List" token listing initiative, partially handing over listing decisions to the community. This crypto-democracy experiment involving millions of users has drawn widespread industry attention while also sparking deep discussions about the boundaries of community governance, risks of market manipulation, and the feasibility of decentralized governance.

From Centralized Review to Community Co-Governance

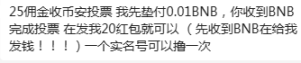

According to Binance’s official announcement, the first round of voting will run until March 27. Users must hold at least 0.01 BNB (approximately $6.20) to participate, with each user allowed one vote for up to five tokens from the BNB Smart Chain ecosystem. The initial candidate list includes nine projects: BANANAS31 (Banana For Scale), BID (CreatorBid), Broccoli (Broccoli), Broccoli (CZ's Dog), KOMA (Koma Inu), SIREN (SIREN), mubarak (mubarak), TUT (Tutorial), and WHY (why). The top two vote-getters will advance to Binance’s professional due diligence process.

Regarding concerns about vote manipulation in Binance’s listing poll, Binance co-founder He Yi commented that fraudulent votes would be filtered out through cleansing mechanisms to ensure fairness.

Notably, the rules feature a dual-balancing mechanism:

-

Participation threshold and anti-sybil measures: The low 0.01 BNB entry barrier ensures broad participation, while “vote washing” technology filters out fake accounts, maintaining openness without enabling manipulation

-

Linking community sentiment with professional review: Voting results do not directly determine listings; projects still undergo compliance, security, and traditional due diligence checks

-

Ecosystem-focused strategy: Limiting the first round to BNB Chain tokens strengthens ecosystem cohesion and reduces the complexity and risk of cross-chain project evaluations

This hybrid model of “democratic screening + professional oversight” has been described by Cointelegraph analysts as “a compromise between the ideal of decentralization and the reality of centralization.”

Community Dynamics: Enthusiastic Support and Undercurrents

Within 24 hours of launch, discussions around the event surged on X. Most users welcomed the delegation of decision-making power, reflecting strong market demand for open governance. Yet beneath the surface, complexities emerged:

An arms race among tokens: Several project communities are offering rewards such as token airdrops to incentivize voting; Widespread short-selling discussions: Since only a few tokens will ultimately be listed, those not selected may drop in price. Some suggest profiting by shorting all participating tokens. After Binance added multiple new futures pairs yesterday, all candidate tokens in this vote now have active futures contracts on Binance—meaning “you can short if you’re bearish” is no idle threat.

This frenzied voting atmosphere echoes the excitement surrounding Binance’s first token listing vote in 2017. In response to a user comment noting that “Binance’s 2017 voting mechanism was effective,” CZ replied, “It started well. But later it began fracturing the community, leading to infighting among projects—like PvP battles. Preventing cheating became increasingly difficult over time. We had to keep changing the model. We can still do it occasionally.”

Mechanism Evolution: Eight Years of Iteration in Voting

Looking back at the evolution of Binance’s listing mechanisms reveals a continuous search for dynamic balance between centralization and decentralization. During the startup phase from 2017 to 2019, Binance relied entirely on internal teams for project reviews. Although the initial voting-based listings generated enthusiasm, they were also accompanied by issues like ballot stuffing and vote buying.

From 2020 to 2024, Binance entered a period of adjustment, temporarily suspending public voting and instead using more controlled models like Launchpad and Launchpool for project listings, while building an Alpha project repository for long-term monitoring. By 2025, Binance relaunched its voting initiative with renewed structure—introducing holding requirements and vote-cleansing algorithms, limiting voting to pre-screened projects, and retaining final veto authority via professional due diligence.

Through stake-based verification and rigorous rule design, Binance aims to build a healthier, more sustainable governance ecosystem.

Future Scenarios: Three Possible Paths for This Governance Experiment

Looking ahead, this self-governance experiment could unfold along three distinct paths. In the best-case scenario, community consensus elevates high-quality projects, anti-cheating systems effectively clean the voting environment, and a replicable governance framework emerges.

In a less favorable outcome, manipulation by large players could lead to bad projects driving out good ones; the strategy of shorting all candidates might trigger a collapse in smaller token prices.

The most likely middle-ground reality may be: a few dark horse projects succeed, while occasional vote-rigging scandals force the platform to continuously refine its rules.

CoinMarketCap shows over 13 million cryptocurrencies currently exist

Beneath the listing vote lies Binance’s latest attempt to drive traffic after navigating regulatory challenges. Within this vast crypto empire, a supercharged traffic loop formed by exchange + wallet + blockchain + community + KOLs is beginning to take shape. What turbulence it will stir in the crypto world remains to be seen.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News