Crypto's New Order: From Wild West to Wall Street Fortress

TechFlow Selected TechFlow Selected

Crypto's New Order: From Wild West to Wall Street Fortress

Veterans retire, newcomers falter, but the game is not over. The adaptable survive, the resistant fall.

Author: Sankalp Shangari

Translation: TechFlow

This isn’t just another typical crypto cycle — it’s more like your favorite underground bar getting acquired and turned into a high-end cocktail lounge. The decentralized gamblers and retail speculators who once ruled the market are licking their wounds, while hedge funds, sovereign wealth funds, and traditional financial giants stride in wearing tailored suits, armed with algorithmic strategies ready to dominate the game.

Crypto OGs have lived through more drama than a reality TV series — from the Mt. Gox collapse and ICO mania to the DeFi summer frenzy and the NFT gold rush that ended up looking like a garage sale. Now they’re hoping Bitcoin quickly rebounds to $120,000–$150,000, wondering whether to cash out like retired poker pros or if there’s still one last “crazy hand” left to play.

But here’s the thing — crypto hasn’t died; it’s simply undergoing corporate rebranding. New rules are emerging. The real question is: will you adapt, or keep asking, “Can Dogecoin hit $10?”

1. The Market Is Not What It Used To Be

The crypto market is like a chaotic Wild West frontier town that suddenly got a Starbucks and a city planning committee — disorder is fading, and institutional capital is flooding in. The days when a meme and a dream could 100x an asset are over. The new game is played in suits, compliance, and macroeconomic strategy.

Bitcoin’s New Puppet Master: Macroeconomics, Not the "Halving Fairy"

If you still believe Bitcoin's price is solely driven by its four-year cycle, then you're as outdated as someone waiting for a dial-up connection — completely disconnected from reality. Bitcoin is now a macro asset, reacting to interest rates, global liquidity, and risk sentiment like a seasoned Wall Street trader. If you don’t understand macroeconomics, you’re bringing a fidget spinner to a chess match.

Retail Retreats, Institutions Take Control

Remember when your Uber driver and barber were pitching altcoins and debating Ethereum gas fees? Those days are gone. Now it’s BlackRock, sovereign wealth funds, and traditional finance giants pulling the strings. ETFs have injected billions, but they’ve also turned Bitcoin into a corporate asset — no longer a wild stallion, but more like Tesla stock with a bit of theatrical flair.

Liquidity Splits: BTC & ETH Are VIPs, Altcoins Get Ghosted

Institutional money flows like champagne into BTC, ETH, and a handful of blue-chip altcoins, while liquidity for others is drying up — faster than your New Year’s fitness motivation. Many small-cap altcoins are turning into "ghost chains" — haunted by dreams of past bull runs and bagholders refusing to sell.

The Trump Effect: Meme Magic or Liquidity Trap?

Trump’s recent pro-crypto stance has energized markets — think talk of a U.S. strategic Bitcoin reserve and fast-tracking stablecoin regulation. But his meme coin casino (like $TRUMP, $MELANIA) has become a liquidity black hole, sucking speculative capital and leaving the broader market breathless. It’s like a carnival where everyone spends their last dollar chasing a giant teddy bear, only to realize they can’t afford the ride home.

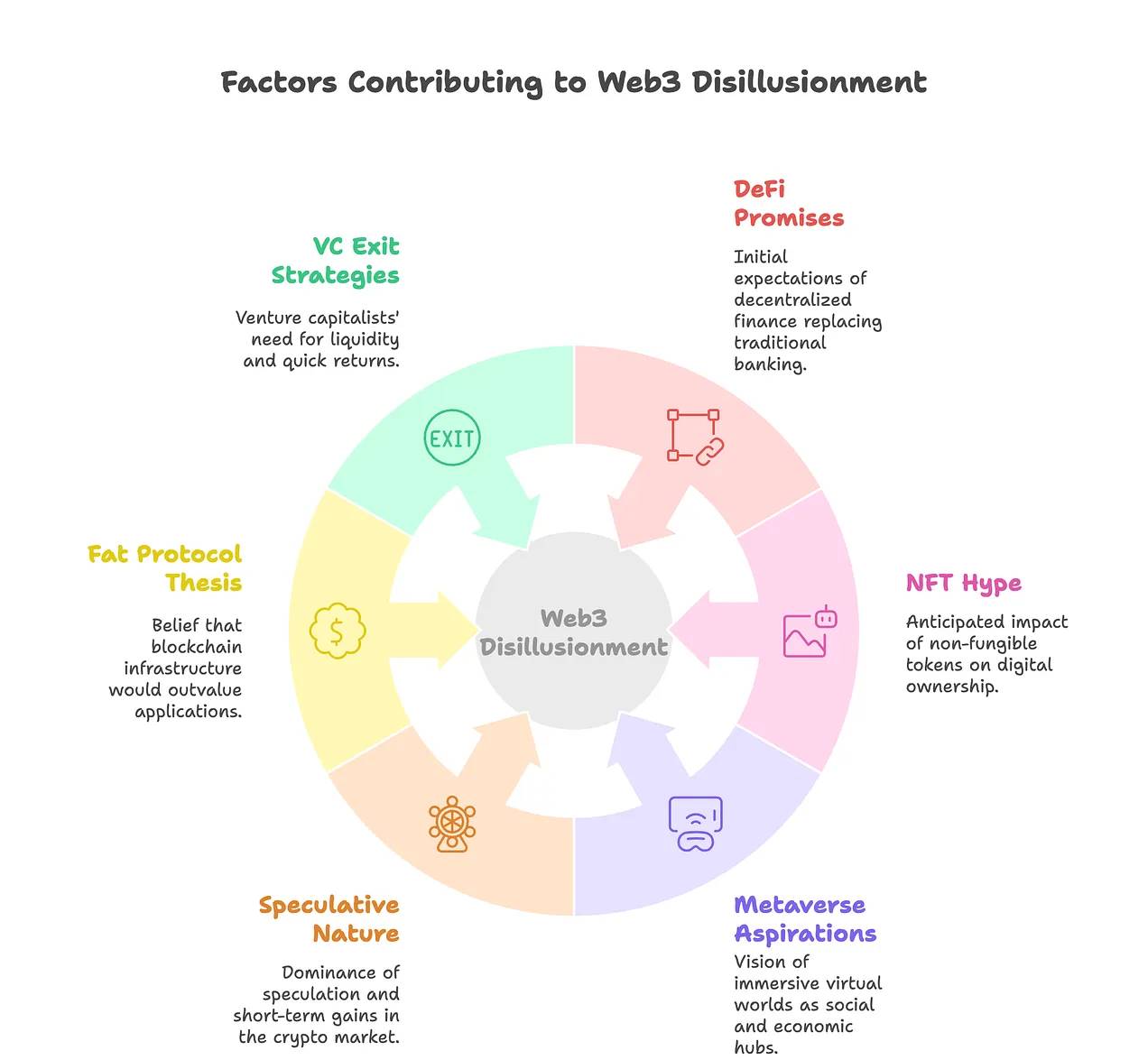

2. Web3 Promised a Revolution — Where’s the Utility?

Web3 was supposed to change the world, but right now it feels more like a Las Vegas buffet — all hype, a few decent dishes, and mostly junk food. DeFi aimed to replace banks, NFTs wanted to redefine ownership, and the metaverse was meant to be humanity’s next hangout spot. Yet after billions in funding, the only widely used product is stablecoins.

The Only Killer App: Stablecoins (aka "Premium Internet Dollars")

Forget DeFi revolutions and NFT empires — crypto’s sole real success is creating digital dollars with fewer middlemen and greater efficiency. If Web3 were a sci-fi movie, stablecoins would be the only working alien tech, while everything else remains concept art and fan theories.

Speculative Economy: Hype Still Reigns Supreme

Crypto remains a risk-fueled Ponzi carnival, where meme coins, influencer pumps, and overhyped “next-gen” blockchains (like TIA, SEI, MONAD, BERACHAIN) launch with valuations over $5 billion despite near-zero users. It’s like opening a five-star restaurant, spending millions on marketing, and forgetting to hire a chef.

The Collapse of the "Fat Protocol" Theory

For years, the blockchain "fat protocol" theory claimed infrastructure should be worth more than the apps built on top. But that’s like investing in roads and expecting them to be more valuable than the cities they connect. Real-world companies trade at 5–15x earnings, yet some stagnant L1s and L2s still command 150x to 1000x multiples — with zero growth. These chains are now like theme parks without rides — expensive tickets, filled with broken promises.

Venture Capital Needs Exit Liquidity (And You’re That Liquidity)

Many so-called “innovative” projects exist solely to let early investors cash out, just like the 2017 ICO craze. If a project launches with immediate token unlocks and a fully diluted valuation higher than Coinbase, congratulations — you’re not investing; you’re serving as their exit liquidity. It’s like buying a house, only to discover the previous owner sold the land, walls, and even the air inside the rooms separately.

3. Talent Drain in Crypto: Developers Are Fleeing to AI

Top developers in crypto are jumping ship to AI like rats fleeing a sinking vessel — or more accurately, like Web3 influencers deleting their “decentralization forever” tweets overnight to become AI “thought leaders.”

Why Are Developers Leaving Crypto for AI?

Because AI is the new hotness, while crypto feels like a washed-up rock star trying to survive on a 2017 hit single.

-

Clearer Regulation

AI is like a brilliant but slightly terrifying child — governments aren’t sure whether to nurture or strictly monitor it. Crypto? Still seen as the rebellious teen who maxed out Grandma’s credit card buying Dogecoin, treated as a problem child.

-

Better Funding Environment

Venture capitalists treat AI like the next Google, while crypto founders pitch their 12th “revolutionary” L1 project to empty Zoom calls.

-

Fewer Extreme Cycles

AI is a reliable honor student, while crypto is more like a student who either wins the science fair or burns down the lab — no in-between.

The Great Migration: From Web3 to AI

The same “visionaries” who once promised to decentralize the world are now training AI models to write corporate emails or generate eerily realistic deepfake videos.

-

Crypto once wanted to replace banks.

-

AI just wants to replace you.

At this rate, the developers still in crypto are either true believers or people too lazy to update their LinkedIn.

4. OGs Are Cashing Out — But the Game Isn’t Over

The OGs — those who survived Mt. Gox collapses, ICO scams, DeFi rug pulls, and the “oops I sent my entire portfolio to the wrong address” phase — are finally cashing in. They’ve been around long enough to know that when BlackRock starts buying Bitcoin, the era of exponential gains is over.

Where Are They Going?

-

AI and Tech

Instead of betting on meme coins, why not build an algorithm that replaces financial analysts?

-

Real Estate

After years of staking, mining, and leveraged trading, the real 100x return might just be a condo in Miami.

-

Semi-Retirement

Some OGs are done with refreshing CoinGecko at 2 a.m., relocating to tropical islands and communicating only in Bitcoin maximalist slang.

But Institutional Money Is Taking Over

OGs exiting doesn’t mean crypto is dead. On the contrary, massive institutional capital is pouring in — like Wall Street elites discovering the charm of DeFi summer, two years late but full of enthusiasm.

Crypto is no longer just a playground for decentralized gamblers and speculators — it’s evolving. The casino is still open, but now Goldman Sachs owns the slot machines.

The question is: are you ready for the next chapter, or are you just here to FOMO into the next meme coin?

5. A Hopeful Outlook: The Next Crypto Boom Will Be… Different

The next crypto wave will be like that wild party friend who now shows up to brunch in a suit, ordering salad instead of tequila shots. Chaos is calming down. The rebellious teenager is maturing into a well-behaved, “investment-grade” adult — at least to some extent.

Regulation Is Finally Taking Shape

Crypto is going through a makeover — like the class clown becoming student body president. It’s still mischievous, but now wears a crisp suit and a “Let’s Follow the Rules” badge.

-

The U.S. SEC has finally decided to stop treating every crypto exchange like a Bond villain. They’re dropping lawsuits against Binance, Coinbase, Kraken, Uniswap, as if realizing crypto isn’t going away — kind of like your dad finally stopping fights over your “controversial” tattoo.

-

DeFi broker regulations? The IRS might actually ease up. Imagine telling your uncle: “You can keep partying — just don’t wreck the place.”

-

The U.S. Senate Banking Committee is voting on the Stablecoin Bill, and the GENIUS Act is gaining traction. It’s like crypto finally getting a parent-signed permission slip for a field trip.

Institutional Adoption Is Accelerating

Big institutions are joining crypto with the swagger of finance’s “cool kids,” finally letting you sit at their lunch table.

-

BlackRock, JPMorgan, and sovereign wealth funds aren’t just dipping toes — they’re diving into the deep end, praying their heavy portfolios don’t hit bottom.

-

Mubadala, the UAE fund, is now a major holder of Bitcoin ETFs — proving crypto finally has that “cool uncle” who tells jokes and pays for vacation flights.

-

Solana, XRP, and other ETFs are in the works, turning the crypto party into a black-tie event, replacing flip-flops with tuxedos.

Crypto IPOs Are Coming

Now dressed in suits, crypto is preparing for its public debut. Kraken, Gemini, and BitGo are moving toward IPOs — bringing transparency and credibility to a space once likened to high-stakes poker in a dimly lit basement.

An IPO is crypto’s graduation ceremony — finally earning a diploma and getting a chance to explain to worried parents what you’ve actually been doing all these years.

Government Attitudes Toward Crypto Are Warming Up

Governments that once saw crypto as the crazy cousin showing up drunk to family gatherings on homemade moonshine are now willing to share a cab. Crypto is finally getting the respect it always thought it deserved.

-

Multiple U.S. states are considering holding Bitcoin reserves — like adding a little “cool factor” to their balance sheets.

-

Hong Kong has approved spot Bitcoin and Ethereum ETFs, essentially saying: “We accept you — just don’t mess it up.”

-

The UAE, Brazil, and Australia are crafting friendly crypto regulations, becoming the new “cool kids” in the space.

-

The EU’s MiCA framework is like a teacher handing out a good behavior certificate, saying: “You were a bit naughty before, but now we’ll let you play with the other kids.”

Final Thoughts: Adapt or Perish

Yes, the market has changed. Yes, OGs are tired and eyeing retirement. Yes, scammers remain as active as Instagram influencers hawking “miracle” weight-loss pills. But every cycle brings new winners — like a never-ending reality show with rotating cast members and ever-shifting rules.

-

2013: Bitcoin pioneers were the狂热 frontiersmen claiming gold mines while everyone else struggled with PayPal.

-

2017: ICO founders saw whitepapers and thought, “Let’s raise $1B and figure out the rest later,” like kids selling lemonade in the desert — except their bank accounts had extra zeros.

-

2020: DeFi developers launched protocols faster than your uncle brags about his latest “high-risk” stock picks. Like mad scientists, they raced to create decentralized money without blowing up the lab.

-

2021: NFT flippers treated pixelated monkey pictures as golden tickets to Willy Wonka’s factory — except instead of candy, they got bags of cash. While the rest of us were still figuring out what “minting” meant, they became Wall Street brokers of the image economy, raking in millions.

-

2024: We witnessed institutional ETF dominance alongside meme coin mania — until meme coin defenders realized Wall Street bankers in suits had taken over far more than imagined. Crypto transformed from a punk-rock-loving rebel to someone in a sharp suit and tie showing up at a board meeting — albeit with coffee stains on the tie.

2025 and Beyond

-

Institutions have taken control. Adapt and learn the game, or get left behind.

-

Bitcoin remains king — a gold-like macro asset. Learn macroeconomics, think like Wall Street, trade like a pro.

-

New governments will continue extracting value from crypto alongside allies — nothing new, just another player, like past entities such as FTX, Luna, 3AC, or VC tokens. You must adapt and learn to play with these “players,” not give up easily.

-

As for altcoins, despite a decade of massive investment, their real utility remains minimal. Most altcoins — including Ethereum and Solana — are still speculative assets with negligible actual demand for their products. Once institutions start evaluating these tokens based on fundamentals, many may appear severely overvalued. This is precisely why Bitcoin becomes even more important.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News