Breaking free from crypto nihilism, what do we need to do?

TechFlow Selected TechFlow Selected

Breaking free from crypto nihilism, what do we need to do?

We just need to start doing things differently.

Author: Kyle

Translation: Luffy, Foresight News

The biggest problem in crypto isn't a lack of talent or funding—it's simply the absence of first-principles thinking. This culture needs to change, and the top 1% must lead the way forward.

If you follow my Twitter, you'll notice I've been loudly advocating for focusing on high-leverage opportunities that seem obvious yet nobody seems to truly "get" or execute well.

In this article, I’ll dive into several key topics:

-

Compounding assets, industry culture, short-termism

-

General-purpose Layer 1s are dead—change is urgent

-

Liquid tokens and investor relations

-

Buybacks and burns are merely the least bad option, not the best

I’ve titled this piece “First Principles” because all these ideas stem from applying common sense to how we might actually transform the industry today.

The truth isn’t complicated. The definition of insanity is doing the same thing over and over while expecting different results. Across three market cycles, we’ve repeated the same pattern: creating illusory, valueless, exploitative tokens and applications, under the absurd assumption that every four years, this “casino” will reopen in a frenzy, drawing global capital for one big gamble.

And what happened? After three cycles—ten years—people finally realized the house, the scammers, the fraudsters, the riggers, and even those selling overpriced food and drinks inside the casino are taking all their money. After months of effort, all you’re left with is an on-chain record of how you lost everything. An industry where everyone thinks, “I’ll get in, make money, and leave,” cannot generate any long-term compounding assets.

This space once had promise—a place of real financial innovation and cool tech. We were excited about novel applications, new technologies, and “changing the future of finance.”

But due to extreme short-termism, deeply exploitative cultures, and bad actors, we’ve fallen into a collective cycle of financial nihilism—where everyone assumes it’s okay to buy tokens from obvious scammers, as long as “I exit before the rug pull.”

You could say I lack entrepreneurial experience—and that’s fair. The space is small and young. I’ve worked in it for four years, partnering with some of the smartest funds, which has given me insight into what works and what doesn’t.

I’ll repeat: insanity is repeating the same actions and expecting different outcomes. Year after year, our industry experiences the same collapse: when prices inevitably crash, we all feel that nihilism, that nothing matters. I felt it when NFTs collapsed. People feel it now after the latest memecoin chaos. They felt it during the ICO era too.

The solution is simple: we just need to start doing different things.

1. Compounding Assets, Industry Culture, Short-Termism

Compounding assets are those that appreciate over time through sustained growth—like Amazon, Coca-Cola, Google. The companies behind them have the potential for durable, long-term expansion.

So why don’t we see compounding assets in crypto?

The answer is complex, but the root cause lies in extreme short-termism and misaligned incentives. Kun puts it well:

“This is also why most things get fairly or even richly valued after just a few multiples of growth—they trade like growth tech stocks in traditional finance, despite being early-stage, and most startups never go public. But here (in crypto), every failed project can still launch a token based purely on a promise.”

https://x.com/0x_Kun/status/1898599628448387482

Indeed, incentive structures are deeply flawed. Cobie’s article explains this well. I won’t delve deeper—the focus here is: what can individuals do right now?

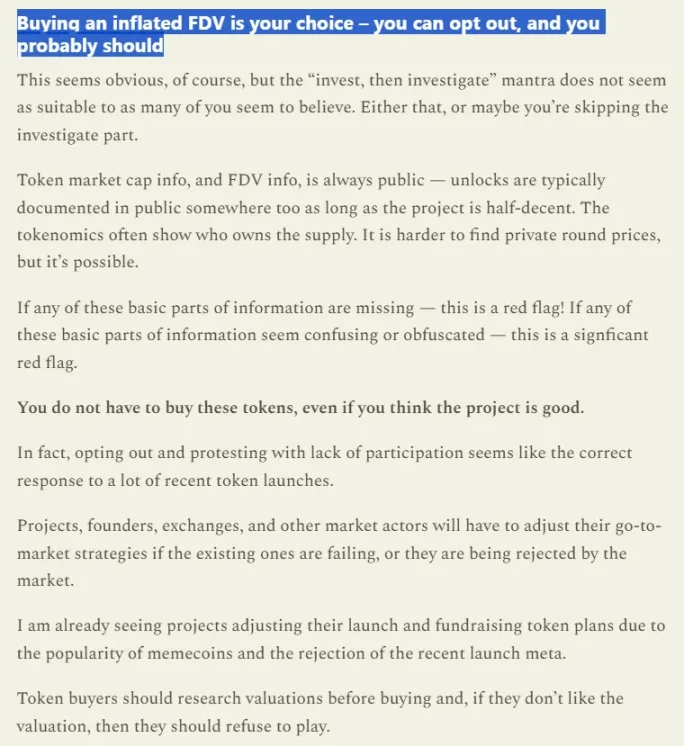

For investors, the answer is clear. As Cobie notes: you can choose to opt out—and probably should.

And people have opted out. This cycle, we’ve seen the decline of centralized exchange (CEX) tokens, as retail investors stop buying them. While individuals may not fix systemic issues, the good news is that financial markets are efficient: people want returns. When existing mechanisms fail, they withdraw capital, making the process unprofitable and forcing change.

But this is only step one. To build true compounding assets, companies must cultivate long-term thinking. It’s not just that “private capture” is bad—the entire mindset leading us here is broken. Like a self-fulfilling prophecy, founders collectively assume, “I’ll make money and leave.” No one genuinely wants to build long-term, resulting in perpetual McDonald’s “M-shaped” price charts.

The critical shift needed: a company is only as strong as its leader. Most projects fail not due to lack of developers, but because leadership decides it’s time to exit. The industry must begin idolizing the top 1% of founders—those with integrity, execution power, and long-term vision—instead of glorifying “pump-and-dump” operators.

It’s no secret that the average founder quality in crypto is low. Calling someone who shills vaporware a “developer” sets the bar extremely low. Just having a long-term vision two months post-token launch already puts you ahead.

I believe the market will start economically rewarding long-termism—and we’re already seeing signs. Despite recent sell-offs, Hyperliquid trades 4x above its initial price—a rare achievement this cycle. When you know the founder is aligned with long-term product growth, it’s easier to justify holding.

The natural conclusion: founders with integrity and execution will capture the largest market share. Frankly, when everyone is tired of scams, they simply want to work for someone visionary who won’t exit fraudulently—and such people are scarce.

Beyond great leadership, building compounding assets requires strong products. In my view, this is easier than finding great founders. A key reason so many “vaporware” projects exist is that their creators share the same “get rich and leave” mentality, opting to copy trending projects instead of solving novel problems.

Yet the industry rewards these illusions—like the AI agent hype in Q4 2024. Once the wave recedes, we see the familiar “M-shaped” chart. Thus, companies must focus on building profitable products.

No path to profitability = no long-term believers/holders = no buyers, because there’s no future to bet on

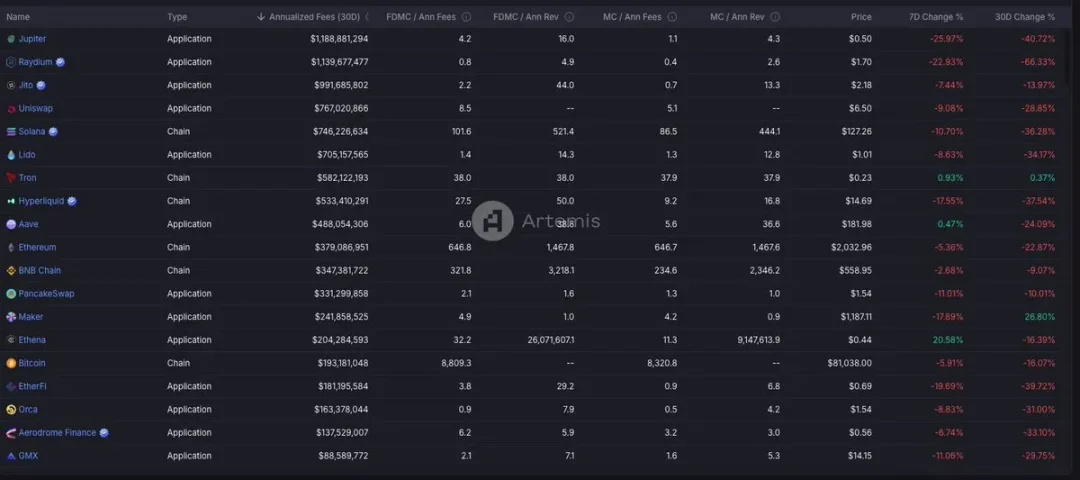

This isn’t impossible. Crypto businesses can be profitable. Jito earns $900M annually, Uniswap $700M, Hyperliquid $500M, Aave $488M—and they remain profitable even in bear markets (just less so).

Looking ahead, I believe narrative-driven speculative bubbles will shrink. We’re already seeing this: 2021’s gaming and NFT valuations reached hundreds of billions; this cycle, memecoins and AI agents peaked at just a few billion.

I believe people should freely invest as they wish. But I also believe they want returns. When the game becomes blatantly obvious—“this is hot potato, I must dump before zero”—the rollercoaster accelerates, and as people exit or lose everything, the market shrinks.

Profitability solves this. For investors, it signals real demand, enabling sustainable growth. Without a profit path, a project is nearly uninvestable long-term. Conversely, profitability enables growth, attracting buyers who bet on sustained appreciation.

In summary, building compounding assets requires:

-

Leaders with long-term vision

-

Focusing on building profitable products

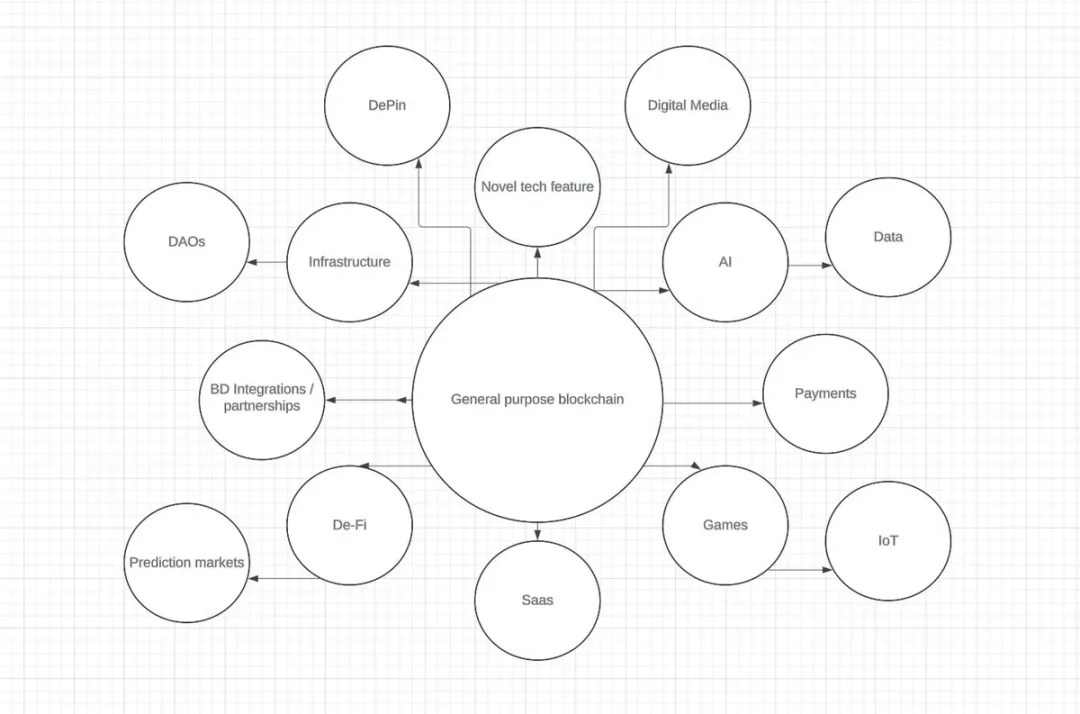

2. General-Purpose L1s Are Dead—Change Is Urgent

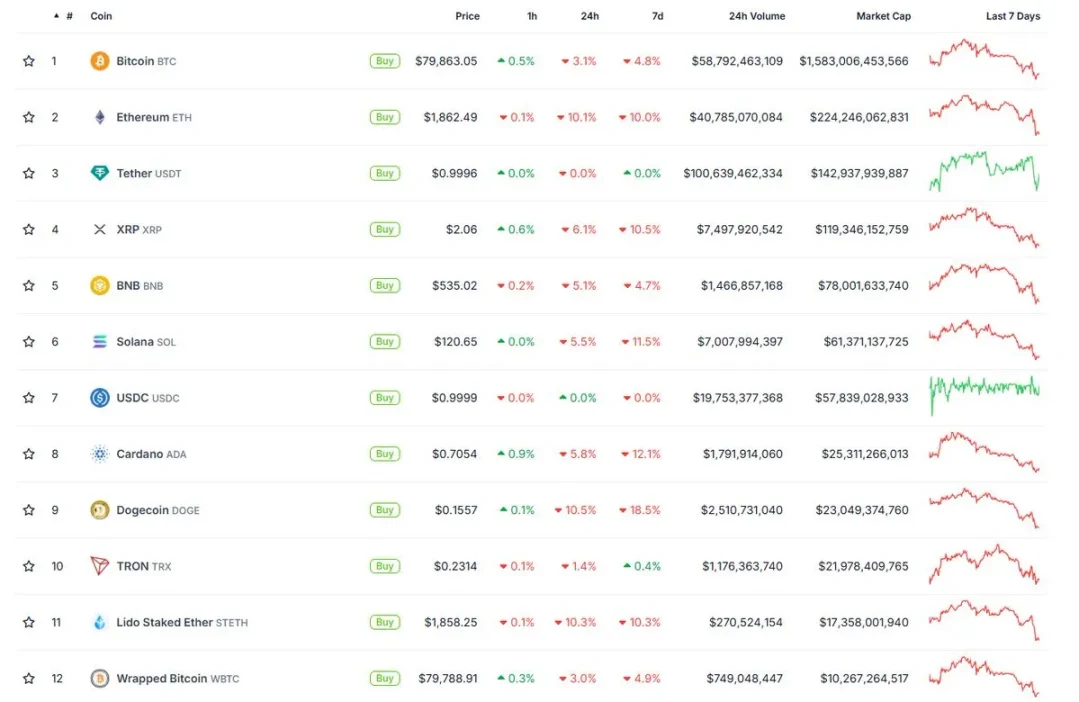

If you sort CoinGecko’s homepage by market cap, over half the top entries are L1 blockchains. Excluding stablecoins, L1s dominate crypto’s value.

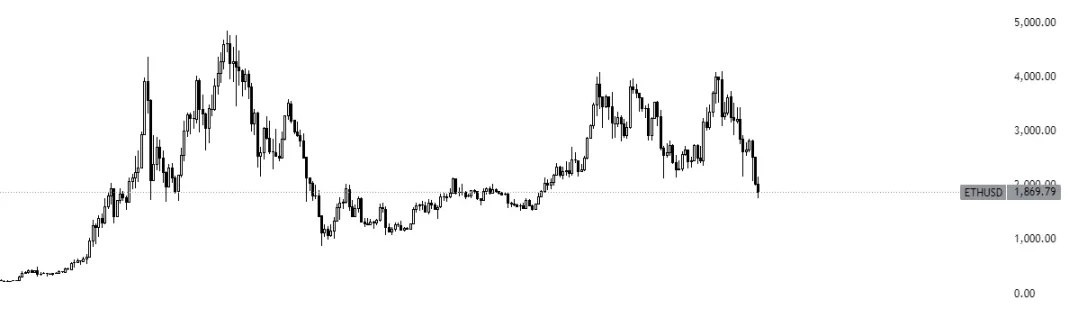

Yet Ethereum, the second-largest crypto asset after Bitcoin, has this price chart:

If you bought Bitcoin in July 2023, you’d be up 163% today.

If you bought Ethereum then, you’d be flat.

And it’s worse. The 2021 “everything bubble” sparked a wave of “Ethereum killers”—new L1s aiming to technically surpass Ethereum, focusing on speed, developer languages, blockspace, etc. Despite massive hype and funding, results fell short.

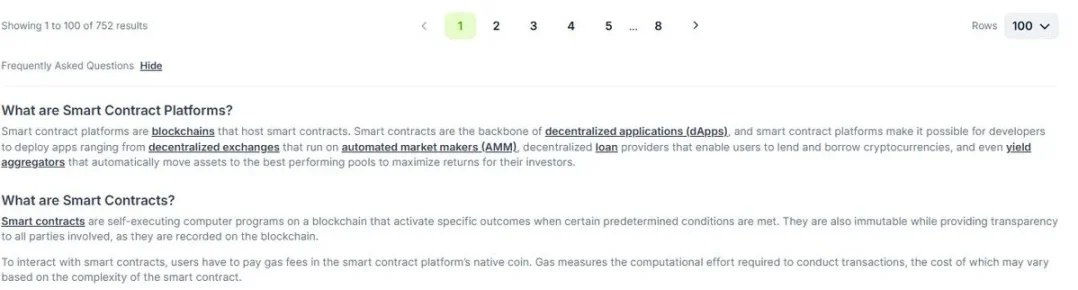

Now, four years later, we still live with the aftermath. CoinGecko lists 752 tokenized smart contract platforms—and likely more without tokens.

Unsurprisingly, most have charts like this—making Ethereum look decent by comparison:

So after four years, billions spent, and 700+ blockchains, only a few show solid activity—and even they haven’t achieved the “breakthrough user adoption” expected four years ago.

Why? Because most were built on flawed premises. As Luca Netz wrote in his article “What Is Consumer Crypto?”, many modern blockchains follow a general-purpose model, each dreaming of “hosting the internet economy.”

But this demands immense effort and fragments the market—because trying to do everything often means doing nothing well. It’s costly and time-consuming. Frankly, many chains can’t even answer: “Why should developers build on you instead of chain #60?”

The current L1 landscape is another case of repeating the same playbook and expecting different results. They compete for the same limited developer pool via grants, hackathons, dev studios—and now we’re apparently building phones (?)

Suppose an L1 succeeds. Each cycle, a few break through. But will success last? This cycle’s standout is Solana. But here’s a controversial take: what if Solana becomes the next Ethereum?

Last cycle, many believed so strongly in Ethereum that they allocated most of their net worth to it. Ethereum remains the highest TVL chain, now even has an ETF—but its price is stagnant. This cycle, the same crowd hypes Solana as the future, anticipating a Solana ETF, etc.

If history is any guide: does today’s success guarantee tomorrow’s relevance?

Rethinking L1s

My view is simple: instead of general-purpose chains, L1s should focus on a core strength. A blockchain doesn’t need to serve everyone—it just needs to excel in one area. I believe the future of blockchains will be substrate-agnostic: users will care only about performance, not technical details.

Developers already signal this shift: for app founders, the key question is no longer raw speed, but user distribution and end-user adoption. Does your chain have users? Does it have the user base needed to make a product take off?

WordPress drives 44% of web traffic, yet parent company Automattic is valued at just $7.5B. Shopify powers 4%, yet is worth $120B—16x more. I expect a similar outcome for L1s: value will accrue to apps built atop them.

Thus, L1s should boldly build ecosystems. If we compare blockchains to cities, cities rise due to unique advantages, evolving into economic hubs specialized in key industries:

-

Silicon Valley → Tech

-

New York → Finance

-

Las Vegas → Entertainment & Hospitality

-

Hong Kong & Singapore → Trade-focused financial centers

-

Shenzhen → China’s hardware manufacturing and tech innovation hub

-

Paris → Fashion, art, luxury

-

Seoul → K-pop, entertainment, beauty

L1s are no different—demand comes from what they offer. Teams must focus on dominating one vertical, carefully crafting compelling use cases instead of haphazardly building random projects.

Once you attract users, you can build an ecosystem around that magnet. Hyperliquid exemplifies this, iterating from first principles. They first built native components—perp DEX orderbook, spot DEX, staking, oracle, multisig—before launching HyperEVM, a smart contract platform for others to build on.

Here’s why it worked:

Focus on “building the attraction” first: by launching perpetuals, Hyperliquid drew traders and liquidity before scaling.

Control the full stack: owning core infrastructure (oracle, staking) reduces vulnerabilities and creates competitive moats.

Ecosystem synergy: HyperEVM now serves as a permissionless dev platform, leveraging Hyperliquid’s existing users and liquidity.

This “build the attraction, then expand the ecosystem” mirrors successful Web2 platforms (e.g., Amazon started with books, then expanded). Solve one problem exceptionally, then let the ecosystem grow organically from that core.

Therefore, I believe blockchains should integrate vertically, create their own attractions, and control their entire architecture. As captain of the ship, your vision aligns the chain with a broader, long-term L1 strategy. It ensures the project isn’t abandoned when on-chain activity dips—because everything is internally built.

Most importantly, this process gives your token monetary properties. If a blockchain is a city, the token is its currency—value derived from usage. People must buy your token to do interesting things on your chain. That gives it value and a reason to hold.

But remember: focus doesn’t guarantee demand. Another hard truth: L1s must seize the right opportunity at the right time, in the right way. They must build what people actually want. Sometimes, people don’t really want “Web3 games” or “more data availability.”

3. Liquid Tokens and Investor Relations

The next topic: how should liquid token projects evolve? Simply put, they need to establish investor relations roles and publish quarterly reports—so both retail and institutional investors clearly understand what the company is doing. This role isn’t revolutionary, but it’s critically missing in crypto.

Despite this, investor relations remain almost nonexistent. Multiple BD leads across projects told me: if you run regular calls pitching your liquid token to funds, you’re already ahead of 99% of the space.

BD helps attract developers and ecosystem capital, but IR—publicly communicating token fundamentals—is far better. If you’re a project seeking buyers, you need to sell yourself—not by renting the biggest booth at conferences or airport ads, but by directly pitching to funded buyers.

By publishing quarterly growth updates, you demonstrate product legitimacy and value accumulation, giving investors confidence in long-term performance.

Here’s a practical checklist:

-

Publish reports on blog/website sharing quarterly fees/revenue, protocol upgrades, key metrics—without material non-public info.

-

Host monthly calls with liquid fund managers to present your product.

-

Run more AMAs (Ask Me Anything sessions).

4. Buybacks and Burns Are Merely the Least Bad Option, Not the Best

My final point: buybacks and burns. My view: they’re acceptable only if funds have no better use. Crypto hasn’t reached a stage where companies can rest on past success—there’s still immense growth potential.

Revenue should primarily fund product expansion, tech upgrades, and market entry. This aligns with long-term growth and competitive advantage. A strong example: Jupiter’s acquisition spree—using cash to buy projects and top talent across the space.

I know some love buybacks and scream for dividends. But most crypto projects resemble tech stocks: their investor base seeks high returns and asymmetric upside.

Thus, direct dividend payouts to token holders make little sense. They could do it, but reinvesting cash into stronger competitive advantages will benefit the product far more over the next 5–10 years.

Crypto is now entering the mainstream. Slowing down now would be unwise. Instead, capital should flood in to ensure the next winners maintain long-term dominance—because despite falling prices, institutional crypto adoption has never been stronger: stablecoin usage, blockchain infrastructure, tokenization, etc.

Therefore, while buybacks and burns are vastly better than rug pulls, given the amount of work left, they’re still suboptimal uses of capital.

Conclusion

This downturn has begun teaching a crucial lesson: building revenue-generating products is essential for sustainability, and formal investor relations roles are inevitable—to transparently communicate your token’s progress. Much work remains. Still, I remain optimistic about crypto’s future.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News