Sonic ve(3,3) Flywheel Returns: A Deep Dive into Reward Mechanisms and Ecosystem Status

TechFlow Selected TechFlow Selected

Sonic ve(3,3) Flywheel Returns: A Deep Dive into Reward Mechanisms and Ecosystem Status

Sonic is an ambitious attempt to replicate Fantom's success and surpass it through entirely new L1 economics, bridge security, and high-speed execution.

Author: arndxt

Translation: TechFlow

Sonic is one of the most underappreciated comebacks in crypto.

While Sei, Berachain, and Monad are still stuck in testnet hype cycles, Sonic is live—with over 80 years of planned runtime. It’s accumulating TVL (total value locked) and rewarding developers in ways no other chain has attempted.

With over 10,000 transactions per second, sub-second finality, and a FeeM model that returns 90% of gas fees to developers, Sonic is building a DeFi flywheel.

Even more significantly, it’s launching a massive airdrop worth over $190 million. Here's what you need to know—and how to earn up to 145,000% APY.

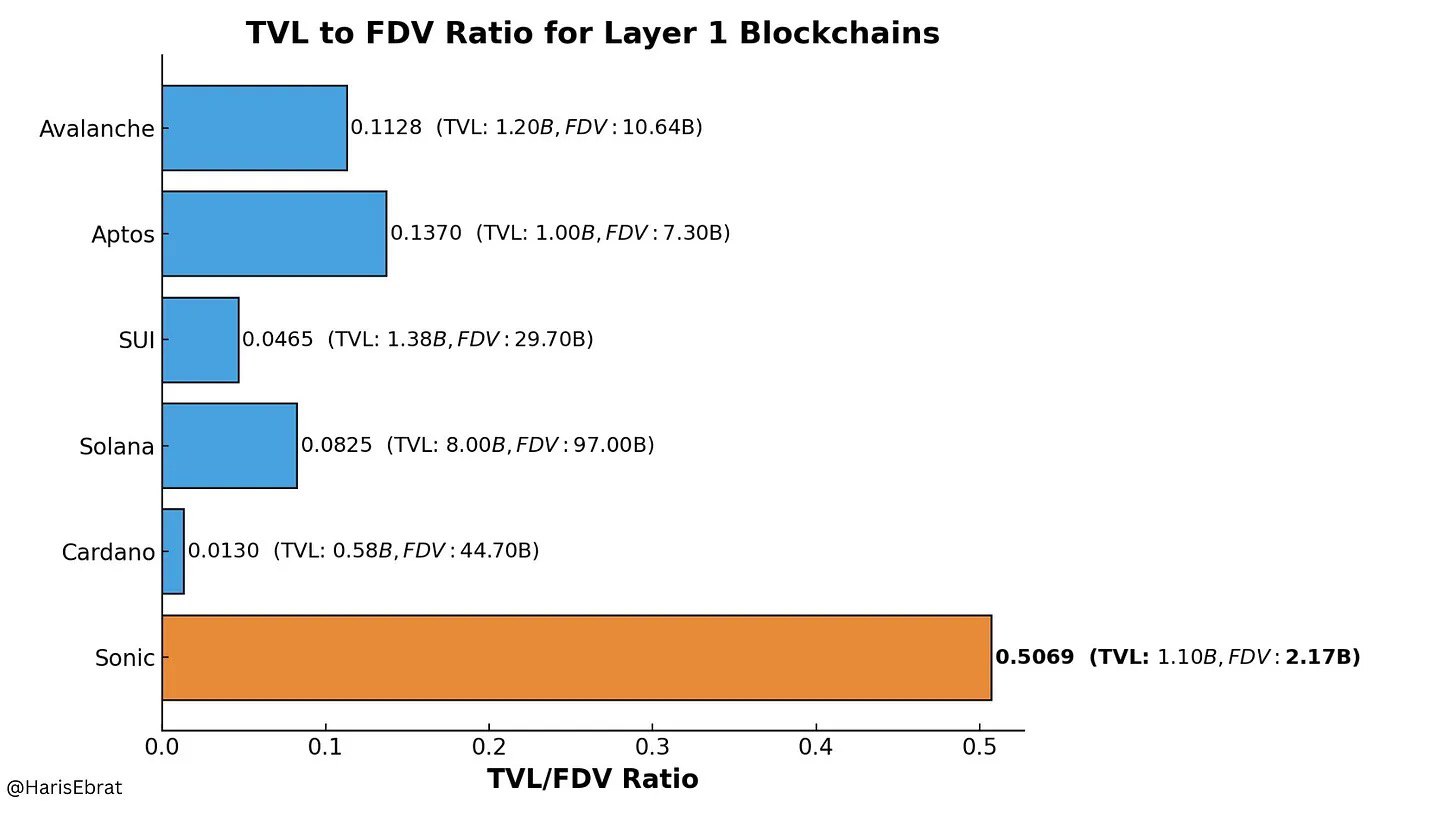

Source: @HarisEbrat

At the end of 2024, Fantom officially rebranded to @SonicLabs, relaunching into the Layer-1 (L1) blockchain space with a renewed focus on transaction speed, ecosystem incentives, and cross-chain interoperability.

In just a few months, Sonic’s total value locked (TVL) has grown significantly, attracting numerous new protocols to deploy on its chain. More notably, Sonic is preparing to launch an airdrop exceeding 190 million $S tokens—an initiative becoming a major draw for DeFi builders and high-yield strategists alike.

1. Origins & Background: What Makes Sonic Unique?

When @SonicLabs first launched, many didn’t see it as a project worth watching. After all, the market is already flooded with countless Layer-1 (L1) blockchains claiming “high speed, low fees.”

Yet Sonic truly stands apart—here’s why:

Live and stable operation: Unlike Sei, Berachain, and Monad, which remain in testnet phases, Sonic is already processing real transactions, liquidity, and users—with plans for sustainable operation spanning up to 80 years.

Built to reward developers: Through its innovative FeeM model, Sonic returns 90% of gas fees to decentralized application (dApp) developers, enabling projects to profit directly from user activity.

Massive airdrop program: Sonic plans to distribute over 190 million $S tokens via airdrop, rewarding staking, liquidity provision, and active ecosystem participation.

Rooted in DeFi’s best innovations: Sonic adopts and improves upon the ve(3,3) model while integrating advanced Ethereum Virtual Machine (EVM) scaling technologies to deliver more efficient solutions for developers.

The DeFi Flywheel Effect: A Cycle of Capital and Growth

Sonic’s success is closely tied to the DeFi flywheel effect—the core idea being the time lag between capital deployment and actual value realization:

Liquidity inflow: As funds enter, token prices rise, drawing in more users driven by fear of missing out (FOMO);

Early participants earn rewards: The ecosystem begins rewarding early adopters, attracting further users and driving gradual expansion;

New users stake or compound: Holders maintain momentum by staking or compounding tokens—the flywheel keeps spinning.

This model was first introduced in 2022 by DeFi legend Andre Cronje through Solidly Exchange on Fantom.

Andre Cronje is the founder of Yearn Finance ($YFI), whose token surged from $6 to $30,000 in just two months during the DeFi summer.

The ve(3,3) model combines Curve Finance’s veToken mechanism with Olympus DAO’s (3,3) game theory:

Voting escrow (ve) model: The longer users lock their tokens, the greater the rewards they receive;

(3,3) game theory: By incentivizing staking over selling, it reduces sell pressure and enhances ecosystem stability.

The core design of ve(3,3) strengthens protocol liquidity through token staking while offering substantial returns to long-term holders.

Unlike traditional liquidity mining models, ve(3,3) does not rely on highly inflationary token emissions to attract “short-term speculative capital.” Instead, it directly distributes protocol-generated fees to locked-up token holders, encouraging those committed to long-term ecosystem growth.

This underlying “flywheel effect” was a key driver behind rapid surges in DeFi.

Protocols adopting the ve(3,3) model often attract significant liquidity, as users seek higher yields through staking—increasing user numbers, which in turn boosts yield generation.

However, this model isn't a perpetual motion machine.

Over time, the flywheel’s momentum inevitably slows. Liquidity cannot grow infinitely; once early participants choose to cash out, the ecosystem shifts from “growth mode” to “exit mode,” causing the cycle to gradually stall.

This leads us to Sonic’s evolution:

Fantom Rebranding

The once-prominent blockchain Fantom (FTM) fell into crisis after the Multichain bridge incident. This involved government asset seizures and instability caused by bridge vulnerabilities, leading to mass withdrawals of liquidity and stablecoins from the ecosystem, a sharp drop in total value locked (TVL), and severely damaged developer morale.

Rise of Sonic

In December 2024, Fantom announced its rebirth under the new Sonic brand. This rebrand preserved EVM compatibility while introducing key technical upgrades—including a more secure cross-chain bridging mechanism and a more attractive, developer-focused tokenomics model. Additionally, it marked the return of Andre Cronje, a central figure in the Fantom community, with a strategic shift toward supporting high-speed, parallel transaction execution. These changes signify a comprehensive upgrade in both technology and ecosystem vitality, reigniting interest among developers and users.

Why Now Is the Time to Pay Attention?

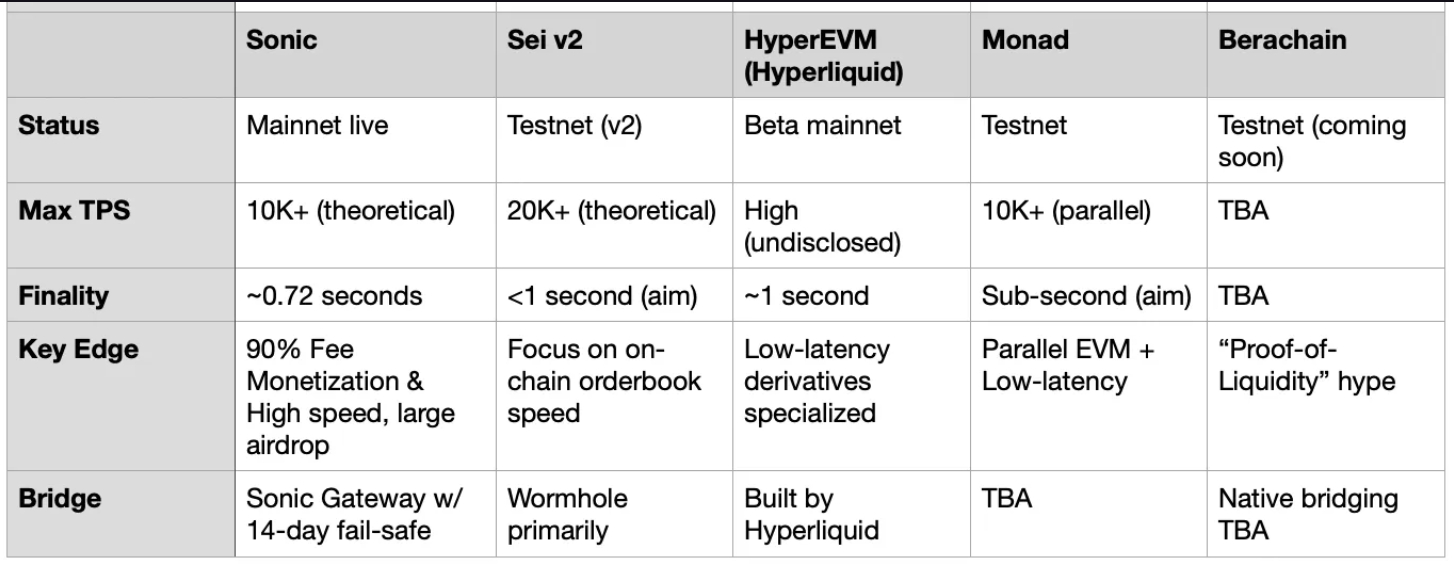

While many next-gen L1 blockchains with advanced execution layers (e.g., Sei V2, HyperEVM, Monad, Berachain, MegaETH) remain in testnet or pre-launch stages, Sonic is already live on mainnet and has passed stress tests with real TVL inflows.

With sub-second finality and a parallel transaction engine, Sonic matches the speed of specialized optimized L1/L2 chains, now drawing attention from DeFi developers and seasoned yield farmers ready to move capital to faster, lower-cost networks.

2. Key Advantages Explained

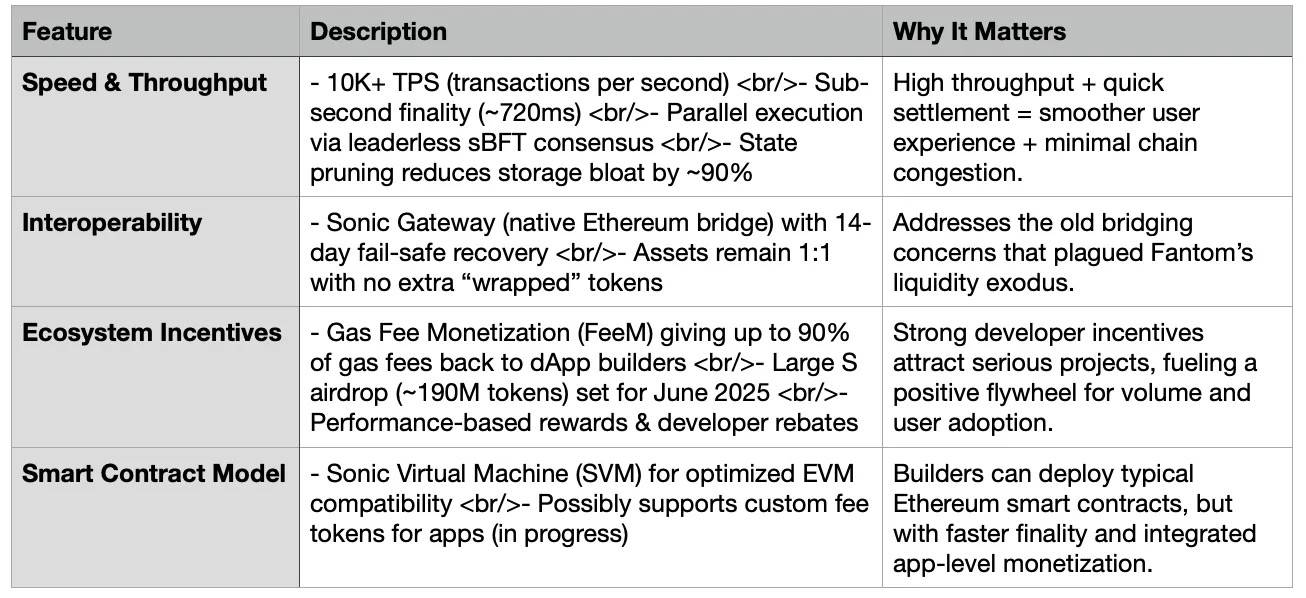

Below is a summary of Sonic’s standout features, based on the image titled “How is Sonic different from others?”

1. Speed

Sonic prioritizes fast transactions, making it one of the fastest EVM-compatible Layer-1 (L1) blockchains. Key highlights:

High Transaction Throughput

Sonic focuses on speed, parallel execution, and efficient state management, outperforming many existing EVM chains in scalability and transaction cost optimization.

-

10,000+ TPS capability: Tested throughput exceeds 10,000 TPS, with daily transaction capacity surpassing 800 million—capable of supporting explosive growth in GameFi/DeFi ecosystems.

-

Leaderless sBFT consensus with parallel execution

Unlike traditional blockchains relying on sequential execution, Sonic’s consensus enables parallel processing of multiple transactions.

This design boosts speed while maintaining security and finality.

Efficient State Management

State pruning (reduces storage bloat by 90%)

By removing unnecessary blockchain data, Sonic makes node operations lighter and lowers hardware requirements for validators. This helps improve decentralization, as more participants can run full nodes.

Dynamic Gas Model

Ensures low fees even under high load

The network automatically adjusts gas fees based on demand, preventing fee spikes during congestion.

This mechanism is crucial for maintaining affordability during high-traffic scenarios like token launches or DeFi trading.

2. Interoperability

Sonic is designed for seamless cross-chain connectivity, allowing assets and liquidity to flow freely across blockchains.

Its interoperability model emphasizes security and reliability, addressing critical weaknesses in current multi-chain ecosystems.

Sonic Gateway – Trustless Native Bridging

No reliance on third parties

Unlike traditional bridges that introduce centralization risks, Sonic’s Gateway is natively integrated into the protocol, significantly reducing exposure to hacks or malicious manipulation.

Failover Recovery System

Users can reclaim assets even if the network or bridge goes offline

One major issue with blockchain bridges is downtime or vulnerability. Sonic’s failover system ensures asset recoverability even when the bridge is temporarily unavailable.

1:1 Asset Backing, No Wrapped Tokens

Assets moving between Sonic and Ethereum are always fully backed Unlike wrapped tokens (e.g., wBTC, wETH), Sonic ensures native assets retain their original value. This improves liquidity and usability while reducing smart contract risks associated with wrapping mechanisms.

3. Incentives

Sonic offers the most developer-friendly incentive structure to drive ecosystem growth. Its model tightly aligns network success with developer profitability and user engagement, fostering organic development.

Gas Monetization (FeeM Program)

Developers receive 90% of transaction fee revenue

Instead of burning fees or allocating them solely to validators, Sonic redirects gas fees directly to the dApps generating the transactions. This creates direct economic incentives for developers to build high-usage decentralized applications (dApps).

Performance-Based Rewards

High-usage apps earn Gems

Popular apps created by developers qualify for additional Gem rewards, which can be passed on to users. This mechanism simultaneously incentivizes both developers and end-users to actively participate in the ecosystem.

$200M $S Airdrop via Sonic Innovator Fund

6% of token supply allocated to users

Users can earn points by interacting with eligible protocols, providing liquidity, or participating in governance. This structure encourages long-term involvement and DeFi experimentation.

4. Smart Contracts

Sonic enhances the Ethereum Virtual Machine (EVM) experience through a more optimized and flexible framework. Its smart contract improvements make it an ideal alternative to traditional EVM environments, offering higher cost efficiency, execution speed, and flexibility.

Sonic Virtual Machine (SVM)

Optimized smart contract performance

SVM optimizes Ethereum-based contract execution, reducing gas costs and improving efficiency—especially important for complex DeFi applications, automated trading strategies, and gaming environments.

Custom Fee Tokens for dApps

Apps can use their native tokens to pay transaction fees

This feature allows projects to cover gas fees using their own native tokens, improving user experience. Developers don’t need to force users to hold $S to pay gas—they can set custom fee structures.

Seamless EVM Compatibility

Ethereum-based smart contracts can be deployed without modification

Developers can easily migrate their dApps from Ethereum, Arbitrum, Optimism, or other EVM-compatible chains to Sonic, ensuring a low-friction onboarding experience.

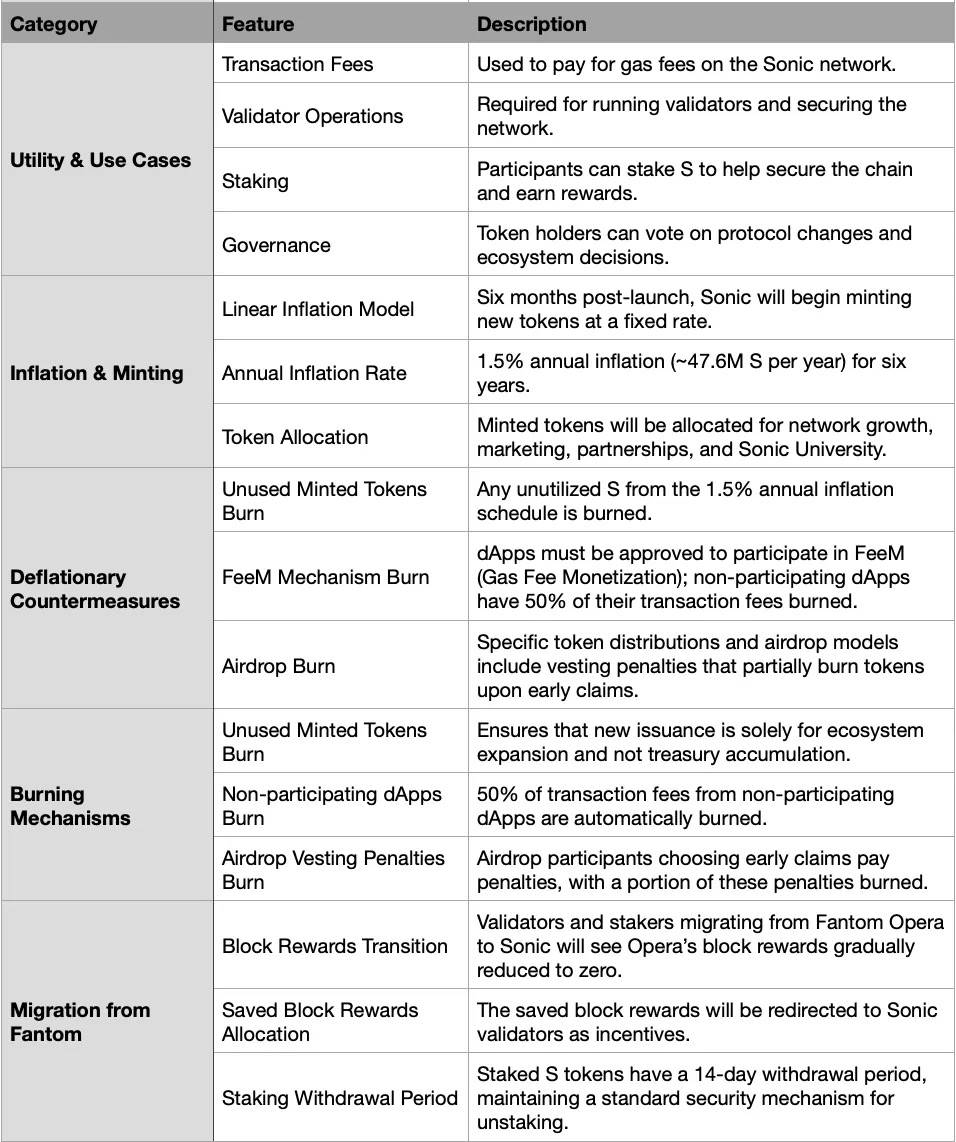

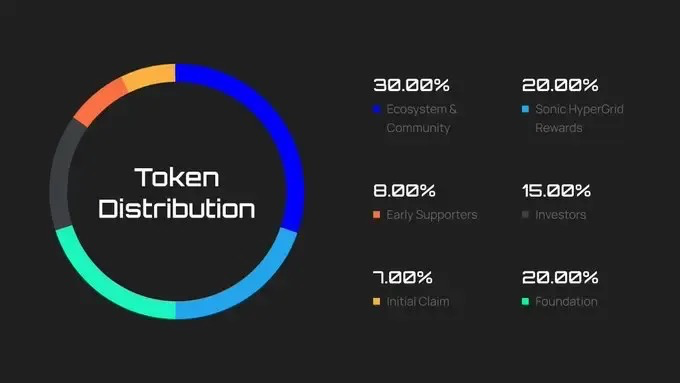

3. Tokenomics and Airdrop Mechanism

The $S token is Sonic’s native asset, serving multiple functions:

Functions and Use Cases

Transaction Fees: Used to pay gas fees on the Sonic network.

Validator Operations: Required to run validator nodes and secure the network.

Staking: Participants can stake $S tokens to help secure the chain and earn rewards.

Governance: Token holders can vote on protocol changes and ecosystem decisions.

Inflation and Minting Mechanism

Linear Inflation Model

Six months after mainnet launch, Sonic will begin minting new tokens at a fixed rate.

An annual inflation rate of 1.5% (approximately 47.6 million $S tokens per year) will continue for up to six years.

Minted tokens will fund network growth, marketing, partnerships, and the development of Sonic University.

Deflation Safeguards

Any unused minted tokens at the end of each year will be burned.

This ensures newly issued tokens are used exclusively for ecosystem expansion—not hoarded in reserve.

Burn Mechanisms

Sonic implements multiple burn mechanisms to balance token issuance:

Unused Mint Burn: Any portion of the annual 1.5% inflation not used will be destroyed.

FeeM Mechanism Burn:

-

dApps must be approved to participate in FeeM (gas monetization).

-

Non-participating dApps: 50% of their transaction fees are automatically burned.

Airdrop Burn: Certain token allocations and airdrop models include vesting penalties—part of the tokens are burned if users withdraw early.

Migration from Fantom Opera

Block Reward Transition

Validators and stakers migrating from Fantom Opera will see Opera’s block rewards gradually phased down to zero.

The saved block rewards are reallocated to Sonic validators as incentives.

Unstaking Period

Staked $S tokens are subject to a 14-day withdrawal delay to maintain standard unstaking security.

Supply and Inflation

Initial Supply: Sonic’s initial total supply matches Fantom’s (approximately 3.175 billion tokens) to enable a 1:1 FTM → S swap.

Ongoing Inflation: Sonic introduces a 1.5% annual inflation for up to six years to fund ecosystem growth. Unused tokens are burned to prevent uncontrolled dilution.

Fee Burns: By default, 50% of transaction fees are burned. As network usage grows, $S could become net-deflationary during periods of high activity.

190.5M $S Airdrop (June 2025)

Purpose: Attract new users, reward early participants, and stimulate DeFi activity on Sonic.

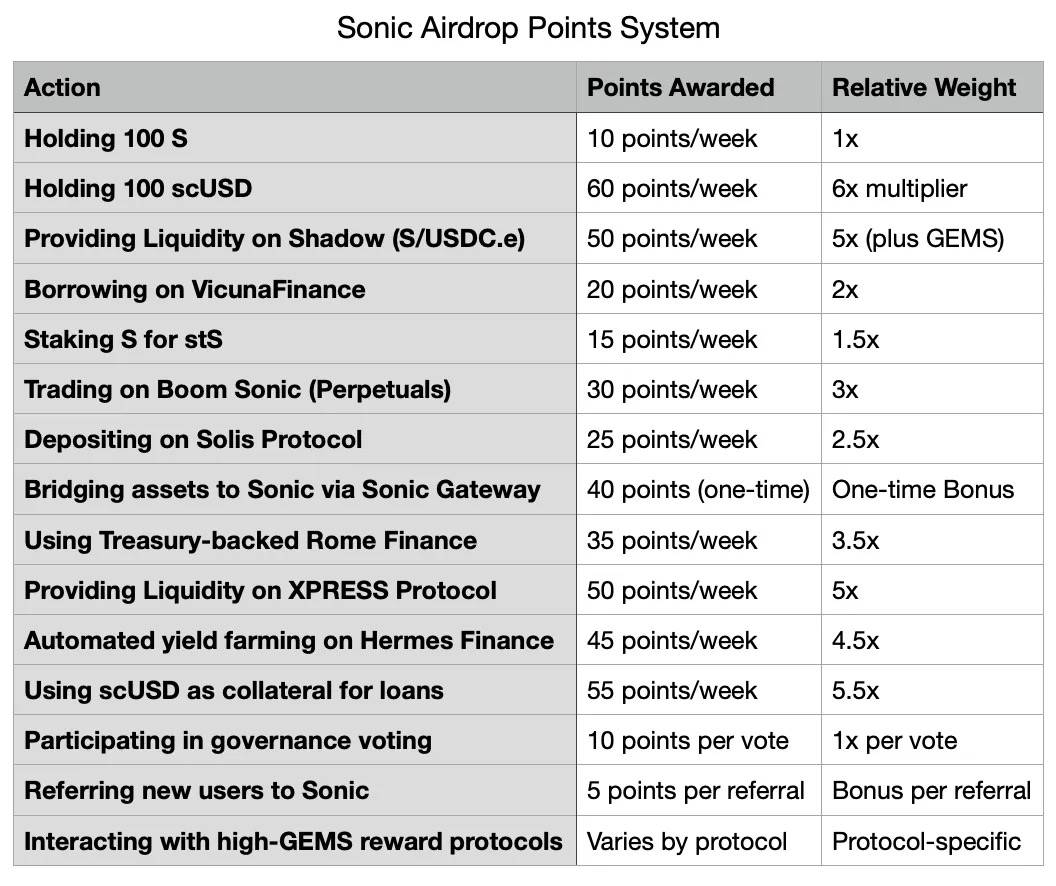

Points System: Users can accumulate “points” by:

Holding whitelisted assets in a Sonic wallet (e.g., scUSD, stS, USDC.e, etc.).

Interacting with dApps (e.g., providing liquidity, borrowing).

Earning GEMS from specific ecosystem protocols (defined by developers).

Vesting Mechanism:

25% of the airdrop can be claimed immediately; the remainder is linearly released over ~9 months.

Users may opt for accelerated claims but must pay a penalty—some tokens will be burned.

Example table showing points and potential airdrop allocation:

Figure: Exact values may vary; check the MySonic dashboard for real-time data

4. Gas Monetization (FeeM) Program

Sonic’s FeeM program is described as “applying Web2 ad revenue models to blockchain.” Under this program, developers of qualifying dApps can receive up to 90% of transaction gas fee revenue.

Key Features:

When users interact with a smart contract, a portion of the transaction fee is automatically routed to the developer’s address (or designated treasury).

This fee-splitting mechanism reduces the amount of fees burned, slightly lowering the blockchain’s default deflationary pressure.

Benefits:

Aligned incentives: dApps generating real usage earn more from transaction fees.

Developer attraction: Reduces reliance on external VC funding or token emissions.

Early data shows top protocols earning tens of thousands of dollars weekly in transaction fees—motivating high-quality developers to deploy on Sonic, even amid fierce L1 competition.

5. Ecosystem and DeFi Protocols

Existing High-Quality Projects

-

A concentrated liquidity DEX using an x(3,3) model (inspired by ve(3,3)).

-

High TVL (around $100 million or more), with daily trading volume reaching $100 million+, making it a top DEX on Sonic.

-

Liquidity providers earn both trading fees and protocol rewards (e.g., GEMS and xSHADOW).

-

A lending protocol.

-

Potential synergies with scUSD or other stable assets.

-

A perpetual DEX focused on advanced trading features, expected to launch on Sonic.

Rome, Solis, XPRESS, Hermes Finance

-

Projects not yet live, covering treasury-backed tokens, yield optimizers, or orderbook-style DEXs.

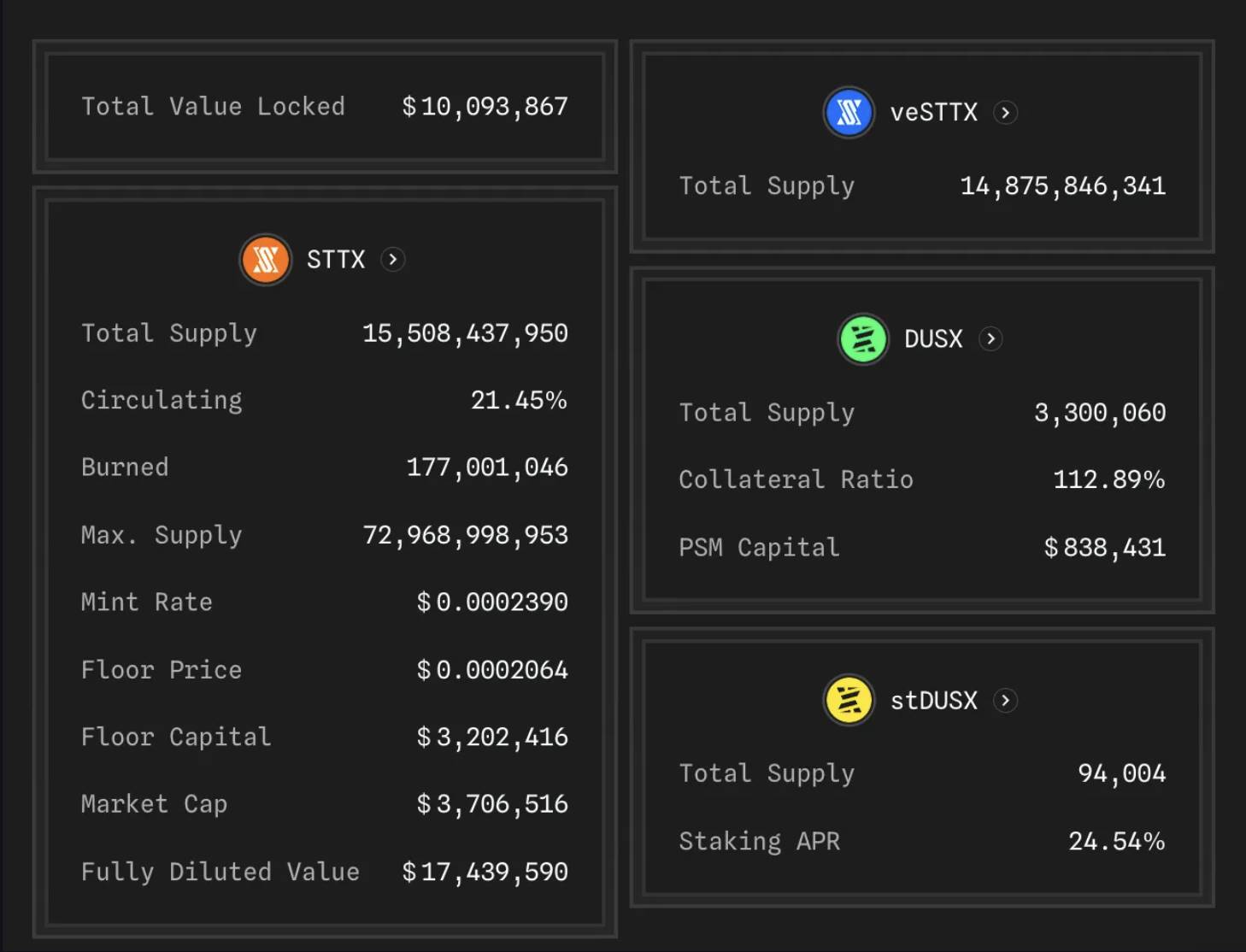

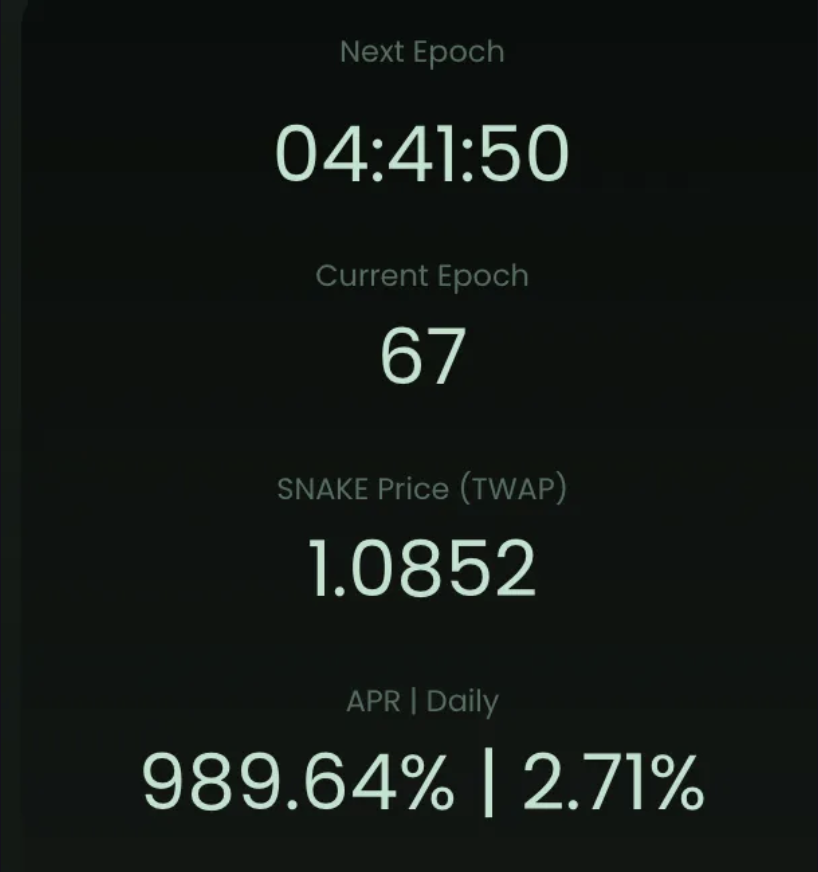

Other Protocols Mentioned by the Community

-

Staking $GSNAKE yields ~990% APR.

-

Introduces a stablecoin ($SNAKE) pegged 1:1 to $S, with high-APR "forest" farming pools.

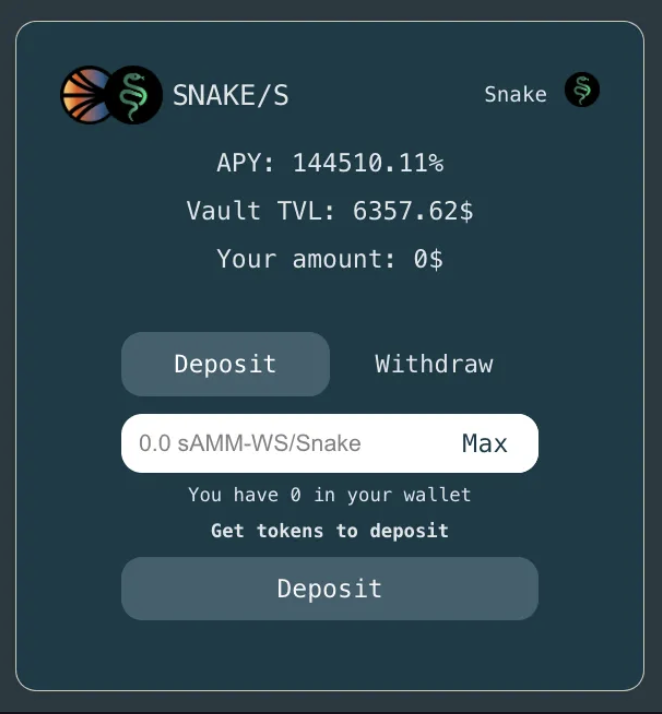

-

Alternatively, staking $wS/$SNAKE on @VoltaFarm—a auto-compounding platform on Sonic—can yield over 144,510% APR.

-

Offers over 1,700% APR.

-

When providing liquidity, carefully set price ranges—narrow ranges offer higher but less frequent returns, while wider ranges provide steadier but lower yields.

-

Users can also mint EGGS by depositing $S or other assets, then use EGGS for leveraged strategies.

-

A lending platform offering leveraged yield.

-

Early users may qualify for future token airdrops.

Rings Protocol, Spectra Finance, GammaSwapLabs

-

Derivatives, yield, and vault protocols advancing sophisticated DeFi use cases on Sonic.

6. Yield Opportunities

Yield farmers have already identified Sonic as a prime destination for high returns:

High-Yield DEX Farming Strategies

-

Pairs like S/USDC.e or USDC.e/EGGS on Shadow, Snake, or other DEXs can generate over 1,000% APY (though with volatility).

-

Concentrated liquidity strategies amplify returns when prices stay within range.

Lending and Liquid Staking

-

Staking $S via MySonic or third-party LSD providers (e.g., Beets, Origin) yields around 5–8% APY.

-

Liquid staking tokens (e.g., stS) can be redeployed into DEX pools for compounded returns.

Airdrop Boosting

-

Protocol-specific “GEMS” or synergistic rewards can also increase airdrop points.

A Potential Farming Strategy:

Use part of your stablecoins (e.g., USDC) on Shadow to acquire $S.

Stake some $S to obtain stS or scUSD.

Create liquidity pairs like stS/S or scUSD/USDC.e on high-APR DEXs.

Claim GEMS or xSHADOW and restake or compound.

Monitor point accumulation on the MySonic dashboard.

As noted by @phtevenstrong, stablecoin farming on Sonic can yield over 300% APY.

7. Comparison with Other L1s

Sonic holds a clear first-mover advantage among the new generation of high-performance EVM L1s. While competitors remain in testnet stages, Sonic is already attracting real liquidity and usage—a lead likely to persist, especially as its airdrop and FeeM programs lock in developer loyalty.

Several “fast L1” blockchains are launching or即将 go live.

8. Conclusion & Outlook

Sonic is a bold attempt to recreate Fantom’s success—and surpass it through new L1 economics, bridge security, and high-speed execution. Its core advantages include:

High throughput (~10,000 TPS)

Sub-second finality (~720 ms)

Generous developer incentives (90% fee monetization, 190M $S airdrop)

More secure cross-chain bridging (14-day failover recovery)

In the short term, real usage, new liquidity, and broad interest in parallel EVM execution give Sonic a strong edge over testnet-stage rivals. Of course, sustainability post-June 2025 airdrop remains the biggest challenge. If user engagement and developer confidence remain strong, Sonic is well-positioned to claim a lasting role in DeFi’s multi-chain future.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News