Final Cycle: ETH Denver Recap

TechFlow Selected TechFlow Selected

Final Cycle: ETH Denver Recap

Participants either turned to building/investing in实体 enterprises, or prayed for the crypto casino to make a comeback.

Author: Noah

Translation: TechFlow

TL;DR

Fewer new faces, less frivolous marketing spending, and a shift toward pragmatism. There are still some lingering issues from the past (e.g., 2018-era infrastructure projects reaching their end, or recently overfunded VC scams burning cash on marketing), but these are less common than in previous years.

Setting the Stage

The industry is generally divided into two categories: crypto-natives and newcomers. I’ll further subdivide each of these into two groups.

-

Crypto natives / mercenaries

-

Crypto-native technologists

-

Low-quality newcomers

-

High-quality newcomers

Crypto Natives

Technologists (VCs/investors, venture-backed projects) primarily focused on capturing large market opportunities and building real products. This group makes up >2/3 of the crypto-native attendees at events, with main interests in AI/DePIN and fintech.

Mercenaries are fewer in number than before. I believe this is due to 1. cold on-chain markets, 2. future growth prospects leaning toward institutions, and 3. most mercenaries either having gone bankrupt or already cashed out. Few remain who are willing to play the high-stakes game.

Newcomers

Newcomers can often be segmented by talent quality. Low-quality talent typically worked in defunct L1/L2s or other capital-saturated companies in soft-skill roles (business development, growth, ecosystem, etc.). These individuals may be crypto enthusiasts—or simply enjoying the relatively high compensation compared to output in this industry.

High-quality newcomers fall into two categories: mercenaries and technologists:

These technologists either come from TradFi, building on-chain finance and stablecoins, or are infrastructure experts from fields like AI, DePIN, security… usually targeting large emerging markets with new tech or capital formation.

Mercenaries are often young founders aged 18–25 who witnessed the financial success of older peers in 2021 and want to replicate it. They’re charismatic, highly intelligent, and somewhat sociopathic. A relatively small group, yet they capture a disproportionate share of attention.

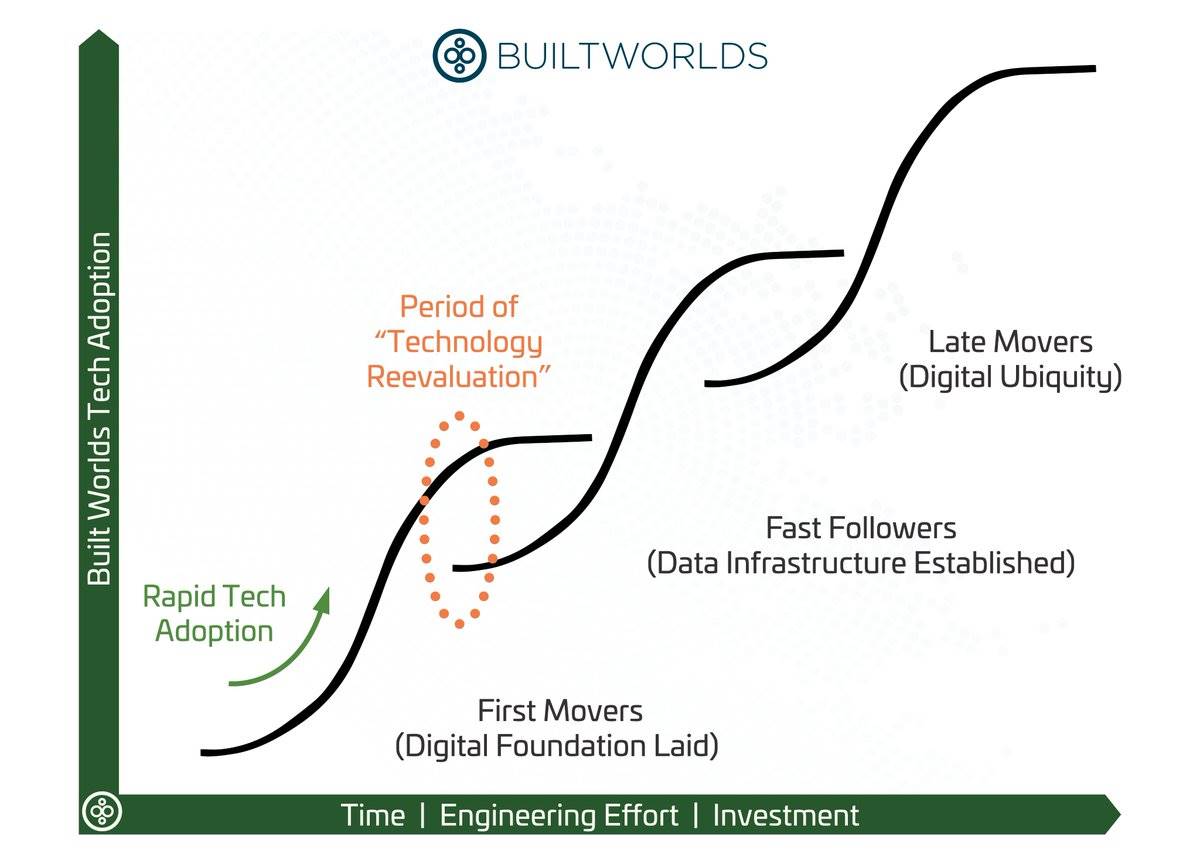

The Industry Enters a Reassessment Phase

So why, as we face mass adoption of blockchain technology, are our token prices plummeting...? Why are some optimistic while others are pessimistic?

The answer is simple: We are at the end of one S-curve and the beginning of another.

A brief recap of the crypto industry’s historical trajectory:

2009–2011: The era of fringe technologists

2011–2016: The darknet/gambling era

2017–2019: First wave of normies (ordinary participants entering during the crypto craze without deep technical or cultural grounding)

2020–2021: DeFi Summer, first/second cycle of normies

2022–2024: Opportunists/vultures, second/third cycle of normies

This is very general, but I believe accurate.

Early entrants were either

1. Technologists

2. Criminals

3. Lucky timing.

Most people who entered crypto before 2017 were either

1. Wealthy and retired

2. Viewing crypto as a lifestyle

3. Unable to make money.

After DeFi Summer, a flood of people entered crypto, indicating that post-2020 cohorts became more representative of the general population.

Many got rich, but extreme wealth within these groups was far less common. Participants were now either

1. Wealthy and retired (a minority)

2. Moderately affluent with options

3. Formerly wealthy and disillusioned with the space.

Post-2024: All sectors will face challenges. Only those who identify real business opportunities and possess exceptional capability will survive. We may see many executives with extensive TradFi or Web2 experience entering the space.

Looking at the current roster of crypto participants, it's clear only three groups remain:

-

Pre-rich early players and pre-2022 entrants: failed to capitalize on opportunities over the past 5–10 years and, in many cases, feel disillusioned with the field

-

After-rich players and hardcore crypto natives (quasi-religious: ETH Maxis, Link Marines, etc.)

-

Newcomers seeking business opportunities

Most bearish/pessimistic people belong to the first group. They envy the wealth created and chase it, but realize much of it was built on luck or fraud.

The second group still believes ETH is money and cannot be reasoned with. They are self-righteous—speaking on podcasts or working at funds—but haven’t done real work for years and are disconnected from the market.

The third group is more optimistic because they aren't burdened by past experiences and can focus on what they believe in. We finally see regulatory clarity emerging, stablecoins gaining mass adoption, and financial markets embracing tokenization.

Where Is the Industry Headed?

I think there’s broad consensus within the industry about the vision for the next few years, but participants who haven’t benefited from this reality choose not to acknowledge it.

Going forward, marginal consumers engaging with crypto will care about how it delivers tangible value to their lives. We’re likely to see significant development in on-chain financial applications—using crypto primitives to ensure security or reduce back-end costs, for example.

We probably won’t see major growth in pure crypto markets, though I don’t think that surprises many. This could negatively impact token fund inflows and lead to liquidity market issues.

We’re in a transitional period—regulation is uncertain but imminent. Liquidity may increasingly access publicly registered equities that directly substitute for token allocations. We may see many on-chain financial products requiring KYC to attract large institutional clients, splitting the on-chain market into gray/black markets and regulated markets. Uncertainty is risk. While the overall outcome may favor our industry, it might not favor many of our individual products.

ETH Denver and its resulting price action served as a wake-up call for the industry. Participants must now choose between building/investing in real businesses or praying for the return of the crypto casino. As actual business outcomes emerge, the relative opportunity offered by the crypto casino diminishes—it’s becoming an increasingly obvious choice.

Many industry participants (companies, traders, funds) have been limping along for years, surviving only because feedback loops were too long or capital was too abundant to force them to confront failure. The turn toward rationality began with the Bitcoin ETF in 2024 and was fully realized with Trump’s inauguration in 2025.

Maybe after just one or two cycles, ordinary people could deliberately ignore the Ponzi casino, but the first major hype cycle was eight years ago—and many have now accepted that the VC-TGE-Cashout cycle is a scam, and won’t change even if it remains profitable.

In 2024, the market rebounded on BTC-led wealth effects and memecoin hype cycles, but traders participated with eyes wide open. They joined only when profitable and believed none of the narratives.

Free money is gone, gamblers have left, and downstream industry participants are assessing the impact on their portfolios.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News