Exclusive Interview with Backpack CEO Armani Ferrante: Building a Bridge Between Traditional Finance and the Crypto World

TechFlow Selected TechFlow Selected

Exclusive Interview with Backpack CEO Armani Ferrante: Building a Bridge Between Traditional Finance and the Crypto World

What we need to do is help the industry mature and bring the value existing in traditional markets into the crypto market.

Interview: Mensh, ChainCatcher

Guest: Armani Ferrante, CEO of Backpack

Armani gives off a very approachable vibe. On the walk to the interview venue, every time someone warmly greeted him, he would politely exchange a few words. But then he'd quickly drift into thought or reply to messages—never a moment of idle downtime.

The Backpack team is staying at a hotel located in the same complex as the Consensus conference venue. Armani explained this was his way of minimizing commute time. In Japan, his residence is also close to the office—on days without social obligations, he's essentially a workaholic shuttling between just two points.

During conversation, perhaps due to an engineer’s inherent precision, he would first pause briefly, define and deconstruct each question before answering. Where he lacked specific evidence, he’d add, “You can go verify that yourself.”

Armani was once an engineer at Apple. In 2017, he encountered Ethereum and became fascinated by the idea of a “world computer.” He almost immediately quit his job at Apple and has since dedicated himself entirely to blockchain technology development.

Backpack Wallet was founded in April 2022. Later that year, following the FTX collapse, the company lost 88% of its treasury funds. Yet amid the crisis, Armani also spotted an opportunity in compliant exchanges. Backpack Exchange officially launched in March 2023.

In April 2023, Backpack released Mad Lads, the first xNFT collection on Solana. It was a major success, ranking first globally in trading volume at one point—even surpassing established Ethereum blue-chip NFTs like BAYC. During the bear market, Backpack had to carefully stretch $1.4 million raised from Mad Lads NFT sales to sustain operations.

In February 2024, Backpack secured $17 million in funding led by Placeholder, with participation from Wintermute, Robot Ventures, Selini Capital, Amber Group, and others.

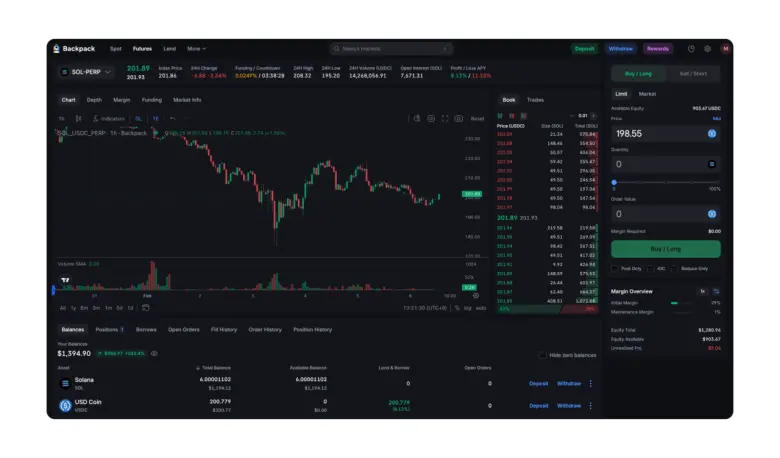

Currently, Backpack offers 57 spot trading pairs, 15 perpetual contracts, and 5 lending/borrowing liquidity pools. According to CoinMarketCap, Backpack currently holds $34.12 million in total assets, with approximately 54% in USDC and 26.22% in SOL. At the time of writing, its trading volume stands at $6,194,018.

Having been warned by the FTX incident, Backpack places great emphasis on compliance across regions and actively pursues licenses. In October 2023, Backpack obtained a Virtual Asset Service Provider (VASP) license from Dubai’s Virtual Assets Regulatory Authority (VARA). On December 10, 2024, it officially registered as a Class II member of the Japan Virtual Currency Exchange Association (JVCEA). On January 7 this year, Backpack acquired the bankrupt European arm of FTX, FTX EU, for $32.7 million. FTX EU previously held a MiFID II license issued by Cyprus Securities and Exchange Commission (CySEC). Armani said the company plans to become Europe’s only regulated perpetual contract provider and has already submitted its MiCA notification, aiming for launch in Q1 2025.

In this interview, we spoke with Armani about Backpack’s positioning as a young exchange, future product plans, and his personal entrepreneurial journey.

From Apple Engineer to Exchange Founder: A Rocky Path of Conviction

ChainCatcher: You were an engineer at Apple. What made you decide to enter the crypto space?

Armani:

After college, you join a big company, working like any other ordinary engineer—you're just a cog in a massive machine. In 2017, Bitcoin and Ethereum prices kept rising, and that moment felt truly magical. I remember clearly sitting in a café on Market Street in San Francisco, laptop open, reading the Ethereum whitepaper—it felt like the coolest thing ever. I was completely captivated. I didn’t know what I should do, how to make money, or who to work for, but I knew I wanted to be part of this. So I quit my job at Apple. I didn’t know exactly what I was doing, but I decided to give it a try because everything back then was so motivating.

ChainCatcher: Can you share your entrepreneurial journey from xNFT to Mad Lads, and then to Backpack Wallet?

Armani:

I entered the Solana ecosystem in September 2020, when there was almost no ecosystem yet. I joined and worked on many things—DeFi, early wallet infrastructure, developer tools, and more. These efforts later proved highly successful, and the network began growing rapidly in its early stages. Because of this growth, I decided to start a venture. Solana made me feel for the first time that infrastructure problems were largely solved, so I started thinking about what problems to tackle next to push the network and industry forward. Back then, many people recognized the importance of mobile, and knew building mobile apps in crypto was challenging because iOS and Android app stores are near monopolies. So my team and I began thinking about how to build a decentralized app store. That’s where xNFT originated—we wanted to tokenize apps just like images, creating a new distribution channel for decentralized applications. That was the original idea, though we eventually pivoted.

ChainCatcher: Why did you choose NFTs as your starting point?

Armani:

NFTs are essentially a universal format representing ownership of collectibles. We usually associate them with 10K PFPs, meme JPEGs, or CryptoPunks, but they’re actually a general-purpose way of owning anything. At the time, these NFT series—especially 10K-style avatar collections—created incredibly strong communities. Examples like CryptoPunks were hugely successful and drew wide attention within the industry, becoming one of crypto’s most exciting social events. This laid the foundation for the Mad Lads story.

We ultimately decided to create our own NFT series for two main reasons: First, if we were going to build an NFT platform and protocol, we should become our own users by launching our own collection. Second, community momentum at the time was extremely strong and genuinely exciting.

The Origins of Backpack: Regional Compliance Opportunities

ChainCatcher: You mentioned seeing a gap in the exchange market when FTX collapsed. What was that gap?

Armani:

As the industry matures, especially as regulations become clearer, it’s no longer useful to classify exchanges simply as centralized or decentralized. A better classification is: One type has censorship-resistant systems, widely distributed globally, without region-specific rules—like the internet itself, or decentralized exchanges such as Uniswap. The other type consists of compliant entities—centralized organizations capable of enforcing rules and operational tools in every jurisdiction they serve.

As the industry evolves, players are forced into one of these two categories. The challenge is, many people excel at product and can build great exchanges, but lack the ability to build all the operational infrastructure required for a compliant financial institution. Meanwhile, others are strong in compliance and operations—often coming from traditional finance—but aren’t good at product development or don’t understand the nuances of crypto. You see many struggling between these two worlds. The real opportunity lies in the middle—building a financial institution well-adapted to this industry, capable of building on-chain products, operating wallets, and bridging the gap between traditional finance and crypto.

You see this happening everywhere. Just one or two weeks ago in Japan, many unregulated exchange apps were removed from app stores for failing to comply with local rules. In Europe, all major derivatives exchanges have been forced to exit for non-compliance. For example, five derivatives exchanges—including OKX Derivatives—now offer almost no derivatives services in Europe because none are compliant. That’s where the opportunity lies—becoming a compliant, trustworthy player that solves the bridge problem between traditional finance and crypto, bringing all the value of traditional finance onto the blockchain.

ChainCatcher: What products is Backpack currently focusing on to connect traditional finance with the crypto industry?

Armani:

Products exist at many different levels. You can't immediately say, "I'm going to build a competitor to Robinhood or Uniswap." We have two parts—two businesses: one is the wallet, the other is the exchange.

On the exchange side, the primary goal is building liquidity. For any product, liquidity is paramount. So our first focus is creating a compelling trading product. About two and a half weeks ago, we launched a public beta of a new product we call “Yield-Bearing Futures” or “Yield-Bearing Pro Futures,” which differs from standard perpetual futures. With our futures product, users earn yield on their collateral. We have a native cross-chain money market where you can lend out your assets and use those lent assets for trading. In just the past two and a half weeks during testing, we’ve achieved over $2.4 billion in trading volume. We plan to officially launch in early March, exiting beta and opening fully to global users. This will be our first major product—an attractive trading experience where spot, margin, lending, and perpetual futures all generate interest. We've invested heavily in building a truly excellent and differentiated product that solves problems DEXs cannot. This is our starting point.

Second, on the wallet side: You can think of Backpack Wallet as a self-custody key management system. We now support Solana, Ethereum, Base, Eclipse, Arbitrum, Optimism, Polygon, and aim to support every chain, similar to MetaMask. But there’s a critical issue in the wallet space today. If you open Solflare (a Solana wallet), they’ll show you a shocking statistic: $2.4 billion is lost annually due to people losing access to their crypto wallets—at least that was last year’s figure. I forget the exact number, but it’s a massive failure for the entire industry. This loss even exceeds annual losses from all centralized exchanges combined.

Self-custody is the solution. Without self-custody, you could question much of what we’re doing. This is another core part of our product—building around wallets and solving self-custody issues so I can confidently tell my parents or friends: You can use crypto safely, without risk. You don’t need to worry about self-custody, losing keys, or managing passwords. This is one of the most important problems to solve today. So this is where we begin.

ChainCatcher: Pump.fun, Moonshot, GMGN—these are all popular right now. How do you view the current competitive landscape between centralized exchanges (CEX) and decentralized exchanges (DEX)?

Armani:

The crucial point I made earlier applies here too: It’s not a competition between DEX and CEX, but between censorship resistance and compliance. Depending on which path you take, you end up with vastly different products and features.

One lesson from this cycle is that nothing beats DEXs when it comes to issuing long-tail assets. Pump.fun might seem absurd, but it’s precisely something that couldn’t be built the same way on a CEX. This is where DEXs truly outperform CEXs. For other product areas—margin trading, futures, spot margin, stocks, U.S. Treasuries, fiat on/off ramps—these are where CEXs shine. Each has nuanced reasons behind it, but ultimately it comes down to compliance and direct bank integrations. For on/off ramps, only regulated exchanges can do it best. That’s the CEX advantage, and it will continue to dominate in deeply regulated products. The U.S. stock market might be the best example—that’s where CEXs derive their appeal. Take Robinhood: if they tokenize stocks, they can do it better than anyone. That’s the CEX edge.

When it comes to margin trading, it’s not just about custody. With margin trading, self-custody doesn’t exist. Whether it’s futures, spot margin, or options, you don’t own your assets. The system owns them, and liquidators control them. So it’s all about the system’s rules, especially risk management. Thus, the line blurs. Margin trading has pros and cons. For instance, decentralized risk management with transparency—projects like Aave do this exceptionally well. But when dealing with high leverage and highly volatile assets, it becomes a niche dominated by a few players—that’s where decentralization hits its limits. Whether on CEX or DEX, the question becomes almost irrelevant. The real question is: Who makes these decisions? Who backs the brand? Who builds the risk models? Those are the critical factors.

ChainCatcher: What are the biggest challenges you face when building on-chain systems and self-custody wallets?

Armani:

These two worlds will continue to converge. That’s why we deliberately integrated both CEX and DEX functionality into a single app. With an exchange, you can build the best wallet; with a wallet, you can build the best exchange. There are strong synergies between the two.

Take asset recovery as a simple example. Remember that shocking statistic I mentioned—billions lost annually to self-custody failures. If you apply modern technologies like account abstraction, you could solve nearly all current UX issues in self-custody. So I believe these worlds will keep merging. The key is leveraging their respective strengths—they’re not zero-sum.

Focus and Dedication: A Workaholic of Two Points

ChainCatcher: How do you allocate your time? How does a typical day look for you?

Armani:

My time falls into two main categories, maybe three. First, hiring and company building. Second, product—I must build a great product and innovate in this space, and I’m proud to say we’ve done that. The third is coordination among compliance, product, and engineering teams so we can truly solve problems and build a market with high trust and integrity. So far, we’ve basically climbed these “mountains.”

Next, the mountain we’re climbing is market penetration. Right now, it all comes down to liquidity. No matter how great your product is, no matter how many compliant jurisdictions you serve, without deep liquidity, nothing matters. That’s the next mountain we’re tackling.

So far, we’ve excelled—whether in product, building strong spot and derivatives offerings, or in compliance. One of our biggest advantages is market trust. We can confidently say we’ll be among the most regulated exchanges in the market—large institutions can trust what they trade here. That’s why U.S. capital markets are so special: they’re the deepest, most liquid, most regulated markets in the world, with trillions traded because people trust them. They know it’s real, not fake or manipulated. Bringing that maturity into crypto is the next mountain we’re climbing—the focus for the coming months.

ChainCatcher: I heard you’re so busy you haven’t had time to shower all week—is that true?

Armani: Unfortunately, yes.

ChainCatcher: As a CEO of an exchange, do you think it’s better to be an excellent trader, or better to not know much about trading?

Armani:

You must understand your users. If you don’t understand them, you can’t build a great product. Your job is to solve user problems. If you weren’t a user initially, you should become one. Not just traders. When discussing futures, you’re talking to traders; when discussing mass-market consumer finance—a “super app” covering all finances—you’re addressing different segments. Whether using on-chain apps, DeFi, wallets, or DApps—you need to understand user needs.

ChainCatcher: Do you personally trade?

Armani:

Yes and no. I do trade, but I view investing like Buffett—imagine a punch card with 20 investment slots. Every time you invest, you punch a hole. You only get 20 punches in life. Then you buy and hold forever. That’s my investment philosophy. Everyone has their own method—this isn’t financial advice. But that’s how I see the market.

Advantages and Strategy: Tackle the Hardest Problems First

ChainCatcher: What is Backpack’s competitive advantage compared to other exchanges?

Armani:

The opportunity we see is that few exchanges can truly penetrate and bring crypto into mainstream consumer finance. The reason? Only a handful are doing the hard work of integrating crypto into societal frameworks—and that boils down to compliance. Revisiting our earlier discussion, look at some of the world’s largest markets—Japan, the U.S., Europe—who can operate there, who can’t. There’s a massive gap and opportunity to bring these products into these regions, which are among the world’s largest markets.

That’s why we chose the harder path. We could’ve built and launched an exchange a year ago, but we didn’t. We spent time solving problems and obtaining global licenses. Our product team has only 16 engineers—doing everything—but the company has about 90 people total, with the rest in compliance, legal, operations, and customer support, supporting not just one language but all languages, meeting the requirements of a credible financial market. Here, you achieve the deepest liquidity because you have market integrity and regulatory oversight, allowing participants—even traditional regulated market players—to enter the crypto market. That’s the huge opportunity. We’re building this correctly, helping the industry mature, bringing the value of traditional markets into crypto, so crypto stops being some unregulated fringe and instead becomes integrated into society’s framework. That’s a massive opportunity few see.

ChainCatcher: Why did you set Backpack’s headquarters in Japan?

Armani:

Japan is one of the world’s largest markets—and one of the hardest to enter—due to its strict compliance requirements. You can’t just serve Japanese users arbitrarily. Many companies have tried, only to recently be kicked out of app stores. So we believe we have the capability and technology to solve these issues and do things right, in a way only a rare few crypto-native exchanges can. Japan is also a great place to live.

ChainCatcher: But Japanese people don’t seem very enthusiastic about trading—perhaps the market is more conservative?

Armani:

Cultures differ everywhere, but many overlook that Japan was once a center of crypto activity. For example, Binance originally started in Tokyo. After multiple exchange hacks, regulation tightened, forcing many to exit. Now, however, Japan has adopted progressive policies, attitudes, and spirit toward crypto—very exciting. Recently, Japan reduced its crypto tax rate from 55% to 20–25%. This is a huge shift that will drive significant capital inflow into Japan’s crypto market. I believe the tide is turning in Japan—the future opportunity lies here.

ChainCatcher: Do you have any upgrade metrics you’d like to share—trading volume, user numbers, or financial data?

Armani:

When we started the exchange, we did $60 billion in trading volume. We called it “pre-season” because the exchange wasn’t fully built yet—we only offered spot trading for Solana, Bitcoin, and Ethereum. Especially in Chinese-speaking markets, people were excited to see a new exchange after the FTX incident. Since then, we’ve done extensive work and are now ready to launch from several major markets with access to the deepest global capital market liquidity. The real opportunity is that crypto is a global, internet-native capital market—not just in China, but in Japan, the U.S., Europe, Africa—everywhere. That’s the essence of crypto: borderless.

March is when we truly begin. Now we have a full beta program, having launched our new yield-bearing futures product, margin system, and all compliance infrastructure. In just the past two and a half weeks during beta, we’ve done around $2.4 billion in volume. As the trading season begins, we expect activity to grow significantly.

ChainCatcher: What was Backpack’s decision-making process for listing memecoins?

Armani:

There are several questions to ask yourself. The most basic: Do users want this? Users are never wrong. There are many KPIs to reference, but qualitatively—do users genuinely demand it?

The next, more important question is market integrity. This is much harder to solve: Is the market safe? Is it not just exciting, but decentralized enough that it doesn’t become a playground for insiders? I think this is a major criticism facing memecoins today.

This applies to both CEX and DEX. So this is one of the most important considerations: Will this market become one of information asymmetry, where certain parties harm others? A major benefit of CEXs is that we act as a filter—this can be good or bad. Many people are frustrated with CEXs now, feeling there’s massive value extraction—everyone fights for the next listing, wants to launch on day one as fast as possible, without really knowing or caring about the project. They just see competitors doing it, so they want in too. Often, price charts follow a pattern: pump then dump. That’s a fair critique, and one we want to challenge.

Everyone is stuck in this prisoner’s dilemma—watching competitors and wondering: Will they list it? If they do, can I afford not to? I take pride in our judgment—we always do what’s right. But these are the internal debates every exchange faces. That’s the underlying dilemma.

ChainCatcher: Backpack recently closed its Series A round last year. What was that funding primarily used for?

Armani:

The last funding round was mainly used to build the team—recruiting talent, ensuring we could obtain the necessary licenses globally, and ultimately enter the market. This includes engineers, compliance staff, customer support, operations, legal, and more. Building an exchange is a massive undertaking. Unlike traditional tech companies, where you just hire a bunch of smart engineers and product people and start, our team has diverse skill sets and comes from various countries. We’re a truly international team.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News