Sonic ecosystem takes off, which projects are worth watching?

TechFlow Selected TechFlow Selected

Sonic ecosystem takes off, which projects are worth watching?

Will opportunities come along with the hot money as the focus shifts?

As the market enters a chaotic period of disorderly volatility, Sonic—formerly known as Fantom—is reentering the spotlight through its core strength in DeFi. The native token $S surged this week, the ecosystem’s total value locked (TVL) doubled within a week, and individual DeFi tokens within the ecosystem saw astonishing gains. The leading project $Shadow achieved a weekly peak increase of over 500%, and similar returns were observed across nearly every high-quality project in the Sonic ecosystem during the past week.

The revival of the Sonic ecosystem is undoubtedly driven by the quality of its DeFi offerings, which have attracted significant external interest. A large part of the momentum also stems from AC (Andre Cronje), the spiritual leader and founder of Sonic, who has been actively promoting projects non-stop. Engaging intensively on social media 24/7, he responds to and amplifies nearly every project within the ecosystem, whether DeFi or Meme-related.

With sentiment cooling down on Solana and BSC, and on-chain liquidity still seeking new outlets, we’ve compiled a list of notable projects within the Sonic ecosystem worth watching—offering insights into how the long-accumulating energy from the original Fantom community can be leveraged in this new phase of growth.

DeFi

-

$SHADOW (@ShadowOnSonic)

Contract address:

0x3333b97138D4b086720b5aE8A7844b1345a33333

Current market cap: $38 million

Peak market cap: $45 million

Recent DeFi enthusiasm around Sonic is closely tied to Shadow’s token $SHADOW. Shadow is a DEX on the Sonic ecosystem based on the x(3,3) model. Its innovation lies in transforming the traditional ve(3,3) staking-for-yield mechanism into an x(3,3) "mutual aid" model: “penalty for early exit, rewards for staying.”

Users deposit $SHADOW to receive staked tokens $xSHADOW and earn income generated by the protocol. They can unstake at any time but will incur a penalty fee (proportion varies with holding duration), with the deducted tokens distributed to those who remain staked.

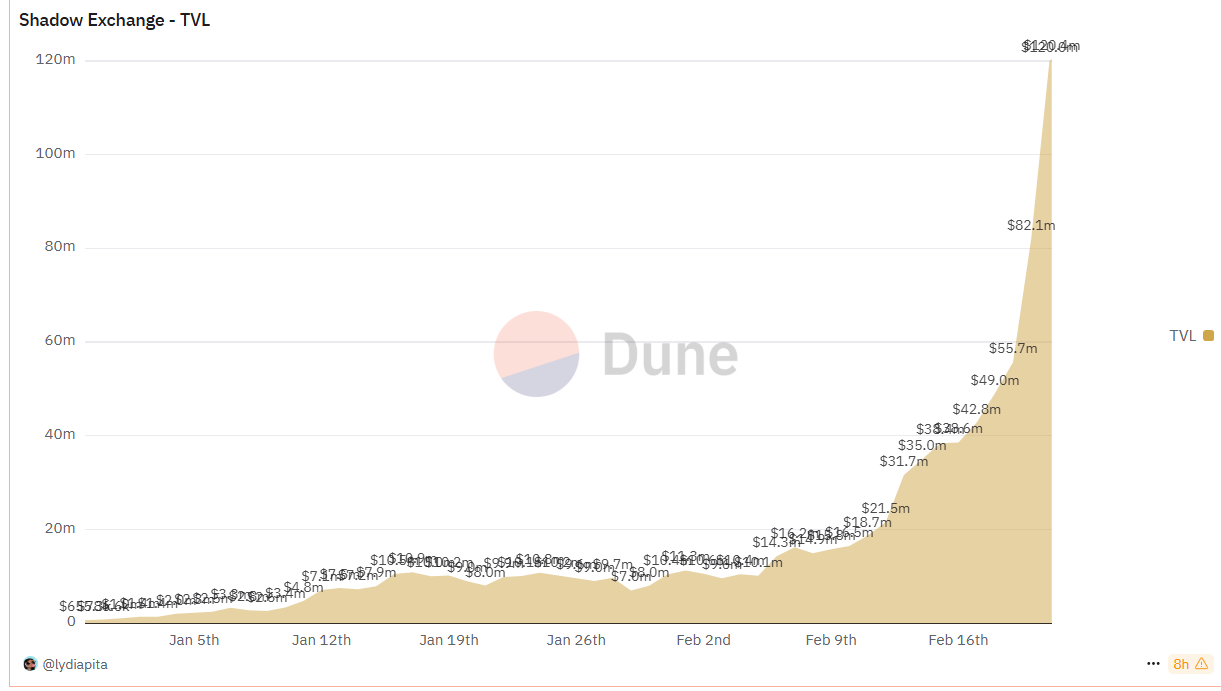

This innovation delivers high staking yields to $xSHADOW holders and has led to a sharp rise in Shadow’s TVL:

-

Beets.fi (@beets_fi)

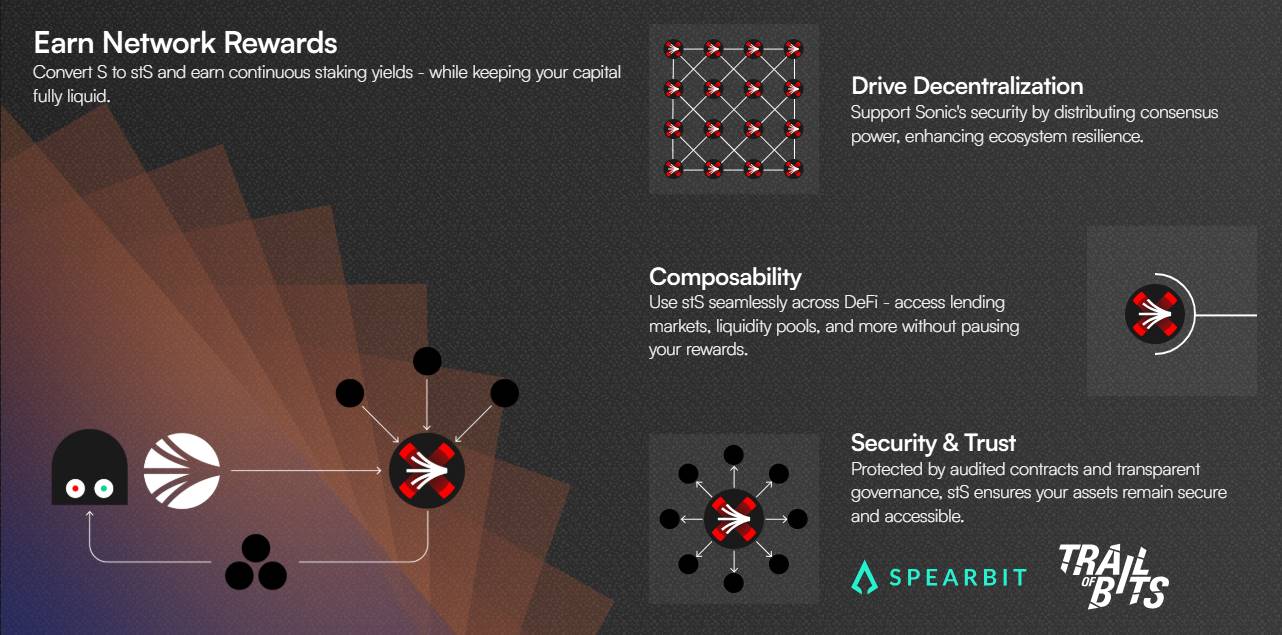

Beets.fi (shortened to Beets) is the LST hub within the Sonic ecosystem, evolved from the Beethoven X team. Transitioning alongside Fantom into Sonic, Beets has shifted from being a DEX to becoming a core staking and liquidity infrastructure project for Sonic, serving as a foundational pillar. It is ideal for users seeking stable returns and long-term participation.

By staking $S, users receive a liquid staking derivative $stS, allowing them to retain staking rewards while maintaining asset liquidity. Its auto-compounding mechanism ensures continuous yield accumulation. The platform builds a diversified matrix of liquidity pools via $stS, such as the $wOS/$stS pool developed in collaboration with Origin Protocol, enabling users to maintain exposure to $S while capturing multiple revenue streams.

-

$EGGS (@eggsonsonic)

Contract address:

0xf26Ff70573ddc8a90Bd7865AF8d7d70B8Ff019bC

Current market cap: $12.7 million

Peak market cap: $13.7 million

Eggs Finance (shortened to Eggs) is a leveraged yield protocol on the Sonic ecosystem that integrates leveraged yield tools with Sonic’s native token $S, creating an internal capital recycling system. Its goal is “enabling $S holders to amplify their returns while maintaining their positions.”

The mechanism of Eggs Finance can be summarized as “minting, leverage, yield cycle”:

Users stake $S into Eggs Finance to mint a derivative token $EGGS, which is pegged to $S but carries leverage. The minting cost increases over time; early participants pay less, while later users’ $S payments are partially redistributed to earlier participants, forming a “Ponzi-like” yield cycle. Users can then use $EGGS as collateral to borrow more $S and reinvest into other pools (such as ShadowOnSonic or Beets) to earn higher returns. On X, some noted that the short-term annualized yield of the $EGGS/$S pool once reached as high as 1800%.

Currently, Eggs Finance is listed on DeFi Llama, and trading primarily occurs on Sonic’s DEX.

Meme Projects

On February 7, the Sonic official launched the Meme Mania competition, running from February 7 to March 8, 2025, selecting eight Sonic-based Memecoins as winners. The top 125 holders of each winning Memecoin will share a prize pool of 1 million $OS tokens (the liquid staking derivative of the Sonic ecosystem).

The Meme Mania event page lists the current top 8 Memecoins:

-

$GOGLZ (@GOGLZ_SONIC)

Contract address:

0x9FDBC3F8ABC05FA8F3AD3C17D2F806C1230C4564

24H trading volume: $8 million

Current market cap: $15 million

Peak market cap: $20.7 million

-

$THC (@TinHat_Cat)

Contract address:

0x17Af1Df44444AB9091622e4Aa66dB5BB34E51aD5

24H trading volume: $1 million

Current market cap: $7.5 million

Peak market cap: $9.5 million

-

$fSONIC (@fantomsonicinu)

Contract address:

0x05e31a691405d06708A355C029599c12d5da8b28

24H trading volume: $664,000

Current market cap: $1.61 million

Peak market cap: $1.97 million

-

$Indi (@indi_sonic)

Contract address:

0x4EEC869d847A6d13b0F6D1733C5DEC0d1E741B4f

24H trading volume: $378,000

Current market cap: $4.53 million

-

$HEDGY (@hedgycoin)

Contract address:

0x6fB9897896Fe5D05025Eb43306675727887D0B7c

24H trading volume: $500,000

Current market cap: $2.9 million

Peak market cap: $3.6 million

-

$TYSG (@tysonicgodd)

Contract address:

0x56192E94434c4fd3278b4Fa53039293fB00DE3DB

24H trading volume: $210,000

Current market cap: $977,000

Peak market cap: $4 million

-

$FROQ (@FROQ_SONIC)

Contract address:

0x131F5AE1CBfEFe8EFbDf93dA23fa4d39F14a817c

24H trading volume: $450,000

Current market cap: $1.42 million

Peak market cap: $2.2 million

-

$SDOG (@sDOG_SONIC)

Contract address:

0x50Bc6e1DfF8039A4b967c1BF507ba5eA13fa18B6

24H trading volume: $243,000

Current market cap: $857,000

Peak market cap: $1.4 million

Note: Meme tokens are highly volatile and carry significant risk. Investors should fully assess risks and participate with caution. This article merely shares information based on current market trends. Neither the author nor the platform guarantees the completeness or accuracy of the content, and this article does not constitute any investment advice.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News