Is it worth debating whether Aave should go to Solana?

TechFlow Selected TechFlow Selected

Is it worth debating whether Aave should go to Solana?

Trust cost is higher than everything else.

Author: shushu, BlockBeats

Yesterday, Virtuals Protocol announced that its VIRTUAL token is now tradable on Solana, with its official LP already live on Meteora and preparations underway for Virtual Protocol's Launchpad on Solana. Meanwhile, Nansen CEO Alex Svanevik tweeted asking when Aave would be available on Solana, tagging members of the Aave team and Solana's founders.

However, the comments section of this tweet turned into a battleground between Solana supporters and Aave loyalists, which more broadly reflects the competition between the Ethereum and Solana ecosystems over market share in specific application areas.

A "War of Words" Over Lending Protocols

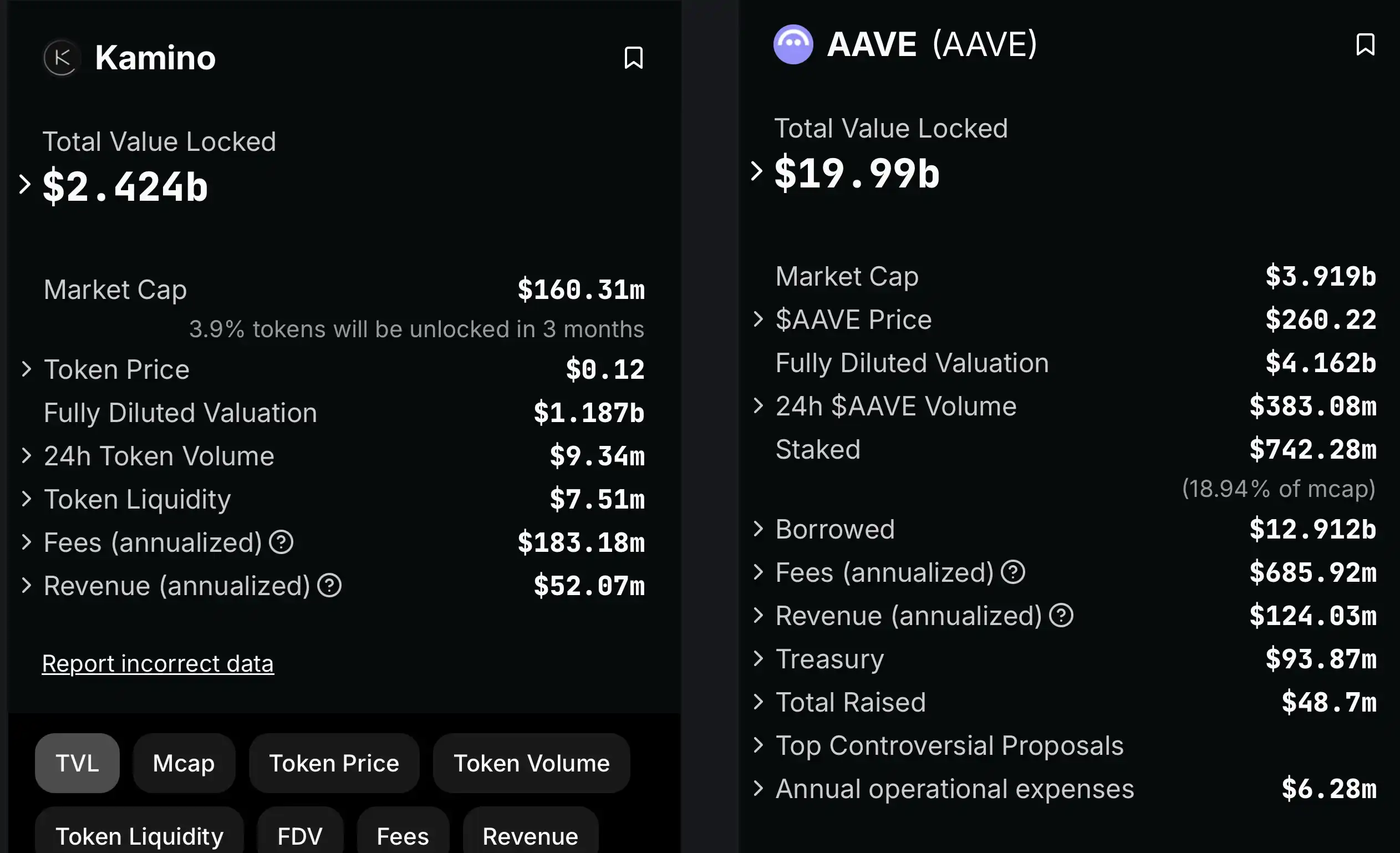

Kyle Samani, partner at Multicoin Capital—one of Solana’s biggest advocates—commented under the tweet by referencing Kamino, a DeFi lending protocol on Solana, implying that Kamino is essentially “Aave of Solana.”

Svanevik replied that Aave is ten times larger than Kamino in scale, stating, “If Aave users could easily switch chains, it would unlock massive TVL.”

But Solana co-founder toly and Solana Foundation president Lily Liu disagreed. Lily claimed Kamino has better products and proudly added, “Today’s metrics don’t represent tomorrow’s performance.” Toly argued that supporting a native team focused solely on Solana’s mainnet is a wiser long-term investment compared to backing a multi-chain team spread thin across ecosystems, effectively shutting down any possibility of Aave coming to Solana.

Unwilling to fall behind, supporters of Aave—and by extension, the Ethereum ecosystem—fought back.

Aave founder Stani launched a direct attack, accusing Solana DeFi of copying outdated Aave technology, pasting together half-baked UIs, and restricting access for UK users. While Stani referred to Solana DeFi broadly, it was clear he was targeting Kamino, a competing lending protocol.

In response, toly shared side-by-side DeFiLlama data comparing Aave and Kamino, noting that while Kamino’s TVL is only 1/8th of Aave’s, its revenue stands at 1/2.5th. “I don’t understand why Aave is considered the superior product—if you can’t extract revenue from it, TVL is just a cost.”

Stani sharply countered, pointing out that Kamino charges a 15% reserve factor on USDC (the portion taken from each transaction or pool), whereas Aave only takes 10%, meaning higher fees extracted from user funds. He viewed this as evidence of insufficient competition within the Solana ecosystem, weakening users’ bargaining power and forcing them to bear higher costs.

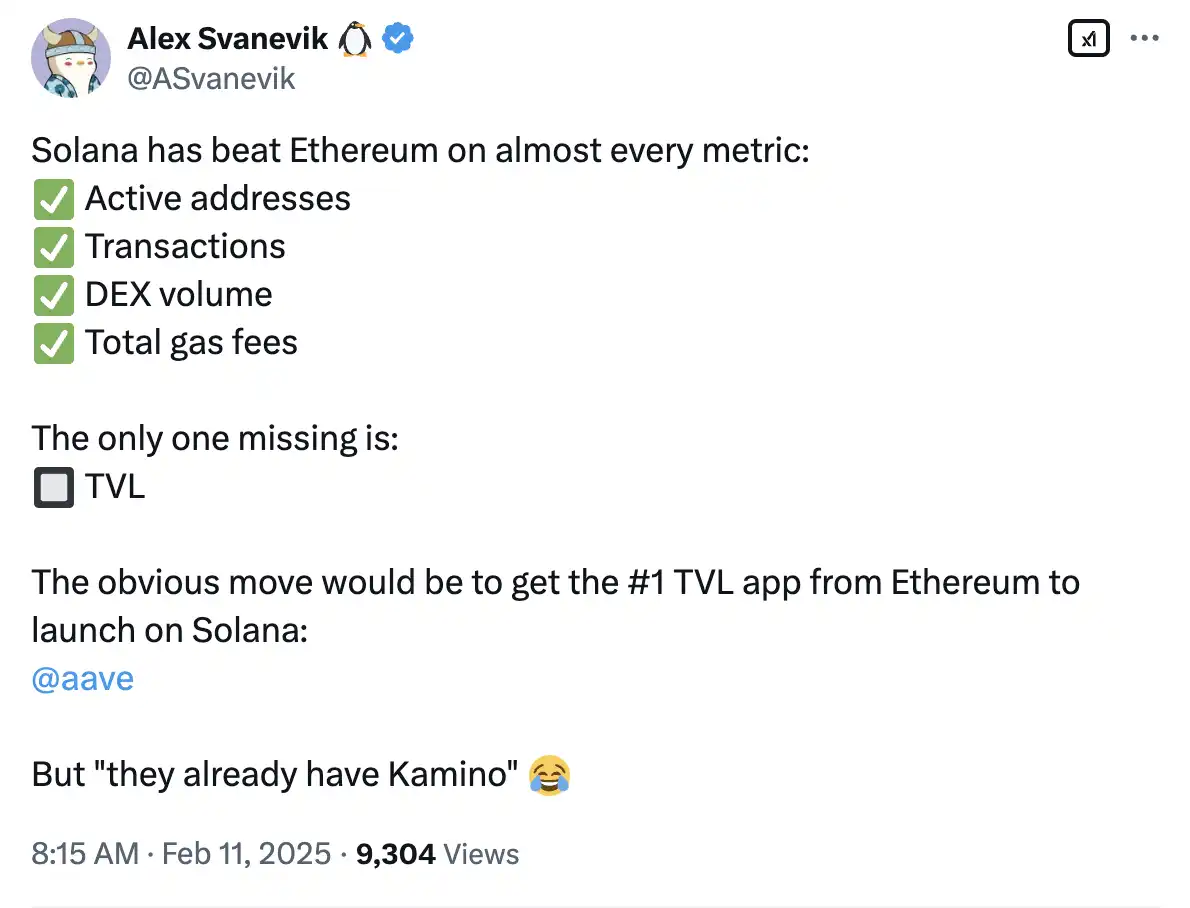

Alex Svanevik, the one who ignited this debate, poured more fuel on the fire by asserting that Solana has already surpassed Ethereum across several key metrics, including active addresses, transaction volume, DEX trading volume, and total gas fee revenue. However, Solana still lags behind Ethereum in TVL. Given this, the most straightforward strategy would be to attract Aave—the top TVL application on Ethereum—to deploy on Solana, thereby boosting its DeFi competitiveness.

Some questioned this logic in the comments, arguing that Aave deploying on Solana wouldn't magically generate new TVL. Svanevik explained that for Aave’s deployment to bring zero TVL growth to Solana, two conditions must simultaneously hold true:

1. None of Aave’s current TVL migrates to Solana;

2. No new TVL flows into Aave on Solana.

Given that Aave has successfully attracted $20 billion in TVL, Svanevik believes it should expand to Solana—leaving many unsure whether he’s an Ethereum maxi or a Solana maxi.

Trust Cost Trumps Everything

Undoubtedly, Aave is a core DeFi application in the Ethereum ecosystem, forming the backbone of Ethereum’s DeFi landscape alongside Uniswap, Lido, and others. Some have questioned why top-tier Ethereum DeFi applications like Aave would overlook a high-potential ecosystem like Solana. Beyond technical factors such as codebase, the reasons an application chooses *not* to migrate mirror those driving expansion—all aimed at achieving incremental growth.

Virtuals Protocol expanded to Solana to tap into broader user bases and liquidity pools. Aave’s absence from Solana likely stems from strategic considerations around competitive dynamics. Solana’s DeFi sector is increasingly mature, with multiple well-established lending protocols—including Kamino, marginfi, and Save—already vying for market share. The cost for Aave to enter would be significantly higher than expected.

More importantly, Aave’s existing brand equity could face uncertainty through expansion. As one community member put it, “If someone with seven to eight figures in capital wants yields above off-chain returns while prioritizing security, I’d recommend Aave on Ethereum—not DeFi on Solana, Tron, Celestia, etc.—ten out of ten times.”

Security is foundational for any lending product. Only with robust security audits, proven incident response experience, and mature contract design will large depositors and average users choose to park their assets. Thus, Aave’s prominence as a leading lending platform on Ethereum rests on Ethereum’s long-standing developer ecosystem, extensive audit history, and vast, battle-tested liquidity pools.

The financial nature of DeFi means “the longer it runs, the stickier it becomes.” This stickiness arises from deep trust in a product’s contract security and stability. This “trust cost” goes beyond evaluating a new chain’s speed, performance, and transaction fees—it encompasses infrastructure maturity, audit firm coverage, community vigilance toward potential vulnerabilities, and the ecosystem’s ability to respond swiftly under extreme conditions.

Related Reading: Re-examining DeFi: The Present and Future of Web3’s Most Mature Business Model

Looking back at Ethereum DeFi’s development over recent years, many projects have faced critical vulnerabilities or security incidents, some incurring losses exceeding hundreds of millions of dollars. It was precisely through repeated responses and iterations that Ethereum DeFi gradually built its security moat. Aave’s widespread adoption is rooted in this very security advantage, making it the preferred choice for large-scale and institutional players. In other words, most people see Aave as synonymous with “low risk, attractive returns,” especially for users managing millions or even tens of millions of dollars—where safety and stability always come before incremental yield gains.

In contrast, Solana, as a high-performance Layer1 blockchain, does offer advantages in transaction speed and gas fees. Yet from the perspective of lending protocols, the core of financial applications lies in the “risk-reward ratio.” Speed and low fees matter, but without a proven track record of security and resilience against attacks, these benefits are often insufficient to drive sustained, large-scale liquidity migration in the DeFi space. Particularly in lending, platforms face multiple risks including liquidations, interest rate volatility, contract audits, and hacker exploits. Any failure can instantly destroy years of accumulated brand reputation and trust—an outcome where the “trust cost” far outweighs the technical challenges themselves.

Furthermore, even if Aave were to expand to Solana, it wouldn’t necessarily result in “magically increased” TVL. Capital is profit-driven and rational; the $20–30 billion in TVL Aave has amassed on Ethereum won’t automatically split and migrate to another chain. On the contrary, due to significant differences in underlying tech stacks, programming languages, and even community cultures across chains, Aave would need substantial time and resources to adapt and audit its deployment—entailing high expansion costs and management risks. Moreover, native lending protocols on Solana are rapidly maturing, so Aave wouldn’t enjoy overwhelming first-mover advantage.

Therefore, given its triple moat of security, brand recognition, and capital scale, it may not be wise for Aave to aggressively expand to Solana. After all, in the long marathon of DeFi, earning user trust and establishing a strong security perception remain the hardest barriers to overcome.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News