OKG Research: The Power Game Behind Wall Street's "On-Chain" Roadmap | On-Chain Wall Street #03

TechFlow Selected TechFlow Selected

OKG Research: The Power Game Behind Wall Street's "On-Chain" Roadmap | On-Chain Wall Street #03

Whose chain is it, really, and who's defining whose Wall Street?

From spot Bitcoin ETFs to the wave of tokenization, institutional forces represented by Wall Street are profoundly influencing and reshaping the trajectory of the crypto market—and we believe this influence will grow even stronger in 2025. To explore this shift, OKG Research launches the "Wall Street on Chain" research series, continuously tracking traditional institutions' innovations and practices in the Web3 space. How are giants like BlackRock and JPMorgan Chase embracing innovation? How will tokenized assets, on-chain payments, and decentralized finance reshape the future of finance?

This is the third installment of the "Wall Street on Chain" research series. For previous reports, see:

1. Old Money Seeks New Growth: Wall Street Accelerates Its Move On-Chain

2. Web3 Insights: How Much Time Does Hong Kong Have Left for RWA Tokenization?

In February 2025, Ondo Chain stirred the calm waters of Wall Street. This L1 blockchain, backed by traditional asset management titans such as BlackRock and Franklin Templeton, has an overt ambition: to create a "compliant yet open" hybrid architecture that enables trillions of dollars in institutional-grade RWA to securely go on-chain while capturing liquidity benefits from major public chains like Ethereum.

Ondo Chain acts as a mirror reflecting the collective anxiety of traditional financial giants entering Web3—how to seize the new on-chain frontier under strict regulatory constraints? Some build high walls, others push forward aggressively, and still others attempt to bridge gaps in the middle. As traditional financial giants enter the space, the divergence in technical approaches is no longer just about code—it’s a battle over who will control the future of finance.

1. How Are the Rules of Wall Street's "On-Chain" Game Changing?

In the 19th century, early Wall Street financial transactions relied heavily on manual processes and face-to-face trading, with brokers and banks serving as essential intermediaries. The emergence of electronic trading platforms and the internet in the 20th century democratized access to financial information, reduced barriers for retail investors, and lowered transaction costs. The fintech boom further enhanced front-end user experience for investors.

These advances were welcome, but the fundamentals of traditional financial markets remained unchanged: centralized systems still dominate, data remains siloed in proprietary databases, and transaction workflows continue to depend on intermediaries for coordination and settlement. Blockchain and tokenization now aim to change this—by making assets more accessible, transparent, and interoperable, they unlock real-time settlement, reduce costs, and enable global access, all while preserving the integrity and trust long provided by traditional systems, potentially transforming how financial markets operate.

Yet as the Web3 technology wave sweeps the globe, traditional financial institutions are not converging on a single path—they are diverging. Behind these different technological choices lies a core tension: the trade-off between compliance and liquidity. Should institutions prioritize security and control, or pursue openness and global circulation?

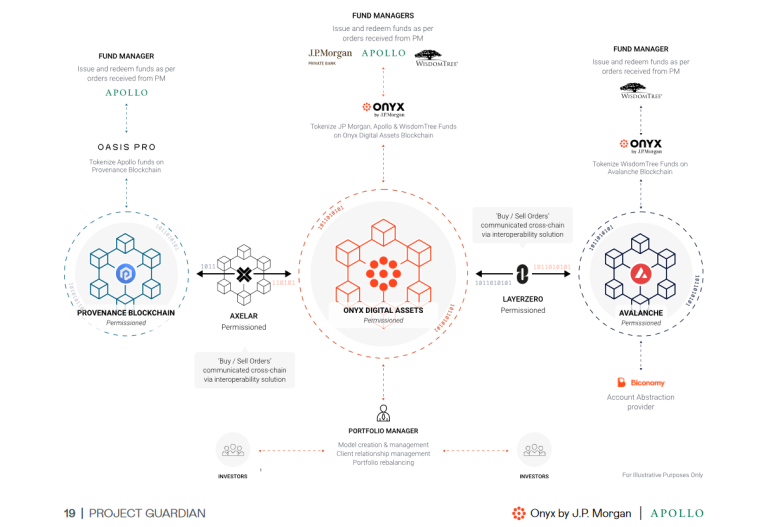

When Wall Street first embraced Web3, permissioned chains were the preferred choice. When JPMorgan announced in 2024 that its Onyx network had reached $300 billion in annual settlements, many realized that this百年 firm, once openly skeptical of cryptocurrencies, had quietly rebuilt its moat using blockchain. Onyx functions like a meticulously designed "digital fortress"—nodes controlled by a select few institutions, counterparty information hidden, every cross-border payment tagged with compliance metadata.

Execution architecture for tokenized asset management exploration via Onyx

But the cost of this closed ecosystem is clear. An anonymous banker involved in the JPM Coin project admitted: "Our on-chain U.S. Treasury tokens can only circulate among partner institutions—the liquidity is like an antique locked in a glass case." BNY Mellon’s on-chain custody service faces similar limitations; despite managing over $100 billion in tokenized assets, it cannot interoperate with DeFi protocols on Ethereum. The inertia of traditional finance is evident: risk is managed through control, but at the expense of openness.

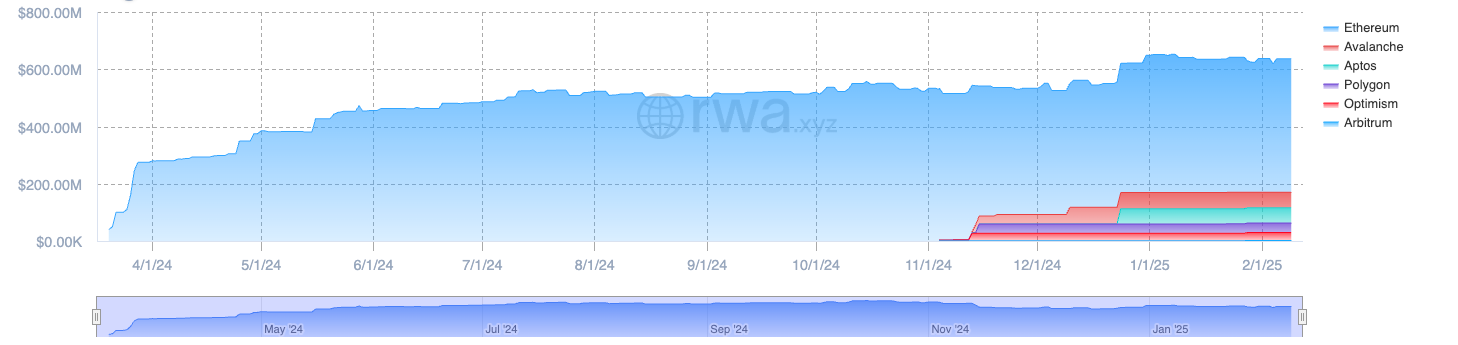

As tokenization gains global momentum and the race for on-chain liquidity intensifies, asset managers like BlackRock and Goldman Sachs are making bolder moves: an increasing number of tokenization initiatives are shifting to public chains, with Ethereum emerging as the top choice for institutional adoption. BlackRock led the charge by launching BUIDL, a tokenized fund on Ethereum—capable of automated settlement via smart contracts, as well as staking, lending, and secondary trading on-chain. This marks the first deep integration between traditional finance and Web3, making public chains a new focal point for institutional interest.

BUIDL tokenized fund manages over $636 million in assets

However, this doesn’t mean public chains like Ethereum can fully meet all institutional-grade Web3 innovation needs. While Ethereum is currently the second-most secure public chain after Bitcoin, the kind of "security" institutions require may differ significantly from common perceptions. Just as many institutions still prefer private cloud deployments despite ample budgets—even as public cloud security is widely touted—technical security does not equate to business or asset security.

Therefore, many institutions with sufficient technical capacity or strategic goals are exploring new possibilities beyond existing models. Ondo Finance, for instance, is attempting to break down the barrier between public and permissioned chains by developing a hybrid architecture better aligned with regulatory and market demands. Ondo Chain combines the openness of public chains with the compliance features of permissioned chains. Its permissioned validator network, operated by major institutions like Franklin Templeton and Wellington Management, ensures compliance and security, while also enabling cross-chain interoperability, allowing assets to flow freely across major public chains such as Ethereum and Solana. Compared to direct deployment on Ethereum, Ondo Chain gives Ondo greater control over security in RWA implementations while solving liquidity challenges through cross-chain connectivity.

Still, it remains uncertain whether this hybrid model can truly strike the optimal balance between efficiency and compliance. In comparison, Layer 2 (L2) solutions may currently be the “preferred option” for institutional adoption.

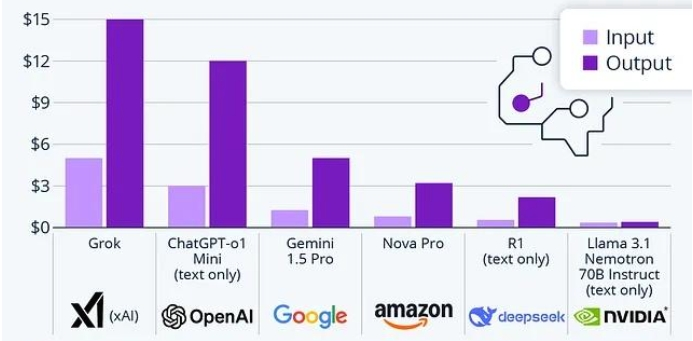

2. L2 for Web3 Might Be What DeepSeek Is for AI

The widespread adoption of any new technology is typically accompanied by a significant drop in usage costs. DeepSeek captured global attention in 2025 precisely because it disrupted the market’s perception of AI costs, demonstrating that high-performance AI doesn’t require prohibitively expensive computing resources. Take DeepSeek R1: it reduced the cost per million tokens from $60 on ChatGPT o1 to just $2.19—a nearly 30-fold decrease. This dramatic price gap is reshaping AI application trends, enabling more companies to experiment and innovate with AI without budget constraints.

DeepSeek-R1’s significant cost advantage

Source: DoccBot

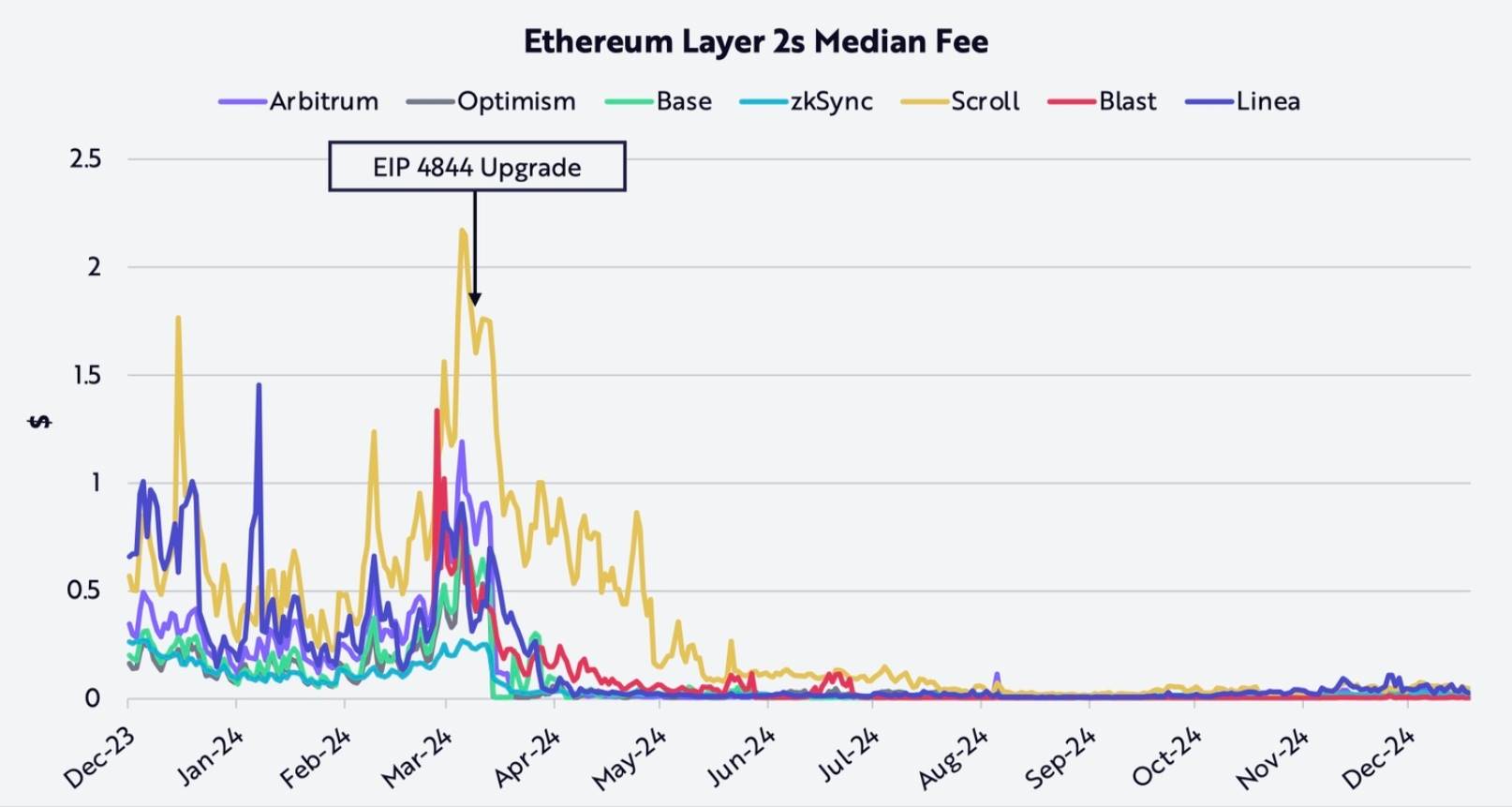

L2 for Web3 might play a role similar to DeepSeek for AI. While the impact isn't as immediately visible as DeepSeek’s breakthrough, post-Cancun upgrade, L2 solutions have drastically cut on-chain costs: networks including OP Mainnet, Base, Arbitrum, and Starknet have seen average transaction fees drop by over 97% in the past six months. Lower transaction costs directly improve user experience, encouraging more frequent use of L2s. According to OKG Research, over 90% of Ethereum-related transaction activity now occurs on L2 networks.

Ethereum’s EIP-4844 upgrade significantly reduces Layer 2 transaction costs

Source: ARK Investment Management LLC

Lower costs also reduce the technical barrier to blockchain adoption, accelerating the migration of applications and services to L2s. Payment giants like Visa and Stripe are launching an “on-chain payment blitz” via L2s: leveraging high-throughput networks like Polygon and Arbitrum, Visa’s stablecoin payment channel has reduced cross-border transaction costs to one-tenth of traditional methods, processing over 500,000 transactions daily. Stripe uses L2 to build seamless crypto on/off ramps, making the underlying public chain invisible to users. “We don’t care if the chain is decentralized—we only care whether a million merchants can seamlessly accept crypto,” Stripe’s Web3 lead once stated bluntly.

This perhaps reveals the most pragmatic calculation of traditional institutions: when public chains still carry security risks and permissioned chains remain too封闭, Layer 2 emerges as a seemingly balanced yet highly cost-effective solution—offering the efficiency and technological benefits of blockchain at low cost, without straying beyond controllable boundaries. With modular rollup infrastructure gaining traction, platforms like OP Stack have dramatically lowered the technical barriers to deploying L2s. One-click chain deployment is becoming reality, enabling new chains to operate healthily without relying on token-based financial incentives or building new consensus networks, and offering clear regulatory advantages over public chains.

Many traditional institutions are turning to L2s for their Web3 strategies. Coinbase’s L2 chain Base, riding the waves of Meme and AI Agent trends, has become the current “darling” of Web3 and could evolve into a key hub for tokenized asset issuance, especially if Coinbase stock tokenization drives additional traffic. Traditional tech and financial firms like Sony and Deutsche Bank are also accelerating their L2 deployments to secure a foothold in the coming wave of tokenization innovation. For these institutions, if Ethereum is chosen as the market for issuing RWA assets, launching a self-controlled L2 may be the smarter move.

As innovation costs plummet and technology becomes simpler and more efficient, we may soon see far greater participation from institutions and users in Web3 innovation via L2s.

Source: Ondo Finance

Conclusion

Today’s Wall Street “on-chain” race is no longer a simple contest of technological superiority. JPMorgan’s private chain, BlackRock’s public chain ETF, Visa’s L2 payment experiments, and Ondo Chain’s hybrid model—each technical path is an attempt to define the future distribution of financial power.

Yet history is often ironic: while traditional institutions rush to replicate the old world’s order on-chain, DeFi protocols are quietly encroaching on their turf. Daily trading volume of Tesla stock tokens on Uniswap exceeds $100 million; Aave’s RWA lending pools attract more and more institutions making “non-compliant” deposits… Perhaps it won’t be long before this quiet technological struggle escalates into a more open conflict: Whose chain will it be, and who will define the future of Wall Street?

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News