Chaos in Mississippi, where to find the third chain?

TechFlow Selected TechFlow Selected

Chaos in Mississippi, where to find the third chain?

The problem with cryptocurrency is the failure of diversification.

Author: Zuo Ye

Ancient people truly did not deceive me: "A state without external threats will inevitably perish."

Vitalik has returned to his familiar on-chain world. The idea that he is indifferent to leadership is merely an old myth. First, he aggressively launched meme coins instead of quietly becoming a black-hole address like Satoshi; then, he declared that Based Rollups are the ideal Layer 2 solution; finally, he published several visionary essays outlining Ethereum's future path. All these actions stem from internal growth driven by external pressure.

After long contemplation, let’s seriously discuss whether a third major public chain or L2—beyond Bitcoin and Ethereum—could emerge in the market.

Mag Seven in Stocks, 14K in Crypto

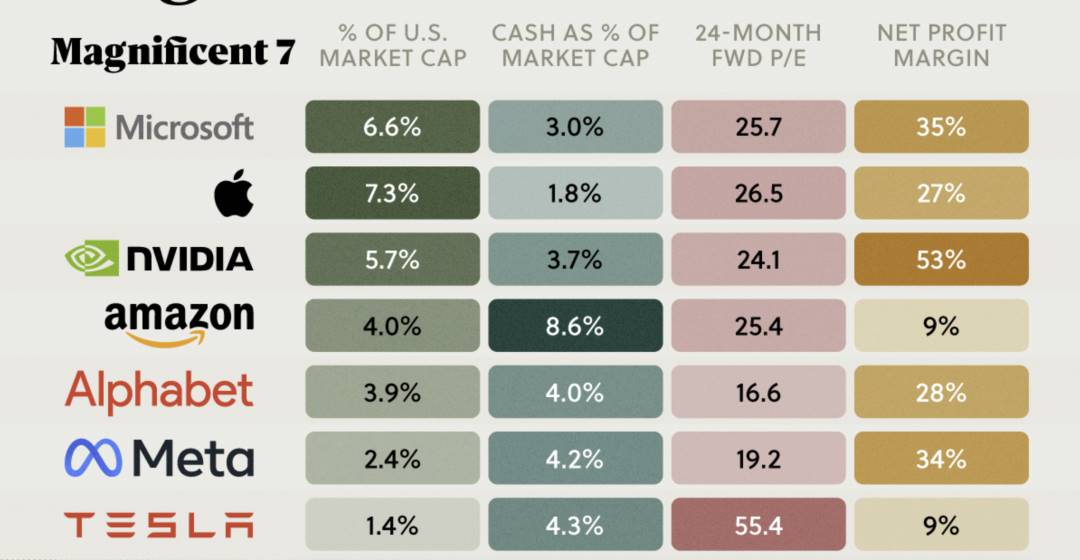

The brief rally in China's A-shares was just a flash-in-the-pan moment before reverting to historical norms. In contrast, U.S. stocks have sustained a long bull run. The root cause lies in the global acceptance of tech giants' "dream valuations." The Magnificent Seven—Apple, Microsoft, Meta, Amazon, Alphabet (Google's parent), NVIDIA, and Tesla—are trillion-dollar AI-era companies whose market capitalizations are globally recognized.

Image caption: Stock performance of the Magnificent Seven, Source

The Magnificent Seven cover both hardware and software aspects of AI—from models and algorithms to data—and include global consumer-facing powerhouses like Apple with billions of users. In contrast, the crypto market suffers from severe imbalance.

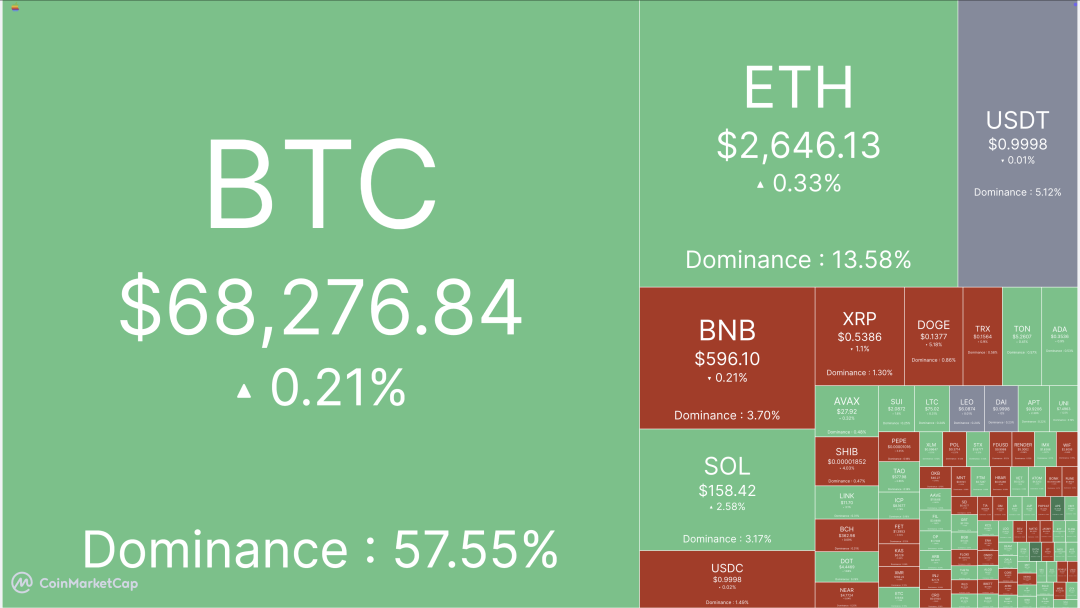

Image caption: Cryptocurrency market cap heatmap, Source: CoinMarketCap

According to CMC data, Bitcoin’s dominance stands at around 60%, while the total global crypto market cap (including stablecoins) is only $2.34 trillion. Based on this, I calculated the HHI index for cryptocurrencies (excluding stablecoins), which comes out to approximately 0.35307.

The Herfindahl-Hirschman Index (HHI) measures market concentration. By standard practice, HHI is calculated using the top 50 market participants. According to Coinglass, the list includes: BTC, ETH, BNB, SOL, XRP, DOGE, TRX, TON, ADA, AVAX, SHIB, WBTC, LINK, BCH, DOT, NEAR, SUI, LEO, LTC, APT, UNI, PEPE, TAO, ICP, WBETH, FET, KAS, XMR, ETC, XLM, POL, STX, RNDR, IMX, WIF, OKB, AAVE, FIL, OP, ARB, INJ, CRO, MNT, FTM, HBAR, VET, ATOM, BONK, METH, RUNE.

Further analysis based on U.S. Department of Justice standards shows that markets with HHI below 1500 are considered competitive, those between 1500–2500 moderately concentrated, and those above 2500 highly concentrated. Scaling up the crypto HHI by 10,000 gives us 3530.7—well above the 2500 threshold. Combined with Bitcoin’s dominance, this highlights crypto’s core problem: a failure of diversification.

We can even quantify this lack of diversity. Using the HHI methodology, among the top 50 crypto assets, only the first 14 hold market share influence above 0.00001 (to five decimal places). The remaining millions of tokens serve little more than as background noise.

Optimistically speaking, if one believes in crypto’s future, further consolidation is possible—with room for at least another doubling in concentration. Positions 2 through 13 still have opportunities. Pessimistically, however, the total crypto market cap remains far too low. Companies like NVIDIA, Apple, and Microsoft each exceed $3 trillion in value. If crypto ever reaches such heights, today’s fragmented landscape may become permanently locked in.

High-Performance L1 or Ethereum L2?

The significance of the HHI index lies in quantifying the current state more clearly than metrics like TVL, since trading volumes among the top 50 tokens are relatively stable and reflective of real activity. Today’s market features extreme Bitcoin dominance, a loosely organized but gradually consolidating Ethereum, and Solana rapidly rising on the back of memes. In a sense, Solana has already passed its own TheDAO moment—reviving after the FTX collapse and gathering a core base of believers and supporters.

But it’s still not enough. Ethereum didn’t solidify its position because its founder (like EOS’s BM) was greedier, but because DeFi Summer supercharged asset issuance. Smart contracts found their ideal testing ground in DeFi, and suddenly, billions in market cap emerged almost overnight.

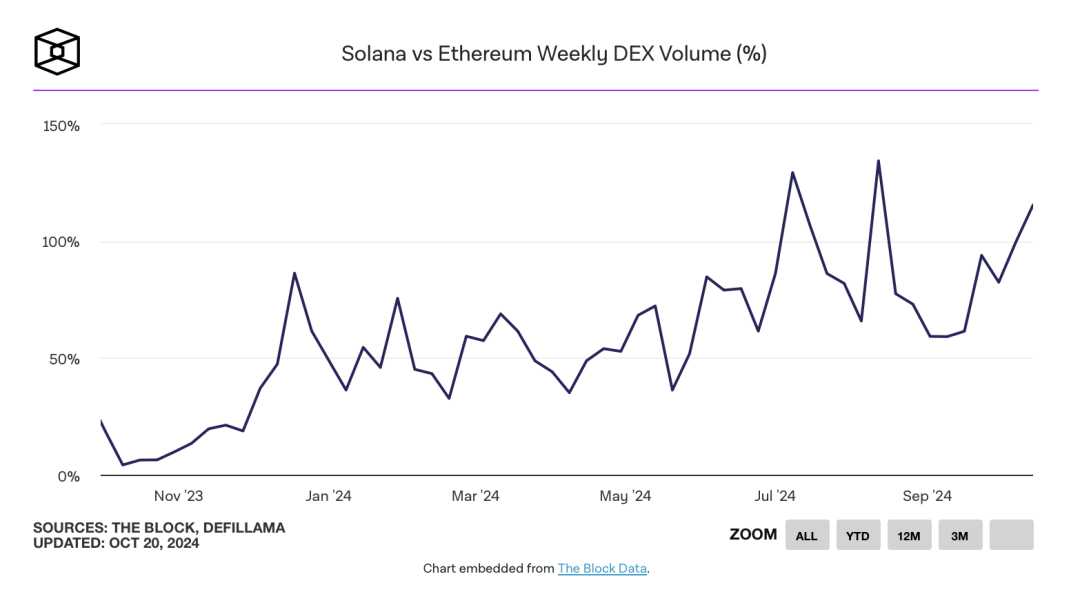

Solana continuing down the DeFi path clearly won’t allow it to surpass Ethereum. While Solana DEXs occasionally outperform Ethereum in trading volume, historical economic patterns suggest dominant players stabilize over time—think “market leader and runner-up,” with everyone else fading into obscurity. Traditional internet trends often show outright monopolies: Didi in ride-hailing, Meituan in local services. New entrants may appear briefly, but structural dominance rarely shifts.

My point is that DeFi alone cannot transform Solana into a new primary asset issuance platform. From a user path dependency standpoint, mass migration from Ethereum to Solana is merely dog-whistle rhetoric in online discourse—not an existing or imminent reality. This becomes even clearer when considering the market moves of other chains like Sui.

Another fact: meme coins offer limited help. In absolute market cap terms, Solana-based meme coins amount to roughly $10 billion, while the total meme coin market cap sits around $60 billion—with Dogecoin alone exceeding $20 billion.

More fundamentally, meme coins are characterized by having “no utility but economic value.” Unlike VC-funded tokens with artificially inflated claims of “token utility,” meme coins openly admit they require no utility—everyone just speculates together. In exposing the hypocrisy of VC token narratives, meme coins have played a crucial role. But without addressing where real utility comes from, their market caps cannot sustainably expand.

All assets go through cycles of rise and fall—even the Magnificent Seven have experienced massive swings over years. Seeking utility isn't about justifying peak prices, but about preserving floor support and maintaining a core base of genuine users to fuel the next speculative wave. Without utility, there’s no reservoir to draw from. The market might accept Doge as the representative of memes, but calling Solana a “Meme Chain” feels deeply unnatural.

Yet I firmly believe the third major chain will most likely not be an L2—that’s why I’ve said little about them. The issue with L2s is economic, not technical: if an L2 becomes too powerful relative to Ethereum, Vitalik himself will step in to oppose it. If it remains weak, then building it serves no purpose. This paradox isn't technological—it's economic. Ethereum’s core value lies in ETH and its DeFi ecosystem, not in any specific scaling technology. If L2s are forced to primarily boost ETH value, their native tokens lose fundamental worth. We’ve already seen this play out in the messy token launches and airdrops of Eigen and Scroll.

Conclusion

As Trump campaigns in the U.S. election, America can only have one president and two major parties. Yet crypto has now entered the political agenda for the first time. Though Satoshi remains missing, a pro-crypto president is likely to take office. Regulatory clarity will bring new industrial ecosystems and fresh opportunities. The entity that seizes this moment could become the third major chain—though its final form remains uncertain.

Before S3 arrives, I hope we all get to witness the emergence of this third chain!

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News