DeFi Sector Project Overview: DEX Emerges Strongly, Lending Sector Continues to Grow

TechFlow Selected TechFlow Selected

DeFi Sector Project Overview: DEX Emerges Strongly, Lending Sector Continues to Grow

In the perpetual contract DEX market, Hyperliquid is the undisputed winner.

Author: Cheeezzyyyy

Translation: TechFlow

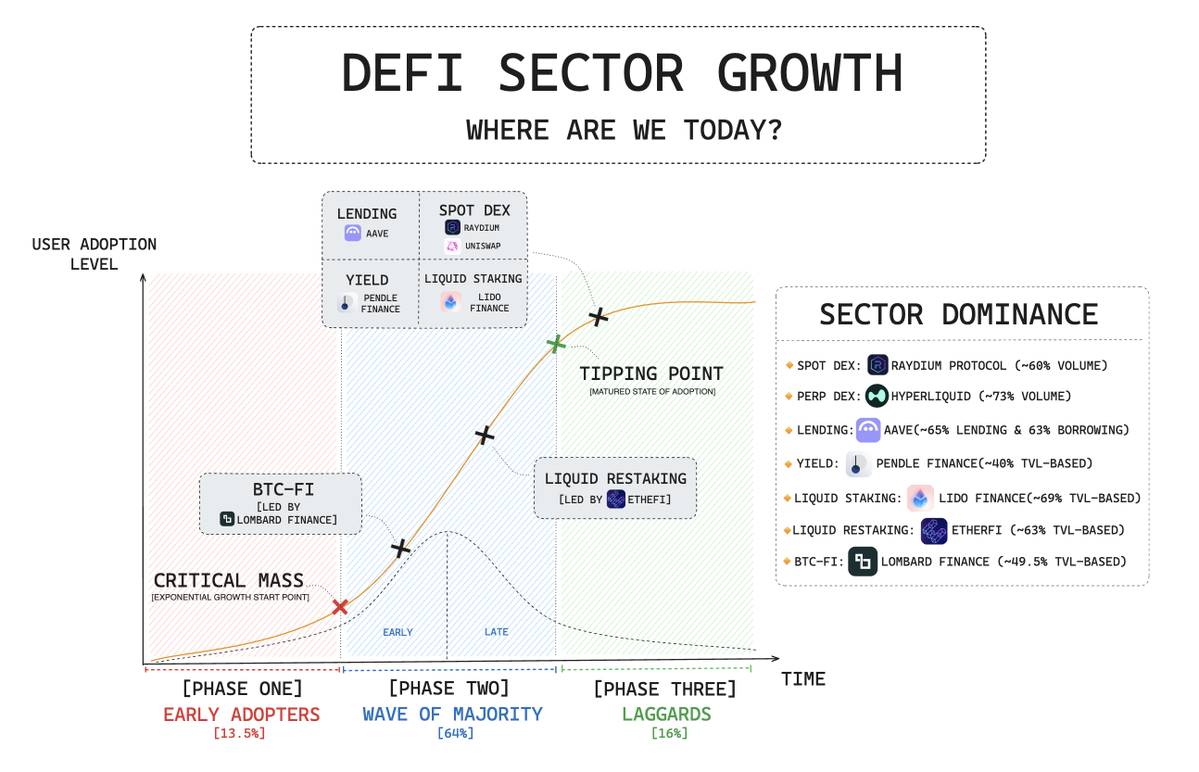

Since the "DeFi Summer" of 2021, DeFi has made significant progress.

Today, DeFi has developed multiple mature sectors that are achieving self-sustaining growth and activity. However, compared to traditional finance (TradFi), the entire crypto space remains in its early stages. Currently, the total market capitalization of cryptocurrencies is approximately $3.3 trillion, while TradFi stands at a staggering $133 trillion.

The core objective of DeFi is to address inefficiencies in traditional finance through innovative and efficient systems. These solutions have already demonstrated strong product-market fit (PMF) across various domains.

Key areas in DeFi often exhibit an oligopolistic market structure. Below are the latest developments in each sector.

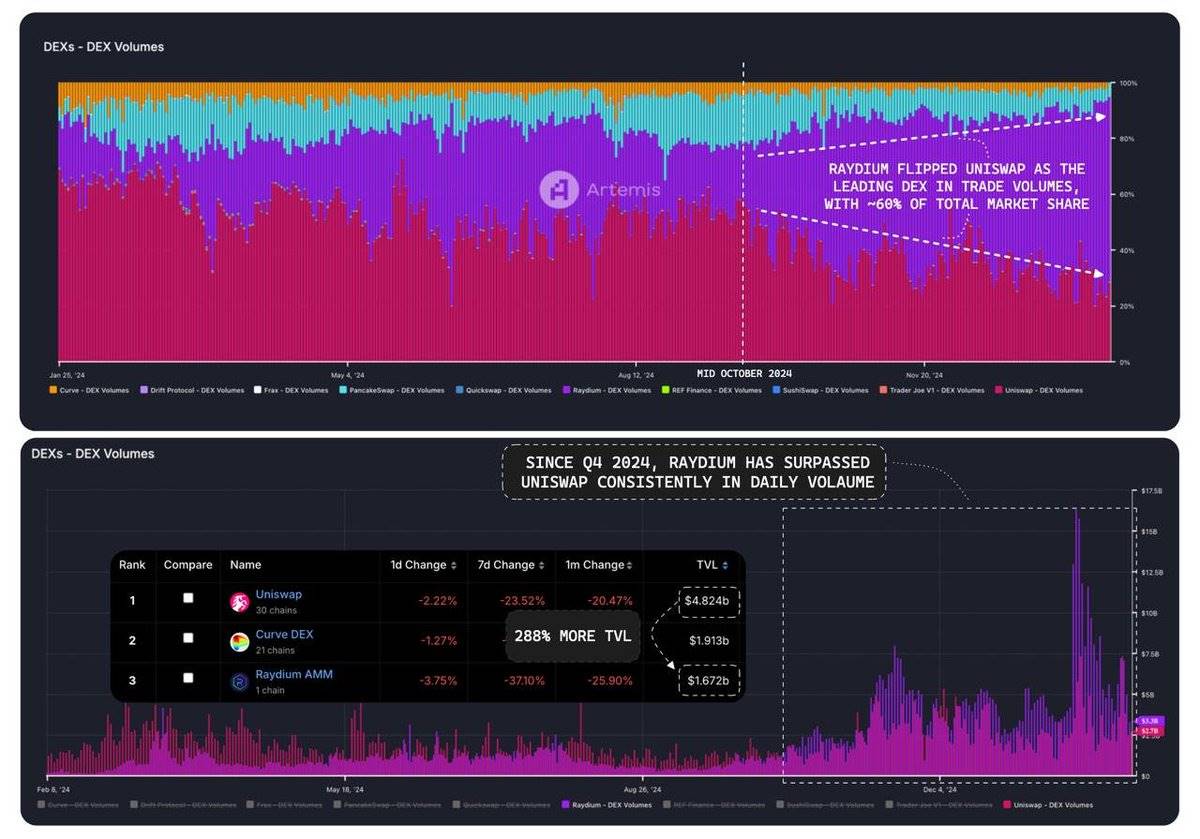

Competitive Landscape of Decentralized Exchanges (DEX)

In Q4 2024, @RaydiumProtocol emerged as the new leader in the DEX market, capturing about 61% of trading volume share and surpassing @Uniswap.

However, Raydium's total value locked (TVL) is only 39% of Uniswap's. This discrepancy may be linked to the Memecoin craze on @solana, but its long-term market performance remains to be seen.

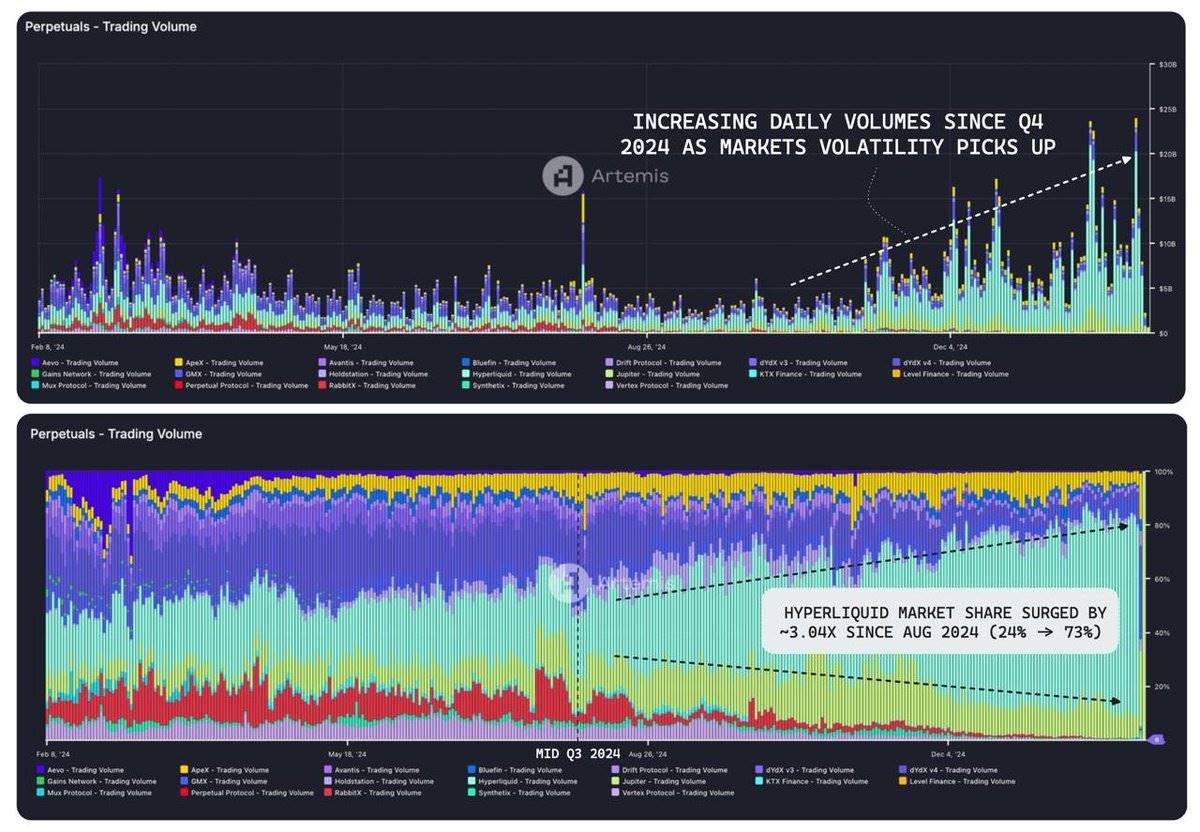

The Winner in Perpetual Contract DEX (Perp DEX)

In the perpetual contract DEX market, @HyperliquidX is the undisputed winner. Since Q3 2024, Hyperliquid’s market share has surged from 24% to 73%, achieving triple-digit growth.

Meanwhile, overall Perp DEX trading volume is also growing rapidly, doubling from $4 billion daily in Q4 2024 to $8 billion today. Hyperliquid is now challenging centralized exchanges (CEX) and gradually becoming a key price discovery platform.

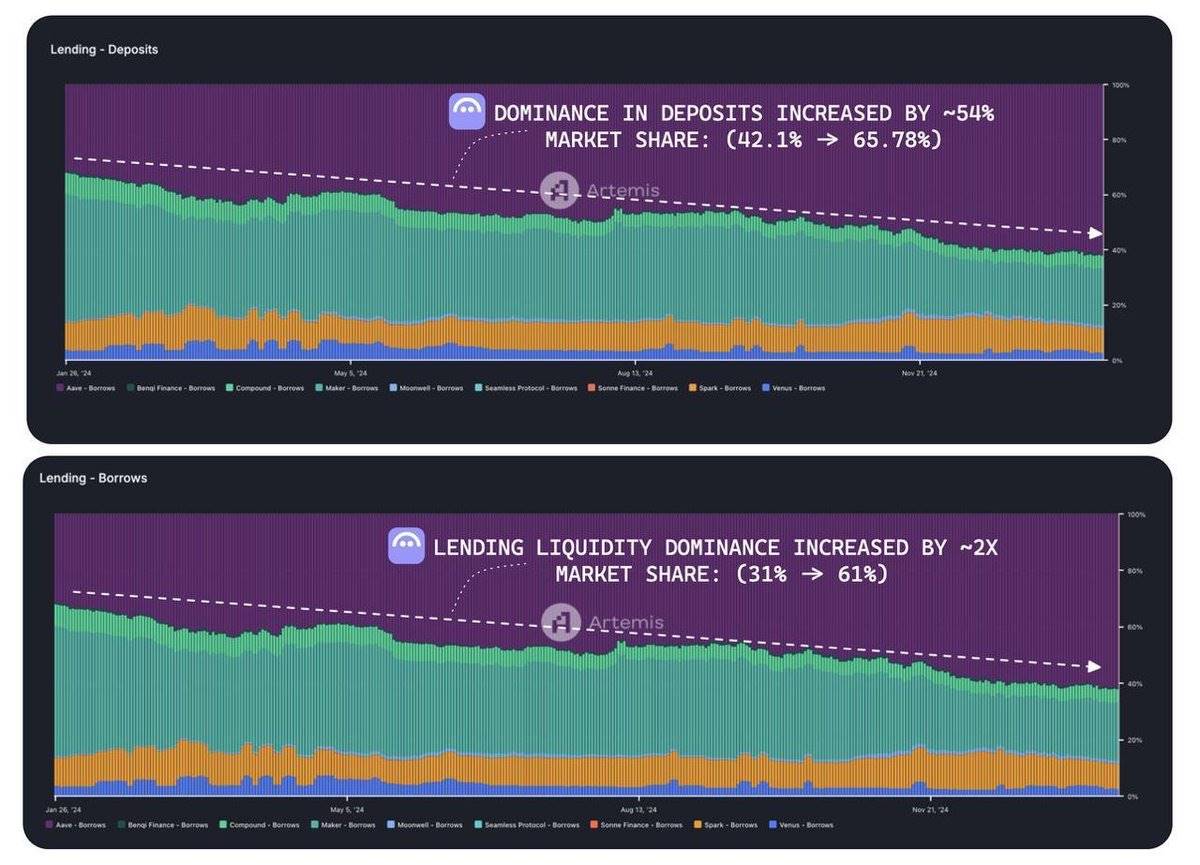

Sustained Growth in Lending

In the lending sector, @aave's dominance continues to strengthen. Since 2024, its market share in both deposits and borrowing has significantly increased:

-

Deposit market share rose from 42.1% to 65.78%

-

Borrowing market share grew from 31% to 61%

Although Aave does not offer the most attractive yields in the market, its long-standing reputation and user trust have made it the preferred platform in lending.

@pendle_fi is leading the yield sector, reaching a record high TVL on Ethereum ($ETH) of approximately $1.59 million.

Its core strength lies in being the primary driver of value discovery in this domain. Even amid an overall slowdown in the DeFi industry and weak market sentiment, it maintains a record-high TVL—strong evidence of robust product-market fit (PMF).

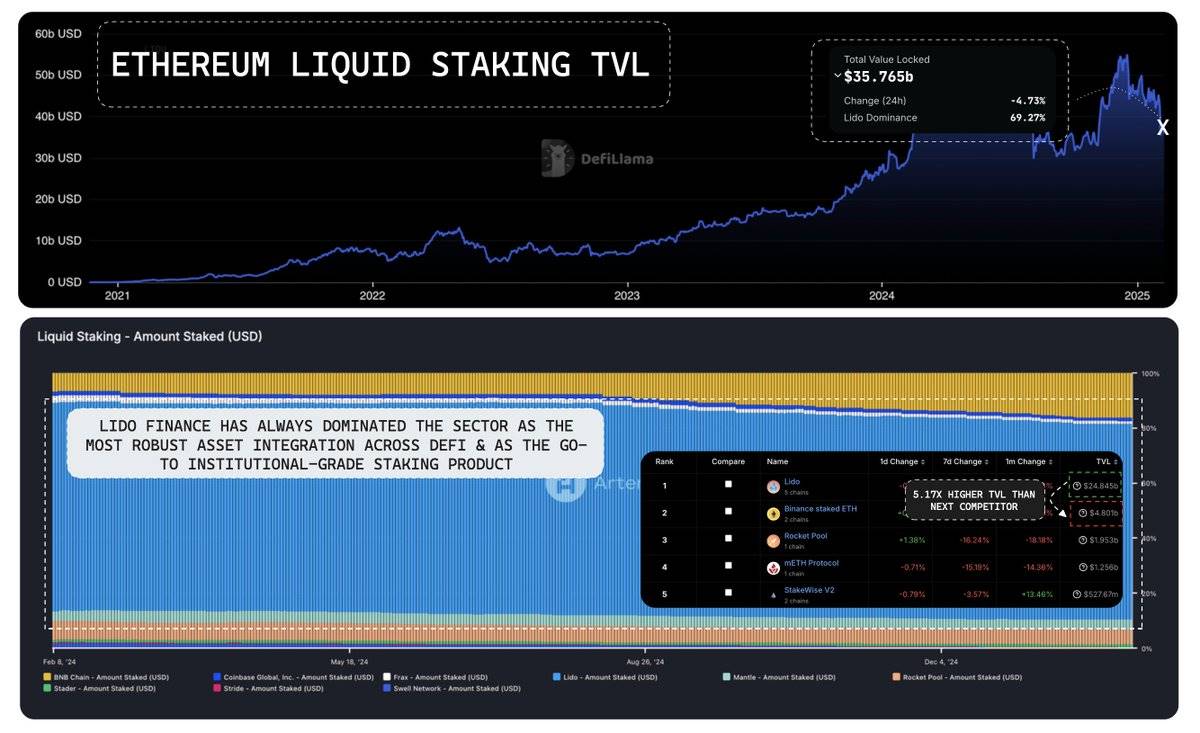

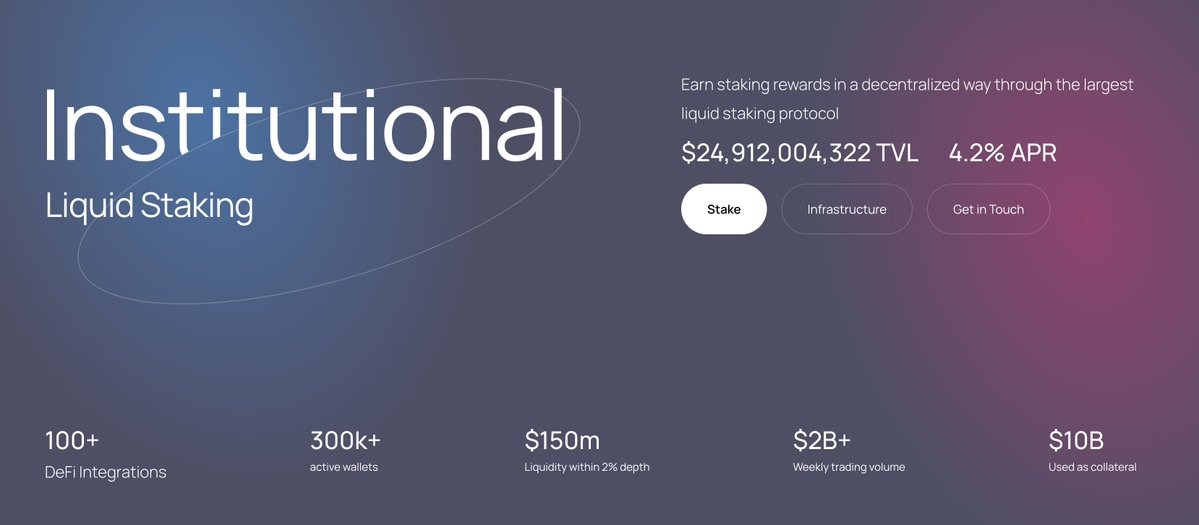

Liquid staking is currently the largest sector in DeFi by TVL, with a total value of around $35 billion.

In this sector, @LidoFinance is the clear leader, holding about 70% market share and nearly monopolizing the liquid staking token (LST) market. Lido’s TVL stands at $24.8 billion, more than 5.17 times that of its closest competitor, @binance’s $bETH ($4.8 billion).

Lido’s dominance is not driven by staking yields but rather by the asset value of $stETH:

-

Best Asset Utilization: $stETH is the most widely used asset across the DeFi ecosystem.

-

Most Trusted Service: As an institutional-grade staking solution, Lido is the top choice for funds and enterprises.

In this space, credibility and trust are key drivers of user adoption.

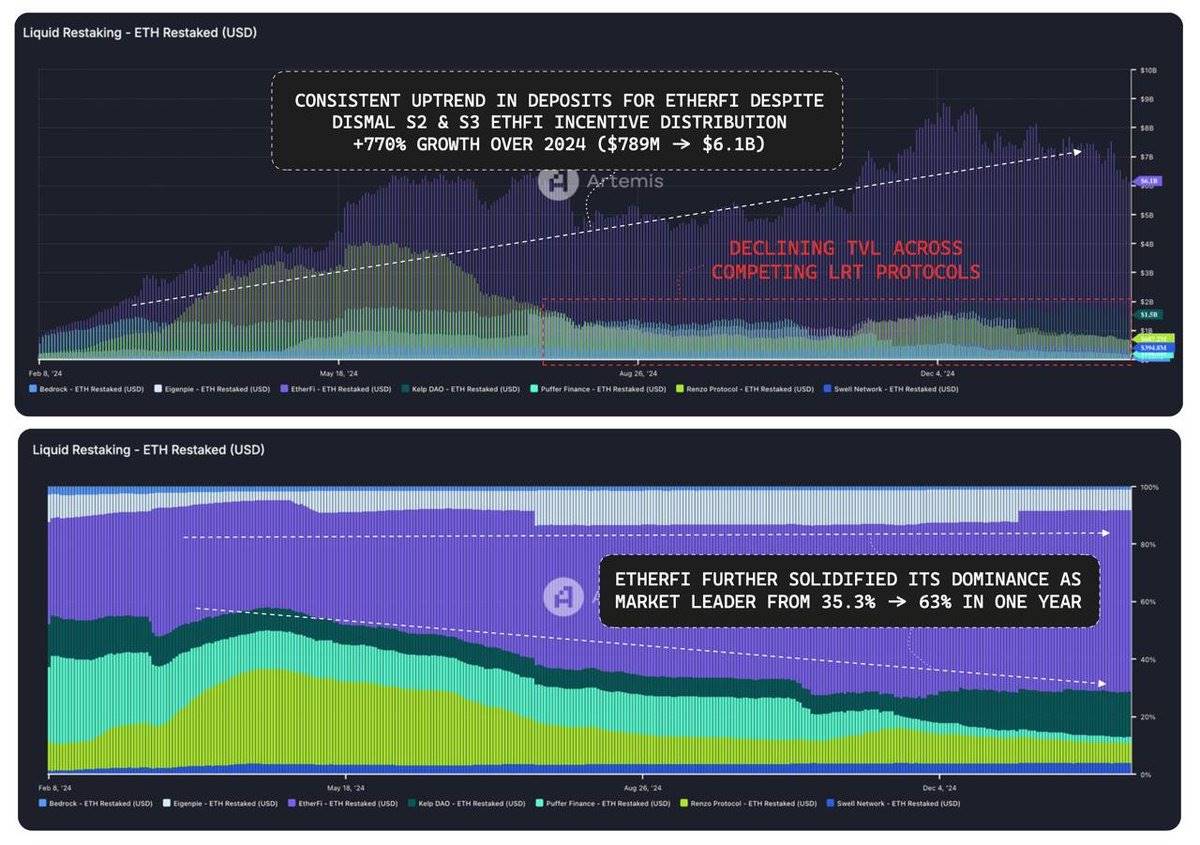

We observe similar trends in the liquid restaking sector.

Notably, @ether_fi has seen continuous market share growth, rising from 35.3% to 63%. Even after the conclusion of S1 and S2 stakedrop events, its TVL grew approximately 770% throughout 2024.

Key factors driving this growth include:

-

First-mover advantage in ecosystems such as @eigenlayer, @symbioticfi, and @Karak_Network.

-

Deep integration with DeFi protocols.

-

High trust in its product suite.

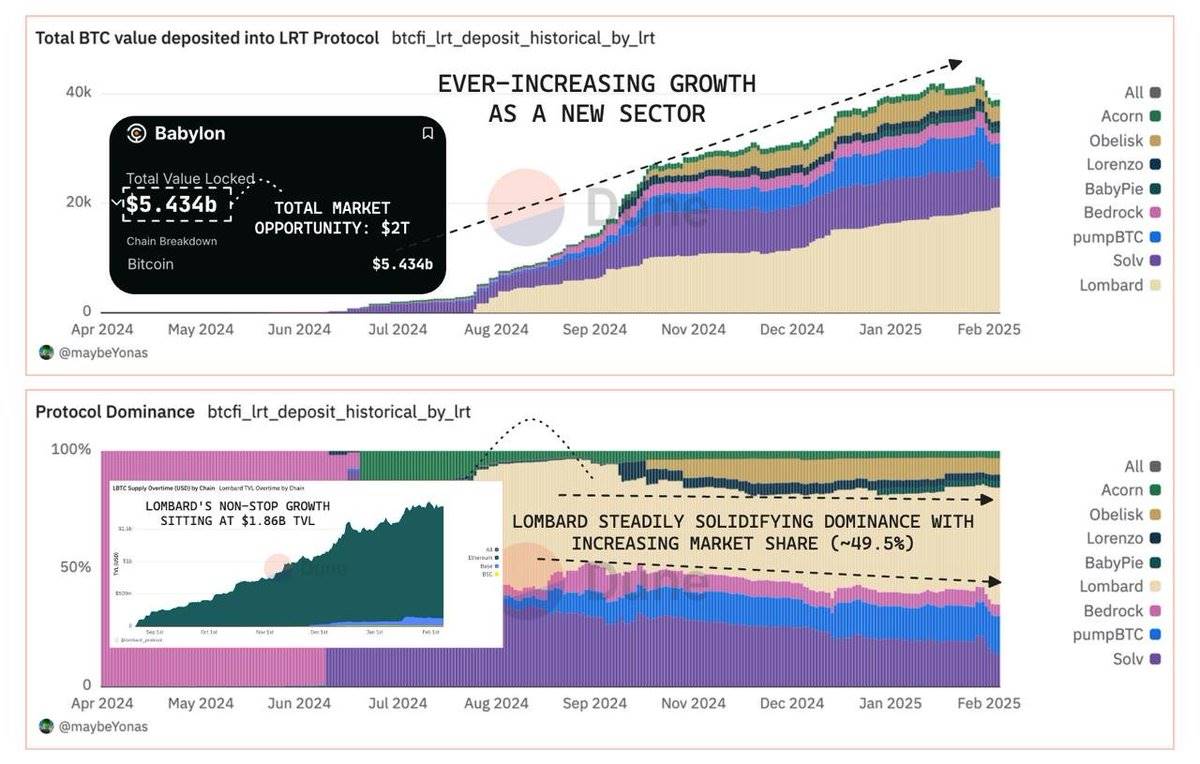

@Lombard_Finance is progressively aligning with trends seen in the LST (liquid staking token) and LRT (liquid restaking token) sectors, steadily increasing its market share to 49.5%.

With the ongoing development of @babylonlabs_io (currently valued at $5.5 billion), demand for Bitcoin ($BTC) as the premier crypto-secured asset is expected to grow exponentially. In the future, the market opportunity in this sector could reach up to $2 trillion.

@Lombard_Finance has successfully mastered the strategy for achieving dominance in this sector.

Its token $LBTC is the most widely integrated, frequently used, and security-focused LRT in the DeFi ecosystem. This advantage positions Lombard as a flagship asset akin to $stETH, capable of earning institutional trust and achieving broad adoption.

Overall, various DeFi sectors have gradually found their footing and are now complementing each other as part of a cohesive ecosystem.

This marks the rise of a new financial paradigm, one that is disrupting traditional centralized finance (CeFi)—and we are fortunate to witness this transformation firsthand.

As DeFi enters its next phase of expansion, we will see more efforts exploring new frontiers, including untapped markets and deeper integration with CeFi:

-

@ethena_labs plans to integrate traditional financial payment functionalities into its products.

-

@Mantle_Official has launched the Mantle Index Fund and Mantle Bank, aiming to bridge cryptocurrencies with traditional financial services.

Additionally, more institutions are turning their attention to DeFi—for example, @BlackRock participating in DeFi via $BUIDL, and @worldlibertyfi launching DeFi portfolios and spot ETFs. These moves all indicate that DeFi’s future potential is highly promising.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News