Interpreting the Story Whitepaper: The "Crypto Lego" of IP Economy in the AI Era

TechFlow Selected TechFlow Selected

Interpreting the Story Whitepaper: The "Crypto Lego" of IP Economy in the AI Era

If knowledge becomes the new oil of the AI era, then Story will become its pipeline.

Author: TechFlow

The recent crypto market is gradually giving off a sense of being caught between ice and fire.

On one side, the on-chain AI Agent sector has collectively cooled down; on the other, major traditional infrastructure projects are starting to make new moves.

Besides Berachain’s recent mainnet launch and token release, another highly anticipated intellectual property protocol, Story, has also updated its whitepaper, detailing its design and changes.

Last year, the project secured an $80 million Series B round led by a16z crypto, bringing total funding to $140 million. Community members have placed high hopes on it as the next “big winner,” and interactions across several testnets have been extremely active.

The whitepaper update may signal that the project’s mainnet and token launch are not far off.

If you’re still unfamiliar with Story, we’ve provided a more accessible interpretation of this latest whitepaper to help guide your understanding.

Why build Story? What problems does it solve?

We all understand that narrative is crucial in crypto projects.

So what exactly is Story’s narrative? It starts with intellectual property (IP).

The crypto space often talks about the “killer app,” but the reality is—the true killer market already exists—it’s just locked inside the iron cage ofWeb2.

Intellectual property (IP) is a perfect example.

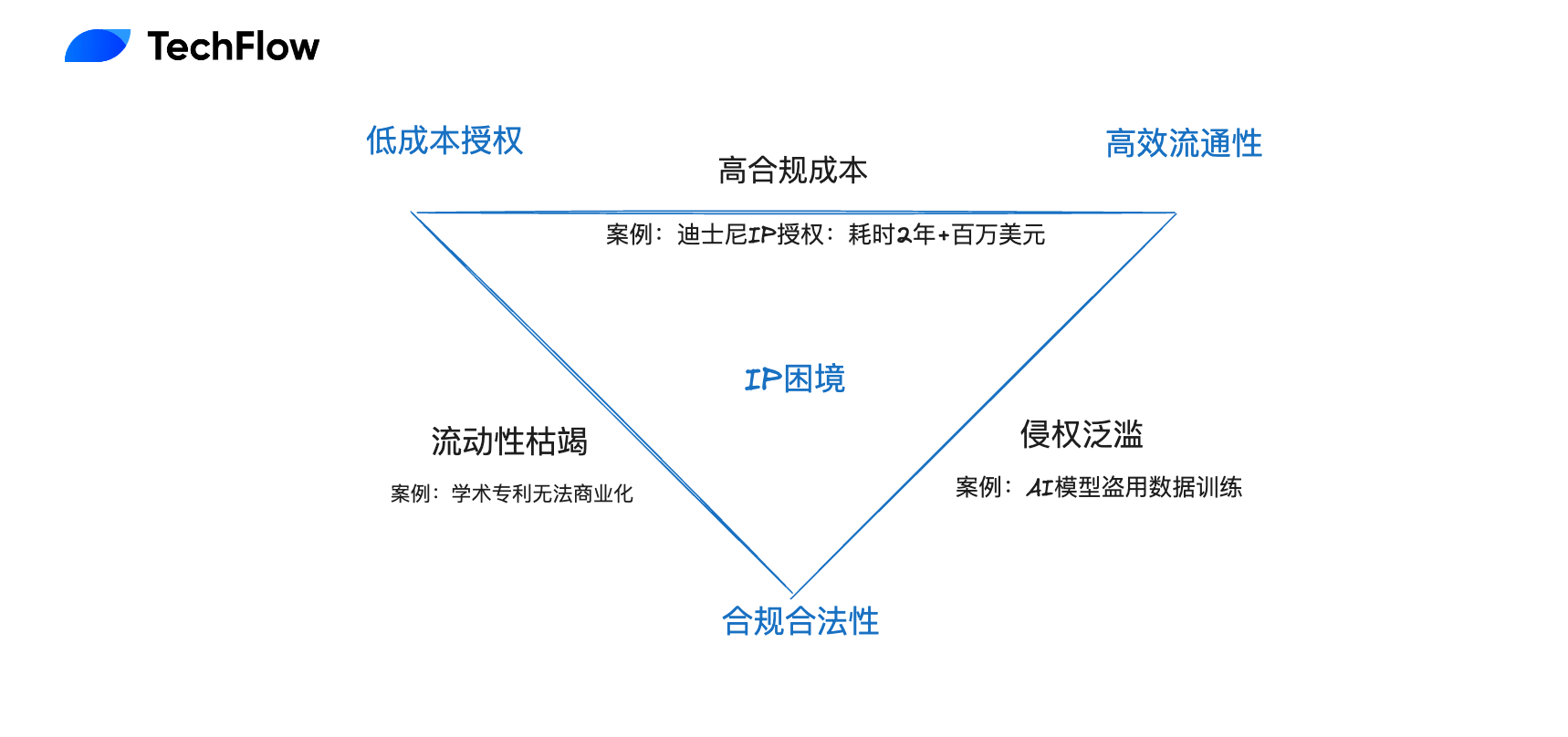

The global IP market is valued at over trillions of dollars, encompassing all creative outputs such as film, music, patents, and AI datasets. Yet this market faces an “impossible trinity”:

Problem 1: The 'Greedy Tax' of Centralized Intermediaries

Whether you're an independent musician or a research institution, commercializing your creativity requires paying hefty “tolls” to platforms:

-

Case: When Spotify pays royalties to record labels, less than 15% actually reaches creators [industry data]. The Story whitepaper notes that centralized platforms “increase transaction costs.”

-

Conflict point: In the AI era, the barrier to creative production has dropped, but the revenue-sharing models of centralized platforms cannot support micropayment needs for “long-tail creators.”

Problem 2: The 'No Man's Land' of AI Training

When Stability AI was sued for using artists’ works without authorization to train its models, it exposed a fatal flaw: the existingIP system is fundamentally incompatible with large-scale AI production.

-

Data: Training GPT-4 requires 45TB of text. If done through traditional licensing negotiations, legal costs alone would exceed model training expenses [estimate];

-

Whitepaper insight: “AI companies cannot generate hundreds of millions of individual licensing agreements” → Result: infringement becomes the norm, creators receive zero returns.

Problem 3: The 'Desertification' of IP Liquidity

A demo of African folk music used in a hit song should enable the original creator to earn ongoing revenue. But in reality:

-

Inability to track derivatives: There’s no automated royalty distribution tool for scenarios like derivative creation or cross-border licensing;

-

Value waste: The whitepaper describes the current state as “isolated silos without interoperability,” preventing IP assets from generating compounding effects like DeFi.

To solve these issues via legal procedures would be costly, time-consuming, and unable to keep up with AI-generated content (e.g., the spread of Deepfake videos far outpaces judicial response times);

Meanwhile, in traditional blockchain solutions, NFTs only address “ownership,” not “usage rights” (e.g., owning a CryptoPunk doesn’t mean you can use it to train an AI model).

Story: The 'Lego' of the IP Economy

Considering the above challenges in the IP economy, here’s how to understand Story: becoming the “underlying ledger of the knowledge economy”—any creative work, from a research paper to anAI-generated video, gains global liquidity here.

Positioning: The 'TCP/IP Protocol' for IP

In the Web2 era, the TCP/IP protocol enabled free flow of data packets across the internet. In the Web3 era, Story aims to define a similar universal standard for IP asset interactions:

-

Core functions:

-

Standardized registration: Transform IP into on-chain assets (IP-Assets), embedding metadata such as ownership and licensing terms;

-

Programmable interface: Any application can invoke IP terms via API (e.g., “allow derivative creations, charge 5% royalty”);

-

-

Comparable cases:

-

SWIFT protocol (interbank settlement) → Story (IP-to-IP settlement);

-

GitHub (code version management) → Story (IP derivative relationship graph)

-

The Three-Layer 'Lego' of IP

-

Base Layer:

-

PoC Protocol: IP registration and compliance verification (e.g., automatically detecting infringement in derivative works)

-

On-chain fingerprinting: Ensuring traceability of AI training data via model hash values (e.g., OML technology mentioned in the whitepaper)

-

-

Middle Layer (IPFi):

-

Fractionalization: For example, splitting a movie IP into 100 million NFTs to lower investment barriers;

-

Collateralized lending: Using unrealized patent IP as collateral to borrow stablecoins;

-

Royalty securitization: Packaging future royalty income into tradable ERC-20 tokens

-

-

Application Layer:

-

Human use case: An independent musician sets automatic revenue-sharing rules for “sampling rights”; anyone using a segment of their demo earns them royalties

-

AI use case: An autonomous driving company purchases rights to use a street-scene dataset for training

-

From Copyright Chain to Settlement Layer for AI Agent Economy

-

Short-term goal: Replace traditional copyright offices by offering lower-cost, higher-transparency IP registration services;

-

Long-term vision:

-

Become the “settlement layer” for the AI Agent economy

-

Build a “on-chain knowledge graph”—globally viewable relationships for every IP’s derivatives, earnings, and collaborations

-

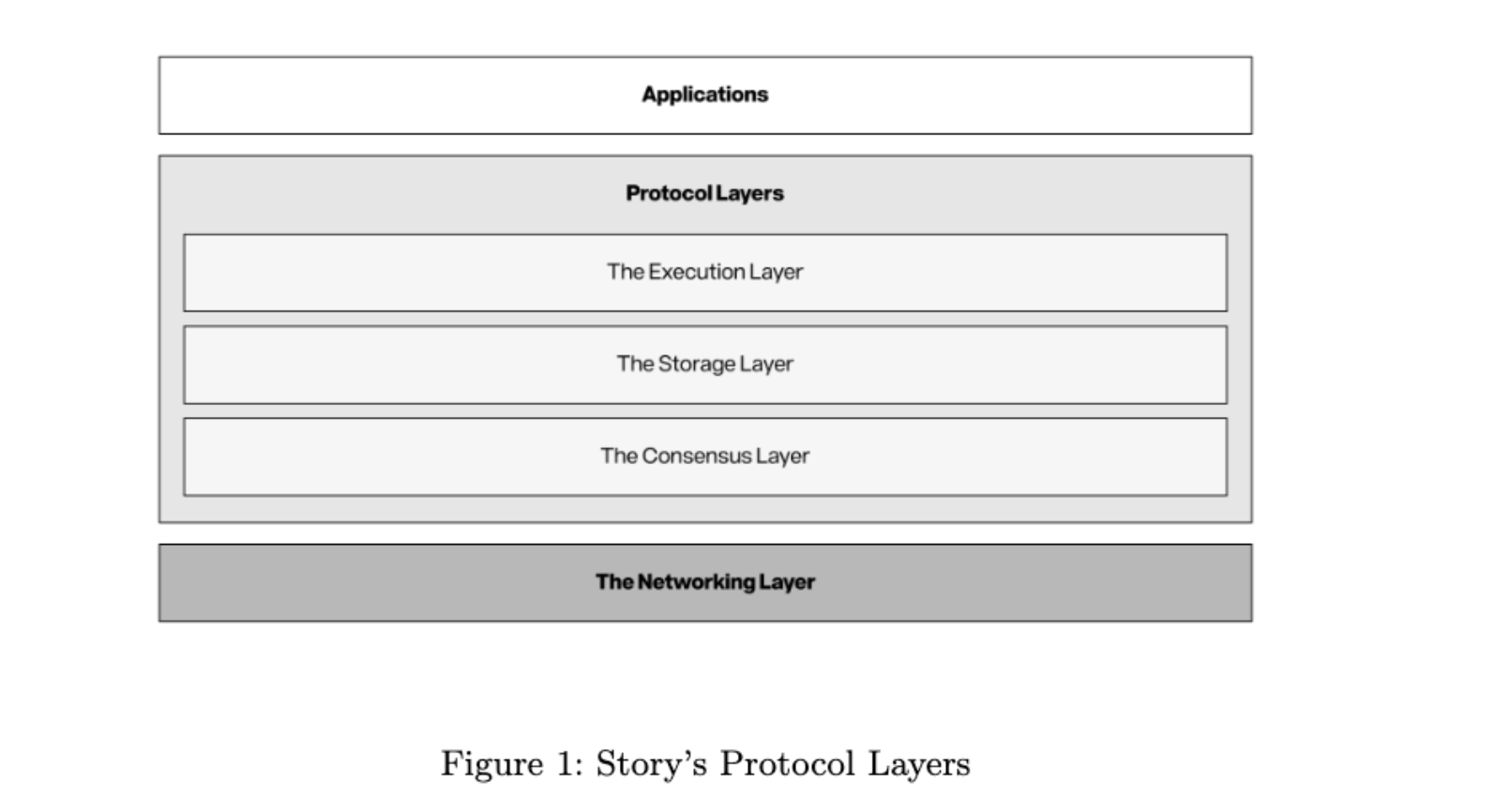

Story's Technical Highlights: Layered Design and the PoC Protocol

While other blockchains struggle with “how to make NFTs move,” Story has chosen a more radical technical path—building a blockchain customized specifically forIP. Its core innovation can be summarized as: not building a general-purpose chain, but rather acting as an “acceleration chip” exclusively forIP.

As a blockchain, it must inevitably cover several layers: execution, storage, and consensus.

We’ve distilled key descriptions and data points from the whitepaper to present its technical design in the most accessible way possible.

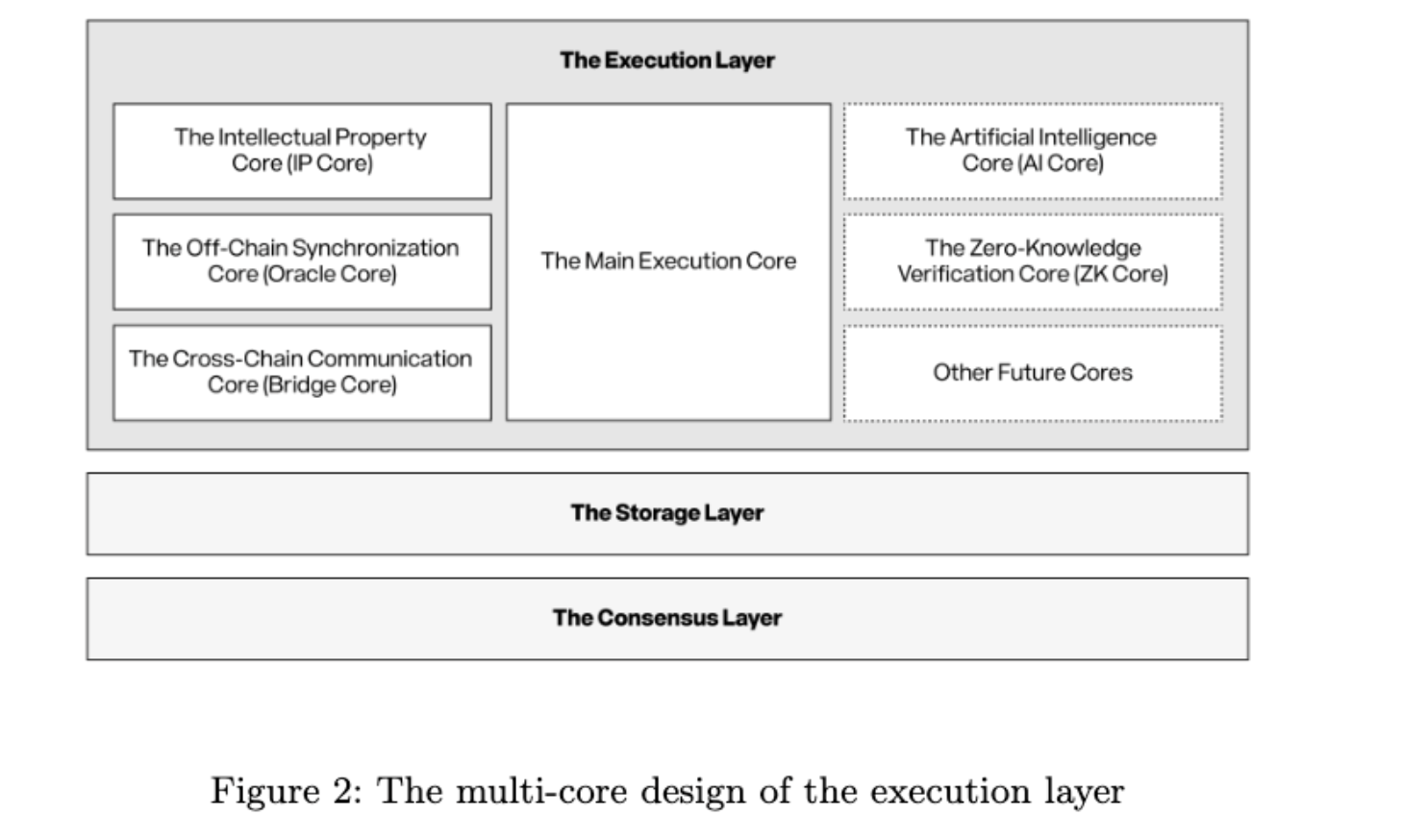

Execution Layer:

-

IP Core: Natively supports complex IP relationship validation (e.g., checking if a song sample has obtained authorization from all ancestral nodes). The whitepaper reveals it is faster than EVM;

-

AI Core (planned): Optimizes on-chain model fingerprint computation to reduce Gas costs.

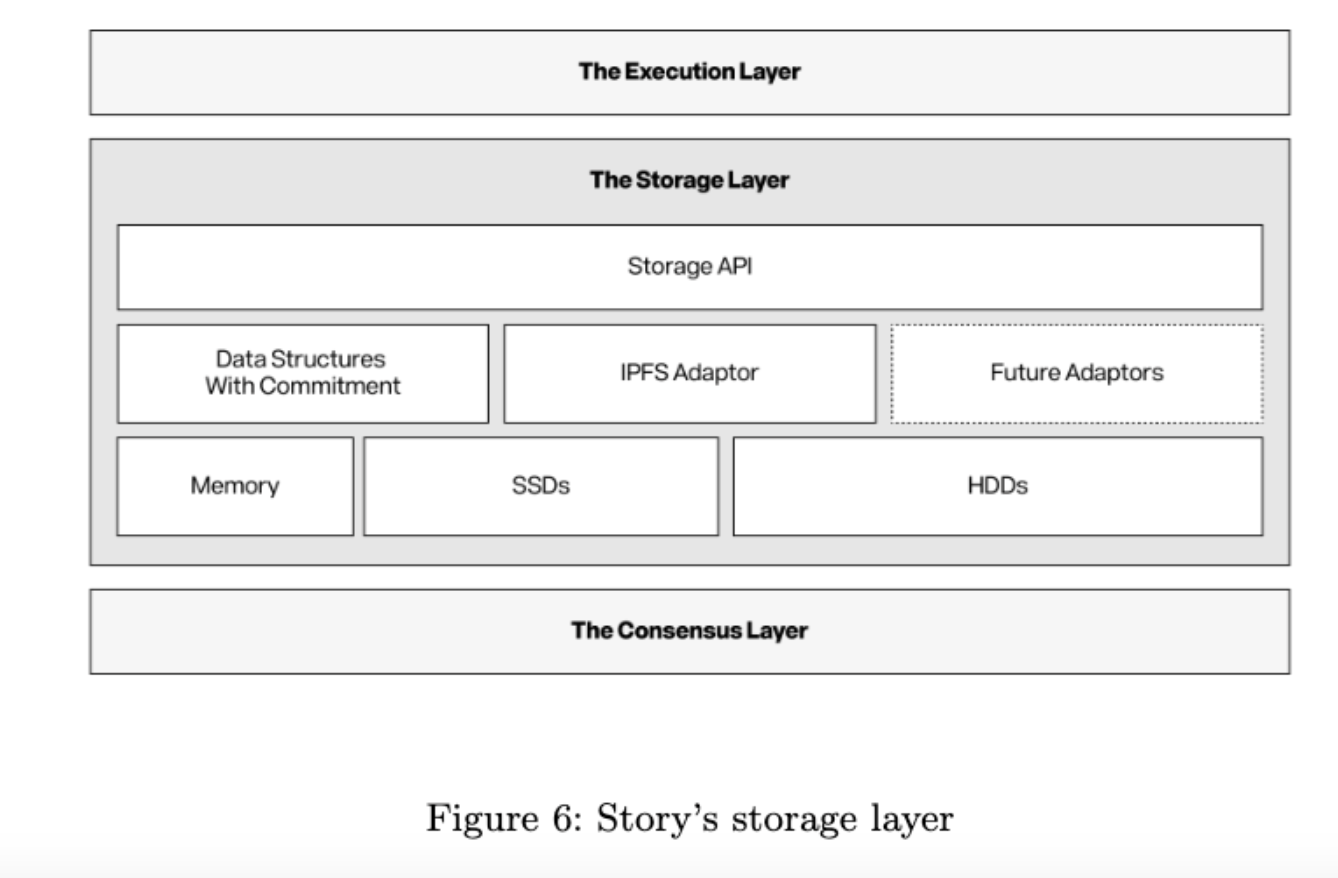

Storage Layer:

-

Dynamic tiered storage: Hot data (e.g., IP license terms) stored on-chain, cold data (e.g., 4K movie source files) stored on Arweave;

-

Proprietary “storage translation layer”: Automatically optimizes data placement, shielding developers from storage complexity.

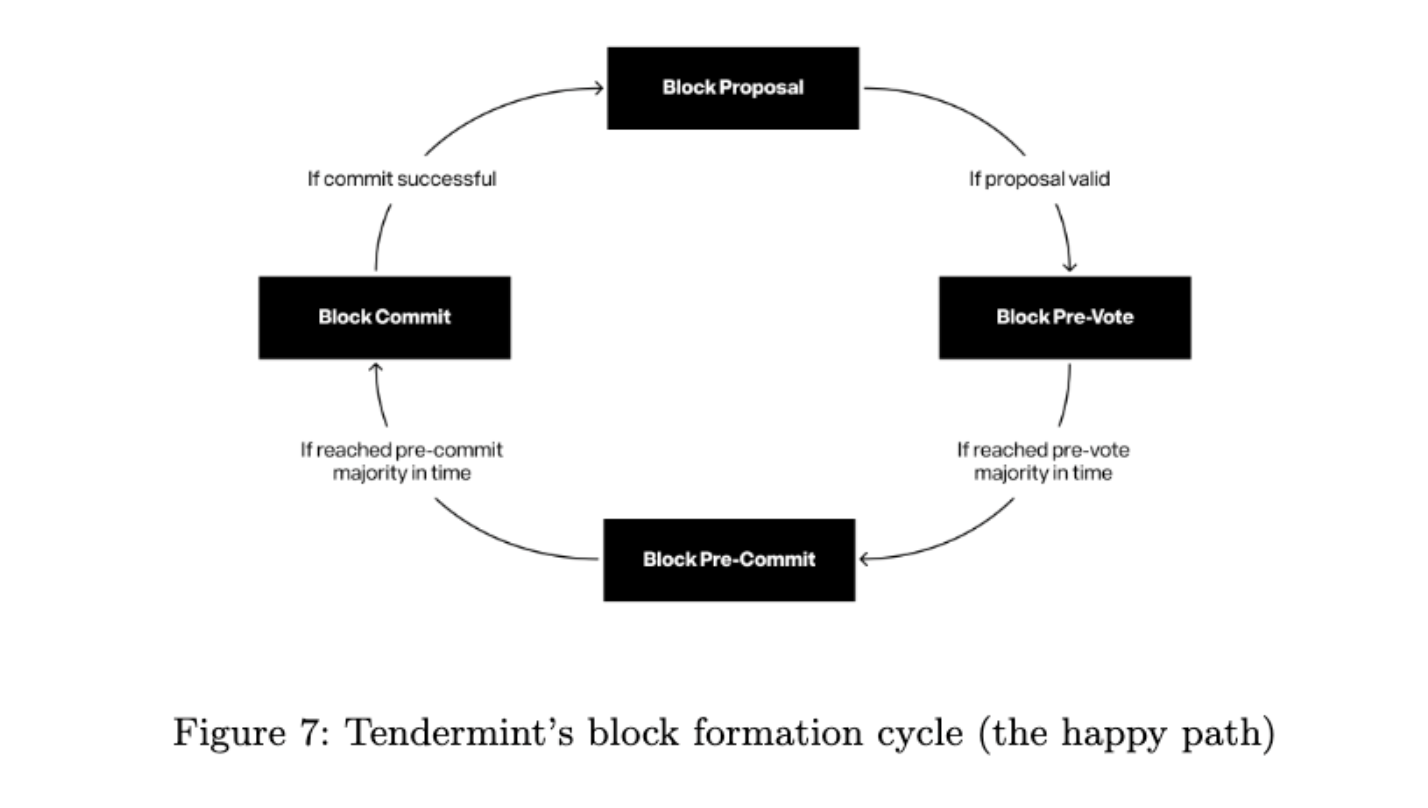

Consensus Layer:

-

Instant finality based on CometBFT ensures IP transactions are confirmed within 3 seconds (compared to Ethereum’s average of 12 seconds)

Highlight: Proof of Creativity (PoC) Protocol

PoC acts as Story’s “IP compiler,” translating legal terms into executable code:

-

IP Account (ERC-6551++):

-

Each IP is bound to a smart contract account, supporting modular extensions (e.g., adding royalty distribution rules) [15];

-

Example: When an artist mints an NFT, the clause “commercial use requires 3% royalty payment” is automatically embedded without manual coding [16].

-

-

Automated Compliance:

-

Conflict interception: If a film soundtrack uses an unauthorized sample, NFT minting is automatically blocked;

-

Global royalty distribution: Automatically allocates earnings to all contributors (e.g., original author, translator, remixer) based on the IP derivative graph.

-

$IP Token: Fueling the Knowledge Economy

If Story is likened to the central bank of the knowledge economy, then the IP token serves as its issued “base currency”—functioning simultaneously as network fuel, value carrier, and governance credential.

-

Network Fuel:

-

Paying transaction Gas fees (e.g., IP registration, license grants);

-

Staking to qualify as a validator (PoS consensus).

-

-

Value Medium:

-

Royalty distribution: IP revenues settled in IP tokens (e.g., split payments for derivative works);

-

Agent-to-agent settlement: AI agents use IP tokens to purchase training data access rights.

-

-

Governance Credential:

-

Voting on protocol upgrades (e.g., introducing new core types);

-

Adjusting key parameters (e.g., royalty distribution ratios).

-

Where might demand for the token come from?

-

Gas consumption: Growing with IP transaction volume;

-

Staking demand: At least 30% of total supply must be staked to maintain network security [8];

-

Speculative demand:

-

IPFi scenarios: Borrowing IP tokens against pledged IP assets;

-

Governance premium: Scarcity of voting rights could drive up token price.

-

The formal IP token economic model and allocation details are not disclosed in the whitepaper and may require further updates.

Conclusion

Story appears to be betting on a larger proposition: if knowledge will become the new oil in theAI era, Story aims to be the pipeline.

Beyond the whitepaper, a fair analysis asks: does Story have a moat?

Technically, the multi-core architecture described in the whitepaper requires deep optimization of IP processing workflows. Imitators may face significant hurdles (e.g., the previously mentioned graph traversal algorithm for the IP core). Additionally, the dynamic optimization of the blockchain’s storage layer depends on long-term accumulation of data patterns. If Story gains first-mover advantage, latecomers will inevitably face a time lag.

Moreover, the a16z-led investment and substantial funding have undoubtedly drawn attention and interest. While business development and narrative matter under high expectations, the token’s market performance will also significantly influence Story’s growth trajectory—this remains to be seen.

Some uncertainties remain:

-

Regulation: Legal recognition of on-chain IP rights varies across jurisdictions (e.g., EU MiCA does not cover IP assets);

-

Cold start: Early success depends on attracting top-tier IP holders (e.g., Disney, Universal Music) to establish network effects. If low-quality IP dominates, a “lemon market” effect may occur (uncertainty about IP quality leads to asymmetric information, suppressing willingness to pay).

Yet narratively, Story could satisfy two key points:

-

For individuals: Any creator can publish IP as easily as posting a tweet and capture full lifecycle value;

-

ForAI: Become the “HTTP protocol” for IP transactions among Agents

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News