DB: China stock "valuation discount" will disappear in 2025, A-shares and Hong Kong stocks to surpass previous highs

TechFlow Selected TechFlow Selected

DB: China stock "valuation discount" will disappear in 2025, A-shares and Hong Kong stocks to surpass previous highs

China's manufacturing and service industries hold a leading position globally, while DeepSeek is more like China's "Sputnik" moment.

Author: Wall Street Horizon

After the explosive rise of Deepseek, it may be the entire Chinese asset class that needs revaluation.

In its latest report on February 5, Deutsche Bank expressed bullish sentiment, stating that 2025 will be the year China surpasses other nations, with expectations that the "valuation discount" on Chinese equities will disappear and the A-share/H-share bull market will continue, exceeding previous highs. Deutsche Bank stated:

2025 is seen as the year when the investment community realizes China's leadership in global competition. It is becoming increasingly difficult to deny that Chinese companies offer high value-for-money and high-quality products across multiple manufacturing and service sectors.

We expect the "valuation discount" on Chinese stocks to vanish, with profitability potentially exceeding expectations due to policy support for consumption and financial liberalization. The bull market in H-shares/A-shares began in 2024 and is expected to surpass previous peaks over the medium term.

Specifically, Deutsche Bank noted that China holds a leading global position in manufacturing and services, while DeepSeek resembles China’s "Sputnik moment":

China leads globally in apparel, textiles, toys, basic electronics, steel, shipbuilding, as well as complex industries such as telecom equipment, nuclear energy, defense, and high-speed rail. In 2025, within just one week, China unveiled the world’s first sixth-generation fighter jet and its low-cost artificial intelligence system DeepSeek.

Marc Andreessen described the launch of DeepSeek as an "AI Sputnik moment," but this is more accurately China’s own Sputnik moment, marking recognition of Chinese intellectual property. The list of high-value-added areas where China excels and dominates supply chains is expanding at an unprecedented pace.

Deutsche Bank believes China today resembles Japan in the early 1980s:

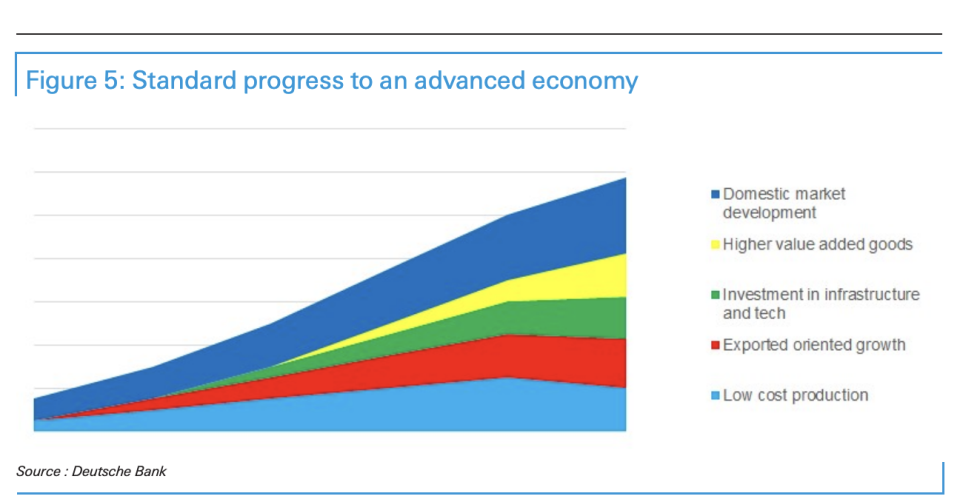

There is a growing realization that China is not in the same position as Japan in 1989, but rather Japan in the early 1980s—when Japanese value chains were rapidly ascending, offering higher quality products at lower prices, and continuously innovating.

Additionally, Deutsche Bank optimistically pointed out that U.S.-China trade issues could bring positive surprises, and that trade and markets are not so closely linked:

As Chinese companies solidify their dominance globally, valuation discounts should ultimately turn into premiums. We believe investors will have to pivot quickly toward China over the medium term, and it will be difficult to gain exposure to Chinese equities without driving up share prices.

China's Manufacturing Advantages Are Becoming Increasingly Evident

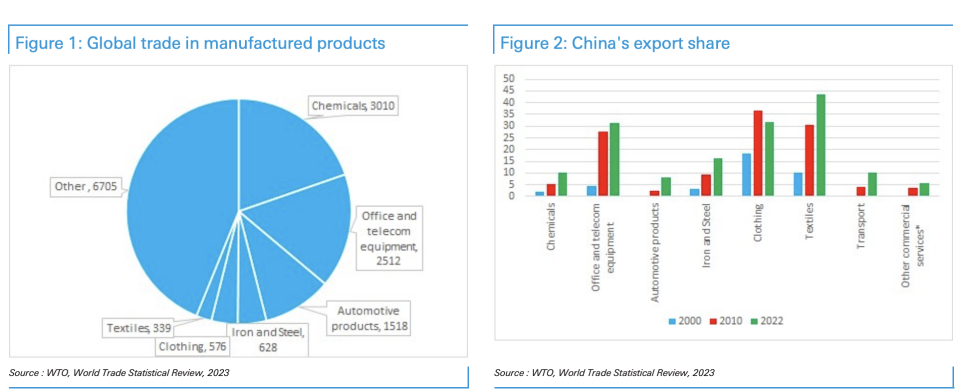

In recent years, China's manufacturing advantages have become increasingly evident on a global scale.

Deutsche Bank stated:

From its initial rise in apparel, textiles, and toys to its current dominance in basic electronics, steel, and shipbuilding, China’s manufacturing trajectory has been remarkable. Particularly noteworthy is the standout performance of Chinese firms in white goods and solar energy.

Notably, China’s emergence in complex industries such as telecom equipment, nuclear power, defense, and high-speed rail demonstrates its strong technological capabilities. At the end of 2024, China’s rapid ascent in auto exports drew global attention, as its high-performance, aesthetically appealing, and competitively priced electric vehicles (EVs) successfully entered international markets. In 2025, within just one week, China launched the world’s first sixth-generation fighter jet and the low-cost AI system DeepSeek—seen as a key milestone in the global recognition of Chinese intellectual property.

China's manufacturing strength can be verified through the following aspects:

-

Export scale: China’s merchandise exports are twice those of the United States, accounting for 30% of global manufacturing value-added.

-

Patent applications: In 2023, China accounted for nearly half of global patent filings. In the EV sector, China holds about 70% of patents, with similar advantages in 5G and 6G telecom equipment.

-

Talent pool: Excluding India, China produces more STEM (science, technology, engineering, and mathematics) graduates than all other countries combined.

-

Industrial clusters: China has created local specialized clusters akin to Silicon Valley for key industries, working closely with universities on research.

China Resembles Japan in the Early 1980s

Deutsche Bank believes China resembles Japan in the early 1980s:

Japan’s growth was driven by abundant cheap labor, intensive capital use, and rising productivity. Domestic investment exceeded 30% of GDP, supported by financial repression policies that kept interest rates low. Japan acquired new technologies through joint ventures. Savings accounted for 40% of GDP in the early 1970s, then declined to nearly 30% in the early 1980s. Japan began setting up overseas factories in the 1970s to avoid trade friction, while China has only recently started doing so.

Deutsche Bank also stated:

A liberalized financial system would help promote consumption by normalizing interest rates and ending the transfer of funds from depositors to enterprises. This would reduce overinvestment and excessive competition, as capital becomes rationed, thereby improving state-owned enterprise (SOE) returns. We expect that as SOEs improve their returns, there will be demands to ease excessive competition to boost stock valuations. We anticipate this will become a key topic in 2025 and serve as a major driver of the bull market.

Moreover, China’s economy and exports continue to grow rapidly. In 2024, China’s exports grew by 7%, with exports to Brazil, the UAE, and Saudi Arabia increasing by 23%, 19%, and 18% respectively, and exports to ASEAN countries under the Belt and Road Initiative growing by 13%. China’s exports to ASEAN and BRICS nations now equal the combined total to the U.S. and EU, and over the past five years, its export market share to these destinations has grown by two percentage points annually.

The drivers of China’s economic growth include:

-

Manufacturing advantage: Across nearly all industries, China hosts world-leading companies that continue to capture market share.

-

Belt and Road Initiative: This initiative has opened up Central Asia, West Asia, the Middle East, and North Africa, expanding China’s potential markets.

-

Leadership in automation: Approximately 70% of industrial robots are installed in China, driving productivity advantages.

-

Domestic demand potential: Household deposit growth has slowed to twice nominal GDP growth, but since 2020, savings have increased by $10 trillion, which we expect to flow into consumption and equity markets over the medium term.

U.S.-China Trade Issues Could Bring Positive Surprises; Trade and Markets Are Not So Closely Linked

According to earlier reports by CCTV News, President Trump signed an executive order on February 1 imposing a 10% tariff on goods imported from China. However, Deutsche Bank believes the actual situation may be more favorable than expected. The Trump administration appears to prioritize tactical victories over maintaining ideologically rigid positions that lack broad support.

The launch of DeepSeek has shaken the belief that China can be contained. A better approach may involve lowering regulations, providing cheap energy, and maintaining relatively low barriers to imported intermediate goods to stimulate business. Ahead of the midterm elections, a more trade-friendly stance is likely to become part of the evolving "America First" agenda.

Deutsche Bank analysis suggests that a swiftly reached U.S.-China trade deal could involve limited tariffs, the removal of some current restrictions, and several large contracts between U.S. and Chinese companies. If this occurs, Chinese equities are expected to rise.

A temporary decline in exports might actually drive stock market gains. China’s dominance across industries has been achieved through overinvestment in many sectors. If supply can be constrained, it could benefit equities and release capital for domestic consumption.

Overall, Deutsche Bank believes that as Chinese companies strengthen their global dominance, investors may need to quickly adjust strategies and increase allocations to China. Hong Kong/Chinese equities are expected to continue outperforming global markets over the medium term, extending their strong performance from 2024.

We believe global investors are often severely underweight China, much like they avoided fossil fuels years ago—until the market punished those making non-market-driven decisions. We see today’s fund positioning on China as similar. Investors who favor leading companies with strong moats cannot ignore that it is now Chinese firms that possess wide and deep moats, not Western ones.

As Chinese companies solidify their global dominance, the historical valuation discount on the China story should ultimately shift to a premium. We believe investors will have to pivot rapidly toward China over the medium term, and it will be difficult to obtain Chinese equities without pushing up prices. We have long been bullish, but previously struggled to identify what catalyst would awaken the world and trigger buying. We now believe China’s "Sputnik moment" (or its dominance in electric vehicles) is precisely that catalyst.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News