China Pilots New Financial Opening Policy: A Step Toward Legitimizing Crypto Finance?

TechFlow Selected TechFlow Selected

China Pilots New Financial Opening Policy: A Step Toward Legitimizing Crypto Finance?

The cryptocurrency and Web3 industry is in a stage of rapid development and standardization.

Author: Jayden Shao

On January 22, 2025, the People's Bank of China, the Ministry of Commerce, the National Financial Regulatory Administration, the China Securities Regulatory Commission (CSRC), and the State Administration of Foreign Exchange jointly issued the "Opinions on Piloting the Alignment with International High Standards in Financial Fields within Eligible Pilot Free Trade Zones (Ports) to Advance Institutional Opening" (hereinafter referred to as the "Opinions").

The Opinions aim to promote pilot openings in the financial sector within pilot free trade zones (ports), covering areas such as allowing foreign-invested financial institutions to provide new financial services comparable to those offered by domestic institutions, streamlining approval procedures, supporting cross-border purchases of overseas financial services, facilitating capital transfers for foreign investors, improving arrangements for cross-border financial data flows, and comprehensively strengthening financial regulation. These measures reflect China’s determination to further open its financial sector and align with international high standards.

Yesterday, Attorney Liu Honglin from ManQin Law Firm provided an immediate commentary titled “Major Cross-Border Financial Opening Policy Released in China – A New Breakthrough for the Crypto Asset Industry?” which received widespread praise and recognition online. Today, we follow up with a second analysis—this time from the perspective of a Web3 lawyer—to dissect the content of the Opinions and examine their implications and significance for the crypto industry.

Positive Opportunities Ahead

1. Financial Services Opening: Potential Legal Recognition for Cryptocurrencies

The Opinions allow foreign-invested financial institutions to offer new financial services on par with domestic institutions, emphasizing the concept of "new financial services," defined as services not yet available in mainland China but already regulated and offered in other jurisdictions. This definition may provide a pathway for cryptocurrencies and related financial products to gain a certain level of legal recognition. Although mainland China has previously taken a cautious stance toward cryptocurrency trading—with documents such as the September 24, 2021 notice deeming crypto-related business activities as illegal financial activities—the global development of the crypto industry has seen products like cryptocurrency ETFs become legitimate, regulated financial offerings in various regions. Currently, securities markets in the United States, Hong Kong, Brazil, Australia, Thailand, Malaysia, and others have launched cryptocurrency ETFs. As a result, within pilot free trade zones (ports), cryptocurrencies could potentially be recognized as a new type of financial asset, thereby gaining clearer and more favorable legal standing.

Theoretically, if crypto-related financial services are recognized under a compliant framework as a form of new financial service, foreign financial institutions may gain opportunities to operate relevant businesses in pilot areas. This would help attract foreign financial institutions into the Chinese market, introduce innovative business models and products, promote diversification and competition in the financial market, and offer investors broader investment choices and opportunities.

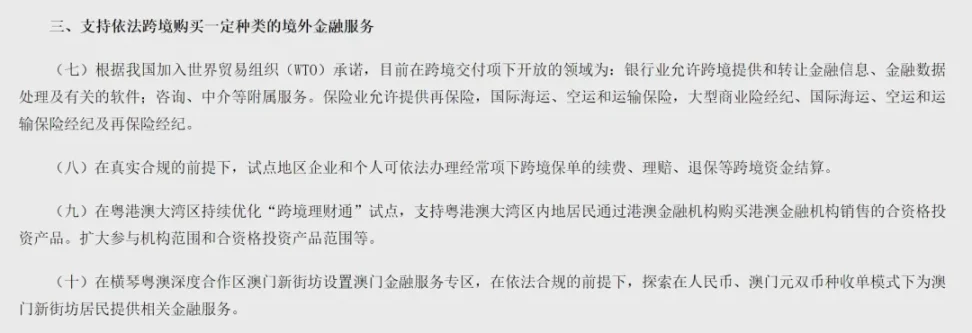

2. Expansion of Cross-Border Financial Services: Diversified Investment Channels for Investors

The Opinions support the lawful cross-border purchase of certain types of overseas financial services and call for continued optimization of the "Cross-boundary Wealth Management Connect" pilot program in the Guangdong-Hong Kong-Macao Greater Bay Area, including expanding the range of participating institutions and eligible products. Currently, the "Southbound Channel" of the Cross-boundary Wealth Management Connect offered by domestic brokers in the Greater Bay Area includes qualified products such as money market funds, bond funds, equity funds, and bonds. If the product scope is further expanded—as suggested by the above analysis—cryptocurrency ETFs and other crypto funds may also be included. This would provide domestic Web3 investors with broader investment channels and more diversified asset allocation opportunities. The expansion of cross-border financial services will help investors seek higher-quality investment targets globally and reduce risks associated with exposure to a single market.

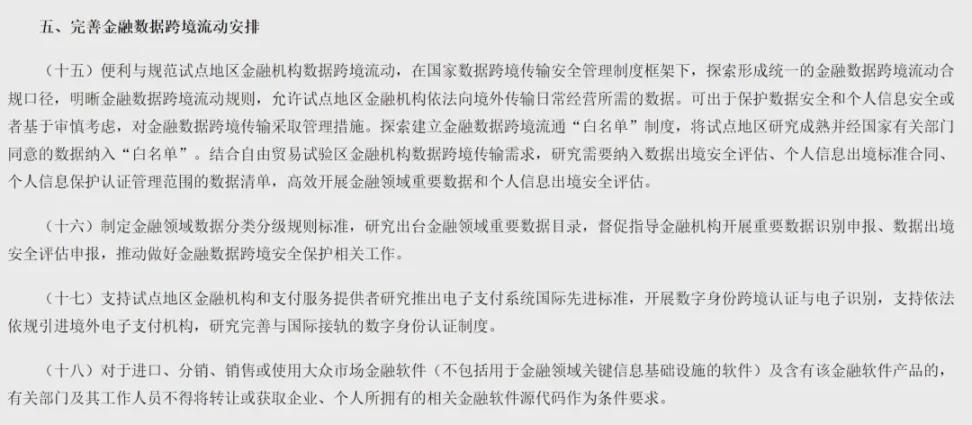

3. Cross-Border Financial Data Flow: Enhancing Industry Compliance and Internationalization

The Opinions permit financial institutions in pilot zones to legally transfer operationally necessary data overseas and explore establishing a "white list" system for cross-border financial data flows. This initiative helps improve the efficiency of international financial data circulation. For the cryptocurrency industry, cross-border data flow is a critical foundation for global operations and compliance. While specific implementation rules have not yet been clarified, this directional exploration opens the possibility for lawful cross-border transmission of crypto-related data, supporting the industry’s compliance and international development.

Notably, the Opinions support pilot regions in developing internationally advanced standards for electronic payment systems and encourage the introduction of foreign electronic payment institutions. This naturally invites comparisons with crypto "U-cards." Many compliant offshore payment providers already offer fiat-to-virtual currency conversion and cross-border remittance services. After the implementation of the Opinions, U-card operators could leverage international standards to enhance transparency and interoperability with Chinese payment systems. At the same time, it creates opportunities for domestic payment institutions to collaborate with global payment giants. Offshore payment institutions can bring advanced risk control technologies and compliance experience, helping U-cards better address challenges related to anti-money laundering, foreign exchange management, and transaction monitoring—thereby further enhancing the security and compliance of their payment systems.

4. Strengthened Financial Regulation: Laying the Groundwork for Compliance

The Opinions propose comprehensive reinforcement of financial regulation, including establishing cross-border dispute resolution mechanisms aligned with international rules. By emphasizing alignment with international high-standard financial regulation, this may provide clearer guidance for the compliance of crypto-related businesses. Globally, regulatory attitudes toward cryptocurrencies are gradually shifting from strict prohibition to orderly supervision. This policy adjustment in China may lay the groundwork for the future legalization and standardization of crypto-related financial products, attracting more international investors to participate in Web3 projects in the Chinese market. In the event of investment disputes in the crypto space, pilot areas may offer more internationalized and standardized resolution pathways, protecting investors’ rights to some extent, reducing维权 costs, and boosting investor confidence.

Uncertainties and Challenges Ahead

1. Tighter and More Detailed Regulation: Rising Compliance Costs

While the Opinions represent a significant step forward in financial opening, their release does not directly alter China’s current regulatory stance on cryptocurrencies. The Opinions signify both greater openness and comprehensive regulatory enhancement. Enhanced oversight will inevitably bring crypto-related investment activities under stricter scrutiny. Combined with previous requirements from China’s State Administration of Foreign Exchange mandating banks to strengthen monitoring and labeling of crypto transactions, investor activities will face closer scrutiny, potentially increasing compliance costs—such as requiring more identity information and transaction background documentation.

2. Market Volatility: Investors Must Proceed with Caution

During the process of regulatory adjustments and pilot openings, the cryptocurrency market may experience short-term volatility due to new rules and measures. High volatility is a defining characteristic of the crypto market. While the Opinions may bring new capital and opportunities, they could also trigger excessive market reactions in the short term, leading to sharp price swings. Investors will need stronger risk tolerance and more professional knowledge to navigate this complex and dynamic environment.

3. Increased Compliance Complexity: Cross-Border Investments Face Multiple Regulatory Hurdles

As pilot openings progress, investors will need to understand and comply with different regulatory policies and laws both domestically and abroad to ensure the legality of their investment activities. Additionally, the facilitation of cross-border financial services may bring compliance challenges related to taxation and foreign exchange. Compliance requirements for cryptocurrency investments may become more detailed and complex. Investors will need to invest more time and effort into understanding and adhering to these regulations; otherwise, they risk legal consequences such as having transactions deemed illegal or assets frozen.

ManQin Law Firm Summary

Globally, the cryptocurrency and Web3 industries are undergoing rapid growth and increasing regulation. Some jurisdictions are moving toward more structured and inclusive approaches—for example, major economies like the United States and the European Union are exploring ways to foster crypto industry development within regulatory frameworks. China’s issuance of the Opinions can be seen as a positive signal, indicating that while advancing financial opening, China is also gradually creating space for the compliant development of crypto-related financial products. While maintaining financial stability and risk prevention, mainland China will inevitably draw on international experience to further refine its cryptocurrency regulatory framework.

In the future, we may witness more innovative regulatory initiatives targeting cryptocurrencies in pilot areas. On a compliant basis, the healthy development of the crypto market could be progressively guided—for instance, blockchain-based cross-border payments and digital asset custody applications might be among the first to launch; specialized cryptocurrency trading pilot platforms could be established, allowing qualified investors and institutions to participate; or mechanisms fostering synergies between digital currencies like e-CNY and crypto assets could be explored, promoting the reasonable application of crypto technology in finance. From being labeled "illegal financial activities" to being recognized as "new financial services," all that stands in between is a balanced regulatory framework. Let us wait and see.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News