What happened and what will happen in the crypto market

TechFlow Selected TechFlow Selected

What happened and what will happen in the crypto market

Memes are now something even the president engages in, and he can also make money through channels unknown to us.

In the past week, many friends have called me asking about the market. I feel it's necessary to publicly share my thoughts and disclose my current views on the market—

【What exactly has changed】

【The future trajectory】

Longtime followers know I'm a long-term investor. Since 2019, I've published an annual strategy update each year. This piece covers 2024-2025 and is meant for discussion with the community.

1. DeepSeek burst the bubble

Regardless of whether DeepSeek truly trained its AI with $500K, the narrative is clear: 【algorithmic improvement】 has at least short-term beaten 【computational power scaling】.

Don't get hung up on whether this is real—if the market collectively accepts the $500K story, treat it as fact.

By late 2024, aside from memecoins, our crypto industry objectively had only one remaining narrative left: AI Agents—the last hope for the entire village.

Yet no one expected AI Agents would be ruthlessly crushed by DeepSeek from the actual AI sector.

DeepSeek's team consists of genuine IQ200 individuals—top graduates from Tsinghua and Peking University, Olympiad medalists everywhere.

Compare that to our industry where we idolize second-tier programmers sitting at home, AI engineers laid off from big tech or moonlighting on side projects. Sometimes we're forced down to IQ50.

So…

On January 27th, I tearfully took profits on all my AI token positions. Didn't sell at the peak, exited after significant drawdown—of course it hurts.

But the harsher truth is this event made our entire AI Agent sector look like clowns—and that might actually be true.

The reason "narrative" puts "narrate" before "event" is because the "event" hasn't materialized yet—it relies purely on storytelling. Once the story collapses, the sector's decline becomes irreversible.

2. The President and his mob

Not sure how everyone spent the holidays, but physically speaking, many relatives and friends asked me how to register Binance or OKX—they want to buy Trump coin.

The last time they were this crazy was during National Day holiday when they rushed to open accounts for China's A-shares.

SSE Index Chart Source: Tencent Securities

If I recall correctly, those brave souls who entered A-shares on October 8th are still hanging at the top of that mountain.

After taking profits on AI, honestly the more I thought about it, the more scared I became. Then I saw this post:

Roughly speaking: The President appears to have lost heavily, but there are two possibilities:

1. He doesn't profit through visible channels;

2. He's an idiot;

I know for certain the answer can't be #2.

Exactly! Memecoins are now being played by the President himself, profiting through channels unknown to us.

Be honest—do our memecoins deserve a seat at the same table as Trump?

A Thai hippo, an American squirrel, a longevity drug extending flies' lives—can these really sit at the same table as the man firmly seated in the Oval Office?

During holidays, adults sit at one table, children at another.

Adults drink premium liquor, kids only get Sprite.

So that day I basically sold off all my memecoins. My memecoin positions once showed massive unrealized gains, but by voluntarily lowering my IQ to 50, I failed to execute a great retreat and kept joining the great revolution instead.

Feels like waking up from a dream.

3. A top signal: High school kid earns millions

I believe everyone in the memecoin space—even those not playing—has heard this recent legendary story.

A high school student sat patiently for a month, then nailed Jelly with ultra-low cost, turning it into tens of millions overnight.

Of course, as the story spread it became increasingly exaggerated with more rumors. I can't confirm 100% authenticity, but I recognize the smell is right.

Looking back at 1-3 days before Bitcoin's historical peak at $69K in 2021, I reflect:

· Interns easily outperformed fund managers in returns;

· Grassroots ENS contributors received million-dollar airdrops;

Then and there,

Just like,

Now and here.

I liked this post where a TIME magazine editor (or possibly hacker) instantly harvested countless SOL with a fake tweet.

Tell me, what does this mean?

It's not that making money is impossible—skilled players can always profit, even at bear market bottoms.

But when the subject becomes ordinary people:

Interns make fortunes, ENS contributors make fortunes, high school kids make fortunes, editors make fortunes.

It means: 【At this moment, everyone's hands are extremely loose】

Experienced poker players know you only get loose when your paper profits are extremely high.

This indicates the greed index has reached a true peak.

This is a super top signal.

So on the 30th, I liquidated almost all altcoins, keeping only BTC and small portions of major coins ETH/SOL/DOGE/exchange tokens.

Though still with some losses, at least preserved a few leftover victory fruits.

I admire the high school kid's brilliant move, and equally respect the iron laws of this alternative investment market.

4. Criticism of Binance and Binance's response

Honestly, I don't want to talk about this.

As a former CEX professional, I've seen this advisor-listing-dump show too many times—from initial anger to eventual numbness, now completely desensitized.

But previously this stayed under the table, considered "minor corruption as lubricant for development";

"Crystal-clear water bears no fish"—slight murkiness beneath the surface was part of the game rules.

After all, we don't live in utopia or a vacuum homeland.

But the worst thing is bringing this from under the table onto center stage.

I don't intend to criticize Binance or the "First Sister" because this exists at nearly every CEX.

In traditional worlds, this would be an enormous scandal—potentially getting hundreds fired, dozens jailed.

Perhaps the First Sister shouldn't have responded—learning from celebrities doing cold treatment might have preserved retail investors' illusions.

But our industry is full of skeptics—such a huge scandal hits like a sledgehammer straight into every holder's heart.

It shattered many people's faith.

Our industry desperately needs "gods" because it runs on consensus.

But when people realize even the "god's" servants want quick money, faith vanishes instantly—and quickly transfers suspicion to everything god-related. All Binance-listed altcoins now face massive skepticism and scrutiny from retail investors. If AI and HOOK are like this, can other coins really be any better?

5. Future scripts

If following the "marking the boat to retrieve the sword" approach, this downturn resembles 5.19—suggesting everyone review post-5.19 movements.

Post-21 519 movement, Source: Bitfinex

Following the 5.19 script, the next phase would be two months of repeated consolidation, shaking out even the most loyal holders, then迎来 new Bitcoin ATH.

Of course, some suspect this is the 12.4 scenario—AKA bear market beginning.

From personal inclination, I hope it's 5.19.

After all, Bitcoin becoming part of US national strategic reserves is gaining clarity—never underestimate this influence, seriously.

Even if Bitcoin reaches 85K-88K, I'd consider adding more position.

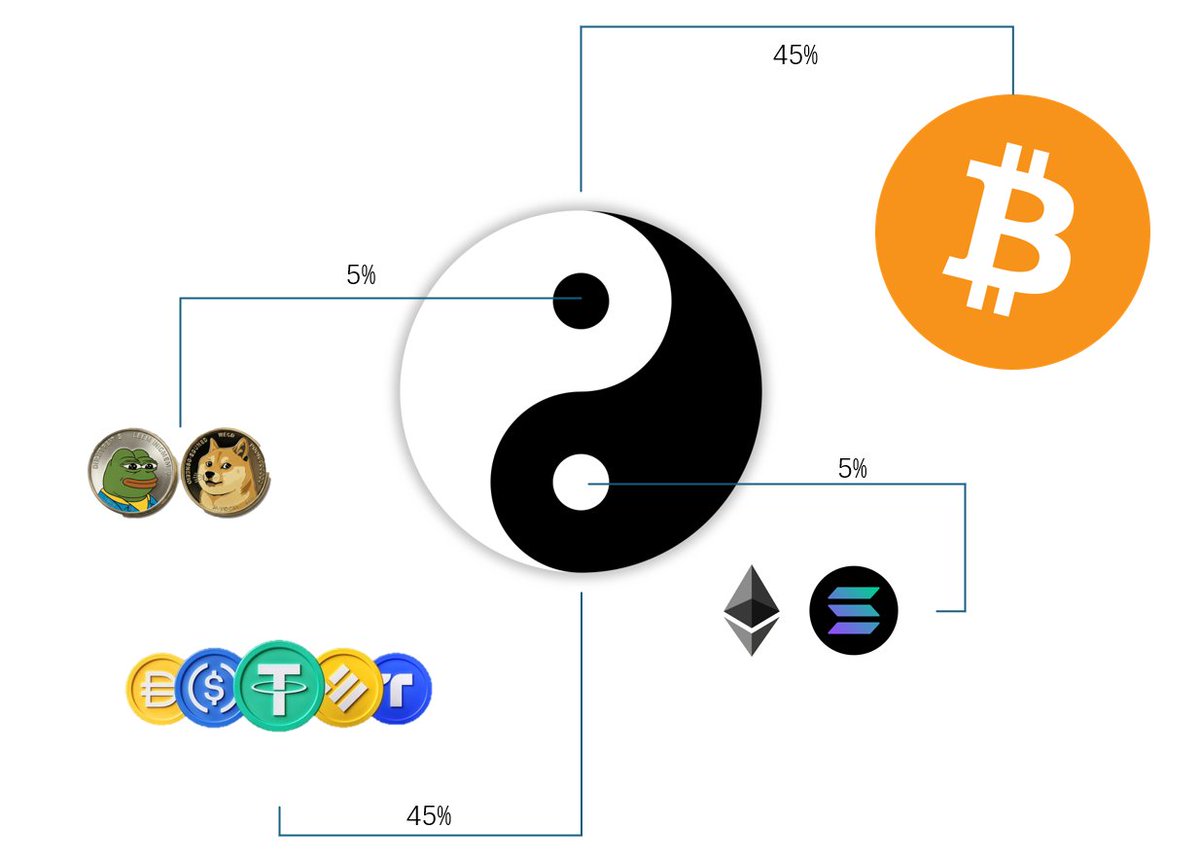

6. My portfolio allocation

My current allocation:

40% BTC;

20% major coins (ETH, SOL, DOGE, BNB/MNT);

40% stablecoin yield;

Bitcoin is my eternal faith. I think I'll never sell BTC again, nor do short-term trading.

Reason for holding ETH:

To be honest, my faith in ETH is weakening.

Objectively though, the President's DeFi project is buying ETH.

Not sure how many of you trade US stocks, but many regret not copying 【Nancy·Capitol Hill Stock Goddess·Pelosi】.

Image source: Commonwealth Magazine

Pelosi's prime was Speaker of the House—just third in line in US politics.

Trump today is the legitimate President—an "encrypted president" now holding large ETH positions (though currently deposited into untraceable Coinbase custody). This weight cannot be underestimated.

Secondly, ETH has fallen to today's level—FUD extreme point reached, possibly triggering reversal thinking. I may not buy when nobody wants it, but at least won't sell when nobody wants it.

Reason for holding SOL:

Small chance of ETF approval;

But cooling AI narratives and short-term meme weakness are two small dark clouds.

Reason for holding DOGE:

Grayscale already launched Dogecoin Trust; Doge also has small ETF probability;

Additionally, Musk is working hard in the D.O.G.E department;

Riding the same vehicle as the world's richest man and "US Development & Reform Commission Director," I can sleep soundly.

Reason for holding exchange tokens:

Let's be blunt—exchanges have zero possibility of ascending to bigger stages.

Coinbase won't list BNB, Binance won't list MNT.

But exchanges are the only profitable institutions in our industry that share profits;

If bear market comes, exchange tokens are relatively more resistant to drops, occasionally an IEO can help recover—surviving bear markets depends on this.

7. Harsh view: Old timers' good times are over

Beyond above, I likely won't hold significant altcoin positions short-term—the reason is simple: inflation too fast.

New user and capital inflow speed simply can't match these coin-printing maniacs' minting speed.

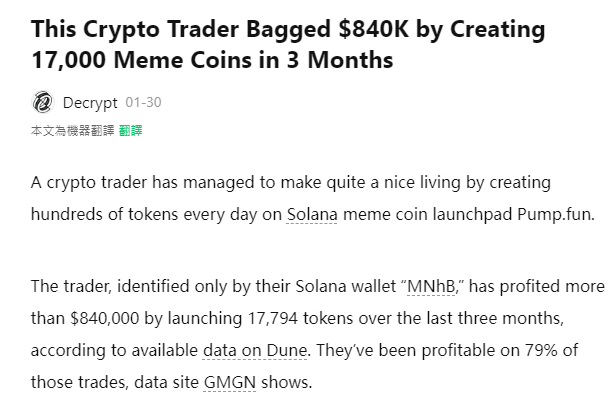

Source: Decrypt

Few days ago statistics showed Pump.fun's top account minted 17,000 coins in 3 months.

Not 170, not 1,700—but 17,000! One person's output may exceed total tokens issued during entire 2017 bull market.

Why have old timers' investment strategies failed?

Too many choices!

Too many angles!

Even same angle has N different contract addresses,

Where's the room for old timers' alts?

Old timers' favorite strategy: Buy mid-cap altcoin at $100M-$200M market cap.

Hold 2-3 months, bet it outperforms Bitcoin.

Now it probably can't even beat ETH.

P Marshal's favorite strategy: Buy $10K valuation project on internal market.

Exit 30 minutes later.

Real men never look back at explosions.

Clearly in today's token hyperinflation, P Marshal far surpasses old timers.

I don't urge everyone to become P junior soldiers, just hope you won't become old timers.

8. Optimal allocation: 50% BTC + 50% stablecoin yield

Also genuinely suggest everyone hold some stablecoins for upcoming period.

Accept this fact: Nobody can truly sell at absolute top.

One peak every 4 years—you have 1,000+ days to pick one selling day. 1/1000 odds—very few achieve it, all super lucky.

At this stage, half-position is optimal.

Put 50% principal into yield, forget mining or complex arbitrage.

Simply use Ethena USDE—currently Pendle offers 18% yield.

If too lazy for Pendle, just deposit into AAVE or mainstream CEX yield—still get 10%.

Other 50% mainly in Bitcoin, quietly waiting for US Bitcoin strategic reserve day.

Steady interest cash flow,

Plus dreams and faith,

You'll definitely feel comfortable,

Guaranteed.

Of course, you can allocate another 5% to altcoins you truly believe in—whether ETH, SOL, DOGE or any faith coins.

Cut another 5% for occasional PvP battles—win and enjoy lavishly, lose and treat as consumption, maintain touch—how wonderful?

Finally forming this Taiji diagram distribution.

PS: This is also how I'm gradually adjusting my own holdings

Source: 0xTodd

9. Finally

I'm fairly satisfied with my current portfolio—after all, it's my 8th year floating in crypto, accumulated experience over time.

Only slight regret—played in Osaka during holidays, got lazy, didn't organize these thoughts to publish immediately.

Same strategy shared earlier might've helped many, but delayed sharing turns it into post-mortem analysis.

But mending the fold after sheep lost—isn't too late.

Hope every community member achieves their own great results in crypto markets.

Of course, if not achieving grand results, preserving some small gains, earning more spiritual wealth and social capital—is still worthwhile.

Finally, wishing everyone—Year of the Snake, golden serpent dancing wildly.

Todd

February 5, 2025

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News