The long season, BNB traverses through cycles

TechFlow Selected TechFlow Selected

The long season, BNB traverses through cycles

Beyond technical terms like AI and public blockchains, BNB Chain continues to explore more possibilities.

In 1606, the Netherlands issued the first stock in human history. This novel form of public fundraising created shared public value accessible to the masses. Today’s $3 trillion NVIDIA is its profound echo four centuries later.

Times have changed. While stock markets remain dominant today, most countries and smaller nations are largely excluded from participation. In contrast, cryptocurrencies like Bitcoin offer small nations a viable path into the global asset pricing system—Salvador has led this trend historically, while Bhutan recently joined officially by entering Bitcoin mining.

With Trump's return to politics, beyond just holding BTC or engaging in mining, both the U.S. and multiple other countries are now experimenting with establishing cryptocurrency reserves—an unprecedented move in human history, traditionally reserved for precious metals like gold and silver, or the U.S. dollar.

Coincidentally, CZ, back on his journey, tweeted that Bhutan might include ETH and BNB in its national reserves. Riding this wave, on January 8, Bhutan’s GMC officially added BNB alongside BTC and ETH to its reserve. Yet compared to digital gold and the distinct narrative of “ETH is Money,” what exactly does BNB represent?

BTC needs no further explanation—it gave crypto its value and legitimacy. ETH has also proven its worth through frequent purchases by retail investors and even Trump himself. However, BNB has long been overshadowed by Binance’s brand halo, with its unique on-chain ecosystem value remaining underexplored.

Today, we begin with Binance to retrace the long eight-year journey through spring, summer, autumn, and winter—a story whose embedded value will shape the blockchain industry for decades to come.

Origin: BNB is Binance

In 2008, Satoshi Nakamoto created Bitcoin, opening humanity’s Eden of decentralized value. Like an ancient mythic founder, his face remains obscured, yet his impact runs deep—especially the transactional nature of Bitcoin, where peer-to-peer electronic cash naturally aligns with value exchange.

Thus began the era of exchanges, starting with Mt. Gox, leading to the "thousand exchange wars." Among them, two giants emerged: Binance and Coinbase. The former focused deeply on the on-chain ecosystem, viewing centralized exchanges (CEX) as a transitional phase toward free value; the latter embraced the existing financial system and pursued public listing.

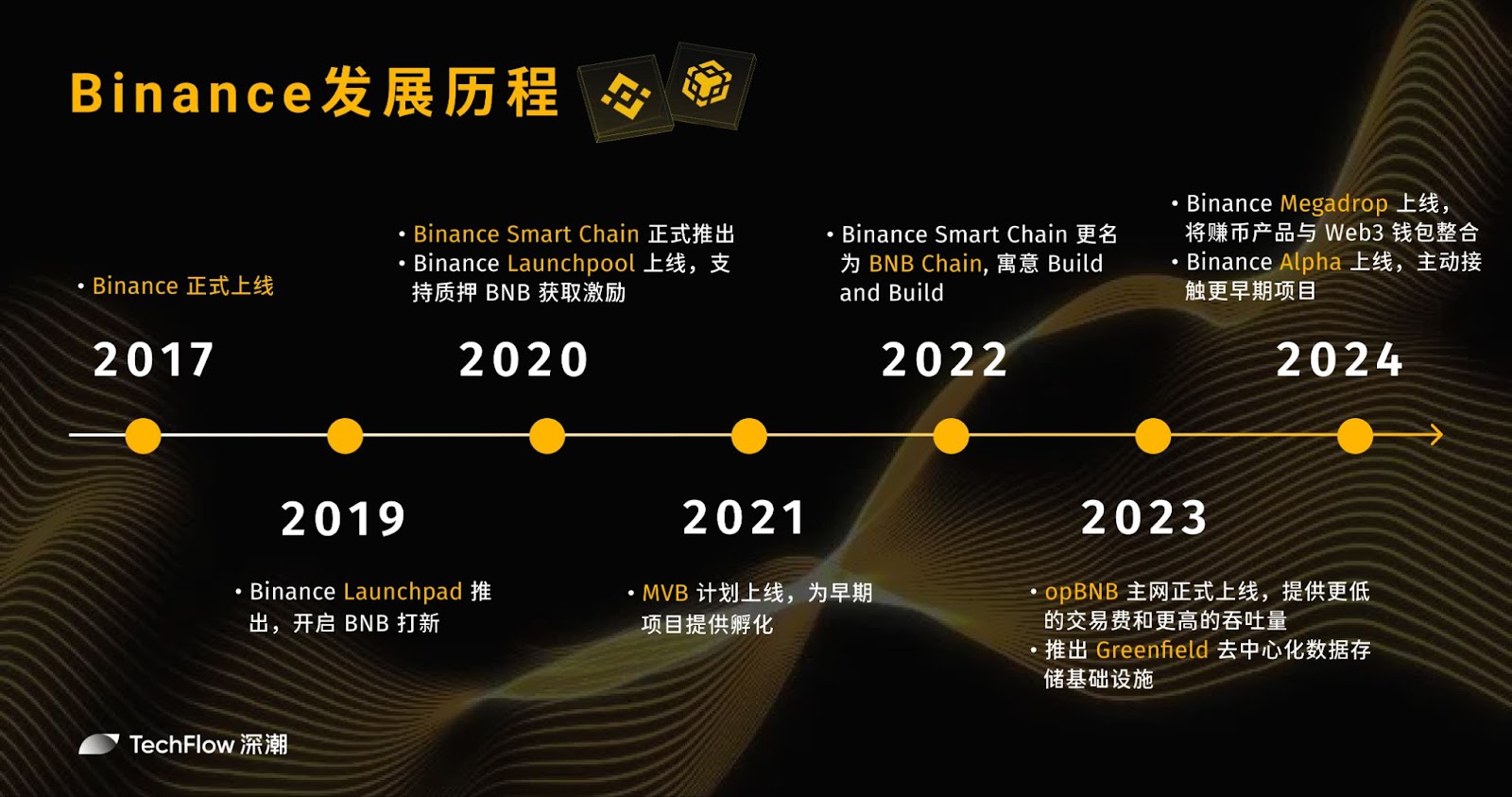

In 2017, Binance, a latecomer to exchange systems, launched its platform along with a clear vision for BNB. From day one, Binance implemented tokenomics—embracing blockchain and tokens is in Binance’s DNA.

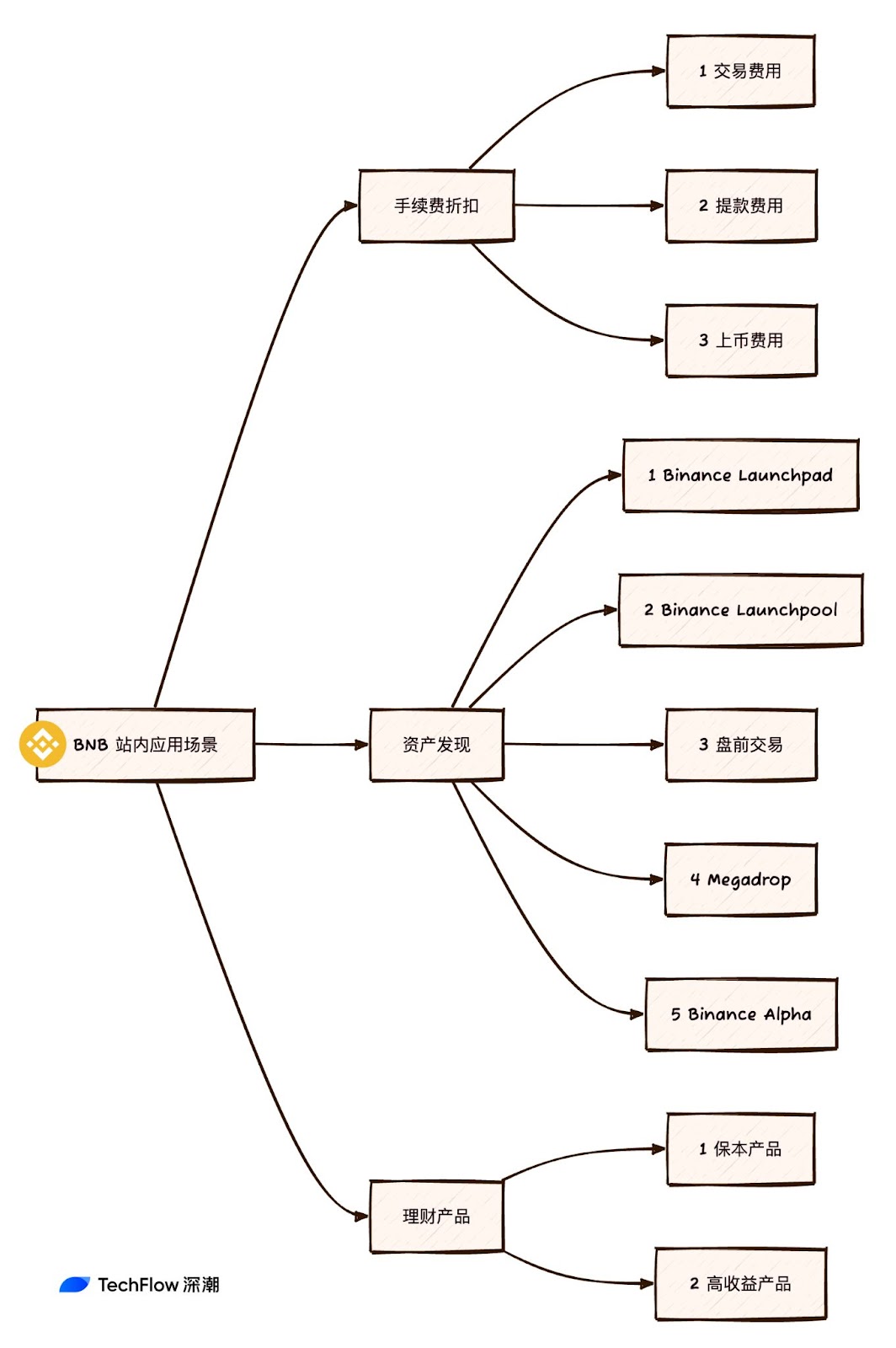

Reviewing Binance’s whitepaper, beyond standard exchange features, it emphasized two core functions of BNB: trading fee discounts and platform governance participation. Fee discounts allow holders within certain tiers to enjoy reduced trading fees—effectively sharing in the platform’s growth and transactional profits.

Governance involves requirements for project teams to hold or deposit platform tokens when applying for listings, as well as allowing BNB holders to vote on which projects get listed.

The exchange must strongly control the platform token’s price, serving as the minimum foundation for its value. Beyond this, two key mechanisms are employed: burning and expanding use cases.

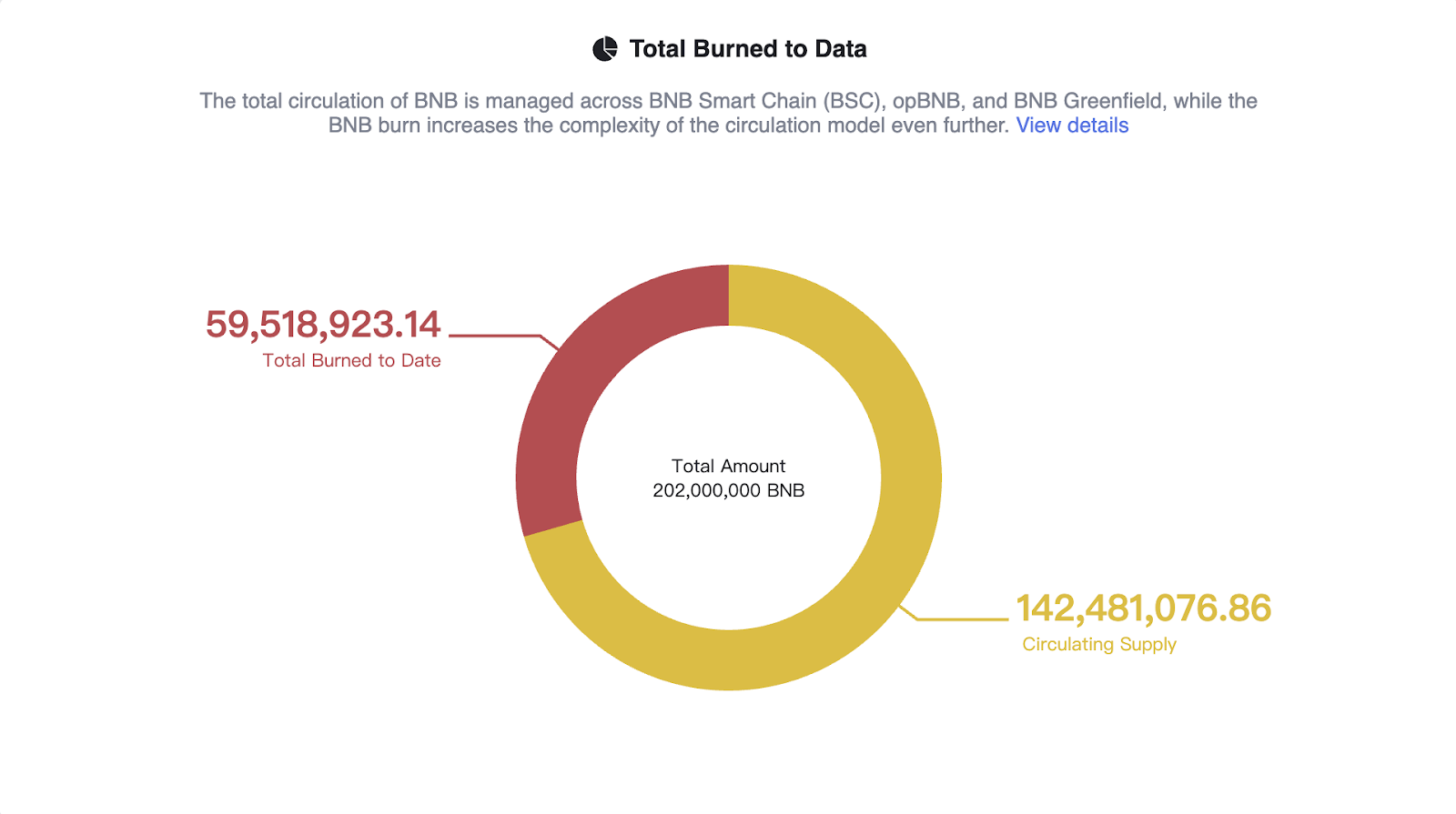

Beyond these foundational roles, BNB’s burn mechanism has operated efficiently. Every quarter, Binance uses its profits to buy back and destroy BNB. Currently, circulating supply stands at around 145 million, and at the current burn rate, the total supply will drop to 100 million in approximately four years.

For example, on January 23, the BNB Foundation conducted its 30th quarterly burn, publicly destroying 1,634,200.95 BNB tokens—worth about $1.16 billion.

More importantly, BNB is tightly integrated with Binance’s value discovery model—from Launchpad, adapted from traditional finance, to Megadrop, inspired by native Web3 practices. Binance has consistently led trends in crypto asset discovery and issuance.

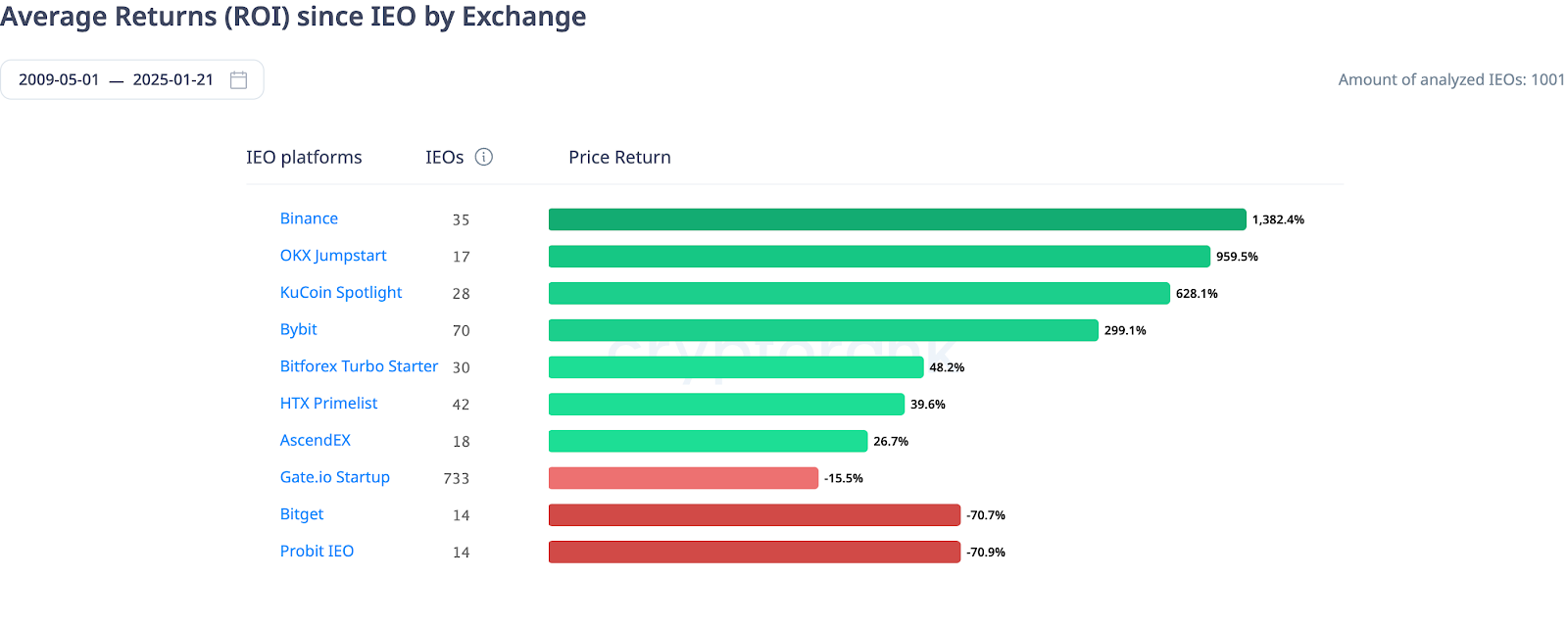

Looking back, Binance introduced the Binance Launchpad in 2019, pioneering a new form of crypto crowdfunding known as IEO—balancing innovation with security by avoiding on-chain chaos and fraud, while granting BNB holders privileged access to new token sales.

In 2020, Binance followed up with Launchpool, enabling users to stake BNB and earn rewards in new tokens. Combined with Launchpad, this maximizes early access to new coin benefits.

In 2024 alone, Binance ran 21 Launchpool campaigns, achieving a total value locked (TVL) of $1.53 billion, with over 6.1 million participants.

Over time, Binance’s launch ROI leads all platforms at 13x, delivering substantial gains to BNB holders.

But this was not enough. Connecting more deeply with the on-chain ecosystem became Binance’s next focus. In 2024, Binance launched Megadrop, seamlessly integrating Binance Earn products with the Binance Web3 Wallet, redefining the airdrop experience.

Binance selects high-potential projects, and projects seek quality users. Key scoring factors include the amount and duration of BNB staked—the longer and larger the stake, the more points earned.

Still, Binance wanted to be even more proactive—seeking alpha projects before they launch or list. Thus came Binance Alpha, operating within the Binance Wallet: early participation increases chances of eventual listing on Binance’s main platform.

Driving asset discovery and issuance, leading industry transformation—that has always been Binance’s mission. Alongside this, Binance developed financial products centered around BNB, creating a comprehensive wealth management system. Within a framework balancing capital protection and high returns, BNB holders can choose diverse investment options, using BNB as principal to generate higher yields.

Beyond abstract architecture, BNB’s real-world value lies in concrete “pragmatism.” Take Solv Protocol as an example: seamless flow of BNB within Binance’s ecosystem. The right way to maximize utility—deposit BNB into Binance Wallet, then participate in on-chain staking and restaking activities.

Through alignment of abstraction and practicality, Binance pushes BNB’s potential to the limit. But we must acknowledge: centralized exchanges are both a necessary bridge to freedom and potentially a trap. Different paths aren’t mutually exclusive—they reflect context-driven compromises.

Humans desire freedom and decentralization, yet also seek efficiency and security. Yet real-world progress is slow, full of trade-offs. The choice isn’t simply between freedom vs. control, or centralization vs. decentralization—it’s about finding the best balance among freedom, safety, efficiency, and usability.

Each participant chooses their own priority, shaping their unique Odyssey.

Odyssey: BNB is BNB Chain

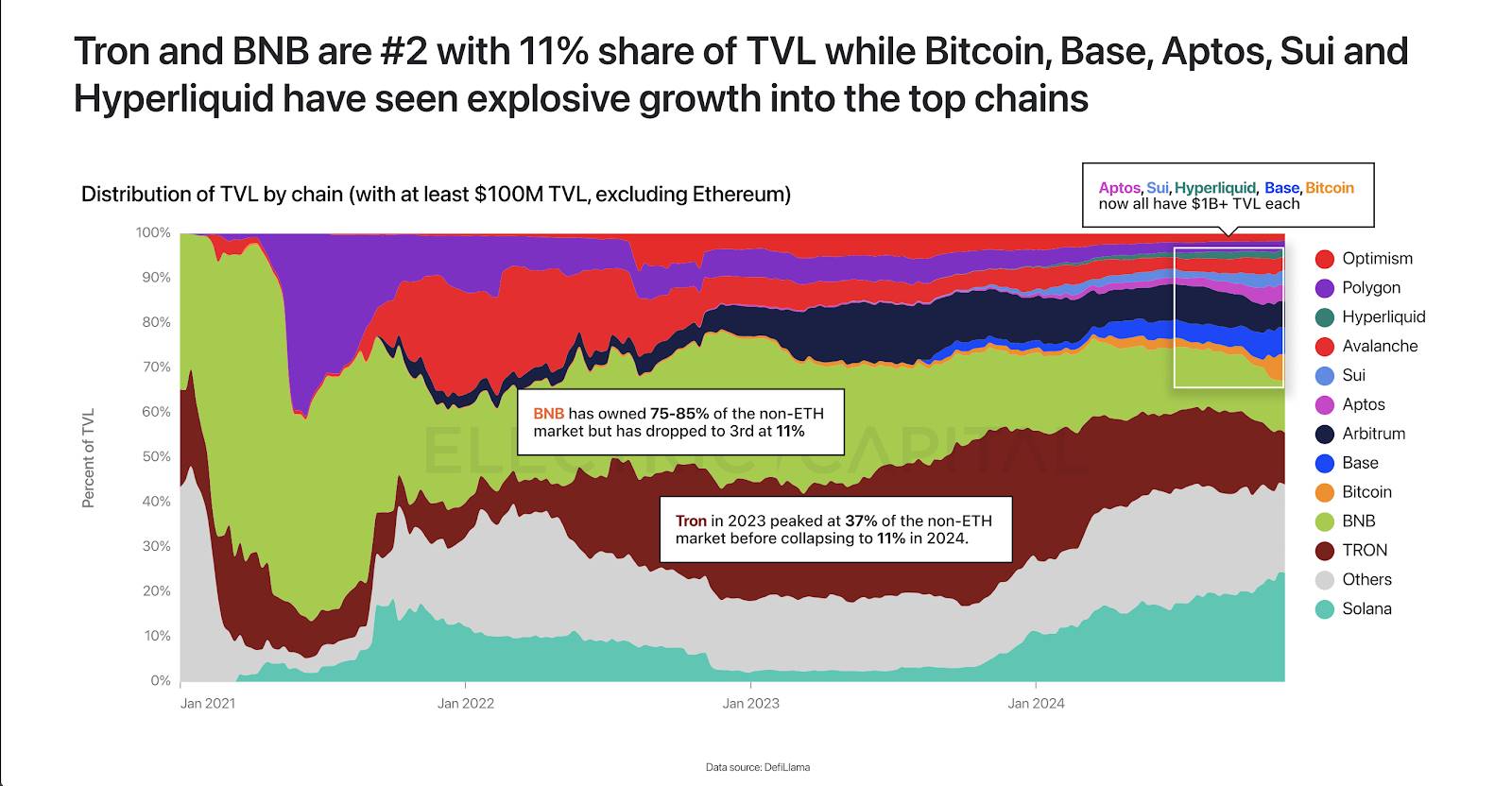

In the long season, lone travelers enter a lawless frontier. Starting in 2021, the public chain wars drew in exchanges—but only three and a half survived: BTC, ETH, BNB Chain (then BSC), and half of Solana, still locked in battle with ETH.

Today, after rebranding, BNB’s ecosystem is unified under oneBNB, comprising BSC, opBNB, and GreenField—the storage-focused component.

BNB Chain is a unique creation—distinct from Solana and FTX’s strategic alliances, and unlike many self-contained exchange-led chains. BNB Chain truly embodies what a public chain should be.

The Serious Side: AI First Chain

BNB doesn’t merely rely on Binance Exchange, nor does BNB Chain. More accurately, the BNB Chain ecosystem boasts massive on-chain users, transaction volume, and active developers.

In terms of on-chain activity, only BNB Chain and Tron demonstrate genuine demand. Tron thrives on daily USDT usage, while BNB Chain evolves as a next-generation chain adapting to changing times.

BNB Chain currently hosts 5,607 DApps, nearly a million unique active wallets (UAW), and $3.6 billion in DeFi TVL—surpassing Ethereum in several metrics.

For instance, after CZ retweeted Magic Eden announcing support for BNB Chain, ME briefly surged past $4.40—demonstrating BNB Chain’s enduring wealth effect.

BNB Chain is also a leading DeFi market outside ETH. Throughout the ecosystem, urgency and user-centric thinking define its approach. After years of development, BNB Chain has clarified its latest identity: becoming a public chain for the AI era.

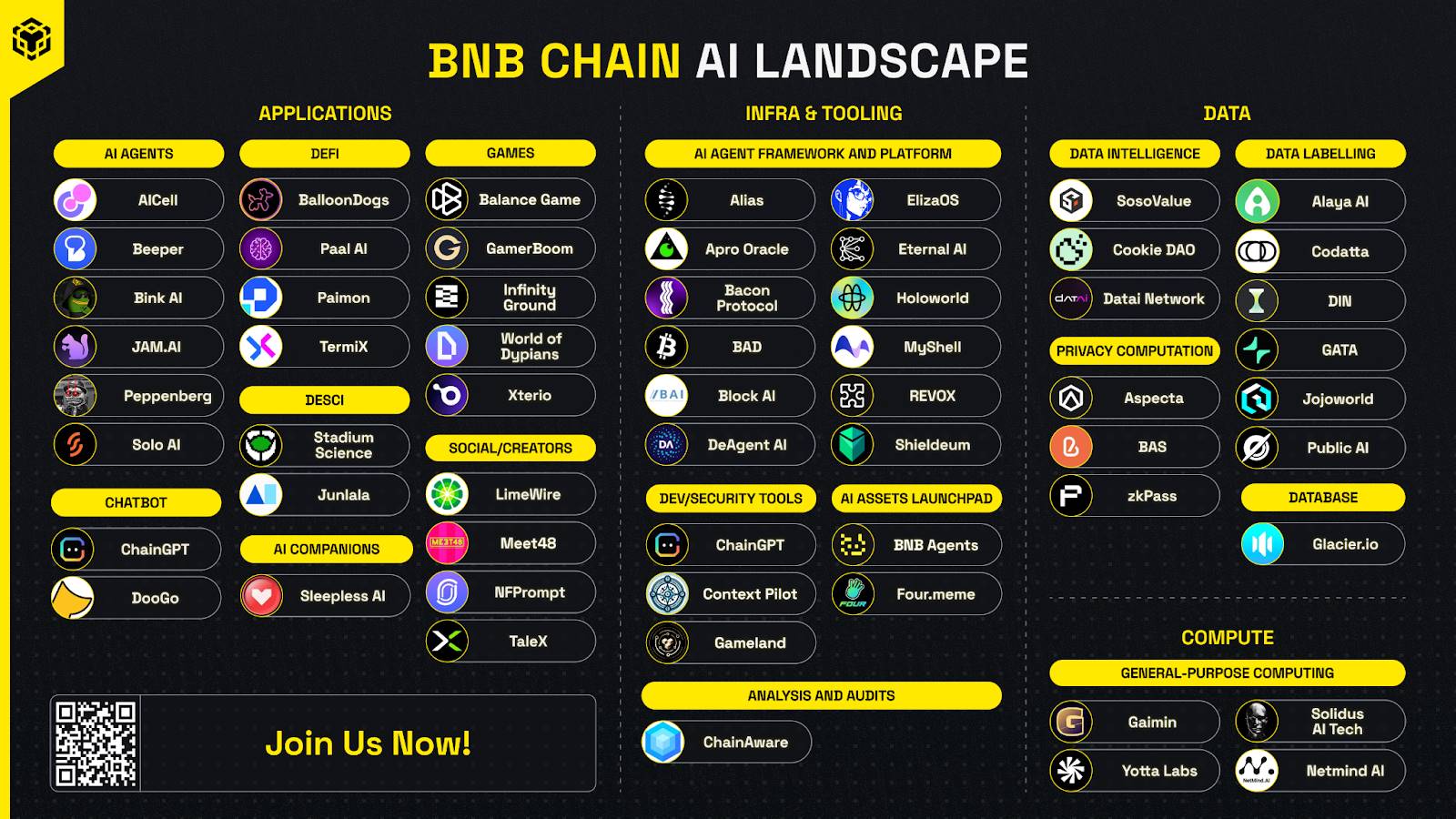

From DeFi and NFTs to today’s Meme and AI trends, BNB Chain remains at the forefront. Guided by its “AI First” philosophy, BNB Chain invests in foundational AI infrastructure—computing power, data, and models—and builds new projects and tokens atop them, completing its commercial loop.

A prime example is MyShell, a veteran AI Agent project. With strong technical capabilities attracting a large user base, MyShell was selected into the 2023 MVB Season VI incubation program by BNB Chain and Binance Labs.

While Memes may seem odd, AI is highly suitable for on-chain execution—using low-cost labor for data labeling, paid via cryptocurrency, with GreenField providing secure storage. Everything can happen within the BNB Chain ecosystem.

Take DIN, a leading data annotation project in the BNB Chain space, modeled after Web2 giant ScaleAI. It has already received investment from Binance Labs.

In 2025, BNB Chain will double down on its AI-first strategy, empowering existing infrastructure across every stage of AI workflows, building the most vibrant on-chain AI ecosystem.

Ecosystem prosperity isn't chaotic speculation—it's built on unique strengths. According to on-chain data, BNB DEX trading volume hit a three-year high, exceeding $17.74 billion weekly.

For protocols and DApps built on BNB, this provides stronger value backing. In the virtuous cycle between price and utility, BNB becomes a long-term value asset.

The Playful Side: Happy-Sci & DeSci

On-chain competition is not just technological—it's also about traffic. Beyond AI and public chain jargon, BNB Chain continues exploring new frontiers.

For example, the Happy-Sci initiative, launched by Binance Labs researcher @cyodyssey, has sponsored 500 PhD students, sending micro-grants via TrustWallet to bring color to otherwise monotonous academic lives.

Rewards are distributed via BNB Chain, earning praise from PhDs for its speed and efficiency. Not only does BNB Chain fund the program, but its broad support for assets—especially stablecoins—ensures fair USD-denominated payouts regardless of recipients’ locations or local financial systems. Thanks to BNB Chain’s high speed and low fees, PhDs can receive funds directly in Binance or Binance Wallet, spending via Binance Pay or converting to fiat with minimal friction.

Beyond joyful research, the more serious field of DeSci (Decentralized Science) has also formed a close bond with CZ and BNB Chain. CZ has shown strong interest in DeSci research and applications, supporting its development in multiple forums.

Whether serious or playful, BNB Chain advances steadily—not only refining core technology but continuously expanding its wealth effect. PancakeSwap evolved from DeFi Summer without falling into decline, while meme platforms like Four show BNB Chain remains ahead of the curve.

Balancing traffic and expertise, BNB Chain is on a revolutionary path—guiding more people toward freedom. Beyond trading and finance, BNB is a deeply valuable crypto asset. Its reach extends far beyond Binance—across the vast landscape of human society.

Revolution: BNB is Future

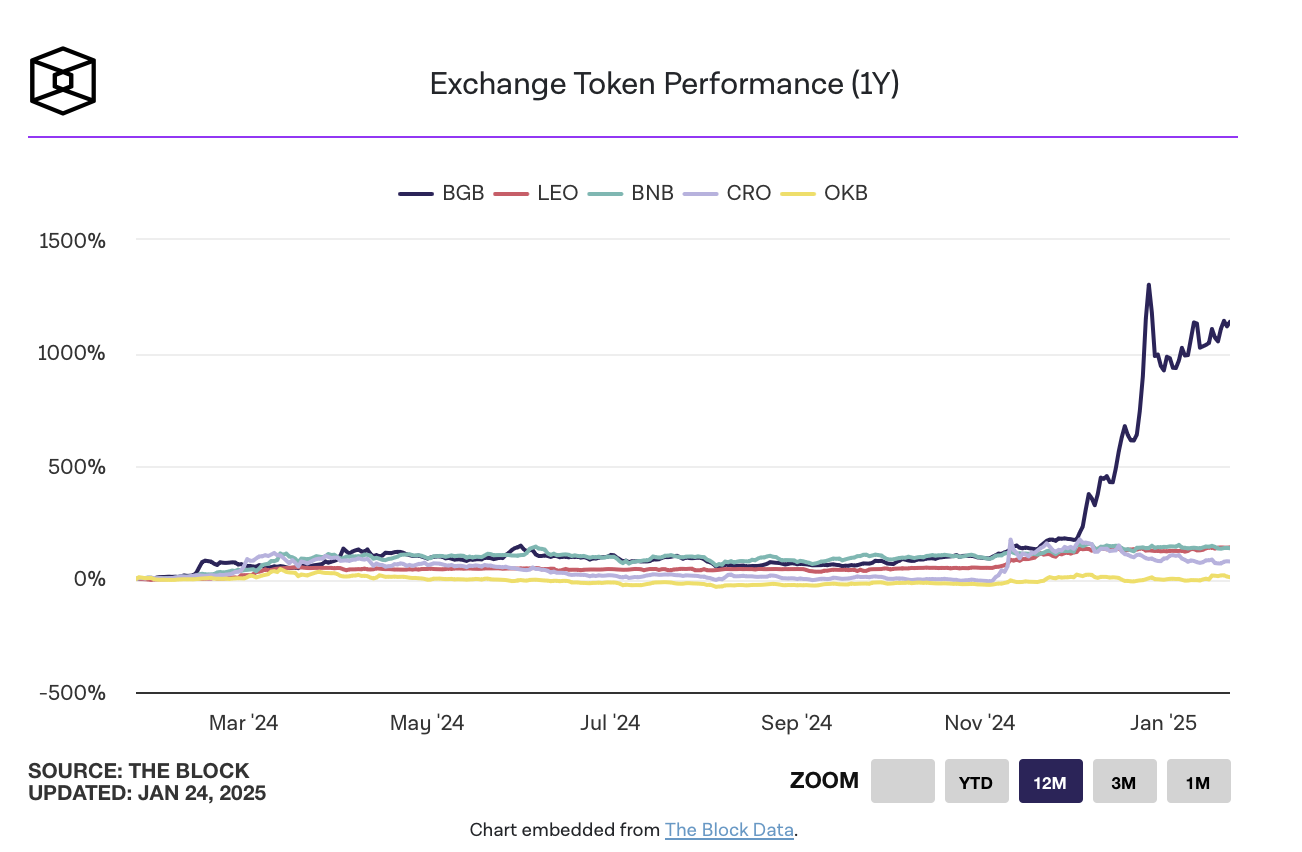

Throughout 2024, BNB rose 1.2x—outperforming ETH’s 46% gain and even slightly beating BTC’s 1.19x increase—making it the strongest performer among top ten cryptocurrencies.

While BTC and ETH dominate public perception of Web3, Binance remains indispensable in bringing crypto to the mainstream. Think of Binance as the gateway or starter zone—only after passing through can one enter the dark forest of on-chain life.

On this path to mainstream adoption, BNB cannot be absent. Consider it like a camera viewfinder: microscopically, it reveals composability in the on-chain world; mid-range, it shows the dominance of CEXs; macroscopically, it captures the emerging trend of national crypto reserves.

Together, these three perspectives shape BNB’s multifaceted identity.

Currently, Binance holds compliance licenses in 20 jurisdictions. Beyond regulation, it enjoys deep user trust—holding $20 billion in user deposits and maintaining transparent Proof-of-Reserves (PoR). This trust enabled Binance to become the first CEX in 2024 to surpass $100 trillion in cumulative trading volume.

Beyond trading, BNB Chain actively expands its horizons.

BNB is more than a cryptocurrency—it’s a vital tool connecting global users, advancing financial inclusion, and driving technological innovation.

In BNB’s expanding footprint, off-chain consumption—especially stablecoin payments—will be a key trend in 2025. With opBNB averaging $0.001 per transaction and BSC at $0.03, fees are significantly lower than traditional card networks—ideal for stablecoin spending.

For example, Singapore-based digital payment provider dtcpay has partnered with BNB Chain to accelerate stablecoin adoption—enabling businesses using dtcpay to accept USDT and USDC payments via the BNB network.

Looking back over the past eight years, BNB’s journey has only just begun. It is no longer a newborn cryptocurrency, but entering a crucial “adolescent” phase.

In 2017, Binance started as an exchange. In 2021, it dove into the on-chain ecosystem, where DeFi and NFTs became practical tools. By 2024, AI, Memes, and DeSci took center stage.

Supreme good is like water: BNB takes no fixed form.

Through eight years of ups and downs, BNB has witnessed crypto evolve from the wild west into a mainstream policy issue—from niche hobby to paradigm-shifting technology. Yet there’s ample reason to believe: today is still early for BNB. The road to mainstream recognition won’t be easy, but the medal will go to those who persevere. The next eight years await.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News