Besides $VINE with a 400 million market cap, what other Silicon Valley tech companies might launch a token BUBBLE?

TechFlow Selected TechFlow Selected

Besides $VINE with a 400 million market cap, what other Silicon Valley tech companies might launch a token BUBBLE?

More internet companies that have faded into history are expected to regain attention through crypto. Those that were pioneers in a certain field, were or still are well-known, and have some connection to crypto will be more likely to participate in this trend.

By: BUBBLE

It's been a week since Trump launched his token, and the on-chain frenzy hasn't cooled down. Today, another tech legend has entered the memecoin arena. First, the late crypto punk and "father of cybersecurity," John McAfee, was cyber-resurrected posthumously—his widow Janice used McAfee’s X account to launch $Ainti, claiming to revive McAfee's legacy via AI. Meanwhile, Rus Yusupov, one of the living legends and co-founder of the pioneering short-form video platform Vine, launched a namesake memecoin $Vine. This marks the first time a well-known tech founder has personally issued a coin under their real name since the Trump memecoin craze. At the time of writing, its market cap has peaked at $400 million.

What Was Vine?

Vine was one of the earliest platforms to popularize short-form video content. With its signature 6-second looping videos, it forced creators to tell complete stories or express ideas within an extremely limited timeframe. American users began embracing rapidly consumable video content, establishing the "short, fast, and punchy" format that laid the foundation for later platforms like TikTok, Instagram Reels, and Snapchat.

Vine videos became part of pop culture, with many iconic clips repeatedly referenced or imitated—even entering mainstream entertainment. Creators such as Logan Paul and Jake Paul rose from Vine fame to become YouTube stars. King Bach gained popularity through humorous Vine shorts before becoming a recognized actor and producer. Liza Koshy and Shawn Mendes also evolved from niche Vine influencers into mainstream artists. Although Vine was acquired by Twitter in 2012 and eventually shut down in 2016, for many Americans, Vine wasn’t just a short-video app—it symbolized the beginning of individual content creation and the rapid spread of internet culture.

How Did Vine Turn Into a $250 Million Token?

This morning at 8:17 AM, $Vine was created on Pumpfun, initially indistinguishable from other speculative meme tokens. It climbed to a $30 million market cap before activity stalled—until Vine co-founder Rus, long silent online, claimed ownership of the contract via his X account, posting a GIF holding that very tweet as proof. Around the same time, multiple early buyers linked to Coinbase addresses began dumping their holdings. FUD spread rapidly, with rumors claiming the GIF was AI-generated. Amid simultaneous panic from the Nasdaq impersonation scam involving the crashing $STONKS memecoin, $Vine plummeted 90%, dropping to just $3 million in market cap.

An hour later, echoing Vine’s own signature brevity, Rus posted a 3-second video proving he wasn’t AI-generated. During this phase, multiple wallets ending in “waamGQ,” “MGVWa,” “qedvzf,” and others aggressively bought into the token, securing positions among the top 30 holders—most of whom still hold today. Shortly after, Rus shared a Bullx dashboard overlaid with the Vine logo and an upward arrow—a classic degen-style move on-chain—that propelled the token’s price toward $50 million.

Two hours later, Rus announced the dev wallet would be locked until April 20 at 4:20 PM, and retweeted commentary on $Vine from several top-tier Western alpha groups. Under professional-grade manipulation and market-making tactics, combined with growing anticipation around Elon Musk reviving discussions about Vine—and bolstered by the 12th anniversary of Vine’s founding—the token surged past $400 million in market cap after a period of consolidation at high levels. Despite ongoing debate over whether Rus is merely capitalizing on Musk-related hype without any real roadmap for Vine’s revival, this is precisely the essence of memecoins. Once a cultural phenomenon transitions into an application-centric asset, it ceases to be just a memecoin and becomes simply a *coin*. For this reason, we will not delve into potential conflicts of interest here.

How Are Web1.0 and Web2.0 Relics Being Revived in Web3.0?

Judging by the momentum generated by $Vine, we can expect a wave of defunct internet companies attempting to reclaim relevance through crypto—whether genuinely seeking rebirth or simply monetizing attention economics. Either way, opportunities exist for retail participants.

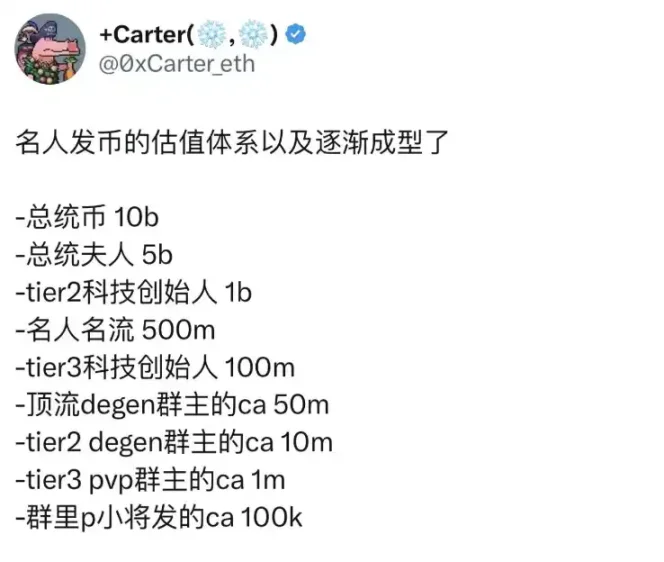

A president or first lady may only get one shot every four years—but tech figures have countless chances. Using Rus’s launch of $Vine as a model, companies meeting the following criteria are more likely to participate:

1. The company was a pioneer in its field or remains regionally famous—either historically or currently.

2. The company is no longer actively operating, minimizing legal complications.

3. There is some existing connection to crypto—through founder interest, investment history, or acquisition by blockchain-aligned entities.

Below are several projects that fit these conditions:

Napster

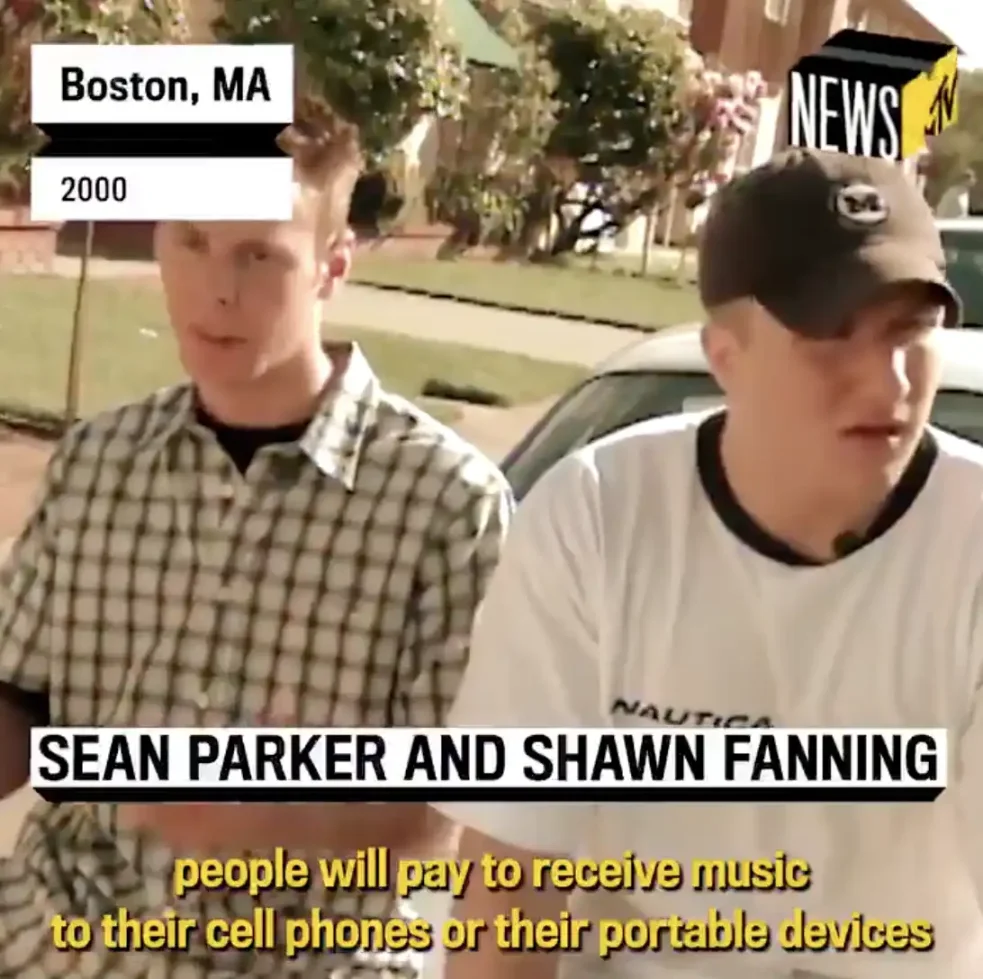

Founded in 1999 by Shawn Fanning and Sean Parker, Napster emerged when record labels tightly controlled music distribution and promotion. Before Napster, users accessed new music primarily through physical stores, radio, or TV, and CDs were highly profitable—especially during the 1990s peak. Napster leveraged peer-to-peer (P2P) technology to allow direct sharing of MP3 files, creating a global music download network that quickly amassed tens of millions of users. Its decentralized architecture made it nearly impossible for labels to shut down, profoundly disrupting the traditional music industry. Though Napster was ordered closed in 2001 due to copyright lawsuits, its impact reshaped the entire music landscape and paved the way for legal digital platforms like iTunes and Spotify.

After multiple acquisitions and pivots, the Napster brand was purchased in 2022 by Hivemind Capital Partners and Algorand, who announced plans for a “Napster Web3 Music Platform” and hinted at launching a Napster token—though no token has been released yet.

Napster Twitter: @Napster

Shawn Fanning Twitter: @ShawnFanning

Sean Parker Twitter: @sparker

Hivemind: @HivemindCap

Algorand: @AlgoFoundation

Myspace

Founded by Tom Anderson and Chris DeWolfe, later sold to Specific Media, with Justin Timberlake involved in the investment. Prior to MySpace, online social interactions were fragmented across forums, instant messaging, and personal blogs. MySpace introduced customizable user profiles, friend networks, and direct artist-fan engagement—effectively allowing musicians to promote themselves and connect directly with fans. If Napster helped users access music, MySpace empowered artists to build audiences. It set the behavioral and technical blueprint for future social media giants like Facebook, Instagram, and Twitter.

Currently, MySpace has no known ties to crypto. However, the author notes that Tom Anderson’s three-year-old tweet saying “Buying The Dip,” featuring a laser-eyed version of himself, feels inherently meme-worthy.

Tom Anderson: @myspacetom

Chris DeWolfe: @Chris_DeWolfe

Mark Cuban

Mark Cuban, owner of the Dallas Mavericks and prominent Silicon Valley investor, recently expressed on X his intention to launch a memecoin similar to $Trump—with one key difference: all proceeds would go toward reducing the U.S. national debt. The market reacted enthusiastically, preferring transparent public benefit over private enrichment seen with $Trump. While no businessman acts entirely without weighing risks and rewards, the narrative itself is compelling enough to watch closely.

Mark Cuban: @mcuban

Netscape

Co-founded in 1994 by Marc Andreessen and Jim Clark, Netscape pioneered the commercial web browser era with its flagship product, Netscape Navigator. As of now, neither Jim Clark nor Netscape maintains an official presence on X.

LimeWire

Like Napster, LimeWire launched in 2000 as a P2P file-sharing platform widely used for downloading music and videos. It faced intense copyright litigation and was largely shut down by 2010. In 2022, Austrian entrepreneurs Paul & Julian Zehetmayr acquired the LimeWire brand and rebranded it as an NFT marketplace. While the platform already has a native token, there remains a possibility the founders could issue a standalone memecoin.

Paul Zehetmayr: @pzehetmayr

Julian Zehetmayr: @julianzehetmayr

Yahoo!

Founded in 1994 by Jerry Yang and David Filo, Yahoo! once dominated global internet traffic with leadership in portal search, email, and instant messaging. In early-stage China, Yahoo! was practically household knowledge. After leaving Yahoo!, Jerry Yang founded AME Cloud Ventures, which invests in tech startups—including several in the crypto space.

Jerry Yang, David Filo: No X accounts

AME Cloud Ventures website: amecloudventures.com

AME Managing Director Jeff Chung: @jefchung

Beyond the above, numerous other iconic products from the past may join this trend—whether to resurrect 2000s nostalgia or simply ride the latest memecoin wave. The ripple effects of the Trump token phenomenon continue to expand. As influencer-led token launches grow increasingly bold, remember to stay cautious even while chasing alpha—and always steer clear of scams.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News