Primitive Ventures: How to Find an Excellent Local Lead When Entering the Asia-Pacific Crypto Market?

TechFlow Selected TechFlow Selected

Primitive Ventures: How to Find an Excellent Local Lead When Entering the Asia-Pacific Crypto Market?

A strong Asia-Pacific regional leader can help assess founders and teams for their leadership potential in global markets.

Author: Primitive Ventures

Translation: TechFlow

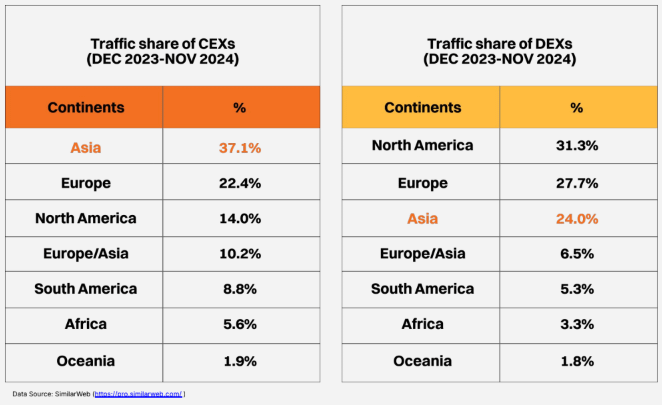

Asia is a critical market in the cryptocurrency space, home to 60% of global users and accounting for 37% of centralized exchange (CEX) traffic.

With a population of 4.8 billion—60% of the world's total—and contributing 40% of global GDP, Asia’s economic scale is significant. The region’s median age is just 32, reflecting a young and dynamic demographic. Supported by over 2.8 billion active internet users, Asia has become the epicenter of on-chain activity—from creative decentralized application (dapp) developers to active traders and "airdrop hunters." Despite this, it remains one of the most underserved regions, yet also the most accessible due to its immense untapped potential.

Summary

-

Plan your Asia-Pacific (APAC) strategy early, led by a locally rooted “hero” figure.

-

Avoid outsourcing operations to third-party agencies, so-called “local consultants,” or ambassadors. Instead, directly hire a local General Manager (GM) who reports directly to founders.

-

Evaluate top APAC candidates based on actions and results, not just résumés or self-promotion. Many strong talents come from grassroots backgrounds—experienced and pragmatic but not necessarily active on Crypto Twitter or boasting polished LinkedIn profiles.

-

Localize early in your go-to-market (GTM) strategy to leverage regional advantages, especially when project names are difficult to pronounce in Chinese or Korean.

-

A strong APAC lead can assess a founder’s and team’s global leadership potential. They quickly determine whether you’re serious about the local market and have a clear strategic vision.

Cryptocurrency is a truly global industry. Its asset class trades 24/7 without interruption, transcending time zones and jurisdictions. This borderless, always-on nature is one of crypto’s core strengths. Crypto is not only digital-first—it’s international-first, with participants worldwide collectively driving the growth of on-chain economies and communities.

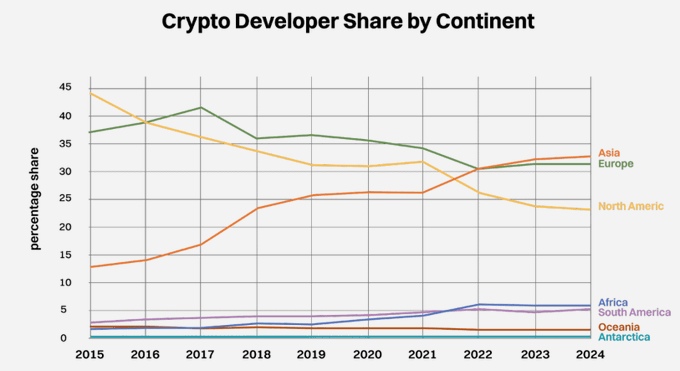

This global character is especially evident in Asia. It’s no coincidence that some of Bitcoin’s earliest miners came from China.

Today, Asian exchanges dominate global retail trading volume.

Over time, other crypto hubs across Asia have emerged. From Hong Kong’s role as a traditional financial center, to Singapore’s forward-looking regulatory framework attracting founders, to South Korea’s passionate retail market, Asia continues to play a pivotal role in crypto’s growth and cultural evolution. Even countries like Malaysia, Vietnam, Thailand, and Indonesia host thriving developer communities and vibrant offline events.

However, the diversity of cultures, languages, regulations, and local market dynamics across Asia makes expansion complex. Successfully entering the region involves far more than occasional visits or hiring an agency with regional knowledge—especially for teams lacking Asian experience.

At Primitive Ventures (PV), bridging the gap between Western and Eastern crypto markets has been our mission since inception. We frequently hear from non-Asian portfolio companies asking how to successfully hire a strong APAC lead.

In this article, we break down key recommendations for founders aiming to build successful businesses in the Asia-Pacific (APAC) region. Below are the main topics we’ll cover:

-

When should you hire an APAC lead?

-

Where to find the ideal APAC lead?

-

What makes a great APAC lead?

-

Common pitfalls when entering APAC markets?

-

How to understand local work culture and business norms?

When Should You Hire an APAC Lead?

Don’t rush. Before searching for an APAC lead, start by answering fundamental questions: Why is APAC crucial for your project? What are your goals—are you seeking developer engagement, liquidity, community growth, or strategic partnerships? Avoid blindly following others into Asia without a deep understanding of your product-market fit and local demand.

Generally, it’s best to first establish credibility in your core market. You don’t need to be #1 in the West or have a fully mature business, but you should have some recognition—such as backing from reputable investors, successful pilot projects, or a clear product roadmap. These elements help build trust in Asia, where crypto communities place high value on reputation. Recognized partners, proven track records, and demonstrated product-market fit are key evaluation criteria.

If your project is still in its early stages, it may not yet be the right time to allocate resources to APAC. The optimal window is typically between mid-development and pre-Token Generation Event (TGE). This allows your APAC team sufficient time to prepare—organizing events, connecting with local developers, planning KOL collaborations, and building brand awareness before launch. Starting too early risks wasting resources; starting too late may mean missing critical opportunities to gain traction.

Where to Find the Ideal APAC Lead?

-

Initial market presence: Begin by establishing influence in APAC. Attend local industry conferences, translate core project documents into regional languages, or partner with small event organizers for brand exposure. Early brand recognition in Asia is vital—not only to boost visibility but also to attract qualified candidates during recruitment.

-

Source from your community: If possible, prioritize recruiting talent from within your own project’s community. Individuals already familiar with your culture and mission often make ideal APAC leads, bringing localized insights and genuine commitment.

-

Leverage local VC networks: Venture capital firms in APAC typically possess extensive talent networks. They can recommend candidates with proven experience—such as those who’ve built exchange relationships, collaborated with local developers, or executed community campaigns.

We conducted a quick survey of 10 APAC professionals on how they found their current roles: 1/10 through recruiters, 5/10 because they already knew the team, 2/10 via investor referrals, 1/10 through direct applications, and 1/10 from community recommendations.

What Makes a Great APAC Lead?

A strong APAC lead must identify and secure the key resources your project needs at different stages. They are not just resource integrators but relationship builders and strategic thinkers. Their effectiveness is measured by their ability to access and convert these resources.

-

Liquidity: In crypto, liquidity is among the hardest resources to obtain. This requires deep relationships with centralized exchanges (CEXs) and uncovering hidden buying power within the region. Given the opaque nature of these networks, success depends heavily on industry experience and extensive personal connections.

-

Marketing & Community: Brand-building and community culture are often driven centrally and cannot be achieved through localization alone. In APAC, media and KOL collaborations are common. The key is selecting the right channels for each campaign to maximize impact.

-

Business Development (BD): BD requires deep engagement, focusing on building long-term relationships with developers and local partners. This effort demands significant time and dedication to cultivate loyal user bases. The core value of a BD team lies in fundraising and go-to-market (GTM) execution. While many local teams excel at product development, they often struggle to connect with top-tier Western VCs. A successful BD team bridges cultural gaps, helping local teams integrate into global ecosystems.

-

Institutional Resources: Although institutional resources are somewhat standardized, trust remains critical. Ultimately, compelling products and well-designed incentive structures naturally attract institutional partners.

In short, while marketing and TVL (Total Value Locked) are relatively easier to generate, business development (BD) demands nuanced operational skill. And within APAC strategy, the most challenging and critical task remains securing sufficient liquidity ahead of a Token Generation Event (TGE).

Common Pitfalls When Entering APAC Markets

-

Lack of clear objectives: Before entering APAC, clarify your goals. Are you targeting retail users, developer ecosystems, or institutional investors? Different goals require distinct strategies. Define your core needs and direction before hiring an APAC lead.

-

Choosing the wrong agency: Many agencies claim they can help you enter APAC, but not all are reliable. Be cautious of those that don’t focus on specific countries but instead promise broad coverage across culturally diverse Asian markets—they often lack depth. True localization remains a key advantage. A specialist agency deeply embedded in one or two markets typically delivers more value than generalists.

-

Misconceptions about remote management: Don’t assume you can manage APAC effectively from afar. Flying in once a year or relying solely on remote oversight rarely works. You need a dedicated local team capable of responding in real time—not just a distant point of contact.

-

Treating APAC as a single market: APAC is not monolithic. From South Korea, Japan, and China to Southeast Asia, each country has unique languages, cultures, and incentive structures. Each has distinct strengths and weaknesses in crypto. Your APAC lead must understand these nuances—or have strong local connections—to navigate diverse market demands. A one-size-fits-all approach not only fails but risks wasted resources and strategic missteps.

When entering APAC, tailor your strategy to individual country characteristics and ensure your team deeply understands local cultures and operating environments.

Understanding Work Culture and Business Norms

It bears repeating: APAC is vast and highly diverse. Each country has its own business culture, though there is generally a stronger emphasis on relationships and trust rather than purely transactional interactions—contrasting with more direct Western business models.

Therefore, hiring an APAC lead who truly understands these cultural differences is essential. They must possess strong social skills and the ability to build rapport with people from varied backgrounds in international settings. This is crucial because behavior seen as respectful in one country may appear inappropriate in another. Learning to balance candor with respect is a key step toward success in APAC.

An ideal APAC lead combines deep strategic understanding of the broader crypto ecosystem with strong business diplomacy—adapting flexibly and authentically engaging with diverse regional business cultures. This blend of capabilities enables companies to build trust, secure partnerships, and achieve sustainable growth across the multifaceted Asia-Pacific landscape.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News