HTX Ventures Latest Research Report | Crypto Compliance Ushers in a "New DeFi" Era, RWAFi and Stablecoin Payments Emerge as New Opportunities

TechFlow Selected TechFlow Selected

HTX Ventures Latest Research Report | Crypto Compliance Ushers in a "New DeFi" Era, RWAFi and Stablecoin Payments Emerge as New Opportunities

Explore potential opportunities and development directions in the new round of transformation within the crypto trading赛道, providing insights and references for industry participants.

Since the DeFi Summer of 2020, AMMs (Automated Market Makers), lending protocols, derivatives trading, and stablecoins have become core infrastructure in the crypto trading landscape. Over the past four years, numerous entrepreneurs have iteratively innovated across these sectors, elevating projects like Trader Joe and GMX to new heights. However, as these products mature, growth in the crypto trading sector is beginning to hit a ceiling, making it increasingly difficult for the next generation of top-tier projects to emerge.

Following the 2024 U.S. presidential election, the legalization and compliance process for the crypto industry is expected to unlock fresh opportunities. The integration of traditional finance (TradFi) with DeFi is accelerating: real-world assets (RWA) such as private credit, U.S. Treasuries, and commodities are evolving from simple tokenized certificates into capital-efficient yield-bearing stablecoins, offering crypto users seeking stable returns a new option—and becoming a new growth engine for DeFi lending and trading. Meanwhile, stablecoins are gaining strategic importance in international trade, and payment-related infrastructure continues to thrive. Traditional financial giants—including the Trump family, Stripe, PayPal, and BlackRock—are rapidly expanding their presence, injecting more potential into the sector.

In the wake of “Old DeFi” pioneers like Uniswap, Curve, dYdX, and Aave, a new wave of unicorns in the crypto trading space is brewing. These emerging leaders will adapt to shifting regulatory landscapes, leverage the integration of traditional finance, and harness technological innovation to open new markets, ushering in a “New DeFi” era. For newcomers, this means moving beyond incremental improvements on traditional DeFi models toward building breakthrough products aligned with new environments and demands.

This article, written by HTX Ventures, analyzes this trend in depth, exploring potential opportunities and development directions in the next phase of transformation within the crypto trading sector, providing insights and references for industry participants.

Changes in This Cycle’s Trading Environment

Stablecoin Regulation Advances, Adoption in Cross-Border Payments Rises

Maxine Waters of the U.S. House Committee on Financial Services and Chair Patrick McHenry plan to introduce a stablecoin bill in the near term—an indication of rare bipartisan consensus in the U.S. on stablecoin legislation. Both sides agree that stablecoins not only reinforce the U.S. dollar's role as a global reserve currency but have also become significant buyers of U.S. Treasury bonds, holding vast economic potential. For instance, Tether generated $6.3 billion in profit last year with just 125 employees, showcasing its profitability.

This bill could become the first comprehensive cryptocurrency legislation passed by Congress, driving widespread adoption of crypto wallets, stablecoins, and blockchain-based payment channels among traditional banks, businesses, and individuals. In the coming years, stablecoin payments may become commonplace—marking another "step-change" moment for the crypto market following Bitcoin ETFs.

While compliant institutional investors cannot directly benefit from stablecoin appreciation, they can profit by investing in related infrastructure. Major blockchains supporting large volumes of stablecoin issuance (such as Ethereum and Solana) and various DeFi applications interacting with stablecoins will all benefit from stablecoin growth. Currently, stablecoins account for over 50% of blockchain transactions, up from just 3% in 2020. Their core value lies in seamless cross-border payments, a function growing especially fast in emerging markets. For example, stablecoin transaction volume represents 3.7% of GDP in Turkey; in Argentina, stablecoin premiums reach as high as 30.5%. Innovative platforms like Zarpay and MentoLabs use local agents and payment systems, employing grassroots strategies to bring users into the blockchain ecosystem, further accelerating stablecoin adoption.

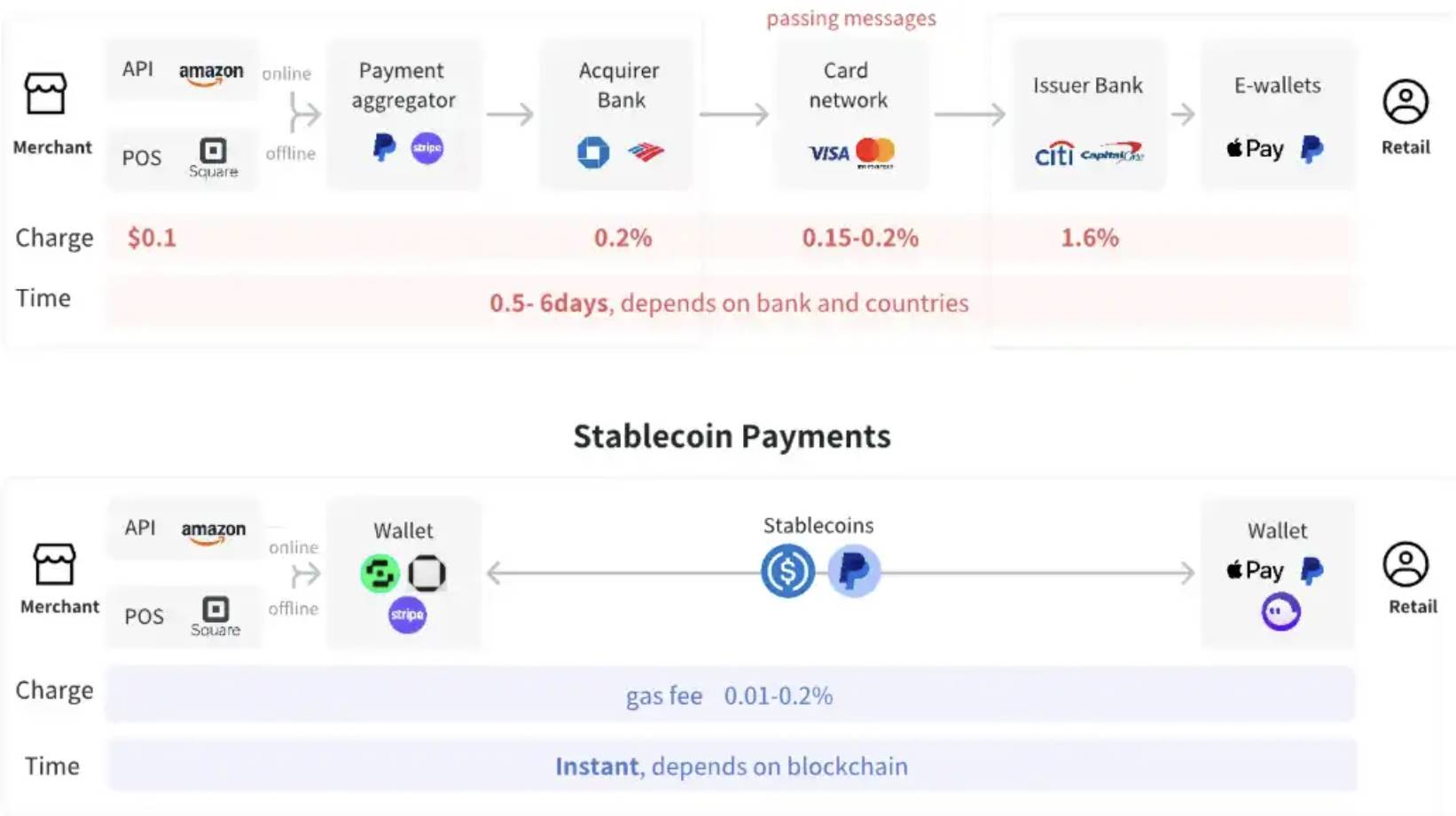

The traditional cross-border B2B payment market is valued at approximately $40 trillion annually, while the global consumer remittance market generates billions in revenue each year. Stablecoins offer an efficient new method for conducting cross-border payments via crypto channels, with rapidly rising adoption rates. They are poised to disrupt and capture significant share of these markets, becoming a major force in the global payment landscape.

https://mirror.xyz/sevenxventures.eth/_ovqj0x0R_fVAKAKCVtYSePtKYv8YNLrDzAEwjXVRoU

Ripple’s RLUSD stablecoin is designed specifically for enterprise payments, aiming to improve efficiency, stability, and transparency in cross-border transactions to meet demand for USD-denominated settlements. Meanwhile, Stripe acquired Bridge, a stablecoin platform, for $1.1 billion—the largest acquisition in crypto history. Bridge enables seamless conversion between fiat and stablecoins for enterprises, further advancing stablecoin usage in global payments. Its cross-border platform processes over $5 billion in annualized payments and already provides global settlement services for premium clients including SpaceX, demonstrating the convenience and effectiveness of stablecoins in international transactions.

Additionally, PEXX, an innovative stablecoin cross-border payment platform, supports converting USDT and USDC into 16 fiat currencies and direct bank transfers. With simplified onboarding and instant conversion, PEXX allows users and businesses to conduct cross-border payments efficiently and cost-effectively, breaking down barriers between traditional finance and cryptocurrencies. This innovation not only delivers faster and more affordable cross-border solutions but also promotes decentralized, seamless global capital flows. Stablecoins are gradually becoming integral to global payments, enhancing both efficiency and accessibility of payment systems.

Regulation on Perpetual Contracts May Loosen

Due to the high leverage associated with perpetual contracts, regulators worldwide have imposed strict compliance requirements. In many jurisdictions, including the United States, centralized exchanges (CEXs) are banned from offering perpetual contract services, and decentralized perpetual exchanges (PerpDEXs) face similar restrictions. This has directly constrained the market size and user base of PerpDEXs.

However, with Donald Trump’s decisive victory in the election, the crypto industry’s compliance trajectory is likely to accelerate, potentially ushering in a springtime for PerpDEXs. Two recent developments are particularly noteworthy: First, David Sacks, Trump’s appointee as crypto and AI advisor, previously invested in dYdX, a veteran player in this space. Second, the Commodity Futures Trading Commission (CFTC) is expected to replace the Securities and Exchange Commission (SEC) as the primary regulator for the crypto industry. The CFTC has extensive experience overseeing futures markets, having facilitated the launch of CME Bitcoin futures. Compared to the SEC, the CFTC tends to take a more favorable stance toward PerpDEXs. These positive signals could open new market opportunities for PerpDEXs, creating more favorable conditions for their compliant growth.

DeFi Users Are Discovering the Stable Yield Value of RWA

In earlier high-risk, high-return crypto market environments, the stable yields offered by real-world assets (RWA) were largely overlooked. However, during the previous bear market cycle, the RWA market grew counter-cyclically, with total value locked (TVL) rising from under a million dollars to the current tens of billions. Unlike other crypto assets, RWA valuations are not swayed by crypto market sentiment. This characteristic is crucial for building a resilient DeFi ecosystem: RWAs enhance portfolio diversification and serve as solid foundations for various financial derivatives, helping investors hedge against volatility amid turbulent markets.

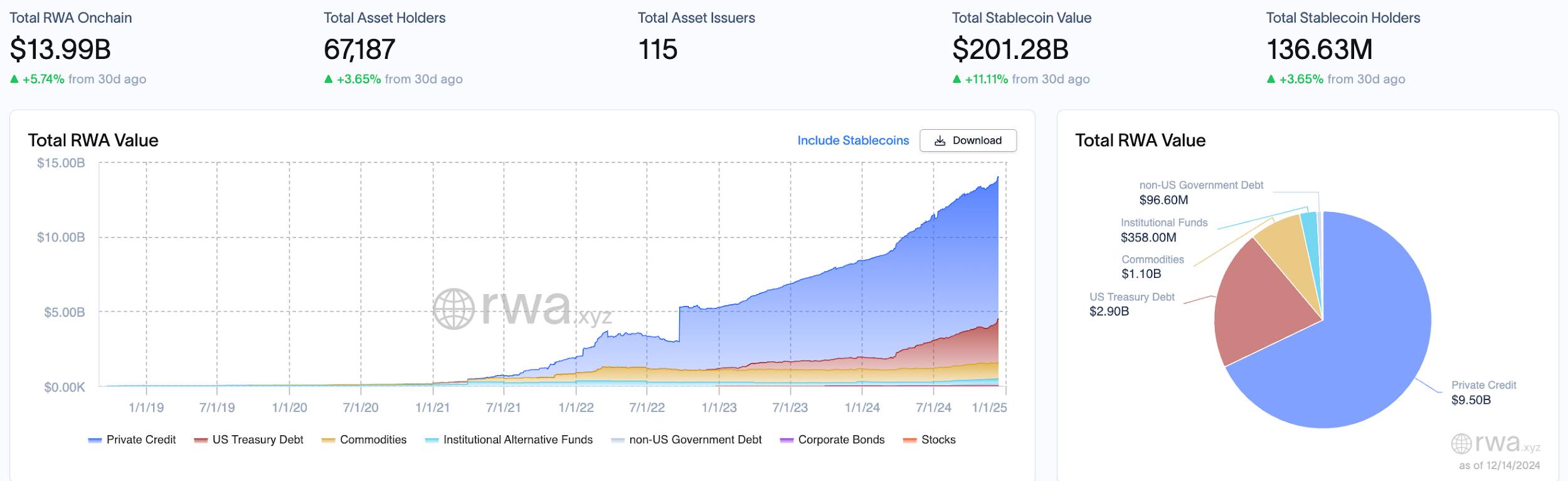

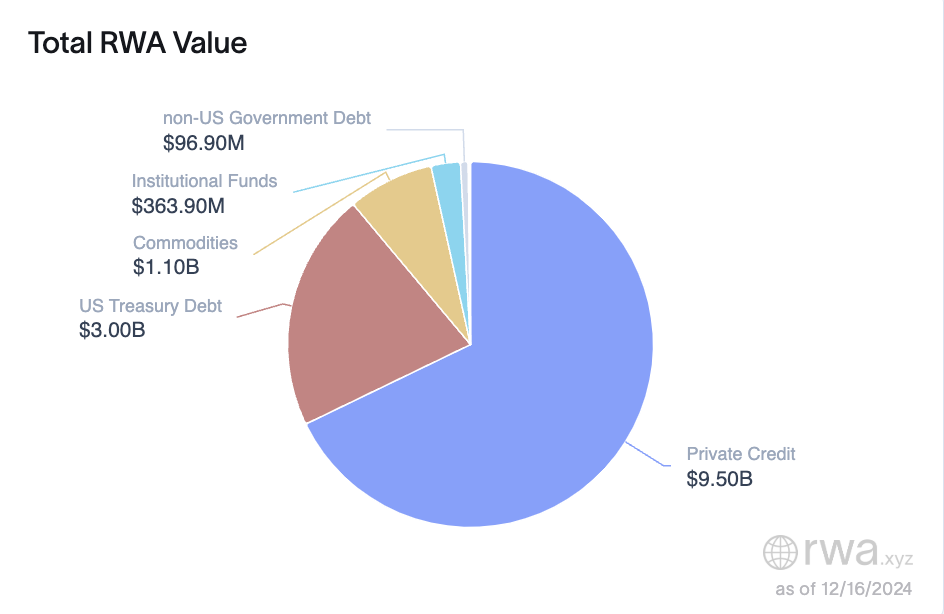

According to data from RWA.xyz, as of December 14, there were 67,187 RWA holders, 115 asset issuers, and a total market cap reaching $139.9 billion. Web3 giants like Binance project that the RWA market could expand to $16 trillion by 2030. This massive potential, combined with attractive stable yields, is making RWA an indispensable component of the DeFi ecosystem.

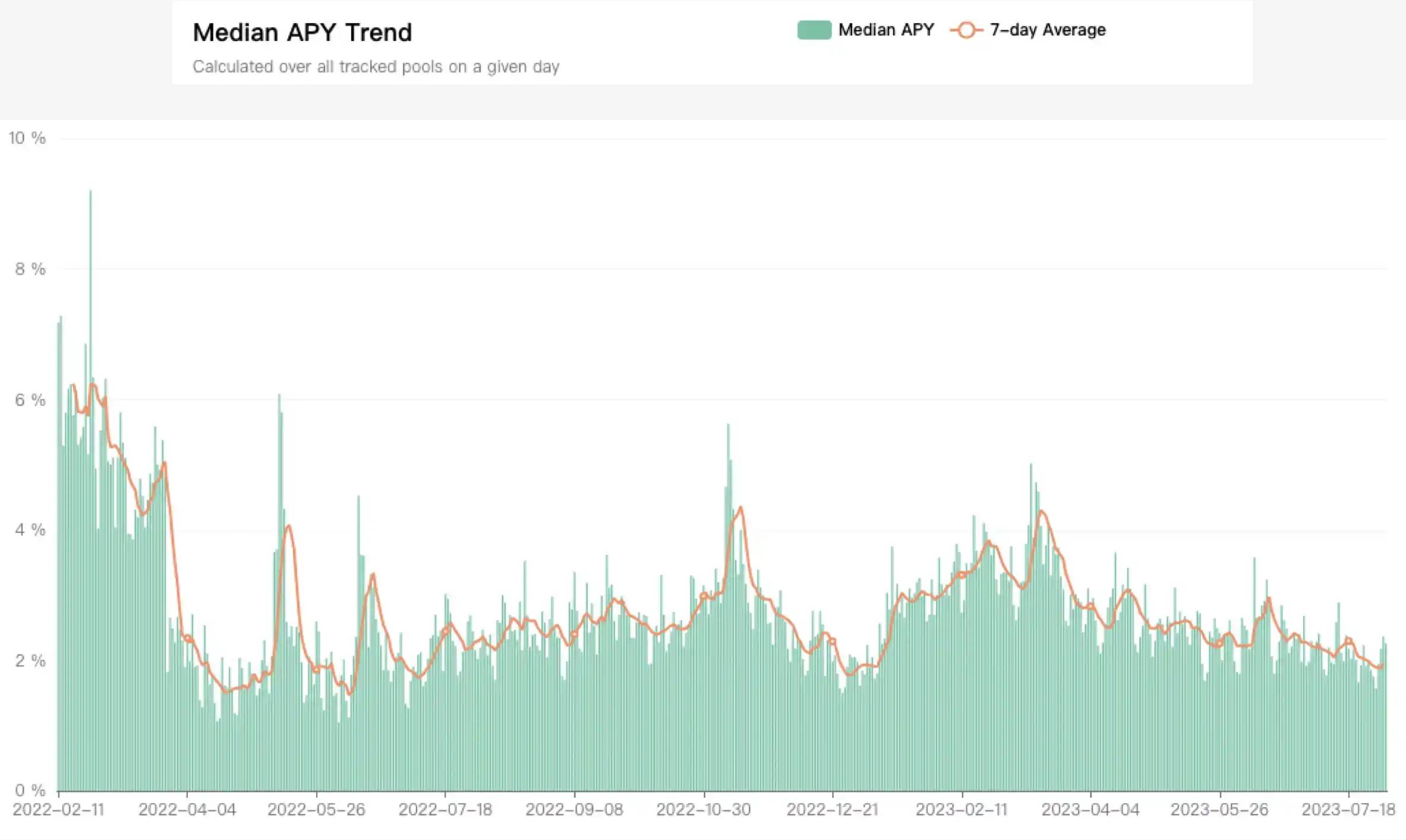

https://app.rwa.xyz/

After the collapse of Three Arrows Capital, a critical flaw emerged in the crypto industry: a lack of sustainable yield-generating use cases. As the Federal Reserve began hiking interest rates, global liquidity tightened, and crypto—classified as a high-risk asset—was hit hard. In contrast, yields on real-world assets like U.S. Treasuries steadily rose since late 2021, attracting investor attention. From 2022 to 2023, the median DeFi yield dropped from 6% to 2%, falling below the 5% risk-free yield of U.S. Treasuries, causing high-net-worth investors to lose interest in on-chain yields. Faced with dwindling on-chain returns, the industry turned to RWA, hoping to revive market vitality by introducing off-chain stable yields.

https://www.theblockbeats.info/news/54086

In August 2023, MakerDAO raised the DAI Savings Rate (DSR) in its Spark Protocol to 8%, sparking a revival in the long-dormant DeFi market. Within a week, DSR deposits surged by nearly $1 billion, and DAI’s circulating supply increased by $800 million—the highest in three months. The key driver behind this surge was RWA (real-world assets). Data shows that over 80% of MakerDAO’s fee income in 2023 came from RWA. Since May 2023, MakerDAO has significantly expanded its RWA investments, purchasing U.S. Treasuries in bulk through entities like Monetalis, Clydesdale, and BlockTower, and deploying funds into RWA lending protocols such as Coinbase Prime and Centrifuge. By July 2023, MakerDAO held nearly $2.5 billion in RWA investments, over $1 billion of which was in U.S. Treasuries.

MakerDAO’s success ignited a new RWA boom. Driven by high-yield blue-chip stablecoins, the DeFi ecosystem responded swiftly. For example, the Aave community proposed listing sDAI as collateral, expanding RWA applications in DeFi. Similarly, in June 2023, Compound’s founder launched Superstate, a company focused on bringing real-world assets like bonds onto the blockchain to provide users with real-world-like stable yields.

RWA has become a vital bridge connecting real-world assets and on-chain finance. As more innovators explore its potential, the DeFi ecosystem is gradually charting a new path toward stable yields and diversified growth.

Licensed Institutions Going On-Chain Expand Market Scale

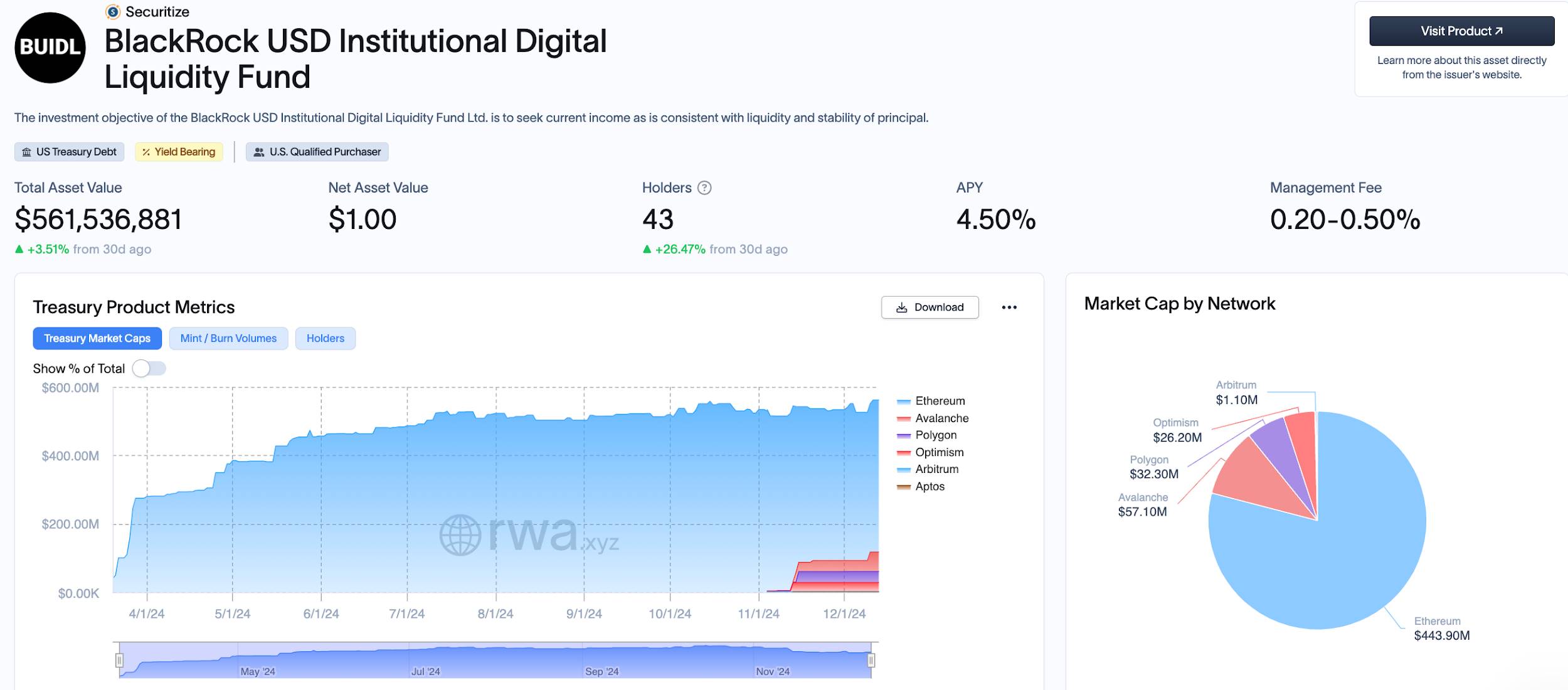

In March this year, BlackRock launched BUIDL, its first U.S. Treasury tokenized fund issued on public blockchains, capturing market attention. The fund offers qualified investors a way to earn yield from U.S. Treasuries and was initially deployed on Ethereum before expanding to multiple chains including Aptos, Optimism, Avalanche, Polygon, and Arbitrum. Currently, $BUIDL serves only as a tokenized receipt without additional utility, but its symbolic launch marks a pivotal step forward for tokenized finance.

https://app.rwa.xyz/assets/BUIDL

Meanwhile, Wyoming Governor Mark Gordon announced plans for the state government to issue a dollar-pegged stablecoin backed by U.S. Treasury bills and repurchase agreements by 2025. The stablecoin is expected to launch in Q1 2025 through partnerships with trading platforms, marking a notable experiment in government-backed stablecoins.

In traditional finance, State Street—one of the world’s leading asset managers—is actively exploring ways to integrate into blockchain-based payment and settlement systems. Beyond considering issuing its own stablecoin, State Street also plans to roll out deposit tokens representing client deposits on blockchain. As the second-largest custodian bank globally, managing over $4 trillion in assets, State Street’s move reflects active progress in digital transformation among traditional financial institutions.

JPMorgan is also accelerating its blockchain expansion, planning to launch on-chain foreign exchange functionality in Q1 2025 to enable 24/7 automated multi-currency settlements. Since launching its blockchain payment platform in 2020, JPMorgan has completed over $1.5 trillion in transactions involving intraday repos and cross-border payments, serving global corporations such as Siemens, BlackRock, and Ant International. The bank plans to extend its platform to support automated settlements in U.S. dollars and euros initially, later expanding to more currencies.

JPM Coin is central to JPMorgan’s blockchain strategy—an institution-focused digital dollar enabling instant global payments and settlements. Its launch has accelerated the digitization of financial institutions’ assets and given JPMorgan a first-mover advantage in cross-border payments and capital flows.

Moreover, Tether’s newly launched Hadron platform advances the tokenization of assets, aiming to simplify the digital conversion of stocks, bonds, commodities, and funds. The platform offers institutions, funds, governments, and private companies services including tokenization, issuance, redemption, KYC compliance, capital markets management, and regulatory functions, further driving digital transformation in asset management.

New Compliance Tools Emerge for RWA Token Issuance

Securitize is an innovative platform specializing in fund issuance and investment on blockchain. It has deep expertise in RWA (real-world assets) and partners with major players like BlackRock, providing professional services for security token issuance, management, and trading. Through Securitize, enterprises can directly issue bonds, stocks, and other securities on blockchain, using the platform’s full suite of compliance tools to ensure strict adherence to legal and regulatory standards across jurisdictions.

Since obtaining transfer agent registration from the U.S. SEC in 2019, Securitize rapidly scaled its operations. In 2021, it raised $48 million in funding led by Blockchain Capital and Morgan Stanley. In September 2022, Securitize helped KKR, one of America’s largest investment firms, tokenize part of its private equity fund on the Avalanche blockchain. The following year, again on Avalanche, Securitize issued equity tokens for Spanish real estate investment trust Mancipi Partners, becoming the first company to issue and trade tokenized securities under the EU’s new digital asset pilot regime.

Recently, leading stablecoin issuer Ethena announced a partnership with Securitize to launch a new stablecoin product, USDtb. The reserves backing USDtb are invested in BlackRock’s Institutional Digital Dollar Fund (BUIDL), further strengthening Securitize’s position in the blockchain financial ecosystem.

In May 2023, Securitize secured another $47 million in strategic funding led by BlackRock, aimed at accelerating partnerships within the financial services ecosystem. As part of this round, Joseph Chalom, Head of Global Strategic Ecosystem Partnerships at BlackRock, joined Securitize’s board. This collaboration signifies deeper integration between Securitize and the convergence of traditional finance with blockchain technology.

Opportunities and Challenges

Private Credit RWA Enters PayFi Era—How to Solve Default Risks?

Private credit currently totals around $13.5 billion, with $8.66 billion in active loans and an average annual interest rate of 9.46%. In the RWA market, private credit remains the second-largest asset class, with Figure Markets accounting for about 66% of issuance share.

Figure Markets is a trading platform built on the Provenance blockchain, covering various asset types including equities, bonds, and real estate. In March this year, it secured over $60 million in Series A funding from Jump Crypto, Pantera Capital, and others. With a TVL (total value locked) of $13 billion, it is now the largest RWA platform by TVL. Unlike traditional non-standardized private credit RWAs, Figure Markets focuses primarily on standardized home loans (HomeLoan), giving it substantial market scale and growth potential, opening up greater future opportunities.

https://app.rwa.xyz/?ref=ournetwork.ghost.io

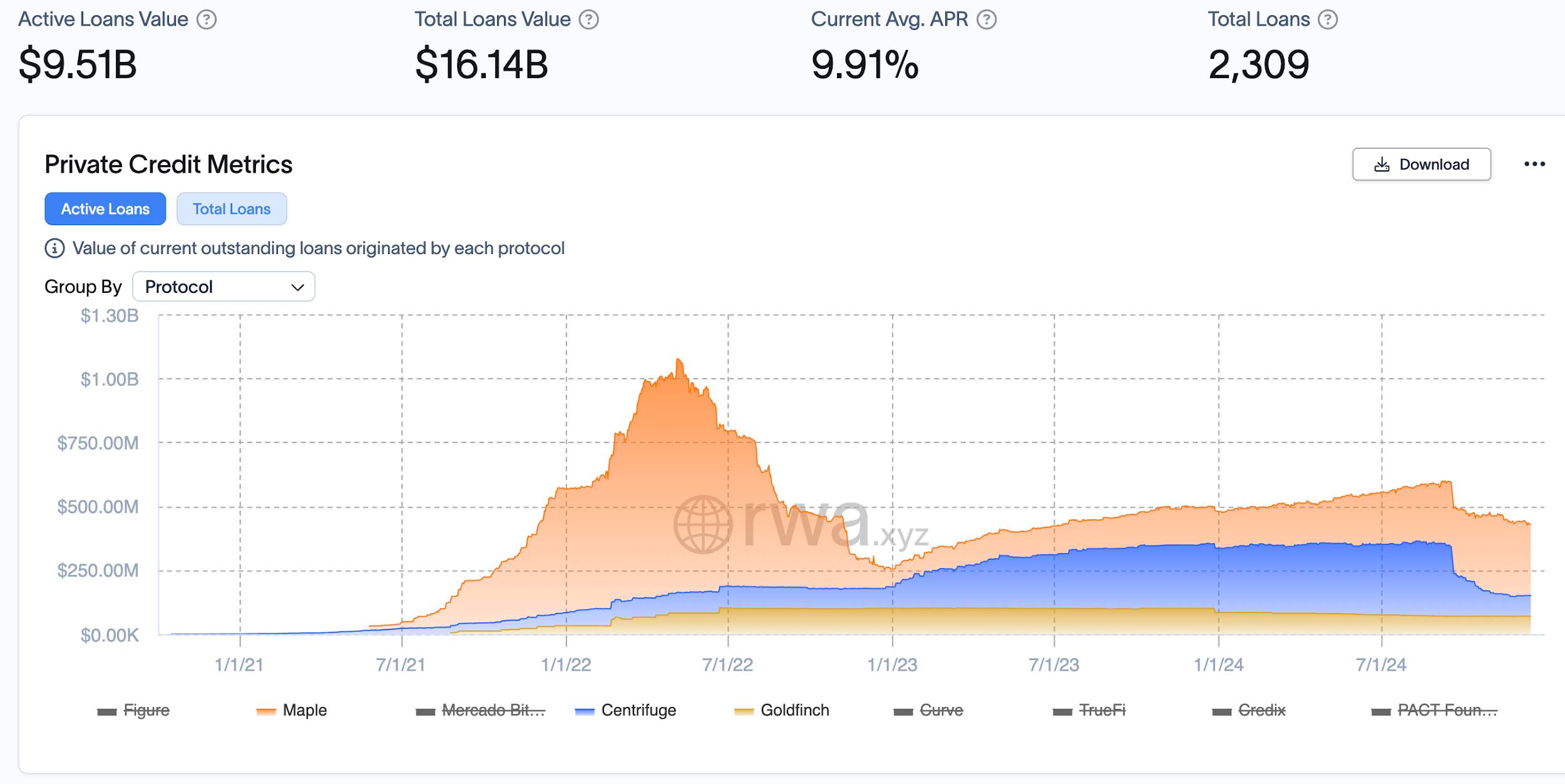

Besides home loans, private credit also includes corporate and institutional lending. Key projects from the previous cycle include Centrifuge, Maple Finance, and Goldfinch.

TVL rebounded this year

https://app.rwa.xyz/?ref=ournetwork.ghost.io

- Centrifuge is a decentralized asset financing protocol that tokenizes real-world assets—such as real estate, invoices, and receivables—into NFTs via its Tinlake protocol, used as collateral by borrowers. Borrowers access liquidity from decentralized pools, while investors provide capital to these pools and earn fixed returns. Centrifuge’s core innovation lies in merging blockchain with traditional finance, enabling lower-cost funding for businesses and startups while reducing credit risk and intermediary costs through blockchain transparency and decentralization.

However, Centrifuge faces risks from market volatility. Although its asset tokenization model is popular among traditional financial institutions, borrowers may default during volatile periods. For example, certain high-volatility assets may fail to meet repayment obligations, especially during bear markets when illiquidity strains borrowers' solvency.

- Maple Finance specializes in providing high-yield secured loans to corporate and institutional borrowers. Loan pools on the platform are typically overcollateralized with crypto assets like BTC, ETH, and SOL. Maple employs an on-chain credit scoring mechanism, allowing institutional borrowers to create and manage loan pools, offering lenders stable yields. This model suits crypto-native institutions well, reducing risk and increasing capital returns through overcollateralized lending.

Nonetheless, Maple faced severe challenges during the bear market, experiencing multiple major defaults, particularly during broad market downturns. For example, Orthogonal Trading failed to repay a $36 million loan on Maple Finance, placing clear stress on the platform.

- Goldfinch is a platform dedicated to on-chain credit lending, aiming to provide loans to startups and small businesses unable to access traditional financing. Unlike other RWA lending platforms, Goldfinch uses unsecured loans, relying on borrower credit history and third-party assessments to evaluate repayment ability. Through funding pools, Goldfinch lends money to borrowers in need and offers fixed returns to capital providers.

Goldfinch’s main issue lies in borrower selection. Many borrowing companies face high default risks, especially startups and SMEs from high-risk markets. For example, in April 2022, Goldfinch suffered a $10 million loan default, primarily due to risky startups and small businesses. Despite receiving investment from a16z, these default events revealed shortcomings in its risk control and market demand alignment.

https://dune.com/huma-finance/huma-overview

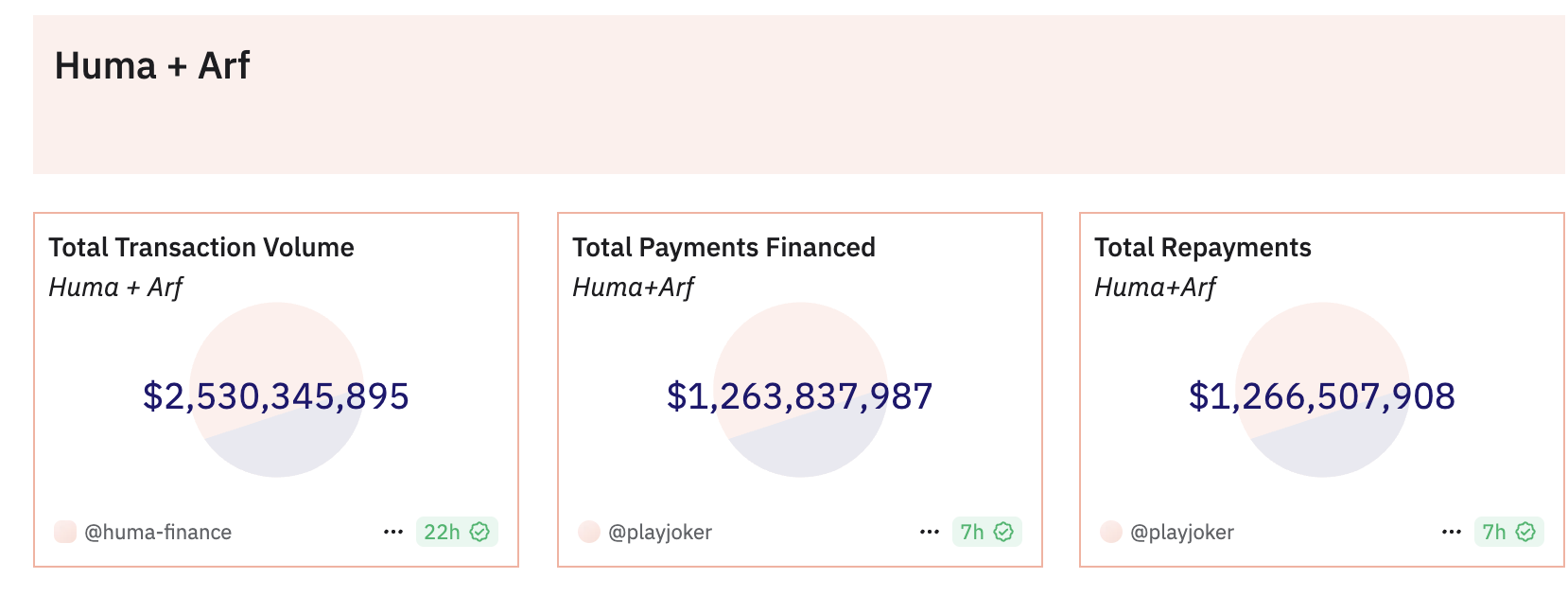

Solana’s recently introduced "PayFi" concept shares similarities with private credit in business logic, further extending its application to diversified scenarios such as cross-border financing, lending, and cross-border payment swaps. Take Huma Finance as an example: the platform provides financial services to investors and borrowers—investors earn returns by supplying capital, while borrowers access loans and repayments. Additionally, Huma’s subsidiary Arf specializes in cross-border payment bridging, greatly optimizing traditional remittance workflows.

For instance, sending money from Singapore or Hong Kong to South Africa traditionally involves time-consuming and expensive SWIFT transfers. While many opt for companies like Western Union, these firms must partner with local agents in South Africa and rely on large local bridging funds to achieve same-day settlement—a heavy burden requiring massive pre-funding in multiple fiat currencies across countries, resulting in inefficiency. Arf abstracts this bridging service using stablecoins, providing payment companies with rapid capital flow support.

For example, when a user sends $1 million to South Africa, Arf ensures funds go into regulated accounts and completes cross-border settlement via stablecoins. Before settlement, Huma conducts due diligence on the payment company to ensure security. Throughout the process, Huma lends and recovers only stablecoins, avoiding any involvement in fiat on/off ramps, enabling fast, secure, and efficient capital movement.

Huma’s primary customers come from developed nations such as the UK, US, France, and Singapore, where default rates are extremely low, repayment cycles range from 1 to 3 days, and fees are charged daily—resulting in transparent and efficient cash flows. To date, Huma has processed $2 billion in transaction volume with a 0% default rate. Through collaboration with Arf, Huma achieves double-digit returns independent of token performance.

Furthermore, Huma plans to integrate with DeFi protocols like Pendle to explore token-based reward mechanisms and broader decentralized finance applications, further enhancing user returns and market appeal. Huma’s model may represent an innovative solution to private credit default issues.

Who Will Become the Leader in Yield-Bearing Stablecoins?

This cycle may see the emergence of a safe, yield-bearing stablecoin offering at least 5% sustainable returns—similar to USDT/USDC. This market undoubtedly holds enormous potential. Currently, Tether, issuer of USDT, earns close to $10 billion annually with a team of about 100 people. If even a portion of those profits could be returned to users, could this realize the vision of yield-bearing stablecoins?

Treasury-Backed Models

Currently, stablecoins backed by U.S. Treasuries are emerging as a new trend in the crypto market. These stablecoins bring traditional financial assets onto blockchain through tokenization, preserving Treasuries’ stability and low risk while adding DeFi’s high liquidity and composability. They employ various strategies to generate risk premiums, including fixed budget incentives, user fees, volatility arbitrage, and leveraging reserve assets via staking or restaking.

USDY from Ondo Finance exemplifies this trend. USDY is a tokenized note backed by short-term U.S. Treasuries and bank demand deposits, structured to comply with U.S. regulations. It can serve as collateral in DeFi protocols and as a medium of exchange in Web3 payments. USDY comes in two forms: accrual-type (USDY), suitable for long-term holding, and rebasing-type (rUSDY), which increases token count to reflect earnings, ideal for settlement. Ondo also launched OUSG, a token offering highly liquid exposure to U.S. short-term Treasuries, with underlying assets held in BlackRock’s institutional fund and supporting instant minting and redemption.

OpenTrade offers multiple Treasury-based Vault products, including fixed-income U.S. Treasury Vaults and flexible-yield USDC Vaults, catering to diverse asset management needs. OpenTrade deeply integrates its tokenized products with DeFi, delivering seamless deposit and yield experiences for holders.

Comparison of profit distribution: Tether vs. Usual

https://docs.usual.money/

Usual Protocol’s stablecoin USD0 tokenizes traditional financial assets like U.S. Treasuries and offers two minting options: users can directly deposit RWA assets or indirectly mint via USDC/USDT. Users can also upgrade USD0 to higher-yielding USD0++ and earn additional loyalty rewards through partnerships with DeFi platforms like Pendle.

Solayer’s sUSD stablecoin on Solana uses U.S. Treasuries as collateral, offering holders 4.33% on-chain yield and supporting staked assets to enhance Solana network stability and security. These mechanisms not only increase stablecoin yields but also strengthen DeFi ecosystem resilience and efficiency, showcasing the immense potential of TradFi-blockchain convergence.

Low-Risk On-Chain Arbitrage Models

Beyond treasury-backed designs, another category of yield-bearing stablecoins leverages crypto market volatility and MEV (Miner Extractable Value) for low-risk arbitrage gains.

Ethena is the fastest-growing non-collateralized stablecoin project since the Terra Luna crash. Its native stablecoin USDe, with $5.5 billion in circulation, surpassed Dai to rank third in market size. Ethena’s core design uses a Delta Hedging strategy based on Ethereum and Bitcoin collateral—opening offsetting short positions on CEXs equal in value to the collateral to hedge against price fluctuations affecting USDe’s peg. This hedging relies on OTC settlement providers, with protocol assets custodied across multiple external entities, aiming to maintain USDe’s stability through counterbalancing gains and losses between collateral and short positions.

Revenue comes from three sources: staking rewards from users’ LST collateral; funding rate or basis spread from hedging trades; and Liquid Stables fixed rewards—interest earned by placing USDC or other stablecoins on Coinbase or other exchanges. At its core, USDe is a packaged low-risk quantitative hedging product combining on-chain and CEX strategies, capable of delivering up to 27% variable APY during favorable market conditions with ample liquidity.

Ethena’s risks stem mainly from potential failures of CEXs or custodians and insufficient counterparties during runs, potentially leading to de-pegging and systemic risk. During bear markets with persistently negative funding rates, risks intensify—earlier this year, protocol yields briefly turned negative (-3.3%), though no systemic failure occurred.

Nevertheless, Ethena introduces an innovative hybrid on-chain/CEX design, using post-merge LST assets to provide scarce short-side liquidity to exchanges while generating fee income and market activity. In the future, with the rise of orderbook DEXs and maturity of chain abstraction technologies, fully decentralized versions of such stablecoins may become feasible.

Other projects are exploring different yield-bearing stablecoin strategies: CapLabs leverages MEV and arbitrage profits, Reservoir uses diversified high-yield asset baskets to optimize allocations, and DWF Labs is soon launching Falcon Finance, a yield-bearing synthetic stablecoin with two versions: USDf and USDwf.

These innovations bring diversity to the stablecoin market and drive further evolution of DeFi.

Mutual Empowerment Between RWA Assets and DeFi Applications

RWA Assets Enhance DeFi Application Stability

Ethena’s recently issued stablecoin USDtb allocates 90% of its reserves to BlackRock’s BUIDL Treasury tokenized fund—the highest BUIDL allocation among all stablecoins. This design helps USDtb effectively support USDe’s stability during difficult market conditions, especially when funding rates turn negative. Last week, Ethena’s Risk Committee approved a proposal to accept USDtb as a supporting asset for USDe, allowing Ethena to deactivate USDe’s primary hedging positions during uncertainty and reallocate support to USDtb, further mitigating market risk.

Additionally, CDP-style stablecoins (Collateralized Debt Positions) have improved their collateral and liquidation mechanisms by incorporating RWA assets to strengthen peg stability. Historically, CDP stablecoins relied heavily on crypto assets as collateral but faced scalability and volatility issues. By 2024, CDP stablecoins began accepting more liquid and stable collateral—for example, crvUSD from Curve recently added USDM (a real-world asset)—enhancing resilience. Some liquidation mechanisms have also improved, such as crvUSD’s soft liquidation, which provides buffers against bad debt and effectively reduces risk.

DeFi Mechanisms Improve RWA Token Asset Efficiency

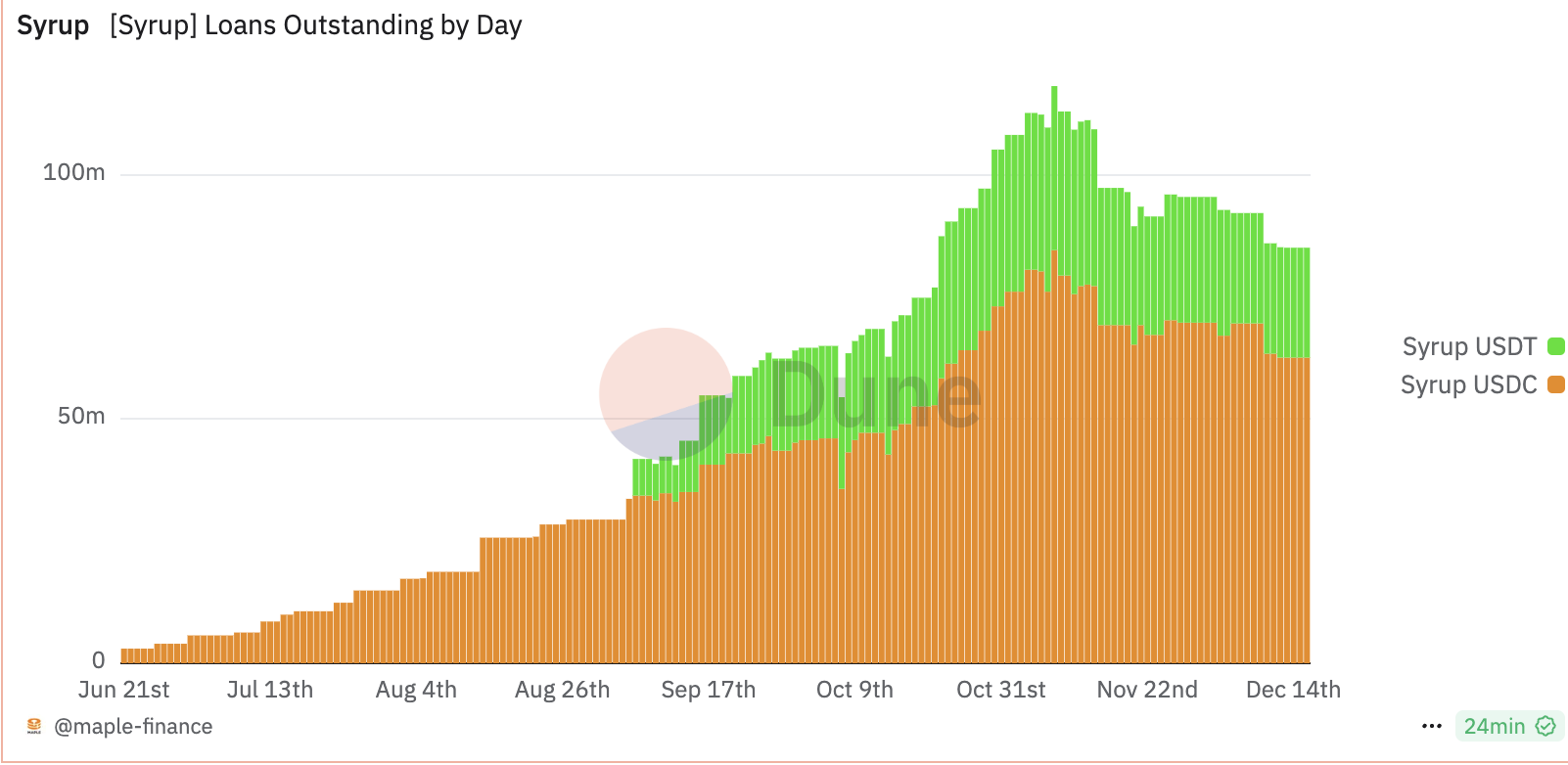

Pendle’s newly launched “RWA” zone has reached $150 million in TVL, encompassing various yield-generating assets including USDS, sUSDS, SyrupUSDC, and USD0++.

Among them, USDS works similarly to DAI—users deposit into SKY Protocol to earn SKY token rewards; sUSDS resembles sDAI, with partial yield derived from MakerDAO’s Treasury investments; SyrupUSDC is a yield asset backed by Maple’s digital asset lending platform, generating returns by offering fixed-rate, overcollateralized loans to institutional borrowers; USD0++ derives all yield from 1:1 Treasury-backed assets, ensuring stable returns.

Current annualized yields on Pendle are highly attractive: sUSDS LP reaches 432.4%, SyrupUSDC LP at 98.88%, USD0++ LP at 43.25%, and USDS LP at 22.96%—high returns drawing users to buy RWA-backed stablecoins.

Maple’s project Syrup, launched in May, achieved rapid growth via DeFi mechanics, helping Maple recover after suffering loan defaults during the bear market.

https://dune.com/maple-finance/maple-finance

Additionally, purchasing YT assets of USD0++ on Pendle qualifies users for airdrops from usual, unlocking additional yield potential for on-chain Treasuries through tokenomics.

Can RWAFI Blockchains Empower Institutional Finance?

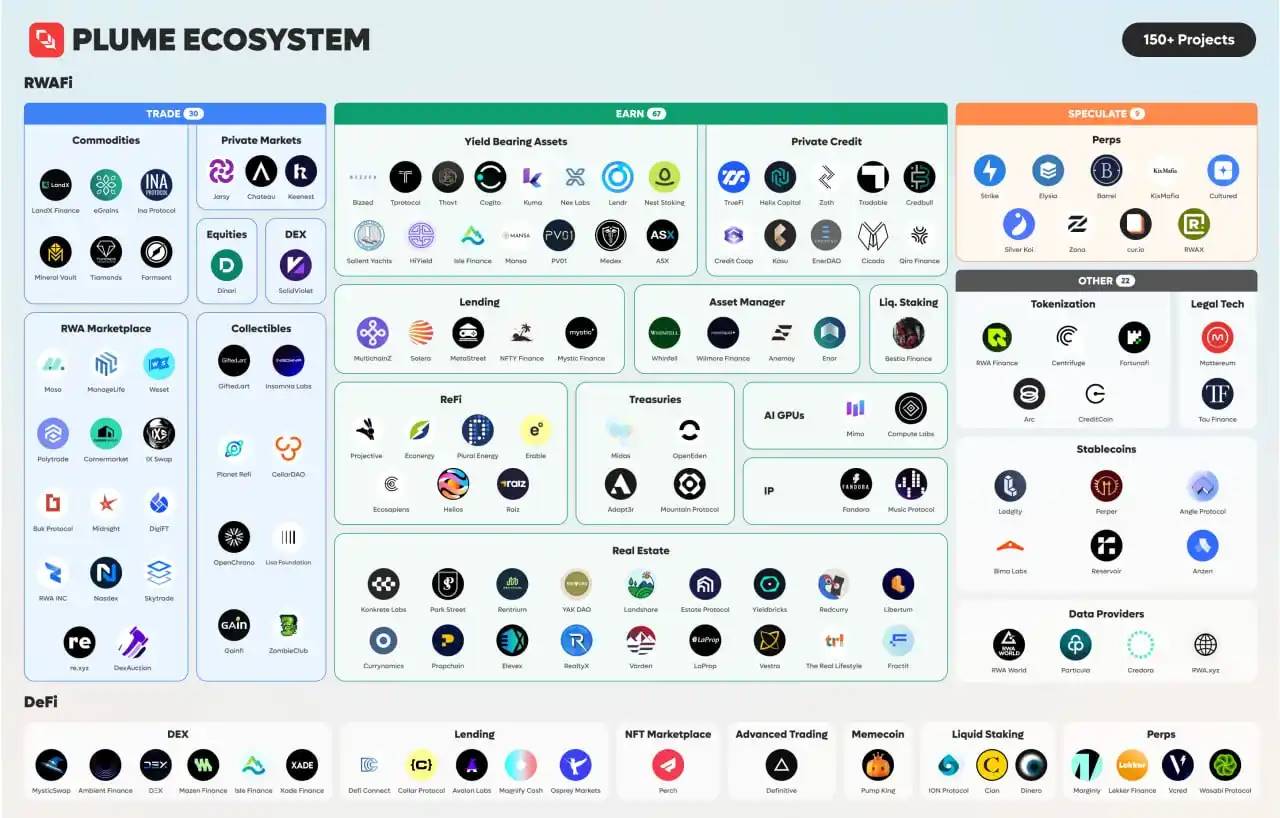

Plume is a Layer 2 ecosystem focused on RWA, dedicated to integrating traditional finance (TradFi) with decentralized finance (DeFi) to build a financial network comprising over 180 projects. Through alliances with the Enterprise Ethereum Alliance (EEA) and Tokenized Asset Coalition (TAC), Plume has formed strategic partnerships with WisdomTree, Arbitrum, JPMorgan, a16z, Galaxy Digital, and Centrifuge, driving adoption of industry standards and institutional-grade RWAfi solutions.

Plume features a modular, permissionless compliance architecture allowing KYC and AML configurations at the application layer. It embeds anti-money laundering (AML) protocols, collaborates with blockchain analytics providers to ensure global compliance, and partners with regulated broker-dealers and transfer agents to guarantee compliant securities issuance and trading in markets like the U.S. The platform implements zero-knowledge proof of reserves (ZK PoR) to verify asset backing privately, supports global securities exemptions like Reg A, D, and S, and serves retail and institutional investors across multiple jurisdictions.

https://www.plumenetwork.xyz/

Functionally, Plume enables users to:

● Use tokenized RWAs (e.g., real estate, private credit) as collateral to borrow stablecoins or crypto assets, providing low-volatility collateral for enhanced security;

● Introduce liquid staking—users stake assets to receive liquid tokens usable in other DeFi protocols, compounding yields; the platform offers compound yield assets like private credit and infrastructure investments, generating steady returns and enabling reinvestment;

● List RWA assets on perpetual DEXs, allowing users to long/short real estate or commodities, merging TradFi and DeFi trading;

● Offer stable-yield assets yielding 7–15% annually across private credit, solar energy, and mining, attracting long-term investors; for speculative assets, Cultured provides on-chain speculation based on sports events and economic indicators, meeting demand for short-term high-return trades.

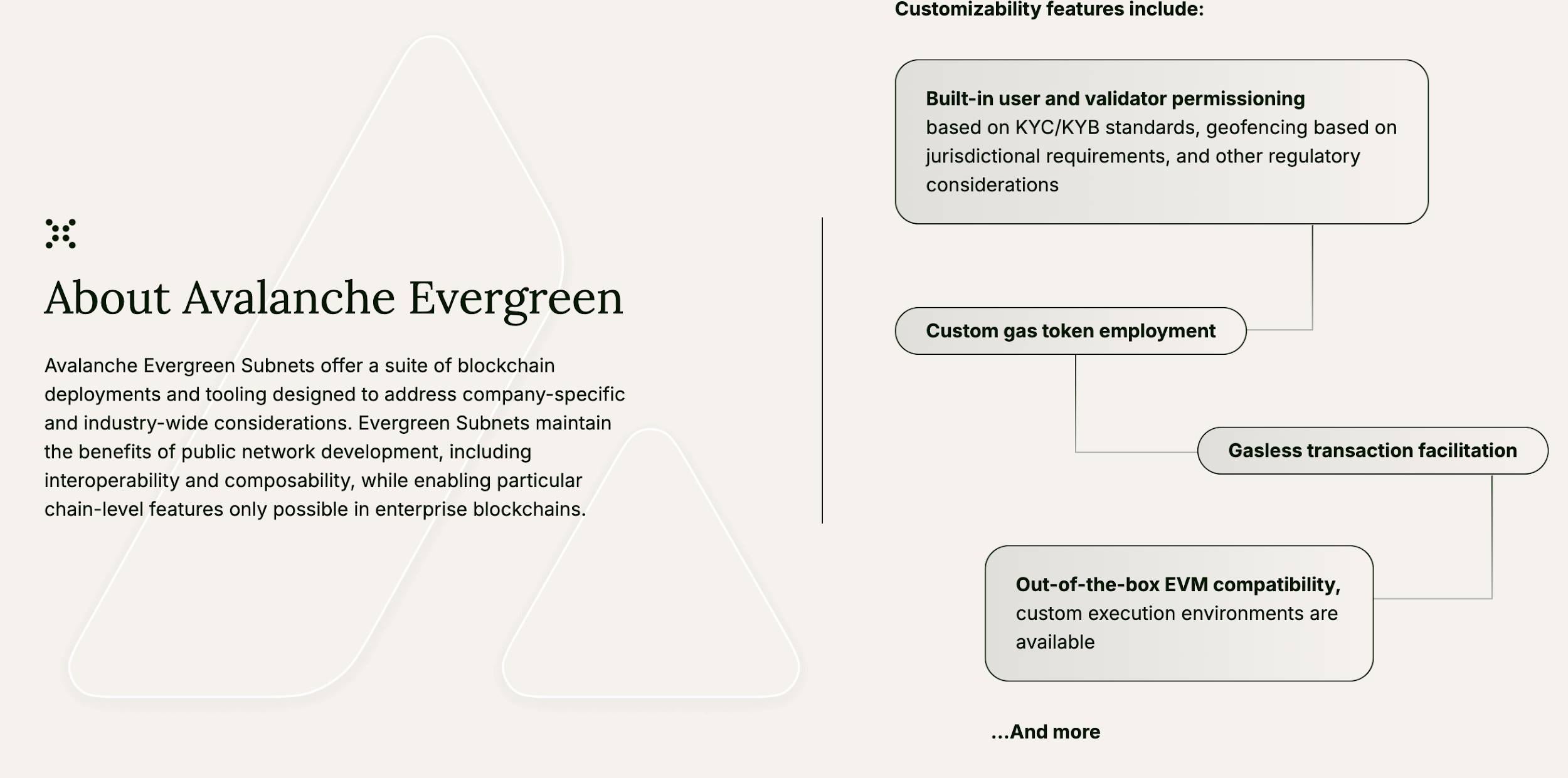

Avalanche is the first L1 blockchain to fully embrace RWA. Since late 2022, it has actively pursued enterprise applications, leveraging its unique subnet architecture to help institutions deploy custom blockchains optimized for specific use cases while maintaining seamless interoperability with the Avalanche network, offering unlimited scalability. From late 2022 to early 2023, entertainment giants from South Korea, Japan, and India built subnets on Avalanche. Recognizing Hong Kong’s momentum in asset tokenization, Avalanche launched the Evergreen subnet at the Hong Kong Web3.0 Summit in April 2023, providing financial institutions with specialized blockchain deployment tools and services for private-chain settlements with permissioned counterparties, while retaining interoperability via Avalanche’s native messaging protocol (AWM), attracting institutions like WisdomTree and Cumberland to join the Spruce testnet.

https://www.avax.network/evergreen

In November of the same year, Avalanche partnered with JPMorgan’s Onyx platform, using LayerZero to connect Onyx and Evergreen, enabling WisdomTree Prime to offer subscription and redemption of tokenized assets. This collaboration was included in the Monetary Authority of Singapore’s (MAS) Project Guardian. Subsequently, Avalanche expanded institutional partnerships—helping Republic launch a tokenized investment fund, Republic Note, in November; conducting private equity tokenization trials with Citibank and WisdomTree on the Spruce testnet in February 2024; collaborating with ANZ Bank and Chainlink in March to settle assets between Avalanche and Ethereum via CCIP; and integrating with Stripe, the payments giant, in April.

Internally, ecosystem foundations are also promoting RWA development—launching the Avalanche Vista initiative to invest $50 million in tokenized assets like bonds and real estate, and funding RWA projects like Balcony and Re through the Blizzard Fund. John Wu, COO of Ava Labs, stated that Avalanche’s mission is “to represent the world’s assets on-chain,” leveraging blockchain advantages like instant settlement to bring heavily regulated TradFi entities on-chain, empowering RWA growth and positioning Avalanche as the top choice for institutional onboarding.

Promising New Directions

On-Chain Foreign Exchange

Traditional FX systems suffer from inefficiencies: counterparty settlement risk (despite CLS improvements, processes remain cumbersome), high coordination costs in multi-bank systems (e.g., an Australian bank buying yen requires six banks), limited overlapping settlement hours across global time zones (e.g., CAD and JPY systems overlap less than five hours daily), and restricted market access (retail users pay up to 100x more than institutions). On-chain FX addresses these issues by using real-time oracles (like Redstone and Chainlink) for instant pricing and decentralized exchanges (DEXs) for cost-efficiency and transparency. For example, Uniswap’s CLMM reduces trading costs to 0.15%-0.25%, about 90% lower than traditional FX. On-chain instant settlement (replacing legacy T+2) creates more arbitrage opportunities to correct mispricing. Moreover, on-chain FX simplifies corporate treasury management, allowing access to multiple products without maintaining separate currency-specific bank accounts. Retail users can get optimal exchange rates via wallets embedded with DEX APIs. On-chain FX also decouples currency from jurisdiction, reducing reliance on domestic banks—though this presents trade-offs, it effectively leverages digital efficiency while preserving monetary sovereignty.

However, on-chain FX still faces challenges: scarcity of non-USD digital assets, oracle security, limited long-tail currency support, regulatory hurdles, and lack of unified on/off-ramp interfaces. Despite this, its potential is vast—Citibank is developing a blockchain-based FX solution under MAS guidance. The FX market sees over $7.5 trillion traded daily, and in Global South regions, individuals often resort to black markets to obtain better USD exchange rates. While Binance P2P offers alternatives, its order-book model lacks flexibility. Projects like ViFi are developing AMM-based on-chain FX solutions, opening new possibilities for the on-chain FX market.

Cross-Border Payment Stack

Cryptocurrencies have long been seen as a key tool for solving the trillion-dollar cross-border payment market, especially in global remittances, which generate billions annually. Stablecoins now offer new pathways for cross-border payments across three layers: merchant layer, stablecoin integration, and FX liquidity. At the merchant layer, apps and interfaces initiating retail or commercial transactions can establish stablecoin flows, creating moats by upselling services, controlling user experience, and achieving end-to-end customer ownership—akin to Robinhood in the stablecoin space. The stablecoin integration layer provides on/off ramps, virtual accounts, cross-border stablecoin transfers, and stablecoin-fiat conversions, where licenses become a key competitive edge, enabling lowest costs and broadest global coverage—Stripe’s acquisition of Bridge illustrates how such moats are built. The FX and liquidity layer handles efficient conversion between stablecoins, USD, fiat, or regional stablecoins. As more crypto exchanges emerge catering to local participants, region-specific cross-border stablecoin payment apps and processors will gradually rise.

Like traditional finance and payment systems, building defensible, scalable moats is key to maximizing commercial opportunities across layers. Over time, these layers will consolidate, with the merchant layer holding the greatest aggregation potential—bundling other layers into a single offering, increasing value, multiplying revenue streams, and controlling choices in FX execution, on/off ramps, and stablecoin issuer partnerships—ultimately forming a comprehensive, efficient cross-border payment solution.

Multi-Pool Stablecoin Aggregation Platforms

In a world where most companies issue their own stablecoins, fragmentation of stablecoin capital is worsening. While traditional on/off ramp solutions offer temporary relief, they fall short of delivering the efficiency promised by crypto. To address this, Numéraire on Solana introduced USD*, an efficient, flexible multi-asset stablecoin exchange platform tailored for the Solana ecosystem, specifically tackling stablecoin fragmentation.

The platform uses AMM mechanisms to enable seamless creation and exchange among different stablecoins, pooling liquidity to prevent capital dispersion and significantly improving capital efficiency and liquidity management. USD* acts as the system’s core unit, simplifying exchange processes and enabling more accurate price discovery by reflecting real-time market valuations of various stablecoins. Users can not only mint stablecoins through the protocol but also customize risk-return profiles using a tiered CDP system, further boosting

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News