How Will the U.S. BTC Strategic Reserve Come Into Being?

TechFlow Selected TechFlow Selected

How Will the U.S. BTC Strategic Reserve Come Into Being?

Several path projections.

Author: Jinze, Pretending to Be on Wall Street

Although Trump did not sign any cryptocurrency-related executive orders upon his formal "inauguration" today, the market remains enthusiastic about the prospect of the U.S. establishing a BTC strategic reserve—and I personally remain optimistic (though the path may differ from popular expectations).

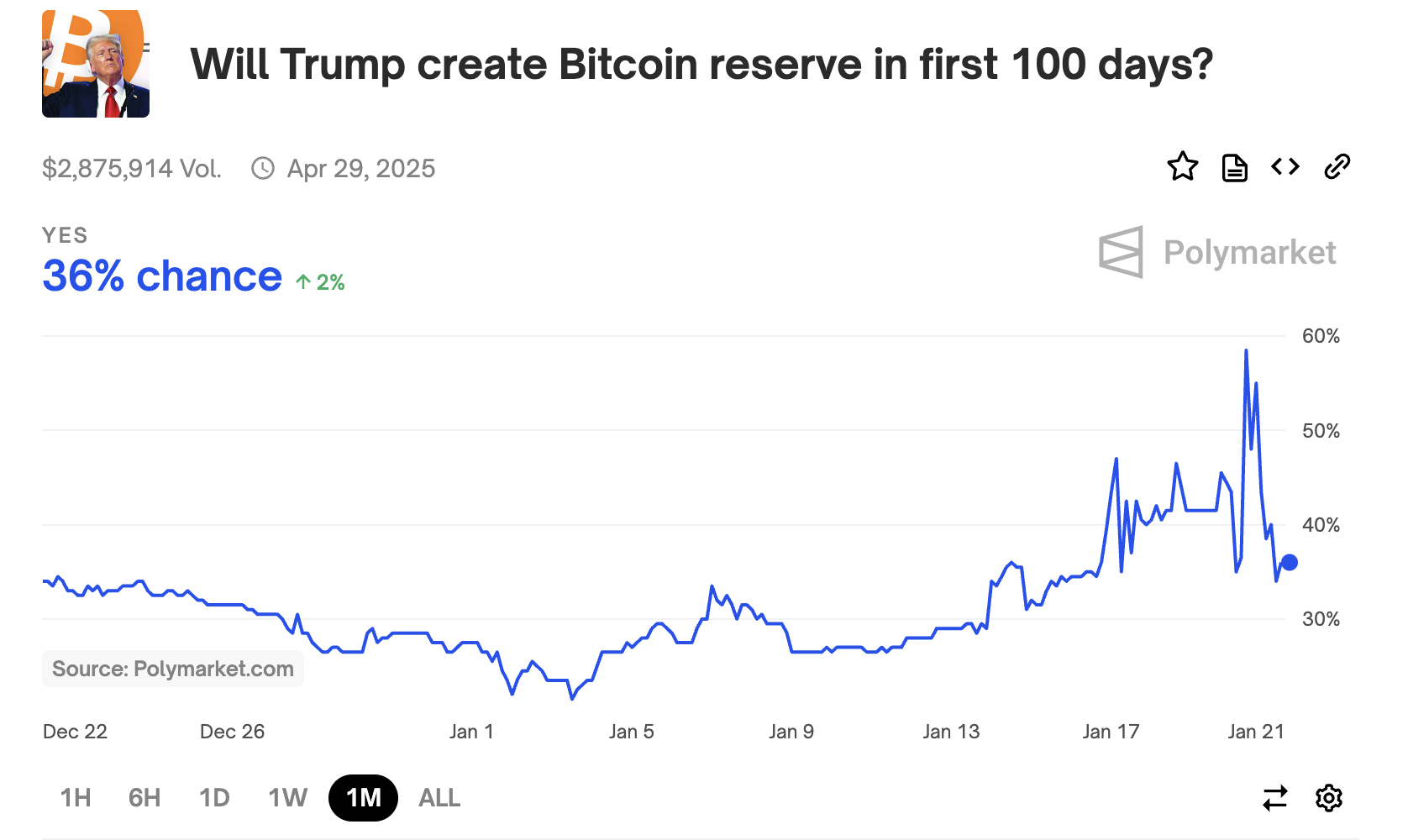

This possibility was first raised by Trump last summer, sparking boundless imagination in the crypto market. In the 100 days following today’s formal “inauguration,” market sentiment一度 suggested more than a 50% chance of it materializing (according to Polymarket betting data, now down to 36% at time of writing).

Many skeptics question BTC's stability and security, but supporters argue that a BTC reserve could strengthen the dollar and hedge against inflation. There is currently no consensus among analysts on whether Trump can use executive authority to create such a reserve, directly instruct the Treasury to spend funds, or whether congressional legislation would be required.

Next, I will walk readers through potential pathways for implementing such a reserve.

1. What Is a Strategic Reserve?

A strategic reserve refers to a stockpile of critical resources maintained by a nation to respond rapidly to emergencies, crises, or wartime scenarios. The most well-known example is the U.S. Strategic Petroleum Reserve—the largest national oil reserve system in the world (700 million barrels), established by an Act of Congress in 1975 in response to the 1973–1974 Arab oil embargo. The U.S. has drawn from this reserve during wars, hurricanes damaging Gulf Coast infrastructure, and the Ukraine war. The U.S. also maintains strategic reserves of gold, minerals, food, and military supplies.

2. How Would a U.S. BTC Strategic Reserve Work?

The primary question: Can Trump establish a BTC strategic reserve via executive power?

— Initial Source

The initial source of the reserve would most likely be BTC confiscated by the U.S. government from criminals—approximately 200,000 BTC, worth around $21 billion at current prices. Trump mentioned in a July speech that these seized coins could serve as the starting point for the reserve, though it remains unclear how they would be transferred out of the Department of Justice.

Trump has not yet clarified whether the government would purchase additional BTC on the open market to expand the reserve.

— Funding Source 1: ESF

Some believe Trump could use an executive order to leverage the Exchange Stabilization Fund (ESF) under the U.S. Treasury to create the reserve. This fund can be used to buy or sell foreign currencies and might also hold BTC. This option is relatively realistic and could be implemented quickly. The ESF has broad operational flexibility and does not require individual congressional approvals for its actions within defined limits. Currently holding over $200 billion, the ESF is primarily used to stabilize the dollar and support international monetary liquidity.

— Funding Source 2: Issuing New Debt

Another view suggests the government might issue new debt to finance BTC purchases—personally, I consider this unlikely. U.S. debt issuance requires congressional approval, and with recurring debt ceiling battles, neither party is likely to agree on increasing national debt to buy BTC. There are far higher-priority spending needs—Social Security, healthcare, defense, etc. That said, historically the U.S. has issued bonds to finance gold purchases, so there remains a slim possibility.

— Funding Source 3: Selling Gold

Some BTC reserve advocates imagine the U.S. could sell part of its gold reserves and use the proceeds to buy BTC. The main problem here is that selling gold could trigger severe disruptions in global gold markets, affecting reserve security worldwide and potentially destabilizing international financial systems. Gold serves as collateral for many financial institutions—its sale could have cascading effects. Moreover, given gold’s price stability, global recognition as a scarce asset, and high liquidity, swapping it for BTC seems improbable. Ideally, both assets should grow as reserves rather than one replacing the other.

— Funding Source 4: Launching a Government-Backed Token

In an era where the U.S. struggles with mounting debt while the president’s family launches their own tokens, creative thinking is warranted. It's conceivable that a federal agency could issue a new digital token. Large-scale government BTC purchases could distort the market, inflate prices, and create bubbles. When such bubbles burst, both the government and late-arriving investors could face massive losses.

Hence, the government could launch a program inviting individuals to deposit BTC or WBTC into a smart contract address, issuing a governance token in return—with no right to redeem the original assets, much like Trump’s $WLFI. Such a mechanism would likely attract significant participation, enabling the U.S. government to acquire BTC without distorting market prices or increasing public debt—an optimal solution.

— Funding Source 5: Creating an MSTR-Like Entity

The U.S. government could establish a government-controlled corporation that raises capital through debt or other capital market instruments to purchase BTC, thereby diversifying the nation’s strategic reserves. Similar to $MSTR, it could issue bonds, conduct equity offerings, or raise convertible debt—three-pronged financing.

There are precedents for federal ownership of corporate entities. Fannie Mae and Freddie Mac are prime examples. After being bailed out in 2008, they effectively became “government-sponsored enterprises,” with explicit federal backing for their debts. As corporate entities, they issue bonds and securities to finance and guarantee residential mortgages—not purely for shareholder profit, but for macroeconomic goals: enhancing housing market liquidity and lowering mortgage rates.

During the 2008 crisis, the U.S. Treasury and Federal Reserve provided massive loans to these two firms and later acquired majority stakes in them.

So is it possible for the government to invest in $MSTR or create a similar entity? Not entirely out of the question—if BTC becomes deeply embedded in traditional finance, reaching a level of systemic importance comparable to mortgage-backed securities, then maintaining its stability could become a policy priority.

— Potential Purchase Scale: One Million BTC

Currently, the most concrete BTC reserve proposal circulating in Washington comes from Cynthia Lummis, a pro-crypto Republican senator who owns 5 BTC herself. In July, she introduced a bill that has yet to gain traction—it would establish a Treasury-operated reserve.

Her proposal envisions the Treasury launching a program to buy 200,000 BTC annually over five years, totaling 1 million BTC. This would represent approximately 5% of the total BTC supply (~21 million). Funding would come from profits generated by Federal Reserve bank deposits and gold holdings. The BTC reserve would be held for at least 20 years.

Lummis’s proposal has not yet attracted congressional attention, and its chances of implementation remain uncertain.

— Perhaps States Will Lead the Way

Another possibility is a phased rollout—starting at the state level. States like Pennsylvania or Texas might take the lead (six U.S. states have already proposed BTC strategic reserve plans). State governments enjoy greater autonomy and could treat BTC as a hedge against fiscal uncertainty or a tool to attract crypto investment and innovation—paving the way for eventual federal adoption.

For example, in November last year, Pennsylvania introduced the “Pennsylvania BTC Strategic Reserve Act,” authorizing its Treasury to allocate 10% of its $7 billion reserve toward BTC investments.

One month later, Texas introduced a similar bill—the “Texas Strategic BTC Reserve Act”—proposing a special fund within the state treasury to hold BTC as a financial asset for at least five years.

— What Is WLFI Plotting?

Finally, Trump’s family-controlled project WLFI (WORLD LIBERTY FINANCIAL) has recently used raised funds to aggressively purchase over $50 million worth of cryptocurrencies—including LINK, AAVE, BTC, ETH, ENA, and TRX—with tens of millions more potentially to follow. Whether this has any connection to a potential U.S. strategic reserve remains unclear. I strongly suspect $WLFI is testing the feasibility of government-backed token sales.

3. What Are the Benefits of a BTC Reserve?

To justify such a policy, Democrats would need a coherent rationale.

Trump argues that a BTC reserve would help the U.S. dominate the global BTC market and counter competition from China.

Other proponents believe that holding BTC (which they expect to appreciate long-term) could reduce the federal deficit without raising taxes, thus strengthening the dollar. Lummis claims her plan could halve U.S. national debt within 20 years: “It will help us fight inflation and protect the dollar on the global stage.” Some supporters argue a stronger dollar would give the U.S. greater leverage against rivals like Russia and China.

4. What Are the Risks of a BTC Reserve?

Crypto skeptics argue that unlike most commodities, BTC lacks practical utility or intrinsic value and is not essential to the functioning of the U.S. economy. With only 16 years of history, BTC is still too young and volatile to assume sustained long-term value appreciation. Additionally, crypto wallets are vulnerable to cyberattacks. Critics also warn that due to BTC’s volatility, any government buying or selling could exert excessive influence on its price.

5. Summary: Wants To Do It, But No Money

Trump’s strategic reserve plan clearly faces major obstacles—the biggest being: where will the extra money come from to purchase new reserves? Until this question is resolved, large-scale federal BTC purchases are unlikely. However, we can reasonably expect some states to move forward independently.

More importantly, with Trump’s endorsement and continued regulatory easing—such as significant banking service liberalizations, which are arguably even more impactful than a BTC reserve—the visibility and adoption of cryptocurrencies will inevitably rise. Ultimately, the U.S. will embrace crypto on a broader scale.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News