The Binary Black Hole of Financial Populism: The Course Where Power, Innovation, and Opportunity Converge

TechFlow Selected TechFlow Selected

The Binary Black Hole of Financial Populism: The Course Where Power, Innovation, and Opportunity Converge

The crypto market, amid the interplay of politics and finance, is witnessing a global convergence of liquidity and technological innovation, with success hinging on self-awareness and forward-looking investment.

Author: @DoveyWan, Founder of Primitive Ventures

Translation: Baicai Blockchain

Within the past 24 hours, we have witnessed two historically significant moments. On one hand, TikTok has become a casualty in the ongoing new Cold War between the U.S. and China. On the other, the President of the United States has launched his own meme coin—built on a monetary network once marginalized and widely regarded as a breeding ground for scams. These two events occurring on the same day represent a perfect convergence of geopolitical tension and financial populism.

I remain confident about the future of this industry, as it is the most supranational, global, and permissionless experimental arena. Yet I also want to remind everyone to stay cautious at this stage of the cycle, as numerous signs suggest that this "violence of狂欢" resembles patterns from previous cycles that ultimately led to violent endings.

1. Politicized Financial Populism

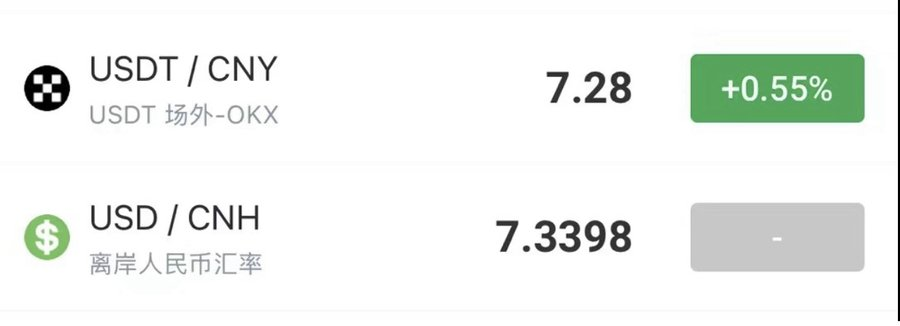

As we observe the "violent狂欢" surrounding $TRUMP, we must also pay attention to developments in East Asian markets: the onshore USDT/CNY exchange rate has reached an all-time high premium, reflecting strong over-the-counter demand for crypto assets among mainland Chinese investors. This marks the first time in this cycle that mass retail FOMO from ordinary Chinese investors has emerged—surpassing earlier trends like Bitcoin NFTs and Ordinals. In the last cycle, DeFi and GameFi attracted globally pooled liquidity; NFTs initially drew Western liquidity before incorporating Eastern capital. This cycle, however, meme coins on-chain were initially concentrated around assets favored by U.S. retail investors, such as Base and Solana. With the emergence of $TRUMP, global liquidity is now accelerating its convergence.

In local peer-to-peer OTC markets, the price of USDT/CNY continues to surge.

2. Western Market Dynamics

In Western markets, Moonshot has been overwhelmed by a flood of users rapidly entering the Solana ecosystem through its platform, propelling the app to the top of download charts. This pattern closely mirrors the previous cycle when Moonpay funneled massive fiat inflows into the ETH network and directly drove traffic to OpenSea.

Coinbase has sold out of SOL, resulting in severe withdrawal delays. This confirms my earlier prediction: centralized exchanges (CEX) will increasingly function as “ATMs” for the on-chain economy over the long term. Just as the DeFi boom and NFT craze in the last cycle accelerated Ethereum scaling solutions, Phantom wallet is now experiencing a staggering surge of over 8 million requests per minute—a level of traffic clearly unanticipated by this $3 billion infrastructure provider.

We are undoubtedly deep into a bull market, yet only a small number of altcoins have reached new all-time highs. This reflects both the industry’s maturing nature and one of the signs I pointed out last year: upstream liquidity drying up. While Trump’s “new order” will certainly create opportunities, sustainability becomes precarious when the market overly depends on a few key figures driving narratives through political spectacle (“pupamental” drivers).

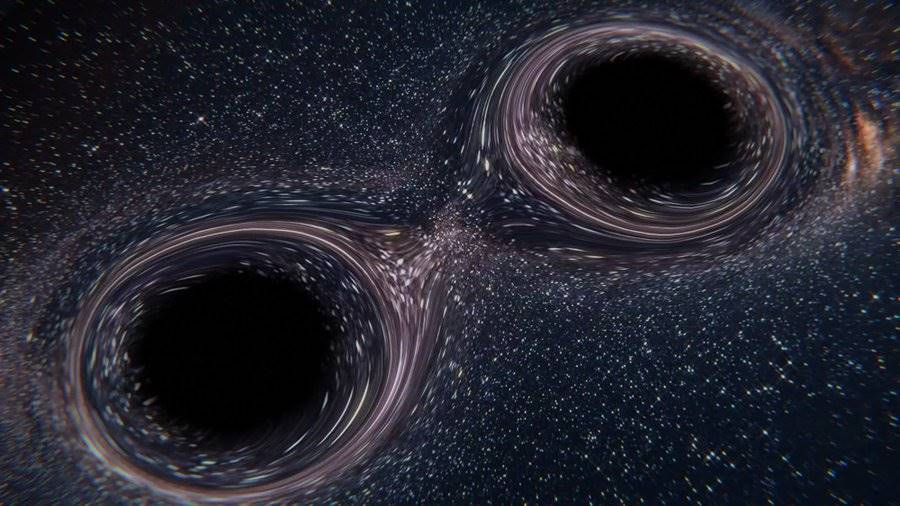

3. Distorted Starfields and Binary Black Holes

When financial populism becomes politicized, it behaves like a binary black hole system—two massive gravitational sources interacting in a powerful cosmic "dance." Just as this astrophysical phenomenon distorts surrounding starfields through extreme gravitational lensing, dragging spacetime itself into chaos, we are witnessing similar distortions in the real world. Social discontent is rising, tensions are escalating, and disorder has reached unprecedented levels. History repeatedly shows that "the violence of狂欢" often ends in violent collapse—but this time, we may have the chance to choose a different monetary trajectory or resource allocation path, potentially leading to more peaceful outcomes.

4. Missing the 100x

In my decade in this industry, I’ve never gotten rich overnight. I’ve missed countless opportunities that could have yielded 100x returns—and that’s okay. The temptation of rapid, outsized gains is undeniably hard to resist, but sustainable success comes from self-awareness: knowing which game you’re built to play. Over time, with consistent accumulation, the market will eventually present another 100x opportunity aligned with your strengths. This is the advice I offered @ManoppoMarco, helping him come to terms with missing his first major 100x as a crypto investor.

5. Play to Your Strengths

If your talent lies in being a PvP player in the meme coin arena, or a fast-reacting trend trader, embrace that edge and continuously sharpen your skills. Take @0xWangarian Darryl and his Pigeon account as an example. While some dismiss him as “a rich kid cosplayer profiting from dumps,” those familiar with his background and track record know he approaches trading execution and market analysis with rigor and passion comparable to any dedicated professional trader.

To those “trench warriors” who’ve earned easy eight-figure gains in the meme coin space, don’t overlook the immense effort behind their profit displays. Countless sleepless nights spent on-chain, relentless market research, and deep obsession with the craft—that’s what truly drives these life-changing results.

I hold deep respect for these trench warriors. Crypto remains one of the few battlefields where anyone, armed only with internet access, relentless willpower, and sharp insight, can achieve financial breakthroughs. It's a meritocratic arena where effort and skill still have the power to rewrite one’s origins.

However, if this isn’t your strength, blindly chasing the "violence of狂欢" could turn into a destructive game. Unless it aligns with your core advantages, money will never come easily. Understanding who you are, what kind of game suits you, and which trench you belong in—this is the foundation of growth. Markets have their rhythm, but success lies in finding your own melody and confidently dancing with it.

6. A Non-Violent End

From the 19th-century adage “the pen is mightier than the sword” to the early 21st-century notion that “software is eating the world,” we now stand at the intersection of a transformative shift:

-

Binary code is evolving into monetary code

-

Machine programs are reshaping social contracts

-

Human language is becoming programming language

Every major socioeconomic transformation occurs through “harvesting entropy”—establishing new orders, typically in the form of entirely new value chains, fundamentally altering how humans collaborate economically and politically. For instance, the Industrial Revolution redefined social contracts through machine automation; the rise of the internet and cryptographically secured digital assets—native internet money—transformed binary code into monetary code. Today, we are entering a new era where human language itself is evolving into programming language, enabling individuals not just to be “10x better,” but capable of achieving “100x capability” breakthroughs.

The future has already begun unfolding—though unevenly distributed. Those bold enough to commit early along the hype cycle, capable of integrating Eastern and Western resources and perspectives, and equipped with global thinking, will inevitably become the protagonists of this era, writing their own chapters in history.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News