Phantom Raises $150 Million in Lavish Funding, But You Might Not Get the Airdrop

TechFlow Selected TechFlow Selected

Phantom Raises $150 Million in Lavish Funding, But You Might Not Get the Airdrop

For airdrop hunters, it remains unclear whether they can share in Phantom's growth红利.

By Pzai, Foresight News

On January 16, crypto wallet Phantom announced the completion of a $150 million Series C funding round at a $3 billion valuation, led by Sequoia Capital and Paradigm, with participation from a16z crypto and Variant. The funds will be used to further develop its application. This is likely the largest financing news in the crypto space recently.

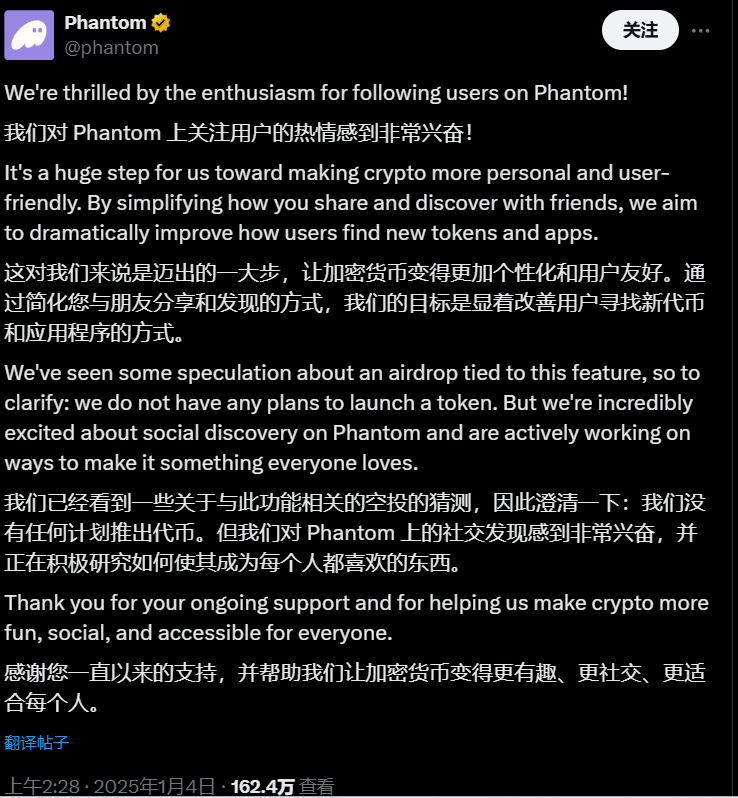

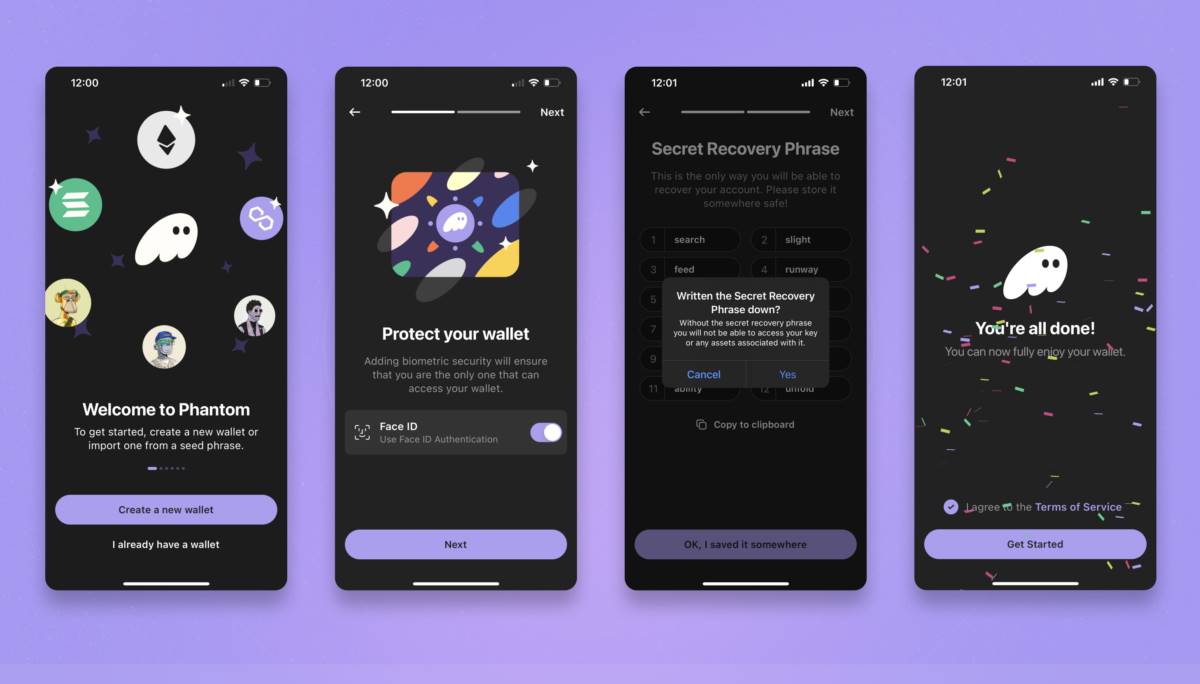

As the leading player in the Solana wallet sector, Phantom has quickly become one of the preferred tools for crypto users thanks to its clean user interface, multi-chain support, and self-custody security. At the same time, Phantom's fundraising has sparked market speculation about its future trajectory. While many crypto projects choose to issue tokens for fundraising and user incentives, Phantom’s founders have repeatedly emphasized their focus on product and user experience rather than tokenomics. In a recent statement, Phantom also confirmed it has "no plans to launch a token for now." This article will deeply examine from multiple perspectives whether Phantom will eventually enter the era of token economics.

Strong Cash Flow

In a 2022 interview, Phantom CEO Brandon Millman clearly stated that Phantom’s core goal is to deliver a best-in-class user experience, not to profit through token issuance. He stressed that Phantom sees itself as a “consumer finance platform,” not just another crypto project, and prefers to pursue long-term growth through traditional financial models rather than relying on token economies. Just over a week ago, Phantom tweeted that it has “no plans to launch a token.”

From a user perspective, wallets are indeed convenient entry points, and issuing a token could create value—such as governance rights, revenue sharing, and enhanced user retention—potentially creating a positive flywheel effect. However, the inherent volatility of the crypto market also introduces uncertainty that could disrupt a project’s development path.

Looking at the investment styles of VCs involved, lead investors Sequoia Capital and Paradigm tend to back projects with clear business models and strong long-term growth potential, especially in infrastructure. Their portfolio companies such as OpenSea and Zora have all expressed varying degrees of skepticism toward token economies.

As an established player in venture capital, Sequoia approaches crypto investments with extreme caution. Within a compliance-focused framework, exiting via IPO aligns better with the preferences of traditional giants like Sequoia, further casting doubt on any potential Phantom ICO.

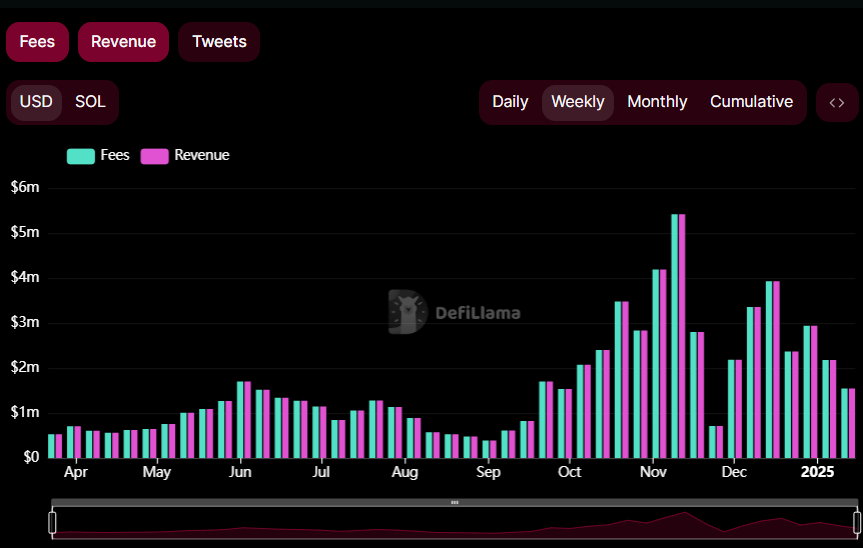

In terms of scale, Phantom currently boasts 15 million monthly active users, manages $25 billion in self-custodied assets, and has processed 85 billion on-chain transactions. Revenue-wise, Phantom primarily earns from transaction fees. During peak periods on Solana, weekly transaction revenue exceeds $5 million, translating to an estimated annual revenue of around $80 million—making it a standout performer in the crypto industry. This stable cash flow and massive user base make Phantom a strong candidate for a traditional IPO.

Against the backdrop of Trump-era crypto regulatory clarity, liquidity for crypto-related U.S. stocks is gaining broader market acceptance. Precedents set by successful public companies like MicroStrategy and Coinbase appear to offer a viable roadmap for Phantom, paving the way for a potential future IPO.

Lessons from Competitors

Within the wallet space, there are already several projects that have embraced token economies. Trust Wallet, Safe, and Bitget Wallet (now merged into BGB) have all issued their own tokens in different ways, leveraging token value to strengthen their ecosystem positioning. These benefits may include:

-

(Trading revenue) Governance rights: Distributing trading revenue to (staked) users via tokens. For example, Tokenlon DEX under imToken uses the LON token to distribute and repurchase trading fees.

-

Ecosystem airdrops: Projects within a wallet’s associated ecosystem collaborate closely with the wallet provider to offer services and incentives to users. This requires tight cooperation between the wallet and ecosystem partners and often carries strong ecosystem endorsement—such as Trust Wallet with BSC, Phantom with Solana, and Safe with the broader EVM ecosystem.

-

Payments: Fee discounts or simplified experiences for users paying with the native token.

In summary, Phantom’s high-profile funding reflects strong confidence from capital markets and serves as another example of a crypto project winning favor from traditional VCs. Yet for blockchain enthusiasts accustomed to hunting airdrops, the opportunity to share in Phantom’s growth remains uncertain.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News