From RWA to RWAfi, Will Plume Be the Alpha Key to Capturing a Trillion-Dollar Epic Narrative?

TechFlow Selected TechFlow Selected

From RWA to RWAfi, Will Plume Be the Alpha Key to Capturing a Trillion-Dollar Epic Narrative?

RWA tokenization is just the first step; RWAfi is the real answer to capturing future growth.

From a purely data-driven perspective, the RWA narrative is undoubtedly the clearest alpha opportunity in the "blockchain+" space over the next decade.

RWA research platform rwa.xyz reports that the current total market size for RWAs exceeds $15 billion. Fidelity predicts this figure will double to $30 billion by 2025, while BlackRock offers an even more optimistic outlook, forecasting that the market capitalization of tokenized assets could reach $10 trillion by the 2030s.

In other words, the potential growth of the RWA narrative over the next seven years could exceed 700x! However, beneath this lies a critical question: who will truly capture the incremental value of this epic narrative?

Source: rwa.xyz

This should be the billion-dollar question for the entire RWA sector going forward—and the answer may lie hidden within the infrastructure built around RWAfi public blockchains.

RWAfi: The Historic Opportunity for RWA

At its core, moving real-world assets (RWA) onto the blockchain only completes the first step—tokenization—and falls far short of unlocking their true potential. To fully realize on-chain value, we need more efficient underlying technical architectures, open foundational toolkits, and robust ecosystem coordination.

In simple terms, RWA onboarding requires not just technological breakthroughs but an end-to-end service framework covering the full lifecycle of RWA assets—especially enabling secure, low-barrier integration of RWA into diverse DeFi scenarios, transforming traditional asset存量 into on-chain增量 value.

This is precisely where RWAfi comes in. Within a tokenization framework, RWA not only gains enhanced liquidity but can also generate DeFi yields through lending and staking, bringing real yield-backed assets into DeFi and strengthening the value foundation of the crypto market.

Vitalik Buterin once offered an interesting analogy: each blockchain network has its own unique "soul." Some focus deeply on niche DeFi applications, others specialize in NFTs or DAO ecosystems, while some are dedicated to incubating ZK applications.

Yet when we turn our attention to the RWA ecosystem, a curious reality emerges: despite growing interest in RWA, there are very few public blockchains natively designed to manage and circulate real-world assets—chains like Ethereum and Avalanche, though active in RWA, were not originally built to handle trillions of dollars in real-world assets.

The reason is simple: the core mission of RWAfi is to enable free circulation of real-world assets on-chain. Compared to typical DeFi applications, it faces additional challenges beyond complexity—how to make RWA truly “active” on-chain:

-

On one hand, anchoring real-world asset ownership on-chain involves complex tokenization processes and multi-party collaboration, requiring solutions for security, compliance, liquidity, cross-chain interoperability, and developer-friendly environments to ensure efficient liquidity and transparency;

-

On the other hand, tokenization alone isn’t enough. After going on-chain comes empowerment—the real value of RWA lies in building transparent, efficient, and highly liquid on-chain financial markets via blockchain technology. This requires deep integration with DeFi protocols, yield distribution mechanisms, and risk management systems, granting RWA the same liquidity, composability, and interoperability as native crypto assets.

Take real estate as an example: once tokenized and brought on-chain, it ceases to be a "static" asset in the traditional sense. It can participate in various DeFi use cases—such as using smart contracts to transparently distribute rental income or serving as collateral for on-chain financing. Such empowerment demands higher technical and ecosystem standards, breaking down inherent limitations of real-world assets and injecting new dimensions of composability and application potential.

Thus, many may not realize that RWAfi is not merely a technical solution—it fundamentally creates a new asset class with native real yield properties. By introducing real-world assets, capital, and cash flows, it injects blockchain ecosystems with intrinsic “real yield” characteristics.

Against this backdrop, although many blockchain networks have begun exploring RWA, most remain superficial, lacking comprehensive technical support and ecosystem development. The success of RWAfi hinges not only on completing tokenization but providing end-to-end solutions—from development to operation.

Developers and users alike require accessible development environments, scalable infrastructure, and secure, compliant foundations. Hence, the core demand of the future billion- or even trillion-dollar RWA market becomes clear: dedicated RWA blockchains.

Such chains must serve both institutional and crypto-native users. In this vision, an RWAfi blockchain does more than empower RWA assets—it could become the central value capturer within the RWA ecosystem, acting as a hub for liquidity and settlement. All DeFi interactions involving RWA tokens—such as yield farming and抵押 operations—can converge and accumulate value through the RWAfi chain, further driving expansion of the RWA sector.

In short, a dedicated L1 RWA blockchain is a means, not an end. The players most likely to capture the incremental value of the RWA space will be those offering holistic solutions spanning infrastructure to ecosystem enablement—those capable of seamlessly and efficiently running the entire pipeline from “onboarding” to “empowerment.”

Therefore, from this perspective, the golden age of dedicated RWA chains has already arrived.

Plume and the New Paradigm of 'One-Stop RWA Chains'

RWAfi enjoys another natural advantage:

No matter which sub-sector or product ultimately prevails under the broader RWA narrative, as long as the overall market continues to grow, RWAfi blockchains that provide foundational infrastructure will gain access to a future market worth hundreds of billions—or even trillions—of dollars, capturing the underlying incremental value.

After all, RWA is increasingly becoming the primary driver of digital asset growth on-chain, enabling Web3 to tap into vast pools of traditional market assets—such as the global bond market ($133 trillion) and gold market ($13.5 trillion).

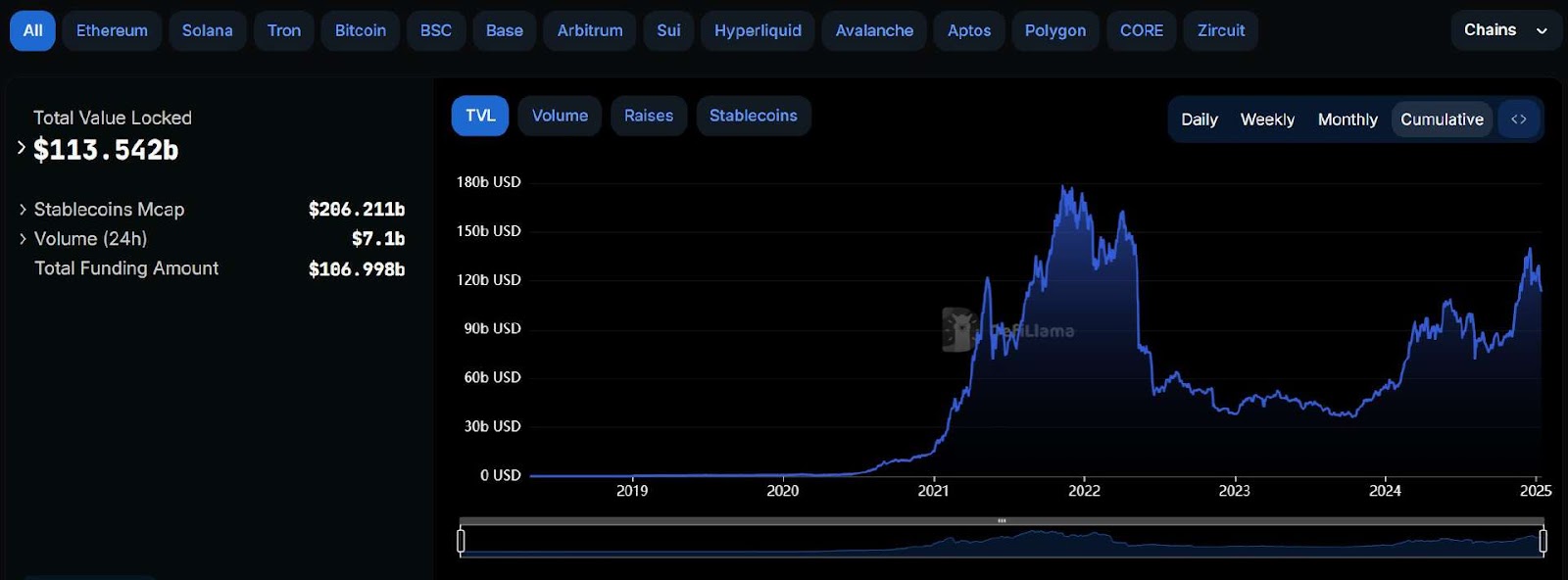

Since Compound ignited the DeFi summer in 2020, the on-chain digital asset ecosystem has seen significant growth. Even after a major pullback from the November 2021 peak of $180 billion, total value locked (TVL) still stood at $113.5 billion as of January 13, 2025.

Source: DeFiLlama

However, compared to the multi-trillion-dollar universe of tokenizable RWA assets—bonds, gold, equities, real estate—this figure remains insignificant. Thus, RWA tokenization will undoubtedly bring a powerful new wave of growth, opening unprecedented market opportunities on-chain.

Yet there are extremely few L1 blockchains explicitly positioned as RWAfi platforms. Plume, which recently raised $20 million in a new funding round, stands out as nearly the only true RWAfi blockchain today—an event that marks a milestone in the RWAfi space.

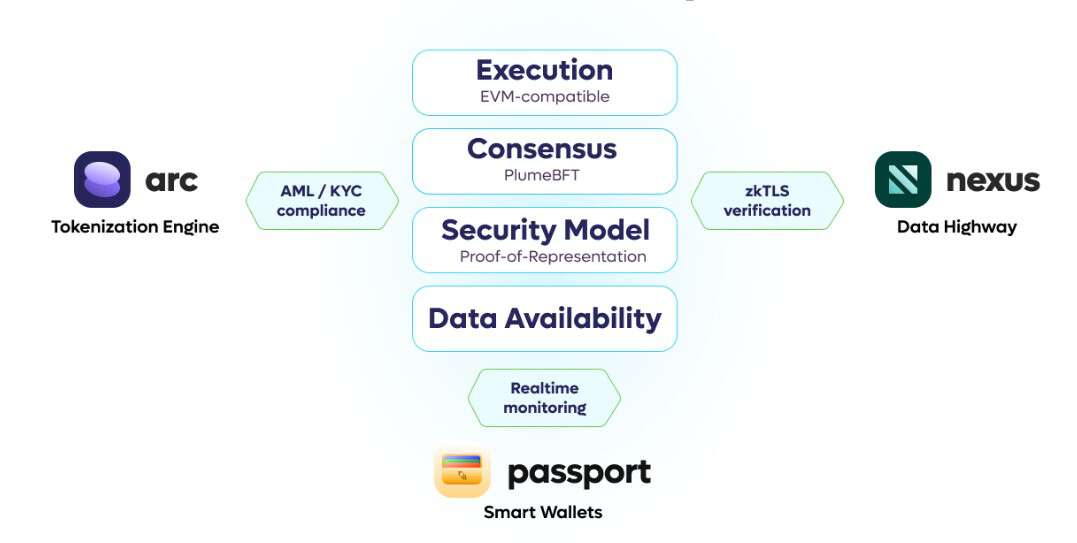

Plume’s defining feature is its modular design. Through a one-stop solution, it systematically addresses key challenges in RWA tokenization: compliance, liquidity, and interoperability—offering developers and institutions a complete toolkit for the full lifecycle of RWA tokenization.

This systematic approach deserves close attention. For a blockchain, how “advanced” the technology is matters less than whether developers and users choose to adopt and stay on the platform—that’s the real competitive edge. Especially for RWA, which involves high complexity across on- and off-chain components, fragmented point solutions won’t attract serious developer or institutional adoption.

Plume’s strength lies in integrating multiple modular tools into a unified suite, giving developers a full-stack solution for bringing RWA on-chain. These tools lower technical barriers and embed compliance directly into the system via a “compliance-as-a-service” model, integrating regulated partners upstream to ensure tokenized assets meet regulatory standards from day one:

-

Arc – Tokenization Engine: Arc streamlines the tokenization process by integrating compliance workflows and reducing barriers for asset issuers, offering an effective path to bring RWA on-chain;

-

Passport – Smart Wallet: Passport allows users to store contract code directly within their externally owned accounts (EOA), a native function supporting composable RWAfi, yield management, and advanced account abstraction;

-

Nexus – Data Highway: Nexus securely integrates real-world data into blockchains using cutting-edge technologies like zkTLS, enhancing on-chain security and transparency while unlocking novel use cases;

Through these modular tools, Plume empowers developers and significantly lowers the barrier for traditional financial institutions entering Web3. Developers benefit from reduced technical complexity, enabling rapid deployment of sophisticated RWA solutions; meanwhile, the “compliance-as-a-service” model helps traditional firms overcome regulatory hurdles while receiving strong technical support.

This means Web2 giants like UBS or Blackstone looking to enter Web3 can leverage Plume’s one-stop RWA tokenization services to directly embed tokenization capabilities into existing products, accelerating product iteration and market expansion.

It enables institutions to easily tokenize assets and introduce them into the blockchain ecosystem, while preserving the smooth user experience of Web2 and empowering users with asset sovereignty and Web3 functionality.

From a macro perspective, in the Web2 world ruled by private traffic, maximizing profits came down to capturing as much private user data as possible—leading to fat apps and thin protocols, with super-apps like WeChat, Alipay, and Meituan growing ever larger through closed ecosystems.

In Web3, the logic flips:底层 components and middleware are gaining traction, acting as “building blocks” that plug into various layers and capture maximum aggregation value. Plume’s modular infrastructure perfectly aligns with this Web3 product philosophy, offering lightweight RWA integration tools so traditional institutions and Web2 giants can rapidly transition into Web3.

This is where Plume’s appeal lies. For the RWAfi sector, future competition won’t just be about technical prowess, but about building an efficient, user-friendly ecosystem support system centered around developers and users. This model of connecting on-chain innovation with off-chain assets could become the true inflection point for RWA’s evolution.

The Inevitable Path for RWAfi: Bridging Institutions and the DeFi 'Friend Circle'

For Web3, “incremental growth” is the eternal theme—whether in new capital inflows or expanding user bases.

The core appeal of RWAfi lies precisely in its innate “two-way connection”: linking both old and new Web3 participants, while bridging the massive dormant assets of traditional finance. This not only opens new asset classes and yield opportunities for crypto-native users but also paves the way for traditional financial titans to deeply integrate with the on-chain DeFi world, creating a powerful “1+1 > 2” synergistic effect.

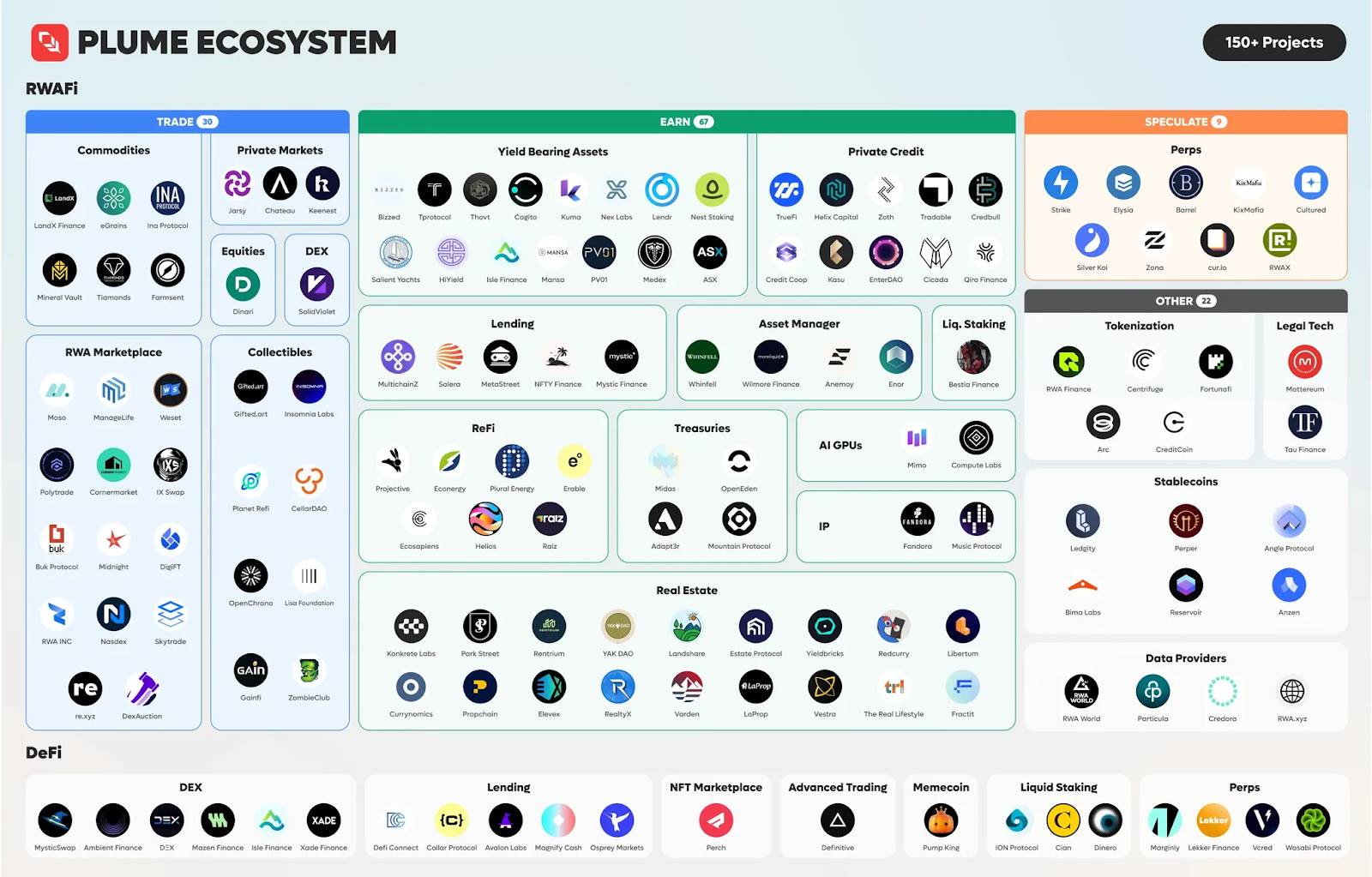

Take Plume as an example: it currently builds a dual-focused ecosystem anchored by institutional partners and extended through DeFi collaborations:

-

Institutional Partners: Provide compliance, trust, and high-quality assets—forming the trusted core of its RWAfi ecosystem;

-

DeFi Partners: Offer flexible, high-yield participation options for on-chain users, further boosting RWA liquidity and composability;

A closer look reveals Plume’s institutional network focuses on traditional asset tokenization, compliance, and asset management—leveraging Plume’s on-chain infrastructure to enhance RWA liquidity and transparency, paving the way for deeper integration between traditional finance and RWAfi. Examples include:

-

Anchorage Digital Bank: Provides compliant custody for Plume’s on-chain assets, allowing institutional clients direct access to RWA yields;

-

DeFiMaseer: Institutional partner focused on carbon market tokenization, bringing $200 million in carbon allowances on-chain to improve regulatory efficiency and accessibility;

-

DigiFT + UBS: Collaborated to launch uMint, advancing the tokenization of financial assets on-chain;

-

Dinari Global + Blackstone: Bringing Blackstone’s ETFs on-chain to boost institutional asset liquidity;

-

Elixir + Blackstone: Supporting Elixir in building more on-chain asset circulation infrastructure;

-

NestCredit + MountainUSDM + m0 Foundation + Anemoy Capital/Centrifuge: Building a multi-party cooperation network to drive sustainable development of diverse on-chain assets;

-

Pistachiofi: Introducing real yield services on-chain for LATAM and APAC regions, expanding regional market coverage;

-

Busha: Providing on-chain real yield for African markets, broadening the global reach of financial services;

-

Cultured RWA: Exploring the speculative potential of RWA ecosystems on-chain;

-

Google Cloud: Leveraging AI to offer RWA pricing services, making on-chain asset valuation smarter and more efficient;

Meanwhile, DeFi protocols integrated with Plume primarily convert the存量 benefits of traditional assets into on-chain增量 value—through liquidity provision, yield optimization, and new use case exploration—offering diverse participation avenues for on-chain users:

-

Ondo Finance: Leading protocol for tokenizing U.S. Treasuries (USDY), injecting credible asset liquidity into Plume’s RWA ecosystem;

-

Anzen Finance: Innovating stable asset offerings on-chain (USDz), improving the tokenization experience for dollar-denominated assets;

-

Royco (Berachain): Offering transparent yield liquidity markets tailored for DApps, expanding into the RWAfi ecosystem through partnership with Plume;

-

Bouncebit: As a CeDeFi gateway partner, enables users to access trusted institutional-grade yield products via its platform, amplifying Plume’s influence in the CeDeFi space;

-

Midas: A DeFi project focused on high-yield, institutional-grade assets, offering Plume users more on-chain yield options;

-

PinLink: DeFi infrastructure provider collaborating with Plume to introduce fractionalized DePIN assets and yield opportunities, enhancing ecosystem liquidity;

-

Avalon Finance: Plume’s BTCfi liquidity layer partner, focusing on Bitcoin lending and circulation within the RWAfi environment, further expanding use cases for on-chain assets;

Objectively speaking, Plume’s team carries a strong “tech + market” DNA—featuring both degens from Web3 giants like Coinbase, BNB Chain, and Galaxy Digital, as well as veterans from traditional finance and tech such as Robinhood, JPMorgan, and Google. This enables them to effectively address the complex needs of traditional financial markets while leveraging the unique advantages of blockchain technology to build modular, compliance-friendly infrastructure.

Overall, Plume has already established two expansive ecosystem layers: one comprising both veteran and emerging Web3 participants (on-chain, token-based), and the other including traditional financial titans (off-chain, RWA-focused). With over 180 apps and protocols accumulated and its testnet attracting more than 3.75 million users generating hundreds of millions of transactions, results have been impressive.

This dual-track collaborative network advances both fronts—Web3 players (on-chain, DeFi protocols) and traditional finance (off-chain, RWA)—with Plume serving as the indispensable infrastructure bridging the two. As the RWAfi ecosystem matures, Plume is poised to become essential infrastructure—critical, irreplaceable, and deeply embedded.

This further reinforces Plume’s unique positioning as a “full-stack RWAfi infrastructure,” directly capturing core value generated during RWA tokenization, liquidity aggregation, and on-chain operations—from asset minting to deep DeFi integration, offering comprehensive technical and ecosystem support, enabling seamless conversion of traditional asset value into on-chain growth.

From this vantage point, such “full-lifecycle empowerment” represents the non-replicable competitive edge of RWAfi-dedicated chains like Plume. These chains don’t just serve institutions and developers—they engage end-users directly, capturing participation value and sharing in the broad-scale growth红利 of the wider RWA ecosystem, becoming the core engine powering trillion-dollar market expansion.

Interestingly, as a sector closely tied to regulation, Plume holds an often-overlooked policy advantage: Katie Haun, one of Plume’s investors, previously served as Assistant U.S. Attorney and Cryptocurrency Coordinator at the Department of Justice, former a16z partner, and joined the Coinbase board. She is among the rare few in the crypto industry who deeply understand the profound impact of U.S. regulation on blockchain.

This background positions Plume much closer to regulatory centers of power—an important positive signal. As the U.S. regulatory framework evolves, especially with the appointment of crypto-friendly officials in the Trump administration post-January 20, Plume is well-positioned to become the RWAfi project closest to the “core of U.S. regulation,” potentially reaping the largest policy support and market红利.

Conclusion

Great winds arise from the rustling of grass. Market logic always follows subtle threads—every narrative's value discovery unfolds according to its internal logic.

RWAfi is one of the few narratives today capable of bridging on-chain and off-chain worlds, drawing its potential equally from Web3 innovation and the immense存量 of traditional financial assets.

The value of RWAfi blockchains needs no further explanation—they serve as the foundational infrastructure that elevates RWA tokenization into a true “Internet of RWA Assets,” offering a viable roadmap for billion-dollar growth in the RWA narrative.

Whether leaders like Plume—balancing both on-chain (DeFi) and off-chain (traditional finance) ecosystems—will emerge as winners depends on their ability to continuously attract developers, grow their ecosystems, and foster vibrant integration between on- and off-chain worlds. After all, in a blue ocean unclaimed by any player, opportunity has only just begun. Everything remains uncertain.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News