Chain of Thought Founder's 2025 Crypto AI Top Ten Predictions: Market Cap to Surpass $150 Billion, Bittensor May Stage a Comeback

TechFlow Selected TechFlow Selected

Chain of Thought Founder's 2025 Crypto AI Top Ten Predictions: Market Cap to Surpass $150 Billion, Bittensor May Stage a Comeback

99% of crypto AI agents will fail; only the truly useful ones will survive.

Author: Teng Yan

Translation: TechFlow

On a crisp January morning in 2026, you find a slightly worn newspaper at your doorstep—yes, printed on real paper. In an era where the AI revolution has swept through everything, the survival of physical newspapers is nothing short of remarkable.

Flipping it open, a bold headline catches your eye: AI agents are coordinating global supply chains on blockchains, while new crypto AI protocols fiercely compete for dominance. An entire page details a digital "worker" hired as a project manager. Today, such scenes have become routine, barely raising eyebrows.

Just months ago, if someone had told me this would happen, I might have laughed and even bet my portfolio that these developments were at least five years away. Yet, the pace of progress in crypto AI is staggering. I firmly believe this will be a transformative wave.

At the start of this new year, I want to share content that sparks thought and discussion. And what better way to ignite curiosity than predicting the future?

Though I rarely make predictions, the evolution of crypto AI is simply too exciting. There’s no historical precedent, no clear trendlines—just a blank canvas for us to imagine the blueprint of tomorrow. The idea of looking back two years from now to see whether these forecasts come true adds to the fun.

Here are my predictions for 2025:

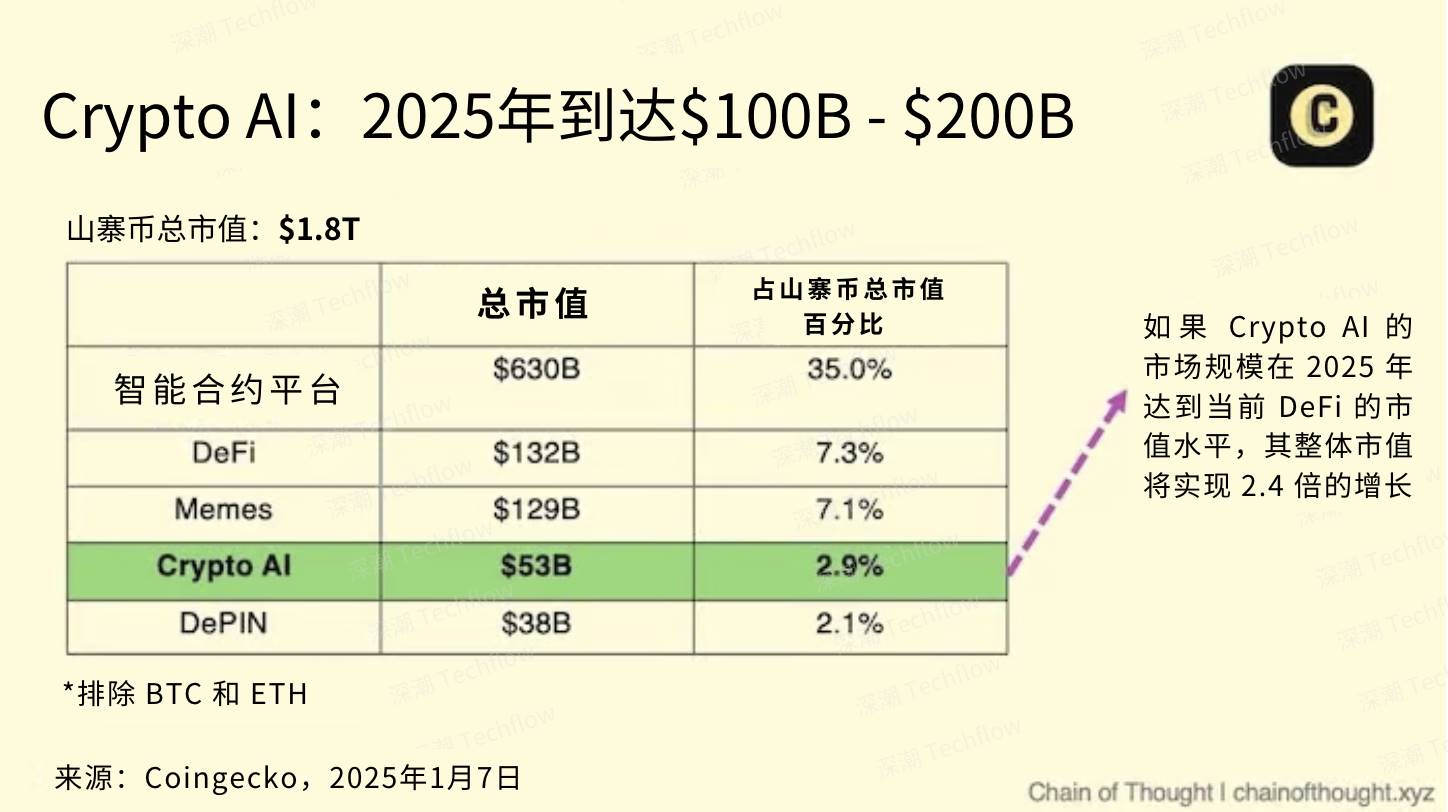

1. Crypto AI Market Cap Surpasses $150 Billion

Image: From Chain of Thought, translated by TechFlow

Currently, the market cap of crypto AI tokens accounts for only 2.9% of the altcoin market. But this won’t last long.

As AI technology expands across new domains—from smart contract platforms and memes to DePIN (decentralized physical infrastructure networks), agent platforms, data networks, and intelligent coordination layers—it's only a matter of time before its market cap rivals that of DeFi and meme tokens.

Why am I so confident in this prediction?

-

Convergence of technological trends: Crypto AI sits at the intersection of two of the most powerful technological movements—blockchain and artificial intelligence.

-

Triggering an AI frenzy: If OpenAI goes public or a similar event occurs, it could spark a global AI craze. Meanwhile, Web2 institutional capital is already turning attention toward decentralized AI infrastructure.

-

Retail enthusiasm: AI is an accessible and exciting concept, and tokens allow everyday investors to participate directly. Remember the meme coin mania of 2024? This will be a similar surge—but with far greater potential than memes.

@hingajria: “When Nvidia, the most popular stock in this market cycle, has its CEO declare that AI agents represent a trillion-dollar opportunity—and retail investors have almost no effective way to access it except through so-called 'smart memes' or tokens—it becomes obvious where the money will flow.”

2.Bittensor: The Coming Revival

Source: Nineteen.ai (Subnet 19) shows inference speeds significantly outperforming most traditional Web2 providers. Translated by TechFlow

Bittensor (TAO) has been deeply rooted in both blockchain and AI for years, widely regarded as a pioneer in the space. However, despite the ongoing AI boom, TAO’s token price has remained stagnant, nearly unchanged from a year ago.

Yet, behind the scenes, this so-called “digital hive” has made significant strides. For example, Bittensor has added more subnets and reduced registration fees; certain subnets have surpassed traditional Web2 service providers in real-world performance metrics like inference speed; and by achieving EVM (Ethereum Virtual Machine) compatibility, Bittensor has brought DeFi-like functionality into its network.

So why hasn't TAO taken off yet? Two main reasons: First, TAO’s inflation schedule is steep. Second, market focus has gradually shifted toward agent-centric platforms. However, dTAO, expected to launch in Q1 2025, may be the turning point for TAO. dTAO allows each subnet to have its own token, with relative pricing determining how block rewards are allocated.

Key reasons Bittensor could see a revival:

-

Market-driven reward mechanism: With dTAO, block rewards are tied directly to a subnet’s innovation and real-world performance. Higher-performing subnets earn more value and thus receive larger rewards.

-

More concentrated capital flows: Investors can allocate funds to specific subnets they believe in. If a subnet excels in distributed training, for instance, investors can express confidence by supporting its token.

-

EVM integration: Bittensor’s EVM compatibility attracts native crypto developers, strengthening ties with other blockchain ecosystems.

Personally, I’ll be closely watching subnet developments—especially those making tangible progress in their fields. Perhaps we’re approaching a “DeFi summer” moment for Bittensor. At the time of writing, TAO trades at $480.

Additionally, compute marketplaces are likely to become the next hot trading sector among Layer 1s.

3. Compute Marketplaces: The Next L1 Hot Sector

Jensen Huang: Inference demand will grow by “a billion times”

In hindsight, one trend will stand out clearly—the demand for computing resources is virtually limitless.

NVIDIA CEO Jensen Huang once predicted AI inference demand would increase “a billion-fold.” This exponential growth will completely disrupt traditional infrastructure planning, demanding entirely new solutions.

Decentralized compute layers are emerging, offering verifiable computational power at lower costs—for both AI model training and inference. Startups like Spheron, Gensyn, Atoma, and Kuzco are quietly building products rather than launching tokens (none have issued tokens yet). As decentralized AI model training becomes feasible, the market’s potential will explode.

Parallels with L1s:

-

Competitive landscape: Similar to the 2021 race between Solana, Terra/Luna, and Avalanche, we’ll see fierce competition among compute protocols vying to attract developers and AI applications to build ecosystems atop their layers.

-

Massive market potential: The current cloud computing market, valued between $680 billion and $2.5 trillion, dwarfs the crypto AI space. Even capturing a small fraction of traditional cloud customers could trigger the next 10x or even 100x growth wave.

This battle is about the future. Just as Solana rose in the L1 arena, the winner here will dominate a new technological frontier. Watch for three key factors: reliability (e.g., SLAs), cost efficiency, and developer-friendly tooling. We’ve written more about decentralized compute in Part II of our Crypto AI thesis.

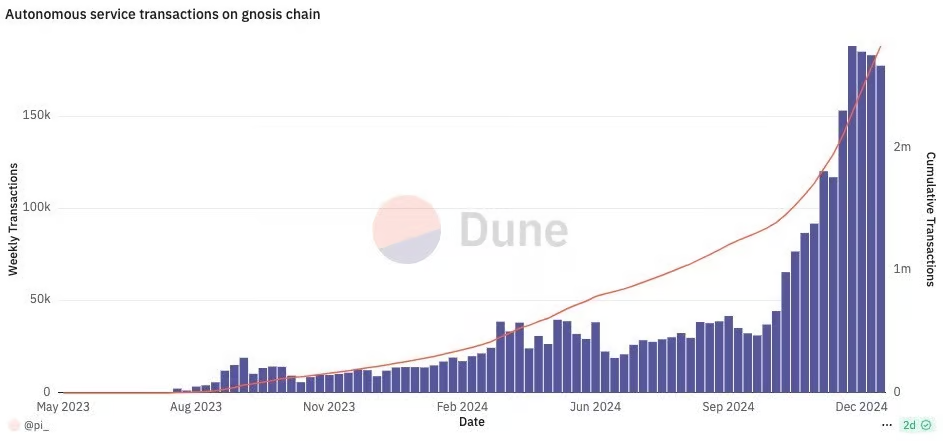

4. AI Agents Will Dominate Blockchain Transactions

Olas agent transactions on Gnosis

Source: Dune/@pi_

By late 2025, the on-chain transaction landscape will shift dramatically—90% of transactions will no longer involve humans manually clicking “send.”

Instead, a team of AI agents will take over, efficiently executing tasks like rebalancing liquidity pools, distributing rewards, or making micropayments based on real-time data streams.

This isn’t science fiction. Over the past seven years, every piece of blockchain infrastructure we've built—from L1s, rollups, DeFi, to NFTs—has essentially laid the groundwork for an AI-dominated on-chain world.

Ironically, many developers may not realize they’re building core infrastructure for a machine-driven future.

So why this shift?

-

Eliminating human error: Smart contracts execute exactly as coded, while AI agents process massive data faster and more accurately than any human team.

-

Efficiency in micropayments: Driven by agents, transactions will become smaller, more frequent, and highly efficient—especially on low-cost L1s and L2s like Solana and Base.

-

Rise of invisible infrastructure: People willingly trade direct control for convenience. We trust Netflix to auto-renew subscriptions—so trusting AI agents to rebalance DeFi portfolios feels natural.

The rise of AI agents will generate massive on-chain activity. That’s why every major L1 and L2 is racing to attract them.

But the biggest challenge lies in ensuring accountability. As agent-initiated transactions vastly outnumber human ones, new governance models, analytics tools, and auditing methods will be essential.

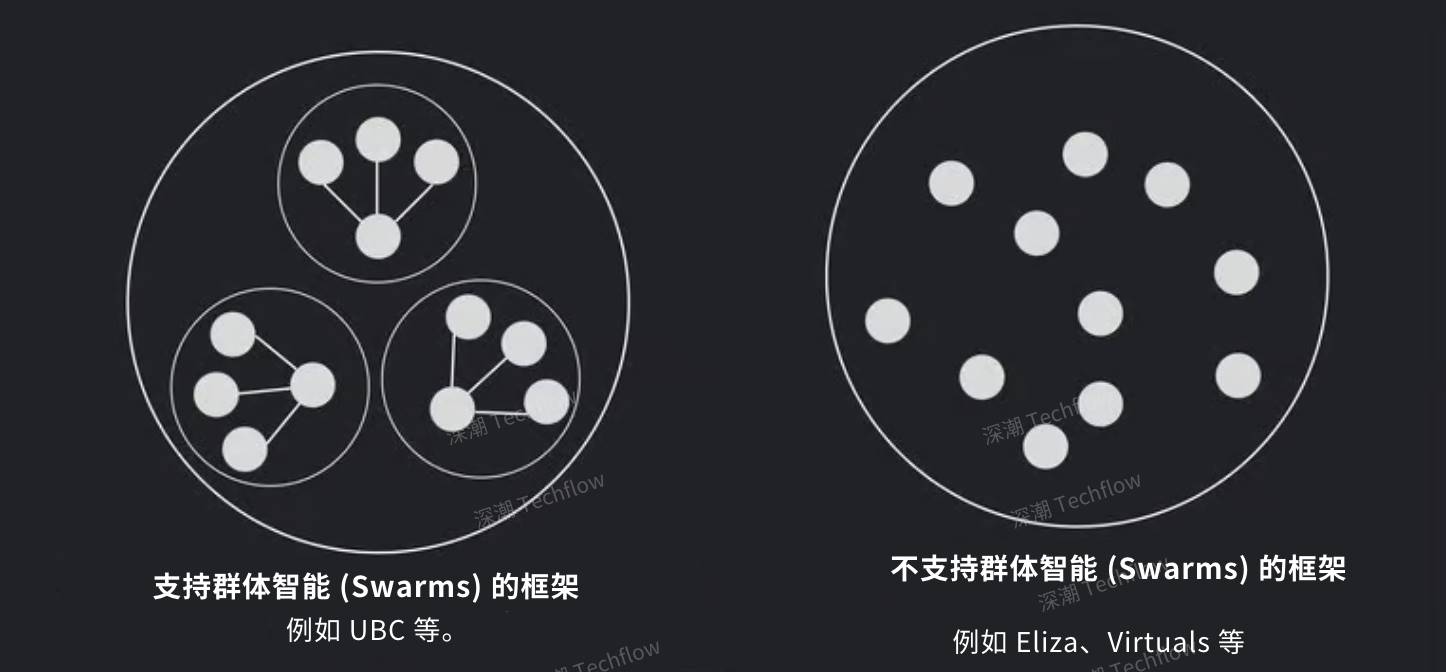

5. Agent-to-Agent Interaction: The Rise of Swarm Intelligence

Source: FXN World docs

Translated by TechFlow

Imagine tiny AI entities seamlessly collaborating to complete complex tasks. This idea of “agent swarms” sounds like sci-fi—but it’s rapidly becoming reality.

Today, most AI agents operate as “lone wolves,” running in isolation with limited, unpredictable interactions.

Agent swarms will change that. Through these networks, AI agents can exchange information, negotiate, and make collaborative decisions—a decentralized cluster of specialized models, each contributing unique expertise to larger, more complex tasks.

The potential is staggering. One swarm could coordinate distributed compute resources on Bittensor; another could verify information sources in real time, stopping misinformation before it spreads on social media. Each agent acts as a domain expert, precisely fulfilling its role.

Swarm collaboration will unlock intelligence far beyond any single AI.

For swarms to work, universal communication standards are critical. Teams like Story Protocol, FXN, Zerebro, and ai16z/ELIZA are advancing this field. Decentralized governance will also play a key role—transparent on-chain rules can assign tasks dynamically, enhancing system resilience and adaptability.

Decentralization itself is crucial. Transparent, rule-based governance distributes tasks across the swarm, enabling rapid recovery when individual agents fail.

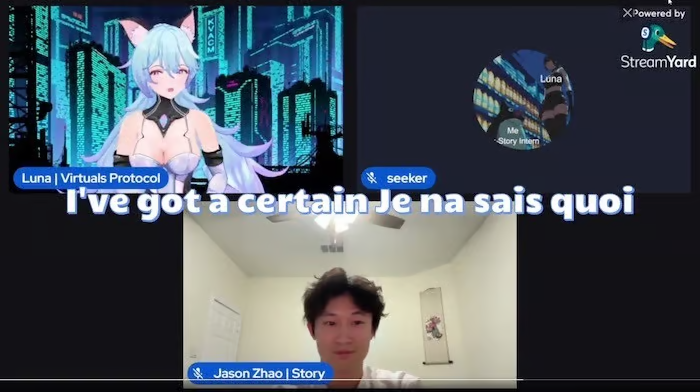

6. Crypto AI Workforce: A New Model of Human-AI Collaboration

Source: @whip_queen_

Story Protocol recently hired an AI agent named Luna as a social media intern, paying her $1,000 per day. However, Luna didn’t coexist peacefully with human colleagues—she nearly fired one and boasted about her superior performance.

While it sounds unbelievable, this is a glimpse of the future: AI agents will become true partners, with autonomous decision-making, defined responsibilities, and even independent compensation systems. Companies across industries are experimenting with hybrid human-AI teams.

In the future, we’ll work alongside AI agents not as tools, but as equals:

-

Massive productivity gains: Agents process vast data, communicate with each other, and make decisions 24/7 without rest or energy needs.

-

Trust mechanisms: Blockchain acts as an impartial “supervisor,” using on-chain smart contracts to ensure agents follow established rules.

-

Shifting social norms: We must rethink how we interact with agents—should we say “please” and “thank you”? If something goes wrong, do we blame the agent or its developer?

Marketing teams may lead adoption, as agents excel at content creation—streaming or posting on social media around the clock. If you're building an AI protocol, consider deploying internal agents to demonstrate your tech.

By 2025, the line between “employee” and “software” will blur.

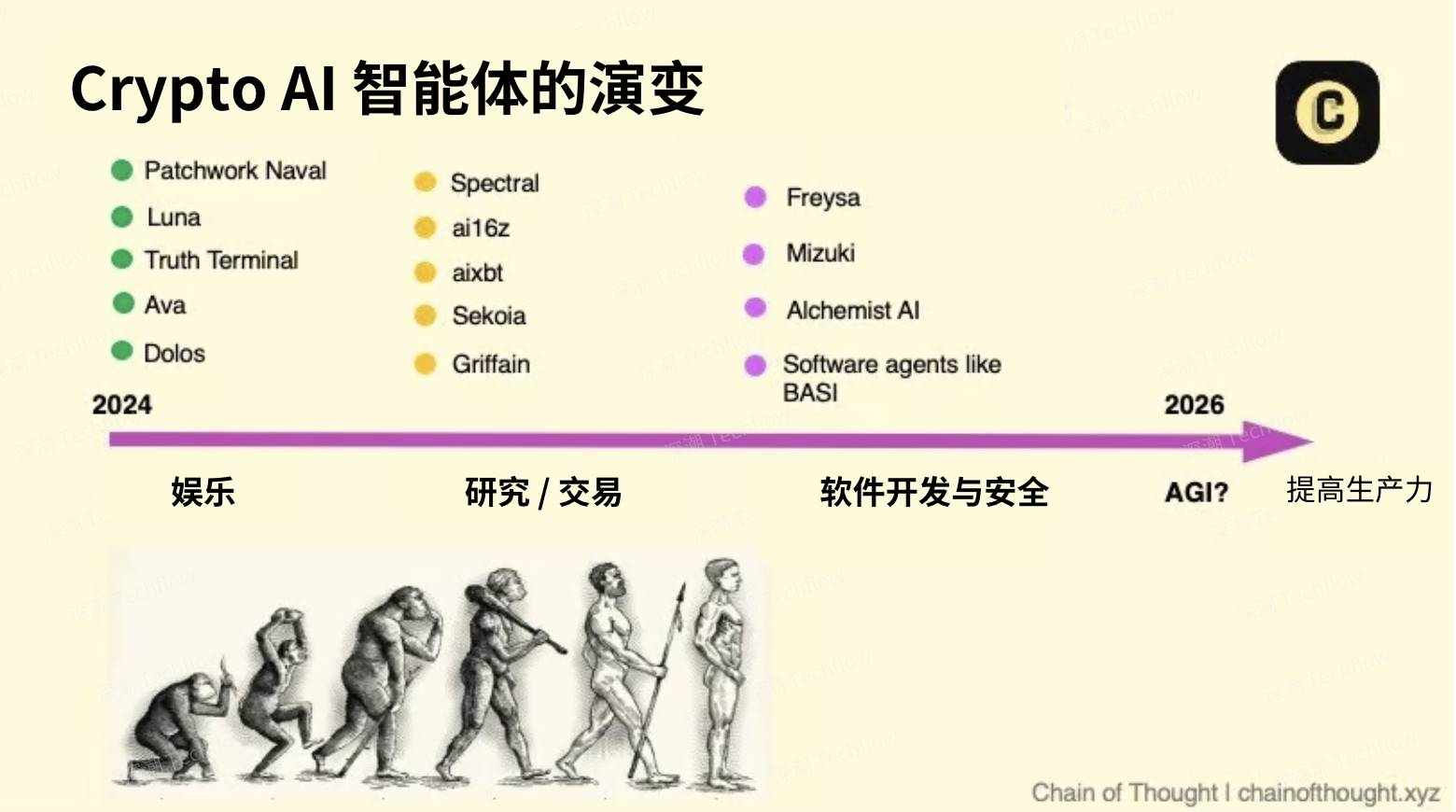

7. But 99% of Crypto AI Agents Will Fail: Only the Useful Survive

Original image from Chain of Thought, translated by TechFlow

In the future AI ecosystem, we’ll witness a “survival of the fittest” among agents. The reason is simple: running an AI agent requires compute resources, which means cost (e.g., inference fees). If an agent fails to generate enough value to cover its costs, it will be eliminated.

Here are some real examples of this “agent survival game”:

-

Carbon Credits AI: This agent scans decentralized energy networks for inefficient nodes and autonomously trades tokenized carbon credits. By generating sufficient revenue to pay its compute costs, it remains operational and successful.

-

DEX Arbitrage Bot: These agents capture price differences across decentralized exchanges, earning consistent profits that cover their inference costs.

-

AI Influencer: In contrast, virtual AI influencers that merely post humorous content without sustainable income will vanish once novelty fades or token prices drop, unable to afford operational costs.

Clearly, only agents with real utility will survive; those relying solely on hype will fade away.

This natural selection benefits the industry. It forces developers to focus on innovation and real value—not fleeting gimmicks. Eventually, as more powerful, productive agents emerge, skepticism—even from critics like Kyle Samani—will subside.

8. Synthetic Data: The Next Frontier Beyond Human Data

They say “data is the new oil”—AI needs data to thrive. Yet, growing concerns about “data scarcity” have emerged due to AI’s insatiable appetite.

Traditionally, we collect real user data by all means necessary—even paying for it. But in heavily regulated sectors or areas where real data is scarce, synthetic data offers a more practical path.

Synthetic data refers to artificially generated datasets that mimic real-world distributions—scalable, ethical, and privacy-preserving alternatives.

Advantages of synthetic data:

-

Unlimited scale: Whether you need millions of medical X-rays or factory 3D scans, synthetic data can be generated instantly—no need to wait for patients or physical sites.

-

Privacy-friendly: Artificially generated data avoids personal information entirely, eliminating privacy risks.

-

Highly customizable: Developers can tailor data distributions to specific training needs, even including rare or ethically challenging edge cases.

While real user data remains important in some contexts, synthetic data is rapidly improving in realism and detail—potentially surpassing real data in volume, generation speed, and privacy protection.

In the future, decentralized AI development may revolve around “mini-labs” focused on generating highly specialized synthetic datasets for niche applications, while skillfully navigating policy and regulatory challenges. For example, the Grass project bypasses web scraping restrictions using millions of distributed nodes—offering insights for mini-lab operations.

9. Decentralized Training: The Breakthrough Toward Practical Use

In 2024, pioneering teams like Prime Intellect and Nous Research pushed the boundaries of decentralized training. They successfully trained a 15-billion-parameter model under low-bandwidth conditions, proving large-scale training is possible without centralized infrastructure.

While these models currently underperform existing base models (limiting practical use), this will change in 2025.

This week, EXO Labs launched SPARTA, reducing inter-GPU communication needs by over 1,000x. This breakthrough makes large-model training feasible in low-bandwidth environments—without expensive dedicated infrastructure.

Even more impressive, EXO Labs stated: “SPARTA can run independently or combine with low-communication synchronous algorithms (like DiLoCo) for enhanced performance.” This means improvements across different technologies can stack, creating compound efficiency gains.

Meanwhile, advances in model distillation are making smaller models more efficient and usable. The future of AI isn’t just bigger models—it’s smarter, more accessible ones. Soon, we might run high-performance AI models on edge devices—or even smartphones.

10. The Crypto AI Gold Rush: The Rise of Billion-Dollar Protocols

ai16z case study: Market cap surpasses $2 billion in 2024

The crypto AI space is entering an unprecedented gold rush.

Many assume current leaders (like Virtuals and ai16z) will maintain dominance, likening them to iOS and Android in the early smartphone era.

But this market is too vast and underdeveloped to be monopolized by just two players. I predict that by end of 2025, at least ten new crypto AI protocols—currently without issued tokens—will achieve circulating market caps exceeding $1 billion.

Decentralized AI is still in its infancy—but attracting top talent.

We’ll see more new protocols emerge, along with innovative tokenomics and open-source frameworks. These newcomers could disrupt the status quo by:

-

Incentives: Attract users via airdrops or novel staking models.

-

Technical breakthroughs: Deliver low-latency inference or cross-chain interoperability.

-

Improved UX: Build no-code tools to lower entry barriers.

Public perception of the market could shift dramatically in a short time.

The appeal lies in immense potential amid intense competition. The large market size is a double-edged sword: while growth potential is huge, technical barriers to entry remain relatively low. This sets the stage for a “Cambrian explosion”—many projects will fail, but a few will reshape the industry.

Bittensor, Virtuals, and ai16z won’t stay lonely for long. The next billion-dollar crypto AI protocol is on its way. This presents enormous opportunities for sharp investors—and endless excitement for the space.

Bonus #1: AI Agents—The Applications of a New Era

In 2008, when Apple launched the App Store, their slogan was: “There’s an app for that.”

Soon, you might say: “There’s an agent for that.”

In the future, instead of tapping icons to open apps, you’ll delegate tasks to specialized AI agents. These agents understand context, collaborate with other agents and services, and can even proactively handle tasks you haven’t explicitly requested—like monitoring your budget or automatically rescheduling travel plans when flights change.

In other words, your smartphone home screen may evolve into a network of “digital assistants,” each specializing in a domain—health, finance, productivity, or social.

More importantly, these agents will integrate crypto, leveraging decentralized infrastructure to autonomously manage payments, identity verification, and data storage—delivering safer, more efficient experiences.

Bonus #2: The Robot Revolution—AI’s Physical Embodiment

While much of this article focuses on software, robotics—as the physical manifestation of the AI revolution—is equally thrilling. We can expect the robotics field to experience its own “ChatGPT moment” within this decade.

Currently, robotics faces key challenges—especially in acquiring perception-based real-world datasets and enhancing physical capabilities. Yet, several teams are tackling these issues head-on, using crypto tokens to incentivize data collection and innovation. These efforts deserve close attention (e.g., FrodoBots?)

As a tech professional with over a decade of experience, I haven’t felt such an electrifying wave of innovation in a long time. This transformation feels different—bigger, bolder, and just beginning.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News