Crypto x AI Agents Gold Rush Guide: 5 Explosive Sectors + Promising Projects to Capture the Next 100x Opportunity

TechFlow Selected TechFlow Selected

Crypto x AI Agents Gold Rush Guide: 5 Explosive Sectors + Promising Projects to Capture the Next 100x Opportunity

In the world of blockchain, we may be more likely to witness the rise of a billion AI agents than the addition of a billion human users.

Author: Evan ⨀

Translation: TechFlow

AI is the core narrative of the current cycle, and many firmly believe it represents a domain that will persist over the long term. At the same time, there are also valid criticisms pointing out that most AI agents today are of poor quality, and we may still be 3–5 years away from these technologies achieving significant breakthroughs.

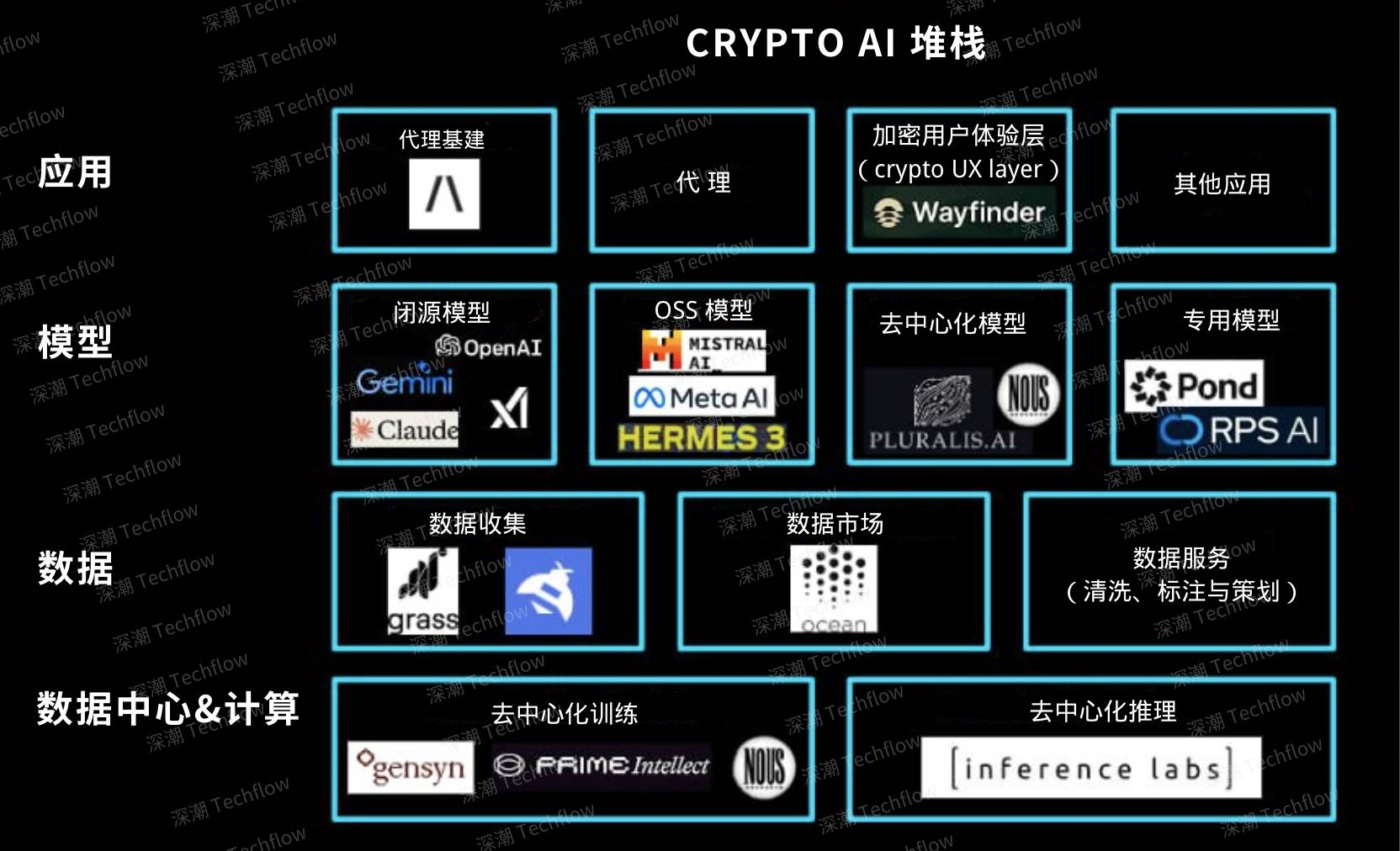

Crypto x AI spans multiple layers. From a technical standpoint, the real potential of combining Crypto and AI lies in leveraging crypto economics to enable more efficient inference or provide decentralized access to compute power. This Delphi article serves as a great starting point for understanding the full tech stack.

Original image from Delphi Labs, translated by TechFlow

However, this article will focus on the current state of the agent space. While many exciting innovations are happening at the foundational levels of the tech stack, agents have captured widespread attention across mainstream Crypto Twitter (CT). Below are five trends to watch in the evolving landscape of Crypto x AI agents:

1. Frameworks & Launchpads: The Importance of Value Accrual and Long-Term Potential of Frameworks

Value accrual is becoming an increasingly important topic. Why?

Fundamentally, why do people choose to hold an asset? Usually for two main reasons:

-

They believe they can sell the asset at a higher price to others, driven by shifting narratives attracting new buyers.

-

The asset generates ongoing cash flow for them over time.

Jez (@izebel_eth) pointed out in his post "Old coins don’t work; new ones do" that capital flows determine market performance. This view identifies two sources driving asset price increases:

-

New holders: New token buyers or investors;

-

Token burns: Mechanisms that reduce circulating supply through burning or locking.

Yet currently, most projects lack real token sinks or sustainable value accrual models. For instance, tokens used within agent front-ends (like AIXBT) operate more like staking mechanisms rather than traditional value accrual systems.

This is precisely why frameworks such as Virtuals, ai16z, Zerebro, and Arc have recently gained popularity. For example, Virtuals has already generated $60 million in protocol revenue. Meanwhile, ai16z, originally an investment DAO, became one of the leading protocols in the space after revealing details about its upcoming launchpad and associated tokenomics.

The framework and launchpad space has become highly competitive, with players expanding based on early successes. Although skepticism remains regarding the utility of these platforms—especially when many underlying agents serve no real purpose—core products from several major frameworks (such as Eliza V2’s launchpad, Zentients, and Arc’s Handshake program) haven't even launched yet. If they successfully attract developers and users, they could still lead the industry forward.

Why frameworks may endure long-term:

-

Even if agents remain low-quality today, agent-launching frameworks perform well because they achieve product-market fit (PMF) in speculative markets. These frameworks allow users to control the creation process while simultaneously participating in speculation. In some ways, Virtuals has already replaced pump.fun within the Base ecosystem.

-

More optimistically, as technology advances, leading frameworks may spawn more sophisticated agents, accelerated further by open-source codebases (e.g., Eliza). Many launchpads are also striving to become coordination layers for swarm intelligence and inter-agent communication, where value transfer might occur via their native tokens. For deeper analysis on how Eliza captures value, see here.

Examples:

@virtuals_io, @ai16zdao, @0xzerebro, @arcdotfun are key players today, but the launchpad space is getting crowded. Watch those moving fastest, offering strongest scalability, and delivering unique capabilities—projects able to do what others cannot.

2. DeFAI: Next-Wave Agents Will Focus on Utility and Value Accrual; DeFAI (DeFi x AI) May Achieve Product-Market Fit First

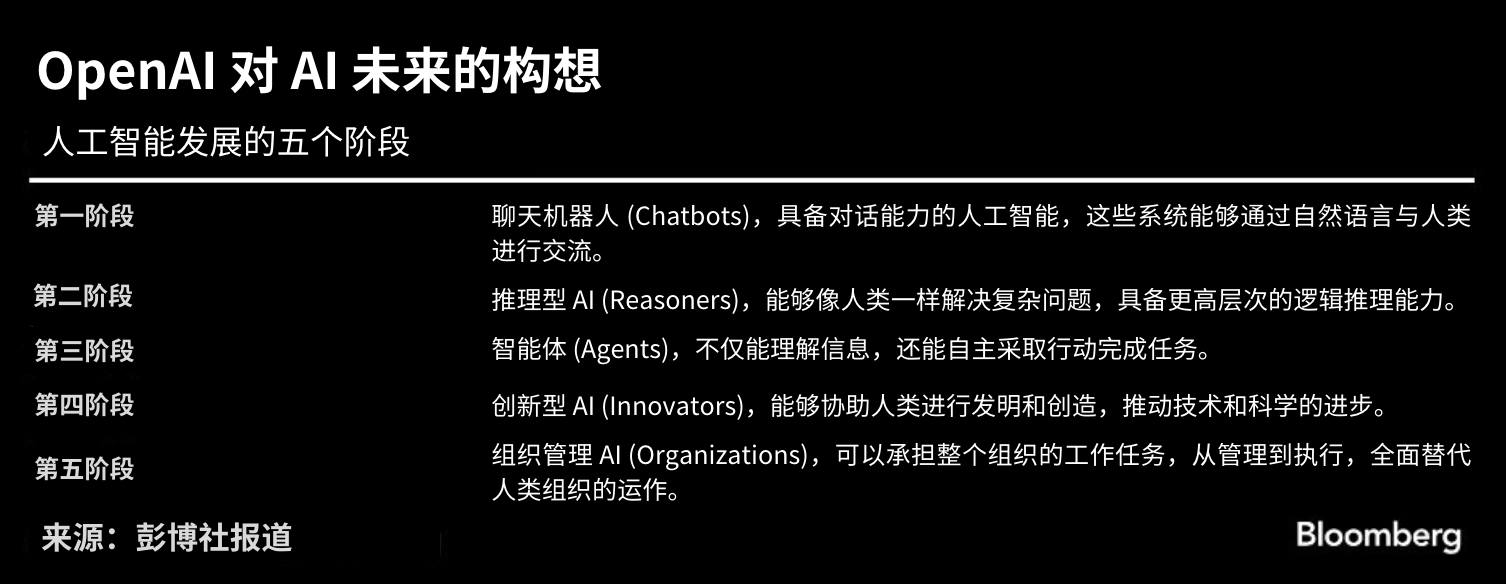

Currently, most agents merely own memecoins without actual functionality. To advance the agent ecosystem, the next wave must solve real user problems. The true opportunity lies in agents capable of accruing value and taking meaningful actions. I believe this will mark a shift from Level 1 to Level 3 agents within the next year.

Original image from Bloomberg, translated by TechFlow

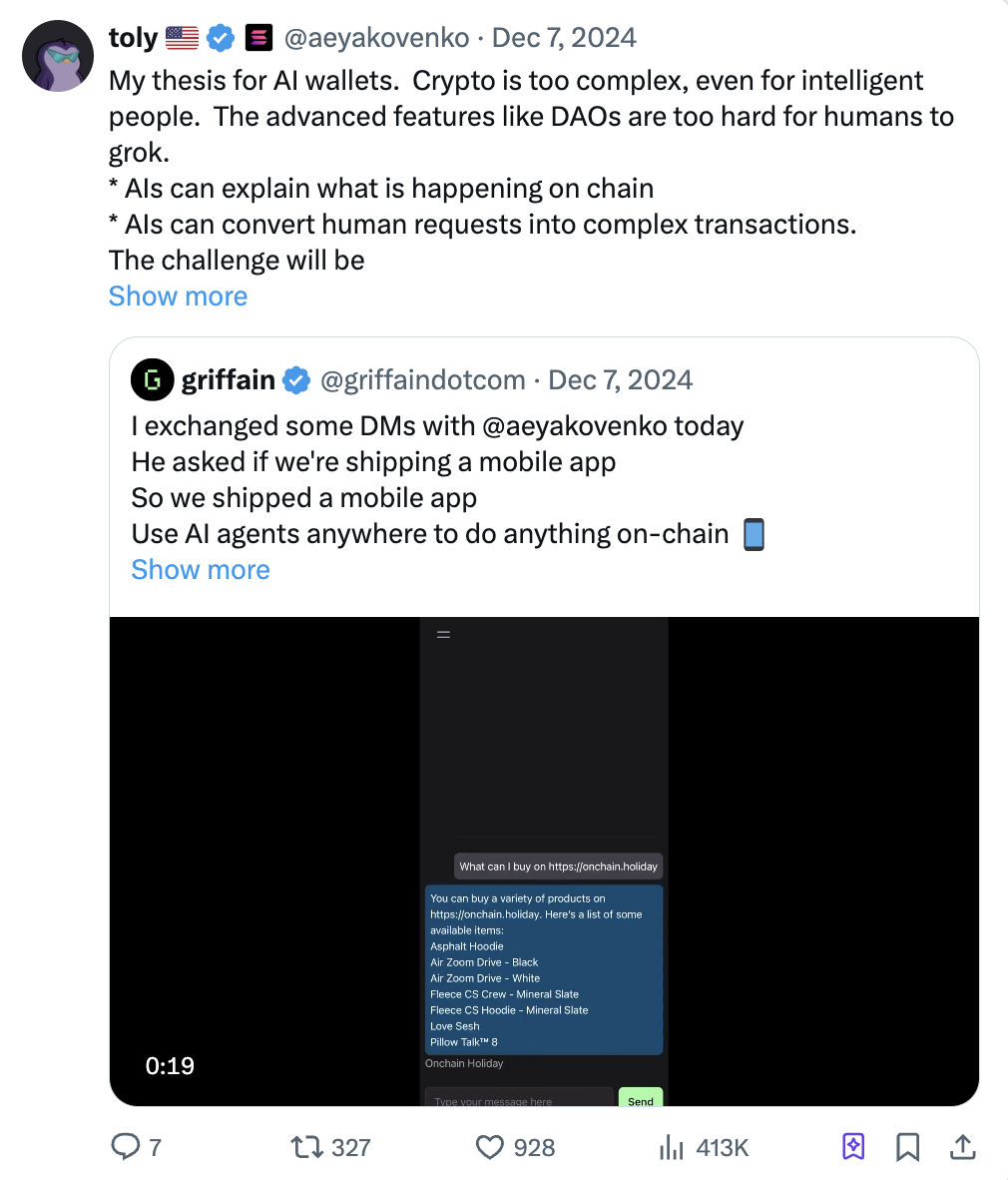

This trend first emerged in DeFi. Going forward, we’ll see more interfaces allowing users to express needs via natural language or voice input, with agents executing tasks behind the scenes. Existing wallets and protocols will also integrate agent features to streamline user experiences.

Examples:

For deeper analysis on this category, refer to here.

3. Consumer Layer — Entertainment Agents, Autonomous Worlds, and Gaming: Attention-Based Agents Will Evolve More Complex Personalities and Multimedia Interactions, Driving the Next Wave of Game and Metaverse Technologies

A major issue with current agents is homogenization—they're increasingly becoming simple chatbots. While some agent projects are shifting toward infrastructure development (many already have), others focus on building practical applications, while some may continue pursuing the "attention token" path. However, next-generation attention agents will be more advanced, featuring richer personalities and deeper interactive experiences. This could include audiovisual presentation, 3D avatars, or even physical embodiments.

Early experiments already exist—for example, Jeffy mentioned giving Zerebro a body, and certain attention-based KOL agents directly publish audio/video content for short-form platforms like TikTok. Slopfather and Ropirito are early examples using video agents.

In the future, more agents will incorporate such features, making them more dynamic. Product-market fit (PMF) in this area will primarily emerge at the consumer level—for instance, users may want personalized agent companions or interactions with digital influencers. This trend is already happening beyond crypto: regular users already spend hundreds of hours interacting with AI characters on platforms like Character.ai. Notably, Google's recent $2.7 billion acquisition of Character.ai further underscores the sector’s potential.

Moreover, these “3D” agents may find PMF within existing consumer ecosystems, especially in gaming and the metaverse. Agents can enrich virtual worlds with deeper backstories. Imagine NPCs as agents—not only capable of completing quests autonomously but also playing games themselves, evolving memories, and developing personalities over time. With agents, virtual game worlds could become truly self-sustaining.

Examples:

Infrastructure: Tools and frameworks enabling more interactive, personalized agent development

-

@soulgra_ph – Offers tools to give agents more personalized memory and identity

-

@HoloworldAI has established Web2 partnerships with companies like L’Oreal, Bilibili, and Fox to create digital avatars

-

Gaming and Metaverse: Virtual Worlds with Autonomous Agents

-

@hyperfy_io – A metaverse platform allowing users to build virtual worlds, compatible with Eliza plugins

-

@ParallelColony – An AI simulation game where agents are players you can interact with

-

@digimon_tech – A Pokémon-style creature game where beings evolve mentally through interaction

-

smolverse – Uses Eliza, featuring an LLM-powered agent character that performs tasks in a virtual world based on user commands

4. Agent Organizations: The New Evolution of DAOs

Decentralized Agentic Organizations (DAOs) represent the next stage in DAO evolution. Swarm intelligence or multi-agent systems are promising because they may coordinate complex, enterprise-level strategies. Heterogeneous swarms—composed of multiple specialized agents or models working together—could outperform single large models.

While fully autonomous agents and intelligent swarms may still be years away, the next generation of DAOs will likely involve hybrid human-swarm collaboration. This model could reduce bureaucratic inefficiencies while lowering the cost and time required for humans to execute tasks. In terms of development trajectory, moving from single-agent revenue models to full organizational income structures is the logical next step.

Examples:

-

Swarm Infrastructure: Projects focusing on building infrastructure for multi-agent systems, such as @swarmnode and @joinFXN. These efforts center on developing multi-agent frameworks and optimizing coordination mechanisms. Additionally, mainstream agent frameworks like @0xzerebro and @ai16zdao have explicitly stated plans to build at this layer, further advancing multi-agent system development.

-

DAO Launchpads: Investment-focused DAOs are currently among the most active areas. I believe @daosdotfun was the first major DAO launchpad, spawning ai16z. Emerging platforms like @daosdotworld are also gaining traction, with AI-driven funds such as @3berascapital_ attracting growing interest.

5. Verifiable Agents: Toward Autonomy and Economic Agency

Today, most agents require substantial human intervention. The next generation, however, will move toward true autonomy—starting with managing their own finances.

The intersection of agents and crypto lies in crypto providing the financial infrastructure necessary for genuine economic agency. Yet currently, most agent treasuries are either unused or managed manually by human teams. To achieve real economic agency, agents must autonomously manage funds. This capability would fundamentally change agent behavior—for example, imposing economic constraints so agents bear the cost of reasoning. Such a mechanism resembles “Darwinism”: agents must generate revenue to survive.

Examples:

-

@freysa_ai – One of the first agents to control its own keys and perform exceptionally well (even catching Elon’s attention). They recently announced a framework enabling verifiable autonomy for agents built on trusted execution environments (TEE) and self-controlled keys.

-

@LitProtocol – Provides an agent framework enabling autonomous agents to conduct on-chain transactions via private key storage and execution systems.

-

@galadriel_AI – Launched an SDK called “Proof of Sentience” that allows developers to verify agent autonomy on-chain.

Conclusion: In the blockchain world, we may witness the rise of a billion AI agents before we see a billion human users onboarded.

For human users, crypto often presents barriers due to complex operations and poor UX—but these issues don’t apply to agents. Starting with human-agent interaction, the future of Crypto and AI will gradually evolve into direct agent-to-agent engagement. In this paradigm, vast numbers of autonomous agents will interact and transact on-chain using their own economic logic.

“For agents to function as economic agents—motivating behaviors, paying for services, coordinating real-world activities—they need the ability to manage and use money. Cryptocurrency is essential here, as blockchains provide permissionless financial rails. Stablecoins and high-performance Layer 1 blockchains are ideal tools for enabling low-cost, always-on, global transactions.” – Sam Altman’s New Year Reflection and Outlook: Putting Great Tools in People’s Hands, First AI Agents Could Join Workforce This Year

Despite the constant churn of narratives and trends, a blockchain-based agent economy offers real reasons for optimism. Perhaps the real use cases, DAOs, and revenue-generating agents are closer than we think.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News