From Pricing to Efficiency: How ODOS Helps You Control Costs and Maximize Returns in DeFi Trading

TechFlow Selected TechFlow Selected

From Pricing to Efficiency: How ODOS Helps You Control Costs and Maximize Returns in DeFi Trading

As one of the leading DeFi aggregators, ODOS demonstrates how to enhance on-chain trading experiences through sophisticated algorithms and extensive liquidity integration.

Author: ODOS

Translation: TechFlow

If you're conducting on-chain cryptocurrency trades without a DeFi aggregator, you're likely leaving profits on the table.

The emergence of decentralized finance (DeFi) has revolutionized crypto trading by granting users unprecedented access to assets and financial products. However, trading directly on individual decentralized exchanges (DEXs) can expose users to price impact, slippage, security risks, and limited token availability—especially for large or complex transactions.

This is where DeFi aggregators come in. These platforms address the challenges of single-DEX trading by splitting orders across multiple liquidity sources to optimize pricing and reduce exposure. As one of the leading DeFi aggregators, ODOS exemplifies how advanced algorithms and broad liquidity integration can elevate the on-chain trading experience.

In this article

-

Why aggregators matter?: Aggregators like ODOS are essential for DeFi traders, solving issues such as price impact, slippage, access to long-tail assets, and enhancing transaction security.

-

Differences between aggregators: Aggregators vary significantly in routing algorithms, liquidity sources, and chain support, resulting in varying service quality.

-

ODOS’s unique advantages: With superior routing algorithms, extensive liquidity integration, multi-token swaps, and a new “Simple Swap” experience, ODOS delivers optimal pricing and efficiency for users.

Why do we need aggregators?

Trading within the DeFi ecosystem can be highly complex. Hundreds of decentralized exchanges offer different tokens, fees, and prices. Just as travel platforms like Expedia or Kayak simplify bookings by comparing airlines and routes, aggregators like ODOS eliminate uncertainty by finding the optimal path for your trade.

Core benefits of aggregators:

-

Better pricing: By aggregating liquidity from multiple DEXs and pools, aggregators ensure users get the most favorable execution prices.

-

Broad token selection: Users gain access to a wider range of tokens—including long-tail assets—without manually searching across platforms.

-

Improved user experience: ODOS offers tools like “Simple Swap” and advanced routing that streamline the trading process, saving time and effort.

Challenges of trading on a single DEX

Decentralized exchanges (DEXs) are foundational infrastructure in the decentralized finance (DeFi) ecosystem. By maintaining reserves of trading pair tokens in liquidity pools and using mathematical pricing curves to determine exchange rates, DEXs ensure permissionless and always-available liquidity. However, this mechanism also introduces unique challenges that can negatively affect trades.

Price Impact

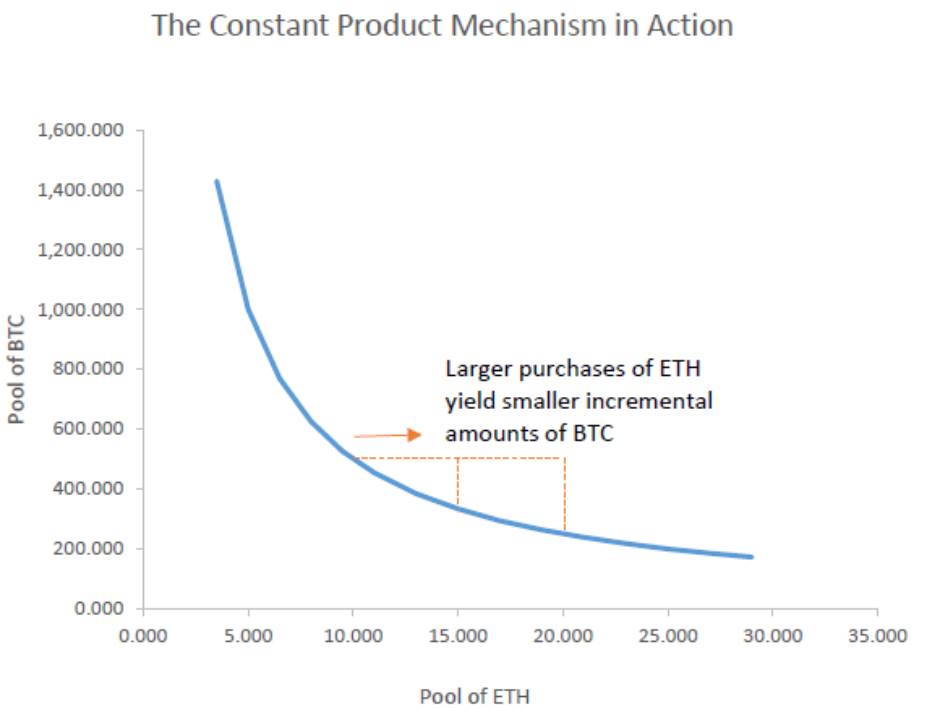

When executing large trades on a single DEX, the significant shift in asset ratios within a liquidity pool can lead to unfavorable price movements—a phenomenon known as price impact.

The degree of price impact depends on both trade size and pool depth. Deep, high-liquidity pools (e.g., ETH/WBTC) experience minimal price changes even with large trades. In contrast, shallow pools may see drastic price swings from moderate-sized trades.

The image below illustrates how pricing curves operate in a typical liquidity pool. As trades occur, the ratio of assets in the pool shifts, altering the exchange rate accordingly.

Visualization example of pricing curves under the automated market maker (AMM) model, where the price curve dynamically adjusts based on token ratios in the liquidity pool, determining the exchange rate.

Source: here

Slippage

Slippage refers to the difference between the expected and actual execution price of a trade. Rapid market fluctuations or network congestion can result in trades being filled at worse-than-expected prices.

Limited Token Selection

A single DEX may not list all tokens—especially obscure or long-tail assets—limiting users’ trading options.

Security Risks

Trading across multiple DEXs requires repeated token approvals, increasing exposure to malicious contracts or potential vulnerabilities. For instance, the BadgerDAO $120 million exploit was caused by a malicious token approval request.

Solution: DeFi Aggregators

DeFi aggregators effectively tackle these trading challenges by optimizing prices, expanding token access, improving security, and simplifying workflows.

By integrating with multiple protocols and their liquidity pools, aggregators minimize price impact and slippage throughout the trading process, offering better exchange rates than any single DEX.

Additionally, aggregators provide a unified and trusted interface, reducing the need for repeated token approvals across various DEXs—thereby lowering security risks and streamlining the trading experience. With an aggregator, complex trades can be executed seamlessly without switching between platforms, saving significant time and effort.

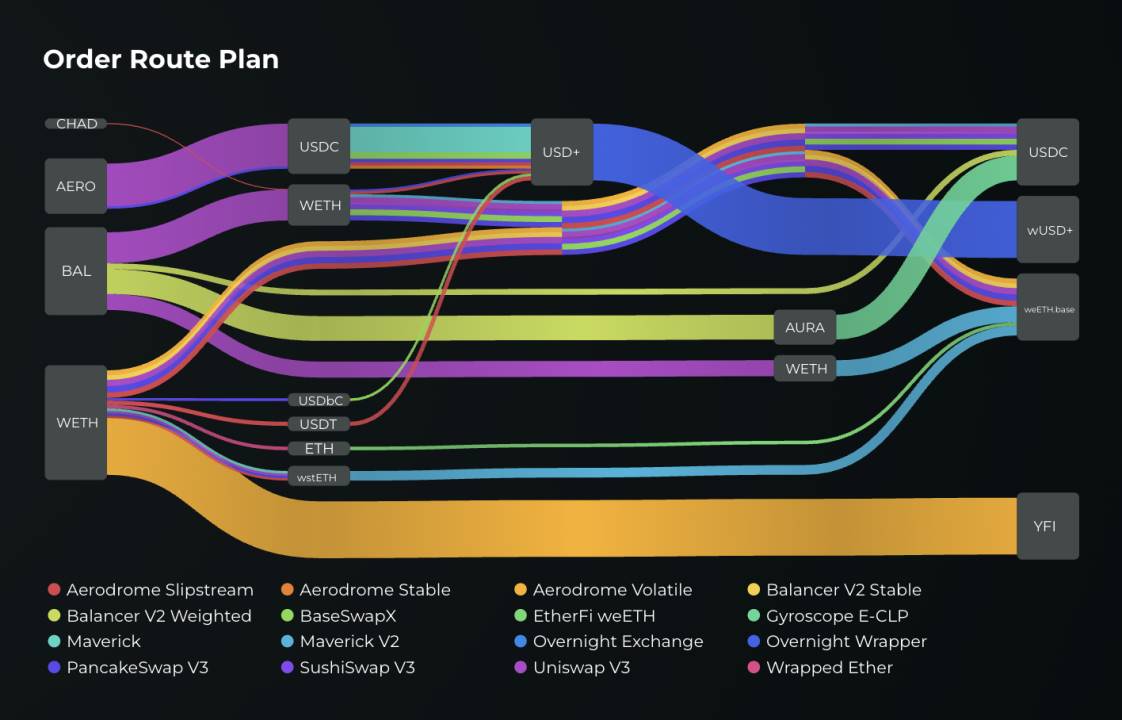

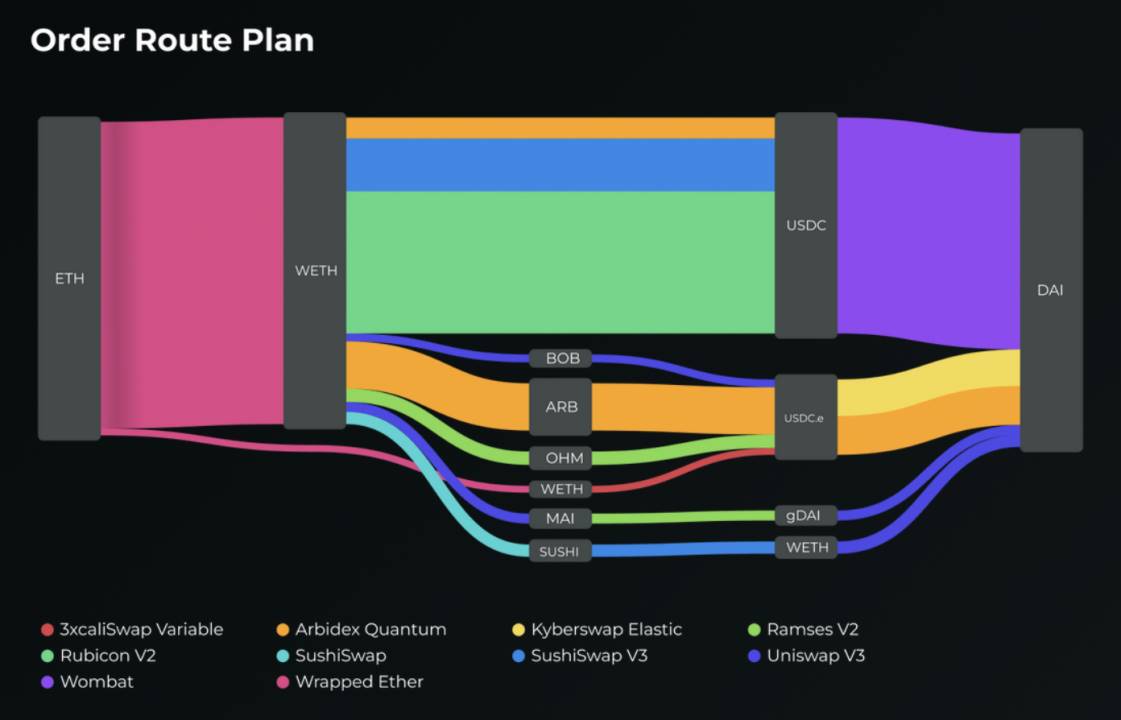

Below is an example of an ETH-to-DAI trade routed through ODOS:

The aggregator automatically finds the optimal trade path

Source: ODOS dApp

Not all aggregators are equal

Aggregators are highly effective at reducing trading costs. Today, there are over 50 aggregators in the market, collectively processing $1–3 billion in daily transaction volume. However, performance varies significantly among them.

Routing Algorithms

The core of any aggregator lies in its routing algorithm. Advanced algorithms split trades across multiple pools to minimize price impact, identify arbitrage opportunities to improve pricing, and efficiently handle complex multi-token swaps. Think of it as an experienced trader working behind the scenes to find the best available deals in the market.

Liquidity Sources

The more—and higher-quality—liquidity sources an aggregator integrates, the better its pricing and asset availability. A broader set of sources increases the likelihood of finding the best price, while deep liquidity pools help reduce price impact and slippage.

Chain Support

Multi-chain aggregators offer wider asset coverage, enabling access to more tokens and trading pairs. They also meet users’ needs directly on their preferred chains, eliminating the need to transfer assets across networks. Choosing an aggregator that supports the chain where your assets reside and aligns with your trading goals is crucial.

ODOS's Market Leadership

ODOS leads on most Layer 2 networks—including Base, Optimism, Arbitrum, zkSync Era, and Mantle—as well as other major chains like Avalanche and Fantom. On Base, for example, ODOS achieves weekly trading volumes of up to $619 million—nearly double that of the second-largest aggregator on the network.

ODOS dominates trading volume on Layer 2 networks, reflecting its strong advantage in pricing optimization

Source: here

Why choose ODOS?

Thanks to its sophisticated smart order routing algorithm, ODOS stands out among top-tier DeFi aggregators. This technology enables ODOS to deliver the best possible trade paths, ensuring optimal pricing and efficiency.

Superior Routing Algorithm

ODOS uses a proprietary algorithm to intelligently identify the optimal trade route. It splits trades across multiple liquidity pools to reduce price impact and leverages price differences between pools to save users money. Moreover, ODOS explores numerous intermediate tokens to uncover arbitrage opportunities—even between tokens not directly traded by the user.

Notably, ODOS supports multi-token atomic swaps, allowing users to exchange multiple tokens in a single transaction. This feature highlights ODOS’s flexibility and boosts trading efficiency. Atomic swaps ensure simultaneous execution by both parties, eliminating counterparty risk and enhancing transaction security.

Extensive Liquidity Integration

ODOS integrates over 900 liquidity sources across a vast network of decentralized exchanges (DEXs). Supporting 14 EVM-compatible blockchains—including Ethereum, Arbitrum, and Base—it offers unparalleled coverage.

Additionally, ODOS supports trading of over 100,000 tokens, encompassing nearly all mainstream and long-tail assets, making it easy for users to find desired trading pairs.

More than just DEXs

What sets ODOS apart is its ability to incorporate various DeFi protocols—not just DEXs—into its routing optimization. For example, ODOS can convert stETH to ETH via the Lido protocol, unlocking more cost-effective trade routes. It also taps into private liquidity sources, revealing hidden value for users. This capability to handle complex scenarios gives ODOS a routing edge far beyond traditional aggregators.

User-Friendly Experience

ODOS provides an intuitive interface suitable for both beginners and experienced traders. For newcomers, the Simple Swap feature greatly simplifies DeFi trading. It allows trades without holding native gas tokens and eliminates slippage entirely through fixed-price quotes, making transactions simpler and more reliable.

For advanced users, ODOS offers Advanced Swaps and Limit Orders. Advanced Swaps let users fully customize parameters such as liquidity sources and slippage tolerance. Innovative visualization tools—like Sankey diagrams—clearly illustrate the trade path, giving full transparency into each step of execution. Whether you're a beginner or a pro, ODOS equips you with powerful tools to optimize your trades.

Ready to transform your trading experience?

In the fast-evolving world of DeFi, using an aggregator like ODOS isn't just an advantage—it's essential. ODOS empowers users to unlock the full potential of their crypto assets by delivering better prices, simplifying complex processes, and enhancing security.

Stop missing out on gains. Start using ODOS today and unlock a new level of trading efficiency.

Visit app.ODOS.xyz, connect your wallet, and begin a smarter trading journey. Explore infinite possibilities in DeFi with optimized trade paths. Make every trade count—do more with ODOS.

Join the ODOS Community

Become a key part of shaping the future of DeFi:

-

Participate in the ODOS Loyalty Program: Earn $ODOS rewards through trading. Learn more at: link.

-

Stay updated: Follow ODOS on Twitter for the latest news.

-

Engage and learn: Join the ODOS Discord to exchange insights with community members.

-

Experience optimized trading: Visit app.ODOS.xyz and see firsthand how ODOS enhances your trading efficiency.

If you're interested in integrating our API, check out our documentation.

Note: This article is for informational purposes only and does not constitute financial advice. Please conduct your own research before engaging in cryptocurrency trading.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News