After handling marketing for over a dozen projects, why does this Web3 cycle feel so fragmented?

TechFlow Selected TechFlow Selected

After handling marketing for over a dozen projects, why does this Web3 cycle feel so fragmented?

Only when a truly phenomenal product that integrates Web3 and AI emerges can the real fusion between Web2 and Web3 be achieved.

Author: SunnyZ

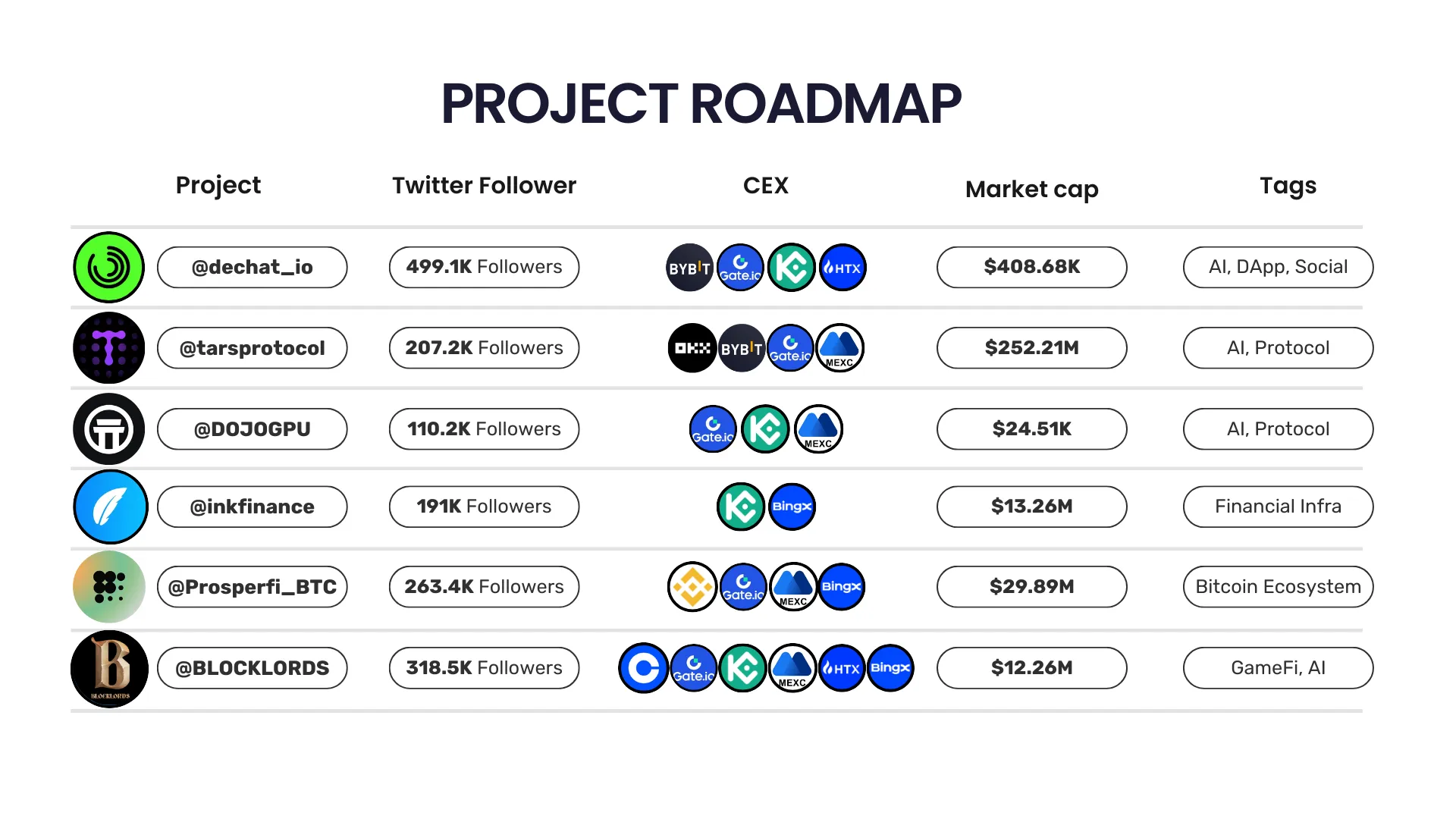

Starting from March 2024, I've been continuously designing pre-TGE marketing strategies for multiple projects throughout the year, with nearly every project achieving user growth ranging from 200k to 500k.

Projects include:

As we can see, each project has its own unique narrative and performed well on exchanges (some NDA projects cannot be discussed yet). From my perspective, these projects’ marketing strategies fall into two schools of thought: top-down and bottom-up.

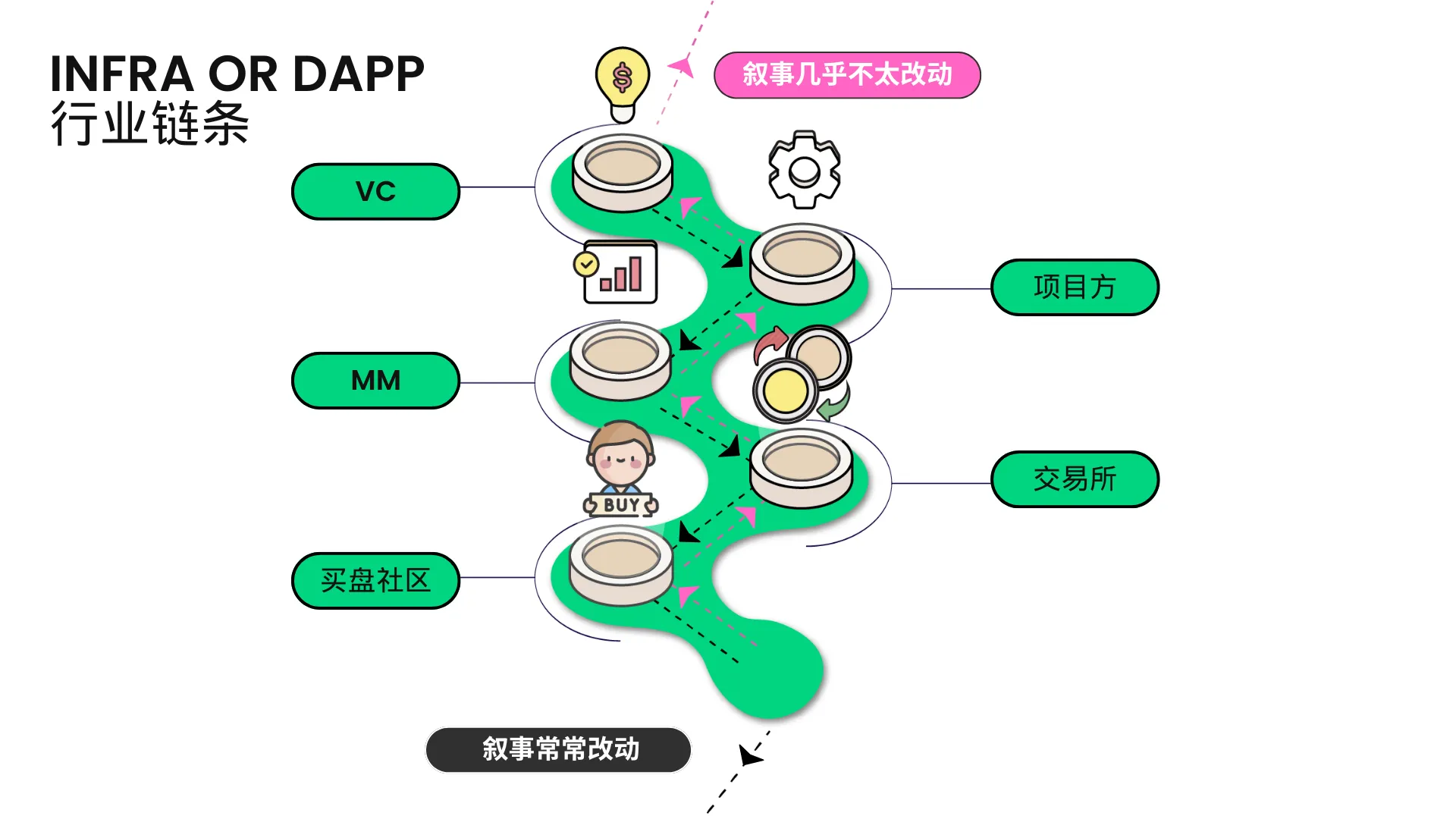

Industry Chain and Barriers

From an industry chain standpoint, Web3 consists of five types of participants: VCs → project teams → market makers (MM) → exchanges → buyer communities. Each side has its own barriers, and this trend is becoming increasingly evident. VCs generally don't understand how to drive user growth; project teams often lack knowledge about MM operations; and buyers struggle to identify promising tokens, relying mostly on which exchange a token lists to make decisions. While I'm not fond of VC-driven coins—many VC-backed projects run out of runway and rug quickly—I must acknowledge that VCs have indeed fueled industry prosperity. Projects funded by Chinese VCs, in particular, have sustained numerous tool-based dApps and games. I still believe mass adoption will ultimately depend on high-quality games.

Many dApp projects, especially those led by Chinese teams, boast large user bases, substantial Twitter followings, and vibrant communities, yet they struggle to list on top-tier exchanges. Some tokens perform poorly post-launch. I’ve observed that many teams are just enduring this cycle, unsure of which market makers to work with or how to attract real buying demand—completely opposite to infrastructure-focused projects. These teams are often highly active socially, attending offline events and networking, but such efforts rarely translate into meaningful business development or access to valuable resources. I’m not sure what the actual value is here.

This fragmentation isn’t limited to project teams—it also exists between domestic and overseas VCs. I initially thought Chinese VCs might compete head-to-head with their global counterparts, but in reality, there's little genuine interaction between them. Instead, both sides tend to stick within their own circles. The returns for VCs who bet heavily on dApps last cycle haven’t been as strong as expected. If the altcoin season arrives later than anticipated this bull run, many projects may collapse right before reaching success.

Marketing Strategies Across Different Projects

This year, I worked on two L1 projects whose marketing approach followed this path: first build the product, secure market makers and initial buyers, finalize the narrative (and stick to it), then actively discuss technical innovations and team philosophy on Twitter. After accumulating enough content momentum, gradually launch community channels and begin sharing whitepapers and project materials in Telegram groups. Once user base reaches a critical threshold—say 10,000 users—they start running engagement campaigns and distribute airdrops to genuinely engaged users, then time their exchange listing carefully. Some L1s even conduct university roadshows and recruitment drives to educate future users early. Take Grass as an example—not an L1, but part of the infrastructure layer—their marketing strategy closely aligns with this model. In 2023, Grass started with a simple, natural tone on Twitter, progressively building memes and shaping user perception. “Touch Grass” became a popular phrase during that period. Later, they partnered with major ecosystems like Solana and became more professional. After Blockworks featured Grass, their Twitter traffic surged exponentially, particularly after the main account published an article on December 2, 2023. With ongoing KOL promotion and news of their funding round, operations gained strong momentum organically.

Of course, many projects burned through funding from two rounds without surviving to token launch. Today, nearly all projects are rebranding themselves with some connection to AI—I’ve noticed most of the project Twitter bios I follow now include "AI-powered" narratives.不得不说, Chinese teams are incredibly adaptable—jumping on whatever trend is hot [no offense intended]. This flexibility raises the bar for marketing effectiveness, making joint campaigns a mainstream tactic due to their low cost and high reach. However, running too many activities leads to premature distribution of tokens. Without real-value airdrops, users lose interest. This creates a paradox. Projects with overly diluted token distribution lack sufficient pricing power when negotiating with exchanges. If they only list on DEXs, organic buy-side volume remains extremely weak.

Convergence of Web2 and Web3 Marketing

Current Web3 marketing tactics are largely limited to social media growth, KOL promotions, project partnerships, real-user community referrals, and BD outreach at conferences—all yielding limited and uninspiring user growth. I believe it’s time for Web3 to adopt Web2-style paid acquisition strategies: properly manage Reddit, Medium, TikTok, Xiaohongshu (Little Red Book), official public accounts, and video platforms. People are inherently social; algorithms naturally recommend content to users interested in Web3, crypto, and AI. For instance, the Xiaohongshu audience following Web3 topics often consists of newcomers eager to enter the space but unsure where to start—these are exactly the target buyers. One must first learn how to lose money before understanding how to make it; the market itself completes user education. That’s why we’re seeing more teams focusing on Xiaohongshu and running paid ads on TikTok—the growth trajectory is clearly shifting toward integration with Web2. Only when a truly viral product emerges—one that seamlessly combines Web3 and AI—will we witness genuine convergence between Web2 and Web3.

Finally, regarding the Infra-type project marketing case mentioned above, here is my deep dive into Grass’s operational journey for reference [each toggle list is expandable]

https://www.notion.so/Research-for-Nebra-153e6b097b588089b93cd96f2283030b?pvs=4

Acknowledgments

Thanks to the stable project teams for sharing insights, and appreciation to TechFlow and MetaEra for supporting this article. Feel free to reach out if you're interested in Web3 marketing or growth. My Telegram: @SunnyZ_Crypto [I receive many messages so replies may be slow—please bear with me]

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News