Key moments in 2024 when Bitcoin reshaped the cryptocurrency landscape

TechFlow Selected TechFlow Selected

Key moments in 2024 when Bitcoin reshaped the cryptocurrency landscape

Reviewing the key moments that shaped Bitcoin's destiny.

Author: Echo, MetaEra

It’s time for the annual review again. The 2024 market has been complex and dynamic—spot Bitcoin ETFs were approved, the halving occurred as scheduled, prices surged to new highs, hash rate hit record levels, ecosystems flourished, and political landscapes shifted rapidly, bringing wave after wave of positive momentum... These factors collectively fueled a global investment frenzy around BTC, pushing its price to unprecedented levels, surpassing the $100,000 milestone. Google Trends data showed more than a doubling compared to last year, marking a shining moment in history! For the entire cryptocurrency industry, 2024 was a landmark year. Each major event inscribed a clear trajectory for Bitcoin and the broader crypto market’s future path.

This report follows a chronological structure, using key events as anchor points. MetaEra will walk through those pivotal moments that shaped Bitcoin's destiny in 2024. Let us step into the annals of Bitcoin in 2024 and reflect on its glory and struggles throughout this remarkable year.

The Floodgates Open: Approval of Spot Bitcoin ETFs

On January 10, a transformative milestone unfolded on the U.S. financial stage—the approval of BTC spot ETFs. This allowed publicly listed companies, pension funds, institutional investors, and various asset managers in the United States to openly enter this once-mysterious domain via regulated financial instruments, ushering in a new era of transparent Bitcoin ownership and investment.

In April, the first batch of spot Bitcoin and Ethereum ETF products from subsidiaries of China Asset Management, Boshi Fund, and Harvest Fund received formal approval from the Hong Kong Securities and Futures Commission (SFC). Subsequently, on April 30, these highly anticipated products proudly debuted on the Hong Kong Stock Exchange.

The market celebrated the launch of ETFs. With increased product depth in the crypto space and large-scale institutional participation, skepticism gave way to enthusiasm for value storage narratives. Traditional capital began flooding into the crypto world, making digital asset investing increasingly aligned with Web 2.0 markets.

In the short term following the announcement, the Bitcoin market remained generally stable without significant volatility. Many criticized the ETF rollout as underwhelming, fueling conspiracy theories about institutional manipulation and accusations of "style over substance." All this uncertainty acted like a magnet, drawing intense attention from investors and industry watchers alike, becoming one of the most suspenseful chapters in Bitcoin’s developmental journey. Amidst these undercurrents, Bitcoin held firm to its “time machine theory,” patiently awaiting new catalysts, allowing time to prove its worth.

Image source: SoSoValue

Bitcoin Halving: A Pivotal Turning Point

On April 20, Bitcoin underwent its fourth halving at block height 840,000, reducing the block reward from 6.25 BTC to 3.125 BTC.

Historically, Bitcoin prices have risen following each halving event, and many investors held similar expectations for the April 2024 halving, viewing it as a powerful new driver for price growth following the ETF breakthrough.

However, in the months immediately after the halving, Bitcoin did not surge to new all-time highs but experienced a brief pullback. Its upward trajectory only gained momentum later, catalyzed by a confluence of factors including major conferences, political elections, regulatory shifts, and strategic corporate holdings. From both mechanism and historical precedent, halvings significantly impact the market—often increasing volatility and speculative activity; reshaping the mining landscape by lowering miners’ profitability thresholds; stimulating technological innovation and community development within the blockchain ecosystem. Additionally, halving events may help counter inflationary pressures and enhance Bitcoin’s appeal as a long-term investment asset.

This evidence suggests that while the halving strengthens Bitcoin’s scarcity narrative, macroeconomic forces also play a critical role in price formation. Bitcoin’s mysterious power cannot be accurately predicted based solely on past patterns—it continuously redefines our understanding at every stage. As Binance CEO Richard Teng stated: We must adopt a longer-term perspective and assess market performance through the lens of market cycles. Rather than obsessing over when bull or bear markets arrive, we should focus on the long-term trends and fundamentals of the crypto market. Bitcoin consistently defies expectations, soaring to mythic gains amid waves of doubt, calm analysis, and anxious deliberation. We need only wait—Bitcoin remains great.

Bitcoin Miners: Foundation of the Ecosystem – Confidence vs. Survival Crisis?

From the miner’s perspective, 2024 was a year of dramatic change. Not only did miners ride an economic rollercoaster due to declining hash prices post-halving, but the rise of inscriptions and runes during the first half quietly transformed their primary revenue streams—an ecological awakening of sorts. Previously reliant solely on traditional block rewards, miners now see a growing share of income derived from infrastructure service fees (Gas fees). During the period surrounding the fourth halving, transaction fees spiked dramatically, with Rune tokens paying high fees on the halving block, becoming a significant contributor to miner revenues. According to statistics, since January 1, 2024, standard financial transactions accounted for 67% of total miner fee income, Runes for 19%, and BRC-20 and Ordinals transactions combined for 14%, with Gas fee revenues steadily rising.

Against this backdrop, the role of miners is undergoing a profound transformation. They are no longer merely block producers but increasingly resemble infrastructure providers within the Bitcoin ecosystem. Leveraging their network resources and infrastructure advantages built through mining operations, miners now offer services for various types of transactions and earn Gas fees. This shift integrates miners deeply into multiple layers of the Bitcoin ecosystem, aligning their fate closely with the health of the entire system and enabling them to explore more sustainable development paths under new economic models.

Bitcoin Conference: The Pulse of the Market

Mid-year arrived, and on July 27, Bitcoin 2024 took place in Nashville—a global spotlight moment where prominent political figures such as Donald Trump and Robert F. Kennedy Jr. made appearances. Their speeches and policy proposals regarding Bitcoin sent shockwaves across the conference and the wider crypto industry.

Trump delivered a nearly one-hour speech (despite starting an hour late), which was met with enthusiastic reception from tens of thousands in attendance. He affirmed Bitcoin’s status as a scarce and safe-haven asset, predicted it would surpass gold to become the world’s leading asset class, and emphasized that the U.S. must maintain its position as a global crypto superpower. He pledged that if elected, he would fire SEC Chair Gary Gensler on his first day in office—someone widely seen as obstructive to crypto innovation—and announced 13 commitments related to cryptocurrencies:

● On Day One, I will fire Gary Gensler and appoint a new SEC Chair.

● If elected, establish a U.S. government strategic national Bitcoin reserve.

● The U.S. government will retain 100% of its Bitcoin holdings.

● Bitcoin will go to the moon.

● Never sell your Bitcoin.

● Bitcoin may one day exceed the market cap of gold.

● I reaffirm my commitment to commute Ross Ulbricht’s sentence.

● There will never be a CBDC during my presidency if I am elected.

● Bitcoin and crypto will soar in ways never before imagined.

● Bitcoin does not threaten the dollar—what threatens the dollar is the current U.S. administration.

● The United States will become the global capital of cryptocurrency and the world’s Bitcoin superpower.

● Bitcoin represents freedom, sovereignty, and independence from government coercion and control.

● I pledge to the Bitcoin community: On the day I am sworn in, Joe Biden and Kamala Harris’s anti-crypto campaign will end.

Regardless of whether it was in character or simply for showmanship, Trump clearly improvised at the end: “Have fun, whether it’s Bitcoin, crypto, or anything else.” Riding the momentum of the conference, he effectively rallied support for his political ambitions.

Much like a star-studded fusion of politics and finance, Bitcoin Conference 2024 saw market prices alternately leap to new highs or briefly retreat to gather strength. The event functioned as a massive vortex of encrypted information—where technological innovations, policy interpretations, and market trend insights converged and then radiated outward like ripples across the entire cryptocurrency domain. Industry reactions to politicians’ statements remain mixed, awaiting the test of time.

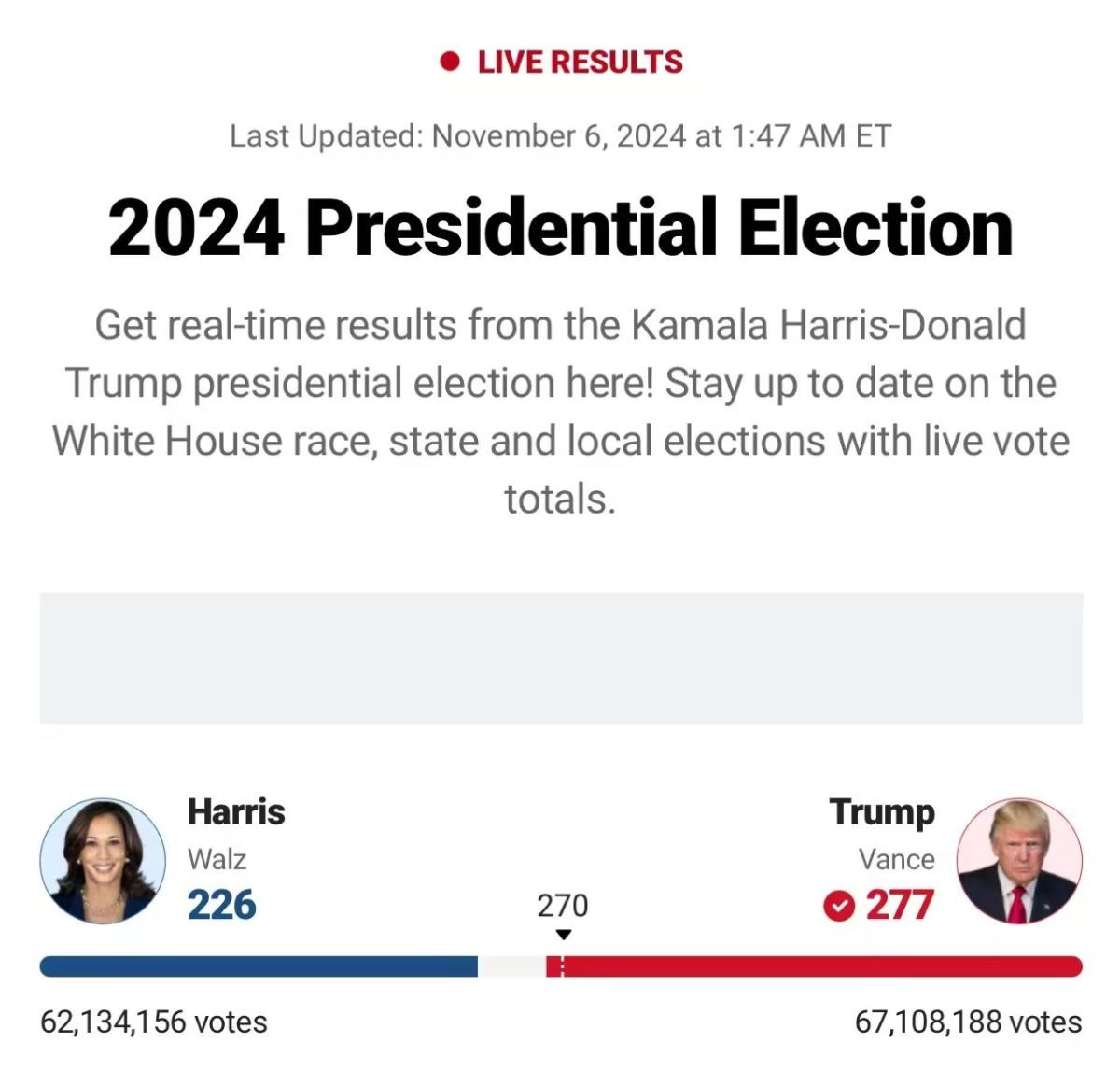

Bull Market Catalyst: Impact of the U.S. Election

November 6, 14:27—U.S. presidential election results were finalized, with Donald Trump emerging victorious, returning to the White House at age 78 with strong backing from the crypto community.

Trump’s victory and his subsequent pro-crypto policy announcements delivered a profoundly positive impact on Bitcoin’s price. Immediately after the results were confirmed, the Bitcoin market reacted swiftly, as investors flooded in based on strong expectations of favorable future policies.

Upon taking office, he announced several measures beneficial to the crypto industry: repealing SAB 121 next year on January 20, removing barriers for traditional financial institutions and accelerating institutional adoption of digital assets, thereby creating legal and compliant channels for substantial new capital inflows into Bitcoin, expanding market capacity and liquidity depth; fulfilling his Bitcoin Conference pledge by replacing the former SEC Chair with Paul Atkins, a known crypto advocate, sending a strong signal of regulatory easing and greatly boosting investor confidence; advancing plans to establish a strategic Bitcoin reserve, influencing supply-demand dynamics—by retaining and potentially expanding Bitcoin holdings, selling pressure is reduced while its appeal as a strategic asset grows; planning to halt government sales of Bitcoin, instead treating it as a long-term investment asset; his affiliated company is also negotiating with Intercontinental Exchange to acquire crypto exchange Bakkt, injecting fresh vitality and imagination into Bitcoin’s trading ecosystem, attracting more participants and indirectly supporting further price appreciation.

Riding this wave of favorable U.S. policy tailwinds, Bitcoin is charging forward along its upward price trajectory. Against this backdrop of converging positive developments, its future potential appears increasingly vast. Welcome to the new era of cryptocurrency, propelled by Trump!

New Political Landscape: Key Figures Voice Support, Government Reserves Enter

Driven by historic market rallies, several nations are now considering establishing national Bitcoin reserves. We are witnessing a notable trend: an increasing number of political leaders are recognizing Bitcoin’s value.

U.S. President-elect Trump vowed to make America the global hub of cryptocurrency, pledging not to sell any Bitcoin held by the federal government and instead hold it as a strategic reserve asset indefinitely.

Russian President Vladimir Putin signed a law taxing digital currencies, classifying them as property usable in foreign trade payments, exempting mining and sales from VAT, requiring mining infrastructure operators to report to tax authorities, and taxing individual income from crypto as in-kind compensation. At a forum, Putin emphasized that no one can ban Bitcoin or other electronic payment methods because they represent new technologies destined to evolve.

Japanese Prime Minister Shigeru Ishiba announced restructuring of the country’s Web3 and crypto policy apparatus, dissolving the ruling LDP’s existing Web3 task force and forming a new dedicated unit under the party’s Digital Society Promotion Department, led by the former secretary-general of the Web3 group—though its exact responsibilities remain unclear.

The South Korean State Council passed the Enforcement Decree of the Virtual Asset User Protection Act, effective July 19, mandating virtual asset service providers to secure user deposits through banks and granting them the right to suspend cash or crypto withdrawals based on reasonable grounds.

El Salvadoran President Nayib Bukele proposed leasing the country’s volcanoes to miners for sustainable Bitcoin mining using geothermal energy. The nation has already successfully mined approximately $46 million worth of Bitcoin using geothermal power.

Argentine President Javier Milei advocates separating cryptocurrencies from state control, criticizes central bank digital currencies (CBDCs), promotes private-sector management of crypto, and warns against excessive government expansion.

Singapore’s Monetary Authority (MAS) announced support for a commercial asset tokenization initiative, convening multinational financial institutions for industry trials, encouraging standard-setting, and promoting the commercialization and adoption of tokenized capital market products.

Suriname presidential candidate Maya Parbhoe promised that if elected in 2025, she would adopt Bitcoin as legal tender, gradually phasing out the Surinamese dollar, plan to dissolve the central bank, reduce taxes, privatize public services, leverage Bitcoin’s transparency to combat corruption, and call Bitcoin key to rebuilding the nation’s financial infrastructure.

Polish presidential candidate Sławomir Mentzen pledged to create a strategic Bitcoin reserve if elected.

These efforts and declarations by global political figures signal that Bitcoin is poised to occupy an increasingly pivotal role in the future financial order. It is steadily entering the grand vision of the global economy—like a shining new star capturing the attention of policymakers worldwide.

Regulatory Shift: Institutions Pour In

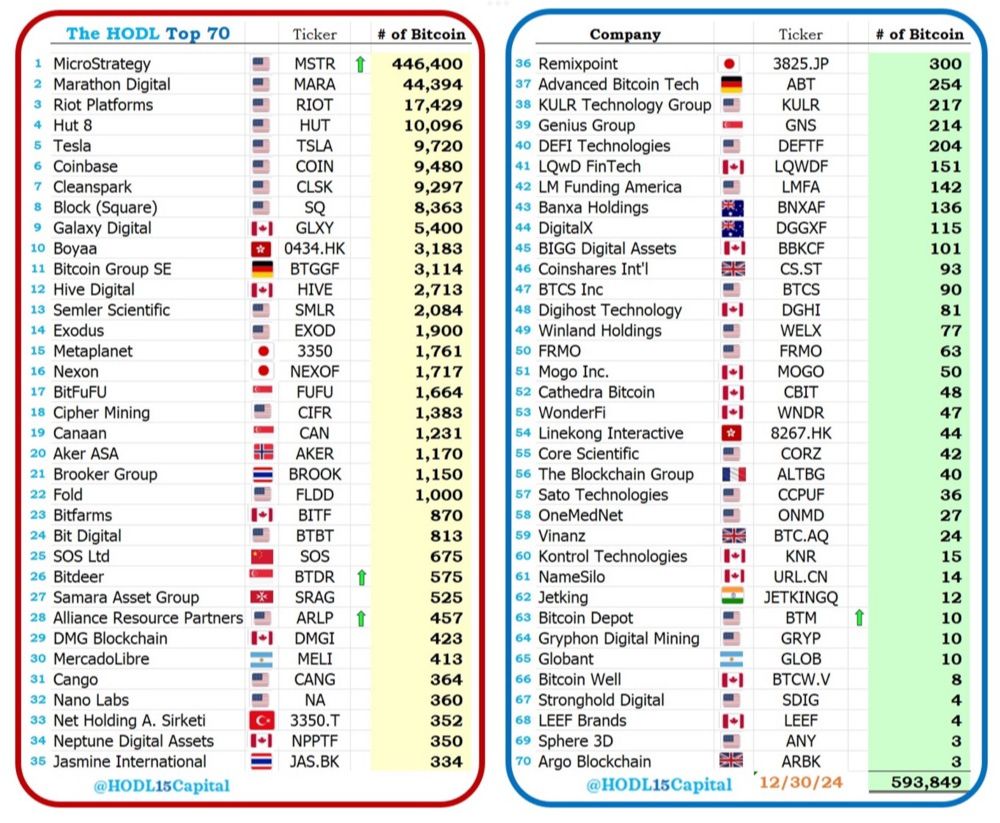

As the 2024 regulatory environment became more open and transparent, the crypto industry entered a new era. Riding this wave, the “crypto-plus-stocks” model emerged as a favorite among listed companies, with many incorporating Bitcoin into their treasury strategies. Tesla and MicroStrategy stand out as pioneers, achieving “diamond hands victory” through steadfast holding. MSTR’s stock price soared from around $194 to nearly $500 in roughly one month—an increase of about 150%. In the Hong Kong market, twin titans Boyaa Interactive and Meitu—both major Bitcoin holders—possess 2,641 and 940 BTC respectively. Coinbase, the first publicly traded crypto exchange, reported total Bitcoin-related profits of $804 million, with its stock price multiplying nearly 7.88 times from its lows.

This success has inspired a wave of follow-on actions. On November 19, Nano Labs Ltd (Nasdaq: NA) announced plans to allocate part of its remaining cash reserves to Bitcoin as a long-term strategic asset; on the same day, U.S.-listed Genius Group Limited (GNS) revealed it had purchased 110 BTC for $10 million at an average price of $90,932; LQR House Inc. (LQR), a niche e-commerce platform focused on spirits and beverages, announced board approval to buy $1 million worth of Bitcoin as part of its capital management strategy; on November 20, U.S.-listed biopharmaceutical firm Acurx Pharmaceuticals (ACXP) approved purchasing $1 million of Bitcoin as a reserve asset; on the same day, another U.S. public company Hoth Therapeutics (HOTH) announced board approval to purchase up to $1 million in Bitcoin...

The message is clear: numerous public companies now fully recognize Bitcoin’s value storage capability and its potential to boost equity valuations, joining the growing “BTC Strategic Reserve Race.”

Image source: HODL15Capital

Bitcoin Ecosystem: Laying Low Through Winter, Waiting to Bloom

The Bitcoin ecosystem resembles an accelerated version of the broader crypto world—from the birth of the Ordinals protocol at the end of 2022, to the NFT mini-bull run in early 2023, followed by a brief bear market mid-year, during which enthusiasts gathered in online spaces to dream and speculate about the future. Then came the BRC-20-fueled second mini-rally. By autumn 2023, the market quieted down, only to ignite a third wave in early 2024, followed by a prolonged consolidation phase. In just two years, Bitcoin’s ecosystem has cycled through what traditionally takes the broader crypto space a full decade.

Over the past year, Bitcoin’s market dominance rose significantly from 45.27% to 56.81%. Its spot ETF holdings grew substantially, signaling the emergence of a new market paradigm centered on Bitcoin, with ETFs and U.S. equities serving as key capital inflow channels and public companies as vehicles—highlighting the urgency of ecosystem development and capital efficiency. On Layer 2, 77 projects showed activity over the past three years. In the first half of 2024, driven by ETF hype, some legacy projects saw increases in trading volume and token prices, with diverse solutions emerging and total value locked reaching $3 billion, with strong growth potential ahead. On Layer 1 execution layers, new execution standards appeared, with steady activity growth initially, though momentum didn’t sustain. Among other infrastructure components, cross-chain bridges and WBTC dominate interoperability, with more solutions expected. On security, given that interoperability risks asset safety, novel solutions like Babylon’s Bitcoin timestamping and staking protocol have emerged, alongside new technologies such as data availability layers (DA layers) like Nubit, unlocking latent value within Bitcoin.

The Bitcoin ecosystem still occupies a relatively nascent and fragmented position. However, it has made significant progress compared to last year. The Bitcoin ecosystem will not miss the next raging bull market—there are still countless untold narratives waiting to be discovered. The prior dormancy and accumulation have already built sufficient momentum. A wave of innovative projects is on the horizon.

Making History: Bitcoin Breaks $100K—What’s Next?

At around 10:30 AM on December 5, BTC briefly surged above $100,000, with a 24-hour gain nearing 5%, marking the first time Bitcoin lived up to expectations by breaking the six-figure barrier. Meanwhile, Ethereum surpassed 3,800 USDT, up 5.35% over 24 hours; SOL broke 230 USDT, narrowing its 24-hour decline to just 2%.

Image source: OKX

The media sensation triggered by Bitcoin surpassing $100,000 has thrust crypto and decentralization firmly into mainstream consciousness. The public finds itself looking back at Bitcoin’s journey—from humble beginnings to towering prominence—its price ascent resembling an epic saga. Counting from the iconic Pizza Day, it has now weathered sixteen years of evolution.

It has gradually moved from the margins to the center. When Bitcoin first crossed $1, few could imagine its extraordinary potential; when it breached $100, $1,000, and beyond, the world began to take notice. Now, surpassing $100,000 elevates Bitcoin to an entirely new echelon.

In closing, may Bitcoin continue to write miracles, and may we, who believe in Bitcoin, create miracles together.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News