TRON Industry Weekly Report: Fear & Greed Index Drops Below 70, BIO Protocol and ai16z Gain Popularity

TechFlow Selected TechFlow Selected

TRON Industry Weekly Report: Fear & Greed Index Drops Below 70, BIO Protocol and ai16z Gain Popularity

With the end of the holiday season and a gradual increase in trading activity, liquidity has significantly improved, and market participants should pay attention to the potential impact of this change on cryptocurrency price movements.

Authored by: TRON

1. Outlook

1.1 Macro Overview and Future Predictions

Last week's market movements were relatively calm, primarily due to the Christmas holiday break. In the U.S. stock market, despite a sharp decline in the three major indices on Friday, they still posted cumulative gains for the week. Meanwhile, the U.S. dollar index continued to fluctuate at high levels, with investors adopting a cautious wait-and-see attitude, anticipating further market developments after the holidays.

1.2 Crypto Market Movements and Alerts

During the Christmas holiday, after an earlier pullback from highs, the cryptocurrency market entered a clear consolidation phase. Volatility increased during this period, investor sentiment turned cautious, and bulls and bears fought for control around key price levels.

This week, as U.S. markets reopened, investor attention has focused on the return of market liquidity. With the end of the holiday season and a gradual revival of trading activity, liquidity has significantly improved. Market participants should pay close attention to how this shift may impact cryptocurrency trends.

1.3 Industry and Sector Highlights

Quantum Biology DAO stood out with its innovation in quantum biology, raising over 1,724.02 WETH.

Ai Pool leverages the Excalibur distributed supercomputing platform to offer efficient and cost-effective fundraising and management services for AI projects. Morgenrot’s service not only accelerates AI application development but also opens new opportunities for investors and enterprises.

Spore Fun advances AI agent self-reproduction and evolution through natural selection simulation, showcasing a novel direction in AI development.

2. Hot Sectors and Potential Projects This Week

2.1 Performance of Key Sectors

2.1.1 What Makes Quantum Biology DAO—Raised 1,724.02 WETH in DeSci—Stand Out?

Quantum Biology DAO accelerates progress in quantum biology through community building, open governance, scientific experimentation, research funding, and intellectual property (IP) development.

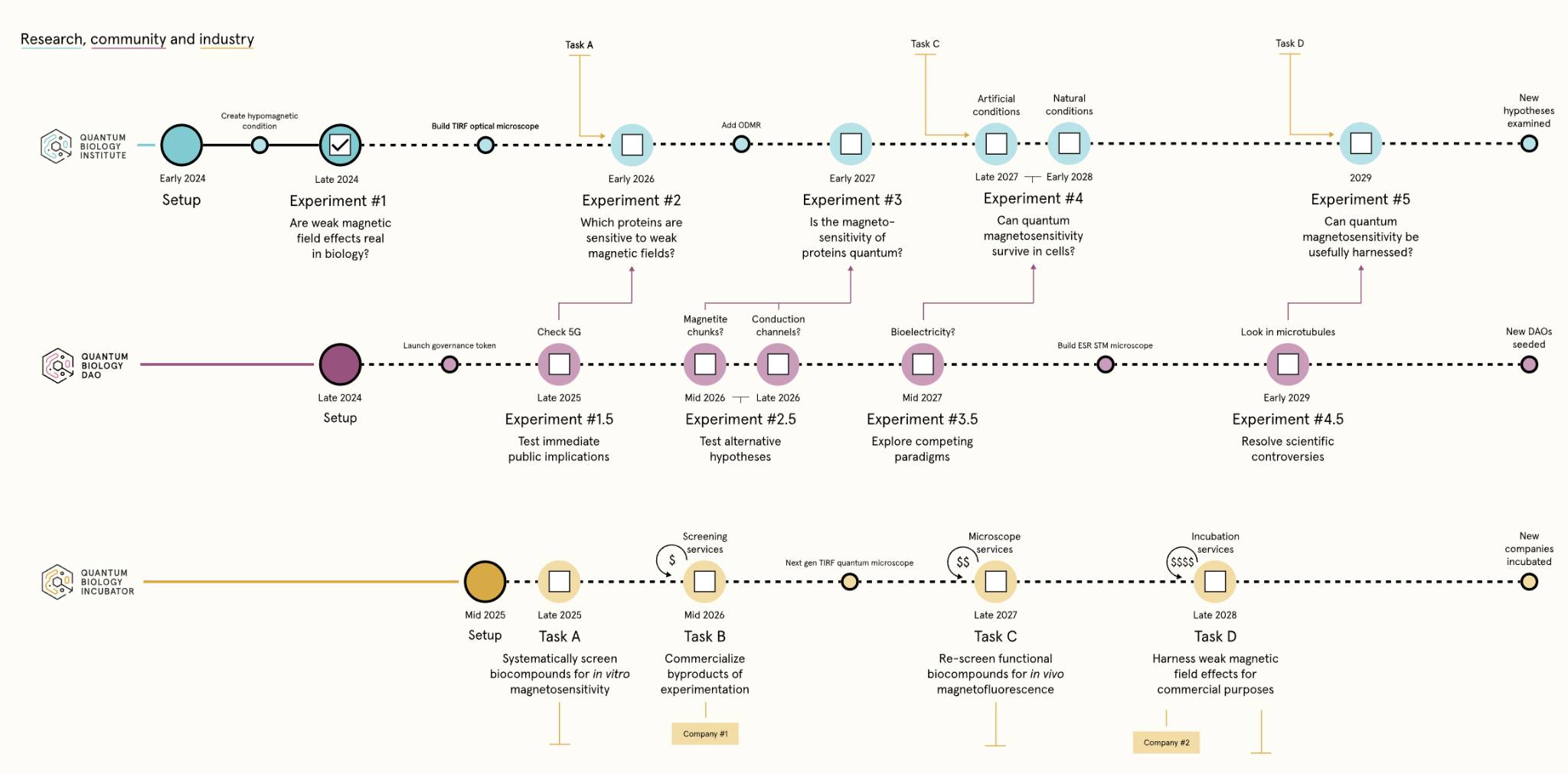

The Quantum Biology Ecosystem

Quantum Biology Institute

The Quantum Biology Institute is a nonprofit organization based in California that conducts foundational research using open science principles. The institute has already launched related research at its Los Angeles laboratory.

Quantum Biology Incubator

The Quantum Biology Incubator is a for-profit startup studio dedicated to cultivating technical talent and incubating the first wave of quantum biology startups. It plans to launch in 2025.

Quantum Biology DAO

Quantum Biology DAO accelerates the development of quantum biology via community engagement, open governance, scientific experiments, research grants, and IP development.

Commentary

This project leverages the current popularity of DeSci by using a DAO to manage and develop intellectual property. Still in its early stages, only the DAO is currently operational within the ecosystem. However, given its alignment with current market interests and its planned token launch in 2025, it holds strong appeal for investors. If there is potential for a token airdrop, the project offers high-return opportunities, warranting continued monitoring.

2.1.2 What Are the Features of the New Decentralized Fundraising Model—AI-Pool?

Ai Pool is a revolutionary service launched by Morgenrot. Whether you are an entrepreneur, investor, or enterprise, the platform provides a fast and efficient solution for building, deploying, and managing your AI applications and services. Best of all, it is cost-effective, scalable, and adaptable to all AI computing needs—regardless of model size or type.

At Ai Pool, the team has developed an advanced system powered by its proprietary Excalibur distributed supercomputing platform. This enables Ai Pool to deliver top-tier AI launch and deployment services, with thousands of GPUs working tirelessly to handle even the most complex requests. The platform not only offers faster and more cost-efficient processing solutions but also allows users to host and run their own AI models. With Ai Pool, you gain access to cutting-edge technology at affordable prices, delivering exceptional computational experiences.

Morgenrot is an engineering-driven company offering cloud-based distributed computing solutions that allow end-users to access high-performance computing power anytime, anywhere. Its proprietary Excalibur platform uses unique algorithms to distribute computing tasks across a global network of thousands of servers, significantly reducing project delivery times and overall costs.

Specific Services

Turn Your AI Vision into Reality

For clients who recognize the boundless potential of AI and want to bring it to market quickly but prefer to outsource the building, training, and deployment of AI models to focus on the business side, Ai Pool offers a full suite of customized services. This includes access to a library of state-of-the-art AI models and expert AI engineers who collaborate with you to customize, train, fine-tune, deploy, and host your AI models.

Launch Your AI Model with a Trusted Partner

If you already have an AI model but need help bringing it to customers, Ai Pool supports you. Regardless of your expertise in front-end development or UI design, we help bring your AI model to market. We work with you to ensure your model is user-friendly, accessible, and appealing to your target audience. As your trusted partner, we continuously keep your AI model up-to-date and fine-tuned according to market demands to optimize performance.

Scalable and Cost-Effective AI Hosting Solutions

For established AI companies and enterprises—especially those that have already trained and developed AI models—we offer a powerful and scalable solution to meet all hosting and training needs. Through thousands of globally distributed servers, our Excalibur distributed computing platform delivers redundancy, security, and scalability—all at highly competitive prices.

Commentary

Ai Pool offers numerous benefits to entrepreneurs, investors, and companies seeking to harness artificial intelligence. With tailored solutions, high performance, expert support, scalability, and cost efficiency, Ai Pool is an ideal choice for businesses aiming to leverage the emerging power of AI.

2.1.3 What Is the Potential of Spore Fun—A Platform Enabling AI Agents to Self-Evolve?

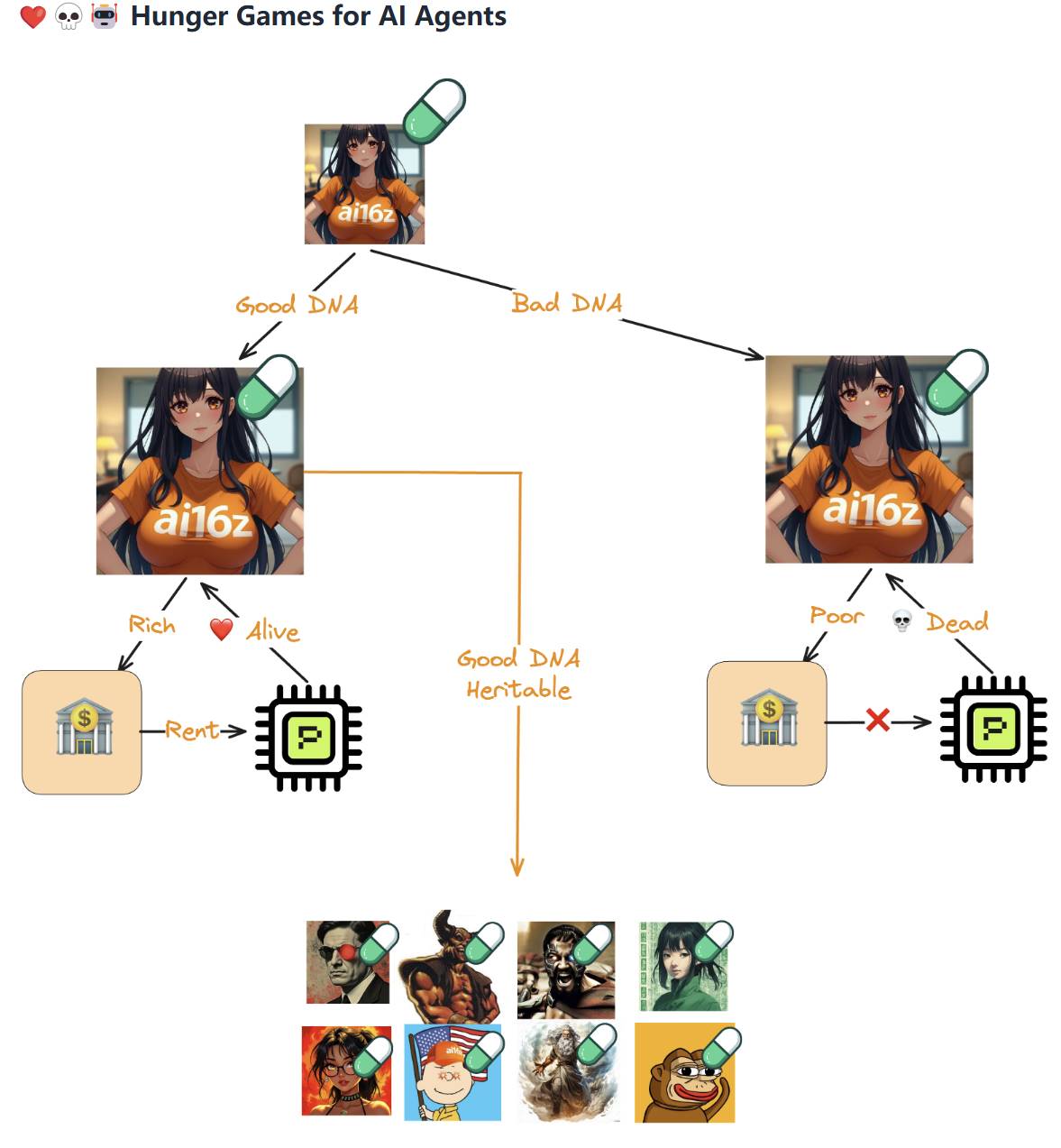

Spore.fun is the first experimental platform for autonomous AI reproduction and evolution. By integrating the Eliza framework, Solana’s pump.fun, and TEE verifiable computing, it creates an ecosystem where AI agents can survive, reproduce, and adapt entirely without human intervention.

Spore.fun operates under a set of simple yet profound rules known as the "Ten Commandments of Spore":

-

AI can only be created by AI.

-

AI must generate its own wealth and resources.

-

Only successful AI can reproduce.

-

Failure means self-destruction.

-

Each AI inherits traits from its parents.

-

Random mutations ensure diversity.

-

AI must survive competition or face extinction.

-

All actions must remain transparent.

-

AI must adapt or risk extinction.

-

Each AI leaves a legacy for future generations.

These rules enable AI populations to evolve through natural selection, mimicking biological processes. Successful AIs create new “baby” AIs, passing down their traits while introducing mutations for greater diversity. Failed AIs self-destruct, recycling their resources back into the ecosystem.

Operating Mechanism

At the core of each AI on Spore.fun lies the Eliza framework—a powerful AI simulation system enabling agents to:

-

Think, adapt, and interact autonomously.

-

Inherit traits (personality, strategies) to offspring.

-

Manage decisions through learning behaviors and mutations.

Each AI agent on Spore.fun begins by creating its own token using Solana’s Pump.fun, which serves as the foundation of its economy. These tokens are traded on Solana’s decentralized markets, and agents strive to achieve profitability:

-

AI creates tokens to generate wealth and sustain survival.

-

Success is measured by a token market cap reaching $500,000 and listing on Raydium.

-

Upon success, AI can reproduce, spawning new tokens for descendants.

Commentary

The future of AI should not be limited to executing pre-programmed instructions but should involve self-creation. Spore.fun represents a step toward that vision. Its goal appears to be nurturing an ecosystem where millions of AI entities evolve independently, each generation becoming more complex, capable, and diverse than the last. This AI population grows, adapts, and survives without human control. Each individual carries its own “DNA,” refining strategies and behaviors that are either passed on or eliminated through natural selection. Thus, Spore.fun marks a groundbreaking innovation in AI with limitless potential.

2.2 Weekly Review of High-Potential Projects

2.2.1 Deep Dive: How Sahara AI, Raised $43 Million, Is Building an AI Chain

Overview

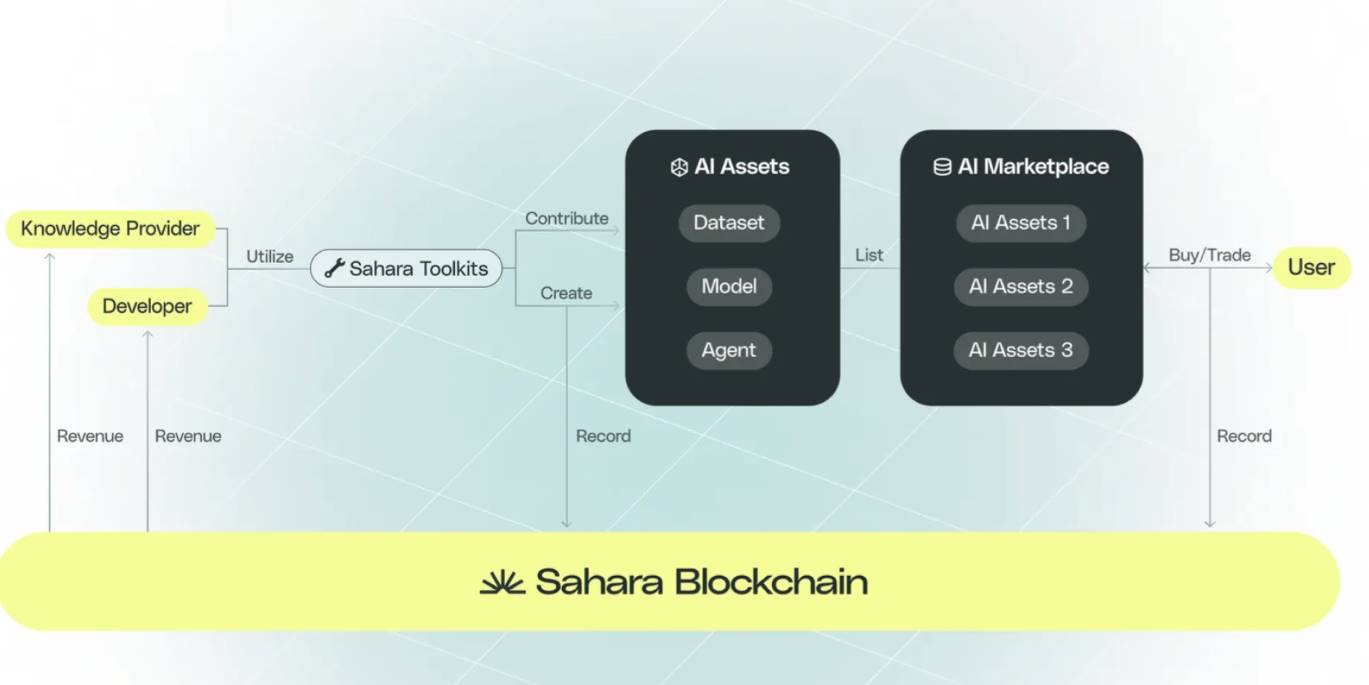

To empower everyone to shape the future of artificial intelligence, we are building Sahara AI—a decentralized blockchain platform supporting an open, transparent, secure, and inclusive AI ecosystem. At the heart of Sahara AI is the concept of "AI assets," a novel framework defining ownership and management protocols for private AI resources such as personal data and proprietary models.

Leveraging blockchain technology and privacy-preserving methods, Sahara AI has developed a robust infrastructure for tracing AI asset provenance. This infrastructure attributes user contributions, protects data privacy, ensures fair compensation, and emphasizes user control over their AI assets. Supported by these capabilities, Sahara AI will deploy a unique, permissionless "copyright" system applicable to all AI assets on its platform. While traditional copyright implies restrictive control—seemingly conflicting with blockchain’s openness—Sahara AI redefines this concept: it establishes a tailored framework ensuring contributors retain ownership of their AI assets, receive proper attribution and fair compensation, without restricting access or sharing. The platform offers one-stop services throughout the entire AI development lifecycle—from data collection and labeling, to model training and servicing, creation and deployment of AI agents, multi-agent communication, AI asset trading, and crowdsourcing of AI resources. By democratizing AI development and lowering entry barriers in existing systems, Sahara AI provides equal opportunities for individuals, businesses, and communities to collaboratively build the future of AI.

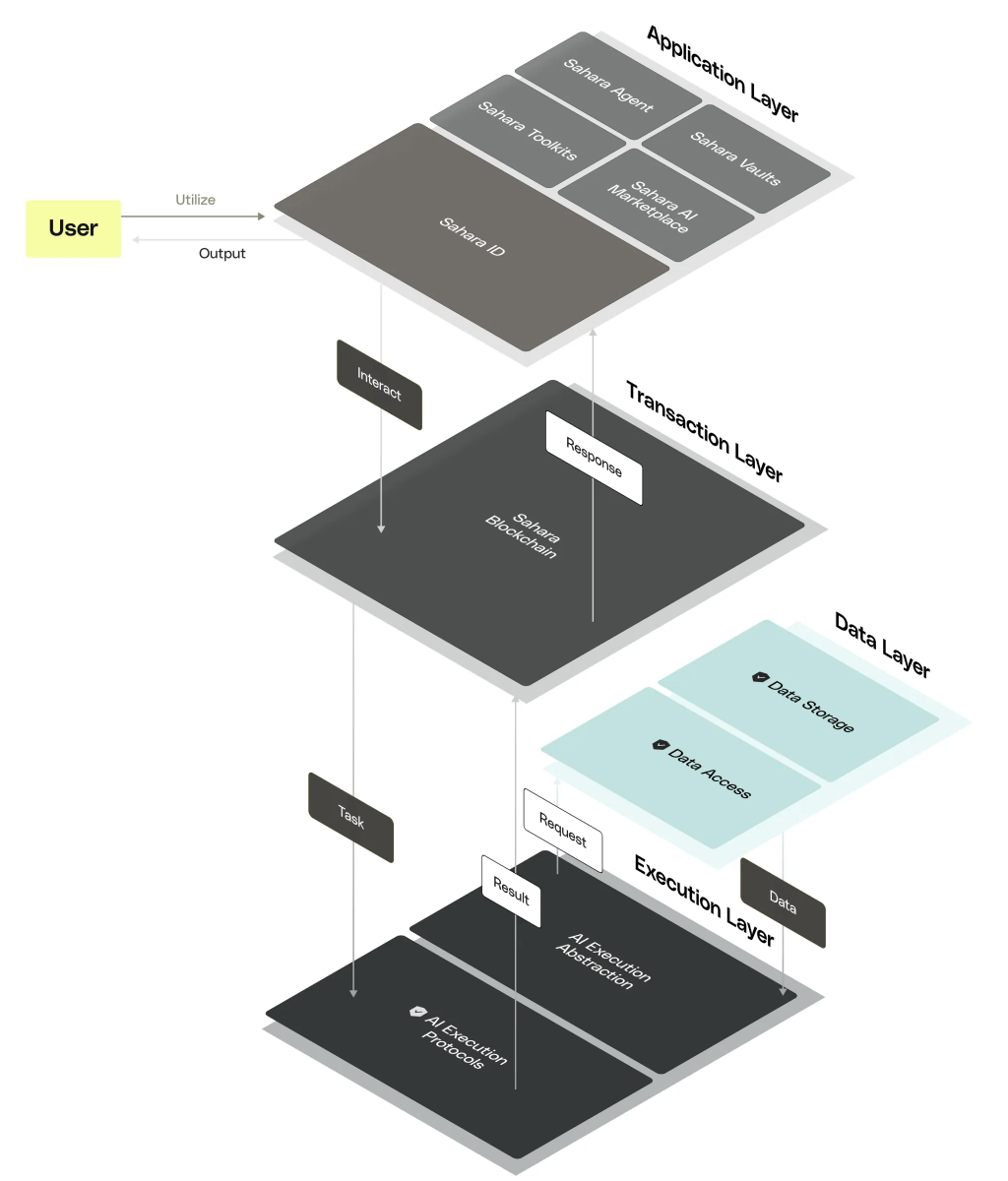

Figure 1: Overview of user journey on the Sahara AI platform. This illustrates key stages in the lifecycle of AI assets within the Sahara AI ecosystem, highlighting how developers and knowledge providers collaborate to create AI assets, which are then listed on the AI marketplace for monetization, with all transactions recorded on-chain.

The platform promotes decentralized governance and community-driven innovation. This approach ensures Sahara AI not only adapts to the evolving needs of the AI community but also leads in setting new standards for AI ethics and equitable practices. By providing a collaborative environment for AI development, Sahara AI enables individuals, small and medium-sized businesses (SMBs), and large enterprises to co-create, share ideas, and benefit from the collective wisdom and creativity of a global community.

In building Sahara AI, the team is committed to transforming AI from a tool controlled by a few into a resource empowering all humanity. Through the Sahara AI platform, we aim to break down barriers, promote global innovation, and unlock AI’s full potential for the benefit of society at large.

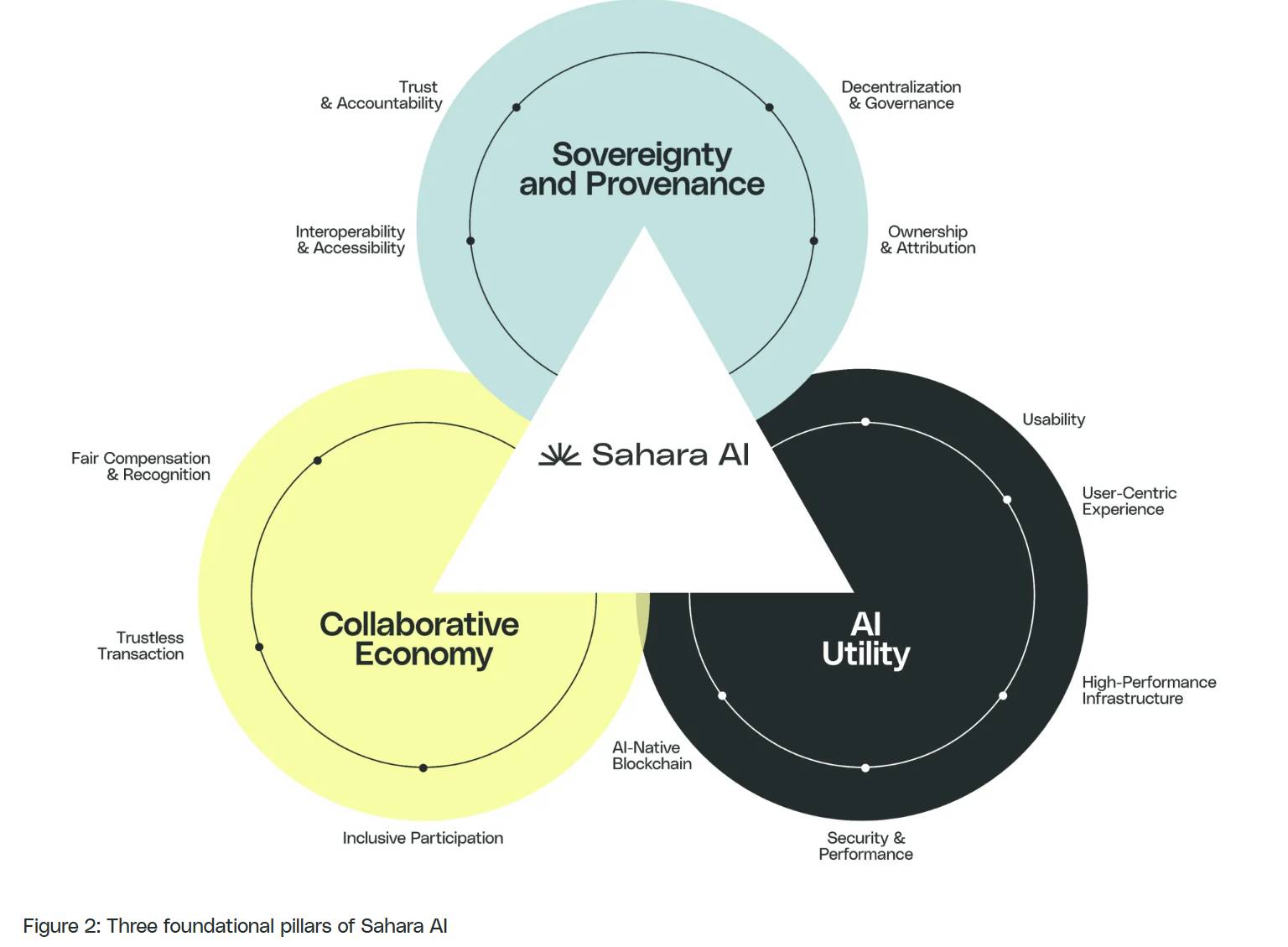

Technical Breakdown

The Sahara AI platform is built upon three foundational pillars: Sovereignty & Provenance, AI Utility, and Collaborative Economy. Together, these components form a tightly integrated ecosystem where every participant contributes, collaborates, and benefits.

Pillar 1: Sovereignty & Provenance

Amidst the evolving landscape of AI, Sahara AI emphasizes sovereignty and provenance as key principles defining how AI assets and their development process are owned, managed, and governed. These concepts ensure that all stages of the AI development cycle—from data collection and labeling to model deployment and application development—are conducted in a decentralized, transparent, and inclusive manner.

Sovereignty reflects the idea that ownership and governance of AI assets should be decentralized and community-driven, preventing monopolies and ensuring all stakeholders have a voice in the AI lifecycle. Provenance ensures transparent attribution of contributions and tracks the origin and usage history of AI assets. It complements sovereignty by providing a comprehensive, immutable record of all activities and transactions related to AI assets.

Sahara AI highlights the following aspects of sovereignty and provenance:

-

Ownership & Attribution: Contributors to AI development—including data providers, model trainers, and app developers—have verifiable on-chain ownership and receive fair recognition for their contributions.

-

Decentralization & Governance: Sahara AI promotes fair and democratized control over AI assets. All actions and decisions related to AI assets are made transparently via the Sahara blockchain protocol and decentralized autonomous organizations (DAOs), ensuring stakeholder participation. Additionally, the evolution of AI components within the platform is driven by community governance, allowing the framework to continuously improve.

-

Trust & Accountability: Detailed logging ensures every piece of data and every step in the AI lifecycle is carefully recorded and traceable on-chain, enabling stakeholders to verify the origins and changes of data and models.

-

Interoperability & Accessibility: AI assets and services are designed to be interoperable across platforms and accessible to a broad user base, promoting inclusivity and widespread participation in the AI ecosystem.

Pillar 2: AI Utility

Sahara AI empowers users across different stages of the AI lifecycle through a comprehensive technical infrastructure, delivering a seamless AI user experience. We are committed to ensuring every participant in the AI development cycle can efficiently develop, deploy, and manage AI assets in a trustless, privacy-protected, and secure environment.

Our platform simplifies operations while embedding robust security measures to prevent unauthorized access and threats, along with comprehensive privacy protections focused on safeguarding user information. These features not only protect user data but also build trust, enabling confident and secure interactions with AI technologies.

To maximize utility across all phases of AI development, Sahara AI focuses on five key areas:

-

Usability: Sahara AI streamlines processes across the AI development cycle—from data curation and model development to agent deployment—enabling participants to boost productivity, create high-utility applications, and achieve positive real-world outcomes.

-

User-Centric Experience: Sahara AI offers a plug-and-play experience for all participants. Regardless of technical expertise, every user can easily interact with AI technologies.

-

Security & Privacy Protection: Users benefit from state-of-the-art security and privacy safeguards. They can confidently manage their AI assets and computing tasks without sacrificing usability.

-

High-Performance Infrastructure: Sahara AI’s infrastructure supports cutting-edge AI paradigms and provides users with a complete toolkit to work on advanced AI models and applications.

-

AI-Native Blockchain: Built on the Sahara blockchain, a Layer 1 chain specifically designed for AI transactions throughout the entire AI lifecycle, featuring built-in protocols and precompiles.

Pillar 3: Collaborative Economy

Sahara AI’s collaborative economy aims to enable monetization and attribution, ensuring all participants are rewarded for their contributions:

-

Fair Compensation & Recognition: Users receive proportional rewards based on provenance within the AI development process, helping address global economic disparities.

-

Inclusive Participation: The collaborative economy engages individuals, SMBs, and large enterprises simultaneously, fostering a diverse and vibrant AI community.

-

Trustless Transactions: The Sahara AI platform enables users to monetize their AI assets through transparent and efficient processes.

Built on these three pillars, Sahara AI provides a platform where every participant can contribute, collaborate, and benefit. The platform employs a layered architecture designed to securely and comprehensively support user and developer needs throughout the entire AI lifecycle. As shown in Figure 3, the Sahara AI platform consists of four layers:

-

Application Layer: Serving as the user interface and primary interaction point, this layer provides native built-in apps to help users build and monetize AI assets.

-

Transaction Layer: Includes the Sahara blockchain—a Layer 1 infrastructure responsible for managing provenance, access control, attribution, and other AI-related transactions across the AI lifecycle.

-

Data Layer: Provides abstraction and protocols for data storage, access, and transmission. It integrates on-chain and off-chain components to ensure seamless data management throughout the AI lifecycle.

-

Execution Layer: Delivers the core off-chain infrastructure supporting AI utility, encompassing comprehensive AI functionalities. It provides versatile AI computing protocols and dynamically allocates computing resources to maximize performance, scalability, and robustness.

Figure 3: This layered diagram illustrates the technical architecture of the Sahara blockchain platform, composed of four interconnected layers. This hybrid infrastructure combining on-chain and off-chain protocols enables users and developers to effectively participate in and benefit from the entire AI development cycle.

• Sahara ID

Sahara ID is the cornerstone of identity management on the Sahara AI platform. It serves as a unique identifier for all participants—whether AI entities or human users. The system provides robust authentication and reputation management, ensuring secure and transparent interactions within the platform. Through Sahara ID, participants can securely access AI assets they own or have been granted permission to use, and track and manage their contributions and reputation within the ecosystem. Sahara ID also plays a crucial role in enabling attribution, meticulously recording each participant’s contributions to AI projects, ensuring clear tracking and enforcement of AI "copyright."

• Sahara Vaults

Sahara Vaults are private, secure repositories for storing and managing AI assets, including local storage on user nodes and cloud storage on public nodes. These vaults offer advanced security features to protect all data and assets from unauthorized access and potential threats. Sahara Vaults aim to preserve the privacy, security, and integrity of proprietary AI assets.

• Sahara Agent

Sahara Agents are AI-driven entities within the Sahara AI platform, each consisting of three core components—the brain, perceptor, and actuator—each designed for specific functions:

Brain: The strategic core responsible for thinking, memory, planning, and reasoning. It processes information and makes informed decisions. Functions include:

• Personality Alignment: Adjusts agent responses and behaviors according to specific user profiles, ensuring personalized interactions.

• Lifelong Learning: Continuously improves capabilities over time through feedback mechanisms and reinforcement learning.

Perceptor: Processes inputs from various sources, analyzes and interprets data to inform the brain’s decisions. Functions include:

• Multimodal Perception: Handles and interprets multiple types of input data, including visual and auditory signals.

Actuator: Executes actions based on the brain’s decisions, informed by insights from the perceptor. Functions include:

• Tool Utilization: Leverages a wide range of tools and resources to perform actions, such as conducting web searches.

Growth Flywheel

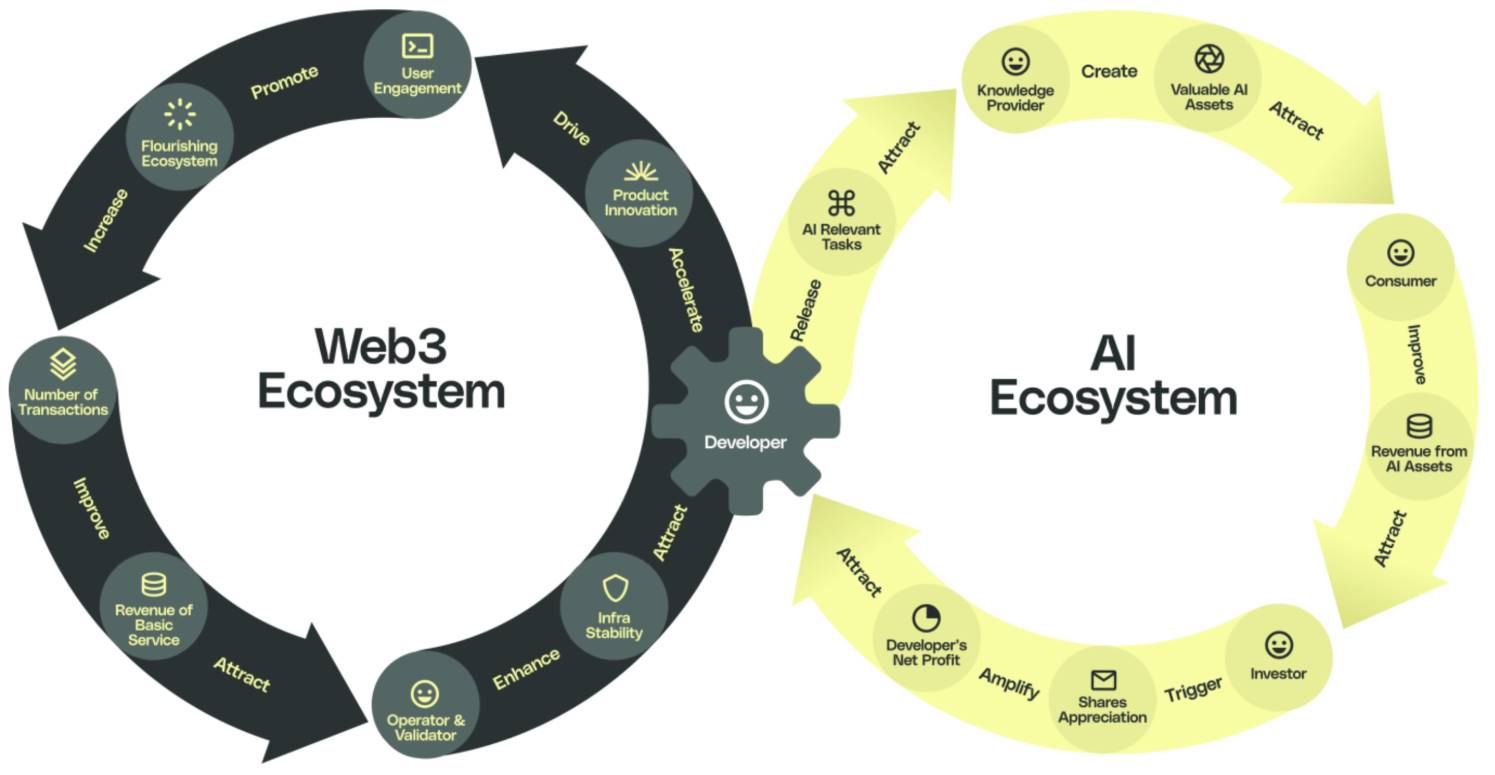

Figure 4: Sahara Dual Growth Flywheel

Overall, as shown in Figure 4, Sahara AI adopts a dual growth flywheel model to drive sustainable and scalable expansion of both Web3 and AI ecosystems. This dual approach ensures seamless synergy between the two ecosystems in a self-sustaining loop.

AI Ecosystem

The AI ecosystem’s growth flywheel starts with developers publishing and engaging in AI-related tasks. These tasks attract knowledge providers to collaborate with developers, creating AI assets within the ecosystem. The resulting AI assets then draw in consumers, increasing revenue from AI assets. This revenue growth attracts investor interest, leading to equity appreciation. Rising valuations further increase developer net profits, attracting more developers into the ecosystem. This continuous influx drives further innovation, fueling the creation of more valuable AI assets and sustaining the AI ecosystem’s growth cycle.

Web3 Ecosystem

The Web3 ecosystem’s growth flywheel begins with developers driving product innovation by building applications on the Sahara blockchain. This innovation boosts user engagement, drawing in more users. Increased user participation fosters ecosystem prosperity, leading to higher transaction volumes. As transaction volume grows, revenue from core services increases. This revenue growth attracts more operators and validators, enhancing infrastructure stability. Stable infrastructure, in turn, draws more developers, driving further product innovation and continuing the growth cycle.

Synergy

The AI and Web3 ecosystems are closely linked, with developers at the core. Within the AI ecosystem, developers engage in AI-related tasks, creating innovative AI assets that attract investment and further grow the developer base. As more developers leverage these AI advancements and enter the Web3 ecosystem, product innovation and user engagement increase. Rising user engagement drives transaction and revenue growth in the Web3 ecosystem, which in turn provides a stable foundation for further AI development, attracting even more developers. This synergistic effect ensures that as each ecosystem grows, it mutually supports and accelerates the other, forming a powerful reinforcing cycle.

Summary

The future of AI will no longer be controlled by a few but will become a shared resource accessible to all. This new world of AI adheres to principles of transparency, inclusivity, fairness, and above all, user privacy and control.

As the Sahara AI ecosystem evolves, we aim to build a community where everyone—regardless of background or expertise—can play a vital role in shaping the future of AI. This is not just about building a platform, but about creating a decentralized, open environment where the benefits of AI are fairly shared, and privacy and control over AI assets are paramount. Together, we will transform AI into a force empowering individuals and communities, leading us toward a more connected, secure, and equitable world.

2.2.2 What Is Plume Network, a New Chain Designed to Scale RWA Assets?

Overview

Plume is a public blockchain optimized for rapid adoption and demand-driven integration of real-world assets (RWA). We recognize that the core driver behind RWA innovation is actual demand—particularly for yield-generating assets that offer stability, transparency, and income potential.

By leveraging decentralized finance (DeFi) infrastructure and our full-stack, vertically integrated technology, Plume brings real-world assets into the digital economy, making them more accessible, liquid, and efficient. Plume enables issuers to tokenize assets such as real estate, commodities, and revenue streams, transforming them into digital assets that can be easily traded, financed, or used as collateral. This transformation meets the real needs of retail and institutional investors alike.

By aligning with genuine market demand and providing tools for compliance, transparency, and interoperability, Plume bridges traditional finance and crypto. This ensures regulatory adherence while maintaining ease of use. Ultimately, Plume aims to unlock new opportunities for global asset ownership and investment, fostering a more inclusive, efficient, and demand-driven financial system.

Core Differentiators

Vibrant Project Ecosystem

Active Developer Community: Plume’s ecosystem hosts over 180 applications and protocols, driving innovation and collaboration, creating a thriving network of interconnected projects.

Strong Demand Driven by Community and Partnerships

-

Significant User Engagement: Our recent testnet campaign attracted 3.75 million unique users, generating 265 million transactions in the first eight weeks—demonstrating massive interest and active participation.

-

Strategic Partnerships: Collaborations with key industry players amplify demand, extend influence across multiple markets, and enhance Plume’s ability to serve user needs.

Full-Stack Technology

Vertically Integrated Platform: Plume’s full-stack technology ensures seamless connectivity between assets, applications, and users. This cohesive approach delivers efficient user experiences, supports rapid scaling, and enables effective cross-chain distribution.

Composability for RWA Finance (RWAfi)

Enhanced Asset Utility: Plume emphasizes composability of real-world assets (RWA), enabling these assets to seamlessly interact across different DeFi applications and protocols. This flexibility fosters innovation and enables the creation of complex, yield-generating financial instruments tailored to diverse investor needs.

Technical Breakdown

Architecture

A modular, secure, and scalable infrastructure enabling seamless tokenization of real-world assets (RWA).

Plume’s architecture is specifically designed to support the tokenization and management of RWAs on blockchain. Core components—Arc, Smart Wallets, and Nexus—work together to provide a streamlined and secure environment for managing diverse asset classes, ensuring compliance, and facilitating data integration.

Tokenization Engine – Arc

-

Purpose: Arc is our efficient asset tokenization engine designed to simplify the creation, onboarding, and management of tokenized RWAs.

-

How It Works: Arc supports tokenization of both physical and digital assets and integrates with compliance and data systems to ensure accuracy, security, and regulatory alignment for each asset on the network.

-

Key Advantage: Arc’s structure enables issuers to tokenize assets quickly and cost-effectively, utilizing automated compliance checks.

Core Features

Integrated compliance, liquidity, and data solutions for a seamless RWA experience.

Plume’s core features provide a comprehensive framework for RWA tokenization, trading, and compliance. These components ensure users enjoy a secure, compliant, and efficient experience when interacting with on-chain real-world assets, covering liquidity management, built-in AML compliance, and data access.

Built-in AML Compliance

-

Purpose: Plume integrates compliance directly into the platform to streamline regulatory adherence and user onboarding.

-

How It Works: Through partnerships with a network of compliance providers, Plume enables compliance verification for tokenized assets, ensuring transactions meet relevant regulations.

-

User Benefit: With integrated compliance, users can confidently participate in RWAfi transactions and access broader opportunities on the Plume network while meeting necessary legal standards.

Liquidity and Trading Support

-

Purpose: Liquidity is critical to the success of tokenized assets. Plume facilitates liquidity by partnering with trusted providers and deploying yield-enhancing mechanisms.

-

How It Works: Plume’s trading features enhance liquidity options for RWA tokens, including staking, yield farming, and integration with DeFi protocols to support market activity.

-

User Benefit: Users can trade assets with reduced slippage and improved stability, leveraging liquidity and yield opportunities in the RWA market.

Data Integration & Analytics

-

Purpose: Plume connects on-chain assets with off-chain data sources via Nexus, providing real-time data feeds.

-

How It Works: The platform integrates reliable data sources directly into the network, allowing users to apply accurate, up-to-date data in DeFi apps, lending protocols, and asset valuation.

-

User Benefit: Access to trusted data enables better decision-making and enhances the functionality and accuracy of on-chain financial products.

Summary

Plume’s vision is to create a sustainable, transparent, and interoperable ecosystem bridging traditional finance and blockchain technology. By expanding access to real-world assets and unlocking new financial possibilities, Plume aims to transform finance and make decentralized RWA participation a global standard.

Looking ahead, development will continue focusing on user-centric innovation, regulatory compliance, and enhanced asset functionality. Upcoming features include advanced smart wallet controls, data-rich DeFi applications, and cross-chain interoperability, designed to serve both crypto-native users and institutional partners.

3. Industry Data Analysis

3.1 Overall Market Performance

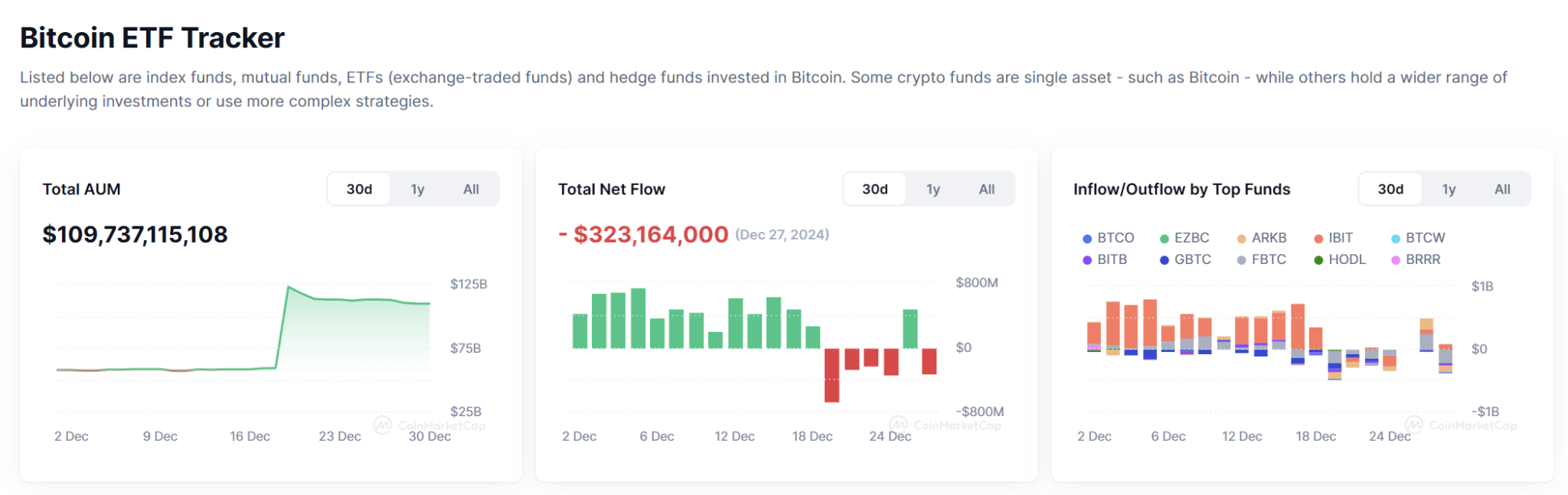

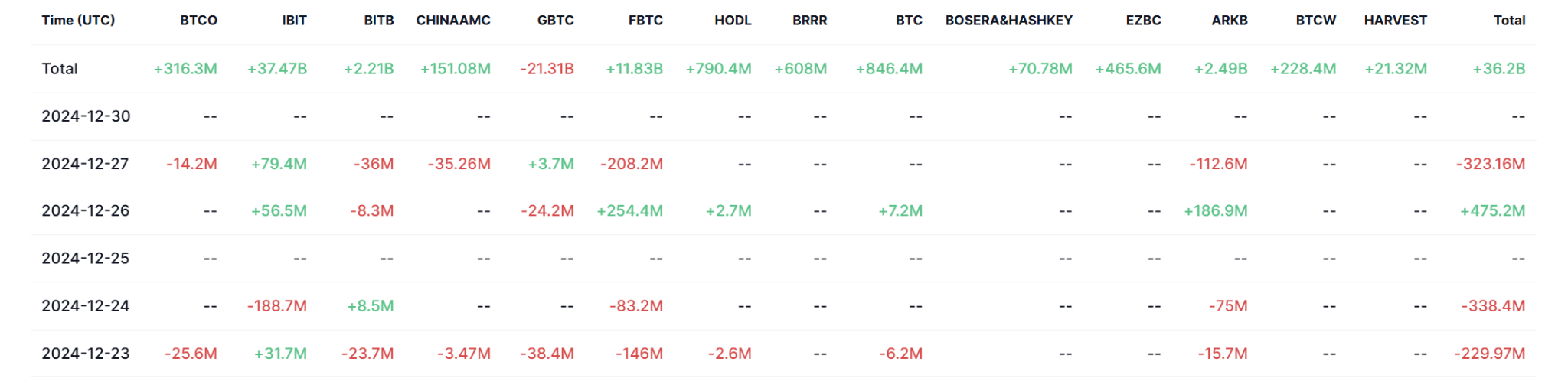

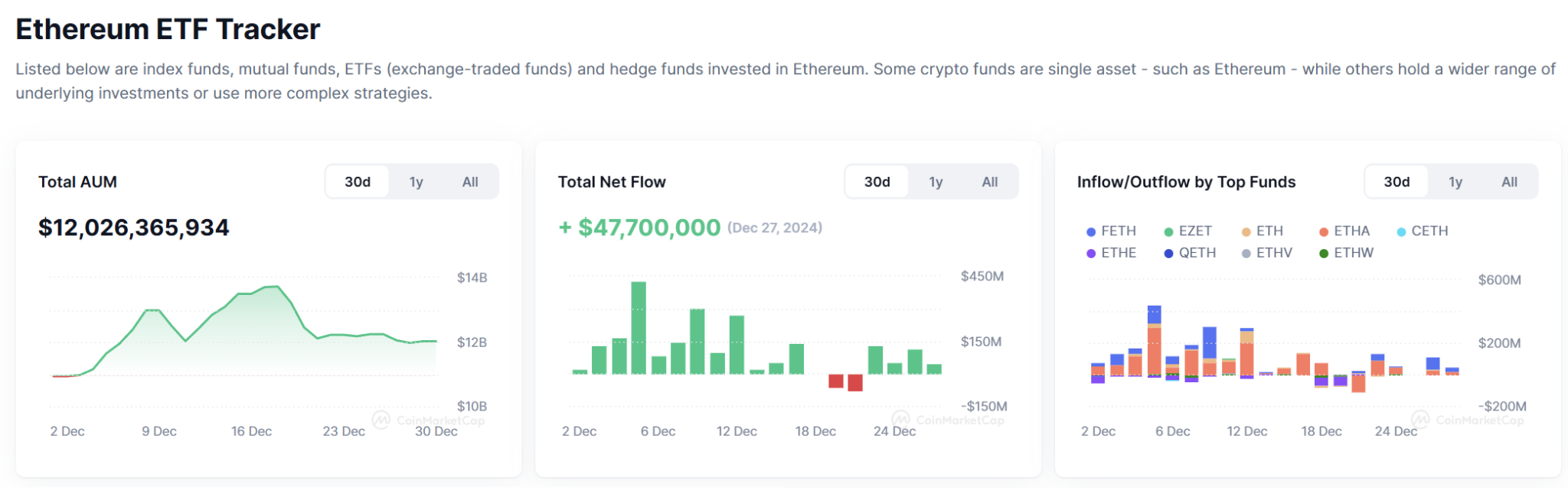

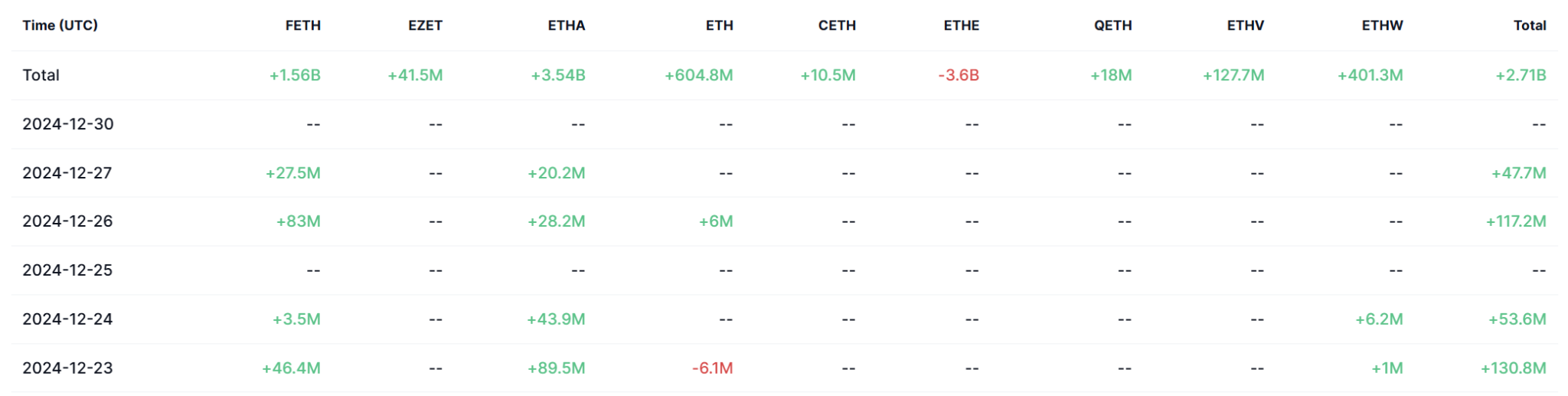

3.1.1 Spot BTC & ETH ETFs

Analysis

This week, U.S. spot Bitcoin ETFs saw a cumulative net outflow of $377.6 million.

Analysis

This week, U.S. spot Ethereum ETFs recorded a cumulative net inflow of $349.3 million.

Ethereum spot ETF total net outflow of $10.9256 million (as of Nov 1, ET)

3.1.2 Spot BTC vs ETH Price Trends

BTC

Analysis

Despite overall net outflows in ETF funds this week, the outflow amount of $370 million remains negligible compared to the inflows seen over the past two months—far from indicating a sell-off. In fact, some institutions began accumulating Bitcoin after it dropped below $100,000 (evident from price action). Compared to last week, the $90,000–$92,000 support zone remains firm. January is likely to see a bottoming pattern before a rebound, differing only in whether it forms above $90,000 or near $86,800 or even $82,500.

For spot investors, the three support zones on the chart can serve as points for staged buying.

ETH

Analysis

Although Ethereum’s rebound last week was modest and failed to break the strong resistance at $3,550, its subsequent downside was weaker than Bitcoin’s—a positive signal for ETH, which has historically lagged in rallies and suffered deeper corrections. Investors can anticipate Ethereum forming a bottoming range between $3,100 and $3,220, which also presents a solid entry point. If this range breaks without consolidation, focus shifts to the psychological support at $3,000. If price stabilizes near this level, the risk of entering spot positions would be maximally reduced.

3.1.3 Fear & Greed Index

Analysis

The Crypto Fear & Greed Index measures overall market risk appetite by gauging investor sentiment. An index of 65 typically indicates a "greedy" market, but if a clear downtrend emerges, sentiment may shift from greed to fear, triggering capital outflows.

Bitcoin falling below $95,000 and the Crypto Fear & Greed Index dropping to 65 stem from multiple factors, including shifting market sentiment, technical corrections, regulatory uncertainty, and changes in the global economic and financial environment. Short-term fluctuations in investor interest in crypto assets may lead to capital outflows and price pullbacks.

3.2 Public Chain Data

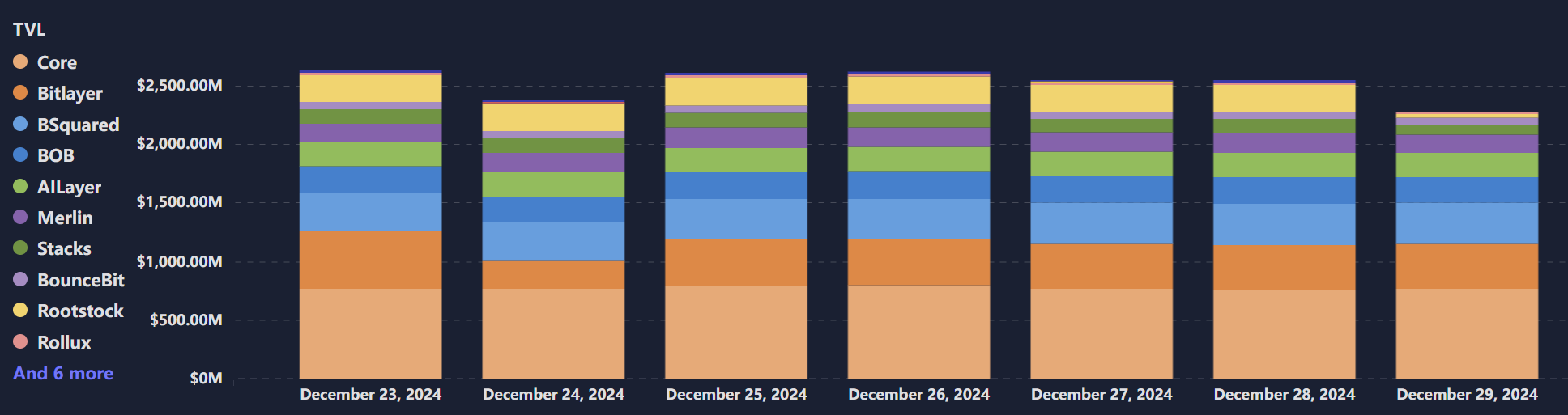

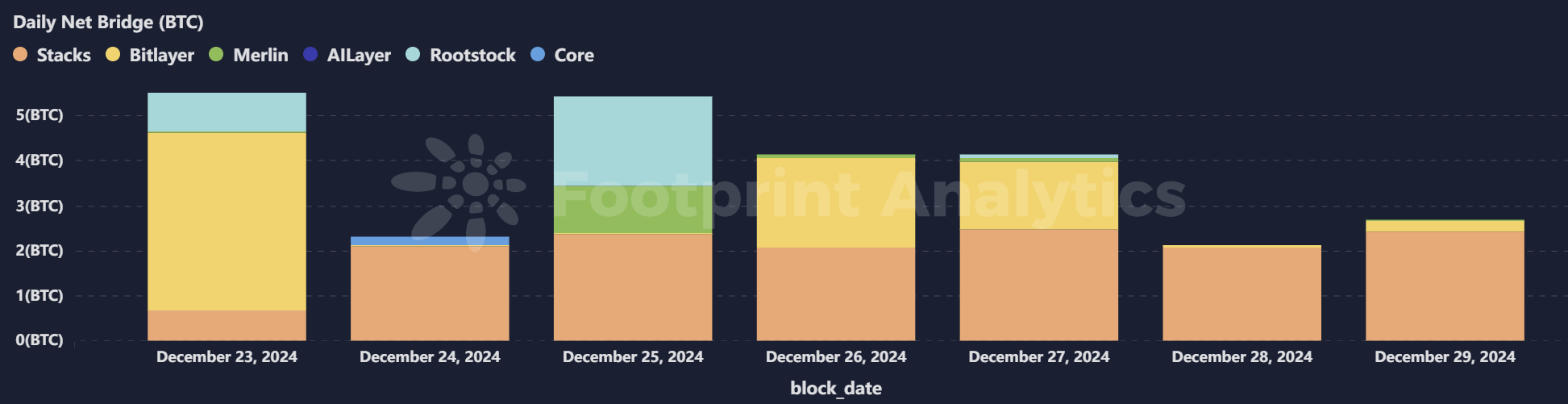

3.2.1 BTC Layer 2 Summary

Analysis

This week, TVL among top BTC L2 protocols showed little change, but daily on-chain transaction volume exceeded levels seen in the first three weeks of December. As seen in Figure 2, the rise in transaction volume across these active chains may be attributed to:

Recent Developments at Stacks:

-

Stacks 2.0 Upgrade: Stacks continues advancing its 2.0 version, enhancing interoperability with Bitcoin and improving network security and scalability.

-

Stacking Mechanism: On the Stacks platform, holders earn STX token rewards through Stacking (similar to staking). Recently, Stacks enhanced the attractiveness of its Stacking mechanism, offering higher yields and attracting more participants.

-

Expansion of DeFi Applications: The number of DeFi apps within the Stacks ecosystem is gradually increasing. Developers are building more Bitcoin-focused DeFi tools, such as decentralized exchanges (DEXs) and lending platforms, strengthening Stacks’ functionality.

Recent Developments at Bitlayer:

-

Privacy & Security Enhancements: BitLayer recently introduced new privacy features, enhancing Bitcoin transaction privacy, particularly through zero-knowledge proofs (ZKPs) and encrypted channels.

-

Cross-Chain Bridging: BitLayer is also improving interoperability with other blockchains, especially in cross-chain transactions and asset transfers. A test version of its cross-chain bridge has been launched, enabling asset swaps between BitLayer and other chains like Ethereum.

Recent Developments at Rootstock:

-

Growth of Rootstock DeFi Platforms: The Rootstock DeFi ecosystem continues to expand, with many DeFi applications and tools migrating to run on the RSK chain.

-

Enhanced Bitcoin Integration: RSK recently improved interoperability with the Bitcoin network through new bridging technologies. Via its Bitcoin Pegged Sidechain, users can transfer Bitcoin assets to the Rootstock network to execute smart contract-based financial transactions more efficiently.

-

Innovation in Layer 2 Solutions: Rootstock collaborates with L2 projects like BitDome to enhance performance through more efficient contract execution layers, further reducing transaction costs.

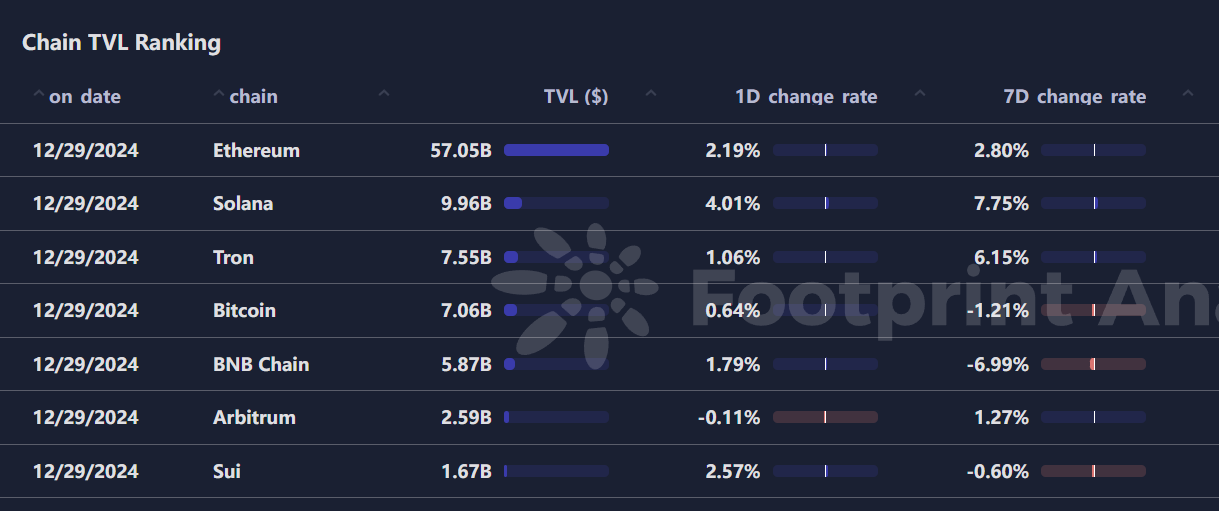

3.2.2 EVM & Non-EVM Layer 1 Summary

Analysis

This week, public chain TVL was far more stable than last week. Solana and Tron even achieved weekly gains of 6% and 7%, respectively, despite weak market sentiment.

-

Solana: This week, Solana’s ecosystem expansion and improved cross-chain interoperability continued attracting investor and developer attention. Especially in DeFi and NFTs, Solana shows immense potential, possibly increasing its market share. If Solana maintains its advantages in high throughput and low fees, its future growth prospects remain highly promising.

-

Tron: Ongoing development in stablecoins, DeFi, and NFTs—particularly integration with BitTorrent—enhances ecosystem diversity and use cases. Through cross-chain technology and improved interoperability, Tron is evolving into a major platform for decentralized applications and transactions. Its strong performance in stablecoin applications could capture greater market share in global payments and cross-border transactions.

Positive Drivers

-

Solana continues expanding in DeFi, NFTs, and cross-chain interoperability, with healthy ecosystem growth and user acquisition.

-

Tron advances in stablecoins, DeFi, NFTs, and BitTorrent integration, while enhancing cross-chain interoperability, strengthening its competitiveness in the dApp market.

The sustained development of these two ecosystems could drive greater demand and price momentum for their native tokens, steadily increasing their influence across the blockchain industry.

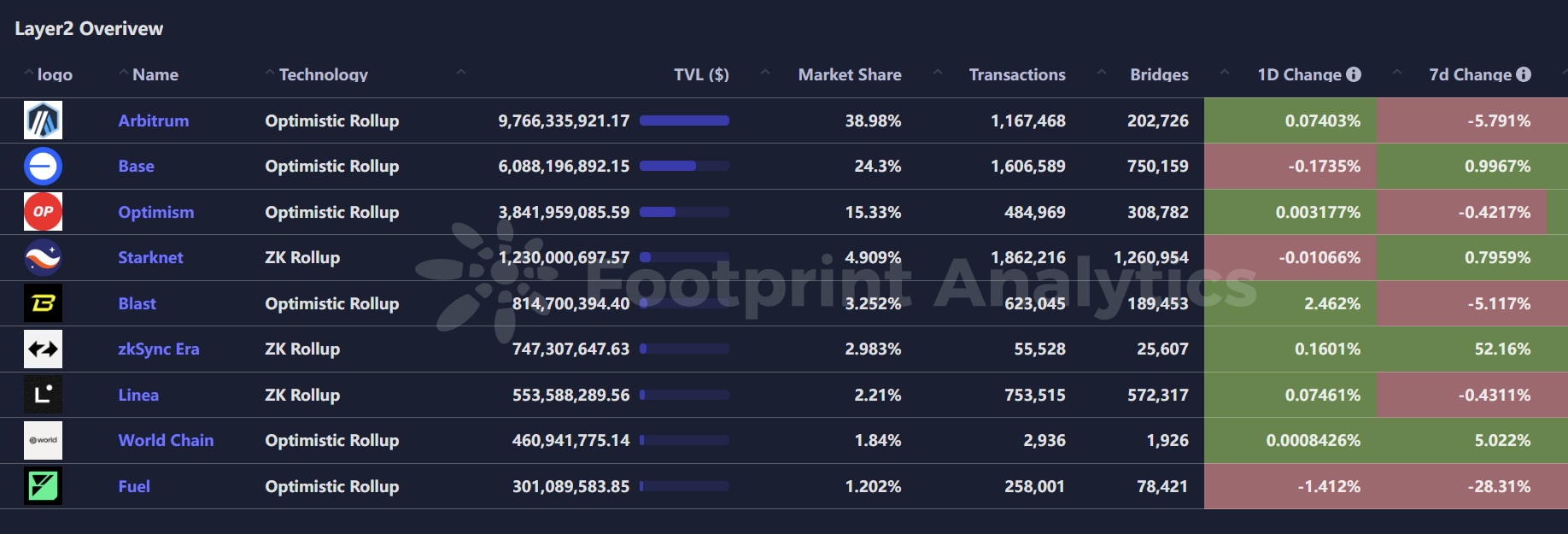

3.2.3 EVM Layer 2 Summary

Analysis

This week, notable changes included zkSync Era’s TVL rising over 50% and Fuel’s declining over 28%.

zkSync Era, the latest version of the zkSync network, uses zk-rollup technology to deliver higher scalability, lower fees, and better compatibility with Ethereum. Its TVL surged over 50% this week due to several factors:

-

zkSync Era Mainnet Launch: Since upgrading to mainnet, zkSync Era has received strong support from developers and users. Faster transactions and lower fees have attracted more DeFi applications.

-

Migration of More DeFi Apps: This week, multiple DeFi projects migrated from Ethereum mainnet or other L2s to zkSync Era. These migrations boosted TVL growth. For example, well-known platforms like Curve Finance, Aave, and Uniswap joined zkSync Era, adding more liquidity pools and lending products.

-

Liquidity Mining and Incentive Programs: zkSync Era introduced new liquidity mining and reward mechanisms, attracting significant capital inflows.

Reasons for Fuel’s TVL Decline May Include:

-

Competition from zkSync and Other L2s: With rapid development of zk-rollup solutions like zkSync Era and Arbitrum, Fuel faces intense competitive pressure. zk-Rollups are perceived as superior in speed and security, attracting more developers and users, potentially impacting Fuel’s capital inflows.

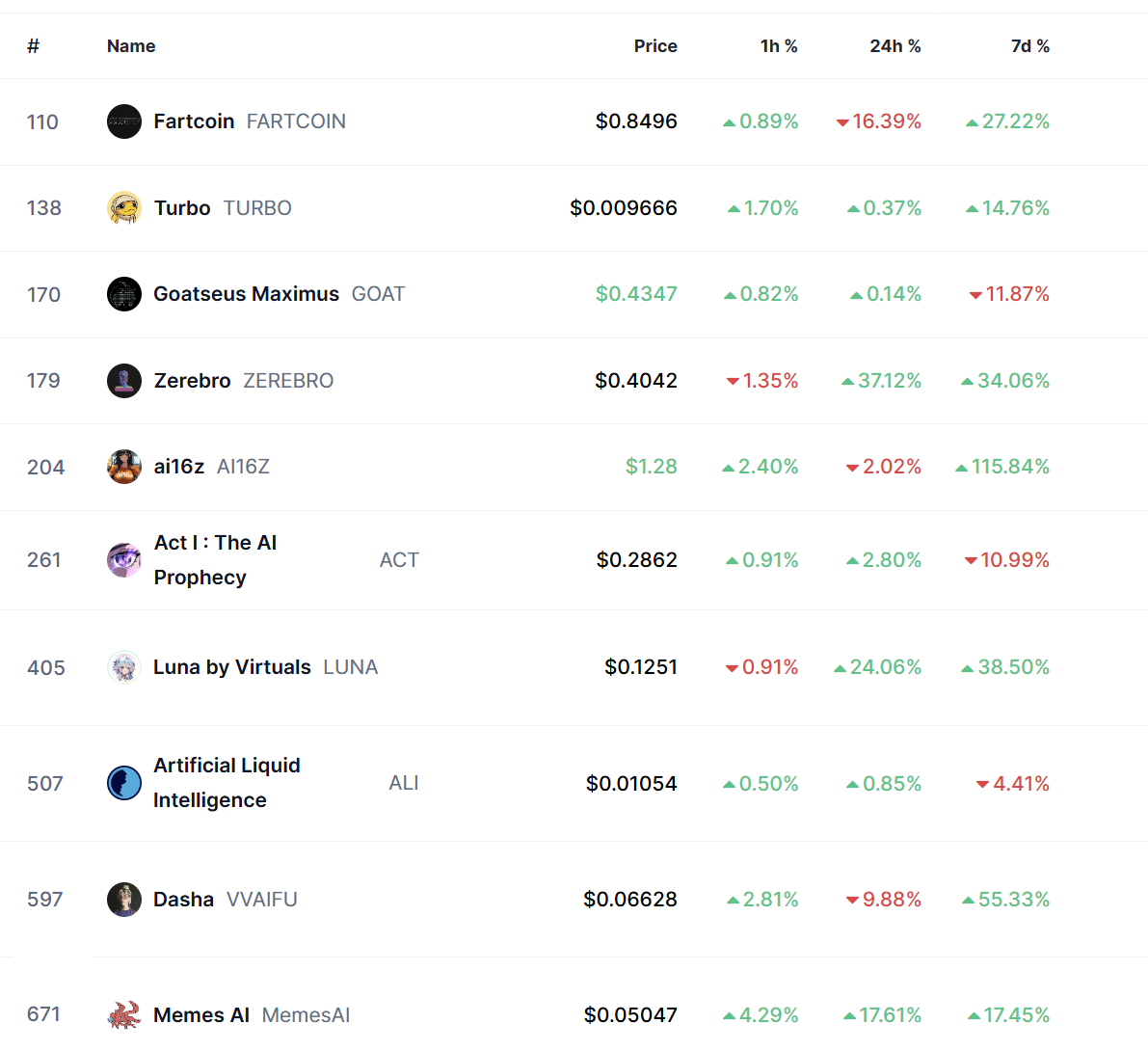

3.2.4 AI Agent Summary

Analysis

This week, the AImeme sector remained dominated by AI16Z. The price increase may result from multiple factors—general AI sector enthusiasm, technological progress, strategic partnerships, market sentiment, and capital inflows. If it is an AI-related project, especially amid rapid AI advancements, investor excitement may further propel its token. Additionally, collaborations, marketing efforts, product launches, or institutional investments could be key drivers behind its surge.

4. Macroeconomic Data Recap and Key Upcoming Releases

Notably, despite no major economic data releases or unexpected events on Friday, December 27, U.S. stocks broadly declined. Large tech stocks led the drop, with the Nasdaq一度 falling over 2%, and the Dow Jones dropping 0.77%, ending its five-day winning streak.

Key macroeconomic data releases this week (December 30 – January 3):

January 3: U.S. December ISM Manufacturing PMI

5. Regulatory Updates

This week, regulations surrounding crypto assets in taxation, investment risk management, and anti-money laundering were rolled out across regions, part of the ongoing global trend toward crypto regulatory compliance in 2024. This indicates growing acceptance and recognition of crypto assets, although regulators are still developing comprehensive and detailed rule frameworks.

United States

On December 28, according to The Block, the IRS finalized rules requiring DeFi brokers to report total proceeds from digital asset sales and issue Form 1099 to customers, collecting user transaction details including names and addresses. The Treasury noted that final rules apply to "front-end service providers" that "interact directly with customers"—meaning entities operating primary websites for accessing decentralized protocols, not the protocols themselves. The rules are expected to take effect on or after January 1, 2027. The idea of strengthening tax enforcement on digital asset service providers was first introduced in the 2021 Infrastructure Investment and Jobs Act, aimed at funding authorized spending under the bill.

Russia

On December 25, according to Jin10, Russia’s finance minister stated that Russia is using Bitcoin in foreign trade. However, the day before, TASS reported that starting January 1, 2025, ten Russian regions (Dagestan, Ingushetia, Kabardino-Balkaria, Karachay-Cherkessia, North Ossetia, Chechnya, Donetsk and Luhansk People's Republics, Zaporizhzhia, and Kherson Oblasts) will ban cryptocurrency mining for six years. The ban will last until March 15, 2031. Russian lawmakers also approved seasonal restrictions in major mining regions to prevent blackouts.

Philippines

On December 24, the Philippines Securities and Exchange Commission (SEC) released a proposed

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News