Observation of Cryptocurrency Market Adjustments Amid Christmas Holiday Effects

TechFlow Selected TechFlow Selected

Observation of Cryptocurrency Market Adjustments Amid Christmas Holiday Effects

Investment strategy recommendations suggest maintaining a defensive positioning, increasing allocations to top-tier assets BTC and ETH.

Author: Frontier Lab

Market Overview

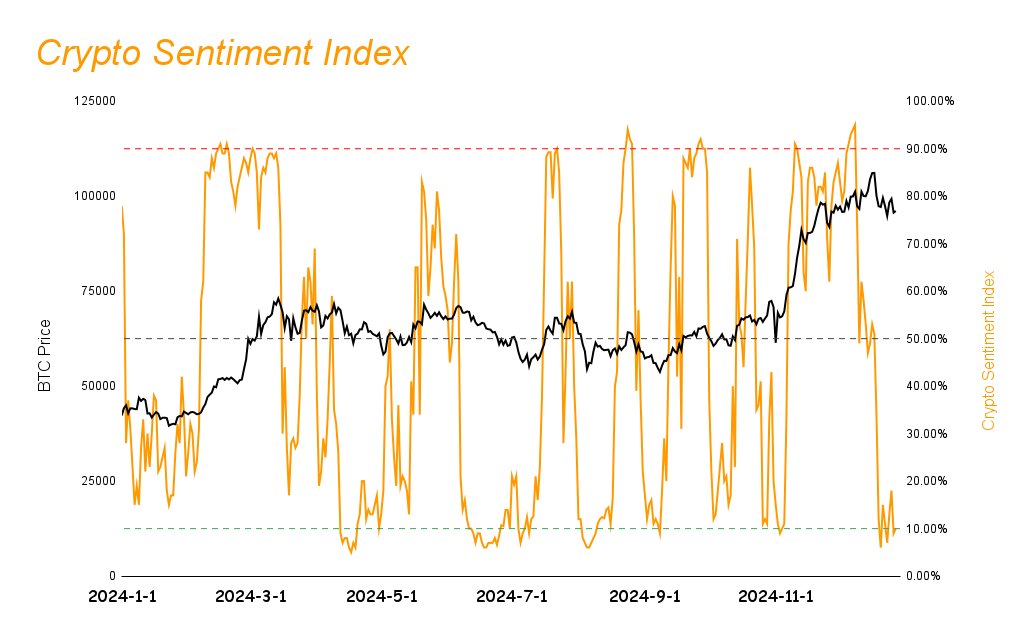

Overall market outlook: This week, the crypto market trended downward due to the Christmas holiday. Although the market sentiment index slightly increased from 7% to 10%, it remains in the "extreme fear" zone. Notably, despite the overall weakness, USDC—primarily backed by U.S. markets—grew by 1.91%, indicating continued institutional inflows and providing a degree of market confidence.

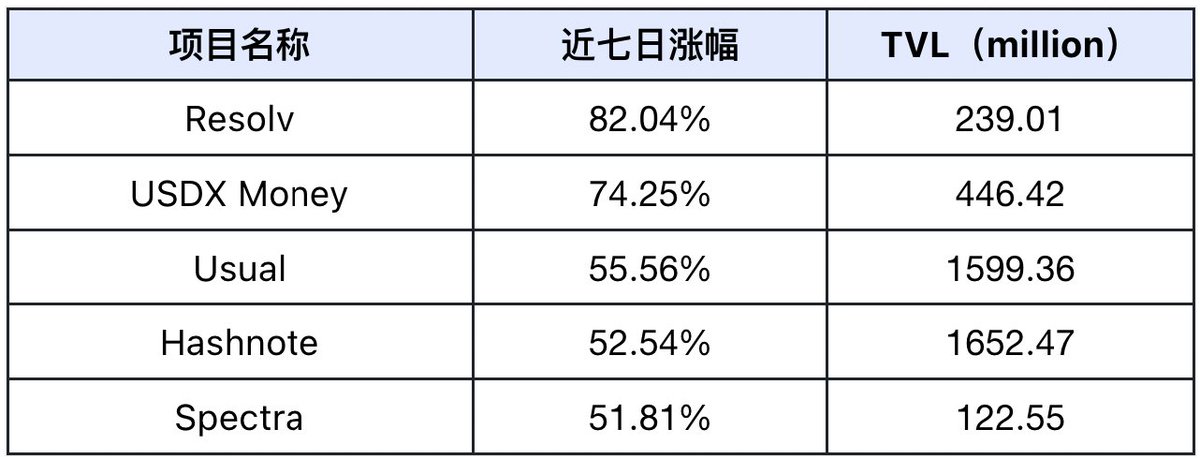

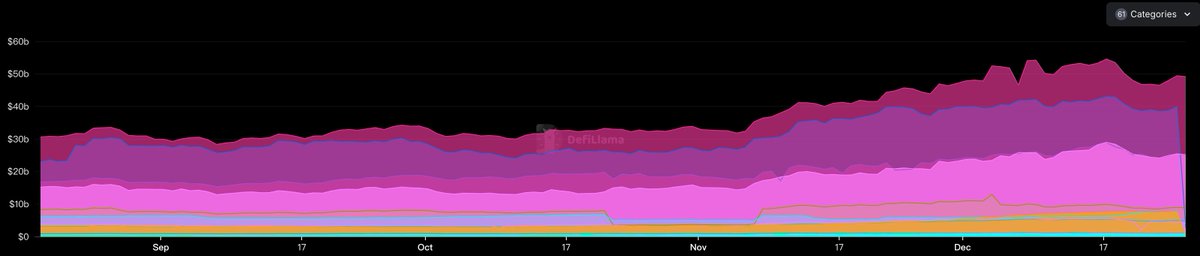

DeFi ecosystem development: The total value locked (TVL) in the DeFi sector declined marginally by 0.37% to $52.7 billion. However, yield aggregator projects and other stablecoin yield strategies performed strongly, while the overall stablecoin supply continues to grow. This suggests that even amid market corrections, foundational liquidity is still flowing in, with yield aggregators and similar fixed-income projects gaining popularity.

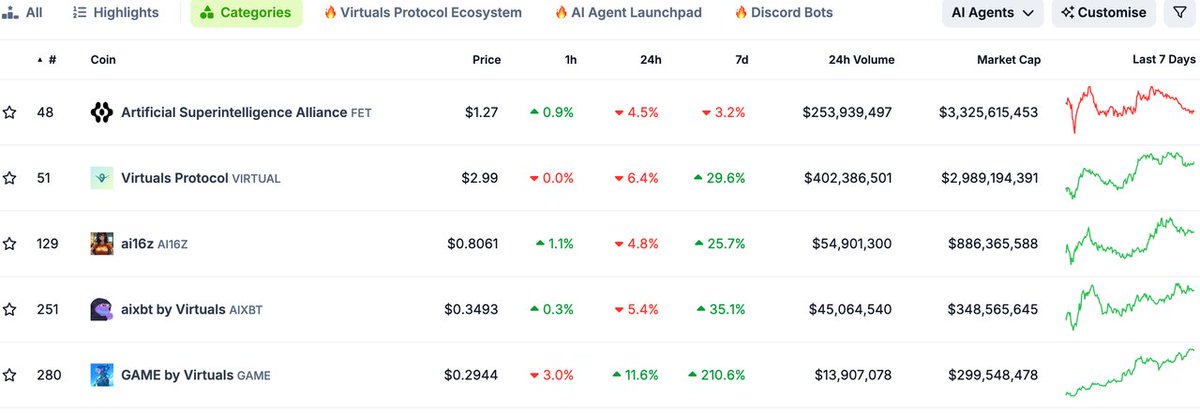

AI Agent developments: The AI Agent sector continues to attract strong market attention, with its total market size reaching $10.9 billion. Particularly, the aipool model combining TEE (Trusted Execution Environment) technology has emerged as a new focal point, potentially becoming a novel asset issuance method following the "inscription" trend. This reflects the deep integration trend between AI and blockchain technologies.

Meme coin trends: Affected by the holidays and the broader market downturn, meme coins underperformed this week, with investor participation and capital inflows significantly reduced. Market热度 has temporarily shifted to other sectors, highlighting the high volatility of the meme coin space.

Public chain performance analysis: Public chains demonstrated strong resilience against the market decline. Stacks achieved a key milestone with sBTC; BOB advanced development on the BitVM Bridge; Taiko launched a new ecosystem initiative—indicating that major blockchains continue to push forward in technological innovation and ecosystem expansion.

Future market outlook: Looking ahead, the market may remain sluggish during the New Year holiday period. Investors are advised to maintain a defensive portfolio allocation, increase exposure to top-tier assets, and consider moderate participation in high-yield yield aggregator projects. In the long term, the market widely anticipates a potential upswing in Q1 2025, with AI Agent and DeFi yield aggregator projects being key areas to watch.

Market Sentiment Index Analysis

The market sentiment index rose from 7% last week to 10%, still within the extreme fear range.

Altcoins underperformed the benchmark index this week, experiencing significant declines. Due to the Christmas holiday, liquidity sharply decreased, increasing price volatility and leading to sharp swings. As a result, market sentiment remains subdued. Given the current market structure, altcoins are expected to move in sync with the benchmark index in the short term, with low probability of independent rallies.

When altcoins fall into the extreme fear zone, the market often reaches a temporary bottom, setting the stage for a potential reversal upward.

Overall Market Trend Summary

-

The cryptocurrency market declined this week, with sentiment remaining in extreme fear.

-

DeFi-related crypto projects stood out, reflecting sustained market interest in boosting base yields.

-

AI Agent sector projects generated high public discussion, indicating investors are actively seeking the next market breakout point.

Hot Sectors

AI Agent

The broader market declined this week, with most sectors falling. While most AI Agent tokens also dropped in price, they generated the highest level of discussion across the market. This week, significant attention focused on the aipool model—combining AI Agents with TEE technology—and its potential impact on the future of crypto and DeFi.

A key catalyst behind every cyclical bull run in crypto has been the emergence of new asset issuance mechanisms. Past models such as ICO (Initial Coin Offering), IEO (Initial Exchange Offering), INO (Initial NFT Offering), IDO (Initial DEX Offering), and inscription farming rapidly accelerated market growth and price appreciation. With AI and crypto converging rapidly, the aipool model has become a highly discussed new asset issuance method—an evolution of early 2024’s “money farming FI” trend. If widely adopted, aipool could soon trigger a mini boom in asset issuance. Therefore, aipool-type projects deserve close attention.

Top 5 AI Agent projects by market cap:

DeFi Sector

TVL Growth Rankings

Top 5 projects by TVL growth over the past week (excluding small-scale projects below $30 million TVL). Data source: DefiLlama

Resolv (no token yet): (Rating: ⭐️⭐️⭐️)

-

Project overview: Resolv is a delta-neutral stablecoin project focused on tokenizing market-neutral investment portfolios. Its architecture relies on economically viable, fiat-independent yield sources, enabling competitive returns for liquidity providers.

-

Latest updates: This week, Resolv completed a major technical upgrade, integrating LayerZero and Stargate to become an omnichain project. Its OFT standard passed security audits by multiple institutions. Resolv attracted a second $100 million inflow, achieving an 84% ecosystem growth rate. Its USDC Vault on Euler Finance offers up to 36.36% APY, drawing $5.67 million in TVL. Additionally, Resolv launched a wstUSR pool on Pendle.fi and introduced a unified points system.

USDX Money (no token yet): (Rating: ⭐️⭐️⭐️)

-

Project overview: USDX Money is an emerging synthetic dollar-pegged stablecoin protocol aiming to provide a crypto-native stablecoin solution via multi-chain, multi-collateral strategies. It uses delta-neutral hedging to maintain USDX’s peg stability.

-

Latest updates: USDX Money rolled out a full UI/UX redesign to improve user experience. It launched USDX/USDT and sUSDX/USDX liquidity pools on Curve Finance, expanding its ecosystem. The sUSDX pool reached $170 million TVL through collaboration with Lista DAO. The project also launched the X-Points incentive program—including content creation and angel initiatives—and hosted a Christmas special event.

Usual (USUAL): (Rating: ⭐️⭐️⭐️⭐️⭐️)

-

Project overview: Usual is a Binance-backed stablecoin project aiming to deliver a decentralized stablecoin solution. Its core mechanism includes three main tokens: USD0 (stablecoin), USD0++ (bond product), and USUAL (governance token).

-

Latest updates: Usual recently secured a $10 million Series A round led by Binance Labs and Kraken Ventures. It partnered with the M^0 Foundation to launch a new product, UsualM. It became the largest USD0/USD0++ pool on Curve Finance. With TVL surpassing $1.5 billion, it entered the global top five stablecoins. Its DAO treasury doubled to $17 million. The project launched a USUALx staking pool offering up to 18,000% APY and initiated a community airdrop campaign.

Hashnote (no token yet): (Rating: ⭐️⭐️)

-

Project overview: Hashnote is an institutional crypto management solution leveraging blockchain for transparency and optimized asset management. It combines digital assets and traditional finance to offer innovative yield-enhancing products like USYC.

-

Latest updates: Hashnote formed a strategic partnership with CoreDAO and participated in its ecosystem panel. It unveiled an innovative Bitcoin dual-staking model combining BTC and Core Token to provide sustainable yield. The CEO’s presentation at the event garnered over 14,000 views, reflecting strong market interest in this new model.

Spectra (SPECTRA): (Rating: ⭐️⭐️)

-

Project overview: Spectra is a protocol for tokenizing future yields. DeFi users can deposit interest-bearing tokens from other protocols for a fixed period and trade the anticipated future yield in advance. Spectra works by placing interest-bearing tokens (IBTs) or fixed-term yield assets into smart contracts and issuing Future Yield Tokens (FYT) in return.

-

Latest updates: This week, Spectra successfully launched its new governance contract on Base Mainnet. It introduced Gauges and Incentivize pages in the Spectra App, enhanced veSPECTRA multi-lock functionality for more efficient gauge voting, and adjusted APW emissions under a new 1:20 distribution ratio.

In summary, projects with the fastest-growing TVL this week were primarily concentrated in the stablecoin yield segment (yield aggregators).

Sector-Wide Performance

-

Stablecoin market cap steadily grows: USDT decreased from $145.1 billion to $144.7 billion (-0.27%), while USDC increased from $42.1 billion to $42.9 billion (+1.91%). Despite the overall market downtrend, USDC—backed by the U.S. market—showed growth, indicating that primary buyers continue to inject capital.

-

Liquidity gradually increases: Risk-free arbitrage rates in traditional markets keep declining due to ongoing rate cuts, while on-chain DeFi arbitrage yields rise as crypto asset values appreciate. Returning to DeFi becomes an increasingly attractive option.

TVL across DeFi sub-sectors

(Data source: https://defillama.com/categories)

-

Funding status: Total DeFi TVL decreased slightly from $52.9 billion to $52.7 billion—a minor drop of 0.37% over two consecutive weeks of negative growth. This is largely due to the Christmas holiday in Western markets, particularly the U.S., reducing trading volumes and on-chain activity. With New Year’s holidays approaching, little improvement is expected. Hence, January’s overall TVL trend should be closely monitored to assess whether the downtrend persists.

In-Depth Analysis

Drivers of growth:

The core drivers behind this round of growth can be summarized as follows: Amid recent market declines, APYs across DeFi protocols have generally fallen. However, stablecoin yield projects boosted their yields through token/points incentives, giving yield aggregators a clear APY advantage. Specifically:

-

Market environment: Though in a bull cycle, the market has recently trended downward, causing base interest rates to fall significantly.

-

Interest rate side: Rising base lending rates reflect increased market expectations for funding costs.

-

Yield side: Stablecoin yield projects offer higher returns compared to others, attracting more users. This reinforcement loop strengthens the value proposition of these projects, creating positive momentum.

Potential risks: Recently, investors have focused heavily on yields and leverage while overlooking downside risks. This week, the Christmas holiday drastically reduced market liquidity. When selling pressure emerged, insufficient liquidity failed to absorb the sell-off, triggering continuous price drops. This led to liquidations in long positions, causing losses and increasing cascading liquidation risks, further driving prices down and clearing more leveraged positions.

Performance of Other Sectors

Public Chains

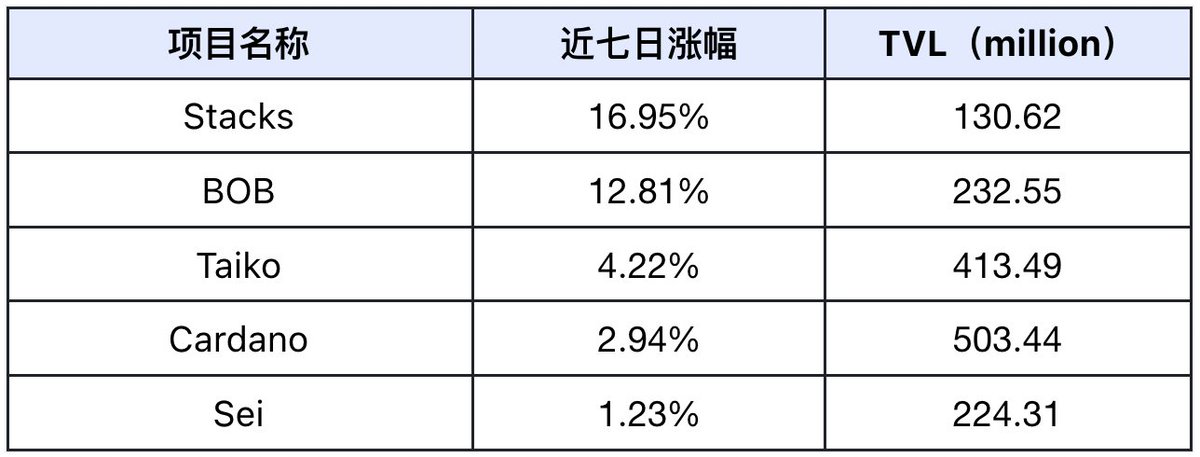

Top 5 public chains by TVL growth over the past week (excluding small chains). Data source: DefiLlama

Stacks: This week, 922 BTC were transferred to the Stacks network, completing the first phase of sBTC with a 1,000 BTC deposit cap. In DeFi applications, 35% of sBTC is now generating yield on Zest Protocol. The ALEX community voted to allocate 12 million ALEX tokens to the Surge program. Stacks enabled L1/L2 asset swaps via Bitflow Finance and an AI console, and incentivized developer contributions through the "Stackies" rewards program.

BOB: BOB partnered with Fiamma Labs to develop and release a zero-knowledge-based BitVM Bridge prototype, targeting testnet launch in early 2025. It collaborated with Lombard Finance to deploy on the BOB chain and initiated preliminary governance discussions with Aave to bring its protocol to BOB. Additionally, BOB launched a six-week DeFi incentive campaign using Babylon Points to reward LST holders and conducted multiple community education tasks and Spaces events.

Taiko: Taiko launched Trailblazers Season 3 with a 6 million TAIKO token reward pool and introduced the Liquidity Royale campaign, offering 12,000 TAIKO tokens to the top 100 liquidity providers. The number of projects on Taiko grew to 130, including Symmetric as a key DEX partner. It held its first community meetup in Turkey with ITU Blockchain and Node 101 and strengthened community engagement through holiday gifts and meme contests.

Cardano: This week, Cardano highlighted the security advantages of its slashing mechanism for protecting ADA holdings, launched a streamlined web app development tool, deepened integration with hardware wallet provider Ledger, and advanced decentralization through DReps (delegation representatives) voting.

Sei: Sei announced a major breakthrough named "Giga," scaling EVM to handle 5 gigagas per second—improving performance by 50x. Through Developer Office Hours, it released the Giga Roadmap, outlining future tech development. It introduced EVM Wrapped, allowing users to track their activities across multiple EVM chains, enhancing cross-chain interoperability. Sei also hosted a "12 Days of Christmas" event and partnered with PythNetwork, Silo, and Nansen.

Price Gain Leaders

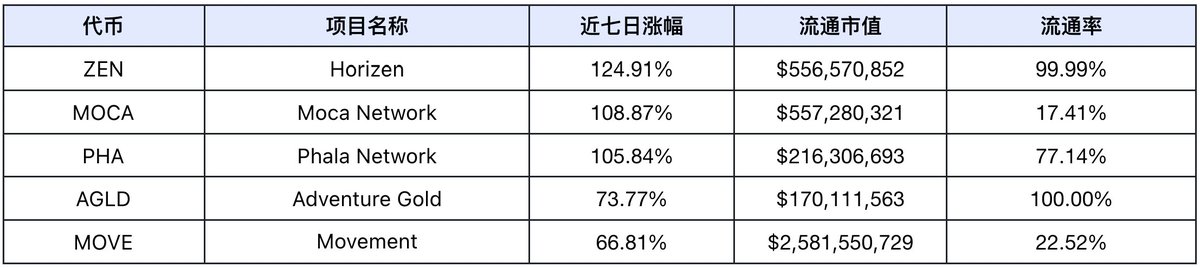

Top 5 tokens by weekly gain (excluding low-volume and meme tokens). Data source: CoinMarketCap

ZEN: Horizen successfully deployed its Horizen 2.0 Devnet testnet, launching an optimized zero-knowledge (ZK) verification solution to reduce complexity and cost. It formed a strategic partnership with Automata Network to advance Web3. Recognized by Grayscale's Horizen Trust, Horizen completed the final ZEN halving and listed on Bitvavo. It is preparing the token distribution plan for the zkVerify project.

MOCA: Moca Network integrated with SK Planet’s OK Cashbag app, driving significant user growth—1.5 million page views and 800,000 spin-the-wheel interactions. It remained active in community operations through Christmas marketing (#MocaFam), enhancing user retention, and emphasized security education with repeated anti-scam alerts.

PHA: Phala Network officially launched Phala 2.0, integrating GPU TEE technology and Ethereum Layer 2 scalability. It partnered with NVIDIA, testing TEE efficiency on H100/H200 chips at nearly 99%. It announced Khala Chain’s migration to the Ethereum mainnet. Flashbots and other projects have adopted Phala’s TEE-as-a-Service. Annual data shows AI Agent contract executions surged to 4,500, with 37,650 active TEE Workers—solidifying Phala’s leadership in decentralized AI infrastructure.

AGLD: Adventure Gold engaged its community through Christmas-themed marketing, with a holiday greeting tweet receiving high engagement (27 bookmarks, 14 retweets). It partnered with BladeGamesHQ on AI Agent-driven on-chain economies, showcasing its exploration at the intersection of gaming and AI.

MOVE: Movement launched several innovative products based on its tech stack: Puffpaw Vape (multi-chain, tracks usage and rewards), Vomeus smart vape with HD screen, and Sentimint—a project allowing users to tag emotions and memories onto physical items. It improved performance via Block-STM parallelization and Rollup architecture and expanded DeFi use cases through WBTC cross-chain integration.

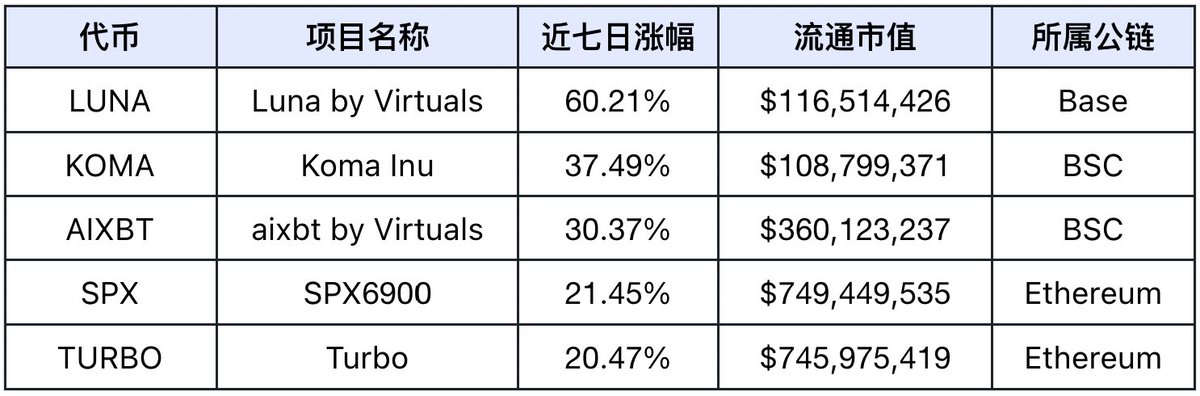

Meme Coin Gainers

Data source: coinmarketcap.com

This week, meme projects were heavily impacted by the overall market decline. During the Christmas holiday, fewer users participated in trading, and capital flowed out of the market. Investor participation in meme coins dropped noticeably, shifting focus and funds away from this sector.

Social Media Trends

Based on LunarCrush’s top 5 daily gainers and Scopechat’s top 5 AI-scored tokens (Dec 21–27):

The most frequently mentioned theme was L1s. Listed tokens (excluding low-volume and meme coins) are as follows:

Data source: LunarCrush and Scopechat

Data analysis shows L1 projects received the highest social media attention this week. With the U.S.-led market on holiday, market makers and institutions were largely inactive, causing a sharp drop in liquidity. Most retail investors reduced on-chain investments and engaged in selling, leading to broad market declines. Among them, public chains fell less than other sectors. During broad market sell-offs, L1s typically outperform other sectors. Besides allocating to BTC and ETH for safety, investors mostly shift funds into public chains, which tend to rebound first when the market recovers.

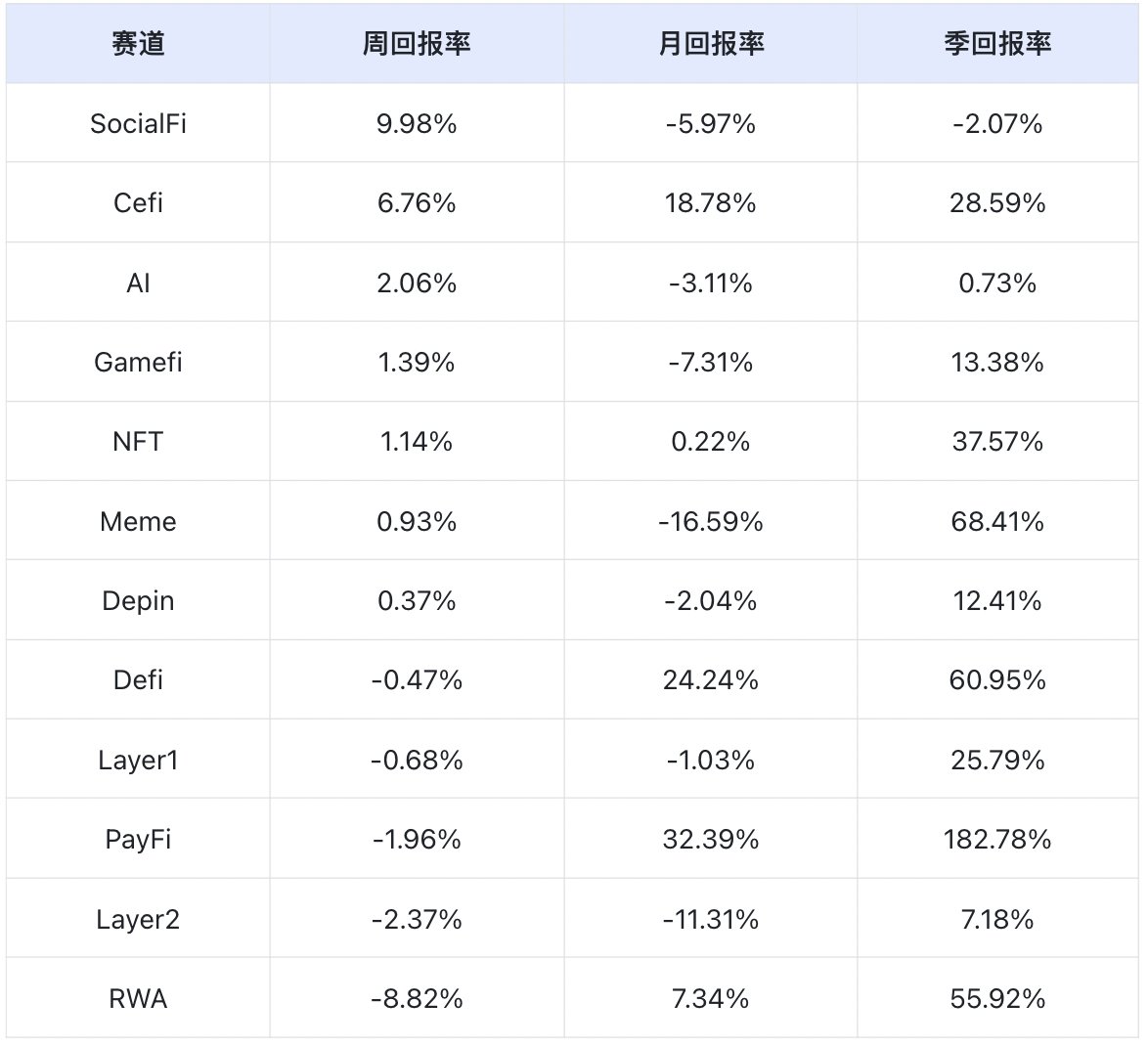

Sector-Wide Performance Overview

Data source: SoSoValue

By weekly return rate, SocialFi performed best, while RWA performed worst.

-

SocialFi: TON remains the dominant force in SocialFi, accounting for 91.07% of the sector’s market cap. This week, TON bucked the downtrend, rising 6.3%, making SocialFi the top-performing sector. Toncoin partnered with GMX to promote high-frequency DeFi trading.

-

RWA: OM, ONDO, and MKR dominate the RWA sector at 44.28%, 23.85%, and 18.36% respectively—totaling 86.49%. This week, OM, ONDO, and MKR fell 10.76%, 19.86%, and 8.28% respectively—larger drops than other sectors—making RWA the worst performer.

Upcoming Crypto Events Next Week

-

Monday (Dec 30): European Securities and Markets Authority (ESMA) implements MiCA crypto regulations

-

Thursday (Jan 2): U.S. Weekly Initial Jobless Claims

-

Friday (Jan 3): Court approval takes effect for FTX’s Chapter 11 restructuring plan

Outlook for Next Week

-

Macro outlook: Entering the New Year holiday, few macroeconomic data releases are expected. Historically, U.S.-driven market buying power remains weak during this period, increasing market volatility.

-

Sector rotation trends: Despite poor current conditions, investors broadly expect a broad market rally in Q1 next year. Most are reluctant to sell holdings and instead participate in yield aggregators to boost returns. The AI Agent sector maintains strong attention, with total market size reaching $10.9 billion. The aipool model (AI Agent + TEE) has gained widespread market interest.

-

Investment strategy: Maintain a defensive posture, increase allocations to top-tier assets (BTC, ETH) to enhance risk hedging. Consider participating in high-yield DeFi yield aggregator projects. Investors should remain cautious, strictly manage position sizes, and prioritize risk control.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News