The Three-Plate Theory: The Ultimate Guide to Building Ponzi

TechFlow Selected TechFlow Selected

The Three-Plate Theory: The Ultimate Guide to Building Ponzi

"Matter is conserved at every moment—until humans invented money."

Author: Weituo Crypto

TL;DR

Whether or not you admit it, much of human civilization's progress stems from baseless yet optimistic assumptions—and money is the ultimate example of such an assumption: a blind, optimistic belief in other entities' ability to deliver "equivalent return."

Our ancestors unquestioningly accepted money as a substitute for food to exchange the value they created. Yet in truth, money is merely an accounting symbol representing social relationships between creditors and debtors—it never needed intrinsic value.

But today, we give this phenomenon a more fitting name: "Ponzi." Next, I will explain my theory on how to identify, understand, design, and ultimately control Ponzi mechanisms in crypto and beyond to maximize profit—this is what I call the "Three Ponzi Problem."

What Is a Ponzi?

In short, a Ponzi is an economic system where a mismatch between funding demand and expected returns creates a "gap"—and this "gap" can only be filled by further mismatches. (This definition is original to me, for the record.)

Is every Ponzi a deliberately engineered system? Yes. But that doesn't make it a scam. It depends on whether the audience perceives the "gap" as reasonable and acceptable. Historically, these "gaps" have often been dressed up with terms like "sovereign credit," "legitimacy," or "market consensus." A Ponzi isn’t an absolute concept. Its true nature often requires a macro-level view, as many Ponzis don’t exhibit typical traits at the micro level.

In fact, Ponzis are far more common in daily life than you think—and they often appear rational. Take the residential real estate market, which has existed since 3000 BC and is seen as a "productive" store of value. Yet in reality, this value logic would collapse without modern fiat printing driving rapid, sustained inflation.

What Is the Three Ponzi Theory?

Every Ponzi must be built upon one or more of these three fundamental forms: Mining (dividend), Pooling (mutual aid), and Splitting (split).

This may sound absurd, but the Three Ponzi Theory can serve as a guiding framework for designing and operating nearly any Ponzi system—whether at macro or micro levels.

The Three Ponzi - Mining (Dividend)

A mining Ponzi is a system where users bear upfront sunk costs, expecting fixed returns over time.

Types of Mining Ponzis

A. Capital-based sunk cost: Users must invest capital (including liquidity opportunity cost) to start earning. Examples include Bitcoin/KASPA/FIL mining ecosystems (excluding Bitcoin itself), PoS staking/restaking on L1s, DePIN, and dividend schemes like Plustoken.

B. Time/effort-based sunk cost: Users invest significant time or effort for future gains. Examples include Pi Network, Galxe badge campaigns, meaningless Discord role wars, and Telegram mini-apps like DOGS.

Key Metrics for Evaluating Mining Ponzis

-

Fixed Sunk Cost: One-time, non-recoverable investment (e.g., Bitcoin mining rigs).

-

Incremental Sunk Cost: Periodic, non-recoverable cost per unit of incremental gain (e.g., electricity and maintenance).

-

Extractable Return: Gains that can be freely withdrawn and cashed out.

-

Reinvestment Cycle: The period after which sunk costs must be reinvested upon expiration.

-

External Liquidity: Available liquidity for this dividend token in external trading venues.

Breakdown Model

Mining Ponzi collapse condition: Actual incremental sunk cost + external liquidity < extractable return. At this point, creators should stop payouts and "rug pull" to profit.

How to delay collapse (using BTC mining as example):

-

Activate flywheel effect: High coin price → higher miner demand → higher rig prices → manufacturers get more cash → manufacturers push coin price higher.

-

Increase total sunk cost: Continuously raise minimum total sunk cost to obtain additional tokens, pushing up the "shutdown price."

-

Priced in fiat: Avoid pricing in tokens, which gives early participants unfair advantages and undermines the purpose of raising shutdown prices via higher sunk costs.

-

Control early-stage liquidity: Minimize external liquidity early to prevent premature dumping and maintain control over token holding.

Case Study: Bitcoin Mining Ecosystem

Let’s revisit the Bitcoin mining ecosystem—one of the most classic and well-functioning crypto Ponzi systems—and Bitcoin ($BTC) itself. Many historical mysteries become clear.

Why did BTC surge in 2013 ($10 → $1,000)?

2013 was the year ASIC miners emerged, allowing rig manufacturers to dominate profits and sales, becoming Bitcoin’s first "market makers." That year, there were no efficient, high-liquidity trading venues or models—low external liquidity made price manipulation easier, triggering the flywheel effect.

How did Bitcoin rise in miner-dominated cycles before 2021?

-

Mining costs (electricity and facilities) priced in fiat.

-

Incremental costs far exceeded electricity, especially in China, where post-2019 government crackdowns led many miners chasing cheaper power to face total losses.

-

Due to these policies, total sunk cost and "shutdown price" were much higher than book values, unintentionally pushing up Bitcoin’s price.

The Three Ponzi - Pooling (Mutual Aid)

A pooling Ponzi is a system where users provide liquidity in exchange for promises of fixed returns per unit contributed. Unlike mining, pooling doesn’t lock assets but relies on high transaction volume—like casinos profiting not from individual wins/losses but from a cut of total turnover.

Types of Pooling Ponzis

-

Pure MLM payout type: Users earn dividends by recruiting more participants, relying solely on fund inflows (e.g., Forsage.io, 1040 Sunshine Project).

-

Quasi-option type: Funds circulate among participants—new money pays old ones (e.g., A→B→C→A)—often including liquidation or restart clauses if funding targets aren’t met (e.g., FOMO3D, 3M, meme coin markets overall).

-

Liquidity mining type: Users earn by providing liquidity, often sacrificing exit opportunities for higher returns.

DeFi users aren’t strangers to pooling Ponzis, as most DeFi tools are essentially part of a "macro L1 mutual aid Ponzi," where speculative token dynamics in systems like lending protocols are the core source of mismatch.

Breakdown Model

Pooling Ponzi collapse condition: Systemic debt > liquidatable assets + external liquidity.

Ponzi designers typically profit via fees or front-running.

How to Delay Collapse

-

Define clear liquidation thresholds: Set maximum profit caps or enforce stop-loss/restart mechanisms;

-

Prevent arbitrage: Eliminate loopholes that break systemic debt rules and drain liquidity;

-

Prevent bank runs: Allow orderly exits to avoid destructive impacts on remaining pool assets;

Case Study: AMMs and the Evolution of Pooling

AMMs (Automated Market Makers) represent a major breakthrough in pooling infrastructure, comparable to the emergence of commercial banks.

Why did LP liquidity mining collapse after DeFi Summer?

Why do new yield pooling Ponzis trend toward Uni V3-like models, such as @MeteoraAG's LP Army?

Uni V2 liquidity mining:

In Uni V2, users could provide liquidity indefinitely and earn rewards in the same token at high APY.

Why it collapsed:

-

No liquidation threshold: Rewards distributed across entire liquidity pools, even if only a fraction was actively used. As long as provided liquidity stayed in the pool, it earned uncapped native token emissions;

-

Arbitrage loophole: "Mine, sell, withdraw" strategies let early players recoup costs fast, then engage in risk-free arbitrage by dumping native tokens, draining remaining LPs’ liquidity;

-

No run prevention: No exit limits caused panic selling when APY dropped, collapsing the whole pool;

How Uni V3 fixes the issues:

-

Liquidation threshold: Only liquidity within specific price ranges qualifies for reward incentives.

-

Run prevention: Withdrawing liquidity from one price range doesn’t affect rewards or liquidity in others.

-

Fix arbitrage loophole: Most projects removed immediate token rewards, switching to point systems (Post-DeFi Summer), though this introduced new issues in split design.

The Three Ponzi - Splitting

A splitting Ponzi is a system where total funds remain constant at a given moment, but the number of units or claims per dollar is multiplied, while the price per new unit drops proportionally to attract new capital—very similar to stock splits in traditional finance.

In my view, splitting Ponzis are the most complex and hardest to control. They rarely exist alone but instead act as a "deflationary mechanism" nested within one or both of the other Ponzi types.

Crypto Splitting Ponzis

In crypto, all L1s/L2s are本质上 mining Ponzis—but once they build an "ecosystem," they also become splitting Ponzis. For example:

-

BTC inscriptions/runes/L2s relative to BTC;

-

PumpdotFun relative to Solana;

-

aixbt/Luna/Game relative to Virtual;

The ultimate goal of a splitting Ponzi is to turn a certain token into a pricing unit for as many assets as possible—just like the USD for US stocks.

Why?

Because both USD and L1 tokens are fundamentally conjured from thin air. By offering higher nominal ROI, they perform alchemy—"fake money for real money."

Breakdown Model

Splitting Ponzi collapse conditions:

-

ROI below market benchmark Beta: Competing split systems with higher ROI and similar risk lure users away.

-

Split rate too high or too low: High split rates dilute liquidity; low split rates fail to sustain ROI.

-

Capital flight: New inflows dry up, existing holders rapidly exit using their holdings as exit liquidity.

The main profit point for Ponzi designers lies in front-running.

Case Study: Ethereum, ICOs, and Solana

Ethereum is a classic mining Ponzi, but through the ICO era became history’s most important splitting mechanism.

Why did Ethereum need ICOs?

-

Mining = inflation: Rising "shutdown price" naturally blocks new entrants.

-

Splitting attracts capital: ICOs incentivized holding $ETH, requiring participants to buy ICO tokens, turning $ETH into a pricing unit and achieving deflation.

Why did ICOs succeed/fail?

- High ROI: ICO returns vastly exceeded holding $BTC or outdated tokens. Many ICOs had near-100% circulating supply and low FDV, creating explosive ROI in low-liquidity environments.

-

High split rate: Too many, too-fast ICOs diluted overall liquidity.

- Capital flight: Most ICO tokens lacked liquidity, preventing participants from recovering funds, unlike $ETH. Developers sold ETH faster than inflows, turning ICO participants into exit liquidity. This eventually collapsed ROI.

Thus, $ETH experienced a "double whammy" at the time.

Ethereum’s Dilemma in 2024

-

Capital flight: Locking funds via LSD, restaking, and PointFi reduces effective circulating supply (speculative trading volume).

-

Too-slow splitting: New projects dominated by inner circles under the guise of "alignment with Ethereum Foundation and Vitalik," doing V-startups.

-

Low ROI: Compared to Solana reviving ETH-era ICO models (like Pump.fun), Ethereum’s ROI competitiveness is weak.

Why Did Solana’s 2024 Split Succeed?

Balancing Split Rate and Dilution via Pump

Meme coins are Solana’s split assets, priced in $SOL, accelerated by Pump mechanics. Pump itself operates as a pooling Ponzi, with liquidity turnover so fast it simulates a quasi-option cycle. This effectively mitigates liquidity dilution from high split rates, keeping capital in the system for continued speculation while maintaining low entry barriers for new users.

Boosting ROI via Marketing Machine

Solana is the only L1 with a dedicated "marketing machine," from Colosseum/Superteam communities to large video influencers and KOL networks (e.g., Jakey, Nick O'Neil, Banger, Threadguy).

Combined with core influencers like Toly, Mert, and Raj, Solana deliberately channels liquidity into emerging, low-liquidity meme coins and projects, delivering super-exponential ROI (above market beta) and fueling a $SOL-meme coin flywheel.

Similar strategies are mimicked by Sui and Virtual (e.g., Luna and aiXBT).

Three Ponzi Design Principles & Combining Models

Each Ponzi operates under closed-system assumptions, constrained by its inherent breakdown model. These constraints can be alleviated by integrating features of Mining, Pooling, and Splitting—each serving unique roles:

-

Mining: Lock assets to maximize AUM (assets under management).

-

Pooling: Extract value via high transaction volume.

-

Splitting: Use sub-Ponzi price volatility to deflate bubbles in the main Ponzi.

When designing a Ponzi, start with these foundational questions:

-

How does the house profit?

-

What kind of collapse can the house accept?

Then you’ll know which model to choose.

Pick your cabal, know your audience.

A Ponzi is a zero-sum game—profits and losses share the same source. The key question: Who are your allies, who are your "prey"?

First, understand your cabal’s reach:

-

a. People you can directly influence and persuade

-

b. People you can reach but not fully convince

-

c. People completely out of reach

An effective cabal should:

-

Maximize coverage of a + b

-

Be highly aligned in interests

-

Assign clear roles to each member

-

Have no more than 7 members to ensure smooth coordination

This explains why some "popular" advisors appear across multiple teams, or why certain VCs get replaced by exchange VCs in early funding rounds.

Second, understand your audience and their traits. Key metrics include:

-

Age group: 80s, 90s, or 00s? How free was their upbringing?

-

Information sources: Twitter, Telegram, TikTok, or WeChat?

-

Financial mindset: Attitudes toward freelancing, financial freedom, and time autonomy?

-

Knowledge level: Can they grasp crypto basics?

-

Risk preference: Passive income (yield) vs active returns (trading)?

Typical "destined to join crypto fam" profile:

-

At least Gen 80/90/00

-

Uses Twitter, TikTok, or Telegram

-

Favors freelancing, rejects corporate rat-race

-

Prefers active financial activities, values trading

TikTok users differ slightly—they lean more toward PVP models, having grown up in an era of stagnant macro growth and zero-sum games.

These are the "New Humans" (like in Gundam), embracing hyper-financialized worldviews. Sell them narratives of "fair launch," "anti-institution," and "anti-PC."

If your audience doesn’t match this profile:

Borrow or fake endorsements from authorities they blindly trust. They’re more like obedient citizens under authoritarian rule.

First Principle of Three Ponzi Design: Never Defy Human Nature

History proves one thing: Developer conviction doesn’t matter. For any crypto project (not just Ponzis), sustainability usually yields to hype (you must survive first), and hype depends on alignment with human nature:

-

Nothing lasts forever: Don’t expect your project to be the exception.

-

Perception beats reality: The core of a Ponzi is manipulating minds. Your project doesn’t need to be what you claim—only match your audience’s perception and make them believe it is.

-

Let them gamble: Don’t rob your users of betting opportunities for safety’s sake. Your audience likes risk—otherwise they wouldn’t be in crypto.

-

Gracefully say “Thanks for playing”: Be rational. Your primary goal is profit, not emotional attachment. When momentum fades, exit decisively.

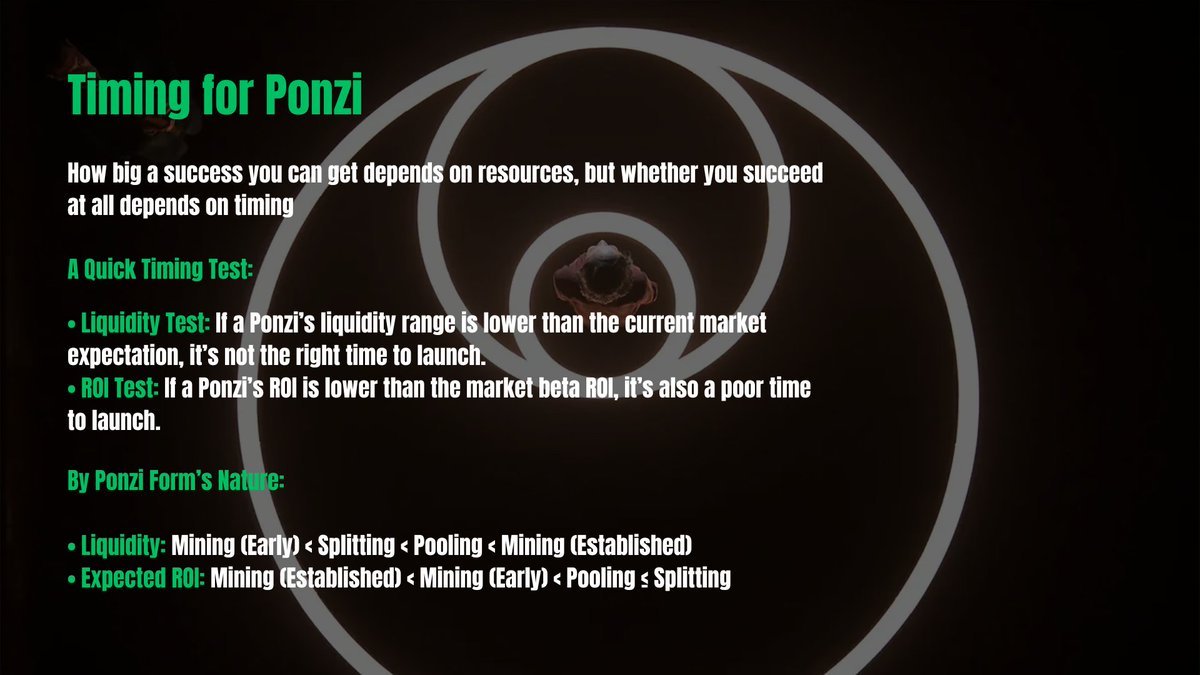

Timing

"When timing aligns,天地 assist; when fortune fades, even heroes lose freedom." Your success scale depends on resources, but whether you succeed at all depends entirely on timing. Many Ponzis take off purely by launching at the right moment, while others with full products struggle to break even.

How to Assess Timing?

For crypto users, the primary consideration is risk-reward ratio—the balance between perceived risk and expected return.

Two expectations to consider:

-

Liquidity expectation relative to market: Users are influenced by accustomed average daily volumes. For example, during bull runs, $SOL might see $1B daily volume, while in bear markets, most coins trade ~$500K daily on Binance. - Why it matters: Liquidity determines how easily users convert paper gains to cash—a key decision factor. - How to measure: Analyze 30-day DEX and CEX volume for clear signals.

-

Expected market Beta ROI under similar risk: In bull markets, even 100% APY might struggle to attract $1M TVL, while in bear markets, people may chase safer 10% mining yields. - Why it matters: Users compare returns against current market conditions and adjust risk appetite accordingly.

Specific to Ponzi types:

-

Liquidity: Mining (early) < Splitting < Pooling < Mining (mature)

-

Expected return: Mining (mature) < Mining (early) < Pooling ≤ Splitting

Quick tests:

-

Liquidity test: If the Ponzi’s liquidity is below current market expectations, it’s not a good launch window.

-

Return test: If the Ponzi’s return is below market Beta, it’s not a good launch window.

Never Be Overconfident—Opportunities Fade Fast

Timing flows like water, constantly shifting. If your resources can’t shift tides, focus on speed: rapid delivery and fast market entry. In such cases, industrialized, replicable, cost-effective product frameworks may become critical.

Can Ponzis Be Rationalized?

Honey, isn’t this exactly what we’ve done for millennia—rationalizing predatory systems into social norms? This process is so efficient that people no longer seek predictable returns but chase "a chance," blaming losses on their own "skill issues." So what are the endgames of the three Ponzis?

-

Mining: Evolves into mutual-fund analogs (via locked TVL dividends, e.g., mining pools, JITO model)

-

Pooling: Evolves into casinos (e.g., PumpdotFun, Crash Games, JLP/GLP pools)

-

Splitting: Evolves into alternative asset markets (e.g., Pop Mart, BTC inscriptions, NFTs, ICOs)

Before We Wrap Up

Thank you for taking the time to read this long piece. I’ve tried to be concise yet comprehensive. The Three Ponzi Theory was first released last year as part of Open Rug (Open Source Rug Pull), my teaching project for Chinese-speaking crypto insiders. This series draws from eight years of accumulated experience—both wins and losses—where Ponzi project funds peaked over $100M, with millions successfully exited.

Today, the Three Ponzi Theory has become one of the most widely cited analytical frameworks among Asian degens and developers. From a gentler perspective, it’s an extremely potent growth hacking methodology.

The true purpose of the Three Ponzi Theory is primarily to demystify and deconstruct the overly complex, hypocritical narratives spun by Western crypto circles, refocusing developers on what truly matters: leveraging ubiquitous Ponzi economics to build a hyper-financialized world where everything is pricable, tradable, and frictionless.

Of course, mostly—to make big money.

Hope this helps, in whatever way.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News