Berachain & StakeStone Vault: Ushering in a New Era of Multi-Dimensional Yields

TechFlow Selected TechFlow Selected

Berachain & StakeStone Vault: Ushering in a New Era of Multi-Dimensional Yields

Users simply deposit funds to enjoy automated yield optimization and intelligent asset allocation, leveraging economies of scale to achieve higher returns.

By Bingwa

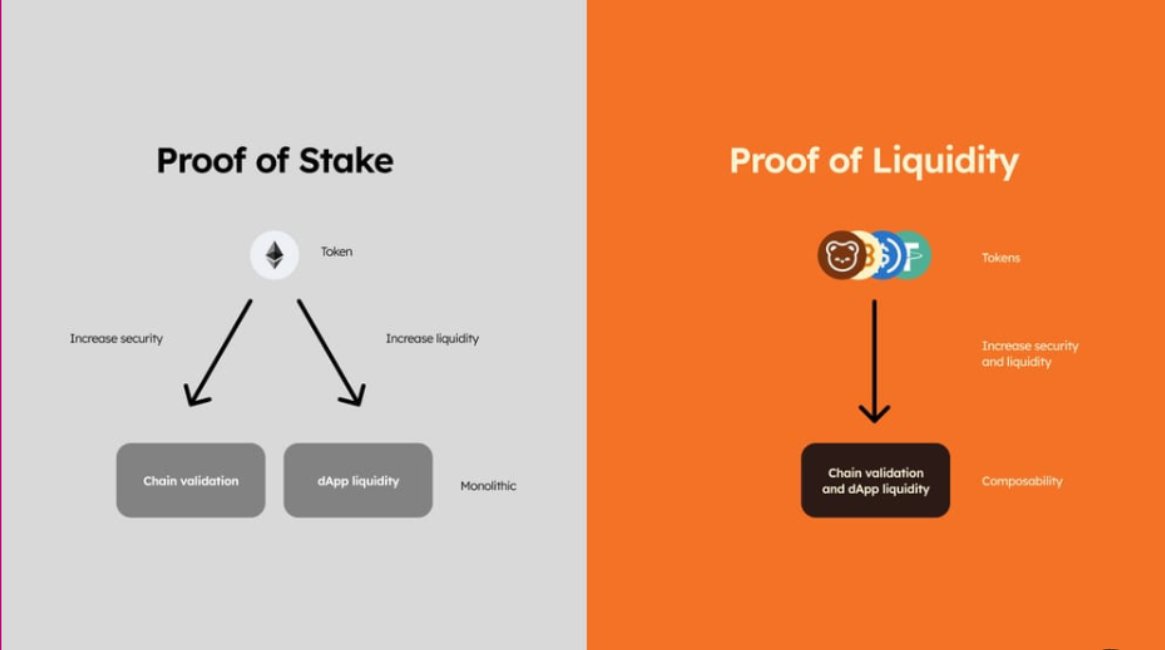

Berachain, a top-tier public blockchain that has raised $142 million, is building an entirely new ecosystem through its innovative Proof-of-Liquidity (PoL) consensus mechanism.

Berachain’s PoL mechanism creates strong synergies among validators, users, and the project ecosystem. However, this innovation also brings challenges—its three-token model and complex LP mechanisms set high barriers to entry for ordinary users.

Complicated operational processes, high technical requirements, and difficulties in asset allocation optimization have, to some extent, constrained the project’s further development.

StakeStone Berachain Vault Opens a New Chapter

As one of Berachain's earliest officially endorsed deposit channels, StakeStone’s Berachain Vault perfectly addresses these pain points.

Through intelligent asset management, StakeStone Vault offers users a one-stop participation solution. Users simply deposit funds and enjoy automated yield optimization and smart asset allocation, leveraging economies of scale to achieve higher returns.

Innovative Three-Layer Architecture Design:

The Significance of Vault (Funds Pool)

By aggregating numerous small deposits into large-scale capital pools, the vault leverages economies of scale to secure higher token reward allocations on behalf of users, increasing individual yields. At the same time, it provides stable liquidity to the ecosystem, ensuring smooth trading and reducing slippage risk.

For users, it enhances convenience—depositing funds grants access to diversified returns without worrying about complicated procedures, saving time and effort while significantly lowering the barrier to entry.

Vault LP Token (Liquidity Provider Token) Layer

This serves as the critical bridge connecting the Vault with external applications. Acting as a cross-scenario link, the LP token can be used in DEXs to provide liquidity and earn trading fees, participate in innovative options strategies within Pendle to unlock potential yields, or serve as high-quality collateral in lending protocols to borrow funds, enabling leveraged operations and amplified returns. This flexibility breaks asset limitations, allowing users to dynamically allocate assets across multiple scenarios based on market conditions and personal goals, meeting diverse investment needs.

LP Token in DEX / Pendle / Lending (Cross-Scenario Synergy)

StakeStone Vault builds a closed-loop system for multi-layered yield generation: earning trading fees on DEXs as base income, expanding yield portfolios through strategy optimization in Pendle, then entering the lending space to leverage capital for new opportunities—creating a self-reinforcing value cycle. For example, after being optimized in Pendle, the LP token increases in value; it can then be re-collateralized for loans and redeployed into DEXs for additional returns. As the LP token flows between these three domains, it not only breaks down silos but also fosters powerful synergy: DEXs supply assets and traffic to Pendle, Pendle adds value and attracts more users to DEXs, and lending platforms provide essential leverage support to both. These interdependent relationships drive ecosystem growth and create greater value for users.

Reward Distribution Mechanism

StakeStone Berachain Vault maximizes user investment returns through a multi-tiered yield structure.

Three-Tier Progressive Yield Structure:

1⃣ Base Layer – PoS Rewards

Base yield from ETH staking—stable and lowest-risk return source, automatically captured via STONE assets.

2⃣ Berachain Ecosystem POL Rewards

Earn early allocations of governance token $BERA by participating in Berachain’s liquidity mining, and capture token rewards from ecosystem projects (e.g., Kodiak, Dolomite).

3⃣ Ethereum DeFi Strategy Yields

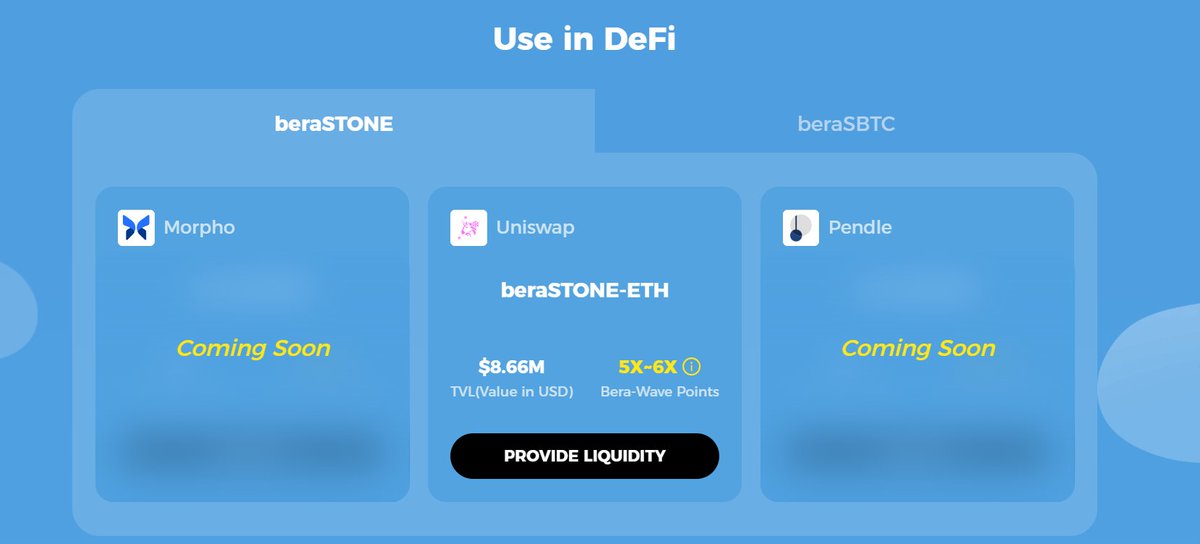

Deploy beraSTONE/beraSBTC into DeFi protocols such as Pendle and Morpho to perform leveraged operations and amplify returns, gain extra token rewards from liquidity mining, and seize arbitrage opportunities through flexible trading.

The innovation of StakeStone Vault extends beyond capturing Berachain-native yields—it maps these returns back to the Ethereum mainnet, significantly enhancing asset liquidity and composability. This enables exponential yield amplification and offers users diversified investment strategies, substantially boosting overall ROI.

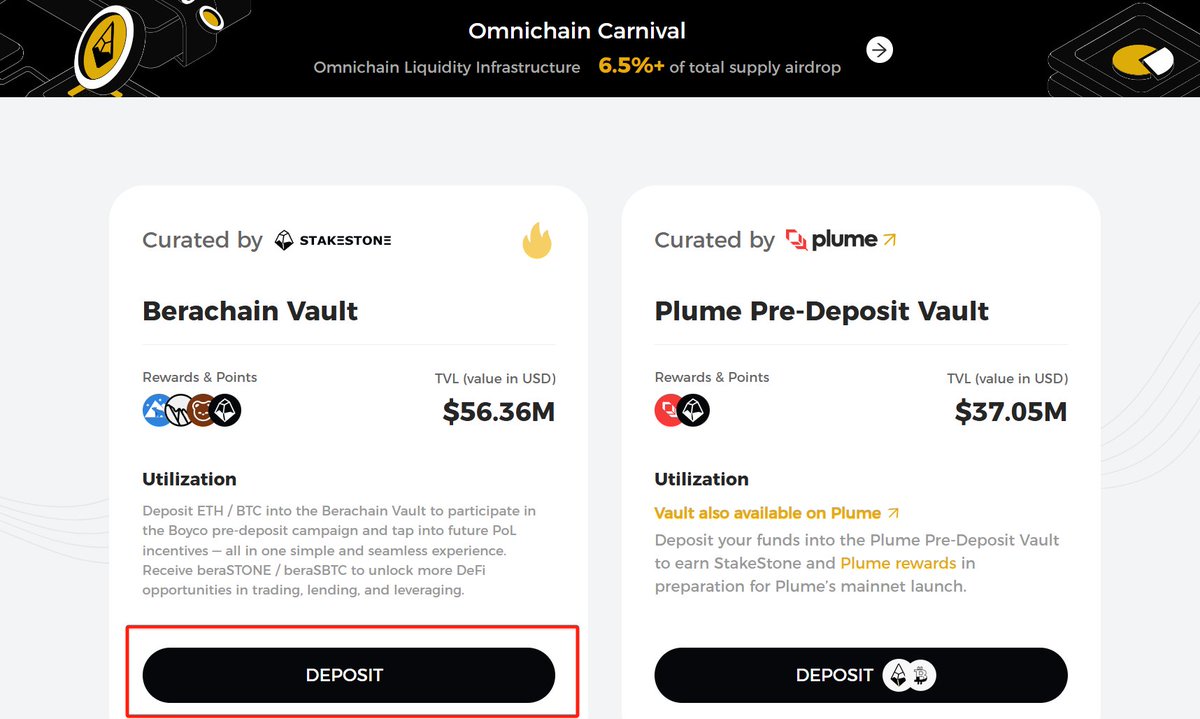

New Campaign Overview

StakeStone Berachain Vault introduces two brand-new yield-bearing assets: beraSTONE and the upcoming beraSBTC.

Currently, only Ethereum mainnet assets are supported. Deposited assets are automatically converted into beraSTONE points, which qualify for future airdrops.

Rewards include incentives from Berachain and its ecosystem protocols on Boyco, StakeStone airdrop rewards, staking and restaking bonuses, and future Berachain PoL yields—a multi-layered reward system accessible immediately upon deposit.

The first 10,000 participants receive early bird rewards (users who deposit ≥0.042 ETH or ≥0.0015 BTC will each receive 150 STO).

Detailed Reward Rules

Current Metrics

200K users, $60M TVL

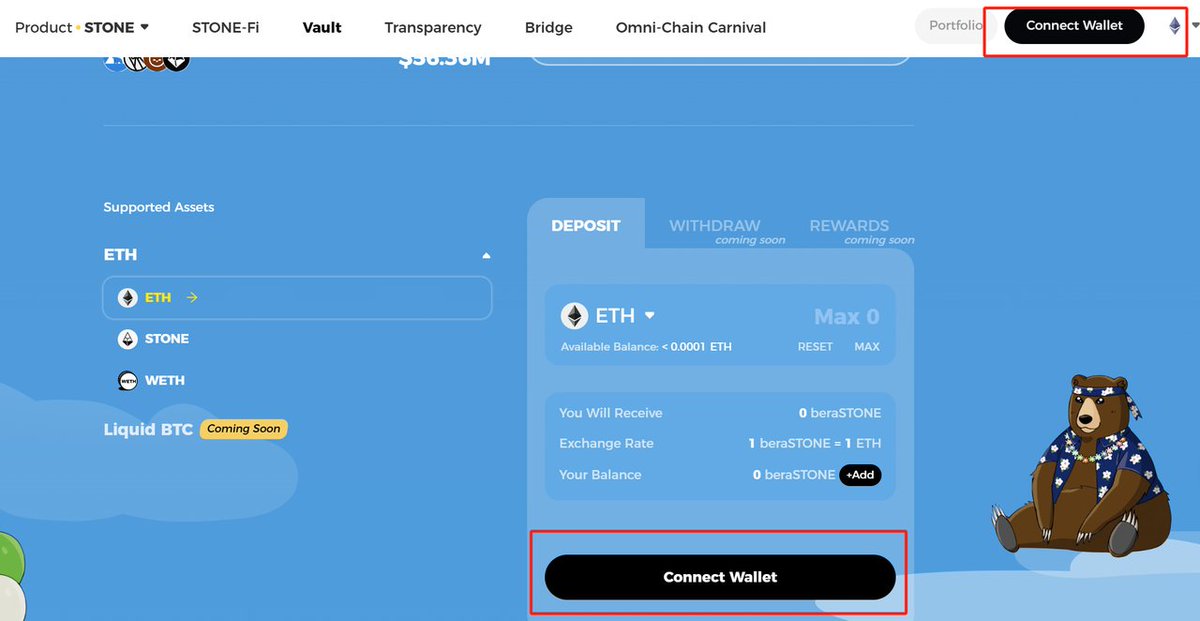

How to Participate

-

Click to enter the StakeStone Vault interface

-

Connect your wallet in the upper right corner and switch to Ethereum mainnet

-

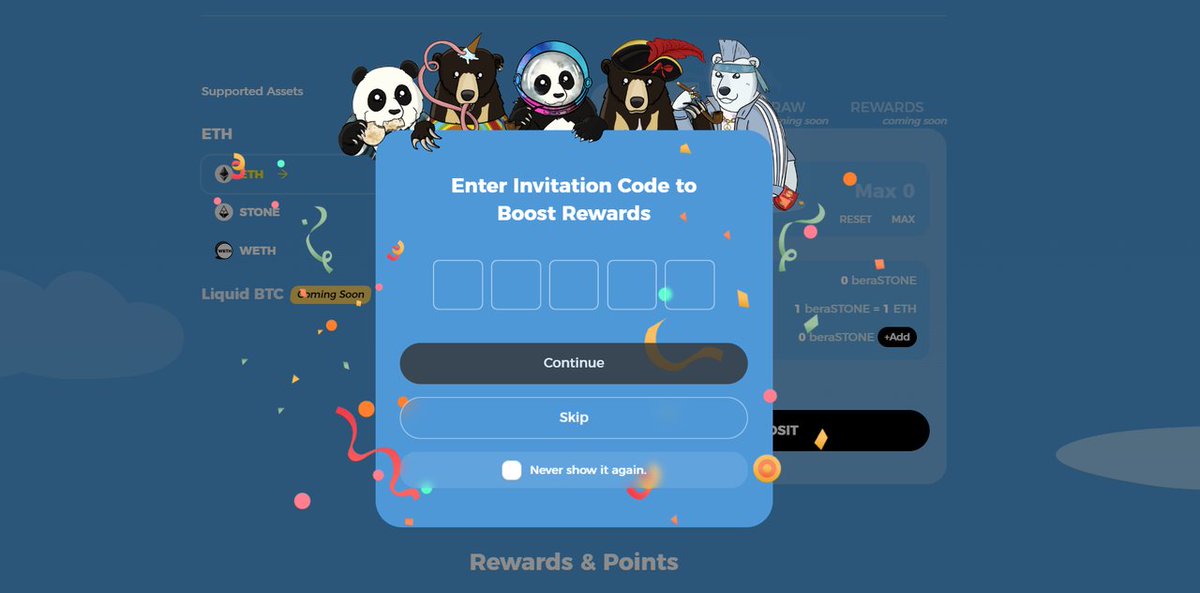

After connecting your wallet, enter the referral code to receive a 10% points boost bonus

-

Deposit ETH/STONE/WETH to earn beraSTONE points

-

Participate in DeFi protocols to earn even more rewards—providing liquidity on Uniswap can generate 5–6x more points

Follow official Twitter: @Stake_Stone for updates. For more details, read the official post: Link

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News