Cryptocurrency 2025: Where to Go After the Milestones of 2024?

TechFlow Selected TechFlow Selected

Cryptocurrency 2025: Where to Go After the Milestones of 2024?

Bitcoin's 2024 halving, ETF approvals, and Trump's victory drove market growth, with the cryptocurrency market poised for continued expansion in 2025, particularly propelled by Bitcoin, altcoins, and real-world asset tokenization.

Author: CoinGecko

Translation: Baic Blockchain

As we step into 2025, looking back at 2024, the cryptocurrency market has undergone significant transformation and development. Bitcoin's strong growth and the rise of altcoins have rapidly evolved the entire industry. Let’s dive deep into the major trends of 2024 and explore the market dynamics expected in 2025.

1. Key Trends in 2024: Bitcoin and Altcoins

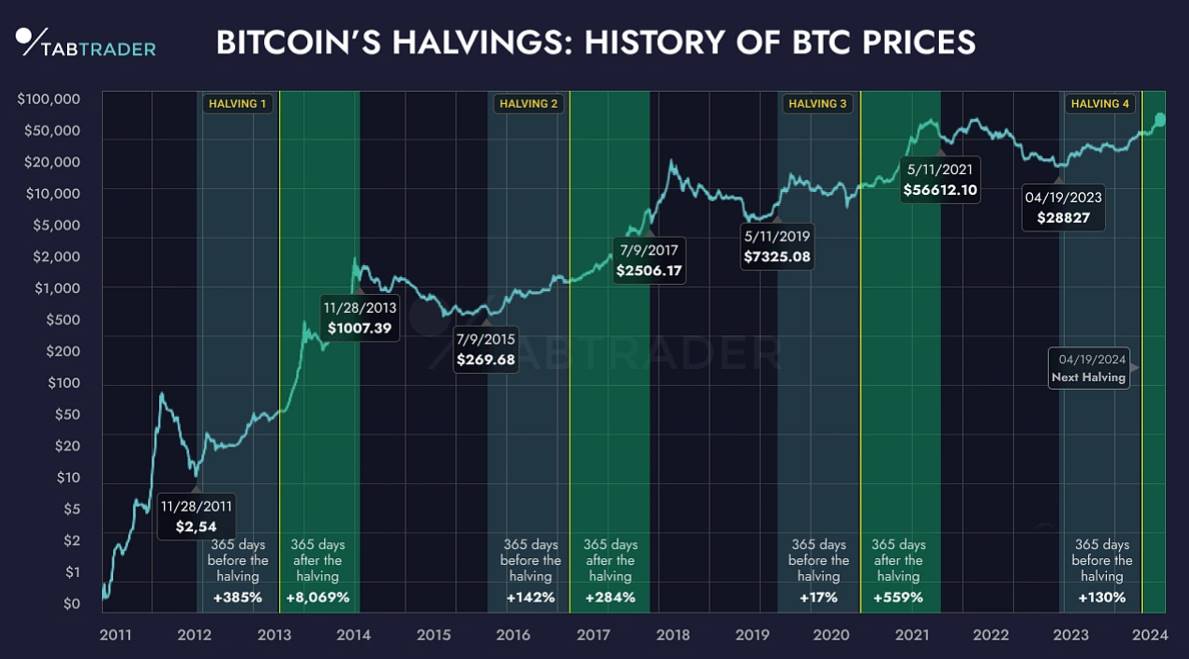

1) Bull Run Triggered by Bitcoin Halving

In 2024, the Bitcoin halving once again acted as a catalyst for the bull market, with Bitcoin’s price surging 146%, delivering an outstanding performance. The halving event occurs roughly every four years, cutting in half the rewards miners receive for validating transactions. This reduction in new Bitcoin supply often triggers significant market movements due to increased scarcity.

Historically, Bitcoin prices typically experience notable increases following each halving. For example, after the 2016 halving, Bitcoin surged from $650 to $20,000 within just over a year. Similarly, after the 2020 halving, Bitcoin rose from around $8,000 to its peak of $69,000 in 2021.

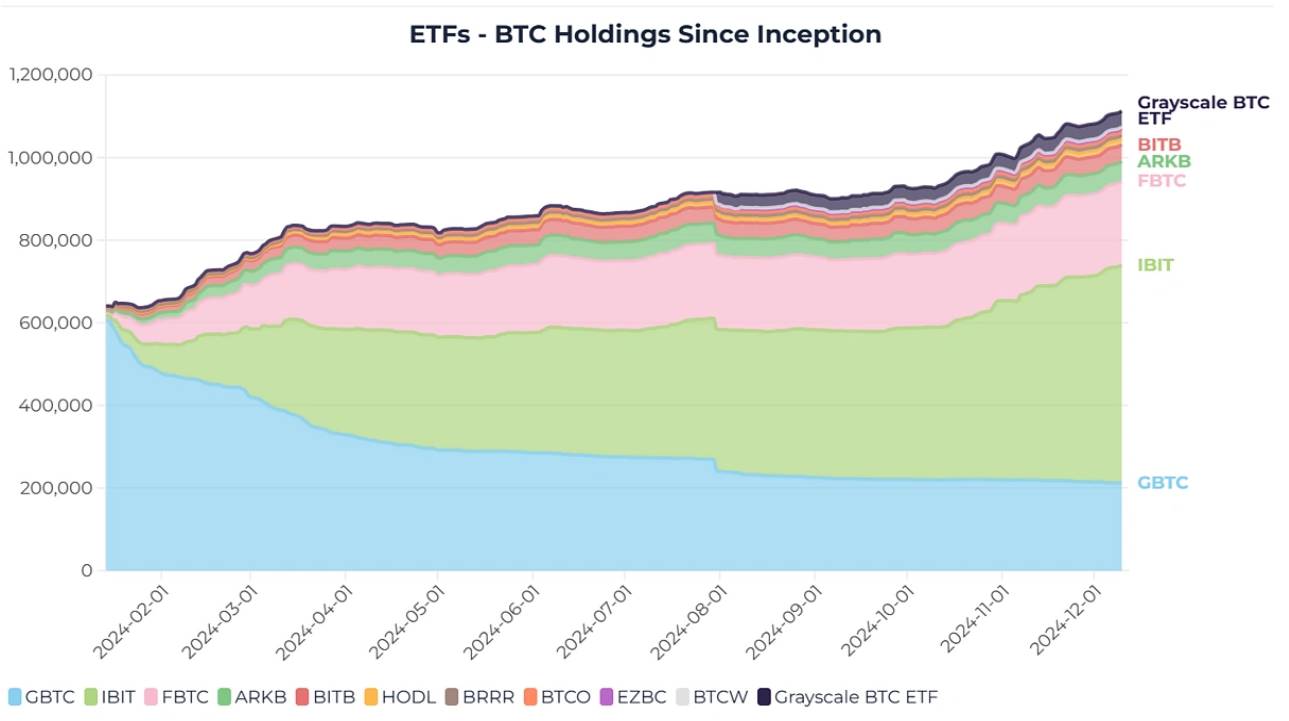

2) Approval of Bitcoin and Ethereum ETFs

The approval of Bitcoin and Ethereum ETFs in 2024 marked a milestone for the crypto market, significantly accelerating institutional participation. The long-awaited green light from the U.S. Securities and Exchange Commission (SEC) on spot Bitcoin ETFs became a reality, allowing traditional investors to access Bitcoin through a regulated and convenient framework. This approval led to a massive influx of institutional capital, driving a sharp increase in Bitcoin’s price following the announcement.

Likewise, the approval of Ethereum ETFs further solidified ETH’s status as a key investment asset. With the SEC approving spot Ethereum ETFs, traditional financial institutions can now include ETH in their portfolios, reinforcing Ethereum’s position as the world’s second-largest cryptocurrency.

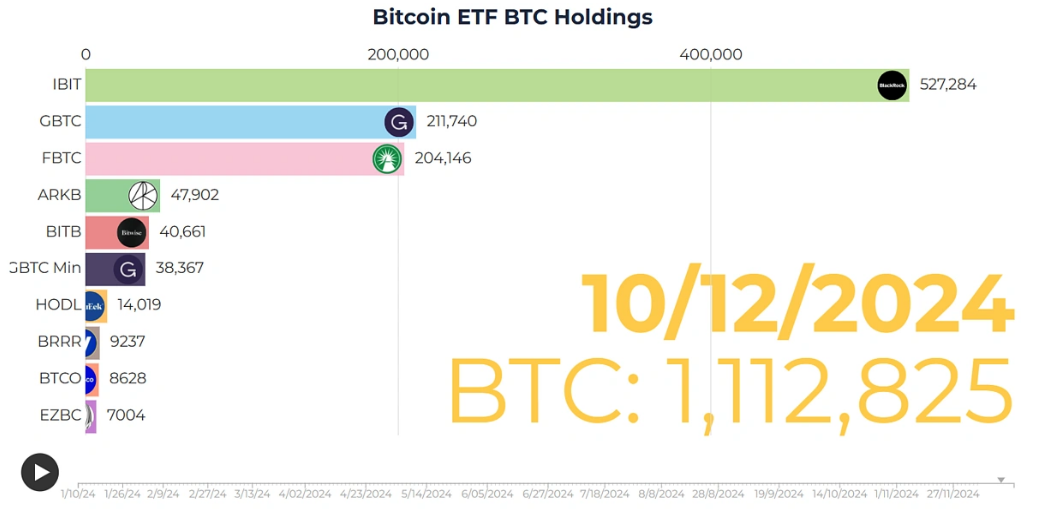

Latest data shows that institutional investors currently hold approximately 20% of all Bitcoin held in U.S.-listed Bitcoin exchange-traded funds (ETFs). Although BlackRock’s iShares Bitcoin Trust ETF (IBIT) has a below-average institutional adoption rate of only 18.38%, it leads in total BTC holdings, exceeding 71,000 BTC. Grayscale’s GBTC follows closely with 44,707.89 BTC held by institutions, accounting for 20.25% of its shareholders. Fidelity’s FBTC ranks third with 44,623.23 BTC held by institutions, representing 24.14% institutional ownership.

ARK 21Shares’ ARKB stands out with the highest institutional adoption rate—32.8% of shares are held by asset managers, equivalent to 17,166 BTC. In contrast, Grayscale’s Bitcoin Mini Trust has the lowest institutional participation at just 1.52%. CoinShares Valkyrie ETF (BRRRR) holds the smallest amount of Bitcoin among institutional holders, with only 451.26 BTC.

Leaked reports indicate that BlackRock, the world’s largest asset management firm, is negotiating to acquire shares in the “king” of spot Bitcoin ETFs.

These approvals have opened the door for future ETF applications for other cryptocurrencies. Currently, the SEC is reviewing more than ten ETF applications, including assets such as Solana (SOL) and XRP, signaling growing institutional interest in a broader range of digital assets. These developments could drive further adoption and price momentum across the entire cryptocurrency market.

3) Trump Wins the Presidential Election

Donald Trump’s victory in 2024 proved to be a game-changer for the cryptocurrency market. His pro-crypto stance and public discussion of using Bitcoin as a potential tool to repay U.S. debt greatly boosted market confidence. This bold vision aligns with his broader policy agenda of supporting business and deregulation, sparking optimism among traders and institutional investors alike.

Following his election win, Bitcoin broke through the $100,000 mark. Investors anticipate that a Trump administration will adopt crypto-friendly policies, driving further adoption and fostering innovation in the blockchain space. His victory also sparked discussions about integrating cryptocurrencies into the broader economic framework, creating a favorable environment for digital assets to thrive.

2. Key Events to Watch in 2025

1) Bitcoin as a Global Economic Policy Tool

One of the most compelling developments is the discussion around using Bitcoin to repay U.S. national debt. First introduced during Trump’s campaign, this bold idea has gained traction and attracted global attention. Trump has also expressed support for proposals to create a “strategic Bitcoin reserve,” similar to how the Federal Reserve holds gold reserves today. Such a reserve could serve as an alternative asset to address sovereign debt challenges, demonstrating Bitcoin’s potential as a legitimate reserve asset.

Driven by record-high borrowing and persistent fiscal imbalances, the U.S. sovereign debt crisis has prompted policymakers to explore unconventional solutions. Proponents argue that holding Bitcoin as a reserve could hedge against inflation and allow debt repayment without devaluing the dollar, diversifying the nation’s financial toolkit.

On a national level, following El Salvador’s pioneering move, countries like Tonga, Paraguay, and Panama are considering adopting Bitcoin as legal tender. Motivated by economic opportunities, financial inclusion, and remittance efficiency, these nations aim to leverage the potential of cryptocurrencies to modernize their financial systems and attract global investment.

Additionally, Binance founder Changpeng Zhao stated that it is inevitable for China to establish a strategic Bitcoin reserve. He noted that despite unpredictable crypto policies in China, the country has the capacity to make rapid decisions in this area. Zhao emphasized that if other nations begin building Bitcoin reserves, China may follow suit to maintain its competitive edge in global finance.

Major corporations like Amazon and Microsoft are also receiving shareholder inquiries about allocating part of their corporate treasury to Bitcoin. Although Microsoft shareholders voted against adding Bitcoin to the balance sheet based on board recommendations, their engagement in the discussion marks a shift in large companies exploring potential Bitcoin use cases, laying the foundation for broader adoption in the coming years.

2) Approval of Other Cryptocurrency ETFs

Building on the success of Bitcoin and Ethereum ETFs, 2025 could become a turning point for ETFs of other cryptocurrencies, including Solana (SOL) and XRP. While the SEC previously rejected a Solana ETF application, it continues to review more than ten such filings, indicating sustained interest in expanding crypto-based investment options.

This ongoing review leaves room for optimism, as market maturity and clearer regulations may pave the way for approvals, enhancing market liquidity and investor confidence.

3) Widespread Adoption of Real-World Assets (RWA)

By 2025, the tokenization of real-world assets (RWA) is expected to accelerate, fundamentally transforming how traditional finance interacts with blockchain technology. Real estate, commodities, and even artworks are being converted into blockchain-based tokens, enabling fractional ownership and broader accessibility.

According to CoinGecko, tokenization has the potential to unlock trillions of dollars in previously illiquid assets, making them tradable within the crypto ecosystem. This shift bridges traditional and digital finance, offering investors new avenues for diversification while driving innovation across industries.

4) End of the Halving Cycle

Historically, the period following a Bitcoin halving tends to result in prolonged price increases, often lasting up to a year (approximately 365 days). This trend suggests that the first quarter of 2025 will still be influenced by the residual effects of the 2024 halving, sustaining bullish sentiment and driving price growth. The halving reduces miner rewards, creating tighter supply and rising demand, forming a favorable environment for Bitcoin’s appreciation. This effect is expected to last until April 2025, providing ample opportunity for investors and traders.

3. Predictions for 2025: The Outlook for Crypto Markets

1) Bitcoin Forecast

Built on strong momentum from 2024 and combined with anticipated key events in 2025, Bitcoin’s growth trajectory appears highly promising. Logarithmic analysis of Bitcoin’s monthly chart shows it steadily moving within an ascending channel. Currently, Bitcoin is approaching a critical pivot point within this channel, resembling previous bull market cycles.

Optimistic projections suggest Bitcoin could reach the upper boundary of this channel, reflecting a potential 154% increase in value. This trend aligns with historical post-halving patterns, under which Bitcoin’s price could reach $250,000, further cementing its leadership in the crypto market.

2) Total Cryptocurrency Market Cap Forecast

The total cryptocurrency market cap exhibits strong bullish momentum, currently forming an ascending wedge pattern. Historically, bull market rallies often target the upper boundary of such structures. Given the current rebound from the lower trendline, the upper boundary is projected at $3.4 trillion, representing a potential 270% increase.

3) Market Cap Forecast Excluding Top Ten Cryptocurrencies

Meanwhile, the total market cap excluding the top ten cryptocurrencies is forming a classic "cup and handle" pattern on the monthly chart. The market is currently testing a resistance level of $370 billion. A breakout above this key level could trigger a 317% surge, with a potential target of $1.6 trillion, signaling the beginning of a powerful altcoin season.

4. Conclusion

The cryptocurrency market is poised for substantial growth in 2025, fueled by key milestones achieved in 2024—such as the post-halving rally, ETF approvals, and Trump’s pro-crypto policies. With Bitcoin potentially integrating into economic frameworks, rising altcoin adoption, and the tokenization of real-world assets, the market stands at the forefront of innovation and expansion. Despite regulatory challenges, the outlook remains optimistic, with Bitcoin likely reaching new highs and the crypto ecosystem reshaping traditional finance.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News