Presto Research Crypto Industry Annual Review and Outlook: From Chaos to Clarity, Ushering in a New Era for the Industry

TechFlow Selected TechFlow Selected

Presto Research Crypto Industry Annual Review and Outlook: From Chaos to Clarity, Ushering in a New Era for the Industry

Bitcoin is gaining adoption as a store of value at both the sovereign and corporate levels.

Author: Presto Research

Translation: TechFlow

Our 2024 market review reveals a dynamic panorama of the crypto market: Memecoins dominated the top-performing assets, while VC-backed tokens underperformed. Meanwhile, the rise of real-world assets (RWA) as a key theme signals transformative trends that will shape the market in 2025.

Presto Research's investment theses have proven prescient, accurately predicting several defining trends this year—including weak performance from low-circulating supply/high fully diluted valuation (FDV) tokens, the importance of Bitcoin strategic reserves, and a post-election bull run. These evolving trends remain critical to monitor as we look ahead to the next market cycle.

Our outlook for 2025 reflects an increasingly mature and poised industry landscape. Key themes include:

-

Bitcoin adoption as a store of value at both sovereign and corporate levels

-

U.S. consolidation as the global center of gravity for crypto

-

Broad industry consolidation

We expect continued progress among major smart contract platforms—especially EVM-compatible chains, Solana, and DAG-based networks—while Ethereum is set for a rebound. Decentralized exchanges (DEXs) are expected to gain greater share of trading volume, and NFT volumes may recover, transitioning toward more sustainable cultural and economic applications.

Presto Research’s key predictions for 2025 include:

-

Bitcoin surpassing $210,000

-

Crypto market cap expanding to $7.5 trillion

-

ETH/BTC ratio rebounding to 0.05 as Ethereum resolves user experience issues

-

Solana surging to $1,000

-

Stablecoin market cap reaching $300 billion

-

DEX trading volume exceeding 20% of CEX trading volume

-

A new EVM L1 public chain achieving $20B market cap and $10B TVL

-

A sovereign nation or S&P 500 company adding Bitcoin to treasury reserves

-

Crypto hedge funds outperforming crypto VCs

-

And more predictions!

Chapter One: Introduction

"Some decades nothing happens; some weeks decades happen." It would be hard to find a better way to describe the evolution of the crypto industry in 2024. This year was packed with milestone events: spot Bitcoin/Ethereum ETF approvals, IBIT options debut, Republican sweep leading to a 180-degree shift in U.S. crypto policy, Bitcoin Strategic Reserve Act, parabolic rise in MicroStrategy’s stock price, prediction markets taking off, strong comebacks for Solana and stablecoins, and memecoin mania—to name just a few.

While most of these milestones occurred in the United States, their impact resonated globally, highlighting America’s leadership in shaping crypto thought. Many countries continue to use U.S. crypto policy as a benchmark; Hong Kong, for example, rolled out its own spot crypto ETF just months after the U.S. did.

In this context, Presto Research is proud to present *From Chaos to Clarity: The 2024 Crypto Market Review & 2025 Outlook*, our inaugural annual report. This document reviews key trends and themes from the 2024 crypto market and offers forward-looking insights into 2025.

The report is divided into two parts. The first half recaps the year’s best- and worst-performing crypto assets and highlights the core investment theses we explored across 221 publications. The second half is a compilation of 2025 predictions, with each member of the Presto Research team contributing two to four unique forecasts. Given our team members’ diverse backgrounds and expertise, these unfiltered perspectives offer multifaceted views on the crypto market in 2025. We hope these insights provide valuable food for thought as readers form their own opinions. We believe every reader will find something useful within this report.

As the crypto industry moves from chaos to clarity, we hope this report serves as both a guide and a source of inspiration for investors, builders, and curious observers navigating future opportunities and challenges. Let’s dive in.

Chapter Two: 2024 Review

2.1 Best and Worst Performing Assets

In a well-functioning market, asset prices can be seen as aggregations of collective wisdom, dynamically reflecting narratives, themes, and trends. Thus, reviewing the best- and worst-performing assets provides valuable insight into past market dynamics—the focus of our analysis below.

A few notes on methodology. First, we limited our scope to three major centralized exchanges (CEXs): Binance, Bybit, and OKX. Second, we categorized assets into two groups: “newly listed assets” (launched in 2024) and “existing assets” (launched in 2023 or earlier). Finally, from these six subcategories, we identified the top five best- and worst-performing assets in each. Results are summarized in Figures 2 and 3.

It should be noted that this study excludes large-cap assets such as BTC or ETH, since smaller-cap assets typically exhibit more extreme performance. Our analysis focuses instead on uncovering potentially overlooked industry themes or individual projects. Under this premise, we identified three key trends: poor performance by VC coins, the memecoin craze, the rise of RWA (real-world assets), and rapid growth in decentralized exchanges (DEXs).

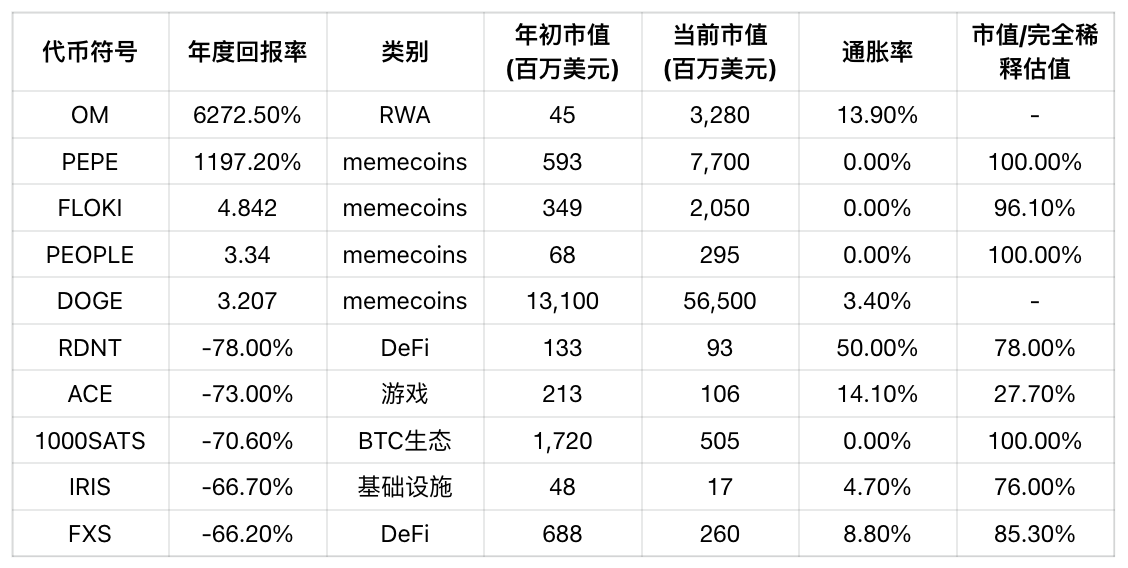

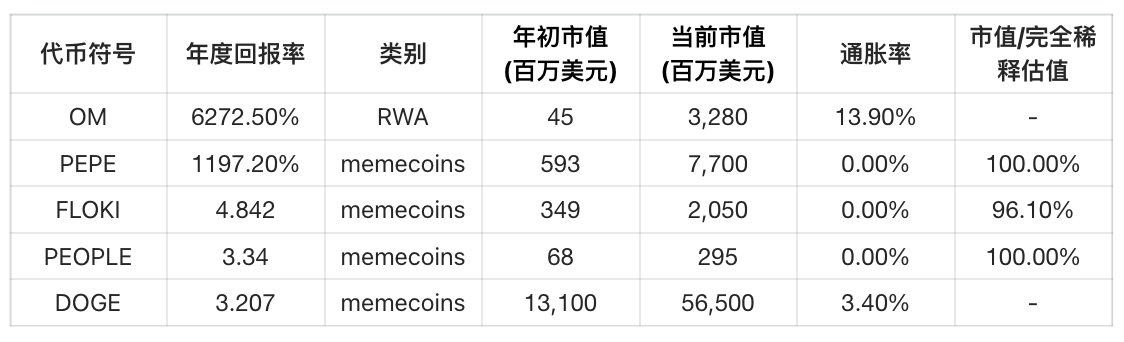

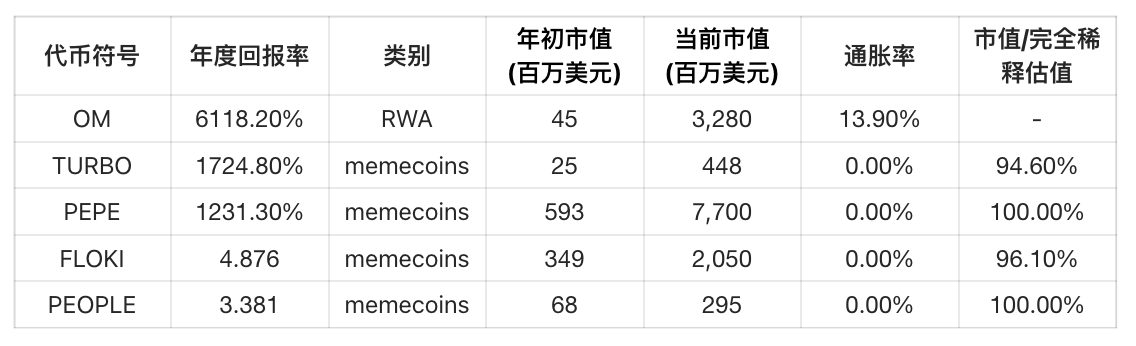

Figure 2: Top 5 Best and Worst Performing Newly Listed Projects in 2024 (Data as of November 29)

Binance Performance Statistics

Bybit Performance Statistics

OKX Performance Statistics

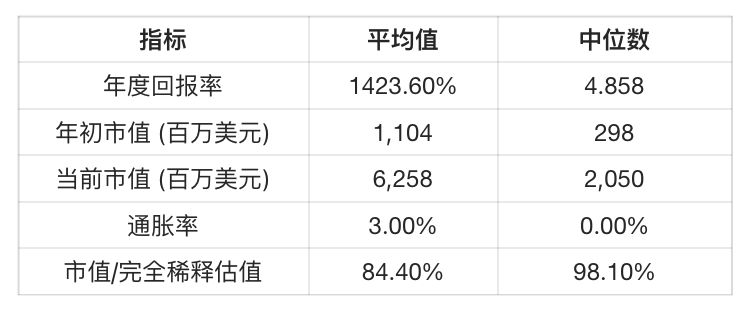

Overall Performance Overview

Best Performing Projects Overview

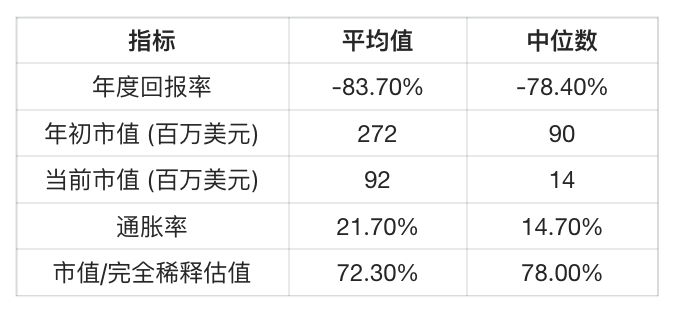

Worst Performing Projects Overview

Meme Coins Performance Overview

Data sources: Binance, Bybit, OKX, CoinGecko, CoinMarketCap, Token Terminal, Presto Research

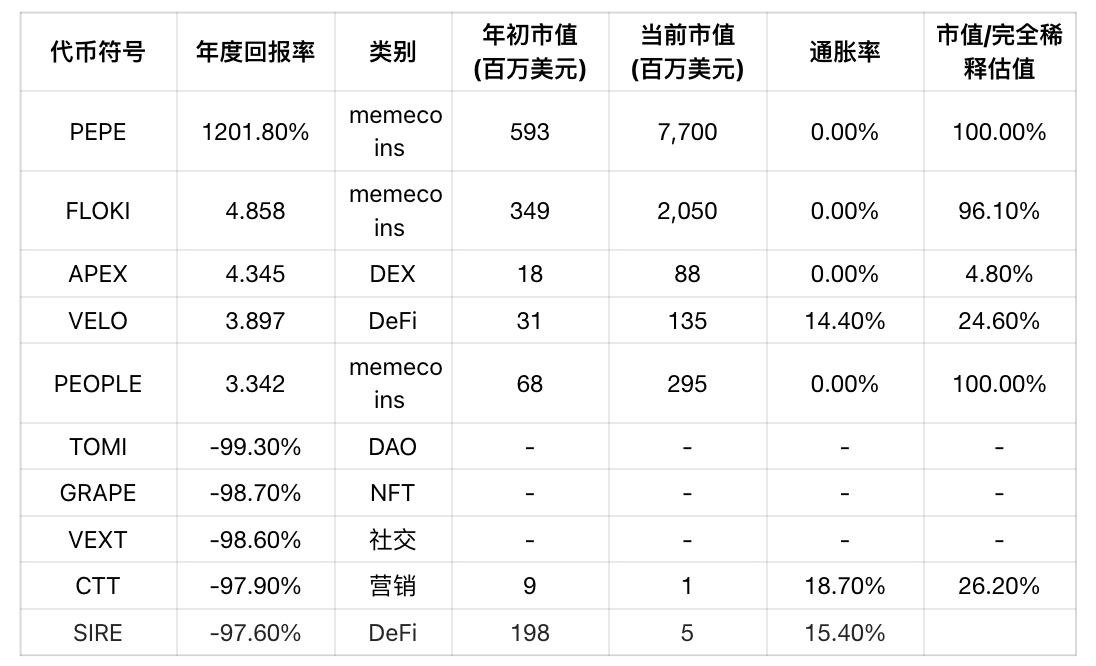

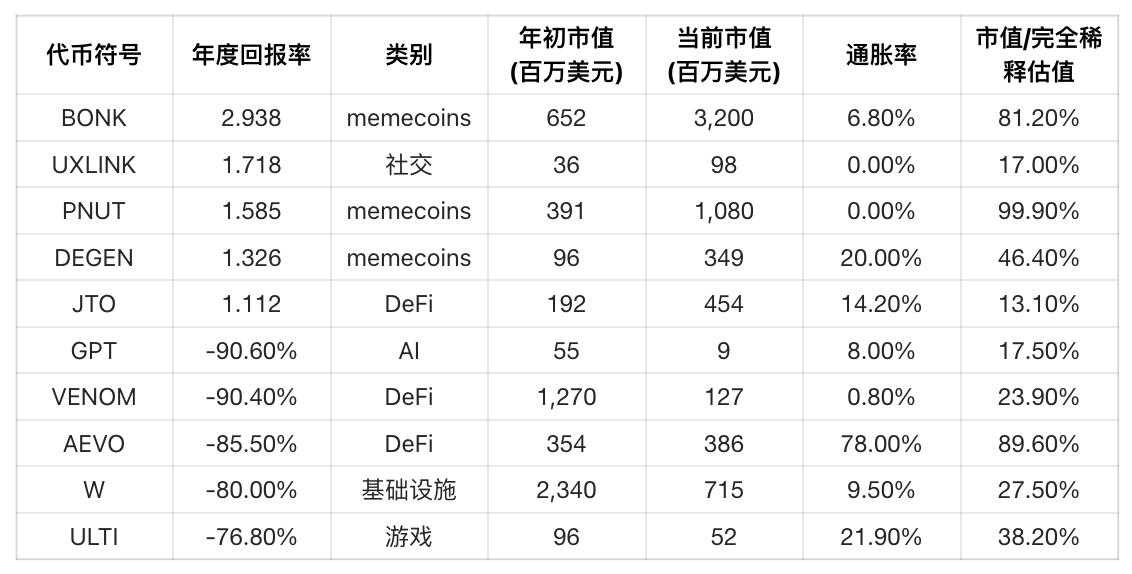

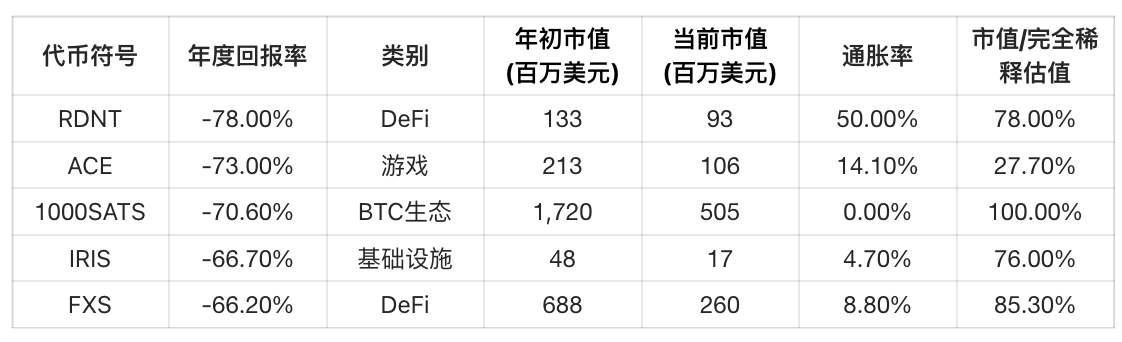

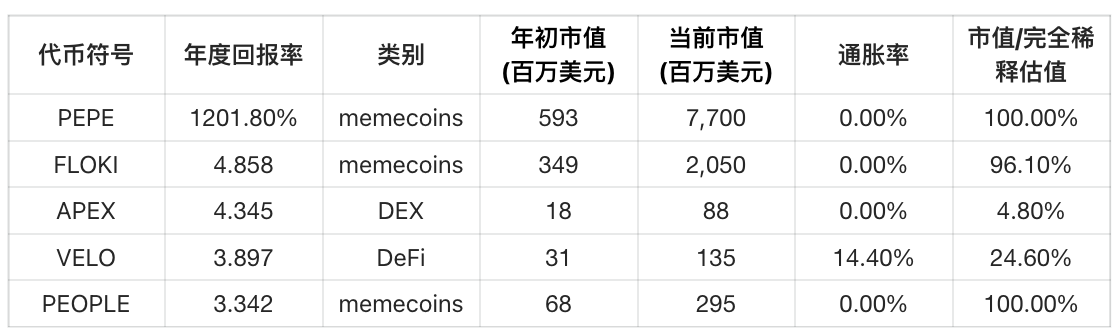

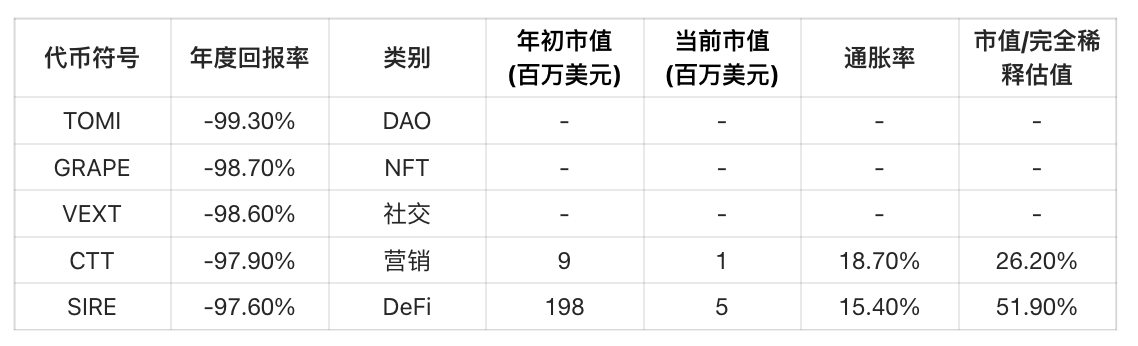

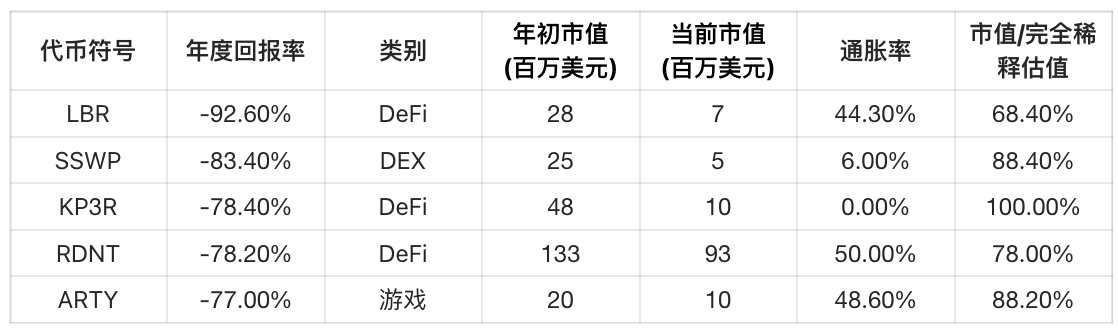

Figure 3: Top 5 Best and Worst Performing Legacy Projects (Data as of November 29)

Binance Exchange

Top 5 Best Performing Projects

Worst 5 Performing Projects

Bybit Exchange

Top 5 Best Performing Projects

Worst 5 Performing Projects

OKX Exchange Performance Analysis

Top 5 Best Performing Projects

Worst 5 Performing Projects

Best Performing Projects Overall

Worst Performing Projects Overall

Meme Coins Performance Overview

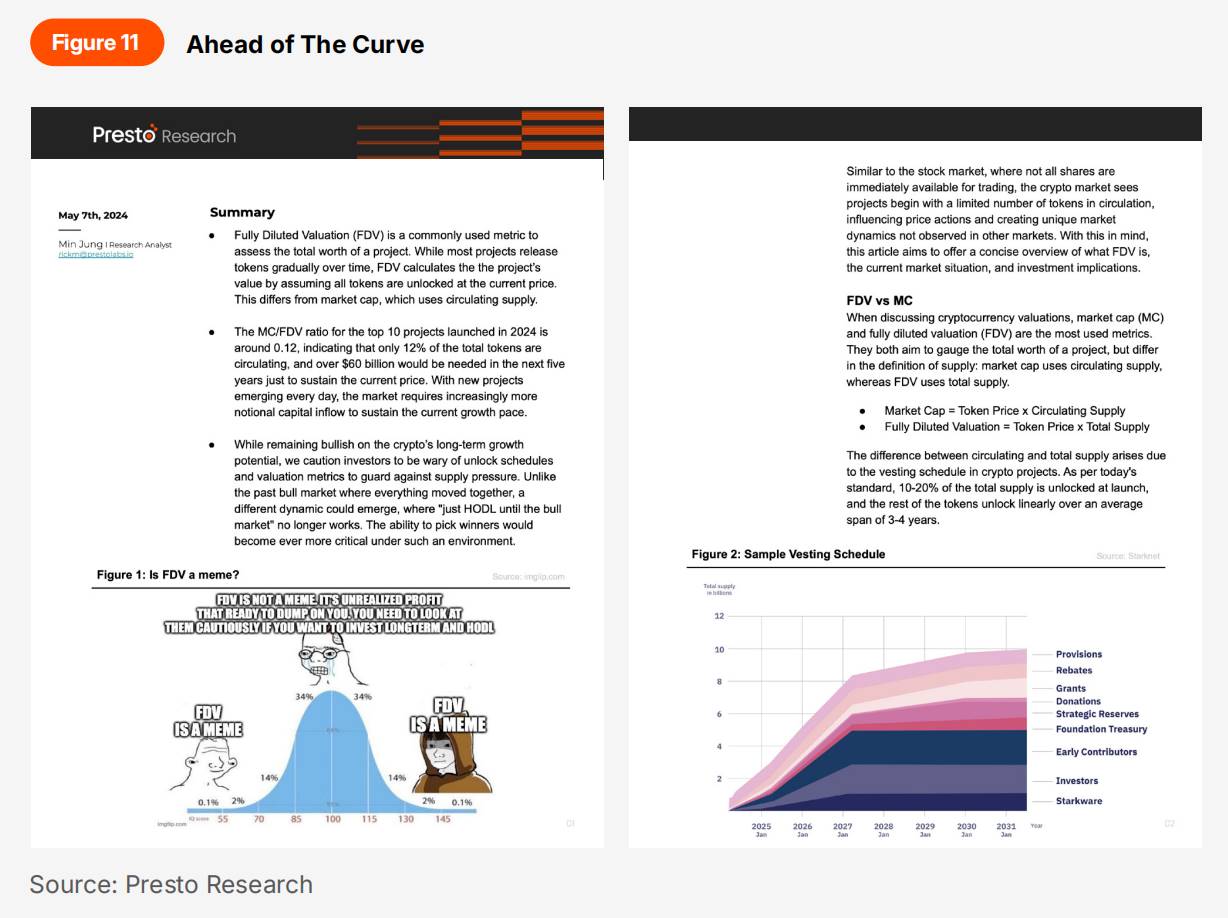

2.1.1 Poor Performance of "VC Coins" (Low Circulation / High FDV)

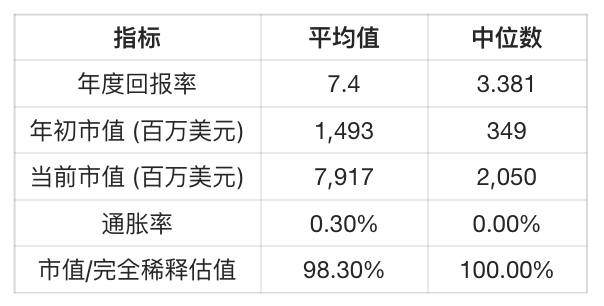

The data tables clearly show that underperforming tokens often share these characteristics:

-

High inflation rates (median 22% for newly listed, 15% for existing)

-

Low circulating supply ratios (median 30% for newly listed, 78% for existing)

This trend became a defining feature of the 2024 crypto market. While the negative impact of large-scale token unlocks has long been recognized as a risk, this year it became a dominant narrative, with all market participants—exchanges, projects, and investors—now acutely aware of it.

We view this shift as a sign of healthy market maturation. Simply launching a newly minted asset, no matter how polished it appears or how many prominent VCs back it, no longer guarantees retail investors will blindly chase it. This indicates that strategies relying on information asymmetry to exploit retail investors as exit liquidity for centralized exchanges are failing. Such tactics, commonly used by second-tier VCs, have persisted too long. We will discuss this further in section "2.2.5 Is FDV Just a Meme?"

2.1.2 Meme Mania

As retail investors increasingly perceive VC coins as "unfair," many have turned to what they see as fairer alternatives: memecoins. This shift has been a primary driver behind the unprecedented boom in the memecoin space. The prominence of memecoins across all six top-performing project lists underscores their influence.

This trend can be seen as a reaction to the point above, as memecoins typically feature low inflation and/or high circulation—precisely the opposite of VC coins. Whether memecoins are truly "fair" or not, the narrative is powerful enough to mobilize retail investors like never before. As such, memecoins have firmly established themselves as a hallmark of the 2024 crypto market.

2.1.3 RWA Projects Outperforming Memes

One project stood head and shoulders above all others in terms of price performance this year: Mantra (OM). Even the best-performing memecoin in our dataset, PEPE (up 1,231%), pales in comparison to OM’s explosive return (up 6,118%). Mantra positions itself as "a purpose-built RWA Layer 1 blockchain capable of meeting real-world regulatory requirements through seamless on/off-ramping protocols for fiat, equities, and tokenized RWAs." OM is the governance token of MANTRA DAO, granting users access to reward programs tied to key initiatives and ecosystem development.

Without delving into the project’s prospects, its outstanding performance highlights growing market enthusiasm for the RWA theme—suggesting retail investors now see RWA’s potential as comparable to, or even surpassing, that of memecoins.

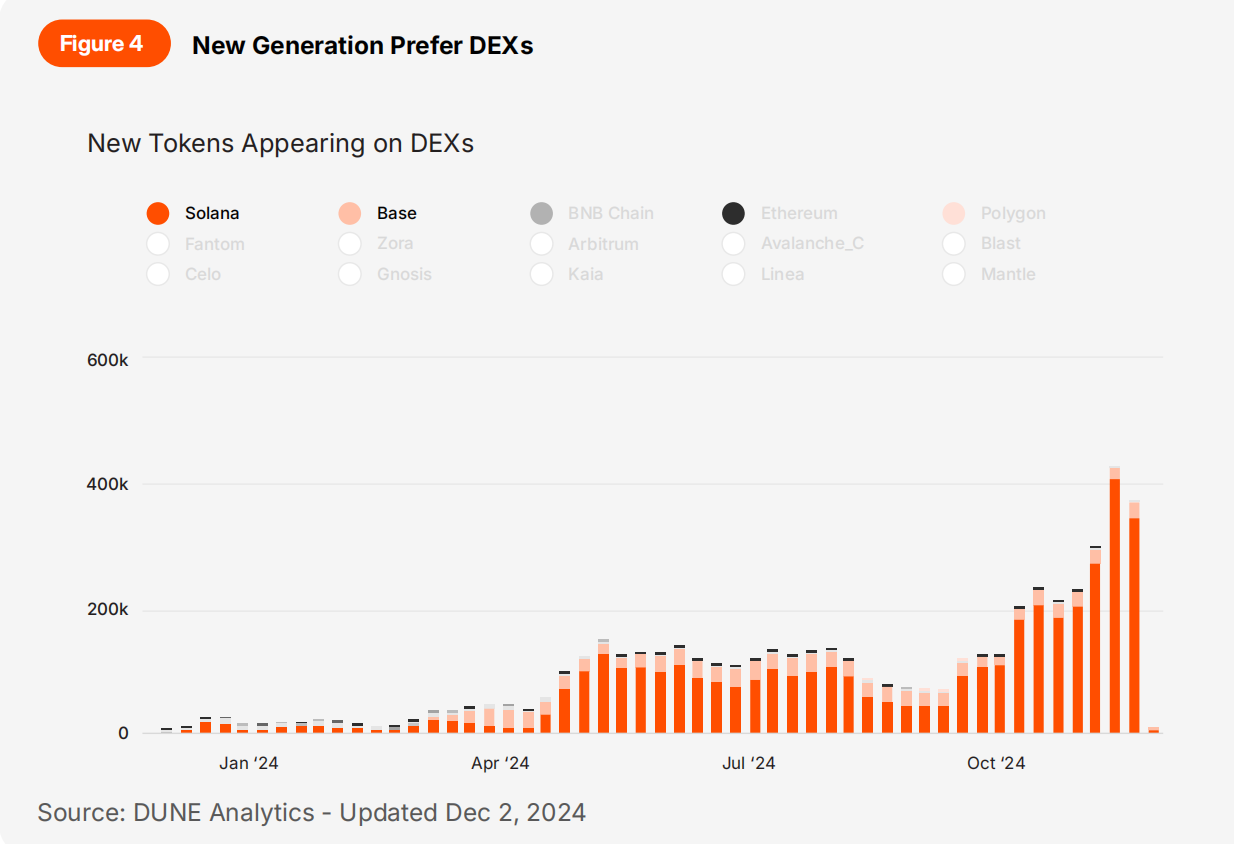

2.1.4 Early Gains Shifting to DEXs

Interestingly, existing projects showed higher returns than newly listed ones—a counterintuitive finding given that new listings historically correlate with the start of hype cycles. However, this reflects an important emerging trend: DEXs have become the preferred venue for early price discovery before projects list on CEXs.

Thanks to improved DEX functionality and user experience, many projects now launch first on DEXs. As a result, the steepest price increases often occur on DEXs, with CEXs capturing only the later stages of the rally. In the early days of crypto, CEXs were the undisputed leaders in liquidity provision. But with the rise of DEXs like Hyperliquid and Raydium, and platforms like Moonshot and Pump.fun, the landscape has shifted. We’ll explore this further in section "3.5.1 DEX Gold Rush."

2.2 Presto Investment Themes Recap

Many of the investment themes we discussed this year proved highly relevant throughout the year. In this section, we highlight five particularly resilient research pieces.

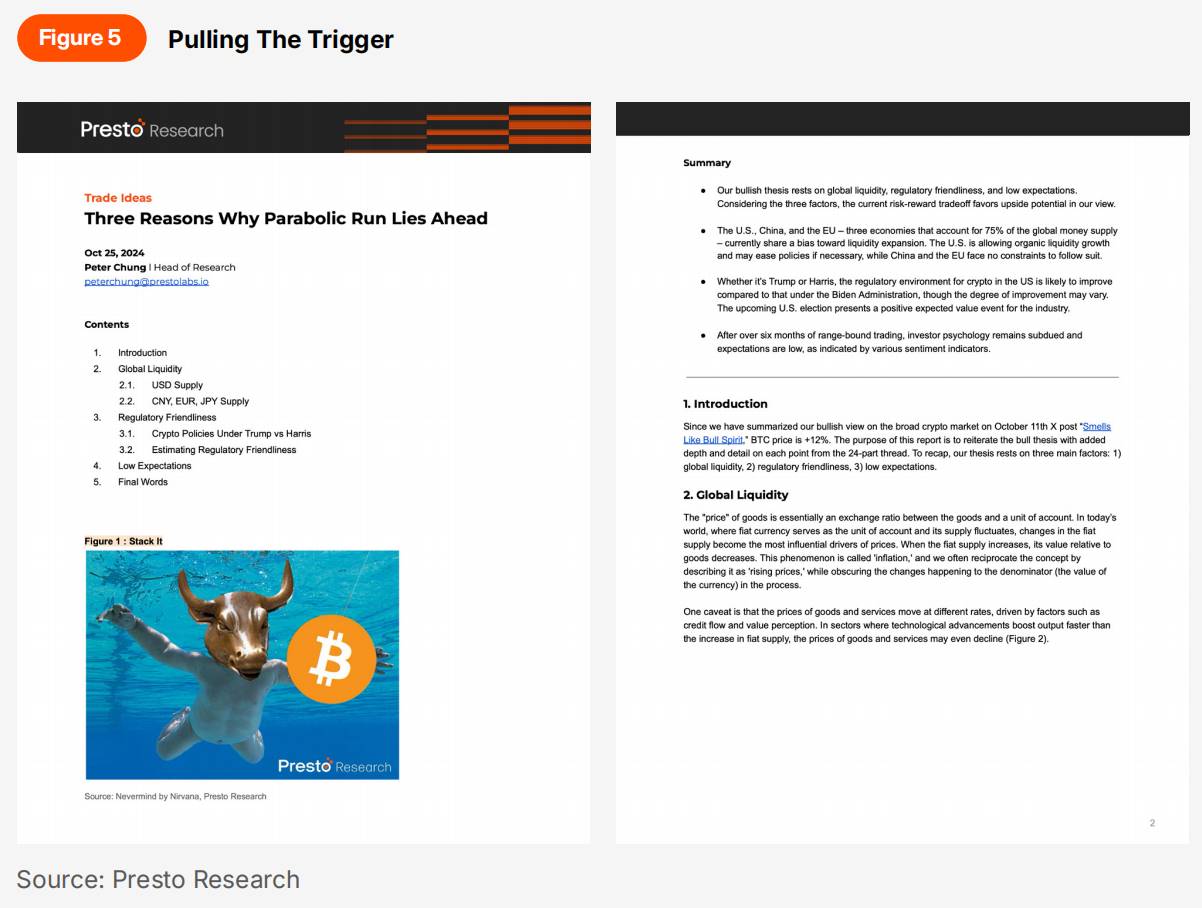

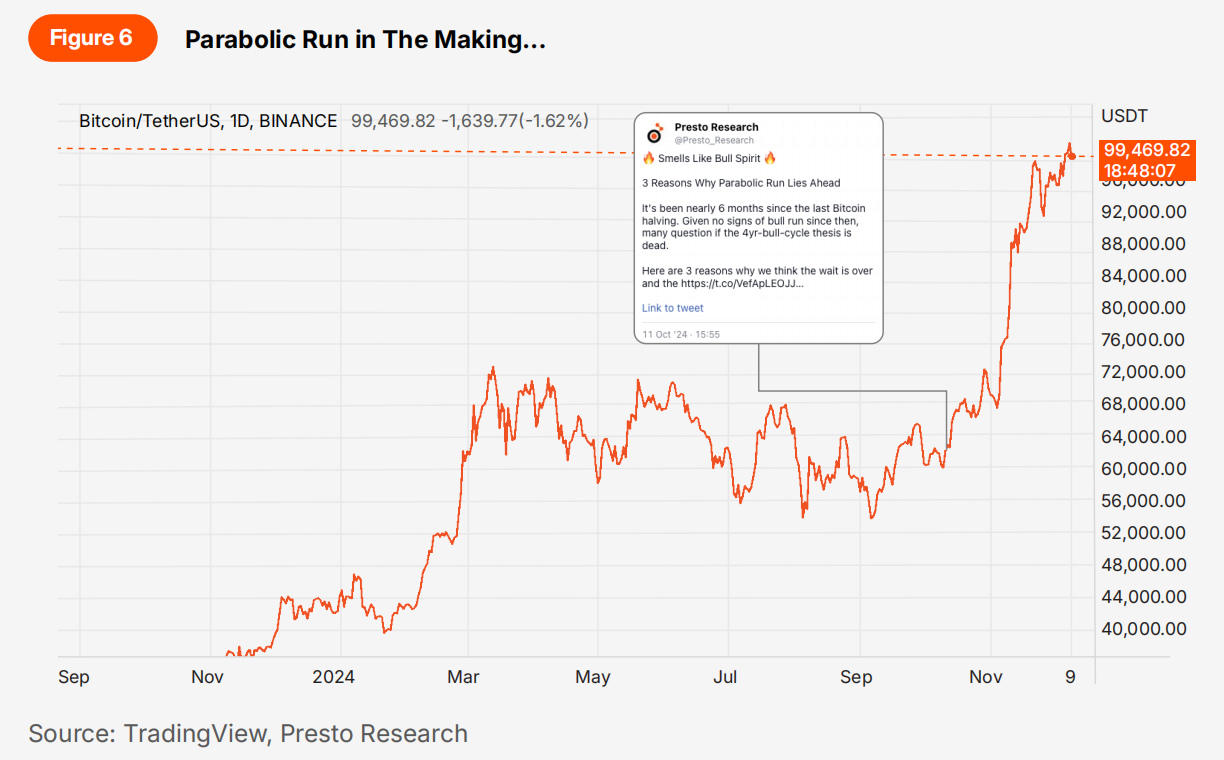

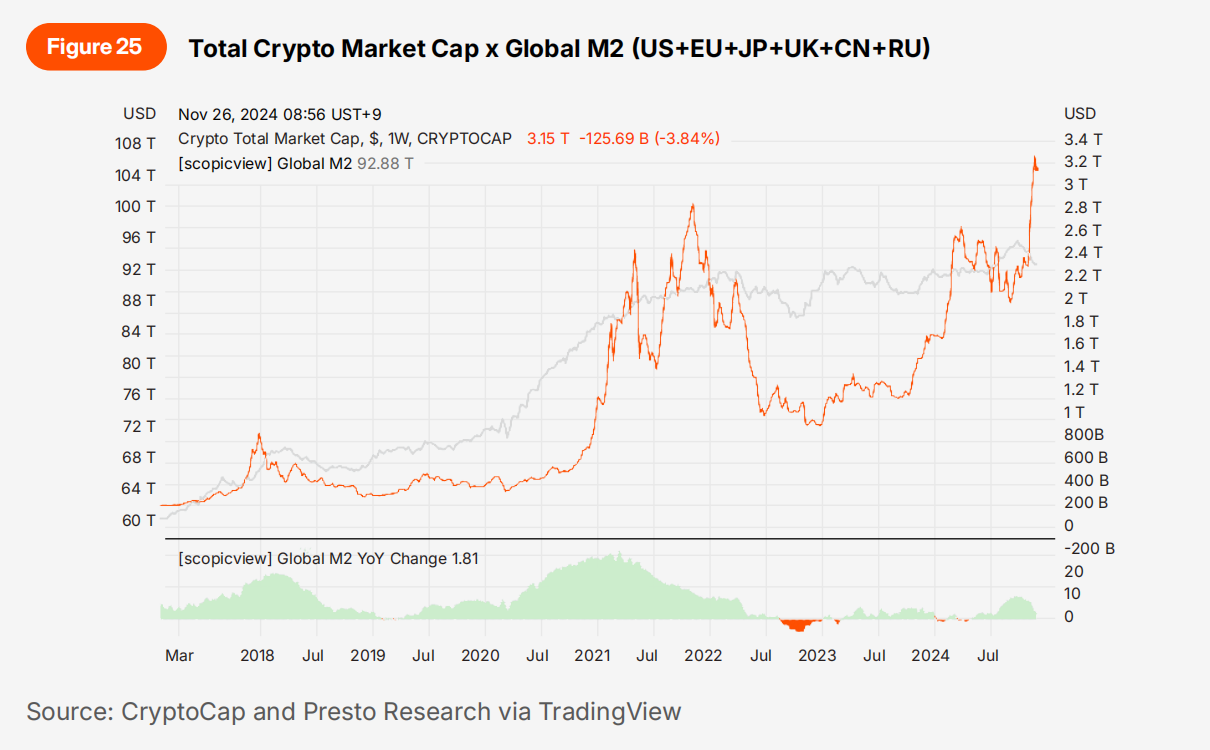

2.2.1 Three Reasons for an Imminent Parabolic Move

On October 11, we published a bullish thesis titled "Three Reasons for an Imminent Parabolic Move" via X (formerly Twitter), later supplemented with additional data on October 25. The bullish case rested on three factors: global liquidity, regulatory friendliness, and low expectations. Since then, Bitcoin has risen 67%, and macroeconomic and political developments have largely aligned with our thesis.

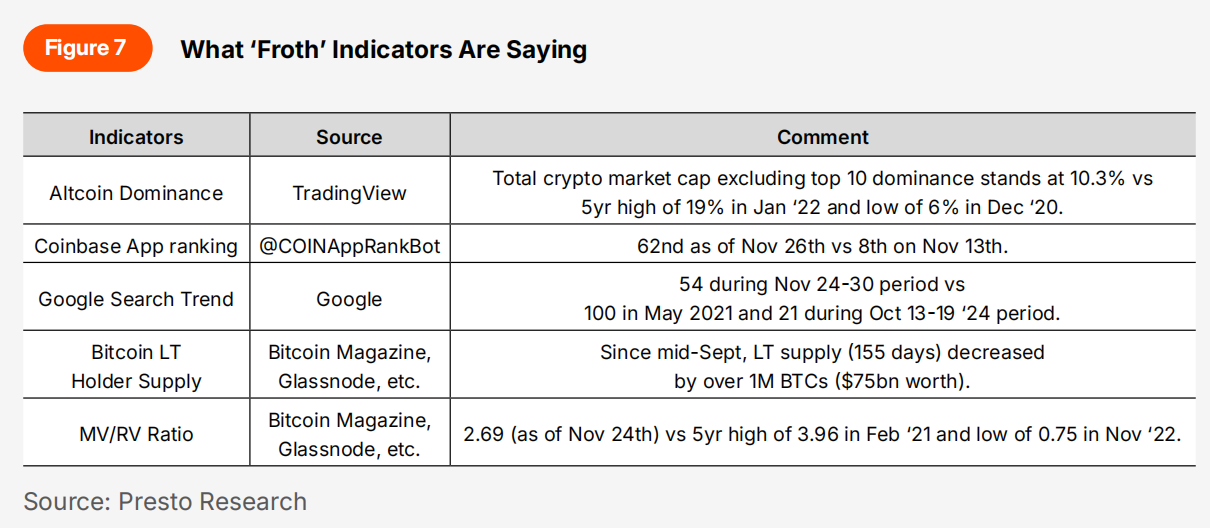

While our argument still holds, we believe it’s crucial to monitor for signs of short-term over-optimism as Bitcoin enters uncharted territory and market expectations rise. Figure 7 summarizes useful indicators and their current status. Note that this list is not exhaustive.

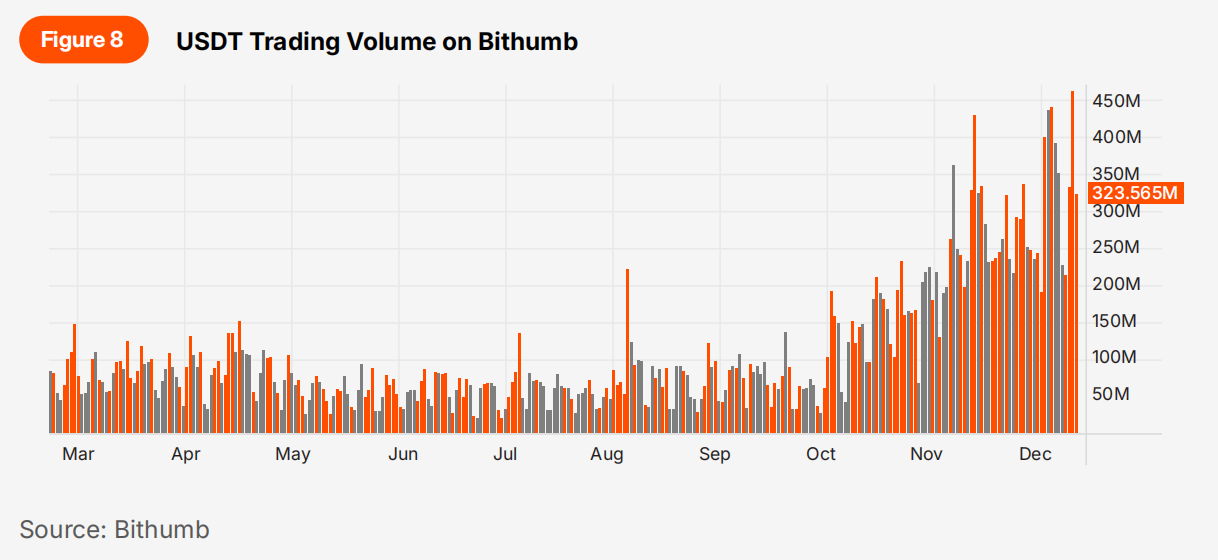

Although the original X (Twitter) post mentioned the "kimchi premium" as a sign of overheating, we believe it is no longer as reliable. The widespread availability of USD stablecoins on Korean exchanges has enabled more effective arbitrage, flattening price differences. This point is clearly explained in Min’s X thread.

TechFlow Note:

-

"Kimchi premium" refers to the phenomenon where cryptocurrency prices on South Korean exchanges trade at a premium compared to international markets

-

"Arbitraged away" means price differences between markets are eliminated through arbitrage trading

2.2.2 Bitcoin Options Market Prediction for Election Day

In early October, we released an analysis on Bitcoin election premium, finding that options markets priced in an 8% increase in daily volatility during the U.S. presidential election in November 2024. However, we believed this premium was overestimated and recommended a calendar straddle strategy: shorting the election premium while going long on March 2025 volatility in a "vega-neutral" manner (a hedging method to avoid volatility risk).

Post-election data validated our assessment. The realized premium, calculated using actual volatility, was approximately 4.8%, far below the 8% implied by markets a month prior. Our recommended trade performed well: the short 55k/72k 08Nov24 straddle expired at a loss of 0.1653 BTC, while the long 65k/75k 28Mar25 straddle had gained 0.4145 BTC by December 2, resulting in a net profit of 0.2492 BTC.

Recent market changes suggest it’s time to take profits. First, one of our main reasons for favoring long-term volatility in March 2025 was the expectation of multiple Fed rate cuts that quarter. However, under the post-election macro environment of a Trump administration, interest rate expectations have significantly adjusted, with the Z4H5 Fed Funds futures spread narrowing from -42.5 basis points in October to -20 today.

Second, the launch of $IBIT options on November 19 introduced structural changes that could suppress volatility. As Joshua Lim of Arbelos noted, traditional financial options markets often reduce volatility through structured product supply. Even $5 billion worth of $IBIT-linked notes could represent a quarter of Deribit’s open interest. Academic research supports this view—for instance, Arkorful et al. (2020) found that the introduction of SSE 50ETF options in China significantly reduced underlying asset volatility due to improved information flow and market efficiency. Given Bitcoin’s global nature and mature market-making infrastructure, this effect may be even stronger.

2.2.3 U.S. Strategic Bitcoin Reserve: Impact Analysis

Initially, we were puzzled by the lukewarm response from the industry to Senator Lummis’s Bitcoin Strategic Reserve Act (BITCOIN Act of 2024), announced in Nashville. Presto Research recognized the significance and quickly published an 11-page report, while most crypto commentators gave it only passing mention, aside from a few podcast hosts.

Today, the idea of the U.S. government purchasing Bitcoin for geopolitical purposes—though it may sound implausible to the general public outside crypto—has become plausible (Polymarket assigns a 26% probability). The U.S. election outcome has accelerated this "genie-out-of-the-bottle" effect, prompting other nations and local governments to seriously consider similar moves (see "Section 3: 2025 Predictions"). Key takeaways from our report:

With Wall Street gradually embracing the asset class and urgent fiscal deficit concerns, the bill could gain momentum under favorable political conditions.

Even if passage takes years, the bill’s introduction means discussions will begin, lawmakers will seek education, and other governments will have a reference point. Compared to a year ago, this is tremendous progress, and the market has yet to fully digest this improvement.

Now, "favorable political conditions" have indeed arrived, and momentum is building. Just as the Grayscale v. SEC court ruling in 2023 paved the way for this year’s ETF frenzy, Lummis’s bill and the Republican sweep have laid the groundwork for a global race to buy Bitcoin.

2.2.4 Is FDV Just a Meme?

When we published "Is Fully Diluted Valuation (FDV) a Joke?" on May 7, 2024, the issue of high FDV and low circulating supply was not widely recognized or a focal point in industry discourse. Interestingly, it wasn’t until Binance Research released their take on the topic a week later that the concept began gaining significant traction. Today, the high-FDV, low-circulation phenomenon is reshaping crypto investment paradigms, affecting everything from valuation methods to issuance strategies.

This year has been especially harsh for VC-backed projects. Retail investors are increasingly aware of being used as exit liquidity for VCs and early investors, causing the once-common "first listing pump" to vanish. Even on premier exchanges, projects like Scroll and EigenLayer underperformed. Investors now better understand the long-term implications, recognizing their holdings may face continuous dilution over the next three to four years.

One key observation from the report remains highly relevant: the role of tokenomics in driving memecoin rallies. While memecoins were active in early 2024, the current mania dwarfs those earlier levels. Platforms like pump.fun, initially launched as memecoin launchpads, have evolved into general-purpose project incubators. We now see these tokenomic trends extending beyond memecoins. This suggests memecoin rallies aren’t merely speculative bubbles—they’re deeply influenced by tokenomic structures. As the report noted:

In this regard, recent memecoin rallies serve as exemplary models. Unlike other crypto sectors plagued by massive unlocks—such as coins with only 10% initial circulating supply—most memecoins unlock 100% at launch, avoiding ongoing dilution. While memecoin rallies cannot be solely attributed to tokenomics, it undoubtedly plays a significant role in their appeal and sustained attention.

In this context, the "barbell strategy" has proven remarkably prescient. One end includes assets like BTC and SOL, benefiting from institutional interest and real-world demand. The other end includes memecoins—immune to dilution from unlock schedules—that attract speculative capital thanks to intuitive tokenomics. Meanwhile, investors across the board are gaining deeper understanding of concepts like FDV, market cap, and vesting schedules. They’re increasingly wary of how token unlocks erode value, and "successful listing on a tier-one exchange" no longer guarantees success.

2.2.5 Babylon: Killing Two Birds with One Stone

On September 3, we released a report on Babylon, a Bitcoin staking protocol. While wrapped-Bitcoin staking protocols exist, Babylon stands out technically as a "remote staking protocol." Babylon enables Bitcoin staking without wrapping BTC onto another chain or surrendering private keys, ensuring self-custody.

As a two-sided market, Babylon bridges Bitcoin holders and small PoS chains, enhancing the latter’s security through Bitcoin staking. Its remote staking protocol leverages innovations in timestamping, finality gadgets, and bond contracts to provide robust security for consumer chains (PoS chains) and Bitcoin holders alike.

Babylon is currently undergoing phased mainnet rollout. Phase 1 allows only Bitcoin deposits; Phase 2 launches the staking protocol; Phase 3 introduces multi-staking. At the time of writing, Phase 1 Round 1 had just concluded, with overwhelming demand—1,000 BTC deposit cap filled in 74 minutes. In Round 2, with no deposit cap, ~23,000 BTC were deposited within ten Bitcoin blocks.

Phase 1 Round 3 is set to begin soon (December 10, 2024), while mainnet activation and TGE launch will occur during Phase 2 in February 2025. BTC remains the most dominant crypto asset by market cap ($1.89T as of December 2024). The key question is how much BTC Babylon can accumulate by early 2025 and how large its ecosystem will grow from there.

Chapter Three: 2025 Predictions

3.1 Full-Speed Institutionalization (Author: Peter Chung)

Mainstream adoption of crypto is an ongoing process that will reach new heights in 2025 as top institutions fully embrace the trend, accelerating its momentum. I expect this shift to manifest in four key areas.

3.1.1 Bitcoin Reaches $210,000 in 2025

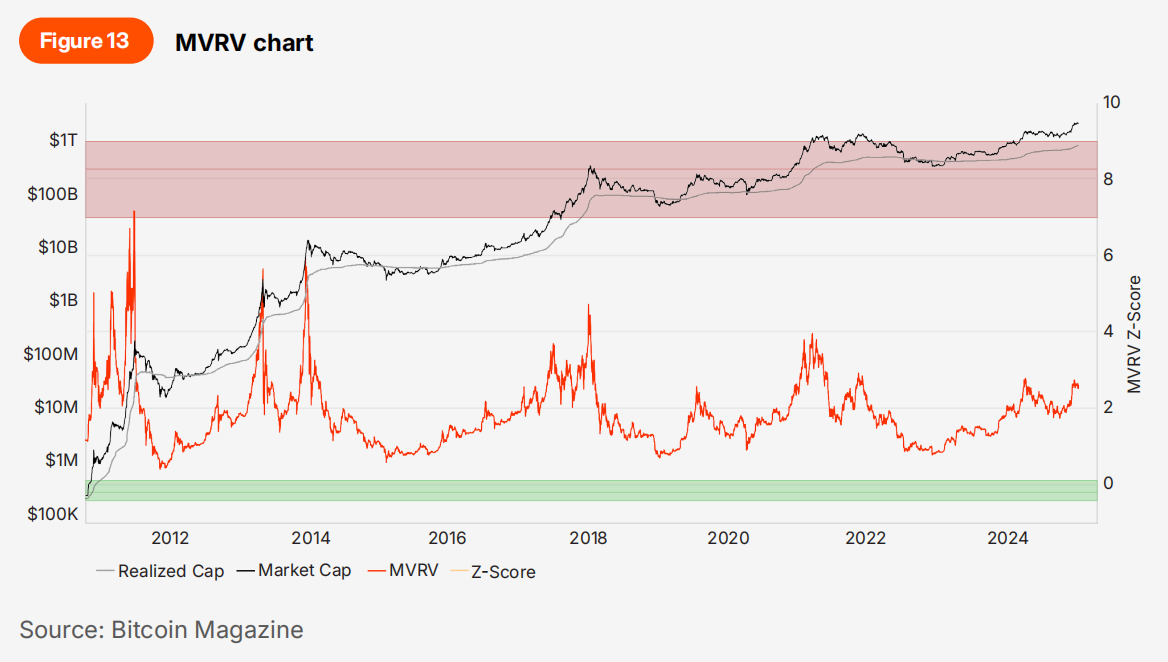

For years, the MVRV ratio has been one of the more reliable Bitcoin valuation tools in the digital asset industry. MVRV is calculated as Market Value (MV) divided by Realized Value (RV). MV values all circulating bitcoins at the current market price (i.e., market cap). RV, however, values each circulating bitcoin based on its last acquisition price derived from on-chain transactions—representing the average cost basis of all circulating BTC.

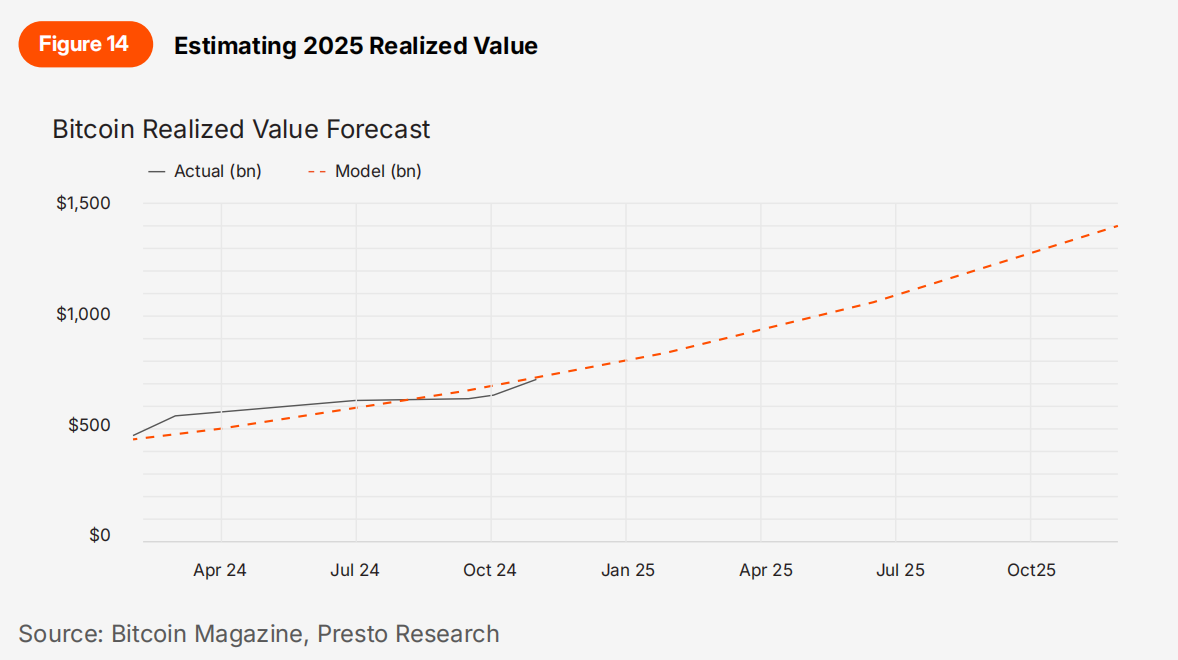

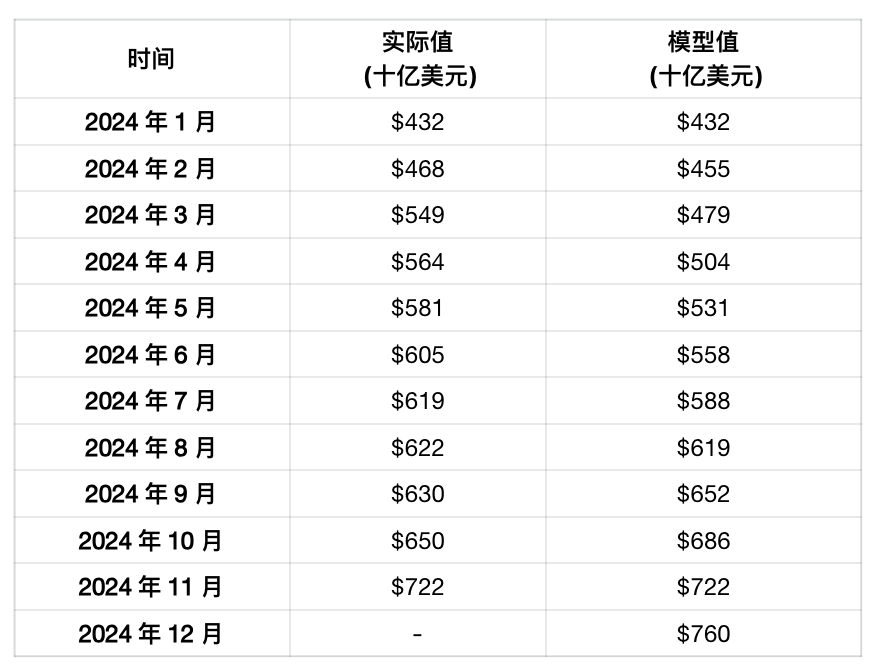

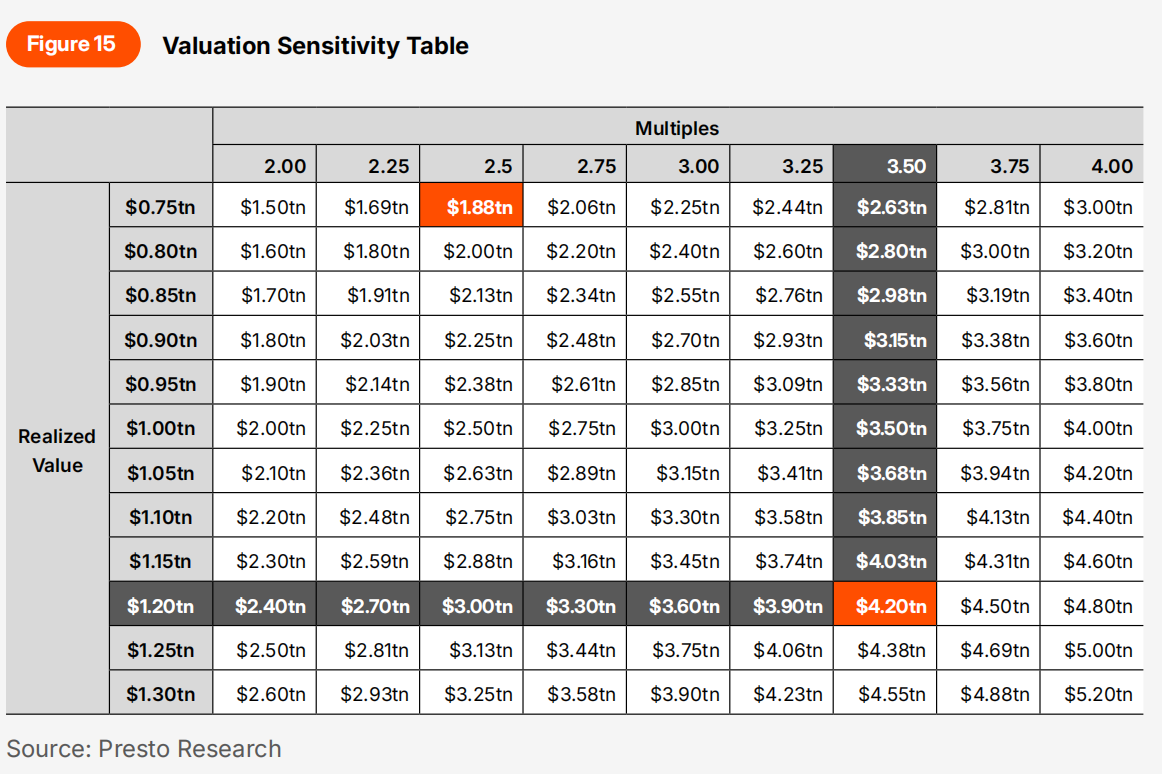

Historically, Bitcoin’s MVRV ratio has fluctuated between 0.4x and 7.7x. Excluding early extreme volatility (i.e., since 2017), the range narrows to 0.5x–4.7x (Figure 13). In the past two bull markets (2017 and 2021), Bitcoin peaked at 4.7x and 4x, respectively. I take a conservative approach, applying a 3.5x multiple to an estimated Q3 2025 RV of $1.2T, assuming monthly RV growth of 5.3% from today’s $722B. This 5.3% reflects the monthly compound growth rate from Jan–Nov 2024, driven by easier institutional access via spot ETFs (which raise RV as they acquire more BTC). This leads to a target network value of $4.2T in 2025 (vs. $1.9T today), or $210,000 per BTC (= $4.2T / 19,986,416 BTC) (Figures 14, 15).

Monthly Growth Rate of Realized Value: 5.27%

Data source: Bitcoin Magazine, Presto Research

3.1.2 Bitcoin "Land Grab": A Sovereign Nation or S&P 500 Company Will Adopt Bitcoin as Reserves

I predict a sovereign nation or an S&P 500 company will announce Bitcoin adoption into its reserve strategy. For sovereigns, I define "adoption" as a government proposing to include Bitcoin in its national treasury. Notably, at least one sovereign nation has taken such action each of the past three years (Figure 16). While it's hard to predict which country may follow in 2025, Trump’s campaign promise regarding Bitcoin storage/reserves may already be prompting others to study similar strategies due to game-theoretic dynamics.

Figure 16: It’s Been Happening Already

Data source: Presto Research

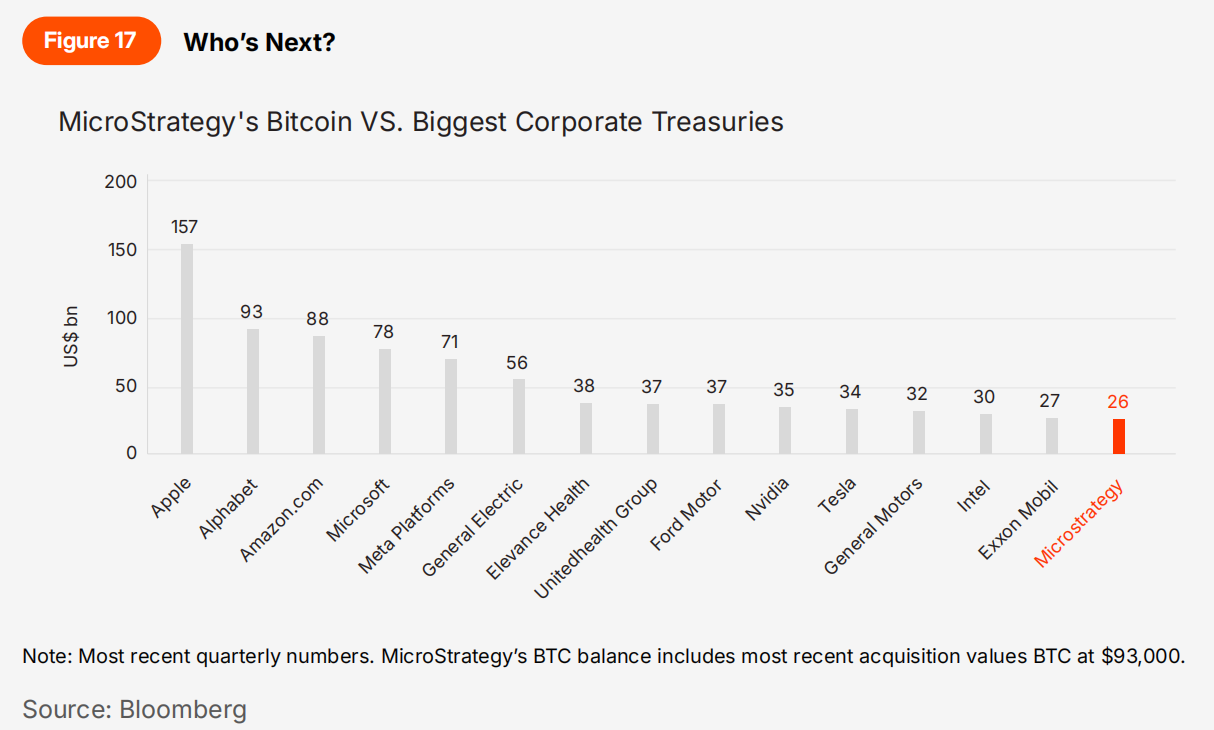

On the corporate side, MicroStrategy’s parabolic stock surge this year has drawn unprecedented corporate attention, prompting others to explore similar strategies. Traditional accounting treatment of Bitcoin holdings on balance sheets has been a major barrier to broader corporate adoption. However, with FASB’s rule change earlier this year—shifting from lower-of-cost-or-market to fair-value accounting—this hurdle is easing. MicroStrategy plans to implement this by Q1 2025, providing greater clarity and stronger incentives for others to follow.

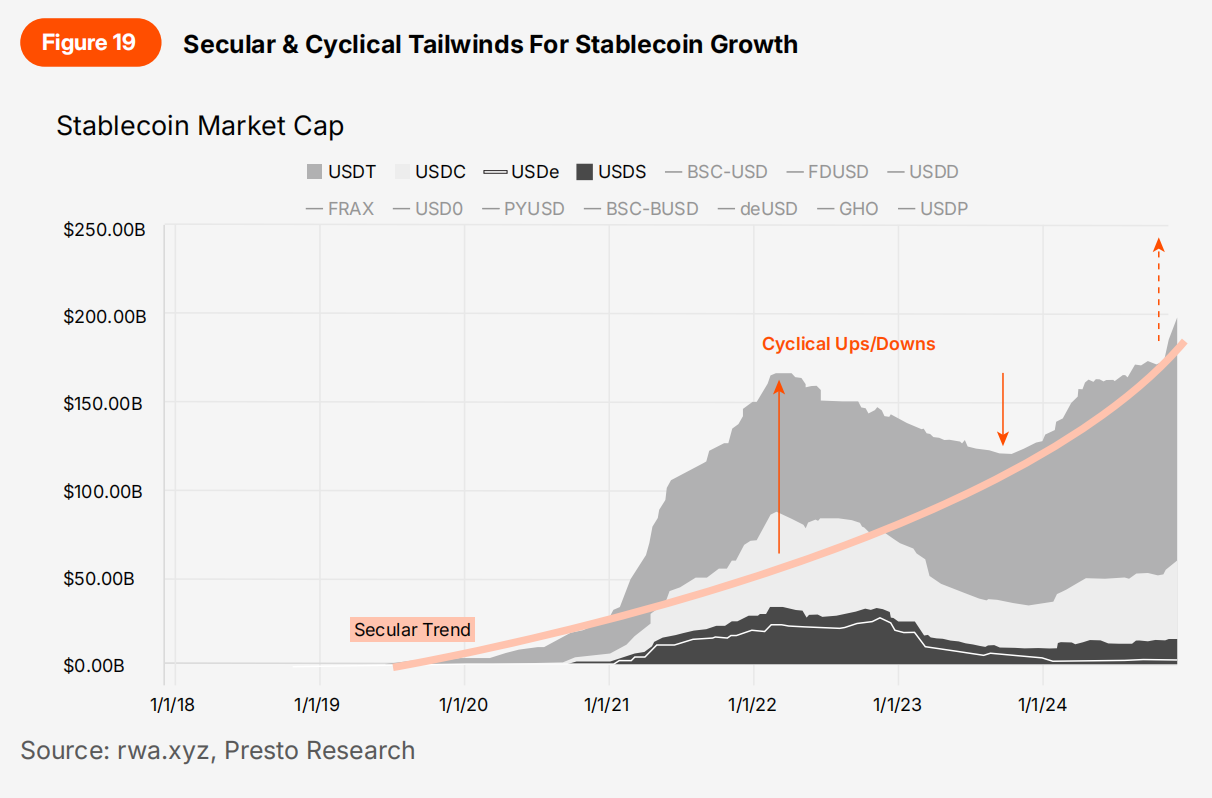

3.1.3 Stablecoins Sweep the Globe: Total Market Cap Hits $300 Billion

Stablecoins may not excite those chasing moonshots, but they are undeniably blockchain’s killer app. After rebounding from a late-2022 local low, stablecoin market cap has reached $200B, making it the largest crypto application category.

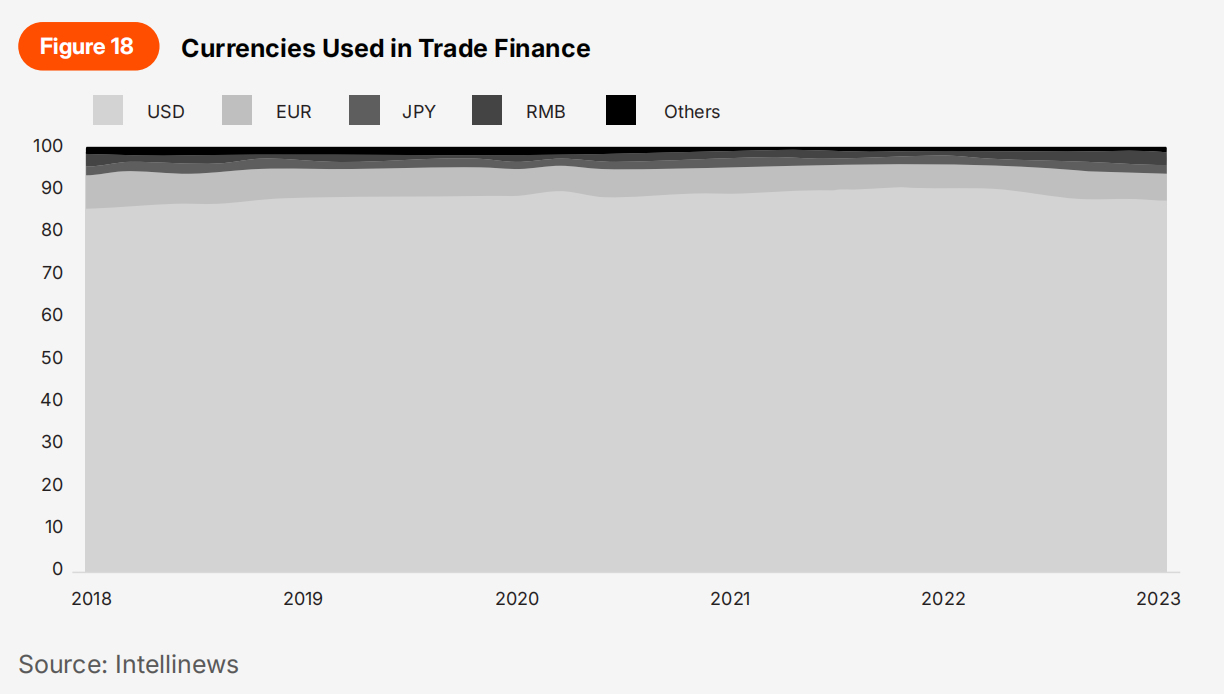

Their success delivers an important but often overlooked lesson: 99% of stablecoins are USD-pegged because non-USD stablecoins haven't taken off—and there's a reason. Tokenizing an asset doesn’t magically create demand; rather, the asset must already be globally desired. Few currencies enjoy the dollar’s universal demand, evident in its dominance as the preferred settlement currency (Figure 18). That’s why blockchain finds perfect product-market fit with USD stablecoins—but not others. Blockchain’s value proposition as a frictionless value transfer channel is strongest when assets move across borders—where friction is highest. Most other currencies are used primarily within their issuing jurisdictions, rarely needing cross-border movement.

This has broader implications for RWA practitioners: tokenized assets must be globally coveted. If an asset is inherently "local"—like non-major fiat from closed economies or IP valued only by small local communities—it might see modest 2–3x improvement. But achieving the 10x leap required for mass, sustainable adoption will be far harder.

I forecast stablecoin growth will continue, reaching $300B in 2025, driven by secular and cyclical tailwinds. Secular drivers include growing recognition of tokenized dollars’ superior functionality—as payment solutions in developed nations and stores of value in developing ones. U.S. Congressional progress on stablecoin legislation could add further momentum. Cyclical drivers include a broader crypto bull cycle (increasing inflows into stablecoins due to convenience) and yield spreads between on-chain and traditional financial savings tools. Even at $300B, this represents only 1.4% of USD M2 supply—leaving enormous room for growth.

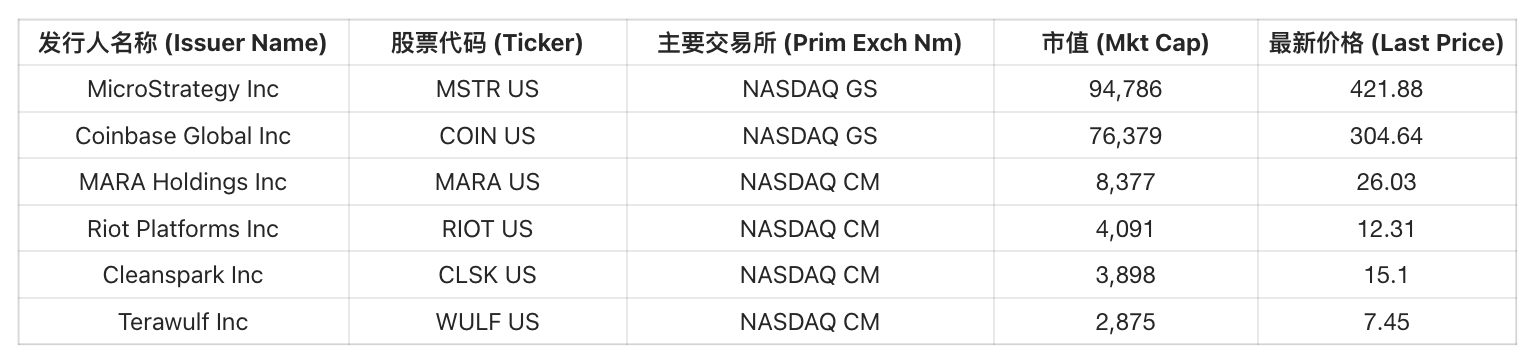

Figure 20: Expanding Crypto Equity Club

Notes:

-

This table shows only U.S. publicly traded companies with market cap >$1B as of Nov 29.

-

Data Source: Bloomberg

3.1.4 More Corporate Moves: Circle/Ripple/Kraken Will IPO

The U.S. isn’t just the hub of crypto innovation and intellectual capital—its societal values also align closely with crypto ideals. A crypto-friendly environment under a Trump administration could unlock opportunities previously hindered by political risk. Traditional firms expanding into crypto will see crypto startups as attractive assets, fueling more M&A and higher valuations. Signs are already visible: even struggling Bakkt found an acquirer in Trump Media.

Late-stage growth companies eyeing IPOs won’t miss this window. Circle, Ripple, and Kraken—long seen as likely IPO candidates—could go public. For reference, Coinbase went public in April 2021 at the peak of the last bull market.

If any of these three list, it will advance the industry in two key ways. First, alongside Coinbase and MicroStrategy, it will add legitimacy by increasing the market cap of emerging crypto firms in public equity markets. Second, public disclosures will bring greater operational transparency, offering valuable insights for the next generation of startups.

3.2 The Stockification of Crypto (Author: Min Jung)

3.2.1 U.S., the New Crypto Capital: Coinbase Excels in Both Stock and Crypto Markets

Trump, known for his "Make America Great Again" (MAGA) slogan and "America First" policies, has no reason to treat crypto differently. If he intends to make the U.S. the crypto capital, his administration must ensure American leadership in the global crypto landscape, surpassing competitors including China. Rumors suggest plans to eliminate capital gains taxes on cryptocurrencies issued by U.S.-registered companies—an indication of intent to attract crypto innovation. I believe this is just the beginning, with further announcements likely to solidify the U.S. as the global epicenter of crypto.

Such moves would fundamentally reshape the industry. Currently, crypto is viewed as a global asset class, with little attention paid to a project’s or founder’s location. But as the U.S. differentiates itself through favorable policies, this perception will shift. Just as a company’s nationality matters in traditional stock markets, the same could happen in crypto. In this scenario, “American crypto” would command a clear premium, attracting top talent and projects. The U.S. would replicate its stock market success, where American-listed firms enjoy valuation premiums due to legal and economic stability. This shift would redefine the global crypto landscape, placing the U.S. at the forefront.

The ripple effects of U.S. dominance would extend to trading dynamics. With macro and project-level news concentrated in U.S. trading hours, volume and volatility during those hours could surge. Moreover, U.S. exchanges—especially Coinbase—are poised for significant growth, with listings becoming a global signal of legitimacy, akin to major IPOs on Nasdaq.

At the project level, one of the clearest beneficiaries of U.S. dominance will be ecosystems like Coinbase’s Base. As a flagship example of American crypto innovation, Base’s success stems from low fees, user-friendly design, and crucially, U.S.-based regulatory clarity. These advantages, combined with talent influx, will position Base as a leading blockchain platform, cementing its status as a top-tier L2 ecosystem—not just in TVL, but across all dimensions.

Figure 21: Base vs. Other Blockchains

Data source: DefiLlama

3.2.2 Crypto Shifts to Fundamentals: Liquid Hedge Funds Will Outperform

The crypto industry is shifting from speculation to fundamentals-driven investing, driven by the emergence of standardized valuation frameworks. These frameworks are reshaping how projects are evaluated, funded, and traded, enabling a more disciplined approach that brings crypto closer to traditional finance principles.

For years, crypto lacked rigorous valuation standards like those in traditional markets, reinforcing its image as a speculative asset class. But as projects increasingly generate revenue via staking rewards, token buybacks, and trading fees, they’ve become systematically evaluable. Investors now have tools to calculate actual returns for token holders and assess sustainability. Metrics like TVL-to-MC ratio and protocol revenue multiples are gaining traction, offering standardized comparison methods.

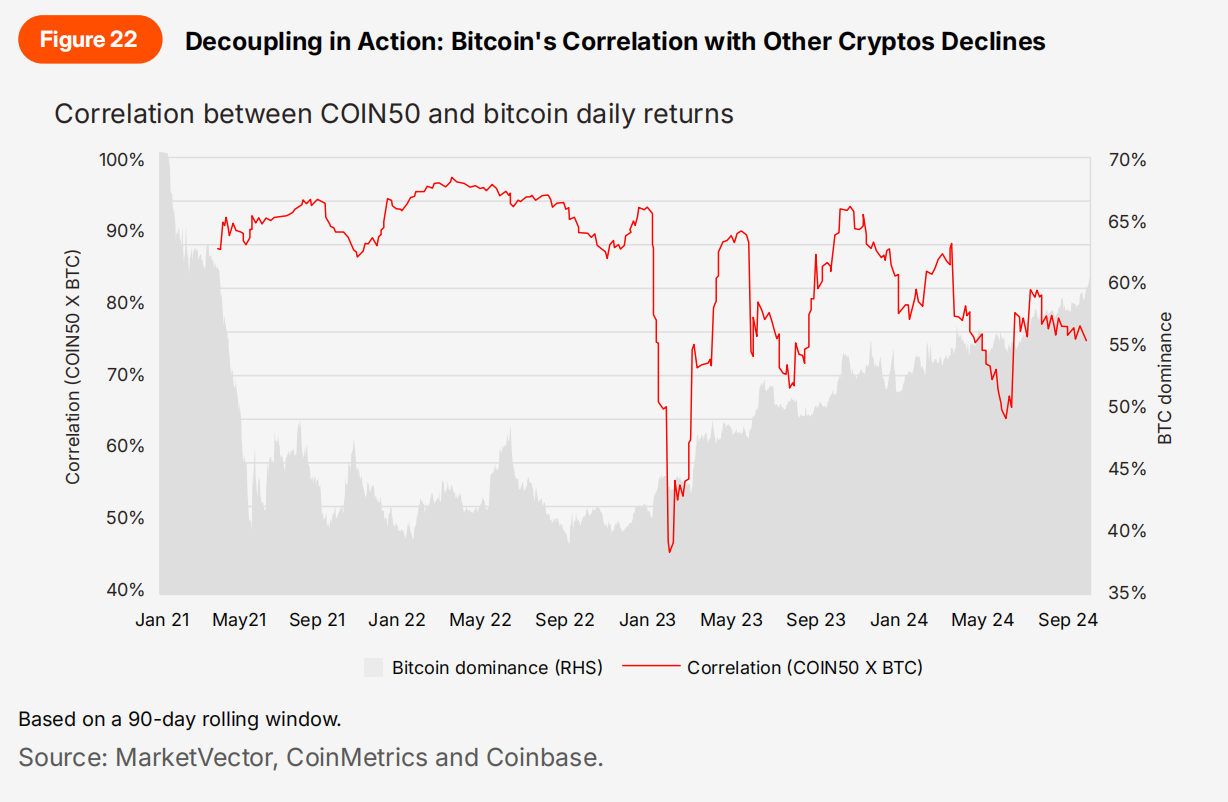

This shift to fundamentals is also transforming the broader investment landscape. Historically, venture capital dominated crypto, thriving on early-stage projects and speculative listings. Liquidity investors struggled to differentiate projects or execute effective strategies due to immature metrics, limited historical data, and crypto’s tendency to move in lockstep with Bitcoin. But the industry has matured. Markets are now sophisticated enough for meaningful comparisons using fundamental metrics.

Meanwhile, the current environment—marked by criticism of high FDV and low circulating supply—has diminished traditional VC’s appeal. In contrast, liquid hedge funds are leveraging these mature valuation tools to execute dynamic long/short strategies, exploiting real-time market inefficiencies. Their ability to systematically evaluate fundamentals gives them a distinct edge, allowing navigation of volatile conditions and delivery of sustainable returns regardless of market direction.

In 2025, I expect liquid hedge funds to outperform VC funds, using valuation-focused strategies to capitalize on both bullish and bearish trends. This marks a turning point for the crypto market, as liquid funds prove their adaptability and efficiency in volatile conditions. As crypto becomes a prime destination for alpha generation, at least five major macro or equity long/short hedge funds are expected to enter, combining traditional expertise with digital asset opportunities. Leading investment banks are also expected to formally cover digital assets, adopting equity-style valuation metrics. This institutional involvement will raise asset evaluation standards, push for greater project transparency, and drive the industry toward further maturity.

3.2.3 Rise of Crypto Indices: An Index Will Rank Among Top 5 by Trading Volume

The crypto market is growing rapidly, and crypto is increasingly seen as a mainstream asset class essential for portfolio diversification and competitive returns. As ordinary investors recognize the importance of including crypto in portfolios, demand for simplified, diversified investment options is rising. Just as stock investors shifted from picking individual stocks to broad market exposure via indices like the S&P 500, crypto is poised for a similar transformation, driven by its growing role in modern investment strategies.

In traditional finance, ETFs now account for 13% of total U.S. equity assets, reflecting growing preference for diversified exposure. Crypto is likely to follow a similar path, with index products offering curated baskets across sectors or themes.

Early attempts at crypto indices, like Binance’s Bluebird Index (tracking BNB, DOGE, MASK), struggled to gain traction in this niche market. Altcoins largely mirrored Bitcoin’s beta, making BTC the logical choice for broad exposure. Moreover, most investors considered themselves “speculators,” preferring individual tokens and believing they could beat the market.

But the landscape is changing. Projects are developing unique use cases and behaviors, with sector-specific performance driven by distinct fundamentals—not just Bitcoin’s price. Additionally, new investors—seeking exposure to the crypto industry or adopting macro views (e.g., bullish on DePIN or high-market-cap cryptos)—are increasing demand for diversified, sector-specific products.

With this evolution, indices are expected to become staples on major exchanges. Crypto equivalents of $SPDR-like products—such as the Coinbase 50 Index (COIN50)—may emerge and consistently rank among the top five by trading volume. This shift will redefine how investors interact with crypto—making it more accessible, diversified, and aligned with traditional finance principles.

3.3 Bull Market Phase Two (Author: Rick Maeda)

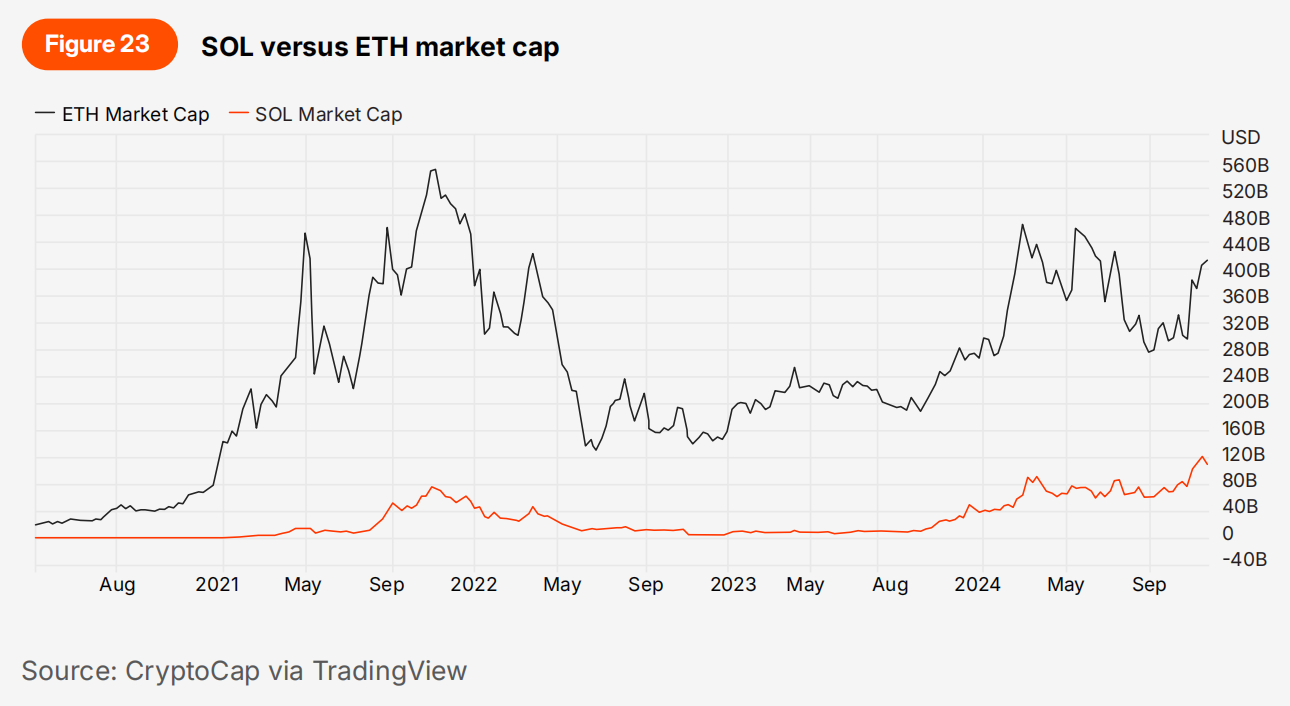

3.3.1 Solana Reaches $1,000

The path to $1,000 for SOL rests on the network’s transformation from a high-performance blockchain to a deeply institutionalized ecosystem. Surging institutional adoption, coupled with $173M raised by projects in Q3 2024, reflects a mature platform that has hit the sweet spot of technical excellence and institutional embedding.

This momentum is amplified by unprecedented network activity—Solana accounts for over 50% of all on-chain daily transactions, with activity up 1,900% YoY. This explosive growth reveals a deeper truth about the network’s success: as Placeholder’s Mario Laul explored, success isn’t purely technical—it’s driven by institutionalization through professional infrastructure and developer network effects. Solana’s differentiation lies in its unique culture—prioritizing rapid innovation over theoretical perfection, contrasting sharply with Ethereum’s research-first approach.

This pragmatic ethos is evident in its tech roadmap: while Anatoly advances the vision of a globally synchronized state machine with 120ms block times, as Maven 11’s Mads noted, the architecture is naturally suited for rollup-based scaling, laying the foundation for unprecedented scalability. The upcoming Firedancer client aims for 1M TPS, further demonstrating practical progress.

Only 1.93% of tokens will enter circulation next year, and at $1,000, the projected market cap of $485.93B falls well within Ethereum’s historical precedent. The combination of cultural differentiation, institutional adoption, technological evolution, and favorable tokenomics creates a compelling case for SOL’s ascent—with spot ETF potential further catalyzing institutional inflows.

3.3.2 Crypto Market Cap Reaches $7.5 Trillion

I outlined my plan for positioning in this bull market back in February 2024. This target is an updated version of that logic—Bitcoin at $150K, with 40% market dominance.

Like 2023, 2024 was a Bitcoin-dominated year. ETF inflows, Bitcoin’s broad institutionalization, and Trump’s victory caused this original crypto to outperform many altcoins. As Bitcoin approaches $95K and dominance hits 60% (as of Nov 20, 2024), I expect Bitcoin to stabilize above $100K before dominance drops to 40%. I believe this cycle will see Bitcoin reach at least $150K. Back-calculating with $150K BTC and 60% dominance gives a $7.49T total crypto market cap. At the previous cycle peak in Nov 2021, BTC was $69K with 42.5% dominance, totaling $2.9T market cap.

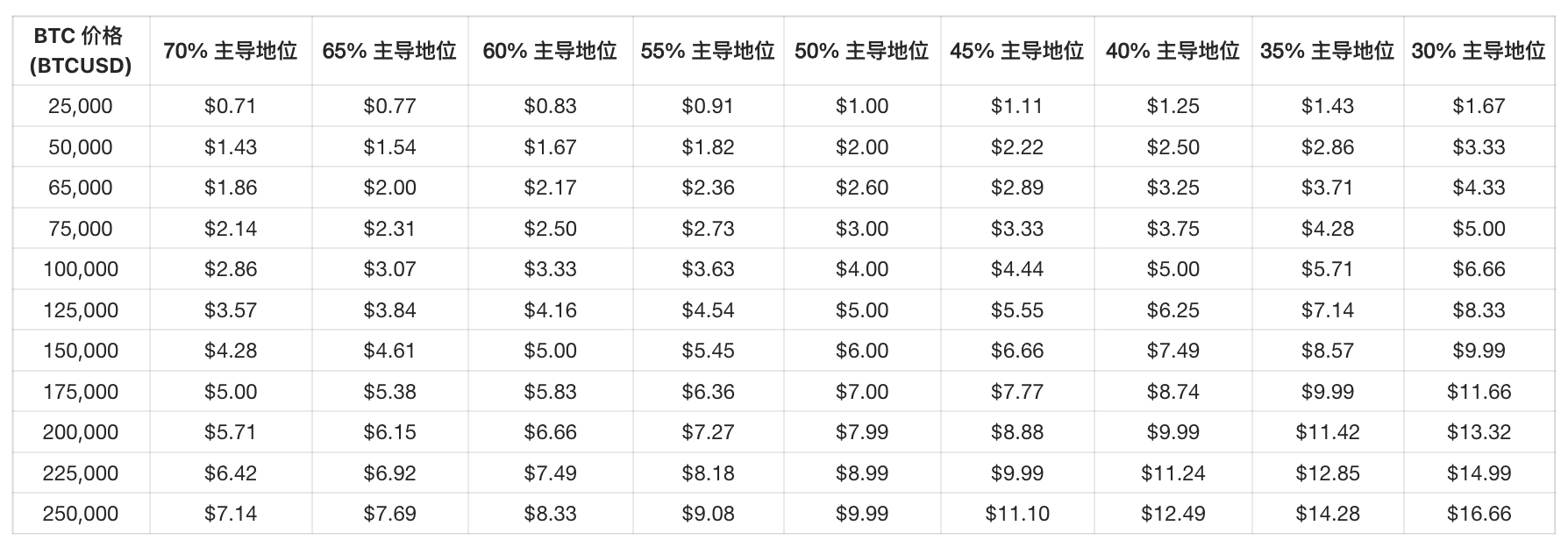

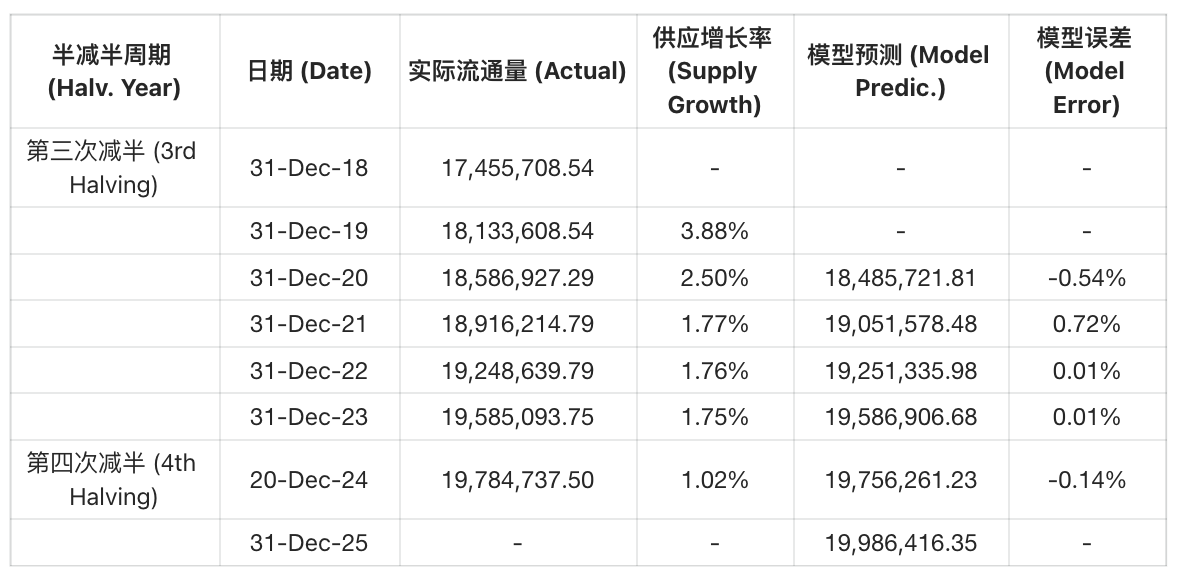

Figure 24: BTC Price x BTC Dominance

Editor’s Note:

-

The table shows potential BTCUSD performance at varying BTC dominance levels (70% to 30%).

-

Dominance refers to Bitcoin’s share of total crypto market cap.

-

For example, at $100,000 BTC and 50% dominance, market value could reach $4.00T.

Prediction:

-

Bitcoin supply by end of 2025: 19,986,416.35 BTC

Bitcoin Circulating Supply

Editor’s Note:

-

The table records actual and modeled Bitcoin circulating supply from 2018 to 2025.

-

Each halving event significantly reduces supply growth. Post-2024’s fourth halving, growth is projected at 1.02%.

-

Model accuracy improves annually, reducing error margins.

Data Sources:

-

Data from Glassnode and Presto Research; 2024 forecast based on Nov 20, 2024 stats.

Clearly, the global macro backdrop—especially considerations around a Trump presidency—is crucial to how long this bull run lasts. A simple scenario analysis reveals possible outcomes:

-

In a positive scenario, Trump focuses on pro-growth policies and deregulation, minimizing tariffs/immigration restrictions (potential outcome: higher real rates, stronger dollar, higher equities, lower gold)

-

In a negative scenario, we enter a trade war (e.g., 60% tariffs on China, 10–20% globally), with strong retaliation and strict U.S. immigration policies (potential outcome: rate cuts from Fed, dollar strong then weak, equity correction, gold rises)

Arguments for crypto support exist in both scenarios (essentially, if Bitcoin correlates positively with risk assets in the positive case, and with gold/negatively with dollar in the negative). But considering other factors—Trump’s cabinet picks and White House appointments (and moderate optimism)—I lean toward the positive scenario, which would support risk-asset cryptos.

3.3.3 2025 NFT Rebound: Monthly Volume Hits $2B

When I see Bitcoin hitting new all-time highs (and scrolling crypto Twitter all day), this time feels different. The usual euphoria accompanying such milestones seems muted—compared to past cycles, it’s clear we haven’t yet reached the magical moment where the tide lifts all boats. But that’s precisely why I’m optimistic about NFTs in 2025. We’re entering the mature phase of this cycle, and history shows this is when the most interesting cultural phenomena emerge.

The cultural significance of NFTs in the last cycle was profound, though often overlooked by market analysts. At their peak, NFTs represented something pure in crypto: genuine community. While saying “GM” and “WAGMI” daily on our Twitter timelines and Discord channels might seem trivial to outsiders, it created a sense of belonging that transcended mere speculation. This contrasts sharply with today’s memecoin landscape, where community has become weaponized—often masking predatory behavior behind a facade of shared purpose. Particularly notable are certain NFT communities like Pudgy Penguins and Miladys, which maintained cultural authenticity even at the depths of the 2022 bear market—their resilience rooted not just in floor prices, but in enduring cultural relevance.

Current data supports this latent cultural revival: NFT sales hit $562M in November 2024, up 57.8% from prior months. But beyond numbers, what’s striking is how NFT subcultures continue evolving and influencing broader crypto culture. The emergence of distinct art movements—from trash art to generative art—reflects a maturing ecosystem where cultural value isn’t solely tied to financial speculation. These subcultures act as innovation incubators, much like underground music scenes historically spawning new genres and cultural movements.

Mainstream adoption by brands like Nike and Sony isn’t just corporate co-option—it’s recognition of these digital subcultures’ legitimacy. Ironically, this mainstreaming may help preserve rather than dilute NFT community authenticity. As technology becomes more accessible via L

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News